Industrial Tubes Market by Type (Process Pipes, Mechanical, Heat Exchanger, Structural), Material (Steel, Non-steel), Manufacturing (Seamless, Welded), End-use (Oil & Gas and Petrochemical, Automotive, Chemical), and Region - Global Forecast to 2023

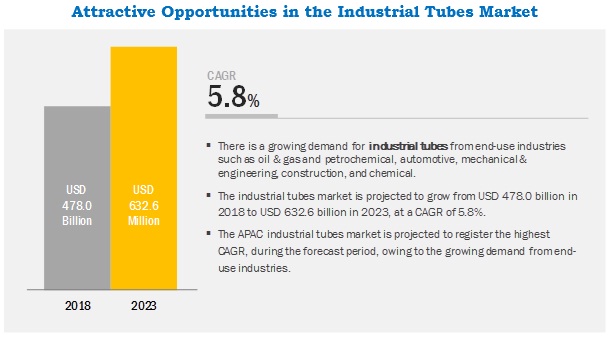

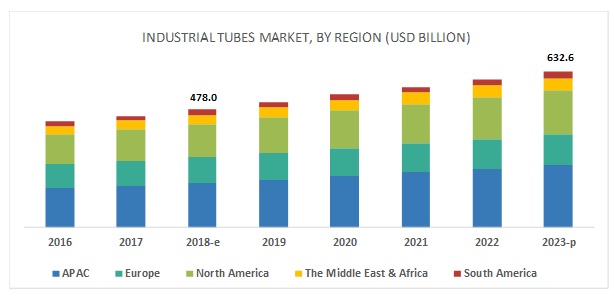

[133 Pages Report] The industrial tubes market size is estimated at USD 478.0 billion in 2018 and is projected to reach USD 632.6 billion by 2023, at a CAGR of 5.8%. Growth in the global petrochemical and chemical industry is the major driver for the industrial tubes market. In addition, the growing energy & power segment is also driving the demand for industrial tubes.

The steel tubes segment dominates the industrial tubes market and is projected to be the fastest-growing material segment

Steel has high strength, high durability, excellent chemical and corrosion resistance, formability, and weldability due to which it has a high consumption rate. It is widely used in the manufacturing of these industrial tubes used in the chemical, oil & gas and petrochemical, energy & power, automotive, and many other industries. The steel segment, thus, dominates the industrial tubes market. Also, it is projected to register the highest growth rate during the forecast period owing to the rapidly growing end-use industries in emerging economies such as China and India.

The oil & gas and petrochemical industry segment is projected to register the highest CAGR during the forecast period.

The oil & gas industry is the dominant end user of steel tubes, and therefore the growth in oil & gas production is the major driving factor for the industrial tubes market. According to BP Statistics, the Middle East countries, the US, and Russia are expected to account for 69% of the oil production in 2040, a significant increase from 60% in 2016. The oil & gas sector is very important for seamless tube demand as approximately 50% of all seamless tubes & pipes are used for oil & gas applications including OCTG, topside process pipes, riser pipes, subsea flowlines, and heat exchanger tubes or instrumentation tubes among others. This has increased the consumption of steel tubes in the oil & gas and petrochemical and chemical industries.

APAC is projected to be the largest market, in terms of value, during the forecast period.

APAC has the largest populous countries such as China and India. These countries are rapidly going through capacity expansion in the petrochemical and chemical industry owing to the increased consumption of the chemical products. In addition, automobile production is also expected to grow significantly with the growth in the disposable income of the middle-class population. The industrial tubes market is, therefore, expected to experience a positive growth trend in the automotive industry. The construction industry is also expected to witness moderate demand for industrial tubes with the growth in the commercial infrastructure in key regions.

Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan), Vallourec S.A. (France), Sandvik AB (Sweden), Tenaris (Luxembourg), and Tata Steel (India) are the key players operating in the industrial tubes market.

