This study involved the extensive use of primary and secondary sources. The research process involved the study of various factors affecting the catheters market to identify segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources, such as directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the catheters market. It was also used to obtain important information about the key players, market classification, segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the catheters market. Primary sources from the demand side include healthcare professionals from hospitals, ambulatory surgical centers (ASCs), long-term care facilities, diagnostic imaging centers, outpatient clinics, and other end users.

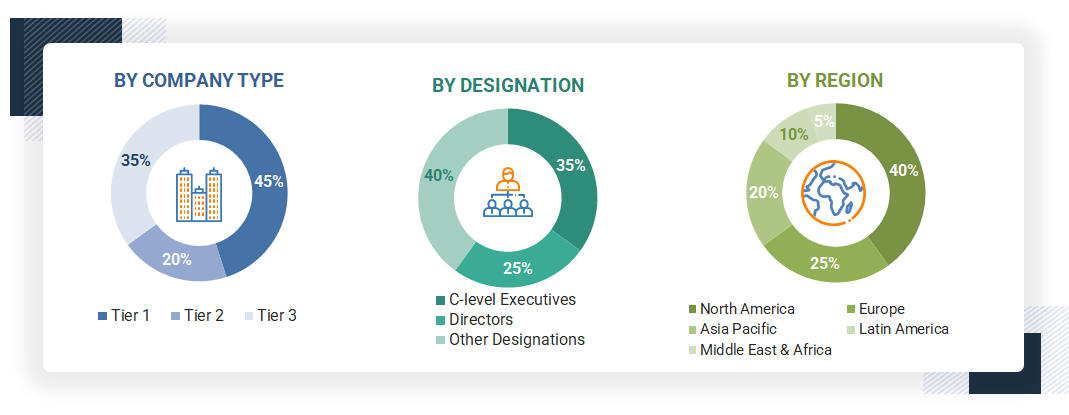

A breakdown of the primary respondents is provided below:

Note 1: C-level Executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other Designations include Sales, Marketing, and Product Managers.

Note 3: The tiers above are defined based on the companies’ total revenue as of 2024. Here are the categories considered:

Tier 1 = > USD 1 billion; tier 2 = USD 500 million to USD 1 billion; and tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the catheters market was arrived at after triangulating data from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

The catheters market comprises a wide range of medical devices designed as thin, flexible tubes inserted into the body to perform therapeutic or diagnostic functions. Catheters are used to deliver medications, fluids, or gases and to drain bodily fluids across multiple specialties, such as cardiology, urology, neurology, and gastroenterology. They are commonly utilized in procedures, such as angioplasty, dialysis, urinary drainage, and intravenous access, which makes them essential tools in modern medical practice. Most catheters are single-use and sterile and are used in various care settings, including hospitals, outpatient clinics, ambulatory centers, and home care.

Stakeholders

-

Catheter Manufacturers

-

Medical Device Companies

-

Cardiologists

-

Interventional Radiologists

-

Urologists

-

Vascular Surgeons

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Outpatient Clinics

-

Long-term Care Facilities

-

Emergency Medical Service (EMS) Providers

-

Research Institutions

-

Academic Medical Centers

-

Contract Manufacturing Organizations (CMOs)

-

Regulatory Authorities (e.g., FDA, EMA)

-

Healthcare Procurement Organizations

-

Medical Device Distributors and Suppliers

-

Health Insurance Providers

Report Objectives

-

To define, describe, and forecast the size of the catheters market, by type, indication, end user, and region

-

To provide detailed information about the key factors, such as drivers, restraints, opportunities, challenges, and industry trends, influencing the market growth

-

To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s five forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI on the catheters market, trends/disruption impacting customers’ business, and impact of the 2025 US tariff on the market

-

To analyze the micromarkets concerning individual growth trends, prospects, and contributions to the overall catheters market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To strategically profile the key players in this market and comprehensively analyze their market share and core competencies

-

To strategically analyze the catheters market for five regions, namely North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

-

To track and analyze competitive developments, such as product launches and approvals, acquisitions, partnerships, collaborations, and expansions in the catheters market

Growth opportunities and latent adjacency in Catheters Market