Industrial Dryers Market by Product (Direct, Indirect, Specialty), Type (Rotary, Fluidized Bed, Spray), Application (Food, Pharmaceutical, Fertilizer, Chemicals, Cement), and Region - Global Forecast to 2026

[148 Pages Report] The global industrial dryers market was valued at USD 4.00 Billion in 2015 and is projected to reach USD 6.37 Billion by 2026, at a CAGR of 4.3% from 2016 to 2026.

The objectives of this study are:

- To define, segment, and project the global industrial dryers market on the basis of product, type, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape of the market

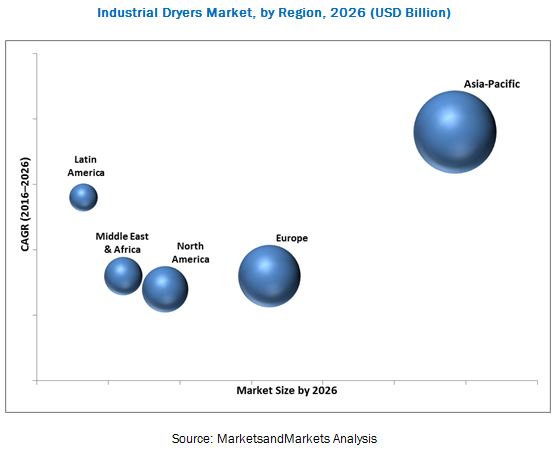

- To project the market size by value with respect to five main regions, namely, North America, Asia-Pacific, Europe, Middle East & Africa, and Latin America

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as partnerships, agreements, and joint ventures; mergers & acquisitions; expansions; new product developments; and research & development activities in the industrial dryers market

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021 (short term) and 2026 (long term)

- Forecast Period – 2016 to 2021 (short term) and 2016 to 2026 (long term)

For company profiles in the report, 2015 has been considered as the base year. In certain cases, wherein information is unavailable for the base year, the years prior to it have been considered.

Research Methodology

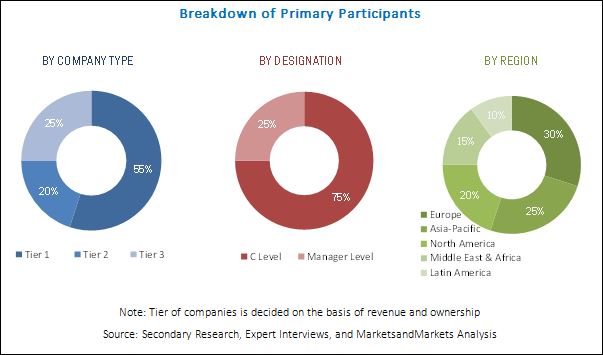

The research methodology used to estimate and forecast the global industrial dryers market began with capturing data on key vendor revenues through secondary research from secondary sources such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and various other government and private websites. The vendor offerings have also been taken into consideration to determine the market segmentation. After arriving at the overall market size, the total market was split into several segments and subsegments, which were later verified through primary research by conducting extensive interviews with key personnel, such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The breakdown of profiles of primaries is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The global industrial dryers market has a diversified ecosystem of upstream players, including raw material suppliers, along with downstream stakeholders, vendors, end users, and government organizations. Companies operating in the global industrial dryers market include ThyssenKrupp AG (Germany), Andritz AG (Austria), GEA Group (Germany), Metso Corporation (Finland), FLSmidth & Co. A/S (Denmark), Buhler Holding AG (Switzerland), ANIVI Ingeniería SA (Spain), Carrier Vibrating Equipment, Inc. (U.S.), COMESSA (France), and Mitchell Dryers Ltd. (U.K.), among others.

Target Audience

- Industrial Dryers Producers

- Industrial Dryers Traders, Suppliers, and Distributors

- Government and Research Organizations

- Associations and Industrial Bodies

- Raw Material Suppliers and Distributors

- Industry Associations

“This study answers several questions for the stakeholders, primarily the market segments which they need to focus upon during the next two to five years so that they may prioritize their efforts and investments accordingly”.

