Industrial Films Market by Film Type (LLDPE, LDPE, HDPE, PET/BOPET, PP/BOPP, CPP, PVC, Polyamide/BOPA), End-Use Industry (Agriculture, Industrial Packaging, Construction, Medical, Transportation), & Region - Global Forecast to 2028

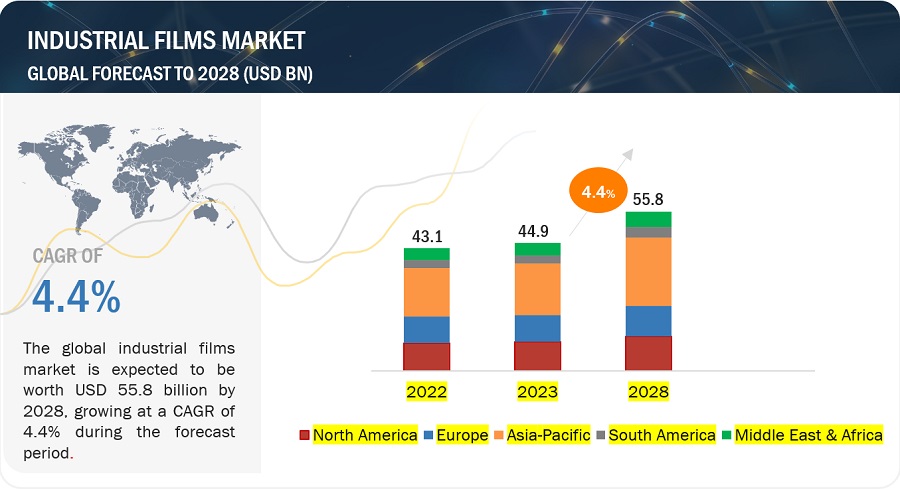

The industrial films market is estimated to be USD 43.1 billion in 2022 and is projected to reach USD 55.8 billion by 2028, at a CAGR of 4.4% between 2023 and 2028. The increased consumption of industrial films in end-use industries is due to their potential advantages, such as high tensile and impact strength, heat sealability, and protection of goods.

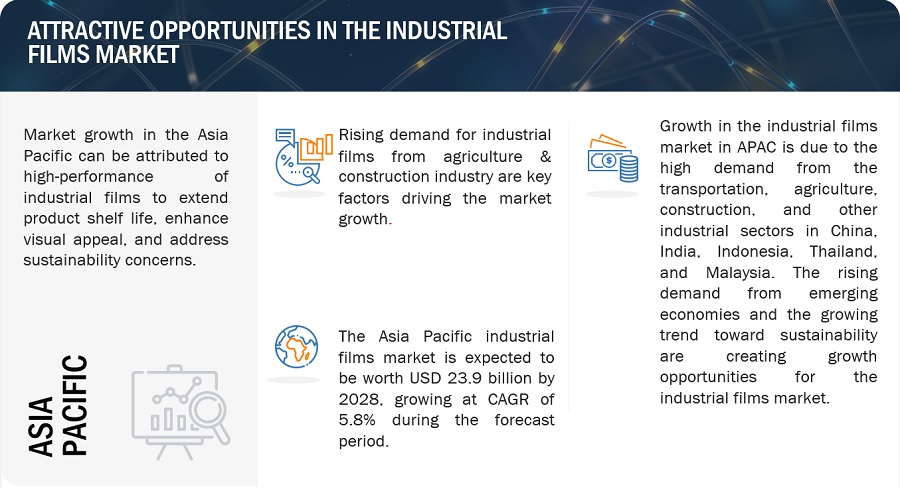

Attractive Opportunities in the Industrial Films Market

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Films Market Dynamics

Driver: Capitalizing on urban-industrial boom

The global surge in industrialization and urbanization has had a pronounced impact on the industrial films market. The World Bank data showcases that from 2000 to 2021, the global urban population grew by over 50% to roughly 4.4 billion, catalyzing expansive construction activities, both residential and commercial. This urban boom inherently drives the demand for industrial films used in construction for applications like surface protection and lamination.

Urban consumption patterns, set to dictate nearly 91% of global consumption growth between 2015 and 2030, according to the British Plastics Federation, amplify the demand for packaged goods, thus propelling the role of industrial films in packaging. As cities and industries grow symbiotically, the demand for industrial films continues to rise, underscoring its pivotal role in modern urban-industrial landscapes.

Restraint: Adapting to changing regulatory landscape

Over the past few years, increased environmental awareness has resulted in governments across the globe implementing stricter regulations concerning the production, use, and disposal of industrial materials, including films. For the industrial films sector, this means that the materials traditionally used in manufacturing, many of which are non-biodegradable, have come under scrutiny. As countries aim to achieve their sustainable development goals and align with international environmental accords, such as the Paris Agreement, industries are facing increased pressure to reduce their carbon footprint and limit the use of materials that could harm the environment.

