India Data Center Market by Component (Electrical, Mechanical, Communication, Security), Model (Captive, Outsourced), Vertical (BFSI, Telecom and ITES, Defense), Trends, Vendor Ecosystem Analysis, and Porters Five Forces Analysis - Forecast to 2022

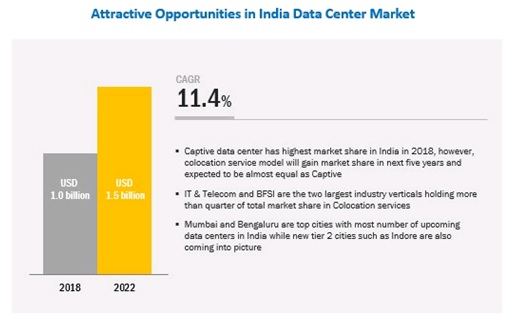

[72 Pages Report] The India data center market size is expected to reach USD 1.5 billion by 2022 from USD 1.0 billion in 2018, at a Compound Annual Growth Rate (CAGR) of 11.4% during the forecast period. The market is driven by the deeper internet penetration, increase in digital data traffic, public cloud services, and higher expected growth for IoT.

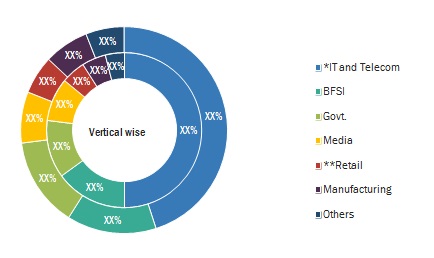

By industry verticals, the IT & telecom sector is expected to lead the market during the forecast period.

The IT & telecom segment is expected to lead the data center market in India. Media & entertainment, retail (eCommerce), and manufacturing sectors are the next significant verticals that require the most number of data centers. The government is increasingly reliant on IT-intensive services to improve its performance and has developed many Government-to-Citizen (G2C) delivery platforms, such as the National eGovernance Plan (NeGP), e-visa, and National CSR Data portal.

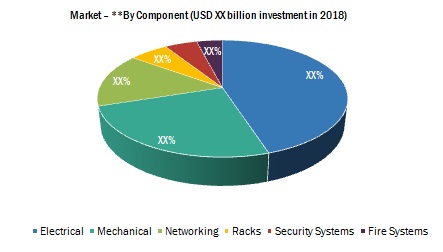

By components, the electrical segment will lead the market during the forecast period.

The electrical segment is set to lead the data center market in India during the forecast period. The majority of the capital investment goes into electrical and power systems, including substations, distribution transformers, diesel

By region, Mumbai is expected to lead the market during the forecast period.

Mumbai is projected to lead the market share during the forecast period. >75% of the data centers are located in major Indian cities, such as Mumbai, Bengaluru, Chennai, New Delhi, and Hyderabad. Mumbai and Bengaluru are providing Infrastructure to most data centers, as they are hubs for BFSI(Banking, financial services, and insurance) and IT & ITeS start-ups.

Market Dynamics

Driver: Public Cloud Services Market Will Double by 2020

Higher cloud adoption will lead to a rise in the volume of data generation and hence, an increase in requirement for data storage and processing. Also, the Indian government’s National Digital Communications Policy in 2018 has mandated data localization in the country, which means cloud providers will have to set up their data centers in India.

Opportunity: High growth of the hyper-converged infrastructure market

HCI (hyper-converged infrastructure) equipment is power-hungry and requires energy management solutions to reduce operating costs. Energy-efficient solutions and devices would be an attractive option here for HCI providers to reduce energy consumption. Hence, the demand for energy-efficient solutions and accessories will increase.