These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2018 to strengthen their position in the market. New product launch and supply contract were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for industrial tubes from emerging economies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) and Volume (Kiloton) |

|

Segments covered |

Type, Material, Manufacturing Method, and End-use Industry, and Region |

|

Regions covered |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies covered |

Nippon Steel & Sumitomo Metal Corporation (NSSMC) (Japan), Vallourec S.A. (France), Sandvik AB (Sweden), Tenaris (Luxembourg), Tata Steel (India) |

This research report categorizes the industrial tubes market based on type, material, manufacturing method, end-use industry, and region.

Industrial Tubes Market by Type:

- Process Pipes

- Mechanical Tubes

- Heat Exchanger Tubes

- Structural Tubes

- Hydraulic & Instrumentation Tubes

- Others (Capillary Tubes, Boiler Tubes, Precision Tubes)

Industrial Tubes Market by Manufacturing Method:

- Seamless

- Welded

Industrial Tubes Market, by Material:

- Steel

- Non-steel

Industrial Tubes Market, by End-use Industry

- Oil & Gas and Petrochemical

- Automotive

- Mechanical & Engineering

- Construction

- Chemical

- Others (Sanitary Systems, Water Treatment, Medical Tubes, Pharmaceutical, Food & Beverage, Aerospace, and Marine)

Industrial Tubes Market, by Region

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The industrial tubes market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In September 2016, Nippon Steel & Sumitomo Metal Corporation established NIPPON STEEL & SUMITOMO METAL VIETNAM COMPANY LIMITED in Vietnam to cater to the steel tubes demand in the country.

- In July 2018, Vallourec S.A. developed copper tubes for the long period storage of wasted nuclear fuel. This project was undertaken in 2006, with a contract from customer Posiva Oy (France), a nuclear waste management organization.

- In November 2017, Vallourec S.A. received a contract to supply 16,000 tons of OCTG tubular solution to China National Offshore Oil Corporation (CNOOC), in Shenzhen, Shanghai, Tianjin, and Zhanjiang in China.

- In September 2018, Sandvik AB secured a deal to supply advanced tubes worth USD 55.2 million to the oil & gas industry. The deal was secured in the third quarter of 2018.

- In July 2018, Sandvik AB secured a deal to supply advanced tubes worth USD 55.2 million to the power & energy industry. The deal was secured in the second quarter of 2018.

Critical questions the report answers:

- What are the upcoming hot bets for industrial tubes market?

- How is the market dynamics changing for different types of industrial tubes?

- How is the market dynamics changing for different end-use industries of industrial tubes?

- Who are the major manufacturers of industrial tubes?

- How is the market dynamics changing for different regions of industrial tubes?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

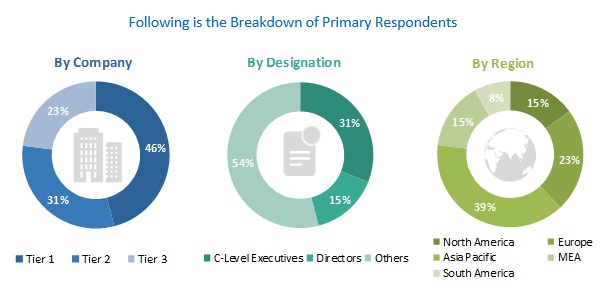

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Estimation

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Industrial Tubes Market

4.2 Industrial Tubes Market, By Material

4.3 Industrial Tubes Market, By Manufacturing Method

4.4 Industrial Tubes Market, By Type

4.5 Industrial Tubes Market, By End-Use Industry

4.6 Industrial Tubes Market in APAC, By End-Use Industry and Country

4.7 Industrial Tubes Market: Major Countries

5 Macro Indicator Analysis (Page No. - 37)

5.1 Macro Indicator Analysis

5.2 Real GDP Growth Rate Forecast of Major Economies

5.3 Energy Consumption Data

5.4 Crude Oil Production Data (Million Tonnes)

6 Market Overview (Page No. - 40)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Increasing Consumption of Steel Tubes in End-Use Industries

6.2.1.2 Increasing Energy & Power Production

6.2.1.3 Effective Characteristics and Properties of Industrial Tubes

6.2.2 Restraints

6.2.2.1 Saturated Markets Have Less Demand for Industrial Tubes

6.2.3 Opportunities

6.2.3.1 Increase in Offshore Spending and New Oilfield Discoveries

6.2.4 Challenges

6.2.4.1 Volatile Prices of Raw Materials

6.2.4.2 Stringent Government Regulations in Different Countries

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Industrial Tubes Market, By Material (Page No. - 48)

