Industrial Access Control Market by Component (Hardware (Card-Based Readers, Biometrics Readers, Electronic Locks, and Controller/Server), and Software), Service (Installation, Maintenance, and ACaaS), Application, and Geography - Global Forecast to 2023

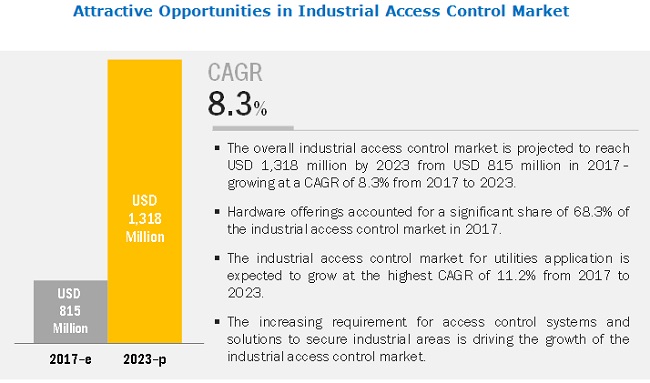

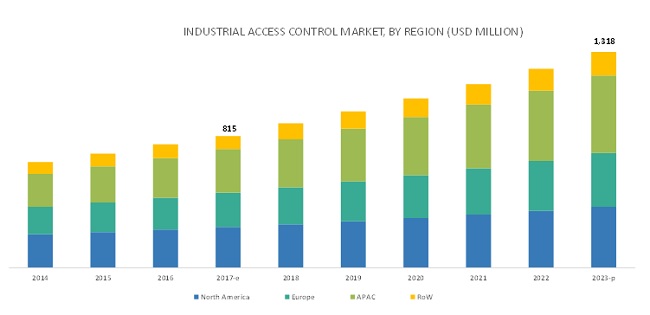

The overall industrial access control market is projected to grow from USD 815 million in 2017 to USD 1,318 million by 2023 - grow at a CAGR of 8.3%. The growth of the industrial access control market is driven by the high adoption of access control solutions due to growing security concerns, technological advancements and deployment of wireless technology in security systems, and adoption of Internet of Things (IoT)-based security systems. Adoption of access control as a service (ACaaS) is expected to provide huge growth opportunities to market players.

Smart card readers to hold largest share of industrial access control market, by card-based readers, during forecast period

Cards are used as credentials to authenticate user identity and determine access grant/denial (also the appropriate level of access). Access control readers can be magnetic stripe, proximity, or smart card readers. Card-based readers are proven to be more reliable than biometric readers and electronic locks. The increasing demand for smart and proximity cards to monitor and record employee activities is one of the drivers for the growth of card-based readers. Smartcards are proven to be more reliable than magnetic stripes and proximity cards. The increasing demand for smart and proximity cards to monitor and record employee activities is one of the drivers for the growth of smart card readers.

Need for high security for assets and personnel enables largest share for utilities application in industrial access control market

The market for utilities is expected to grow at a high rate between 2017 and 2023. The growing demand for security concerns and terrorist attacks in utilities application is contributing to the growth of the industrial access control market. The large market shares of these applications can be attributed to a high demand for access control solutions in industrial applications.

Market in APAC expected to grow significantly during forecast period

The industrial access control market in APAC is expected to grow at the highest CAGR during the forecast period. Factors driving the growth of the market in this region include growing industrialization, commercialization, and high demand for security systems. Also, rising terror threats and crime rates in APAC countries and low police officer to population ratio are expected to support the high demand for access control systems in APAC. China accounted for the largest share of the access control market in APAC in 2018. Increased terror threats and growing government spending to enhance security are some of the key factors driving the growth of the access control market. The growing economy of China also creates a significant requirement for security systems. Large population and increasing industrialization in APAC would drive the adoption of security systems.

Key market players

The industrial access control market is currently dominated by ASSA ABLOY AB (Sweden), Johnson Controls International PLC (Ireland), dormakaba Holding AG (Switzerland), Allegion PLC (Ireland), Honeywell Security Group (US), NEC Corporation (Japan), Bosch Security Systems Inc. (Germany), Identiv, Inc. (US), Siemens Building Technologies (Switzerland), and 3M company (US). A few of the major strategies adopted by these players to compete in the industrial access control market include product launches and developments, partnerships, and mergers and acquisitions.

