Data Center Colocation Market

Data Center Colocation Market by Service Type (Traditional and Managed), Service Scale (Retail and Wholesale), Workload Type (General Purpose IT and HPC & AI), End User (Enterprises and Hyperscalers) with Impact of AI/GenAI - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

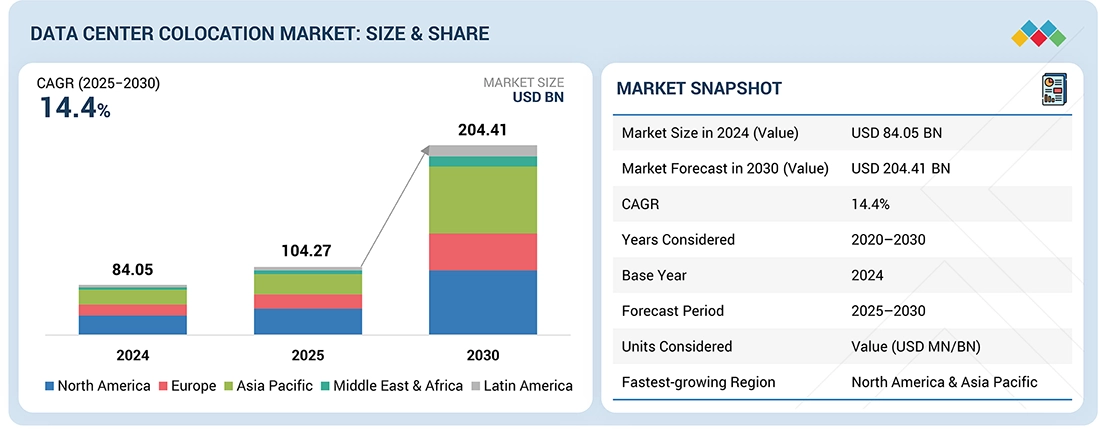

The data center colocation market is projected to grow from USD 84.05 billion in 2024 to USD 204.41 billion by 2030, at a 14.4% CAGR. Growth is driven by hyperscaler expansion, cloud adoption, AI workloads, and demand for scalable, cost-efficient infrastructure. Enterprises across BFSI, IT, and telecom increasingly prefer colocation to reduce capital costs and ensure operational reliability. North America remains the largest market, while Asia Pacific is the fastest-growing region, fueled by digital transformation, government initiatives, and rising demand for edge and interconnection services.

KEY TAKEAWAYS

- Asia Pacific is expected to grow at a CAGR of 18.3% during the forecasted period, driven by hyperscale data center expansion, AI-led workloads, and accelerating cloud adoption across India, China, Japan, and Southeast Asia. Government incentives, stricter data localization, and investments in renewable integration and liquid cooling are strengthening the region’s role as a global hub for sustainable digital infrastructure.

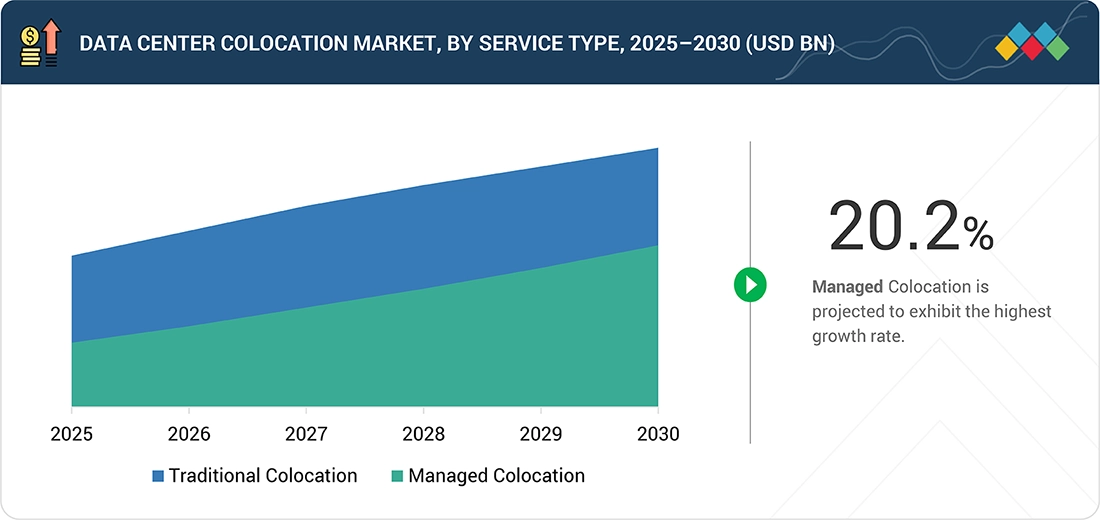

- Managed colocation leads growth with a 20.2% CAGR as enterprises shift toward outsourced operations, remote monitoring, security management, and SLA-based services. Growing complexity in hybrid cloud environments increases reliance on managed colocation providers.

