Incontinence Care Products Market / ICP Market Size by Product (Absorbents (Bed Protectors, Pads & Guards), Non-absorbents (Catheters, Drainage Bags)), Usage (Reusable, Disposable), Distribution Channel (E-commerce), End User (Hospitals) & Region - Global Forecast to 2028

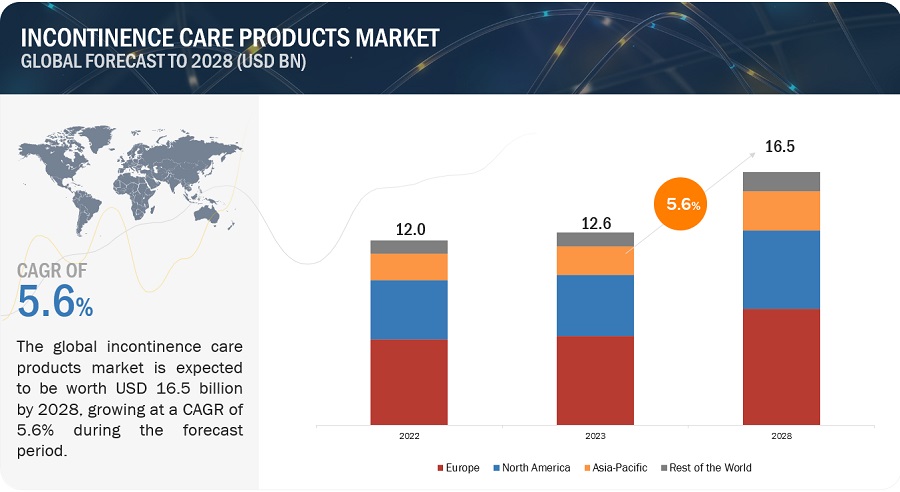

The global size of incontinence care products market in terms of revenue was estimated to be worth USD 12.6 billion in 2023 and is poised to reach USD 16.5 billion by 2028, growing at a CAGR of 5.6% from 2023 to 2028. TThe research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Market growth is largely driven by the increasing geriatric population and subsequent rise in the prevalence of chronic medical conditions, coupled with rapid urbanization and rising disposable income.On the other hand, the social stigma associated with incontinence care products restrain the growth of this market to a certain extent.

Attractive Opportunities in the Incontinence Care Products Market

To know about the assumptions considered for the study, Request for Free Sample Report

Incontinence Care Products Market Dynamics

DRIVER: Increasing geriatric population with chronic medical conditions

Incontinence is a common clinical problem, and its incidence is known to increase with age. Certain reports suggest that incontinence is mainly associated with frailty, whereby the ability of the body to cope with stress and physiological functions decreases. The World Health Organization (WHO) has identified incontinence as one of the priorities in the health field as it impacts the quality of life of the older population, leading to psychological, physical, and social consequences.

With the rapid increase in the aging population across the globe, urinary incontinence (UI) is a growing concern. In several large studies of women aged 50 years and above, nearly one-third to two-thirds of women in the US reported UI, while in the UK, it is estimated to affect around 30% to 40% of women. In a previous study for South Korea, UI was reported by 40.8% of female adults aged 30–79 years.

As per the WHO, by 2030, one in six people in the world will be aged above 60 years. The population aged 60 years and above will increase from 1 billion in 2020 to 1.4 billion in 2030. By 2050, this figure will approximately double (2.1 billion). The number of persons aged 80 years or older is anticipated to triple from 2020 and 2050 to reach nearly 426 million.

RESTRAINT: Social stigma associated with incontinence care products

People, especially women, often have to deal with the stigma associated with incontinence and the use of incontinence care products . The Essity 2020-21 survey revealed that 33% of respondents find incontinence the most difficult issue to talk about, even more so than issues such as depression and personal hygiene. It also indicates that incontinence remains a stigma in many parts of the world. While the stigma associated with depression, menstruation, and personal hygiene among women reduces with age, that associated with UI remains constant. Research shows that nearly one in three women in the UK have some form of weak bladder, but they do not address the same.

Stigma related to the use of incontinence care products, such as adult diapers, is very evident in certain countries. In India, for instance, cultural and societal norms identify urinary incontinence as a shameful and embarrassing condition. The reluctance to discuss or acknowledge urinary incontinence has resulted in an environment where adults requiring diapers are ashamed to seek the necessary assistance from family members or their doctors. Many women prefer to hide their condition, leading to social isolation and mental health problems. The lack of access to proper care and support can also cause physical discomfort and health issues.