The implications of these regulations for the industrial films market are multifold. Firstly, manufacturers are now mandated to invest in R&D to develop more eco-friendly materials that meet both the industry’s functional needs and regulatory standards. This can increase the production costs, making industrial films more expensive in the short term. Secondly, the life cycle of the film, from production to disposal, is now under the regulatory lens. This means that producers are accountable not just for the film’s manufacturing but also for its disposal, pushing them to explore recycling or biodegradable options. Finally, non-compliance with these evolving regulations can result in hefty fines, legal actions, or tarnished brand reputations, thereby influencing the strategic decisions of manufacturers.

In summary, the stringent environmental and governmental regulations have reshaped the industrial films market landscape, pushing producers towards innovation and sustainable solutions while navigating the challenges of compliance and evolving consumer expectations.

Opportunities: Eco-friendly innovations in industrial films

In the wake of escalating environmental concerns and increasing awareness among consumers and businesses, there has been a pronounced shift towards sustainable practices across industries. The industrial films market is no exception to this trend. The demand for eco-friendly films, ones that are biodegradable or made from renewable resources, has been steadily growing. The very essence of these films aligns with the broader global objective of reducing the carbon footprint and minimizing the adverse environmental impact of non-biodegradable waste.

Governments worldwide, driven by international agreements such as the Paris Agreement, have been implementing policies encouraging or even mandating the use of eco-friendly products. This regulatory environment, coupled with a conscious consumer base that is willing to pay a premium for sustainable products, creates fertile ground for the growth of eco-friendly industrial films. In sectors like packaging, construction, and automotive, there is a keen interest in replacing traditional materials with their greener counterparts. For instance, in the packaging sector, the move away from single-use plastics offers a vast opportunity for sustainable films that can decompose naturally without leaving a lasting environmental imprint.

To sum up, the global thrust towards sustainability is redefining the industrial films landscape. Companies that adapt by focusing on eco-friendly film solutions are not only catering to a growing demand but are also positioning themselves favorably in an increasingly environment-conscious market.

Challenges: Raw material price fluctuations

The industrial films industry relies heavily on a range of raw materials, many of which are derivatives of petrochemicals, polymers, and other specialty chemicals. The prices of these foundational materials are not always stable; they tend to fluctuate based on various global factors, making the cost of production for industrial films inherently unpredictable.

Historically, the oil & gas industry has been a principal factor affecting the cost of petrochemical derivatives. Factors such as geopolitical tensions in key oil-producing regions, decisions made by organizations like OPEC regarding production levels, and even major natural disasters can lead to significant swings in oil prices. These price swings subsequently cascade down to petrochemical-based raw materials crucial for industrial films.

Moreover, as economies grow, so does their consumption of commodities, leading to supply-demand imbalances. A surge in demand from major manufacturing economies can tighten the availability of raw materials, leading to price hikes. On the other hand, economic downturns, such as recessions, can have the opposite effect, leading to oversupply and price depressions.

For businesses in the industrial films sector, this volatility can be particularly challenging. It complicates budgeting and financial forecasting and can also lead to fluctuating profit margins. For instance, a sudden rise in raw material costs might not immediately be passed on to the consumer, leading to squeezed profit margins. Conversely, a drop in costs does not guarantee a proportionate drop in final product prices due to competitive dynamics and other market factors.

In essence, the inherent volatility in raw material prices is a significant challenge for the industrial films industry. Companies often have to employ hedging strategies, develop alternative material sources, or innovate in material usage to mitigate the impact of these fluctuations and maintain a steady growth trajectory.

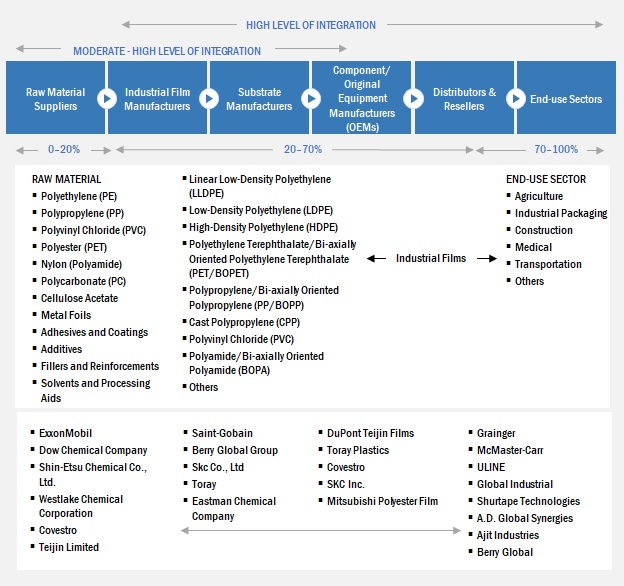

ECOSYSTEM

By Film Type, LLDPE Films accounted for the highest market share in 2022

LLDPE films are the most widely used industrial films. LLDPE is an advanced form of LDPE. It is similar to LDPE in terms of density but has gained popularity owing to its relative transparency, higher tensile strength, puncture resistance, and superior impact strength. These properties of LLDPE permit converters to adopt down-gauging technology and produce thinner films, leading to reduced costs and material savings without compromising on strength.