Other players operating in the industrial access control market are NEC Corporation (Japan), IDEMIA (France), Salto Systems (Spain), Axis Communications (Sweden), Lenel Systems International (US), Time and Data Systems International (UK), AMAG Technology (US), Gunnebo (Sweden), Gallagher Group (New Zealand), Napco security Technologies (US), Kisi Inc. (US), Cansec Systems (Canada), Vanderbilt Industries (US), Adman Technologies (India), and Brivo, Inc. (US).These players have adopted several strategies, such as product developments and launches, mergers and acquisitions, and partnerships and collaborations to grow in the industrial access control market.

Major market developments

- In September 2018, Johnson Controls (Ireland) introduced the C•CURE 9000 v2.70 Service Pack 2 (SP2), one of the industry’s most powerful security management systems, providing 24x7 mission-critical security to people, buildings, and assets.

- In April 2017, Identiv (US) launched the extended version of uTrust TS Cards for high security, high-frequency smart credentials to upgrade physical access control.

- In March 2017, Tyco Security Products, a part of Johnson Controls (Ireland), introduced S700e Intelligent IP Reader and the companion S700 Exit Reader from CEM Systems (UK) for extending the powerful reach of AC2000 access control and security management system.

- In April 2016, Allegion partnered with Genetic Inc. (US) to integrate its Schlage AD 300 and 400 Series wireless locks into Genetec Synergis— the IP-based access control module as part of Genetec Security Center. This partnership enables both companies to offer a cost-effective and scalable solution for a wide range of customers, including higher education, healthcare, and commercial real estate establishments.

Key questions addressed by the report:

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming security trends in the industrial access control market?

- What are the opportunities for existing market players and those planning to enter the market?

- How inorganic growth strategies implemented by key players would impact the growth of the industrial access control market, and who would have the undue advantage?

- What are the current investment trends in the industrial access control market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope

1.3.1 Geographic Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.2 Secondary and Primary Research

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.3.2 Top-Down Approach

2.3.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Industrial Access Control Market, 2017–2023 (USD Million)

4.2 Market, By Component and Service

4.3 Industrial Access Control, By Application

4.4 Market: Utilities and Aerospace Applications (2016)

4.5 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 High Adoption of Access Control Solutions Due to Growing Security Concerns