Scope of the Report: This research report categorizes the global industrial dryers market on the basis of product, type, application, and region, forecasting revenues as well as analyzing trends in each of the submarkets.

On the basis of Product:

- Direct Dryers

- Indirect Dryers

- Specialty Dryers

On the basis of Type:

- Rotary Dryers

- Fluidized Bed Dryers

- Spray Dryers

- Flash Dryers

- Conveyor Dryers

- Drum Dryers

- Freeze Dryers

On the basis of Application:

- Food

- Pharmaceutical

- Fertilizer

- Chemicals

- Cement

- Others (Minerals and Paper & Pulp)

On the basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- Latin America

The following customization options are available for the report:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakdown of the Rest of APAC and Rest of Europe industrial dryers markets.

Company Information

- Detailed analysis and profiling of additional market players (up to five companies).

The global industrial dryers market was valued at USD 4.00 Billion in 2015 and is projected to reach USD 6.37 Billion by 2026, at a CAGR of 4.3% from 2016 to 2026. This growth is mainly attributed to the increasing demand for industrial dryers from various end-use industries such as food, pharmaceutical, chemicals, fertilizer, cement, minerals, and paper & pulp. Industrial dryers are equipment that can efficiently process large quantities of bulk materials which need reduced moisture levels. This helps several industries to meet their drying requirements.

The direct dryers segment accounted for the largest share of the industrial dryers market in 2015 owing to the steep increase in their usage across several industries owing to their simple functionality and efficiency.

Among all applications, the food segment holds the largest market share, in terms of value, as of 2015. There is a high demand for industrial dryers from the food industry. The food industry uses industrial dryers on a large scale to dry raw materials before they can be processed and converted into final products. The food industry typically uses industrial dryers for drying products such as dairy (milk, whey, creamers), coffee, coffee surrogates, tea, flavors, powdered drinks, processed cereal-based foods, potatoes, starch derivatives, sugar beet pulp, fruits, vegetables, and spices. The food industry uses dryers such as spray dryers and fluidized bed dryers to meet its requirements.

The Asia-Pacific region accounted for the largest share of the industrial dryers market in 2015, and is expected to continue its dominance till 2026. China, India, and Japan led the Asia-Pacific industrial dryers market in 2015. The industrial dryers market in China is projected to grow at the highest CAGR among all countries in the Asia-Pacific region between 2016 and 2026.

The factors inhibiting the growth of the industrial dryers market are unstable market and economic conditions. Apart from this, stringent environmental regulations also act as a challenge for the industry. Agreements such as that of BREXIT, which will lead to the U.K. moving out of the European Union, will also impact the drying equipment industry, as most of the exports of the U.K. are to the countries in the European Union due to the free trade agreement. Key market players operating in the industrial dryers market, such as ThyssenKrupp AG (Germany), Andritz AG (Austria), GEA Group (Germany), Metso Corporation (Finland), FLSmidth & Co. A/S (Denmark), Buhler Holding AG (Switzerland), ANIVI Ingeniería SA (Spain), Carrier Vibrating Equipment, Inc. (U.S.), COMESSA (France), and Mitchell Dryers Ltd. (U.K.), among others, have adopted various strategies to increase their market shares. Agreements, new product developments, expansions, and acquisitions are some of the key strategies adopted by market players to achieve growth in the industrial dryers market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Regional Scope

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency Considered for the Industrial Dryers Market

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Key Industry Insights

2.1.3.1 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Industrial Dryers Market