By End Use Industry, Agriculture is the fastest-growing Industry of Industrial Films market in 2022

The potential advantages of plastic films in agriculture, in terms of improved food quality, crop protection, increased crop productivity, and minimization of soil erosion, have contributed toward their increasing use. A wide range of plastic films, such as PE, PP, PVC, PC, and PO, is used in the agriculture industry. These plastic films provide sustainable and innovative solutions, along with recovery and recycling opportunities. Agricultural films are primarily used in three broader areas, namely, greenhouse, mulch, and silage.

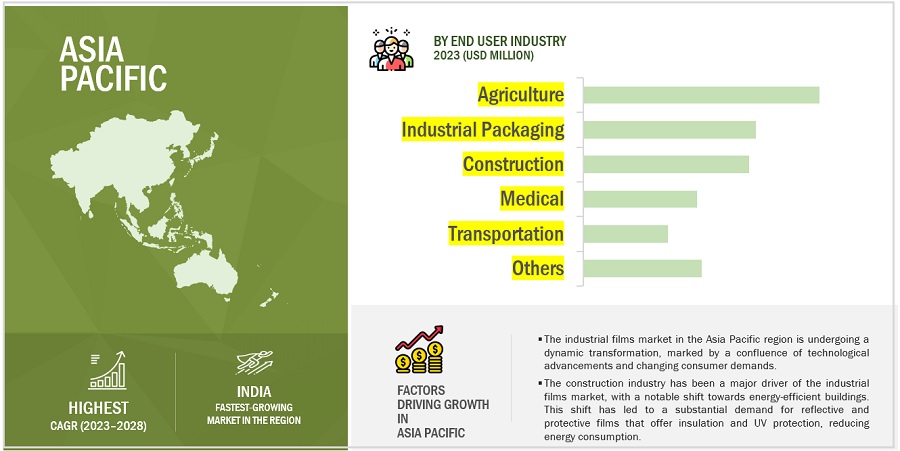

Asia Pacific is projected to account for the highest CAGR in the industrial films market during the forecast period

APAC is estimated to be the largest market for industrial films and is also projected to register the fastest CAGR of 5.82% during the forecast period. China is expected to account for the largest share of the market in APAC till 2028. China’s significant industrial growth and urbanization are mainly driving the industrial films market in the country. The emergence of China as a global manufacturing hub has increased the demand for industrial films. The increasing usage of agricultural films to boost crop production on account of the rapidly growing population in the country is further encouraging market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Industrial films market comprises key manufacturers such as Saint-Gobain (France), Eastman Chemical Company (US), Berry Global Inc. (US), 3M Company (US), and Toray Industries, Inc. (Japan) and others. Expansions, acquisitions, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the industrial films market.

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Million Sq. Meter) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Saint-Gobain (France), Berry Global Inc. (US), Toray Industries, Inc. (Japan), Eastman Chemical Company (US), RKW SE (Germany), 3M Company (US), Mitsubishi Chemical Group Corporation (Japan), DuPont Teijin Films (US), Sigma Plastics Group (US), Kolon Industries (South Korea) and Others. |

This research report categorizes the global industrial films market on the basis of type, end use industry, and region.

On the basis of type

- LLDPE

- LDPE

- HDPE

- PET/BOPET

- PP/BOPP

- CPP

- PVC

- Polyamide/BOPA

- Others

On the basis of end use industry

- Agriculture

- Industrial Packaging

- Construction

- Medical

- Transportation

- Others

On the basis of region

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In April 2023, Berry Global launched a new version of its high-performance, patented NorDiVent form-fill-seal (FFS) film for powdered products, incorporating up to 50% recycled plastic content.

- In April 2023, Berry Global opened an International Center of Excellence and Circular Innovation Hub in Barcelona, Spain, to develop innovative product solutions for consumers.

- In February 2023, Eastman Chemical Company announced it has acquired Ai-Red Technology Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region.

- In December 2022, Toray Industries, Inc. announced that it has developed a polyethylene terephthalate (PET) film that combines excellent applicability and adhesion for water-based, solvent-free coatings and can eliminate solvent-derived carbon dioxide emissions.