- Wholesale colocation is the fastest-growing segment with a 17.1% CAGR, driven by hyperscale demand, large IT footprints, and rising multi-MW deployments. Enterprises prefer wholesale for cost efficiency, long-term scalability, and high-density power configurations.

- HPC & AI workloads are accelerating as colocation providers deliver high-density racks, advanced liquid cooling, and low-latency interconnections required to support GPU clusters and data-heavy applications.

- Large enterprises are expanding their presence in colocation to consolidate legacy data centers, integrate hybrid cloud solutions, and access interconnection hubs that are critical for digital transformation and global operations.

- Hyperscalers are increasingly leveraging colocation for rapid geographic expansion, edge coverage, and access to interconnection ecosystems, thereby reducing the risk and time associated with greenfield construction.

- Retail and e-commerce firms are scaling colocation usage to support surging digital transactions, enable omnichannel platforms, and ensure proximity to consumers through edge and metro colocation facilities.

- Equinix, Digital Realty, and NTT Global Data Centers lead the colocation market with extensive global footprints, hyperscale-ready facilities, and strong interconnection ecosystems. Their scale, carrier density, and enterprise workloads continue to attract high-value deployments across cloud, telecom, and digital services.

- DataBank, Aligned Data Centers, and ScaleMatrix stand out among startups and SMEs, supported by modular expansion models, power-efficient architectures, and regionally distributed facilities. Their agility and service-rich colocation offerings drive strong adoption among mid-market enterprises and emerging digital businesses.

- The US Data Center Colocation Market is projected to grow from USD 38.80 billion in 2025 to USD 65.45 billion by 2030, reflecting an 11.0% CAGR.

- The Europe Data Center Colocation Market is projected to grow from USD 21.97 billion in 2025 to USD 41.08 billion by 2030, at a 13.3% CAGR.

- The Latin America Data Center Colocation Market is projected to grow from USD 5.85 billion in 2025 to USD 12.87 billion by 2030, reflecting a CAGR of 17.1%.

- The Saudi Arabia Data Center Colocation Market is projected to grow from USD 949.6 million in 2025 to USD 1,982.6 million by 2030, at a CAGR of 15.9%.

Enterprises are increasingly adopting colocation services to navigate the rising complexity of IT while maintaining operational efficiency and scalability. As workloads become increasingly data-intensive and latency-sensitive, colocation provides access to advanced power and cooling infrastructure without requiring significant capital investment. This shift is further accelerated by the rise of edge computing and hybrid cloud strategies, with organizations seeking carrier-rich, flexible environments that support seamless digital experiences, regulatory compliance, and next-generation applications. Colocation is emerging as a strategic enabler of sustainable, high-performance infrastructure in the evolving enterprise IT landscape.