5.1.1.2 Technological Advancements and Deployment of Wireless Technology in Security Systems

5.1.1.3 Adoption of Iot-Based Security Systems

5.1.2 Restraints

5.1.2.1 Lack of Awareness for Advanced Security Solutions at Present

5.1.3 Opportunities

5.1.3.1 Adoption of Access Control as A Service (ACaaS)

5.1.4 Challenges

5.1.4.1 Security Concerns Related to Unauthorized Access in Access Control Environment

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

7 Types of Access Control Systems (Qualitative) (Page No. - 41)

7.1 Introduction

7.2 Physical Access Control

7.3 Electronic Access Control

7.4 Logical Access Control

7.5 Network Access Control

8 Industrial Access Control Market, By Component (Page No. - 43)

8.1 Introduction

8.2 Hardware

8.2.1 Card-Based Readers

8.2.1.1 Magnetic Stripes and Readers

8.2.1.2 Proximity Cards and Readers

8.2.1.3 Smart Cards and Readers

8.2.2 Biometric Readers

8.2.2.1 Fingerprint

8.2.2.2 Hand Geometry

8.2.2.3 IRIS Recognition

8.2.2.4 Facial Recognition

8.2.3 Multi-Technology Readers

8.2.4 Electronic Locks

8.2.4.1 Electromagnetic Locks

8.2.4.2 Electric Strike Locks

8.2.4.3 Wireless Locks

8.2.5 Controllers/Servers

8.3 Software (Management System and Other)

9 Industrial Access Control Market, By Service (Page No. - 56)

9.1 Introduction

9.2 Installation and Integration

9.3 Support and Maintenance Services

9.3.1 Access Control as A Service (ACaaS)

9.3.1.1 Hosted ACaaS

9.3.1.2 Managed ACaaS

9.3.1.3 Hybrid ACaaS

10 Industrial Access Control Market, By Application (Page No. - 64)

10.1 Introduction

10.2 Automotive

10.3 Aerospace

10.4 Utilities

10.5 Machinery and Electronics

10.6 Chemical and Synthetics

10.7 Pulp & Paper

10.8 Steel and Metal

10.9 Pharmaceuticals and Cosmetics

10.10 Others

11 Geographic Analysis (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 UK

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 RoW

11.5.1 Middle East and Africa

11.5.2 South America

12 Competitive Landscape (Page No. - 97)

12.1 Introduction

12.2 Market Ranking Analysis: Industrial Access Control Market

12.3 Competitive Scenario

12.4 Vendor Dive Overview

12.4.1 Vanguards

12.4.2 Dynamic Players

12.4.3 Innovators

12.4.4 Emerging Players

12.5 Business Strategies Adopted By Major Players in the Industrial Access Control Market (25 Companies)

12.6 Analysis of the Product Portfolio of Major Players in the Market (25 Companies)

Top 25 Companies Analyzed for This Study are - Assa Abloy AB, Johnson Controls International PLC, Dorma+Kaba Holding AG, Allegion PLC, Honeywell Security Group, Bosch Security Systems Inc., Siemens Building Technologies, NEC Corporation, 3M Company, Identiv, Inc., Gemalto N.V., Lenel Systems International Inc., Hid Global, Amag Technology Inc., Napco Security Technologies, Inc., Gunnebo Group, Gallagher Group Ltd., Crossmatch Technologies, Inc., Morpho Sa, Avaya Inc., Keyscan Inc., Brivo Inc., Adman Technologies Pvt. Ltd., Vanderbilt Industries, and Access Control Innovation

13 Company Profiles (Page No. - 104)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

13.1 Introduction

13.2 Assa Abloy AB

13.3 Johnson Controls International PLC

13.4 Dorma+Kaba Holding AG

13.5 Allegion PLC

13.6 Honeywell Security Group

13.7 NEC Corporation

13.8 Bosch Security Systems Inc.

13.9 Identiv, Inc.

13.10 Siemens Building Technologies

13.11 3M Company

13.12 Key Innovators

13.12.1 Brivo, Inc.

13.12.2 Adman Technologies Pvt. Ltd

13.12.3 Vanderbilt Industries

13.12.4 Access Control Innovation

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 139)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (61 Tables)

Table 1 Industrial Access Control Market, By Component and Service, 2014–2023 (USD Million)

Table 2 Market, By Hardware, 2014–2023 (USD Million)

Table 3 Market for Hardware, By Region, 2014–2023 (USD Million)

Table 4 Market for Card-Based Readers, By Type, 2014–2023 (USD Million)

Table 5 Market for Card-Based Readers, By Type, 2014–2023 (Thousand Units)

Table 6 Market for Card-Based Readers, By Region, 2014–2023 (USD Million)

Table 7 Market for Biometrics Readers, By Type, 2014–2023 (USD Million)

Table 8 Market for Biometrics Readers, By Type, 2014–2023 (Thousand Units)

Table 9 Market for Biometrics Readers, By Region, 2014–2023 (USD Million)

Table 10 Industrial Access Control Market for Multi-Technology Readers, By Region, 2014–2023 (USD Million)

Table 11 Market for Electronic Locks, By Type, 2014–2023 (USD Million)

Table 12 Market for Electronic Locks, By Type, 2014–2023 (Thousand Units)

Table 13 Market for Electronic Locks, By Region, 2014–2023 (USD Million)

Table 14 Market for Controllers/ Servers, By Region, 2014–2023 (USD Million)

Table 15 Market, By Software, 2014–2023 (USD Million)

Table 16 Market for Software, By Region, 2014–2023 (USD Million)

Table 17 Market, By Service, 2014–2023 (USD Million)

Table 18 Market for Service, By Region, 2014–2023 (USD Million)

Table 19 Market for Installation and Integration, By Region, 2014–2023 (USD Million)

Table 20 Industrial Access Control Market for Support and Maintenance Services, By Region, 2014–2023 (USD Million)

Table 21 Market for ACaaS, By Type, 2014–2023 (USD Million)

Table 22 Market for ACaaS, By Region, 2014–2023 (USD Million)

Table 23 Market for Hosted ACaaS, By Region, 2014–2023 (USD Million)

Table 24 Market for Managed ACaaS, By Region, 2014–2023 (USD Million)

Table 25 Market for Hybrid ACaaS, By Region, 2014–2023 (USD Million)

Table 26 Market, By Application, 2014–2023 (USD Million)

Table 27 Industrial Access Control Market for Automotive Application, By Region, 2014–2023 (USD Million)

Table 28 Market for Aerospace Application, By Region, 2014–2023 (USD Million)

Table 29 Market for Utilities Application, By Region, 2014–2023 (USD Million)

Table 30 Market for Machinery & Electronics Application, By Region, 2014–2023 (USD Million)

Table 31 Market for Chemical & Synthetics Application, By Region, 2014–2023 (USD Million)

Table 32 Market for Pulp & Paper Application, By Region, 2014–2023 (USD Million)

Table 33 Market for Steel and Metal Application, By Region, 2014–2023 (USD Million)

Table 34 Market for Pharmaceuticals and Cosmetics Application, By Region, 2014–2023 (USD Million)

Table 35 Market for Other Applications, By Region, 2014–2023 (USD Million)

