Medical Supplies Market by Type (Diagnostic supplies, Dialysis Consumables, Disinfectants, Catheters, Radiology Consumables), Application (Urology, Cardiology, Radiology, IVD), End User (Hospitals, Clinics & Physician Offices) & Region - Global Forecast to 2027

The global medical supplies market in terms of revenue was estimated to be worth $138.4 billion in 2022 and is poised to reach $163.5 billion by 2027, growing at a CAGR of 3.4% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The new research study provides the company evaluation quadrant for 30 companies operating in the medical supplies market. The new research study provides the company evaluation quadrant for 18 companies and the startup/SME company evaluation quadrant for 12 companies operating in the medical supplies market. The research study also consists of the market sizes for major countries in all regions, including North America, Europe, the Asia Pacific, and the Rest of the World. The growth in this market is driven by the increasing demand for infection control measures to control hospital acquired infections, the increasing demand for medical devices, the increasing number of ICU beds in hospitals and surgical centers, and the rising number of accidents and trauma cases.

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Supplies Market Dynamics

Driver: High prevalence of infectious and chronic diseases

Rising government-funded investments and initiatives in healthcare projects; Increasing demand for infection control measures to curb HAIs; Rising number of surgical procedures; Increasing demand for medical devices; Rising number of agreements between companies to manufacture cost-effective medical devices; An increase in the number of ICU beds in hospitals and surgical centers, as well as an increase in the number of accidents and trauma cases

The increasing prevalence of chronic and infectious diseases, and the high volume of injuries place a great demand on medical supply products. The geriatric population across the globe is also expanding. The vast geriatric population base and the high prevalence and incidence of related diseases among them drive the growth of the market. Market participants and researchers are more focused on advancing medical supply products, with collaborations among companies to launch advanced products and the incoming latest technologies driving market growth. The government's investments in disease research and studies drive the market's growth rate even higher.

Opportunity: Rising medical tourism and Emerging markets

The emerging economies such as India, China, and Brazil offer lucrative potentials in the market with their vast population base, rising incidence of infectious and chronic diseases, improving healthcare infrastructure and expenditure. The improving healthcare infrastructure and the more affordable treatment and diagnosis as compared to North America and Europe are promoting medical tourism in the region.

Challenge: Medication errors and risks associated with medical supplies and Shortage of skilled medical professionals

The market faces certain challenging elements that hinder its growth rate. The death of the skilled professionals who are needed for various interventions that utilise medical supplies and consumables. Several medical supply products, such as wound care dressings, infusion supplies, etc., are associated with side effects and medical errors that may be fatal to patients.

Catheters segment to grow with the fastest CAGR in the medical supplies industry during the forecast period of 2022 to 2027

By type, the medical supplies market is fragmented into catheters, wound care consumables, sleep apnea consumables, infusion & injectable supplies, dialysis consumables, diagnostic supplies, personal protective equipment, radiology consumables, sterilisation consumables, intubation & ventilation supplies, disinfectants, and other medical supplies. The catheter segment is estimated to grow with the fastest CAGR during the forecast period. This is attributed to the rising incidence of cardiovascular disease and the increasing volume of catheter related surgeries, across the globe.

Other applications segment to dominate the medical supplies industry

By application, the medical supplies market is further fragmented into respiratory, cardiology, infection control, radiology, wound care, IVD, urology, and other applications. The other applications segment accounted for the dominant share in the global market in 2021, primarily due to the increasing prevalence of dental related diseases and the high volume of surgical procedures.

To know about the assumptions considered for the study, download the pdf brochure

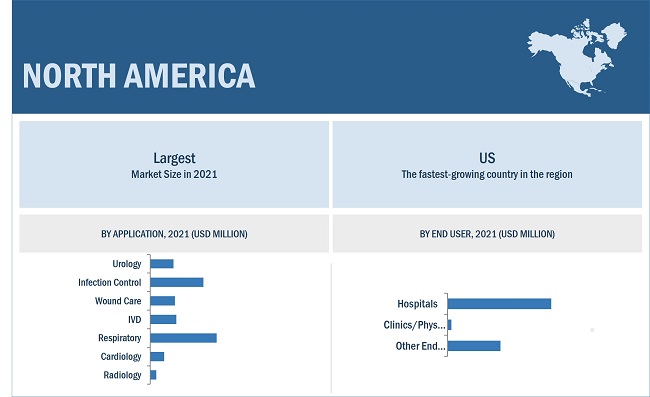

North America was the largest region in the medical supplies industry.