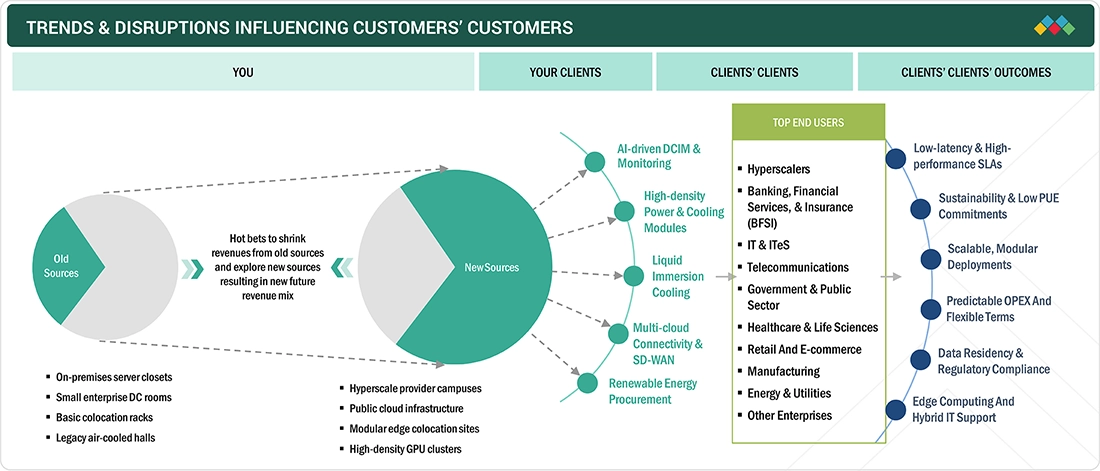

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The major players in the Data Center Colocation market are expanding capacity and services through acquisitions, partnerships, and technology-driven upgrades. Leading operators such as Equinix, Digital Realty, CyrusOne, NTT, and Iron Mountain are focusing on hyperscale-ready facilities, renewable energy adoption, and advanced interconnection platforms. Strategic investments in modular builds, liquid cooling, and hybrid IT ecosystems are positioning these players to meet enterprise demand for scalability, sustainability, and seamless multi-cloud connectivity.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for AI & high-density GPU workloads

-

Surge in use of hybrid-multicloud interconnected ecosystems

Level

-

Long lead times for critical electrical and mechanical gear, delaying builds and revenue

-

High upfront capital costs strain cash flows and complicate financing for expansions

Level

-

Growing demand for sustainable colocation practices creates opportunities to attract green-focused enterprises

-

Rising adoption of managed AI infrastructure services drives new revenue streams for colocation providers

Level

-

Skilled labor shortage slows deployment and inflates costs

-

Retrofitting legacy halls for advanced liquid cooling is complex, costly, and disruptive

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for AI & high-density GPU workloads

The data center colocation market is being reshaped by the explosive growth of AI-driven compute demand and high-density GPU infrastructure. Providers like Digital Realty reported USD 252 million in Q1 2024 rental revenue, with 79% sourced from data blocks exceeding 1 MW, priced 60% above previous market peaks. Enterprises are increasingly deploying liquid-cooled data halls supporting 40–60 kW rack densities, driving a USD 541 million backlog into 2025. Meanwhile, Equinix has leased 300 MW and is targeting a global capacity of 700 MW, underscoring the urgency for AI-ready colocation environments with scalable power, thermal efficiency, and multi-cloud interconnection.

Restraint: Long lead times for critical electrical and mechanical gear, delaying builds and revenue

Despite strong demand, colocation growth is constrained by extended lead times for critical infrastructure components. High-power transformers, chillers, and breakers face delivery delays of 24–40 weeks, with transformer backlogs stretching up to 36 months. Each month of energization delay can cost operators USD 1.5 million per MW, complicating project financing and time-to-market strategies. Simultaneously, the industry faces a shortage of skilled professionals, including power engineers, facility operators, and liquid cooling specialists, despite a 60% increase in the workforce since 2017. Rising wages (up to 30% higher for AI-specialized roles) and certification bottlenecks are delaying builds by 6–12 months, with 300,000 roles projected to remain unfilled by 2025.

Opportunity: Growing demand for sustainable colocation practices creates opportunities to attract green-focused enterprises

Sustainability has become a core differentiator, with 72% of enterprises ranking it a key site-selection factor in 2024, up from 48% two years earlier. Operators are scaling renewables through PPAs, with Digital Realty surpassing 1 GW of clean energy, Equinix pledging to source 100% of its energy from hourly-matched renewables by 2027, and Iron Mountain monetizing carbon-free certificates. Facilities with 90%+ renewable matching command USD 250–300/kW premiums, turning sustainability into both a compliance shield and profit enabler.

Challenge: Skilled labor shortage slows deployment and inflates costs

Despite a 60% increase in the workforce since 2017, critical roles—such as power engineers, facility operators, and liquid-cooling experts—remain scarce. The U.S. industry employed 4.7M professionals in 2023, yet 300,000 positions are projected to remain unfilled by 2025. Rising wages, up to 30% higher for AI-ready specialists, and certification bottlenecks are delaying builds by 6–12 months. Surveys reveal 98% of European operators expect a tighter labor supply, underscoring the urgent need for academic-industry training pipelines.