Challenge: Use of solar power in data centers

Colocation providers in India are slowly shifting toward solar energy to reduce their carbon footprint. For example, NxtGen’s data center at Bidadi, Karnataka, partially draws power from solar panels. CtrlS has announced its plans to convert all its datacenters to solar enabled in the next five years. The adoption of solar-powered data centers will affect the demand for UPS and generators in data centers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2022 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2022 |

|

Forecast units |

USD Billion |

|

Segments covered |

Industry vertical, Component, Region |

|

Geographies covered |

Mumbai, Bengaluru, NCR, Chennai, Hyderabad, Pune, Kolkata, Indore, and Rest of India |

|

Companies covered |

Key market players including, Fujitsu (Japan), Honeywell (US), NEC (Japan), Siemens (Germany), IBM (US), Johnson Controls (US), Hikvision (China), Dahua Technology (China), and Schneider Electric (France) |

The research report categorizes the India Data Center Market to forecast the revenues and analyze the trends in each of the following sub-segments:

India Data Center Market By Industry Verticals

- Banking Financial Services & Insurance (BFSI)

- Government

- IT & Telecom

- Media

- Retail

- Manufacturing

- Others

India Data Center Market By Component

- Electrical

- Mechanical

- Networking

- Racks

- Security Systems

- Fire Systems

India Data Center Market By Region

- Mumbai

- Bengaluru

- NCR

- Chennai

- Hyderabad

- Pune

- Kolkata

- Indore

- Rest of India

Key Market Players

CTRLS, ST Telemedia, ESDS, Netmgagic, Sterling & Wilson.

Recent Developments

- In October 2018, To cater to the growth in the IT and ITeS sector in Bengaluru, ESDS launched its third data center in the city. The DC was launched in partnership with Trigyn Technologies in OBT model in collaboration with the Ministry of Electronics and Information Technology body in STPI

- In July 2018, STT GDC, through its subsidiary VIRTUS datacenters (acquired in 2017), opened London's largest DC with 70,000 Square meters of space and 40MW of power capacity.

- In March 2018, Sterling & Wilson consolidated its subsidiaries and integrated its Mechanical, Electrical, and Plumbing business into the Shapoorji Pallonji Group. It is now eyeing a group annual revenue of ~INR 3,000 Cr. by March 2020.

- In March 2018, CtrlS launched its second data center in Hyderabad, also known for its Disaster recovery abilities.

Frequently Asked Questions (FAQ):

What does the data center market include?

What is the market size of India data center market?

What are the key trends in India data center market?

What are the major cities that have deployed data centers?

What are the top five major players of India data center market?

What are the different types of data centers?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the India data center market Study

1.2 Market Definition

1.3 Market Scope

1.4 Definition and Assumptions

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 India data center Market Size Estimation: Vendor Landscape Analysis & Deep Dive Competitive Analysis

2.3 Primary Contacts for Colocation Vendor and Partner Analysis

3 Executive Summary

3.1 India Data Center Market Overview

3.2 Market Size Estimation: Vendor Landscape Analysis & Deep Dive Competitive Analysis

3.3 Primary Contacts for Colocation Vendor and Partner Analysis

4 Recommendations

5 Data Center Market Outlook

5.1 India Data center Market Overview

5.2 India Datacenter Physical Infrastructure Market Overview

5.3 Migration From Captive Model to Cloud

5.4 Datacenter Infrastructure – Business Model in India

5.5 Vendor Ecosystem

6 India Data Center Market Dynamics

6.1 Drivers

6.2 Opportunities

6.3 Challenges

7 Porter’s Five Forces Model Analysis

7.1 Component Vendor’s Perspective

7.2 Colocation Vendors’ Perspective

8 India Data Center Market Potential – Market Size and Forecast

8.1 Market Insights - Overall

8.2 Market Insights – Segment & Components

8.3 Market Insights – Components in Depth Analysis

8.4 Market Insights - Vertical & City

8.5 Mdc Market Insights

9 Market Share Analysis – By Major Third Party Data Center Players

9.1 Market Share Insights

10 Data Center Case Studies in India

10.1 Ctrl – Tier Iv Data Center in Mumbai

10.2 ST Telemedia – Datacenter in Hyderabad

10.3 Prasa – Turn Key Data Center in Pune

10.4 Ctrl – Tier Iv Data Cenetr in Noida

11 Third Party Data Center Providers Profiles (Top 5)

11.1 Ctrl

11.2 ST Telemedia

11.3 ESDS

11.4 Netmagic

11.5 Sterling & Wilson

12 Appendix

12.1 Marketsandmarkets Knowledge Store: Snapshot

12.2 Related Report

12.3 Disclaimer

List of Tables (13 Tables)