OPPORTUNITY: Rising adoption of smart diapers

Superabsorbent polymers (SAPs) retain up to 1,000 times their weight in liquids and are used in applications that require high water absorption, quick solidification, and extended fluid retention. SAPs are utilized in a number of everyday products such as hot and cool packs, adult and baby diapers, absorbent and incontinence pads, and feminine hygiene products.

In the current market scenario, conventional SAPs used are non-biodegradable and hold a significant share of landfills across the globe. Hence, investments in the development of SAPs based on renewable materials are anticipated to create new opportunities for the global market. SAPs made of renewable materials are a suitable alternative to petrochemical-based polymers, such as sodium polyacrylate and potassium polyacrylate, currently used in disposable diapers’ absorbent core, among other personal hygiene products.

CHALLENGE: Disparities in reimbursement for incontinence care products

Patients of incontinence generally do not receive reimbursement for absorbent incontinence products. In the US, Incontinence supplies for seniors who qualify for Medicaid may be partially to completely reimbursed. Currently, 45 states and Washington, DC offer some level of reimbursement for absorbent incontinence products. However, Medicare reimbursement coverage allows intermittent catheter (IC) users to be reimbursed for a maximum of 200 sterile, single-use catheters per month.

In Germany, a minimum of 0.2% of the total expenditure of health insurances is allocated to incontinence products such as briefs, pads, or pants. The regulatory process and public-private insurance systems related to incontinence care products are not well-developed in these countries. Hence, manufacturers face challenges targeting countries with a single approach; customized approaches must be followed for greater market penetration.

Incontinence Care Products Ecosystem/Market Map

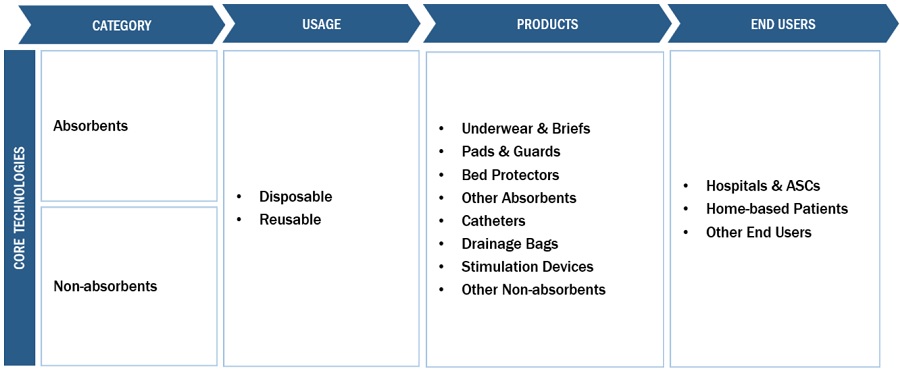

Absorbents segment accounted for the largest share of the incontinence care products industry in 2022, by product type

Based on product type, the incontinence care products market is segmented into absorbents and non-absorbents. Absorbents accounted for the market’s larger share (67.9%) in 2022. This can primarily be attributed to better ease of use and enhanced leakage coverage, and ease of use. Unlike UTI that is caused by the use of catheters, absorbents such as diapers cause less harm to the patients and are associated with less complications.

Females segment accounted for the largest share in the incontinence care products industry in 2022, by gender

On the basis of gender, the global incontinence care products market is categorized into females and males. In 2022, the female segment held the largest share in the market, by gender. The growth of the segment can be attributed to the high incidence of urinary incontinence among women.

Disposable segment accounted for the largest share in the incontinence care products industry in 2022, by usage

Based on usage, the incontinence care products market is segmented into disposable and reusable. In 2022, the disposable segment accounted for the larger share (82.1%) of the ICP market. This segment is also projected to register the higher CAGR during the forecast period due to the rising demand for single-use products such for the management of urinary incontinence.