Data Center Colocation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SAP needed to rapidly expand its global cloud infrastructure across more than 150 countries. Building proprietary data centers was slow and capital-intensive, prompting a strategic partnership with Digital Realty to accelerate deployment, centralize vendor management, and align with hybrid cloud and sustainability goals. | Leveraging PlatformDIGITAL, SAP scaled its infrastructure six times faster, reducing deployment time from 18 months to 3 months| Achieved 99.999% uptime, expanded capacity across continents, ensured green building compliance, and supported Net-Zero 2030 targets |

|

BMW required a highly stable, automated global network and data center environment to support 31 production sites. With growing IT demands and a cloud-first strategy, BMW partnered with NTT DATA for managed colocation, enterprise networking, and Infrastructure-as-a-Service (IaaS) integration. | NTT DATA’s solution automated 85% of server deployments, achieved 99% network issue detection accuracy, and reduced manual effort | Enhanced stability across 30,000+ servers and 40,000 devices, enabling IT teams to focus on innovation and cloud enablement |

|

Facing surging traffic and performance demands, CBS Interactive needed high-density, energy-efficient colocation to replace legacy infrastructure lacking adequate cooling and power. Partnered with Iron Mountain for scalable, SLA-driven colocation. | Iron Mountain’s Phoenix facility delivered 100% uptime SLA, reduced costs by two-thirds, and improved energy efficiency via sealed racks, ultrasonic humidification, and containment systems | The carrier-neutral setup enhanced flexibility, resilience, and global content delivery performance |

|

Nestlé Japan sought to modernize EDI systems, support AI-driven e-commerce services, and ensure secure, compliant connectivity with AWS. Required hybrid monitoring and reduced IT overhead to maintain system stability. | Equinix’s siteROCK services enabled seamless hybrid cloud migration, real-time visibility, and faster disaster recovery | Reduced operational workloads, ensured global compliance, improved system stability, and accelerated digital transformation |

|

Exabeam faced an unexpected closure of its colocation site, impacting its QA environment. Needed rapid migration, cost optimization, and infrastructure consolidation while maintaining compliance. Partnered with Evocative for colocation, IP transit, and remote access. | Evocative executed a flawless migration within one week, consolidating hundreds of servers into fewer racks | Achieved cost savings, improved architecture, enhanced remote access, and delivered a leaner, scalable, and resilient IT environment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center colocation ecosystem is broadly divided into carrier-neutral providers and carrier-owned operators, each playing a critical role in global connectivity and infrastructure scalability. Carrier-neutral providers enable flexible interconnection, multi-cloud access, and cross-carrier networking, supporting enterprises with high agility and scalability. Carrier-owned operators, on the other hand, leverage extensive telecom networks to deliver integrated colocation and connectivity services, ensuring performance, security, and seamless global reach. Together, this ecosystem supports the growing demand for hybrid IT, digital transformation, and low-latency infrastructure among enterprises.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Colocation Market, By Service Type

In 2024, traditional colocation holds the biggest share as enterprises seek predictable SLAs, compliance alignment, and cost control while retaining infrastructure governance and outsourcing facilities, energy, and on-site operations.

Data Center Colocation Market, By Service Scale

In 2024, retail colocation accounts for the most demand because customers favor smaller, flexible increments, rapid turn-ups, and dense interconnections that enable modular expansion without long commitments or heavy upfront capital.

Data Center Colocation Market, By Workload Type

In 2024, general-purpose IT remains the widest workload base as organizations host core apps and databases needing consistent performance, secure connectivity, and standardized environments rather than extreme density or specialized accelerators.

Data Center Colocation Market, By Organization Size

In 2024, large enterprises contribute the highest share given expansive IT estates, stringent regulatory obligations, hybrid-cloud roadmaps, and requirements for reliable, multi-region colocation capacity near users, networks, and clouds.

Data Center Colocation Market, By End User

In 2024, enterprises represent the broadest adoption base as firms continue outsourcing operations to optimize costs, improve resilience, and ensure compliance through interconnection-rich, carrier- and cloud-proximate colocation partnerships.

Data Center Colocation Market, By Enterprise

In 2024, IT & ITeS accounts for the biggest vertical share due to always-on service delivery, high peering needs, cloud adjacency, and scalable capacity for fast-growing digital platforms and software services.