Table 1 Key Data From Secondary Sources

Table 2 Key Data From Primary Sources

Table 3 Hot Pockets

Table 4 Essential

Table 5 Secondary

Table 6 Trivial

Table 7 Vendor Ecosystem

Table 8 Market Scenario in India

Table 9 Recent Developments – Ctrl S

Table 10 Recent Developments – ST Telemedia

Table 11 Recent Developments – ESDS

Table 12 Recent Developments – Netmagic

Table 13 Recent Developments – Sterling & Wilson

List of Figures (18 Figures)

Figure 1 India Data Center Market Covered

Figure 2 Years Considered in the Report

Figure 3 Million Sq. Feet – Operational Area

Figure 4 USD Billion – Market Size

Figure 5 Segment

Figure 6 Components

Figure 7 Electrical Break-Up

Figure 8 Mechanical Break-Up

Figure 9 Communication Break-Up

Figure 10 Vertical Break-Up

Figure 11 City Wise Break-Up

Figure 12 Micro Data Center Market

Figure 13 Segment – Market Share

Figure 14 Colocation Vendors – Market Share

Figure 15 Capital Expenditure (Inr Cr.) – Total Expenditure: Inr 335–350 Cr.

Figure 16 Capital Expenditure (Inr Cr.) – Total Expenditure Inr 260−275 Cr.

Figure 17 Capital Expenditure (Inr Cr.)

Figure 18 Capital Expenditure (Inr Cr.) – Total Expenditure: Inr 180–200 Cr.

The study involved 4 major activities in estimating the current size of the India data center market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the associated segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg BusinessWeek, Forbes, and Factiva were referred to, for identifying and collecting useful information for a technical, market-oriented, and commercial study of the data center market in India. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, World Bank reports, and reports from the Organization for Economic Co-operation and Development (OECD).

Secondary data was collected and analyzed to arrive at the overall market splits, which was further validated using primary research. Secondary research was mainly used to obtain key information around the industry’s supply chain, the total pool of key players, market classification, and segmentation. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

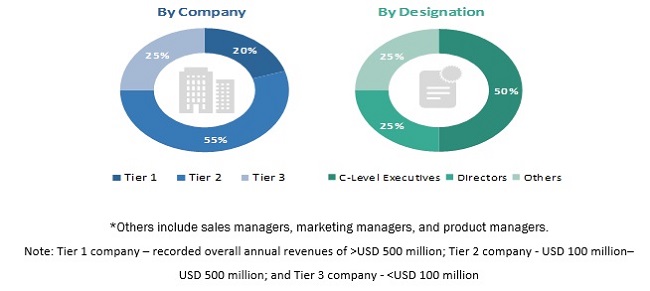

Extensive primary research was conducted after acquiring extensive knowledge about the data center market in India through secondary research. Primary interviews were conducted with market experts in India. Approximately 30% and 70% of primary interviews were conducted with both the demand and supply sides. This primary data was collected through questionnaires, emails, online surveys, and telephonic interviews. The breakup of the primary respondents’ profiles is given below:

To know about the assumptions considered for the study, download the pdf brochure

India Data Center Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the India data center market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research

- Hardware product portfolios were studied for each player

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After deriving the market size of the overall India data center market, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing trends for both the demand and supply side macroindicators.

Report Objectives

- To define, describe, segment, and forecast the Data center market in India by Captive, Outsourced, Electrical, Mechanical and Communication

- To provide detailed information about major factors (drivers, opportunities, and challenges) influencing market growth

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze India data center market opportunities for the stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market’s segments in India

- To profile the key players and comprehensively analyze their core competencies in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments, such as acquisitions, product developments, partnerships, agreements, collaborations, and business expansions in the data center market in India

Critical questions the report answers:

- What are the key trends in the India data center market?

- What are the major cities that have deployed data centers?

- What are the top five major players of the market?

- What is the market size of the market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific needs.

Growth opportunities and latent adjacency in India Data Center Market

Detailed report.. Like to know if there is a forecast for DC infrastructure