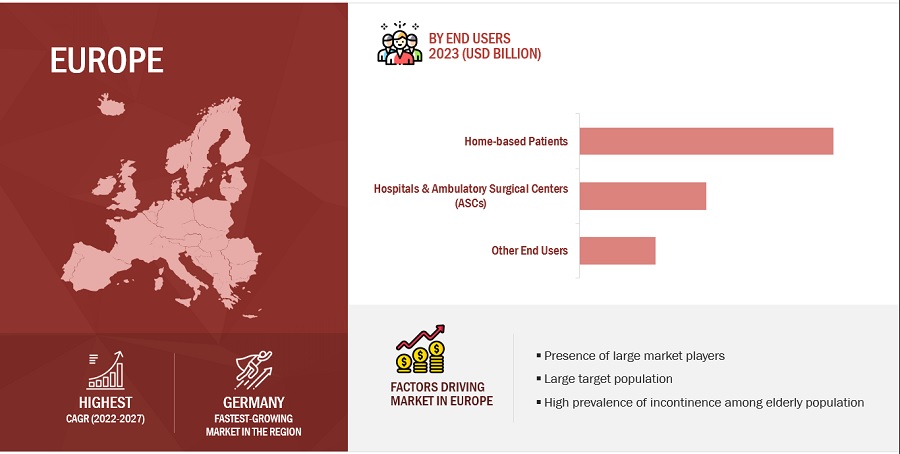

Europe accounted for the largest share of the incontinence care products industry in 2022

The incontinence care products market is segmented into four major regions: North America, Europe, the Asia Pacific, and the Rest of the World. In 2022, Europe emerged as the leading contributor, claiming the largest portion of the market share in the incontinence care products industry. With the presence of major players in the region, Europe has witnessed various advancements in the field of incontinence care products. These companies have expertise, resources, and well-established sales networks, contributing to the region’s market dominance. Examples of prominent incontinence care products companies in Europe include Essity Aktiebolag (publ) (Sweden) and HARTMANN (Germany).

To know about the assumptions considered for the study, download the pdf brochure

The major players in incontinence care products market are Essity Aktiebolag (publ) (Sweden), The Procter & Gamble Company (US), and Kimberly-Clark Corporation (US), HARTMANN (Germany), and Ontex BV (Belgium). These players’ market leadership is due to their comprehensive product portfolios and expansive global footprint. These dominant market players have several advantages, including strong research and development budgets, strong marketing and distribution networks, and well-established brand recognition.

Scope of the Incontinence Care Products Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$12.6 billion |

|

Estimated Value by 2028 |

$16.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.6% |

|

Market Driver |

Increasing geriatric population with chronic medical conditions |

|

Market Opportunity |

Rising adoption of smart diapers |

This research report categorizes the Incontinence Care Products Market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product Type

- Absorbents

- Non-absorbents

By Usage

- Disposable

- Reusable

By Gender

- Female

- Male

By Distribution Channel

- E-commerce

- Retailer Pharmacies

- Hospital Pharmacies

By End User

- Home-based Patients

- Hospitals & Ambulatory Surgical Centers (ASCs)

- Other End Users

Recent Developments of Incontinence Care Products Industry

- In May 2023, Cardinal Health established a distribution center in the Greater Toronto Area (GTA) to meet the Canadian healthcare system's medical and surgical product demands.

- In February 2023, Medline partnered with Synthase Collaborative. As part of the partnership, Medline will be the primary supplier of essential medical supplies, including incontinence care products and general nursing supplies to Synthase’s member organizations — Avow, Treasure Coast Hospice, St. Francis Reflections Lifestage Care, and Haven

- In September 2022, Attindas Hygiene Partners announced its innovative new adult disposable incontinence underwear product in North America.

- In July 2022, Essity acquired 80% of the Canadian company Knix, a leading provider of leakproof apparel for periods and incontinence. Post-acquisition, Essity is regarded among the market leaders in the leakproof apparel industry.

- In April 2022, Kimberly-Clark Corporation launched New Poise Ultra Thin Pads with Wings for bladder leaks under the Poise brand.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global incontinence care products market?

The global incontinence care products market boasts a total revenue value of $16.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global incontinence care products market?

The global incontinence care products market has an estimated compound annual growth rate (CAGR) of 5.6% and a revenue size in the region of $12.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