4.2 Industrial Dryers Market

4.3 Industrial Dryers Market Growth

4.4 Industrial Dryers Market, By Product

4.5 Industrial Dryers Market: Emerging & Developing Nations

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Wide Application of Dryers

5.3.1.2 Emerging Economies are A Big Market

5.3.1.3 Large Market of Food Industry

5.3.2 Restraints

5.3.2.1 Unstable Market and Economic Situation

5.3.3 Opportunities

5.3.3.1 Growth in the Food Processing Industry

5.3.3.2 Growth in the Pharmaceutical Industry

5.3.4 Challenges

5.3.4.1 Cement Industry Reaching Maturity Stage

5.3.4.2 Environmental Regulations

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Revenue Pocket Matrix

6.2.1 Revenue Pocket Matrix for Industrial Dryers Market, By End-Use Industry, 2016-2021

6.2.2 Revenue Pocket Matrix for Industrial Dryers Market, By Type, 2016-2021

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Food Industry

6.3.1.2 Pharmaceutical Industry

6.3.1.3 Fertilizers Industry

6.3.1.4 Cement Industry

6.4 Supply Chain Analysis

6.4.1 Industrial Dryers Manufacturers

6.4.1.1 Establised Companies

6.4.1.2 Establishing Enterprises

6.4.2 Distributors

6.4.3 End Users

6.5 Cost Structure Analysis

7 Industrial Dryers Market, By Product (Page No. - 49)

7.1 Introduction

7.2 Market Size and Projection

7.3 Direct Dryers

7.4 Indirect Dryers

7.5 Specialty Dryers

8 Industrial Dryers Market, By Type (Page No. - 54)

8.1 Introduction

8.2 Market Size and Projection

8.3 Rotary Dryer

8.4 Fluidized Bed Dryers

8.5 Spray Dryers

8.6 Other Dryers

8.6.1 Flash Dryers

8.6.2 Conveyor Dryers

8.6.3 Drum Dryers

8.6.4 Freeze Dryers

9 Industrial Dryers Market, By Application (Page No. - 60)

9.1 Introduction

9.2 Market Size and Projection

9.3 Food

9.4 Pharmaceutical

9.5 Chemical

9.6 Fertilizer

9.7 Cement

9.8 Others

9.8.1 Mineral

9.8.2 Paper & Pulp

10 Industrial Dryers Market, By Region (Page No. - 67)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 Australia

10.2.5 South Korea

10.2.6 Malaysia

10.2.7 Rest of Asia-Pacific

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Russia

10.3.4 U.K.

10.3.5 Italy

10.3.6 Netherlands

10.3.7 Rest of Europe

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 Middle East & Africa

10.5.1 Uae

10.5.2 Turkey

10.5.3 South Africa

10.5.4 Saudi Arabia

10.5.5 Egypt

10.5.6 Rest of Middle East & Africa

10.6 Latin America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 107)

11.1 Overview

11.2 Industrial Dryers Market: Company Share Analysis

11.3 Agreements

11.4 New Product Development

11.5 Acquisitions

11.6 Expansions

12 Company Profiles (Page No. - 113)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Thyssenkrupp AG

12.3 Andritz AG

12.4 GEA Group

12.5 Metso Corporation

12.6 Flsmidth & Co. A/S

12.7 Buhler Holding AG

12.8 Anivi Ingeniería SA

12.9 Carrier Vibrating Equipment, Inc.

12.10 Comessa

12.11 Mitchell Dryers Ltd

12.12 Other Companies

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 138)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (72 Tables)

Table 1 Global Industrial Dryers Market Snapshot

Table 2 Industrial Dryers Market, By Product

Table 3 Industrial Dryers Market, By Type

Table 4 Industrial Dryers Market, By Application

Table 5 Industrial Dryers Market– Cost Structure Analysis

Table 6 Industrial Dryers Market, By Product, 2014–2026 (USD Million)

Table 7 Industrial Dryers Market for Direct Dryers, By Region, 2014–2026 (USD Million)

Table 8 Industrial Dryers Market for Indirect Dryers, By Region, 2014–2026 (USD Million)

Table 9 Industrial Dryers Market for Specialty Dryers, By Region, 2014–2026 (USD Million)

Table 10 Industrial Dryers Market, By Type, 2014–2026 (USD Million)

Table 11 Industrial Dryers Market for Rotary Dryers, By Region, 2014–2026 (USD Million)

Table 12 Industrial Dryers Market for Fluidized Bed Dryers, By Region, 2014–2026 (USD Million)

Table 13 Industrial Dryers Market for Spray Dryers, By Region, 2014–2026 (USD Million)

Table 14 Industrial Dryers Market for Other Dryers, By Region, 2014–2026 (USD Million)

Table 15 Industrial Dryers Market, By Application, 2014–2026 (USD Million)

Table 16 Industrial Dryers Market for Food Application, By Region, 2014–2026 (USD Million)

