Dairy Processing Equipment Market by Type (Pasteurizers, Homogenizers, Mixers & Blenders, Separators, Evaporators, Dryers, Membrane Filtration Equipment), Mode of Operation (Automatic and Semi-Automatic), Application and Region - Global Forecast to 2028

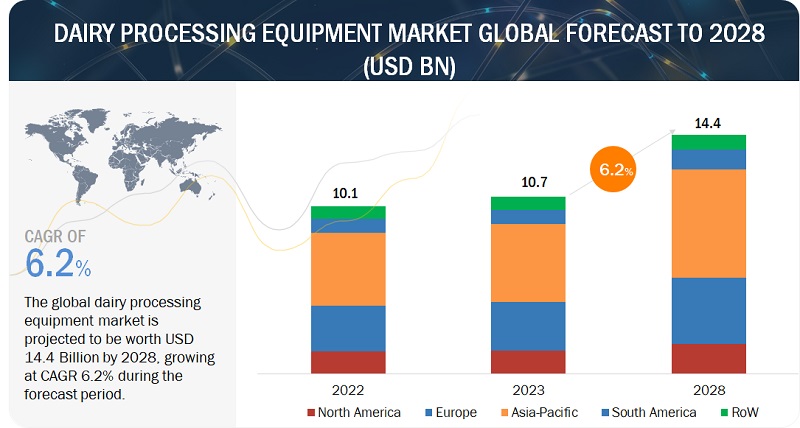

[285 Pages Report] The global dairy processing equipment market is projected to reach USD 14.4 billion by 2028 from 10.7 billion in 2023 at a CAGR of 6.2% during the forecast period, 2023-2028, in terms of value. The growth of the dairy processing equipment market is notably influenced by the diversification of dairy product portfolios. Dairy processors are actively expanding their product offerings to meet evolving consumer preferences and capture a broader market share. This diversification necessitates versatile processing equipment capable of handling a wide array of dairy products efficiently. The demand for equipment that facilitates flexibility in processing different products, such as varied types of milk, cheese, yogurts, and other dairy derivatives, is on the rise.

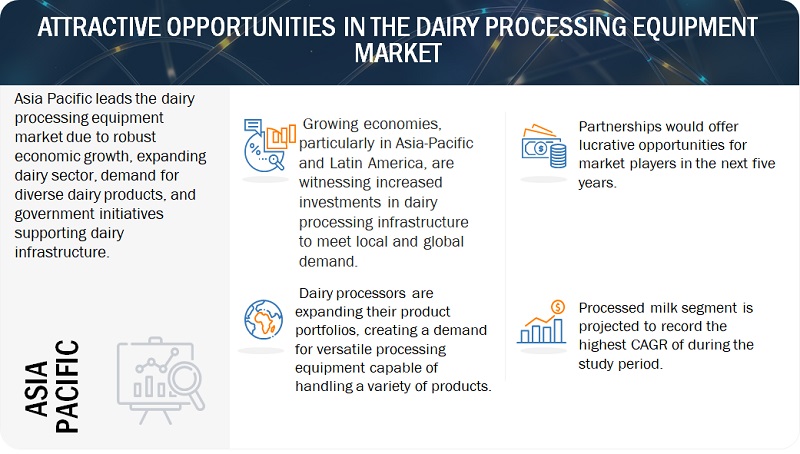

Furthermore, investments in emerging markets, particularly in Asia Pacific and South America, play a pivotal role in propelling the dairy processing equipment market. As economies in these regions experience significant growth, there is an increased focus on developing robust dairy processing infrastructure to cater to both local and global demands. The investments aim to enhance production capacities, improve processing efficiency, and ensure compliance with stringent quality standards, fostering the overall expansion of the dairy processing equipment market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers: Growing demand for dairy products

The escalating demand for dairy products is a key driver fueling the growth of the dairy processing equipment market. Changing dietary preferences and an increasing awareness of the nutritional benefits associated with dairy consumption propel the demand for diverse dairy products. Moreover, lifestyle shifts, including a rising preference for convenience and ready-to-eat dairy items, contribute significantly. The global popularity of dairy-based snacks and beverages further amplifies the demand. Additionally, evolving consumer trends favoring specialty and functional dairy products, such as probiotic-rich offerings, contribute to the market growth. To meet this heightened demand efficiently, dairy processors invest in advanced processing equipment to ensure enhanced production capabilities, maintain product quality, and comply with evolving hygiene and safety standards, collectively fostering the expansion of the dairy processing equipment market.

Restraints: Increasing energy costs

Increasing energy prices amplify operational expenses for dairy processing facilities, impacting their overall profitability. Energy-intensive processes, such as pasteurization and refrigeration, substantially contribute to operational costs, prompting a need for more energy-efficient equipment. In response to environmental concerns, stringent regulations also drive the adoption of sustainable and eco-friendly practices, influencing dairy processors to invest in energy-efficient equipment. The focus on reducing the carbon footprint and adhering to stringent emission norms adds an additional layer of complexity. As a result, dairy processors navigate the delicate balance between technological advancements and cost-effective solutions to mitigate the impact of rising energy costs, thereby influencing the trajectory of the dairy processing equipment market.

Opportunities:Support by the government and non-government bodies in terms of funding for SMEs and startups

Government and non-government support for funding small and medium-sized enterprises (SMEs) and startups in the dairy sector presents a significant opportunity in the global dairy processing equipment market. Initiatives like the Common Agricultural Policy (CAP) in the EU and the Dairy Business Innovation (DBI) Initiatives in the US play a crucial role in fostering innovation, development, and expansion within the dairy industry. The availability of funding through schemes such as the School fruit, vegetables and milk scheme, direct payments under the European Agricultural Guarantee Fund, and the European Agricultural Fund for Rural Development provides financial backing for small companies to invest in advanced dairy processing equipment.