REGION

Asia Pacific to be fastest-growing region in global data center colocation market during forecast period

The Asia Pacific colocation market is expanding rapidly, driven by hyperscaler cloud investments, growing adoption of AI and HPC, and widespread 5G deployments. Rising enterprise digital transformation and government-led smart city initiatives are driving demand for scalable, interconnected, and sustainable colocation facilities across key hubs, including Singapore, India, Japan, and Australia.

Data Center Colocation Market: COMPANY EVALUATION MATRIX

This competitive landscape highlights the positioning of colocation providers based on market share and product footprint. Equinix (Star) shows a strong global presence, expansive interconnection ecosystem, and leadership in sustainable, AI-ready facilities. China Telecom (Emerging Leader) is driven by its growing regional dominance and the rapid expansion of its digital infrastructure, particularly in response to the Asia-Pacific region’s rising hyperscale demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 84.05 Billion |

| Market Forecast in 2030 (Value) | USD 204.41 Billion |

| Growth Rate | CAGR of 14.4% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

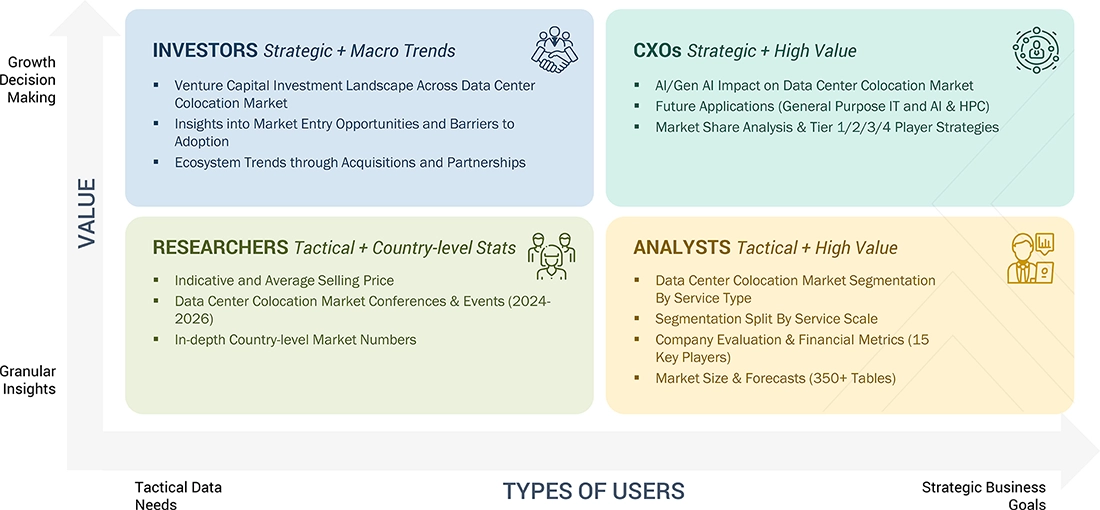

WHAT IS IN IT FOR YOU: Data Center Colocation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Hyperscaler (Asia Pacific) | Wholesale colocation provider benchmarking | Accelerated large-scale expansion by identifying multi-MW ready sites with advanced cooling, dense interconnection, and renewable-backed infrastructure |

| Leading Banking Enterprise (US) | Retail colocation vendor profiling | Strengthened compliance readiness and hybrid cloud adoption by selecting providers with financial-grade certifications and direct connectivity to major cloud on-ramps |

| Leading Retail & E-commerce Firm (Europe) | Edge colocation market assessment | Enhanced digital platform performance through proximity hosting, faster customer response times, and scalable infrastructure to support high online transaction volumes |

RECENT DEVELOPMENTS

- June 2025 : CyrusOne partnered with E.ON to deliver on-site power generation, advanced cooling, and heat recovery solutions at its FRA 7 campus in Frankfurt. The initiative will add 61 MW of capacity by 2029, addressing grid constraints and enhancing colocation reliability, energy efficiency, and sustainability in one of Europe’s key digital hubs.

- March 2025 : NTT DATA and UPS entered a 10-year strategic partnership to modernize UPS’s global IT infrastructure, including colocation data centers. The initiative integrates AI, cloud services, and digital transformation frameworks to enhance UPS’s logistics innovation, delivery optimization, and infrastructure resilience.