- In October 2022, Saint Gobain decided to boost production capacity by 60% for Lumirror™ biaxially oriented polyester release films for manufacturing multilayer ceramic capacitors (MLCCs).

- In March 2022, Toray Industries, Inc. developed a stretchable film with exceptional resistance value stability. The film is very flexible. It recovers its shape between -68°F and 176°F. It also maintains heat resistance even after treatment at 392°F

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the industrial films market?

The major driving factors for the industrial films market are the global surge in industrialization and urbanization which has had a pronounced impact on the industrial films market, technological advancements and innovations in film materials, and increasing use of industrial films in sustainable agriculture

What are the major challenges in the industrial films market?

The major challenging factor faced by the industrial films market are Raw material price fluctuations and Challenges in recycling of plastics.

What are the restraining factors in the industrial films market?

The major restraining factor faced by the industrial films market is Adapting to changing regulatory landscape

What is the key opportunity in the industrial films market?

Eco-friendly innovations in industrial films and Specialized films for advanced industrial needs

What are the end-use industries where industrial films components are used?

The industrial films are majorly used in agriculture, industrial packaging, construction, medical, transportation, and others

What are the different types of industrial films?

The different film types of industrial films are Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polyethylene Terephthalate/Bi-axially Oriented Polyethylene Terephthalate (PET/BOPET), Polypropylene/Bi-axially Oriented Polypropylene (PP/BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), Polyamide/Bi-axially Oriented Polyamide (BOPA), and Others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Capitalizing on urban-industrial boom- Harnessing technological prowess- Increasing use of industrial films in sustainable agricultureRESTRAINTS- Adapting to changing regulatory landscapeOPPORTUNITIES- Eco-friendly innovations in industrial films- Specialized films for advanced industrial needsCHALLENGES- Raw material price fluctuations- Challenges in recycling of plastics

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

-

6.3 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT FOR INDUSTRIAL FILM PLAYERS

-

6.4 TARIFF AND REGULATORY LANDSCAPEUNITED STATES INTERNATIONAL TRADE COMMISSION (USITC)BUREAU OF INDIAN STANDARDS (BIS)

-

6.5 REGULATORY BODIES AND GOVERNMENT AGENCIESEUROPEAN CHEMICALS AGENCY (ECHA)MINISTRY OF HEALTH, LABOUR AND WELFARE (MHLW) AND MINISTRY OF ECONOMY, TRADE AND INDUSTRY (METI)

- 6.6 PRICING ANALYSIS

-

6.7 ECOSYSTEM MAPPING

-

6.8 TECHNOLOGY ANALYSISSMART FILMSANTI-GLARE AND ANTI-REFLECTIVE COATINGS TECHNOLOGYAUGMENTED REALITY (AR) FILMS

-

6.9 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTSTRENDS AND FORECASTS OF AGRICULTURE INDUSTRY AND THEIR IMPACT ON INDUSTRIAL FILMSGLOBAL AUTOMOBILE PRODUCTION AND GROWTHINFLATION RATE, AVERAGE CONSUMER PRICE

- 6.10 SUPPLY CHAIN ANALYSIS

-

6.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPE FOR AGRICULTURAL FILMS (2013–2022)INSIGHTSTOP COMPANIES/APPLICANTS (TILL 2022)

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 TRADE ANALYSIS

-

6.14 CASE STUDY ANALYSISBERRY PLASTIC GROUP, INC. IMPROVED EFFICIENCY OF FARMING OPERATIONS WITH SILOTITE 1800BASF PLANS TO USE ECOVIO FOR CIRCULAR ECONOMY