The medical supplies market has been analysed for North America, Europe, Asia Pacific, and the rest of the world. North America held the dominant share of the market, followed by Europe. The massive pool of geriatric population, advanced healthcare infrastructure, high prevalence of chronic diseases and infections, and the strong presence of leading industry players account for the majority of North America.

Prominent players in the medical supplies market include Medtronic plc (Ireland), Cardinal Health (US), BD (US), Johnson & Johnson, Inc. (US), and B. Braun Melsungen AG (Germany).

Medical Supplies Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$138.4 billion |

|

Projected Revenue by 2027 |

$163.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 3.4% |

|

Market Driver |

High prevalence of infectious and chronic diseases |

|

Market Opportunity |

Rising medical tourism and Emerging markets |

This study categorizes the global medical supplies market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Diagnostic Supplies

- Blood Collection Consumables

- Other Sample Collection Consumables

- Infusion & Injectable Supplies

- Intubation & Ventilation Supplies

-

Disinfectants

- Hand Disinfectants

- Skin Disinfectants

- Surface Disinfectants

- Instrument Disinfectants

-

Personal Protective Equipment

- Hand & Arm Protection Equipment

- Eye & Face Protection Equipment

- Protective Clothing

- Foot & Leg Protection Equipment

- Surgical Drapes

- Other Protection Equipment

- Sterilization Consumables

-

Wound Care Consumables

- Advanced Wound Dressings

- Surgical Wound Care

- Traditional Wound Care

-

Dialysis Consumables

- Hemodialysis Consumables

- Peritoneal Dialysis Consumables

- Radiology Consumables

-

Catheters

- Cardiovascular Catheters

- Intravenous Catheters

- Urological Catheters

- Specialty Catheters

- Neurovascular Catheters

- Sleep Apnea Consumables

- Other Medical Supplies

By Application

- Urology

- Wound Care

- Radiology

- Respiratory

- Infection Control

- Cardiology

- IVD

- Other Applications

By End User

- Hospitals

- Clinics/Physician Offices

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In February 2022, Medtronic plc launched its NuVent Eustachian tube dilation balloon, which is intended for the treatment of chronic and obstructive eustachian tube dysfunction.

- In April 2022, Boston Scientific Corporation received the FDA 510(k) clearance for the EMBOLD Fibered Detachable Coil, which is indicated to obstruct or reduce the rate of blood flow in the peripheral vasculature.

- In June 2021, Ethicon, part of Johnson & Johnson Medical Devices Companies, launched its ENSEAL X1 Curved Jaw Tissue Sealer. The device is indicated for colorectal, gynecological, bariatric surgery, and thoracic procedures.

- In May 2022, Cardinal Health has signed an agreement with URAC, the largest independent health care accreditation organization in the US. Under the agreement, Cardinal Health will pursue accreditation for its specialty pharmacies and practices.

- In June 2022, BD has acquired Parata Systems, an innovative provider of pharmacy automation solutions. The acquisition will strengthen the portfolio of BD with portfolio of Parata for innovative pharmacy automation solutions.

- In January 2022, Johnson & Johnson Medical Devices Companies signed a strategic partnership with Microsoft to further enable its digital surgery solutions.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the medical supplies market?

The medical supplies market boasts a total revenue value of $163.5 billion by 2027.

What is the estimated growth rate (CAGR) of the medical supplies market?

The global medical supplies market has an estimated compound annual growth rate (CAGR) of 3.4% and a revenue size in the region of $138.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MEDICAL SUPPLIES MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

TABLE 2 KEY DATA FROM PRIMARY SOURCES

2.1.1.2 Key industry insights

2.1.2 PRIMARY DATA

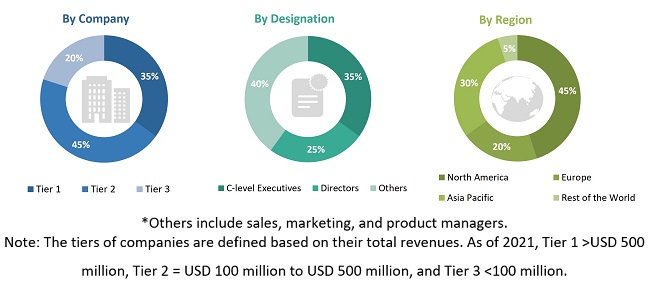

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BLOOD COLLECTION DEVICES MARKET– REVENUE SHARE ANALYSIS ILLUSTRATION: BECTON, DICKENSON AND COMPANY