- February 2025 : Equinix partnered with Engie Solutions to implement a heat recovery system at its newly launched PA13x colocation facility in Meudon, France. The system channels excess thermal energy into the municipal heating network, reinforcing Equinix’s commitment to sustainable urban infrastructure and carbon reduction.

- February 2025 : Iron Mountain and Ooredoo announced a strategic partnership to accelerate data center expansion across the Middle East and North Africa (MENA) region. The collaboration aims to strengthen digital infrastructure, support the growth of cloud and colocation services, and meet the rising demand for enterprise data services in emerging markets.

- February 2025 : QTS Data Centers partnered with the City of Cedar Rapids and Alliant Energy to develop a large-scale colocation campus, marking the city’s largest economic development initiative. The project will drive regional job creation, expand interconnected infrastructure, and position Cedar Rapids as a hub for technology growth.

- July 2024 : Digital Realty acquired a colocation campus in Slough, UK, for USD 200 million, expanding its footprint in the London metro market. The acquisition enhances customer access to carrier-neutral interconnection services, supporting the region’s growing demand for scalable digital infrastructure and cloud connectivity.

Table of Contents

Methodology

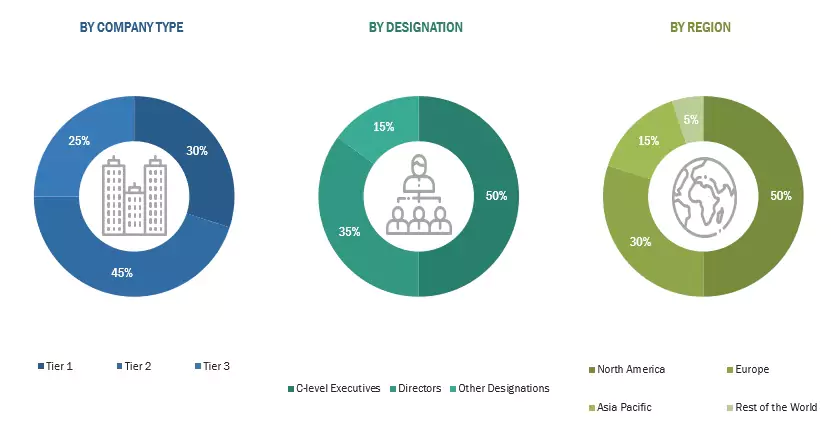

This research study on the data center colocation market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred data center colocation service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the data center colocation spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and data center colocation service providers. It also included key executives from data center colocation vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion;

and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

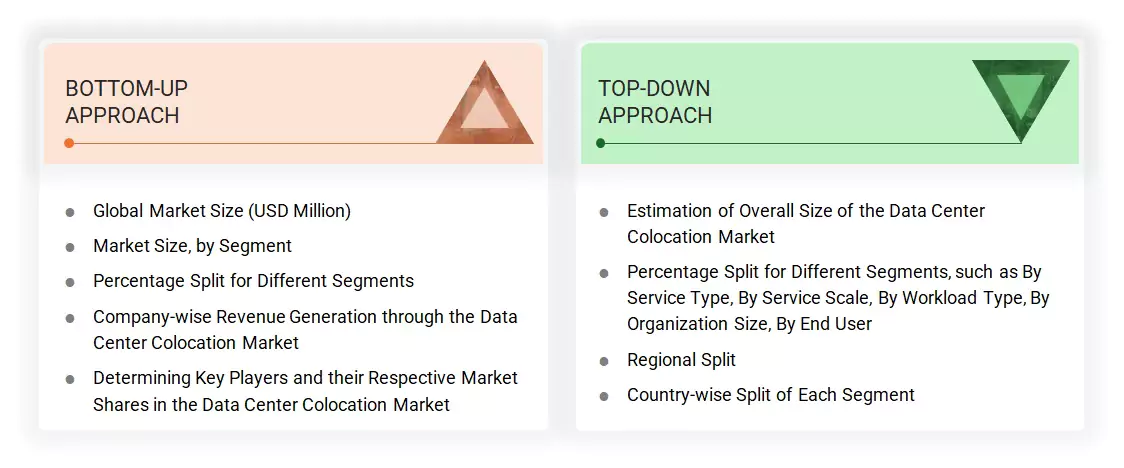

Multiple approaches were adopted to estimate and forecast the data center colocation market. The first approach involved estimating the market size by companies’ revenue generated through the sale of data center colocation services.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the data center colocation market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of data center colocation services among different verticals in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of data center colocation services among enterprises, along with different use cases for their regions, was identified and extrapolated. Weightage was given to use cases identified in different areas for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the data center colocation market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major data center colocation providers, and organic and inorganic business development activities of regional and global players were estimated.