- 6.15 KEY CONFERENCES

- 7.1 INTRODUCTION

- 7.2 INDUSTRIAL FILMS MARKET, BY FILM TYPE

- 7.3 LLDPE

- 7.4 LDPE

- 7.5 HDPE

- 7.6 PET/BOPET

- 7.7 PP/BOPP

- 7.8 CPP

- 7.9 PVC

- 7.10 PA/BOPA

- 7.11 OTHER FILM TYPES

- 8.1 INTRODUCTION

-

8.2 AGRICULTURERISE IN DEMAND FOR FOOD DUE TO INCREASE IN POPULATION AND CLIMATE CHANGES

-

8.3 INDUSTRIAL PACKAGINGPREVENTION OF GOODS DAMAGE DURING TRANSPORTATION TO DRIVE DEMAND

-

8.4 CONSTRUCTIONPREVENTION OF DAMAGE TO FURNISHINGS FROM UV RAYS AND ENERGY CONSERVATION TO DRIVE DEMAND

-

8.5 MEDICALINCREASE IN DEMAND FOR FACE SHIELDS AND PPE KITS TO DRIVE MARKET

-

8.6 TRANSPORTATIONINCREASE IN DEMAND FOR PAINT PROTECTION FILMS TO DRIVE MARKET

- 8.7 OTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTCHINA- Growing construction and automotive industries to drive marketINDIA- Booming e-commerce sector to drive marketJAPAN- Growth of electrical & electronics industry to drive marketSOUTH KOREA- Growing need for packaging materials to drive marketINDONESIA- Growing use of antimicrobial films in healthcare and packaging industries to drive marketTHAILAND- Burgeoning trend in automotive-grade protective films to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICARECESSION IMPACTUS- Strong investment in R&D to drive marketCANADA- Increasing infrastructure investments and supportive government programs to drive marketMEXICO- Increasing infrastructure spending to drive market

-

9.4 EUROPERECESSION IMPACTGERMANY- Growing automotive industry and agriculture sector to drive marketFRANCE- Capital investments in food and pharmaceutical industries to drive marketUK- Growth of healthcare industry to drive marketITALY- Rising demand from healthcare and food & beverage sectors to drive marketSPAIN- Extensive use of plastic films in agriculture industry to drive marketRUSSIA- War tensions to cause sluggish market growthREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Commencement of new construction projects to drive marketUAE- Increasing demand from construction industry to drive marketIRAN- Efficient crop management to drive marketSOUTH AFRICA- Growing manufacturing and construction sectors to drive marketTURKEY- Increase in adoption of greenhouse farming and growing automotive industry to drive marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Increasing adoption of greenhouse farming to drive marketARGENTINA- Growing construction activities and government efforts to drive marketREST OF SOUTH AMERICA

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSSAINT-GOBAIN- Business overview- Products offered- Recent developments- MnM viewBERRY GLOBAL INC.- Business overview- Products offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products offered- Recent developments- MnM viewRKW SE- Business overview- Products offered- Recent developments- MnM view3M COMPANY- Business overview- Products offered- MnM viewMITSUBISHI CHEMICAL GROUP CORPORATION- Business overview- Products offered- MnM viewDUPONT TEIJIN FILMS- Business overview- Products offeredSIGMA PLASTICS GROUP- Business overview- Products offeredKOLON INDUSTRIES, INC- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSTOYOBOPOLYPLEXROGERS CORPORATIONSOLVAYMITSUI CHEMICALS TOHCELLO, INC.THE CHEMOURS COMPANYTHE COSMO FILMSPOLIFILM GROUPIM SANIN SRLDUNMORE CORPORATIONJINDAL POLYFILMSPLASTIK V SDN. BHDINTEPLAST GROUPNOVOLEXZHEJIANG YIMEI FILM INDUSTRY GROUP CO., LTD.

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 AGRICULTURAL FILMS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 12.4 AGRICULTURAL FILMS, BY TYPE

- 12.5 AGRICULTURAL FILMS MARKET, BY APPLICATION

- 12.6 AGRICULTURAL FILMS MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INDUSTRIAL FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ECOSYSTEM OF INDUSTRIAL FILMS MARKET

- TABLE 4 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 5 AGRICULTURE AS PERCENTAGE OF GDP, BY KEY COUNTRY, 2021

- TABLE 6 GLOBAL AUTOMOBILE PRODUCTION (UNITS) AND GROWTH, BY COUNTRY, 2021–2022

- TABLE 7 INFLATION RATE, AVERAGE CONSUMER PRICE (ANNUAL PERCENT CHANGE)

- TABLE 8 TOTAL NUMBER OF PATENTS FOR AGRICULTURAL FILMS

- TABLE 9 PATENTS FOR AGRICULTURAL FILMS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF INDUSTRIAL FILMS

- TABLE 11 KEY BUYING CRITERIA FOR INDUSTRIAL FILMS INDUSTRY

- TABLE 12 UNPROCESSED PLASTIC MATERIALS IN FLAT FORMS LIKE PLATES, SHEETS, FILM, FOIL, OR STRIP, WITHOUT REINFORCEMENT OR BACKING, AND NOT COMBINED WITH OTHER SUBSTANCES WITH EXPORT VALUES FOR MAJOR COUNTRIES, 2022 (USD BILLION)

- TABLE 13 UNPROCESSED PLASTIC MATERIALS IN FLAT FORMS LIKE PLATES, SHEETS, FILM, FOIL, OR STRIP, WITHOUT REINFORCEMENT OR BACKING, AND NOT COMBINED WITH OTHER SUBSTANCES WITH IMPORT VALUES FOR MAJOR COUNTRIES, 2022 (USD BILLION)