FIGURE 5 MEDICAL DEVICE MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF PRODUCTS FOR THE BLOOD COLLECTION DEVICES MARKET

FIGURE 6 CAGR PROJECTIONS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 3 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 MEDICAL SUPPLIES MARKET, BY TYPE, 2022 VS. 2027 (USD BILLION)

FIGURE 10 GLOBAL MEDICAL DEVICE MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

FIGURE 11 GLOBAL MEDICAL DEVICE INDUSTRY REPORT, BY END USER, 2022 VS. 2027 (USD BILLION)

FIGURE 12 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MEDICAL SUPPLY MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS IN THE MEDICAL SUPPLIES MARKET

FIGURE 13 THE RISING PREVALENCE OF CHRONIC INFECTIOUS DISEASES DRIVES THE MARKET GROWTH

4.2 NORTH AMERICA MEDICAL SUPPLIES INDUSTRY: BY APPLICATION AND COUNTRY (2021)

FIGURE 14 THE OTHER APPLICATIONS SEGMENT DOMINATED THE NORTH AMERICA MARKET IN 2021

4.3 GLOBAL MEDICAL DEVICE INDUSTRY STATISTICS, BY REGION (2022 VS. 2027)

FIGURE 15 NORTH AMERICA TO DOMINATE THE GLOBAL MEDICAL SUPPLIES INDUSTRY DURING THE FORECAST PERIOD

4.4 GLOBAL MEDICAL DEVICE MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 16 INDIA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MEDICAL SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of chronic diseases worldwide

FIGURE 18 GLOBAL AGE-STANDARDIZED PREVALENCE OF DIABETES, BY REGION, 2019 VS. 2030 VS. 2045 (%)

5.2.1.2 Increasing government-funded investments and initiatives in healthcare projects

5.2.1.3 Increasing demand for infection control measures to curb HAIs

5.2.1.4 Growing number of surgical procedures worldwide

TABLE 4 NUMBER OF SURGICAL PROCEDURES FOR CATARACTS, BY COUNTRY

(2018–2020) 56

5.2.1.5 Increasing demand for medical devices

5.2.1.6 Increasing number of ICU beds in hospitals and surgical centers

5.2.1.7 Rising number of accidents and trauma cases

5.2.2 RESTRAINTS

5.2.2.1 Product recalls

TABLE 5 MAJOR PRODUCT RECALLS IN 2020

5.2.2.2 Stringent regulatory requirements for approval of medical supplies

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Rising medical tourism

5.2.4 CHALLENGES

5.2.4.1 Medication errors and risks associated with medical supplies

TABLE 6 RISKS ASSOCIATED WITH ADVANCED WOUND CARE PRODUCTS

5.2.4.2 Shortage of skilled medical professionals

5.2.5 COVID-19 IMPACT ON THE GLOBAL MEDICAL SUPPLIES INDUSTRY

5.3 ECOSYSTEM ANALYSIS

6 MEDICAL SUPPLIES MARKET, BY TYPE (Page No. - 64)

6.1 INTRODUCTION

TABLE 7 GLOBAL MEDICAL DEVICE INDUSTRY REPORT, BY TYPE, 2019–2027 (USD MILLION)

6.2 DIAGNOSTIC SUPPLIES

TABLE 8 DIAGNOSTIC SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.2.1 BLOOD COLLECTION CONSUMABLES

6.2.1.1 Rising demand for plasma donation to support demand for blood collection consumables

TABLE 9 BLOOD COLLECTION TUBES AVAILABLE IN THE MARKET

TABLE 10 BLOOD COLLECTION CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.2.2 OTHER SAMPLE COLLECTION CONSUMABLES

TABLE 11 OTHER SAMPLE COLLECTION CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.3 DIALYSIS CONSUMABLES

FIGURE 19 US: PREVALENCE OF ESRD, BY AGE GROUP, 2010–2018

TABLE 12 DIALYSIS CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.3.1 PERITONEAL DIALYSIS CONSUMABLES

6.3.1.1 Benefits such as ease-of-use to support growth of this segment

TABLE 13 PERITONEAL DIALYSIS CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.3.2 HEMODIALYSIS CONSUMABLES

6.3.2.1 Rising demand for home dialysis to support growth of the hemodialysis consumables segment

TABLE 14 HEMODIALYSIS CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.4 WOUND CARE CONSUMABLES

TABLE 15 WOUND CARE CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.4.1 ADVANCED WOUND DRESSINGS

6.4.1.1 Launch of advanced wound dressings to drive market growth

TABLE 16 ADVANCED WOUND DRESSINGS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.4.2 SURGICAL WOUND CARE CONSUMABLES