In the US, the DBI Initiatives offer direct technical assistance and subawards to dairy businesses, encouraging diversification, promoting innovation, and supporting regional milk production. This financial support becomes an opportunity for SMEs and startups to modernize their operations, specialize in niche dairy products, and enhance their value chain. The allocation of approximately USD 23 million for DBI projects creates avenues for dairy businesses to invest in state-of-the-art processing equipment, facilitating improved efficiency, quality, and sustainability. Overall, government and non-government funding initiatives act as a catalyst for the growth and technological advancement of SMEs and startups in the global dairy processing equipment market, fostering a more competitive and dynamic industry landscape.

Challenges: High capital investment

High capital investment poses a significant challenge in the global dairy processing equipment market, affecting both existing players and potential entrants. The dairy industry demands sophisticated and technologically advanced equipment to ensure efficiency, quality, and compliance with stringent hygiene standards. Procuring and implementing such cutting-edge machinery requires substantial financial resources, creating a barrier to entry for smaller enterprises and startups. High capital expenditure is particularly challenging for businesses in developing regions or emerging economies, limiting their ability to adopt state-of-the-art processing equipment.

For established players, the need to continually invest in upgrading and expanding their processing capabilities adds financial strain. The dairy processing industry is evolving rapidly, with advancements in automation, sustainability, and quality control necessitating ongoing investments. This creates a competitive landscape where companies with limited capital may struggle to keep pace with their well-funded counterparts, impacting their overall market standing.

Moreover, the dairy sector often operates on tight profit margins, making it challenging for businesses to allocate substantial funds for capital investment without compromising their financial stability. High capital requirements can hinder the modernization and optimization of processing facilities, affecting operational efficiency and limiting the adoption of eco-friendly and energy-efficient technologies. In essence, the challenge of high capital investment acts as a potential roadblock to the widespread adoption of cutting-edge dairy processing equipment, influencing the market dynamics and competitiveness within the industry.

Market Ecosystem

Based On Type, The Pasteurizers Segment Is Estimated To Hold The Largest Market Share During The Forecast Period Of The Dairy Processing Equipment Market.

Pasteurizers are poised to hold the largest share in the dairy processing equipment market due to their crucial role in ensuring the safety and quality of milk products. Pasteurization is a key process in the dairy industry, involving the heating of milk to specific temperatures to eliminate harmful bacteria, thereby preventing diseases and enhancing the shelf life of milk. The significance of pasteurization in sterilizing raw milk is paramount for delivering high-quality and safe dairy products to consumers.

In dairy processing plants, pasteurization machines play a vital role in the destruction of tubercle bacillus and the thermal destruction associated with cream separation. The versatility of pasteurizers allows for two main processing methods: long-term low treatment temperature and short-term high-temperature treatment. The low-temperature treatment, typically around 60 degrees Celsius for half an hour, is the preferred option due to its effectiveness in preserving milk quality.

Moreover, pasteurization machines are integral in treating bagged milk, ensuring the collection of fresh milk at low temperatures for superior quality and extended shelf life. The complexity of the process underscores the importance of these machines in maintaining the overall hygiene and quality standards of the dairy processing industry.

Given the paramount role of pasteurization in ensuring milk safety, quality, and longevity, pasteurizers are expected to dominate the dairy processing equipment market, reflecting their indispensable position in the overall dairy production process.

Asia Pacific To Have The Fastest Growth In The Dairy Processing Equipment Market.

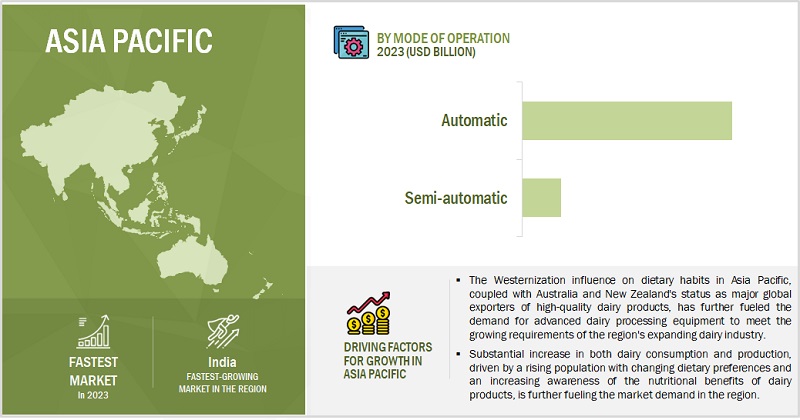

Asia Pacific commands the largest share in the global dairy processing equipment market, driven by the substantial contributions of key players like India and China. India's status as the leading global milk producer, contributing 24% of the total milk production, underscores its pivotal role in the regional and global dairy industry. The significant growth of the dairy sector in India, with a remarkable 61% increase in milk production over eight years, positions the country as a major market influencer.

According to the Dutch Bank, in China, the self-sufficiency rate for dairy products fluctuates between 70% and 80%, necessitating a focus on imports and domestic production to meet rising demand. The Chinese government's initiatives, such as the five-year plan for the dairy sector, emphasize the promotion of large-scale modern dairy farms and digital transformation. The concentration of milk production in regions like Inner Mongolia and Heilongjiang further consolidates China's position in the Asia Pacific market.

The growth in the Asia Pacific dairy processing equipment market is also fueled by the shift in food security awareness, geopolitical considerations, and strategic government actions. With a rising percentage of dairy herds on farms with more than 1,000 head and a focus on improving breeding capabilities and vertical integration, Asia Pacific is poised to dominate the global dairy processing equipment market, reflecting the region's dynamic and evolving dairy industry landscape.