Table 36 Market, By Region, 2014–2023 (USD Million)

Table 37 Market in North America, By Component and Services, 2014–2023 (USD Million)

Table 38 Industrial Access Control Market in North America, By Hardware, 2014–2023 (USD Million)

Table 39 Market in North America, By Services, 2014–2023 (USD Million)

Table 40 Market in North America, By ACaaS Type, 2014–2023 (USD Million)

Table 41 Market in North America, By Application, 2014–2023 (USD Million)

Table 42 Market in North America, By Country, 2014–2023 (USD Million)

Table 43 Industrial Access Control Market in Europe, By Component and Services, 2014–2023 (USD Million)

Table 44 Market in Europe, By Hardware, 2014–2023 (USD Million)

Table 45 Market in Europe, By Services, 2014–2023 (USD Million)

Table 46 Market in Europe, By ACaaS Type, 2014–2023 (USD Million)

Table 47 Market in Europe, By Application, 2014–2023 (USD Million)

Table 48 Market in Europe, By Country, 2014–2023 (USD Million)

Table 49 Market in APAC, By Component and Services, 2014–2023 (USD Million)

Table 50 Market in APAC, By Hardware, 2014–2023 (USD Million)

Table 51 Market in APAC, By Services, 2014–2023 (USD Million)

Table 52 Industrial Access Control Market in APAC, By ACaaS Type, 2014–2023 (USD Million)

Table 53 Market in APAC, By Application, 2014–2023 (USD Million)

Table 54 Market in APAC, By Country, 2014–2023 (USD Million)

Table 55 Market in RoW, By Component and Services, 2014–2023 (USD Million)

Table 56 Market in RoW, By Hardware, 2014–2023 (USD Million)

Table 57 Market in RoW, By Services, 2014–2023 (USD Million)

Table 58 Market in RoW, By ACaaS Type, 2014–2023 (USD Million)

Table 59 Market in RoW, By Application, 2014–2023 (USD Million)

Table 60 Market in RoW, By Region, 2014–2023 (USD Million)

Table 61 Market Ranking of the Top Five Players in the Industrial Access Control Market

List of Figures (43 Figures)

Figure 1 Overview of the Industrial Access Control Market

Figure 2 Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Market, 2014–2023 (USD Million)

Figure 7 Market, By Hardware Component (2016 vs 2023)

Figure 8 Market for Hosted ACaaS Held the Major Market Size in 2017

Figure 9 Market for Utilities Application Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 10 APAC Held the Largest Share of the Industrial Access Control Market in 2017

Figure 11 Attractive Opportunities for the Industrial Access Control Market During the Forecast Period

Figure 12 Market for Software Component Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 13 Controllers/Servers to Hold the Largest Share of the Market for Hardware Component By 2023

Figure 14 Aerospace Application Held the Largest Share of the Market in North America in 2016

Figure 15 Market for Aerospace and Utilities Applications in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 16 China to Emerge as the Fastest-Growing Market for Industrial Access Control Between 2017 and 2023

Figure 17 Growing Demand for Access Control Systems in Industrial Areas to Drive the Growth of the Industrial Access Control Market During 2017–2023

Figure 18 Value Chain Analysis (2016): Maximum Value Added in the Original Equipment Manufacturing and Phases of Security and Management Software Providers

Figure 19 Market for Software Components Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 20 Market for Electronic Locks Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 21 Market for Wireless Locks Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 22 Industrial Access Control Market for ACaaS to Grow at the Highest Rate Between 2017 and 2023

Figure 23 Market for Managed ACaaS Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 24 Industrial Access Control Market for Utilities Application Expected to Grow at the Highest Rate Between 2017 and 2023

Figure 25 Market for Utilities Application in APAC to Grow at the Highest Rate Between 2017 and 2023

Figure 26 Market for Steel and Metal Application in APAC to Grow at the Highest Rate Between 2017 and 2023

Figure 27 Geographic Snapshot: Market in APAC Expected to Witness the Highest Growth Rate Between 2017 and 2023

Figure 28 Market in China Estimated to Grow at the Highest Rate Between 2017 and 2023

Figure 29 Overview of Market in North America, 2016

Figure 30 Overview of Market in Europe, 2016

Figure 31 Overview of Market in APAC, 2016

Figure 32 Companies Adopted Mergers and Acquisitions as the Key Growth Strategy Between 2014 and 2017

Figure 33 Battle for Market Share: Mergers & Acquisitions Were the Major Strategies Adopted By Key Players in the Market