6.4.2.1 Product launches by major players to accelerate demand

TABLE 17 SURGICAL WOUND CARE CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.4.3 TRADITIONAL WOUND CARE CONSUMABLES

6.4.3.1 Growing adoption of advanced wound care products to limit market

TABLE 18 TRADITIONAL WOUND CARE CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.5 RADIOLOGY CONSUMABLES

6.5.1 ESTABLISHMENT OF ADVANCED IMAGING CENTERS TO DRIVE DEMAND

TABLE 19 NUMBER OF MRI EXAMS PERFORMED PER 1,000 INHABITANTS, BY COUNTRY, 2010 VS. 2018

TABLE 20 NUMBER OF CT EXAMS PERFORMED PER 1,000 INHABITANTS, BY COUNTRY, 2010 VS. 2018

TABLE 21 RADIOLOGY CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.6 DISINFECTANTS

TABLE 22 DISINFECTANTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.6.1 HAND DISINFECTANTS

6.6.1.1 Increasing health awareness to drive growth

TABLE 23 HAND DISINFECTANTS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.6.2 SKIN DISINFECTANTS

6.6.2.1 Rising awareness for SSIs and HAIs to boost market

TABLE 24 SKIN DISINFECTANTS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.6.3 SURFACE DISINFECTANTS

6.6.3.1 Surface disinfectants limits transfer of microorganisms transmitted through hand-to-surface contact

TABLE 25 SURFACE DISINFECTANTS OFFERED BY SOME MARKET PLAYERS

TABLE 26 SURFACE DISINFECTANTS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.6.4 INSTRUMENT DISINFECTANTS

6.6.4.1 Growing number of surgical procedures to ensure cleanliness to drive growth

TABLE 27 INSTRUMENT DISINFECTANTS OFFERED BY SOME MARKET PLAYERS

TABLE 28 INSTRUMENT DISINFECTANTS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.7 INFUSION & INJECTABLE SUPPLIES

6.7.1 INCREASING USE OF INFUSION & INJECTABLE SUPPLIES FOR DRUG DELIVERY TO DRIVE MARKET

TABLE 29 INFUSION & INJECTABLE SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.8 INTUBATION & VENTILATION SUPPLIES

6.8.1 HIGH DEMAND FOR INTUBATION & VENTILATION SUPPLIES DUE TO COVID-19

TABLE 30 INTUBATION & VENTILATION SUPPLIES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9 PERSONAL PROTECTIVE EQUIPMENT

TABLE 31 PPE MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.9.1 HAND & ARM PROTECTION EQUIPMENT

6.9.1.1 FDA guidelines for the use of gloves to prevent COVID-19 to drive market growth

TABLE 32 HAND & ARM PROTECTION EQUIPMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9.2 EYE & FACE PROTECTION EQUIPMENT

6.9.2.1 Measures undertaken to curtail the spread of COVID-19 to drive growth

TABLE 33 EYE & FACE PROTECTION EQUIPMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9.3 PROTECTIVE CLOTHING

6.9.3.1 Growing risk of cross-contamination during surgery to drive the growth

TABLE 34 PROTECTIVE CLOTHING MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9.4 FOOT & LEG PROTECTION EQUIPMENT

6.9.4.1 Rising need to reduce contamination in healthcare settings to promote growth

TABLE 35 FOOT & LEG PROTECTION EQUIPMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9.5 SURGICAL DRAPES

6.9.5.1 Rising need to reduce contamination in healthcare settings to promote growth

TABLE 36 SURGICAL DRAPES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.9.6 OTHER PROTECTIVE EQUIPMENT

TABLE 37 OTHER PROTECTIVE EQUIPMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