Key Market Players

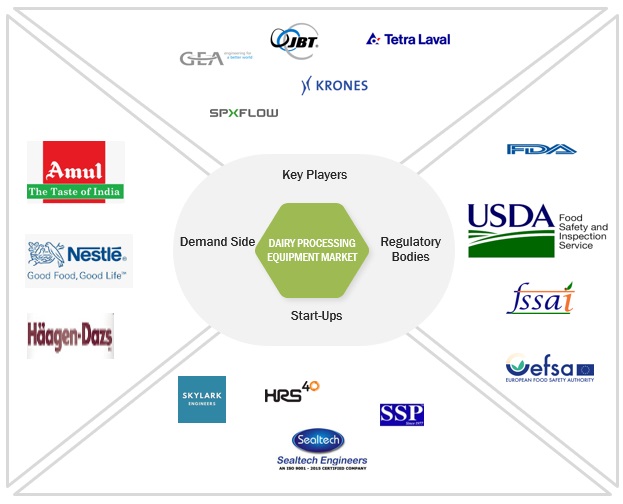

The key players in this market include GEA Group Aktiengesellschaft (Germany), SPX Flow (US), Tetra Laval (Switzerland), ALFA LAVAL (Sweden), JBT (US), Bucher Industries AG (Switzerland), Krones AG (Germany), and The Middleby Corporation (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Application, Mode of Operation, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Rest of the World |

|

Companies studied |

|

This research report categorizes the dairy processing equipment market based on Type, Application, Mode of Operation, and Region.

Target Audience

- Dairy processing equipment producers, suppliers, distributors, importers, and exporters

- Large-scale dairy processing equipment manufacturers and research organizations

- Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, government agencies, and other regulatory bodies

- Dairy product consumers

- Commercial research & development (R&D) institutions and financial institutions

Dairy Processing Equipment Market:

By Type

- Pasteurizers

- Homogenizers

- Mixers and Blenders

- Separators

- Evaporators

- Dryers

- Membrane Filtration Equipment

- Other Types

By Application

- Processed Milk

- Fresh Dairy Products

- Butter & Buttermilk

- Cheese

- Milk Powder

- Protein Ingredients

By Mode of Operation:

- Automatic

- Semi-automatic

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In October 2022, GEA Group Aktiengesellschaft (Germany), the company announced the opening of its new Technology Center in Frisco, Texas. The new facility would allow GEA to display its latest equipment and technology used in the manufacture of food products including dairy, thereby reinforcing the company's position as a leading player in the dairy processing equipment market. The new 15,000 square foot facility would feature more than 40 pieces of GEA equipment, providing customers with an opportunity to see the equipment in action and test it for their specific applications. The opening of GEA's new Technology Center in Frisco would positively impact the company's business operations in North America.

- In June 2021, SPX FLOW (US) unveiled a new APV Pilot 4T Homogenizer designed to test recipes with a new level of versatility in a compact unit. The homogenizer was launched to help customers scale up from their initial laboratory tests to production. The product launch thus aided in the growth of SPX FLOW (US) in the global dairy processing equipment market.

- In March 2021, JBT Corporation (US) launched a new freezer named CleanFREEZE Spiral Freezer. The freeze offers superior performance, easy maintenance, and a sanitary design for high-volume freezing, chilling, and cooling of a wide range of food products. The new product would help JBT to improve its customers' operations and meet the demand in the dairy processing equipment market.

Frequently Asked Questions (FAQ):

What is the current size of the dairy processing equipment market?

The dairy processing equipment market is projected to reach USD 14.4 billion by 2028, at a CAGR of 6.2% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include GEA Group Aktiengesellschaft (Germany), SPX Flow (US), Tetra Laval (Switzerland), ALFA LAVAL (Sweden), JBT (US), Bucher Industries AG (Switzerland), Krones AG (Germany), and The Middleby Corporation (US).

Which region is projected to account for the largest share of the dairy processing equipment market?

Asia Pacific dominates the global dairy processing equipment market, led by India and China. India's robust milk production growth and China's strategic initiatives, including a five-year plan and focus on large-scale modern dairy farms, contribute to the region's prominence. Geopolitical factors and evolving dairy industry dynamics further fuel Asia Pacific's market leadership.

Which type is projected to grow at the highest rate during the forecast period?

Pasteurizers are set to dominate the dairy processing equipment market due to their critical role in ensuring milk safety and quality. The process involves heating milk to specific temperatures to eliminate harmful bacteria, preserving product shelf life. This indispensable function positions pasteurizers as key equipment in the dairy production process.

Which application is projected to account for the fastest growth of the dairy processing equipment market?

Processed milk is set to lead the dairy processing equipment market due to escalating global demand for various processed milk products, such as pasteurized milk, UHT milk, and flavored milk. This demand surge is fueled by evolving consumer lifestyles, preferences for convenient options, and the extended shelf life offered by processed milk. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 EVOLUTION

-

5.3 MACROECONOMIC INDICATORSGLOBALIZATION OF DAIRY INDUSTRYHEALTH AND WELLNESS TRENDS

-

5.4 MARKET DYNAMICSDRIVERS- Growth in demand for dairy products- Adoption of efficiency-enhancing technologies by dairy product manufacturers- Increase in concerns about food safety and quality- Increase in automation offered by technology providers- Abolition of milk quota in European Union- Standardization in product quality and extended shelf-lifeRESTRAINTS- Increase in energy costs- Health risks associated with whey proteinOPPORTUNITIES- Investments and funding by government and non-government bodies- Growth in emphasis on environmental and sustainability concerns- Increase in production of dairy products in emerging economies- Expansion of product lines to cater to emerging applicationsCHALLENGES- High capital investment- Growth in demand for plant-based products- Adulteration of dairy products to deteriorate quality

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTINPUTSPROCESSINGLOGISTICS & DISTRIBUTIONMARKETING & SALES

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 TECHNOLOGY ANALYSISAUTOMATION AND ROBOTICSENZYME-BASED CLEANING-IN-PLACE (CIP) IN DAIRY PROCESSING

-

6.5 PATENT ANALYSIS

-

6.6 ECOSYSTEM MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.7 TRADE ANALYSIS

-

6.8 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY TYPEINDICATIVE PRICING ANALYSIS, BY REGION

-

6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORKCOUNTRY-WISE REGULATORY AUTHORITIES FOR DAIRY PROCESSING EQUIPMENT- North America- Europe- Asia Pacific