Data Center Colocation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The data center colocation market refers to the segment where businesses rent space, power, cooling, and connectivity within third-party data center facilities to host their own servers, storage, and networking equipment. Colocation providers offer physical security, redundant power and cooling systems, and access to multiple network carriers, allowing different enterprises to operate in a shared yet secure environment while maintaining control over their infrastructure. This model enables companies to reduce capital expenditures, improve uptime and scalability, and meet compliance requirements more effectively. The market is expanding due to the rising adoption of cloud computing, big data analytics, and IoT, along with a growing emphasis on modular infrastructure and sustainable operations.

Stakeholders

- Data center colocation service providers

- Hyperscalers & Cloud service providers

- Networking companies

- Information technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the data center colocation market based on service type, service scale, workload type, organization size, end user, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contribution to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company’s product portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the North American data center colocation market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle East & Africa market

- Further breakup of the Latin American data center colocation market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is data center colocation?

According to the International Telecommunication Union (ITU), a colocation center is a commercial data center where businesses install and operate their own servers and networking equipment within a shared facility, using the provider’s infrastructure for power, cooling, and connectivity. This model allows enterprises to avoid the high capital and operational costs of building private data centers while ensuring access to carrier-neutral networks, physical security, and scalability. Colocation supports hybrid IT environments, edge computing deployments, and regulatory compliance needs. It enables businesses to maintain control over their hardware while benefiting from enhanced resilience, operational efficiency, and geographic flexibility across interconnected ecosystems.

What are the colocation services offered by the data center providers based on the scale of colocation?

Data center colocation providers primarily offer two key service types: retail colocation and wholesale colocation. Retail colocation is designed for businesses that need limited space, such as single racks or cabinets, and prefer shared environments with standard power and cooling. It is ideal for small to mid-sized enterprises seeking cost-effective, scalable solutions without managing full data center operations. In contrast, wholesale colocation targets large organizations with high-density IT needs, offering dedicated suites or entire data halls. This model provides greater control, customization, and efficiency in terms of space, power, and cooling infrastructure. Both types enable businesses to outsource physical infrastructure while maintaining control over their hardware and applications.

What are the major factors driving the growth of the data center colocation industry?

The growth of the data center colocation industry is being driven by a surge in demand for AI, cloud computing, and big data workloads, prompting hyperscalers and enterprises to expand infrastructure rapidly. Hybrid and edge computing models are also gaining traction, with businesses colocating infrastructure closer to end users to ensure low-latency and seamless cloud integration. Sustainability is another key driver, as providers such as Equinix and Digital Realty adopt green energy solutions, liquid cooling technologies, and HVO-powered generators to reduce environmental impact. Additionally, innovations such as software-defined power, lithium-ion UPS systems, and AI-powered monitoring are enhancing operational efficiency and uptime. These advancements, along with rising digital transformation efforts across sectors such as BFSI, healthcare & life sciences, retail & e-commerce, manufacturing, and media & entertainment, are making colocation a strategic choice for enterprises seeking scalability, compliance, and high-performance infrastructure.

What challenges are hindering the widespread adoption of data center colocation?

Enterprises face several challenges that hinder the widespread adoption of data center colocation. Increasing concerns over energy and water consumption have prompted public backlash and stricter zoning rules, particularly in regions such as Virginia and California, where local resistance has delayed new projects. Grid limitations present a challenge as the rapid expansion of data centers puts pressure on existing power infrastructure, leading to concerns about potential outages and rising electricity expenses. Moreover, complexity in operations continues to be a barrier; manual processes across different facilities can lead to inefficiencies and delays, and colocation services may restrict infrastructure customization for unique workloads. These factors, environmental impact, power reliability challenges, and limited operational control, are slowing colocation’s broader deployment despite its benefits.

Who are the key vendors in the data center colocation market?

The key vendors in the global data center colocation market include Equinix (US), Digital Realty (US), NTT Data Corporation (Japan), QTS Data Centers (US), KDDI Corporation (Japan), Iron Mountain (US), China Telcom (China), and CyrusOne (Texas).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Colocation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Colocation Market