6.10 STERILIZATION CONSUMABLES

6.10.1 INCREASING NUMBER OF HOSPITAL STERILIZATION PROCEDURES TO DRIVE DEMAND

TABLE 38 BIOLOGICAL INDICATORS OFFERED BY KEY MARKET PLAYERS

TABLE 39 STERILIZATION POUCHES OFFERED BY SOME MARKET PLAYERS

TABLE 40 STERILIZATION CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.11 CATHETERS

TABLE 41 CATHETERS MARKET, BY TYPE, 2019–2027 (USD MILLION)

6.11.1 CARDIOVASCULAR CATHETERS

6.11.1.1 High prevalence of atrial fibrillation to drive the demand

TABLE 42 CARDIOVASCULAR CATHETERS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.11.2 INTRAVENOUS CATHETERS

6.11.2.1 Growing prevalence of chronic diseases to support market growth

TABLE 43 INTRAVENOUS CATHETERS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.11.3 UROLOGICAL CATHETERS

6.11.3.1 Launch of innovative products to drive demand

TABLE 44 UROLOGICAL CATHETERS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.11.4 SPECIALTY CATHETERS

6.11.4.1 Growing use in intrauterine and other specialty catheterizations to support growth

TABLE 45 SPECIALTY CATHETERS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.11.5 NEUROVASCULAR CATHETERS

6.11.5.1 Increasing incidence of neurovascular diseases to support market

TABLE 46 NEUROVASCULAR CATHETERS MARKET, BY REGION, 2019–2027 (USD MILLION)

6.12 SLEEP APNEA CONSUMABLES

6.12.1 GROWING PREVALENCE OF SLEEP APNEA TO SUPPORT MARKET

TABLE 47 SLEEP APNEA CONSUMABLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.13 OTHER MEDICAL SUPPLIES

TABLE 48 OTHER GLOBAL MARKET, BY REGION, 2019–2027 (USD MILLION)

7 MEDICAL SUPPLIES MARKET, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

TABLE 49 GLOBAL MEDICAL SUPPLY MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

7.2 UROLOGY

7.2.1 INCREASING PREVALENCE OF KIDNEY DISORDERS TO SUPPORT MARKET

TABLE 50 BLADDER CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 51 KIDNEY CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 52 PROSTATE CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 53 GLOBAL MARKET FOR UROLOGY APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.3 WOUND CARE

7.3.1 INNOVATIVE LAUNCHES OF WOUND CARE PRODUCTS TO DRIVE DEMAND

TABLE 54 GLOBAL MEDICAL SUPPLY MARKET FOR WOUND CARE APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.4 RADIOLOGY

7.4.1 RISING NUMBER OF RADIOLOGICAL PROCEDURES TO SUPPORT MARKET

TABLE 55 INDICATIVE LIST OF RESEARCH STUDIES

TABLE 56 GLOBAL MEDICAL SUPPLIES INDUSTRY FOR RADIOLOGY APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.5 RESPIRATORY

7.5.1 RISING INCIDENCE OF CHRONIC RESPIRATORY DISEASES PROPELS DEMAND

TABLE 57 GLOBAL MEDICAL DEVICE INDUSTRY STATISTICS FOR RESPIRATORY APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.6 INFECTION CONTROL

7.6.1 INCREASING INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS TO SUPPORT MARKET

TABLE 58 GLOBAL MEDICAL SUPPLY MARKET FOR INFECTION CONTROL APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.7 CARDIOLOGY

7.7.1 INCREASING PREVALENCE OF CVD WORLDWIDE TO SUPPORT GROWTH

TABLE 59 GLOBAL MEDICAL SUPPLIES INDUSTRY FOR CARDIOLOGY APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.8 IN VITRO DIAGNOSTICS

7.8.1 INCREASING ADOPTION OF POINT-OF-CARE TESTS TO SUPPORT MARKET

TABLE 60 GLOBAL MEDICAL DEVICE MARKET FOR IVD APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

7.9 OTHER APPLICATIONS

TABLE 61 GLOBAL MEDICAL SUPPLIES INDUSTRY FOR OTHER APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

8 MEDICAL SUPPLIES MARKET, BY END USER (Page No. - 108)

8.1 INTRODUCTION

TABLE 62 GLOBAL MEDICAL SUPPLY MARKET, BY END USER, 2019–2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 INCREASING INVESTMENTS IN HEALTHCARE SYSTEMS TO SUPPORT GROWTH