-

6.12 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 CASE STUDY ANALYSISMODERNIZING PRACTICES IN PROMINENT DAIRY PROCESSING FACILITY WITH HELP OF ENSIGHT LIKWIFER’S INNOVATIVE BLENDERBURRA FOODS UPGRADED SKIMMED MILK PROCESSING WITH HRS’ HEAT EXCHANGERS

- 7.1 INTRODUCTION

-

7.2 PASTEURIZERSRISE IN CONCERNS FOR FOOD SAFETY, COUPLED WITH ABILITY TO EXTEND SHELF LIFE OF DAIRY PRODUCTS

-

7.3 HOMOGENIZERSINTEGRAL ROLE IN ENHANCING TEXTURE AND APPEARANCE OF DAIRY ITEMS

-

7.4 MIXERS & BLENDERSCRUCIAL ROLE IN ENSURING UNIFORMITY IN QUALITY OF DAIRY PRODUCTS QUALITY

-

7.5 SEPARATORSDEMAND FOR DIVERSE DAIRY PRODUCTS WITH SPECIFIC FAT CONTENT

-

7.6 EVAPORATORSNUTRITIONAL INNOVATION AND HEALTH TRENDS TO SPUR DEMAND FOR EVAPORATORS

-

7.7 DRYERSNEED FOR ENHANCED SHELF LIFE AND PRESERVATION TO PROPEL DEMAND FOR DRYERS

-

7.8 MEMBRANE FILTRATION EQUIPMENTINDUSTRY COMPLIANCE AND QUALITY STANDARDS TO FUEL DEMAND FOR MEMBRANE FILTRATION EQUIPMENT

- 7.9 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 PROCESSED MILKNEED FOR REGULATORY COMPLIANCE AND CONSUMER SAFETY IN MILK CONSUMPTION

-

8.3 FRESH DAIRY PRODUCTSSHIFT IN CONSUMER TRENDS TOWARD HEALTHIER DESSERTS AND GOURMET CUISINES

-

8.4 BUTTER & BUTTERMILKCROSS-CULTURAL ADOPTION OF BUTTER & BUTTERMILK

-

8.5 CHEESEEXPANSION OF QUICK-SERVICE RESTAURANTS AND WESTERNIZATION OF DIETS IN ASIA PACIFIC

-

8.6 MILK POWDEREXTENDED SHELF LIFE AND APPLICATION IN INFANT FORMULA PRODUCTION

-

8.7 PROTEIN INGREDIENTSINCREASE IN AWARENESS REGARDING IMPORTANCE OF PROTEIN IN DIETS, ALONG WITH SURGE IN GYM MEMBERSHIPS

- 9.1 INTRODUCTION

-

9.2 AUTOMATICCONTAMINATION PREVENTION AND CONSISTENT PRODUCT QUALITY REQUIREMENTS IN DAIRY INDUSTRY

-

9.3 SEMI-AUTOMATICOPERATIONAL FLEXIBILITY AND AFFORDABILITY OF SEMI-AUTOMATIC PROCESSING EQUIPMENT IN DAIRY INDUSTRY

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Surging US dairy exports and growing domestic production propel demand for advanced processing equipmentCANADA- Sustained government support and innovation initiatives in Canada’s dairy processing sectorMEXICO- Limited infrastructure and high consumption of dairy products

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Shift in consumer preferences to organic and healthier food products in GermanyUK- Government initiatives to expand dairy exports set in UKFRANCE- Proactive support from major dairy producers to facilitate development of dairy industry in FranceITALY- Food safety concerns and increase in consumer awareness in ItalyNETHERLANDS- Export-oriented dairy industry and high per capita cheese consumption in NetherlandsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increase in consumption of dairy products in ChinaINDIA- Increase in milk production and growing appetite for dairy products in IndiaJAPAN- Health-conscious trends and government initiatives in JapanAUSTRALIA & NEW ZEALAND- Export-oriented dairy industry in Australia & New ZealandREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Shift in consumer preferences toward processed milk products in BrazilARGENTINA- Rise in processed milk product production and government policy shifts in ArgentinaREST OF SOUTH AMERICA

-

10.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISAFRICA- Untapped potential and rise in demand for various dairy products in AfricaMIDDLE EAST- Growth in demand for healthier diets and food security initiatives in Middle East

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.4 REVENUE ANALYSIS

- 11.5 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 11.6 KEY PLAYERS EBITDA

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

11.8 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS

-

11.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.10 COMPETITIVE SCENARIO AND TRENDSNEW PRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSGEA GROUP AKTIENGESELLSCHAFT- Business overview- Products offered- Recent developments- MnM viewSPX FLOW- Business overview- Products offered- Recent developments- MnM viewTETRA LAVAL- Business overview- Products offered- Recent developments- MnM viewALFA LAVAL- Business overview- Recent developments- MnM viewJBT- Business overview- Products offered- Recent developments- MnM viewBUCHER INDUSTRIES- Business overview- Products offered- Recent developments- MnM viewTHE MIDDLEBY CORPORATION- Business overview- Products offered- Recent developments- MnM viewKRONES AG- Business overview- Products offered- Recent developments- MnM viewIDMC LIMITED- Business overview- Products offered- Recent developments- MnM viewFELDMEIER EQUIPMENT, INC.- Business overview- Products offered- Recent developments- MnM viewSCHERJON EQUIPMENT HOLLAND B.V.- Business overview- Recent developments- MnM viewCOPERION GMBH- Business overview- Products offered- Recent developments- MnM viewVAN DEN HEUVEL DAIRY & FOOD EQUIPMENT- Business overview- Products offered- Recent developments- MnM viewGEMAK- Business overview- Products offered- Recent developments- MnM viewANDERSON DAHLEN, INC.- Business overview- Products offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSNEOLOGIC ENGINEERS PRIVATE LIMITED- Business overview- Products offered- Recent developments- MnM viewGOMA- Business overview- Products offered- Recent developments- MnM viewTNA AUSTRALIA PTY LIMITED- Business overview- Products offered- Recent developments- MnM viewFENCO FOOD MACHINERY S.R.L- Business overview- Products offered- Recent developments- MnM viewHRS HEAT EXCHANGERS- Business overview- Products offered- Recent developments- MnM viewSEALTECH ENGINEERS- Business overview- Products offered- Recent developments- MnM viewDAIRY TECH INDIAVINO TECHNICAL SERVICESSSP PVT LTD.SKYLARK ENGINEERS