- TABLE 14 INDUSTRIAL FILMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 15 INDUSTRIAL FILM MARKET, BY FILM TYPE, 2017–2020 (USD MILLION)

- TABLE 16 INDUSTRIAL FILMS MARKET, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

- TABLE 17 INDUSTRIAL FILM MARKET, BY FILM TYPE, 2021–2028 (USD MILLION)

- TABLE 18 INDUSTRIAL FILMS MARKET, BY FILM TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 19 INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 20 INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 21 INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 22 INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 23 INDUSTRIAL FILM MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 24 INDUSTRIAL FILMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 INDUSTRIAL FILM MARKET, BY REGION, 2017–2020 (MILLION SQUARE METER)

- TABLE 26 INDUSTRIAL FILMS MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 27 ASIA PACIFIC: INDUSTRIAL FILMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 28 ASIA PACIFIC: INDUSTRIAL FILM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 30 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 31 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 32 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 34 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 35 CHINA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 36 CHINA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 37 CHINA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 38 CHINA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 39 INDIA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 40 INDIA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 41 INDIA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 42 INDIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 43 JAPAN: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 44 JAPAN: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 45 JAPAN: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 46 JAPAN: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 47 SOUTH KOREA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 48 SOUTH KOREA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 49 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 50 SOUTH KOREA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 51 INDONESIA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 52 INDONESIA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 53 INDONESIA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 54 INDONESIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 55 THAILAND: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 56 THAILAND: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 57 THAILAND: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 58 THAILAND: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 59 REST OF ASIA PACIFIC: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 62 REST OF ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 63 NORTH AMERICA: INDUSTRIAL FILMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 64 NORTH AMERICA: INDUSTRIAL FILM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 67 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 70 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 71 US: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 72 US: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 73 US: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 74 US: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 75 CANADA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 76 CANADA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 78 CANADA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 79 MEXICO: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 80 MEXICO: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 81 MEXICO: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 82 MEXICO: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 83 EUROPE: INDUSTRIAL FILMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 84 EUROPE: INDUSTRIAL FILM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 86 EUROPE: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 87 EUROPE: MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 90 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 91 GERMANY: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 92 GERMANY: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 93 GERMANY: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 94 GERMANY: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 95 FRANCE: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 96 FRANCE: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 97 FRANCE: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 98 FRANCE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 99 UK: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 100 UK: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 101 UK: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 102 UK: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 103 ITALY: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 104 ITALY: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 105 ITALY: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 106 ITALY: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 107 SPAIN: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 108 SPAIN: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 109 SPAIN: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 110 SPAIN: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 111 RUSSIA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 112 RUSSIA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 113 RUSSIA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 114 RUSSIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 115 REST OF EUROPE: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 116 REST OF EUROPE: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 118 REST OF EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 119 MIDDLE EAST & AFRICA: INDUSTRIAL FILMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: INDUSTRIAL FILM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 123 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 127 SAUDI ARABIA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 128 SAUDI ARABIA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 129 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 130 SAUDI ARABIA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 131 UAE: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 132 UAE: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 133 UAE: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 134 UAE: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 135 IRAN: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 136 IRAN: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 137 IRAN: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 138 IRAN: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 139 SOUTH AFRICA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 140 SOUTH AFRICA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 141 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 142 SOUTH AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 143 TURKEY: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 144 TURKEY: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 145 TURKEY: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 146 TURKEY: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 151 SOUTH AMERICA: INDUSTRIAL FILMS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 152 SOUTH AMERICA: INDUSTRIAL FILM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 154 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 155 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 156 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 158 SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 159 BRAZIL: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 160 BRAZIL: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 161 BRAZIL: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 162 BRAZIL: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 163 ARGENTINA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 164 ARGENTINA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 165 ARGENTINA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 166 ARGENTINA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 167 REST OF SOUTH AMERICA: INDUSTRIAL FILMS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 168 REST OF SOUTH AMERICA: INDUSTRIAL FILM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

- TABLE 170 REST OF SOUTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 171 INDUSTRIAL FILMS MARKET: DEGREE OF COMPETITION

- TABLE 172 KEY PLAYERS IN INDUSTRIAL FILM MARKET

- TABLE 173 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 174 PRODUCT LAUNCHES, 2019–2023

- TABLE 175 DEALS, 2019–2023

- TABLE 176 OTHERS, 2019–2023

- TABLE 177 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 178 SAINT-GOBAIN: PRODUCTS OFFERED

- TABLE 179 SAINT-GOBAIN: DEALS

- TABLE 180 SAINT-GOBAIN: OTHERS

- TABLE 181 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 182 BERRY GLOBAL INC.: PRODUCTS OFFERED