TABLE 63 GLOBAL MEDICAL SUPPLY MARKET FOR HOSPITALS, BY REGION, 2019–2027 (USD MILLION)

8.3 CLINICS/PHYSICIAN OFFICES

8.3.1 DIAGNOSTIC AND PREVENTIVE CARE FOR PATIENTS WITHOUT HOSPITALIZATION REQUIREMENTS TO SUPPORT GROWTH

TABLE 64 GLOBAL MEDICAL DEVICE INDUSTRY REPORT FOR CLINICS/PHYSICIAN OFFICES, BY REGION, 2019–2027 (USD MILLION)

8.4 OTHER END USERS

TABLE 65 GLOBAL MEDICAL SUPPLIES INDUSTRY FOR OTHER END USERS, BY REGION, 2019–2027 (USD MILLION)

9 MEDICAL SUPPLIES MARKET, BY REGION (Page No. - 113)

9.1 INTRODUCTION

TABLE 66 GLOBAL DURABLE MEDICAL EQUIPMENT MARKET, BY REGION, 2019–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 20 NORTH AMERICA: MEDICAL SUPPLIES MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: MEDICAL DEVICES INDUSTRY, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MEDICAL SUPPLIES INDUSTRY, BY TYPE, 2019–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: DIAGNOSTIC SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: DISINFECTANTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: PPE MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: WOUND CARE CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: DIALYSIS CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: CATHETERS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: DURABLE MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MEDICAL SUPPLIES INDUSTRY, BY END USER, 2019–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Rapid rise in COVID-19 cases and the increasing incidence of chronic conditions drive the demand for medical supplies

TABLE 77 US: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 78 US: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Supportive government initiatives against the increasing prevalence of chronic conditions in Canada drive the overall market growth

TABLE 79 CANADA: COPD AND ASTHMA STATISTICS (2019 VS. 2020)

TABLE 80 CANADA: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 81 CANADA: DURABLE MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

9.3 EUROPE

TABLE 82 EUROPE: MEDICAL SUPPLIES MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 83 EUROPE: MEDICAL SUPPLIES INDUSTRY, BY TYPE, 2019–2027 (USD MILLION)

TABLE 84 EUROPE: DIAGNOSTIC SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 85 EUROPE: DISINFECTANTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 86 EUROPE: PPE MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 87 EUROPE: WOUND CARE CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 88 EUROPE: DIALYSIS CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 89 EUROPE: CATHETERS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 90 EUROPE: MEDICAL DEVICE INDUSTRY STATISTICS, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 91 EUROPE: DURABLE MEDICAL EQUIPMENT MARKET, BY END USER, 2019–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 The rising prevalence of chronic diseases and increasing healthcare expenditure drive the demand for medical supplies in Germany

TABLE 92 SURGICAL PROCEDURES PERFORMED IN GERMANY, 2019

TABLE 93 GERMANY: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 94 GERMANY: MEDICAL SUPPLIES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Increasing demand for medical supplies owing to the rising cases of COVID-19 supports the market growth

TABLE 95 SURGICAL PROCEDURES PERFORMED IN FRANCE, 2019

TABLE 96 FRANCE: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 97 FRANCE: MEDICAL DEVICES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Initiatives undertaken by government bodies in the UK are expected to offer opportunities for market growth

TABLE 98 SURGICAL PROCEDURES PERFORMED IN THE UK, 2019

TABLE 99 UK: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 100 UK: DURABLE MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 The large senior population in the country and high burden of chronic diseases have increased the demand for medical supplies

TABLE 101 SURGICAL PROCEDURES PERFORMED IN ITALY IN 2019

TABLE 102 ITALY: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 103 ITALY: MEDICAL SUPPLIES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 The high prevalence of HAIs in Spanish hospitals drives the demand for medical supplies

TABLE 104 SURGICAL PROCEDURES PERFORMED IN SPAIN IN 2019

TABLE 105 SPAIN: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 106 SPAIN: DURABLE MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 107 ROE: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 108 ROE: MEDICAL SUPPLIES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 21 ASIA PACIFIC: MEDICAL SUPPLIES MARKET SNAPSHOT

TABLE 109 ASIA PACIFIC: MEDICAL SUPPLIES INDUSTRY, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: DURABLE MEDICAL EQUIPMENT MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: DIAGNOSTIC SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: DISINFECTANTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: PPE MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: WOUND CARE CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: DIALYSIS CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: CATHETERS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 117 ASIA PACIFIC: MEDICAL DEVICES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: MEDICAL DEVICE INDUSTRY REPORT, BY END USER, 2019–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Outbreak of COVID-19 and existing chronic diseases to accelerate demand for medical supplies