Table 17 Industrial Dryers Market for Pharmaceutical Application, By Region, 2014–2026 (USD Million)

Table 18 Industrial Dryers Market for Chemical Application, By Region, 2014–2026 (USD Million)

Table 19 Industrial Dryers Market for Fertilizer Application, By Region, 2014–2026 (USD Million)

Table 20 Industrial Dryers Market for Cement Application, By Region, 2014–2026 (USD Million)

Table 21 Industrial Dryers Market for Other Applications, By Region, 2014–2026 (USD Million)

Table 22 Industrial Dryers Market, By Geography, 2014-2026 (USD Million)

Table 23 Asia-Pacific By Market, By Country, 2014–2026 (USD Million)

Table 24 Asia-Pacific By Market, By Product, 2014-2026 (USD Million)

Table 25 Asia-Pacific By Market, By Type, 2014-2026 (USD Million)

Table 26 Asia-Pacific By Market, By Application, 2014–2026 (USD Million)

Table 27 China By Market, By Application, 2014–2026 (USD Million)

Table 28 India By Market, By Application, 2014–2026 (USD Million)

Table 29 Japan By Market, By Application, 2014–2026 (USD Million)

Table 30 Australia By Market, By Application, 2014–2026 (USD Million)

Table 31 South Korea By Market, By Application, 2014–2026 (USD Million)

Table 32 Malaysia By Market, By Application, 2014–2026 (USD Million)

Table 33 Rest of Asia-Pacific By Market, By Application, 2014–2026 (USD Million)

Table 34 Europe By Market, By Country, 2014–2026 (USD Million)

Table 35 Europe By Market, By Product, 2014-2026 (USD Million)

Table 36 Europe By Market, By Type, 2014-2026 (USD Million)

Table 37 Europe By Market, By Application, 2014–2026 (USD Million)

Table 38 Germany By Market, By Application, 2014–2026 (USD Million)

Table 39 France By Market, By Application, 2014–2026 (USD Million)

Table 40 Russia By Market, By Application, 2014–2026 (USD Million)

Table 41 U.K. By Market, By Application, 2014–2026 (USD Million)

Table 42 Italy By Market, By Application, 2014–2026 (USD Million)

Table 43 Italy By Market, By Application, 2014–2026 (USD Million)

Table 44 Rest of Europe By Market, By Application, 2014–2026 (USD Million)

Table 45 North America By Market, By Country, 2014–2026 (USD Million)

Table 46 North America By Market, By Product, 2014-2026 (USD Million)

Table 47 North America By Market, By Type, 2014-2026 (USD Million)

Table 48 North America By Market, By Application, 2014–2026 (USD Million)

Table 49 U.S. By Market, By Application, 2014–2026 (USD Million)

Table 50 Canada By Market, By Application, 2014–2026 (USD Million)

Table 51 Mexico By Market, By Application, 2014–2026 (USD Million)

Table 52 Middle East & Africa By Market, By Country, 2014–2026 (USD Million)

Table 53 Middle East & Africa By Market, By Product, 2014-2026 (USD Million)

Table 54 Middle East & Africa By Market, By Type, 2014-2026 (USD Million)

Table 55 Middle East & Africa By Market, By Application, 2014–2026 (USD Million)

Table 56 Uae By Market, By Application, 2014–2026 (USD Million)

Table 57 Turkey By Market, By Application, 2014–2026 (USD Million)

Table 58 South Africa By Market, By Application, 2014–2026 (USD Million)

Table 59 Saudi Arabia By Market, By Application, 2014–2026 (USD Million)

Table 60 Egypt By Market, By Application, 2014–2026 (USD Million)

Table 61 Rest of Middle East & Africa By Market, By Application, 2014–2026 (USD Million)

Table 62 Latin America By Market, By Country, 2014–2026 (USD Million)

Table 63 Latin America By Market, By Product, 2014-2026 (USD Million)

Table 64 Latin America By Market, By Type, 2014-2026 (USD Million)

Table 65 Latin America By Market, By Application, 2014–2026 (USD Million)

Table 66 Brazil By Market, By Application, 2014–2026 (USD Million)