- 13.1 INTRODUCTION

- 13.2 RESEARCH LIMITATIONS

-

13.3 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKETMARKET DEFINITIONMARKET OVERVIEWFOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPEFOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

-

13.4 BAKERY PROCESSING EQUIPMENT MARKETMARKET DEFINITIONMARKET OVERVIEWBAKERY PROCESSING EQUIPMENT MARKET, BY TYPEBAKERY PROCESSING EQUIPMENT MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2022

- TABLE 2 DAIRY PROCESSING EQUIPMENT MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 HISTORY OF DAIRY PROCESSING

- TABLE 4 INITIAL SETUP COST OF ULTRAFILTRATION SYSTEM (USD)

- TABLE 5 INITIAL SETUP COST OF DAIRY PROCESSING PLANT WITH PRODUCTION CAPACITY OF 300,000 LITERS PER DAY

- TABLE 6 LACTOSE-INTOLERANT POPULATION, 2020

- TABLE 7 SAFETY AND FRAUD ISSUES RELATING TO MILK AND MILK PRODUCTS FOUND IN GREY LITERATURE, 2018–2019

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO DAIRY PROCESSING EQUIPMENT MARKET, 2013–2022

- TABLE 9 DAIRY PROCESSING EQUIPMENT MARKET: ECOSYSTEM

- TABLE 10 IMPORT VALUE OF DAIRY PROCESSING EQUIPMENT MARKET FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 11 EXPORT VALUE OF DAIRY PROCESSING EQUIPMENT MARKET FOR KEY COUNTRIES, 2022 (USD THOUSAND)

- TABLE 12 DAIRY PROCESSING EQUIPMENT MARKET: INDICATIVE PRICING, BY TYPE (USD PER UNIT)

- TABLE 13 DAIRY PROCESSING EQUIPMENT MARKET: INDICATIVE PRICING, BY REGION (USD PER UNIT)

- TABLE 14 KEY CONFERENCES AND EVENTS IN DAIRY PROCESSING EQUIPMENT MARKET, 2023–2024

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 DAIRY PROCESSING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MODE OF OPERATION

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 21 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 22 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 PASTEURIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 PASTEURIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 HOMOGENIZERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 HOMOGENIZERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 MIXERS & BLENDERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 MIXERS & BLENDERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SEPARATORS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 SEPARATORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 EVAPORATORS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 EVAPORATORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 DRYERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 DRYERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MEMBRANE FILTRATION EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 MEMBRANE FILTRATION EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 OTHER DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 OTHER DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 40 DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 DAIRY PROCESSING EQUIPMENT MARKET FOR PROCESSED MILK, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 DAIRY PROCESSING EQUIPMENT MARKET FOR PROCESSED MILK, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 DAIRY PROCESSING EQUIPMENT MARKET FOR FRESH DAIRY PRODUCTS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 DAIRY PROCESSING EQUIPMENT MARKET FOR FRESH DAIRY PRODUCTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 FORMULATION DIFFERENCES IN NORMAL SALTED BUTTER AND INDIAN BUTTER

- TABLE 46 DAIRY PROCESSING EQUIPMENT MARKET FOR BUTTER & BUTTERMILK, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 DAIRY PROCESSING EQUIPMENT MARKET FOR BUTTER & BUTTERMILK, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 DAIRY PROCESSING EQUIPMENT MARKET FOR CHEESE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 DAIRY PROCESSING EQUIPMENT MARKET FOR CHEESE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DAIRY PROCESSING EQUIPMENT MARKET FOR MILK POWDER, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 DAIRY PROCESSING EQUIPMENT MARKET FOR MILK POWDER, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 DAIRY PROCESSING EQUIPMENT MARKET FOR PROTEIN INGREDIENTS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 DAIRY PROCESSING EQUIPMENT MARKET FOR PROTEIN INGREDIENTS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 55 DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 56 AUTOMATIC DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 AUTOMATIC DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 SEMI-AUTOMATIC DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 SEMI-AUTOMATIC DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MEXICO: FOOD INFLATION, 2022 VS. 2023 (MXN/KG)

- TABLE 63 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 71 US: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 72 US: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 US: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 74 US: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 76 CANADA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 80 MEXICO: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 MEXICO: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 82 MEXICO: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 90 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 91 GERMANY: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 92 GERMANY: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 GERMANY: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 94 GERMANY: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 95 UK: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 96 UK: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 UK: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 98 UK: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 99 FRANCE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 100 FRANCE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 102 FRANCE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 103 ITALY: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 104 ITALY: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 ITALY: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 106 ITALY: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 107 NETHERLANDS: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 108 NETHERLANDS: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 NETHERLANDS: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 110 NETHERLANDS: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 114 REST OF EUROPE: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 123 CHINA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 124 CHINA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 CHINA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 126 CHINA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 127 INDIA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 128 INDIA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 INDIA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 130 INDIA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 131 JAPAN: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 132 JAPAN: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 JAPAN: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 134 JAPAN: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 135 AUSTRALIA & NEW ZEALAND: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 136 AUSTRALIA & NEW ZEALAND: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 AUSTRALIA & NEW ZEALAND: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 138 AUSTRALIA & NEW ZEALAND: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 144 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 146 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 148 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 151 BRAZIL: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 152 BRAZIL: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 BRAZIL: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 154 BRAZIL: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 155 ARGENTINA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 156 ARGENTINA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 ARGENTINA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 158 ARGENTINA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 161 REST OF SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 163 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 164 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 165 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 166 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 168 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 170 ROW: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 171 AFRICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 172 AFRICA: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 AFRICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 174 AFRICA: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST: DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2018–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST: DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 179 DAIRY PROCESSING EQUIPMENT MARKET: DEGREE OF COMPETITION, 2022