Figure 34 Dive Chart

Figure 35 Geographic Revenue Mix of Leading Players

Figure 36 Assa Abloy AB: Company Snapshot

Figure 37 Johnson Controls International PLC: Company Snapshot

Figure 38 Dorma+Kaba Holding AG: Company Snapshot

Figure 39 Allegion PLC: Company Snapshot

Figure 40 Honeywell International Inc.: Company Snapshot

Figure 41 NEC Corporation: Company Snapshot

Figure 42 Identiv, Inc.: Company Snapshot

Figure 43 3M Company: Company Snapshot

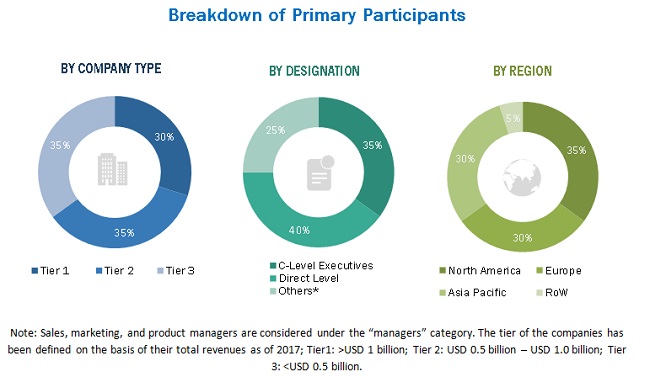

The study involved 4 major activities in estimating the current size of the industrial access control market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts from across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market sizes of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the industrial access control market begins with capturing data on revenues of key vendors in the market through secondary research. This study incorporates using extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the access control market. Vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology includes studying annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The industrial access control market’s supply chain comprises several stakeholders, such as suppliers of standard components, original equipment manufacturers (OEMs), software providers, solutions providers, and system integrators. The supply side is characterized by advancements in access control products and devices and their diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the industrial access control market and various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Key players in major applications and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of card-based readers, biometric readers, multi-technology readers, electronic locks, controllers, and servers.

Research Objective

- To define, describe, and forecast the overall industrial access control market, in terms of value, segmented based on component, services, application, and geography

- To define, describe, and forecast the overall industrial access control market, in terms of volume, segmented based on component

- To define and describe types of access control systems used in the overall industrial access control market

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the industrial access control market

- To provide a detailed overview of the value chain of the industrial access control market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall industrial access control market

- To analyze opportunities in the industrial access control market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies2, and detail the competitive landscape for market leaders

- To analyze competitive developments such as contracts, mergers and acquisitions, product launches, and R&D in the overall industrial access control market

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2014–2023 |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD Million/Billion), Shipment (Thousand/ Million) |

|

Segments covered |

Component, Services, Application, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ASSA ABLOY AB (Sweden), Johnson Controls International PLC (Ireland), dormakaba Holding AG (Switzerland), Allegion PLC (Ireland), Honeywell Security Group (US), NEC Corporation (Japan), Bosch Security Systems Inc. (Germany), Identiv, Inc. (US), Siemens Building Technologies (Switzerland), 3M company (US), NEC Corporation (Japan), IDEMIA (France), Salto Systems (Spain), Axis Communications (Sweden), Lenel Systems International (US), Time and Data Systems International (UK), AMAG Technology (US), Gunnebo (Sweden), Gallagher Group (New Zealand), Napco security Technologies (US), Kisi Inc. (US), Cansec Systems (Canada), Vanderbilt Industries (US), Adman Technologies (India), and Brivo, Inc. (US). |

This report categorizes the access control market based on Component, Services, Application, and Region.

By Component

- Hardware

- Card-Based Readers

- Biometric Readers

- Multi-Technology Readers

- Electronic Locks

- Controllers/Servers

- Software

By Service

- Installation and Integration

- Maintenance and Support

- Access Control as a Service (ACaaS)

By Application:

- Automotive

- Aerospace

- Utilities

- Machinery & Electronics

- Chemical & Synthetics

- Pulp & Paper

- Steel & Metal

- Pharmaceuticals & Cosmetics

- Others (Jewelry, Food and Beverages processing, and Textile and Apparel)

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Rest of Europe (Greece, Spain, Italy, Russia, Finland, Denmark, Netherlands, and Sweden)

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Australia, New Zealand, Singapore, Hong Kong, Indonesia, and Taiwan)

- Rest of the World (RoW)

- Middle East and Africa

- South America

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions

- What new applications are being explored by industrial access control solution providers?

- Which are the key players in the market and how intense is the competition?

Growth opportunities and latent adjacency in Industrial Access Control Market

We are into card readers space and we expect lesser growth for the same in future. Hence, we would like to identify attractive products (other than card based readers) for better growth of our company. Can you help us with this)