7.1 Introduction

7.2 Steel

7.2.1 Carbon Steel

7.2.1.1 Industrial Tubes Made From Carbon Steel are in High Demand From Various End-Use Industries

7.2.2 Stainless Steel

7.2.2.1 Stainless Steel Tubes Offer Excellent Chemical and Corrosion Resistance, Which Makes them Highly Suitable for Use in Various Industries

7.2.3 Alloy Steel

7.2.3.1 Excellent Properties of Alloy Steel Drive Its Demand in Various End-Use Industries

7.2.4 Non-Steel

7.2.4.1 Sanitary Systems, Medical Equipment, and Hvacr Systems Have A High Demand for Tubes Made From Non-Steel Materials

7.2.5 Brass

8 Industrial Tubes Market, By Manufacturing Method (Page No. - 52)

8.1 Introduction

8.2 Seamless

8.2.1 Seamless Industrial Tubes are Expected to Witness High Cagr During the Forecast Period

8.3 Welded

8.3.1 Welded Industrial Tubes Dominated the Industrial Tubes Market With A Higher Market Share

9 Industrial Tubes Market, By Type (Page No. - 55)

9.1 Introduction

9.2 Process Pipes

9.2.1 Growth in Upstream Expansion Projects in APAC is Expected to Drive the Demand for Process Pipes

9.3 Structural Tubes

9.3.1 Commercial Infrastructure Projects are Driving the Demand for Structural Tubes

9.4 Heat Exchanger Tubes

9.4.1 Growing Demand for Hvacr Systems is Expected to Generate A Positive Impact on the Heat Exchanger Tubes Segment

9.5 Mechanical Tubes

9.5.1 The Growth of the Automotive Industry and Increased Demand for Mechanical Machinery are Expected to Drive the Mechanical Tubes Demand

9.6 Hydraulic & Instrumentation Tubes

9.6.1 High Tensile Strength and Corrosion Resistance Properties Drive the Demand for Hydraulic & Instrumentation Tubes

9.7 Others

10 Industrial Tubes Market, By End-Use Industry (Page No. - 60)

10.1 Introduction

10.2 Oil & Gas and Petrochemical Industry

10.2.1 Oil & Gas and Petrochemical Industry Leads the Industrial Tubes Market

10.3 Automotive Industry

10.3.1 Global Growth in the Automotive Industry is Driving the Demand for Industrial Tubes

10.4 Construction Industry

10.4.1 Structural Welded Tubes Have A High Demand From the Construction Industry

10.5 Mechanical & Engineering Industry

10.5.1 Rapidly Growing Industrialization Drives the Industrial Tubes Market in This Segment

10.6 Chemical

10.6.1 Expansion in the Chemical Industry is Expected to Drive the Market for Industrial Tubes

10.7 Others

11 Industrial Tubes Market, By Region (Page No. - 65)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Rapid Expansion in the Oil & Gas and Petrochemical Industry is A Major Boost for the Us Industrial Tubes Market

11.2.2 Canada

11.2.2.1 The Automotive Industry is Among the Major Drivers for the Market Growth in the Country

11.2.3 Mexico

11.2.3.1 Presence of Leading Global Automobile Manufacturers Helps in the Industrial Tubes Market Growth

11.3 APAC

11.3.1 China

11.3.1.1 Expansion of Oil & Gas Industry and Continued Growth of Chemical Industry are Likely to Boost the Market

11.3.2 India

11.3.2.1 Significant Growth in All the Major End-Use Industries of Industrial Tubes is Propelling the Market

11.3.3 South Korea

11.3.3.1 Demand for Industrial Tubes in the Country is Driven By Growing Regional Exports From the Petroleum and Chemical Industries

11.3.4 Japan

11.3.4.1 Presence of Established Automotive and Chemical Industries is Favorable for the Industrial Tubes Market Growth in Japan