TABLE 119 CHINA: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 120 CHINA: MEDICAL SUPPLIES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Large market size with best-equipped healthcare facilities to drive market growth

TABLE 121 JAPAN: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 122 JAPAN: DURABLE MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increasing number of start-up companies to propel market growth

TABLE 123 INDIA: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 124 INDIA: MEDICAL SUPPLIES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 125 SURGICAL PROCEDURES IN SOUTH KOREA, 2019

TABLE 126 REST OF ASIA PACIFIC: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 127 REST OF ASIA PACIFIC: MEDICAL DEVICES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

9.5 REST OF THE WORLD

TABLE 128 MIDDLE EAST & AFRICA: COVID-19 CASES

TABLE 129 LATIN AMERICA: COVID-19 CASES

TABLE 130 REST OF THE WORLD: MEDICAL SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 131 REST OF THE WORLD: DIAGNOSTIC SUPPLIES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 132 REST OF THE WORLD: DISINFECTANTS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 133 REST OF THE WORLD: PPE MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 134 REST OF THE WORLD: WOUND CARE CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 135 REST OF THE WORLD: DIALYSIS CONSUMABLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 136 REST OF THE WORLD: CATHETERS MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 137 REST OF THE WORLD: MEDICAL DEVICES INDUSTRY, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 138 REST OF THE WORLD: MEDICAL DEVICE INDUSTRY STATISTICS, BY END USER, 2019–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 162)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 139 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE MEDICAL SUPPLIES MARKET (2019 TO 2022)

10.3 COMPANY RANK ANALYSIS IN GLOBAL DURABLE MEDICAL EQUIPMENT MARKET, 2021

TABLE 140 GLOBAL MEDICAL DEVICE INDUSTRY REPORT: DEGREE OF COMPETITION

10.4 COMPANY RANK ANALYSIS OF DIALYSIS CONSUMABLES MARKET, 2021

TABLE 141 DIALYSIS CONSUMABLES MARKET: MARKET RANK

10.5 COMPANY RANK ANALYSIS OF STERILIZATION AND INFECTION CONTROL SUPPLIES MARKET, 2021

TABLE 142 STERILIZATION AND INFECTION CONTROL SUPPLIES MARKET: MARKET RANK

10.6 COMPANY EVALUATION QUADRANT (MAJOR PLAYERS)

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 EMERGING LEADERS

10.6.4 PARTICIPANTS

FIGURE 22 GLOBAL MEDICAL SUPPLY MARKET: COMPANY EVALUATION QUADRANT, 2021

10.7 COMPANY EVALUATION QUADRANT (SMES/START-UPS)

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

10.7.4 DYNAMIC COMPANIES

FIGURE 23 GLOBAL MEDICAL SUPPLY MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

10.8 COMPETITIVE BENCHMARKING

TABLE 143 COMPANY PRODUCT FOOTPRINT

TABLE 144 COMPANY REGIONAL FOOTPRINT

TABLE 145 OVERALL COMPANY FOOTPRINT

10.9 COMPETITIVE SITUATION AND TRENDS

10.9.1 PRODUCT LAUNCHES AND APPROVALS

TABLE 146 PRODUCT LAUNCHES AND APPROVALS, 2019–2022

10.9.2 DEALS

TABLE 147 DEALS, 2019–2022

10.9.3 OTHER DEVELOPMENTS

TABLE 148 OTHER DEVELOPMENTS, 2019–2022

11 COMPANY PROFILES (Page No. - 176)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 MEDTRONIC PLC

TABLE 149 MEDTRONIC PLC: COMPANY OVERVIEW

FIGURE 24 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.2 CARDINAL HEALTH

TABLE 150 CARDINAL HEALTH: COMPANY OVERVIEW

FIGURE 25 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

11.1.3 BECTON, DICKINSON AND COMPANY

TABLE 151 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

FIGURE 26 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

11.1.4 JOHNSON & JOHNSON SERVICES, INC.

TABLE 152 JOHNSON & JOHNSON SERVICES, INC.: COMPANY OVERVIEW

FIGURE 27 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2021)