- TABLE 180 STRATEGIES ADOPTED BY KEY PLAYERS IN DAIRY PROCESSING EQUIPMENT MARKET

- TABLE 181 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 182 COMPANY FOOTPRINT FOR KEY PLAYERS, BY APPLICATION

- TABLE 183 COMPANY FOOTPRINT FOR KEY PLAYERS, BY TYPE

- TABLE 184 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 185 DAIRY PROCESSING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 186 DAIRY PROCESSING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 187 DAIRY PROCESSING EQUIPMENT MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 188 DAIRY PROCESSING EQUIPMENT MARKET: DEALS, 2019–2023

- TABLE 189 DAIRY PROCESSING EQUIPMENT MARKET: OTHERS, 2019–2023

- TABLE 190 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- TABLE 191 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 192 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT LAUNCHES

- TABLE 193 GEA GROUP AKTIENGESELLSCHAFT: OTHERS

- TABLE 194 SPX FLOW: BUSINESS OVERVIEW

- TABLE 195 SPX FLOW: PRODUCTS OFFERED

- TABLE 196 SPX FLOW: PRODUCT LAUNCHES

- TABLE 197 SPX FLOW: DEALS

- TABLE 198 SPX FLOW: OTHERS

- TABLE 199 TETRA LAVAL: BUSINESS OVERVIEW

- TABLE 200 TETRA LAVAL: PRODUCTS OFFERED

- TABLE 201 TETRA LAVAL: OTHERS

- TABLE 202 ALFA LAVAL: BUSINESS OVERVIEW

- TABLE 203 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 204 ALFA LAVAL: OTHERS

- TABLE 205 JBT: BUSINESS OVERVIEW

- TABLE 206 JBT: PRODUCTS OFFERED

- TABLE 207 JBT: PRODUCT LAUNCHES

- TABLE 208 JBT: DEALS

- TABLE 209 JBT: OTHERS

- TABLE 210 BUCHER INDUSTRIES: BUSINESS OVERVIEW

- TABLE 211 BUCHER INDUSTRIES: PRODUCTS OFFERED

- TABLE 212 THE MIDDLEBY CORPORATION: BUSINESS OVERVIEW

- TABLE 213 THE MIDDLEBY CORPORATION: PRODUCTS OFFERED

- TABLE 214 THE MIDDLEBY CORPORATION: DEALS

- TABLE 215 KRONES AG: BUSINESS OVERVIEW

- TABLE 216 KRONES AG: PRODUCTS OFFERED

- TABLE 217 IDMC LIMITED: BUSINESS OVERVIEW

- TABLE 218 IDMC LIMITED: PRODUCTS OFFERED

- TABLE 219 FELDMEIER EQUIPMENT, INC.: BUSINESS OVERVIEW

- TABLE 220 FELDMEIER EQUIPMENT, INC.: PRODUCTS OFFERED

- TABLE 221 SCHERJON EQUIPMENT HOLLAND B.V.: BUSINESS OVERVIEW

- TABLE 222 SCHERJON EQUIPMENT HOLLAND B.V.: PRODUCTS OFFERED

- TABLE 223 SCHERJON EQUIPMENT HOLLAND B.V.: PRODUCT LAUNCHES

- TABLE 224 COPERION GMBH: BUSINESS OVERVIEW

- TABLE 225 COPERION GMBH: PRODUCTS OFFERED

- TABLE 226 VAN DEN HEUVEL DAIRY & FOOD EQUIPMENT: BUSINESS OVERVIEW

- TABLE 227 VAN DEN HEUVEL DAIRY & FOOD EQUIPMENT: PRODUCTS OFFERED

- TABLE 228 GEMAK: BUSINESS OVERVIEW

- TABLE 229 GEMAK: PRODUCTS OFFERED

- TABLE 230 ANDERSON DAHLEN, INC.: BUSINESS OVERVIEW

- TABLE 231 ANDERSON DAHLEN, INC.: PRODUCTS OFFERED

- TABLE 232 NEOLOGIC ENGINEERS PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 233 NEOLOGIC ENGINEERS PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 234 GOMA: BUSINESS OVERVIEW

- TABLE 235 GOMA: PRODUCTS OFFERED

- TABLE 236 TNA AUSTRALIA PTY LIMITED: BUSINESS OVERVIEW

- TABLE 237 TNA AUSTRALIA PTY LIMITED: PRODUCTS OFFERED

- TABLE 238 FENCO FOOD MACHINERY S.R.L: BUSINESS OVERVIEW

- TABLE 239 FENCO FOOD MACHINERY S.R.L: PRODUCTS OFFERED

- TABLE 240 HRS HEAT EXCHANGERS: BUSINESS OVERVIEW

- TABLE 241 HRS HEAT EXCHANGERS: PRODUCTS OFFERED

- TABLE 242 SEALTECH ENGINEERS: BUSINESS OVERVIEW

- TABLE 243 SEALTECH ENGINEERS: PRODUCTS OFFERED

- TABLE 244 DAIRY TECH INDIA: BUSINESS OVERVIEW

- TABLE 245 VINO TECHNICAL SERVICES: BUSINESS OVERVIEW

- TABLE 246 SSP PVT. LTD.: BUSINESS OVERVIEW

- TABLE 247 SKYLARK ENGINEERS: BUSINESS OVERVIEW

- TABLE 248 MARKETS ADJACENT TO DAIRY PROCESSING EQUIPMENT MARKET

- TABLE 249 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 250 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 251 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 252 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 253 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 254 BAKERY PROCESSING EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 255 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 256 BAKERY PROCESSING EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 DAIRY PROCESSING EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 DAIRY PROCESSING EQUIPMENT MARKET: RESEARCH DESIGN