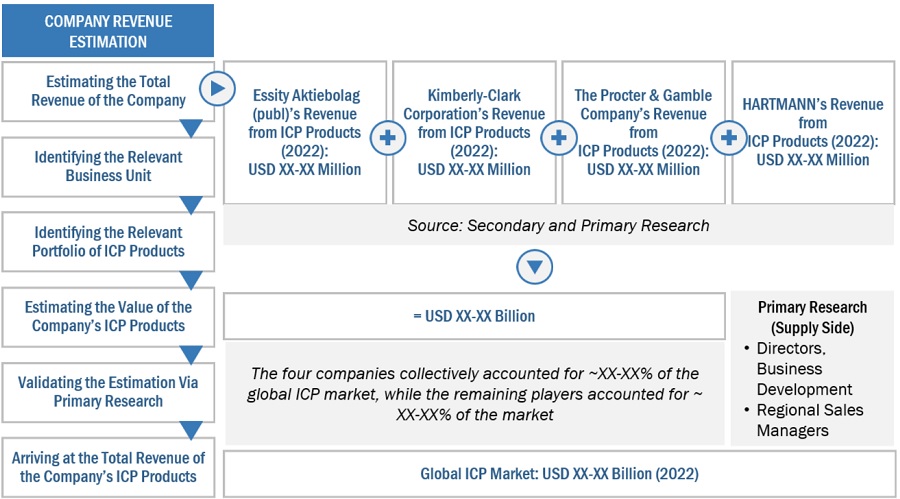

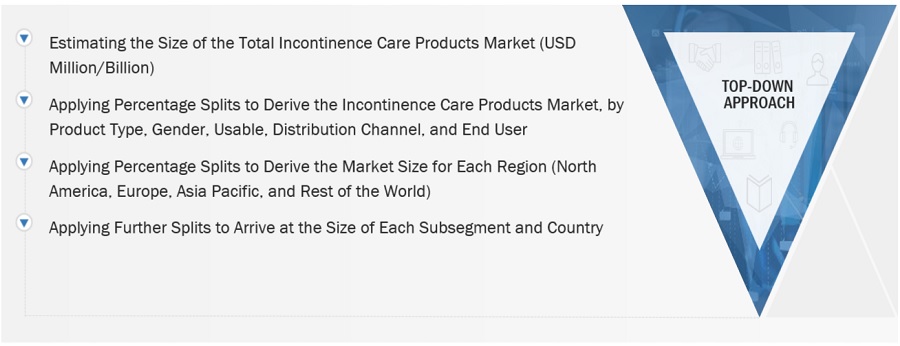

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as product launches and approvals, expansions, and partnerships of the leading players, the competitive landscape of the incontinence care products market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. A database of the key industry leaders was also prepared using secondary research.

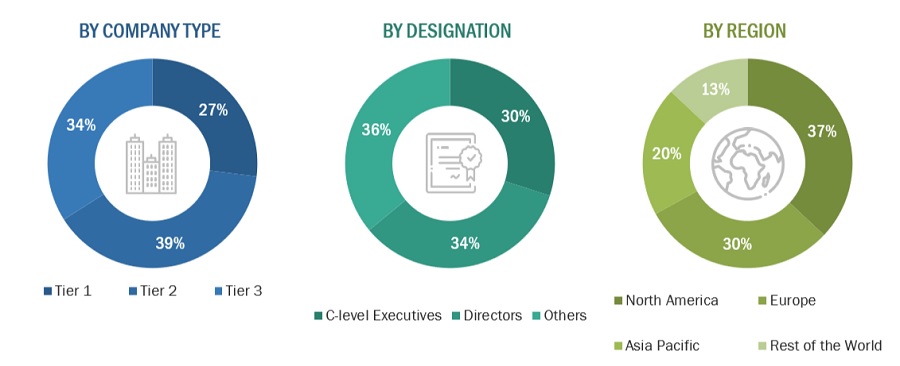

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as doctors, nurses, and hospital purchase managers) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

The Procter & Gamble Company (US) |

Business Manager |

|

Dynarex Corporation (US) |

VP Marketing |

|

Essity Aktiebolag (publ) (Sweden) |

Senior Director |

|

Unicharm Corporation (Japan) |

Regional Sales Head |

Market Size Estimation

All major product manufacturers offering various incontinence care products were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value incontinence care products market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of market at the regional and country-level

- Relative adoption pattern of each market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Incontinence Care Products Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Incontinence Care Products Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the incontinence care products industry.

Market Definition

Incontinence refers to an involuntary loss of urine or feces, which occurs due to problems with the muscles and nerves of the bladder or bowel. Urinary incontinence is defined as the loss of urine from the bladder, while fecal incontinence refers to the involuntary loss of feces from the bowel. Stress, urge, mixed, overflow, and functional incontinence are some of the most commonly occurring types of urine and bowel incontinence, observed usually in the elderly population or in patients with certain illnesses.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the incontinence care products market by product type, usage, gender, distribution channel, end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market in four main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific and Rest of the World

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product launches and approvals; expansions; and partnerships; of the leading players in the market

- To benchmark players within the market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the incontinence care products market

Company profiles

- Additional three company profiles of players operating in the incontinence care products market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the incontinence care products market

Growth opportunities and latent adjacency in Incontinence Care Products Market