Table 67 Argentina By Market, By Application, 2014–2026 (USD Million)

Table 68 Rest of Latin America By Market, By Application, 2014–2026 (USD Million)

Table 69 Agreements, 2011-2016

Table 70 New Product Development, 2012-2016

Table 71 Acquisitions, 2012

Table 72 Acquisitions, 2013

List of Figures (52 Figures)

Figure 1 Industrial Dryers Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Food Industry is Projected to Dominate the Global Industrial Dryers Market During the Forecast Period

Figure 6 Rotary Dryers Account for the Largest Share in the Industrial Dryers Market (2016-2021)

Figure 7 Industrial Dryers Market Share, By Region, 2015

Figure 8 Asia-Pacific is Projected to Have the Highest Growth Potential for the Industrial Dryers Market, 2016-2021

Figure 9 Industrial Dryers Market is Projected to Witness Substantial Growth During the Forecast Period

Figure 10 Food Industry to Account for the Largest Share of the Industrial Dryers Market

Figure 11 Country Level Growth for the Industrial Dryers Market During the Forecast Period

Figure 12 Direct Dryers to Account for the Largest Share of the Industrial Dryers Market During the Forecast Period

Figure 13 Emerging Nations to Grow at the Fastest Rate During the Forecast Period

Figure 14 Industrial Dryers Market, By Region

Figure 15 Growing Food Processing and Pharmaceutical Industry: Major Opportunity for the Industrial Dryers Market

Figure 16 Exports and Imports of Food, USD Million (2012)

Figure 17 Registered Food Processing Units in India

Figure 18 Pharmaceutical R&D Expenditure in Europe, U.S., and Japan, 2000-2015 (USD Million)

Figure 19 Revenue Pocket Matrix: Industrial Dryers End-Use Industry, 2016-2021

Figure 20 Revenue Pocket Matrix: Industrial Dryers Type, 2016-2021

Figure 21 Exports and Imports of Food, USD Million (2012)

Figure 22 Global Pharmaceutical Top Markets, 2011 & 2013

Figure 23 World Demand for Fertilizer Nutrients, 2011-2015 (Million Tonnes)

Figure 24 Top Cement Producing Nations (2014)

Figure 25 Supply Chain Analysis

Figure 26 Industrial Dryers Market – Cost Structure Analysis

Figure 27 Industrial Dryers Market, By Product

Figure 28 Industrial Dryers Market, By Product, 2016 & 2021 (USD Million)

Figure 29 Industrial Dryers Market, By Type

Figure 30 Industrial Dryers Market, By Type, 2016 & 2026 (USD Million)

Figure 31 Industrial Dryers Market, By Application

Figure 32 Industrial Dryers Market, By Application, 2016 & 2021 (USD Million)

Figure 33 Regional Snapshot: Rapidly Growing Markets are Emerging as Strategic Destinations

Figure 34 Asia-Pacific Industrial Dryers Market Snapshot

Figure 35 Europe Industrial Dryers Market Snapshot

Figure 36 North America Industrial Dryers Market Snapshot

Figure 37 Middle East & Africa Industrial Dryers Market Snapshot

Figure 38 Latin America Industrial Dryers Market Snapshot

Figure 39 Battle for Market Share: Agreements Was the Key Strategy

Figure 40 Industrial Dryers Market: Company Share Analysis, 2015 (%)

Figure 41 Geographic Revenue Mix of Top Five Market Players, 2015

Figure 42 Thyssenkrupp AG: Company Snapshot

Figure 43 Thyssenkrupp AG: SWOT Analysis

Figure 44 Andritz AG: Company Snapshot

Figure 45 Andritz AG: SWOT Analysis

Figure 46 GEA Group: Company Snapshot

Figure 47 GEA Group SWOT Analysis

Figure 48 Metso Corporation: Company Snapshot

Figure 49 Metso Corporation: SWOT Analysis

Figure 50 Flsmidth & Co. A/S: Company Snapshot

Figure 51 Flsmidth & Co. A/S SWOT Analysis

Figure 52 Buhler Holding AG: Company Snapshot

Growth opportunities and latent adjacency in Industrial Dryers Market