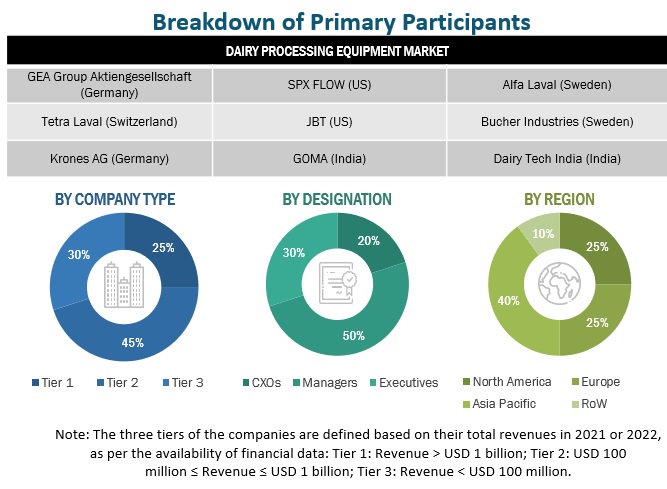

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DAIRY PROCESSING EQUIPMENT MARKET SIZE CALCULATION: SUPPLY SIDE

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 RECESSION MACROINDICATORS

- FIGURE 9 GLOBAL INFLATION RATE, 2011–2022

- FIGURE 10 GLOBAL GDP, 2011–2022 (USD TRILLION)

- FIGURE 11 RECESSION INDICATORS AND THEIR IMPACT ON DAIRY PROCESSING EQUIPMENT MARKET

- FIGURE 12 GLOBAL DAIRY PROCESSING EQUIPMENT MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 13 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 DAIRY PROCESSING EQUIPMENT MARKET, BY REGION, 2022

- FIGURE 17 HEALTH AND WELLNESS TRENDS TO DRIVE GROWTH OF DAIRY PROCESSING EQUIPMENT MARKET

- FIGURE 18 AUTOMATIC SEGMENT AND INDIA ACCOUNTED FOR SIGNIFICANT MARKET SHARES IN 2022

- FIGURE 19 ASIA PACIFIC TO BE DOMINANT MARKET FOR AUTOMATIC AND SEMI-AUTOMATIC EQUIPMENT DURING FORECAST PERIOD

- FIGURE 20 PASTEURIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 INDIA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 22 MILK PROCESSING: PROCESS FLOW DIAGRAM

- FIGURE 23 DAIRY PROCESSING EVOLUTION

- FIGURE 24 CHINA: IMPORTS OF CHEESE, 2019–2023 (THOUSAND TONS)

- FIGURE 25 MARKET DYNAMICS: DAIRY PROCESSING EQUIPMENT MARKET

- FIGURE 26 US: PER CAPITA CONSUMPTION OF DAIRY PRODUCTS, 2000–2021 (POUNDS)

- FIGURE 27 GLOBAL MILK AND MILK PRODUCTS PRODUCTION, 2020–2022 (THOUSAND TONS)

- FIGURE 28 MILK PRODUCTION SHARE PER REGION, 2021

- FIGURE 29 DAIRY PROCESSING EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 DAIRY PROCESSING EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED

- FIGURE 33 DAIRY PROCESSING EQUIPMENT MARKET: MARKET MAP

- FIGURE 34 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSES

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MODE OF OPERATION

- FIGURE 36 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 37 DAIRY PROCESSING EQUIPMENT MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 DAIRY PROCESSING EQUIPMENT MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 DAIRY PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 DAIRY PROCESSING EQUIPMENT MARKET: GEOGRAPHIC SNAPSHOT, 2023–2028 (USD MILLION)

- FIGURE 41 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 42 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 43 US: MILK PRODUCTION VOLUME, 2013–2022 (MILLION POUNDS)

- FIGURE 44 US: KEY MARKETS FOR DAIRY EXPORTS, 2020–2022 (USD BILLION)

- FIGURE 45 CANADA: DAIRY PRODUCT EXPORTS & IMPORTS, 2017–2022 (USD MILLION)

- FIGURE 46 EUROPE: DAIRY PROCESSING EQUIPMENT MARKET SNAPSHOT

- FIGURE 47 EUROPE: COUNTRY-LEVEL INFLATION DATA, 2017–2022

- FIGURE 48 EUROPE: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 49 UK: DAIRY TRADE DATA, 2020–2021 (METRIC TON)

- FIGURE 50 NETHERLANDS: DAIRY EXPORT REVENUES, 2020 (USD BILLION)

- FIGURE 51 ASIA PACIFIC: DAIRY PROCESSING EQUIPMENT MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 53 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 54 COMMODITY-WISE SHARE OF ORGANIZED DAIRY EQUIPMENT, 2019

- FIGURE 55 JAPAN: PRODUCTION OF PROCESSED MILK PRODUCTS, 2018-2022 (METRIC TONS)

- FIGURE 56 AUSTRALIA: UTILIZATION OF MILK IN DAIRY PROCESSING INDUSTRY, 2021–2022 (VOLUME)

- FIGURE 57 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 58 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 59 ROW: INFLATION RATES, BY KEY COUNTRY, 2017–2022

- FIGURE 60 ROW: RECESSION IMPACT ANALYSIS, 2022 VS. 2023

- FIGURE 61 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 62 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022

- FIGURE 63 EBITDA, 2022 (USD BILLION)

- FIGURE 64 DAIRY PROCESSING EQUIPMENT MARKET: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 65 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 66 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 67 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 68 SPX FLOW: COMPANY SNAPSHOT

- FIGURE 69 TETRA LAVAL: COMPANY SNAPSHOT

- FIGURE 70 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 71 JBT: COMPANY SNAPSHOT

- FIGURE 72 BUCHER INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 73 THE MIDDLEBY CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 KRONES AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the dairy processing equipment market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the dairy processing equipment market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the dairy processing equipment market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the dairy processing equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to types of dairy processing equipment, type, product, consumption, distribution channel, freezing technique, and region. Stakeholders from the demand side, such as food and beverage companies and health and personal care companies who are using dairy processing equipment were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of dairy processing equipment and outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