- TABLE 183 BERRY GLOBAL INC.: PRODUCT LAUNCHES

- TABLE 184 BERRY GLOBAL INC.: DEALS

- TABLE 185 BERRY GLOBAL INC.: OTHERS

- TABLE 186 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 187 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 188 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 189 TORAY INDUSTRIES, INC.: OTHERS

- TABLE 190 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 191 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 192 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 193 EASTMAN CHEMICAL COMPANY: OTHERS

- TABLE 194 RKW SE: COMPANY OVERVIEW

- TABLE 195 RKW SE: PRODUCTS OFFERED

- TABLE 196 RKW SE: PRODUCT LAUNCHES

- TABLE 197 3M COMPANY: COMPANY OVERVIEW

- TABLE 198 3M COMPANY: PRODUCTS OFFERED

- TABLE 199 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 200 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 201 DUPONT TEIJIN FILMS: COMPANY OVERVIEW

- TABLE 202 DUPONT TEIJIN FILMS: PRODUCTS OFFERED

- TABLE 203 SIGMA PLASTICS GROUP: COMPANY OVERVIEW

- TABLE 204 SIGMA PLASTICS GROUP: PRODUCTS OFFERED

- TABLE 205 KOLON INDUSTRIES, INC: COMPANY OVERVIEW

- TABLE 206 KOLON INDUSTRIES, INC: PRODUCTS OFFERED

- TABLE 207 KOLON INDUSTRIES, INC.: OTHERS

- TABLE 208 TOYOBO: COMPANY OVERVIEW

- TABLE 209 POLYPLEX: COMPANY OVERVIEW

- TABLE 210 ROGERS CORPORATION: COMPANY OVERVIEW

- TABLE 211 SOLVAY: COMPANY OVERVIEW

- TABLE 212 MITSUI CHEMICALS TOHCELLO, INC.: COMPANY OVERVIEW

- TABLE 213 THE CHEMOURS COMPANY: COMPANY OVERVIEW

- TABLE 214 THE COSMO FILMS: COMPANY OVERVIEW

- TABLE 215 POLIFILM GROUP: COMPANY OVERVIEW

- TABLE 216 IM SANIN SRL: COMPANY OVERVIEW

- TABLE 217 DUNMORE CORPORATION: COMPANY OVERVIEW

- TABLE 218 JINDAL POLYFILMS: COMPANY OVERVIEW

- TABLE 219 PLASTIK V SDN. BHD: COMPANY OVERVIEW

- TABLE 220 INTEPLAST GROUP: COMPANY OVERVIEW

- TABLE 221 NOVOLEX: COMPANY OVERVIEW

- TABLE 222 ZHEJIANG YIMEI FILM INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 223 AGRICULTURAL FILMS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 224 AGRICULTURAL FILMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 225 AGRICULTURAL FILMS MARKET, BY TYPE, 2017–2022 (KILOTON)

- TABLE 226 AGRICULTURAL FILMS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 227 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 228 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2017–2022 (KILOTON)

- TABLE 230 AGRICULTURAL FILMS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 231 AGRICULTURAL FILMS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 232 AGRICULTURAL FILMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 233 AGRICULTURAL FILMS MARKET, BY REGION, 2017–2022 (KILOTON)

- TABLE 234 AGRICULTURAL FILMS MARKET, BY REGION, 2023–2028 (KILOTON)

- FIGURE 1 INDUSTRIAL FILMS MARKET SEGMENTATION

- FIGURE 2 INDUSTRIAL FILM MARKET: RESEARCH DESIGN

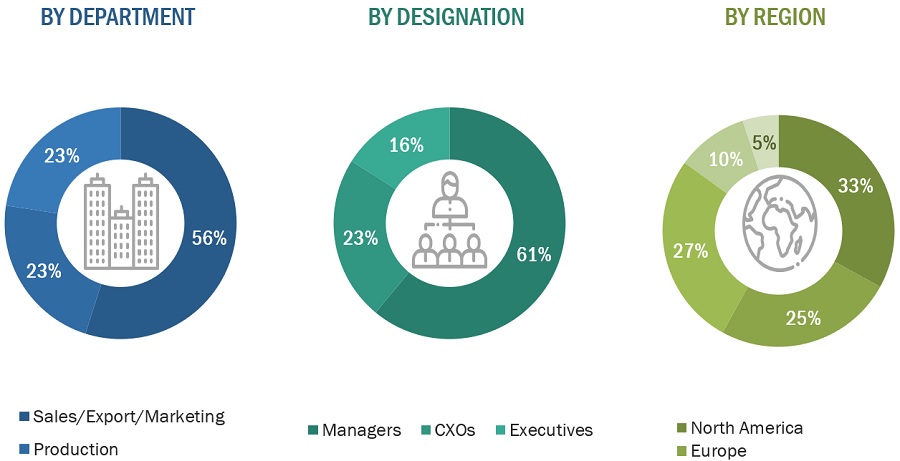

- FIGURE 3 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE

- FIGURE 7 INDUSTRIAL FILMS MARKET: DATA TRIANGULATION

- FIGURE 8 LLDPE SEGMENT TO BE LARGEST FILM TYPE DURING FORECAST PERIOD

- FIGURE 9 AGRICULTURE END-USE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 11 INCREASING DEMAND FROM END-USE INDUSTRIES TO DRIVE MARKET