11.1.5 B. BRAUN MELSUNGEN AG

TABLE 153 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

FIGURE 28 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

11.1.6 BOSTON SCIENTIFIC CORPORATION

TABLE 154 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

FIGURE 29 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2021)

11.1.7 THERMO FISHER SCIENTIFIC INC.

TABLE 155 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

FIGURE 30 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

11.1.8 BAXTER

TABLE 156 BAXTER: COMPANY OVERVIEW

FIGURE 31 BAXTER: COMPANY SNAPSHOT (2021)

11.1.9 3M

TABLE 157 3M: COMPANY OVERVIEW

FIGURE 32 3M: COMPANY SNAPSHOT (2021)

11.1.10 SMITH & NEPHEW

TABLE 158 SMITH & NEPHEW: COMPANY OVERVIEW

FIGURE 33 SMITH & NEPHEW: COMPANY SNAPSHOT (2021)

11.1.11 CONVATEC INC.

TABLE 159 CONVATEC INC.: COMPANY OVERVIEW

FIGURE 34 CONVATEC INC.: COMPANY SNAPSHOT (2021)

11.1.12 ABBOTT

TABLE 160 ABBOTT.: COMPANY OVERVIEW

FIGURE 35 ABBOTT.: COMPANY SNAPSHOT (2021)

11.1.13 MERIT MEDICAL SYSTEMS

TABLE 161 MERIT MEDICAL SYSTEMS.: COMPANY OVERVIEW

FIGURE 36 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2021)

11.1.14 STRYKER

TABLE 162 STRYKER: COMPANY OVERVIEW

FIGURE 37 STRYKER: COMPANY SNAPSHOT (2021)

11.1.15 TERUMO CORPORATION

TABLE 163 TERUMO CORPORATION.: COMPANY OVERVIEW

FIGURE 38 TERUMO CORPORATION: COMPANY SNAPSHOT (2021)

11.1.16 TELEFLEX INCORPORATED

TABLE 164 TELEFLEX INCORPORATED.: COMPANY OVERVIEW

FIGURE 39 TELEFLEX INCORPORATED.: COMPANY SNAPSHOT (2021)

11.2 OTHER PLAYERS

11.2.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

TABLE 165 FRESENIUS MEDICAL CARE AG & CO. KGAA: COMPANY OVERVIEW

11.2.2 COLOPLAST GROUP

TABLE 166 COLOPLAST GROUP: COMPANY OVERVIEW

11.2.3 COOK MEDICAL

TABLE 167 COOK MEDICAL: COMPANY OVERVIEW

11.2.4 HAMILTON MEDICAL

TABLE 168 HAMILTON MEDICAL: COMPANY OVERVIEW

11.2.5 ACELL, INC.

TABLE 169 ACELL, INC.: COMPANY OVERVIEW

11.2.6 INVACARE CORPORATION

TABLE 170 INVACARE CORPORATION: COMPANY OVERVIEW

11.2.7 MEDLINE INDUSTRIES, INC.

TABLE 171 MEDLINE INDUSTRIES, INC: COMPANY OVERVIEW

11.2.8 DEROYAL INDUSTRIES, INC.

TABLE 172 DEROYAL INDUSTRIES, INC.: COMPANY OVERVIEW

11.2.9 SHENZHEN MEDRENA BIOTECH CO., LTD.

TABLE 173 SHENZHEN MEDRENA BIOTECH CO., LTD.: COMPANY OVERVIEW

11.2.10 KERECIS

TABLE 174 KERECIS: COMPANY OVERVIEW

11.2.11 WHITELEY

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 271)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATION OPTIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the medical supplies market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Then, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Several stakeholders, such as medical supplies manufacturers, vendors, and distributors; researchers; and doctors from hospitals, clinics/physician offices, and other end users, were consulted for this report. The demand side of this market is characterized by significant use of medical supplies products due to the increasing prevalence of chronic and infectious diseases across the globe. The supply side is characterized by advancements in technology and a shift towards advanced devices. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical supplies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical supplies market.

Report Objectives

- To define, describe, segment, and forecast the medical supplies market by type, application, end user, and region

- To forecast the size of the market with respect to the main regional segments—North America, Europe, the Asia Pacific, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as collaborations, regulatory approvals, partnerships, acquisitions, and product launches in the medical supplies market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company specific needs. The following customization options are available for this report:

Company Information

- Over 27 companies profiled

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Supplies Market