SPX Flow (US) |

General Manager |

|

Tetra Laval (Switzerland) |

Sales Manager |

|

Krones AG (Germany) |

Process Engineer |

|

GEA Group Aktiengesellschaft (Germany) |

Sales Manager |

|

Bucher Industries (Sweden) |

Deputy Sales Manager |

|

JBT (US) |

Processing Sales Manager |

|

ALFA LAVAL (Sweden) |

Individual Industry Expert |

|

GOMA (India) |

Marketing Manager |

|

Dairy Tech India (India) |

Sales Executive |

|

Gemak (UK) |

Sales Manager |

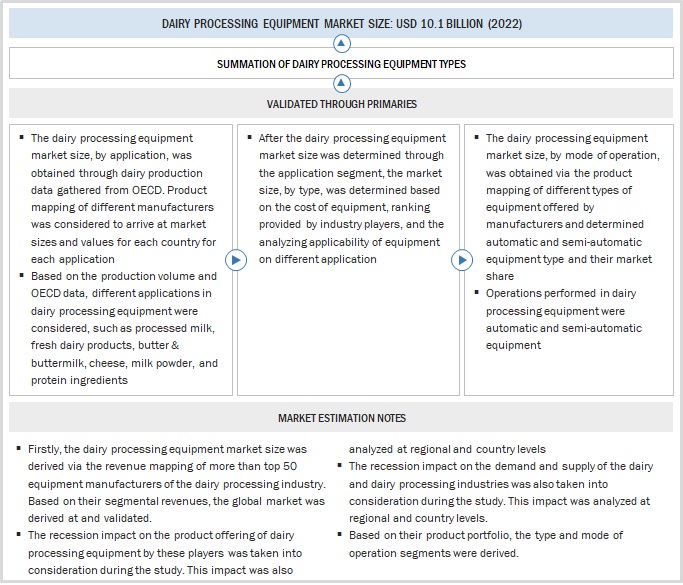

Market Size Estimation

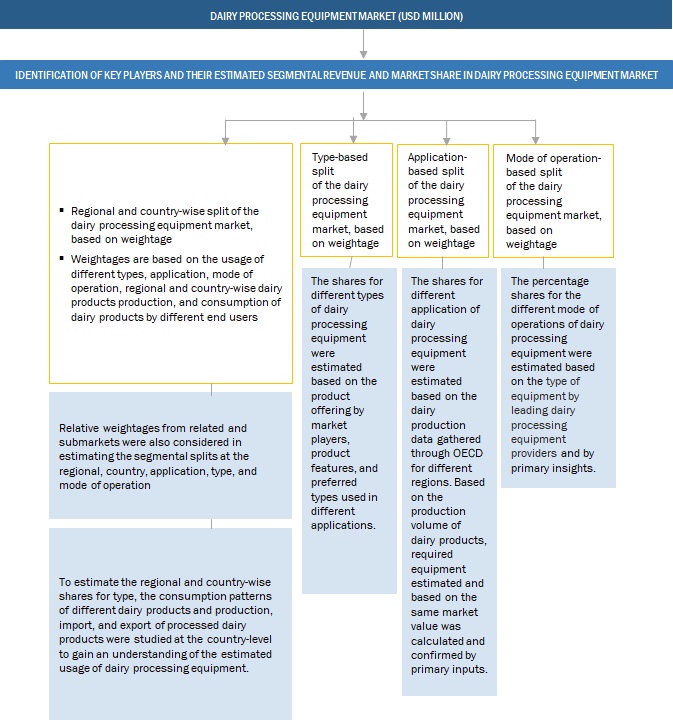

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the dairy processing equipment market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major dairy processing equipment players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the dairy processing equipment market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global Dairy Processing Equipment Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Dairy Processing Equipment Market: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Dairy processing equipment consists of equipment used for the optimum utilization of milk properties and nutrients. To prepare a diverse range of dairy products such as processed milk, fresh dairy products, butter & buttermilk, cheese, milk powder, and protein ingredients, many different processes were developed by the industry. Dairy product manufacturing involves various processes such as pasteurization, homogenization, filtration, drying, and separation. To enable these processes, dairy processors use equipment such as pasteurizers, homogenizers, separators, evaporators & dryers, membrane filtration equipment, mixers & blenders, and other equipment such as churning equipment, crystallizers, chillers, silos, cutters, and cheese vats.

Key Stakeholders

- Manufacturers, dealers, and suppliers of dairy processing equipment

- Government bodies

- Dairy products manufacturers

- Dairy farms

- Intermediate suppliers such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions:

- World Health Organization (WHO)

- Code of Federal Regulations (CFR)

- US Food and Drug Administration (FDA)

- Codex Alimentarius Commission (CAC)

- EUROPA

- United States Department of Agriculture (USDA)

- Food Processing Suppliers Association (FPSA)

- European Dairy Association

- Logistics providers & transporters

- Research institutes and organizations

- Consulting companies/consultants in the agricultural technology sectors

Report Objectives

- Determining and projecting the size of the dairy processing equipment market, with respect to type, application, mode of operation, and region, over five years, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and microeconomic factors on the market

- Impact of recession on the global dairy processing equipment market

- Shifts in demand patterns across different subsegments and regions.

- Identifying and profiling the key market players in the dairy processing equipment market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the rest of Asia Pacific dairy processing equipment market into Taiwan, South Korea, Indonesia, Malaysia, Thailand, the Philippines, Bangladesh, Singapore, and Vietnam.

- Further breakdown of rest of Europe's dairy processing equipment market into Spain, Poland, Belgium, Sweden, and other EU & non-EU countries.

- Further breakdown of rest of rest of South America's dairy processing equipment market into Chile, Peru, Uruguay, Venezuela, and Colombia.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dairy Processing Equipment Market

Good article summarizing about the Dairy processing equipment and its various applications over different regions which is completely a global approach.This is a great example of ecosystem of Dairy processing approach. May I know the future value of the above mentioned approach?!