- FIGURE 12 CHINA DOMINATES INDUSTRIAL FILMS MARKET IN ASIA PACIFIC

- FIGURE 13 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INDUSTRIAL FILMS MARKET

- FIGURE 15 INDUSTRIAL FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS OF INDUSTRIAL FILMS

- FIGURE 17 REVENUE SHIFT FOR INDUSTRIAL FILM MANUFACTURERS

- FIGURE 18 INDUSTRIAL FILMS MARKET: ECOSYSTEM MAPPING

- FIGURE 19 INDUSTRIAL FILM MARKET: SUPPLY CHAIN

- FIGURE 20 AGRICULTURAL FILMS: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

- FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS (2013–2022)

- FIGURE 22 JURISDICTION ANALYSIS (2013–2022)

- FIGURE 23 TOP APPLICANTS OF AGRICULTURAL FILMS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 25 KEY BUYING CRITERIA OF INDUSTRIAL FILMS INDUSTRY

- FIGURE 26 LLDPE FILMS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 AGRICULTURE TO BE LARGEST END-USE INDUSTRY OF INDUSTRIAL FILMS

- FIGURE 28 ASIA PACIFIC TO BE FASTEST-GROWING INDUSTRIAL FILMS MARKET

- FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- FIGURE 32 MARKET SHARE OF KEY PLAYERS IN INDUSTRIAL FILMS MARKET, 2022

- FIGURE 33 MARKET RANKING OF TOP FIVE KEY PLAYERS, 2022

- FIGURE 34 REVENUE OF KEY PLAYERS, 2018–2022

- FIGURE 35 COMPANY EVALUATION MATRIX, 2022

- FIGURE 36 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 37 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 38 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 39 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 40 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 41 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 42 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

The study involved four major activities for estimating the current size of the global industrial films market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of industrial films through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the industrial films market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Dun & Bradstreet, edana.org, associations were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The industrial films market comprises several stakeholders such as raw material suppliers, technology developers, industrial films companies, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of end use applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global industrial films market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

The overall market size has been used in the top-down approach to estimate the sizes of other individual markets mentioned in the segmentation through percentage splits derived using secondary and primary sources.

For calculating each type of specific market segment, the size of the most appropriate immediate parent market has been considered for implementing the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market sizes, in terms of value and volume, obtained for each segment.

The exact values of the overall parent and individual markets have been determined and confirmed through the data triangulation procedure and validation of data through primary interviews. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

Following the estimating process described above to determine the total market size, the market was divided into a number of segments and sub-segments. In order to complete the process of estimating the overall market size and determine the precise statistics for all segments and sub-segments, the data triangulation and market breakdown processes were used, where applicable. By examining multiple factors and trends from both the supply and demand sides, the data was triangulated. In addition, both top-down and bottom-up methods were used to validate the market size. After that, it was verified through primary interviews. As a result, there are three sources for each data segment: a top-down approach, a bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Industrial films are plastic films that are manufactured from polymeric materials such as linear low-density polyethylene (LLDPE), low-density polyethylene (LDPE), polyethylene terephthalate (PET)/biaxially-oriented polyethylene terephthalate (BOPET), polypropylene (PP)/biaxially oriented polypropylene (BOPP), and others. These films are used to hold items and protect goods from damage. They help increase transportation efficiency, increase the shelf life of perishable goods, and prevent product damage, wastage, and deterioration. Industrial films are used in various end-use industries, such as transportation, construction, agriculture, industrial packaging, and medical.

Key Stakeholders

- Manufacturers of industrial films

- Manufacturers in end-use industries such as agriculture, transportation, industrial packaging, medical, construction, and others

- Industry associations

- Industrial film traders, suppliers, and distributors

- Regional manufacturers’ associations and general plastic film associations

- Government and regional agencies and research organizations

Report Objectives

- To define, describe, and forecast the global industrial films market on the basis of end-use industry, type, and region

- To forecast the market size, in terms of value and volume, of the regions, namely, North America, Europe, Asia Pacific, South America and Middle East & Africa.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their key developments such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the industrial films market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information:

- Industrial films market analysis for additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each type of industrial films products

Growth opportunities and latent adjacency in Industrial Films Market