11.3.5 Rest of APAC

11.4 Europe

11.4.1 Germany

11.4.1.1 The Automobile and Chemical Industries Drive the Industrial Tubes Market in Germany

11.4.2 UK

11.4.2.1 Growth in Exploration Spending and Development of Identified Crude Oil Basins are Expected to Drive the Industrial Tubes Demand

11.4.3 Spain

11.4.3.1 Presence of A Well-Established Automotive Industry Supports the Industrial Tubes Market Growth in Spain

11.4.4 Italy

11.4.4.1 High Growth of the Automotive Industry is Likely to Propel the Market in Italy

11.4.5 Russia

11.4.5.1 Expansion in the Oil & Gas Industry is Expected to Drive the Demand for Industrial Tubes

11.4.6 Rest of Europe

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.1.1 Growing End-Use Industries of Industrial Tubes in Saudi Arabia Provide A Boost to the Market

11.5.2 South Africa

11.5.2.1 Construction and Automotive Industries are the Major Drivers for the Country’s Industrial Tubes Market

11.5.3 Rest of Middle East & Africa

11.6 South America

11.6.1 Brazil

11.6.1.1 Huge Growth in Automotive Production is Expected to Drive the Industrial Tubes Market

11.6.2 Rest of South America

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Market Ranking of Key Players

12.3 Competitive Scenario

12.3.1 New Product Launch

12.3.2 Expansion

12.3.3 Supply Contract

12.3.4 Acquisition, Joint Venture, and Merger

13 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Nippon Steel & Sumitomo Metal Corporation

13.2 Vallourec S.A.

13.3 Sandvik AB

13.4 Tenaris

13.5 Tata Steel

13.6 Tubacex

13.7 United States Steel Corporation

13.8 Benteler

13.9 Aperam

13.10 AK Tube LLC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13.11 Other Companies

13.11.1 Acciai Speciali Terni S.P.A.

13.11.2 Kme Germany Gmbh & Co Kg

13.11.3 Wieland

13.11.4 Hutmen S.A.

13.11.5 Macsteel

13.11.6 Tubos Apolo

13.11.7 Ratnamani Metal & Tubes Ltd.

13.11.8 Jindal Saw Ltd.

13.11.9 Heavy Metals & Tubes Ltd.

13.11.10 Ssp Corporation

13.11.11 Divine Tubes Pvt. Ltd

13.11.12 Sanghvi Overseas

13.11.13 Halcor

13.11.14 Eisenbau Krämer Gmbh

13.11.15 Tmk

14 Appendix (Page No. - 127)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (73 Tables)

Table 1 Forecast of Real GDP Growth Rates, 2016–2023 (Annual Percent Change)

Table 2 Industrial Tube Market Size, By Material, 2016–2023 (Kiloton)

Table 3 Industrial Tubes Market Size, By Material, 2016–2023 (USD Million)

Table 4 Industrial Tubes Market Size, By Type, 2016–2023 (Kiloton)

Table 5 Industrial Tubes Market Size, By Type, 2016–2023 (USD Million)

Table 6 Industrial Tubes Market Size, By Type, 2018–2023 (Kiloton)

Table 7 Industrial Tubes Market Size, By Type, 2018–2023 (USD Million)

Table 8 Industrial Tubes Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 9 Industrial Tubes Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 10 Industrial Tubes Market Size, By Region, 2016-2023 (Kiloton)

Table 11 Industrial Tubes Market Size, By Region, 2016-2023 (USD Million)

Table 12 North America: By Market Size, By Country, 2016-2023 (Kiloton)

Table 13 North America: By Market Size, By Country, 2016-2023 (USD Million)

Table 14 North America: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 15 North America: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 16 US: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 17 US: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 18 Canada: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 19 Canada: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 20 Mexico: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 21 Mexico: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 22 APAC: By Market Size, By Country, 2016-2023 (Kiloton)

Table 23 APAC: By Market Size, By Country, 2016-2023 (USD Million)

Table 24 APAC: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 25 APAC: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 26 China: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 27 China: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 28 India: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 29 India: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 30 South Korea: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 31 South Korea: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 32 Japan: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 33 Japan: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 34 Rest of APAC: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 35 Rest of APAC: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 36 Europe: By Market Size, By Country, 2016-2023 (Kiloton)

Table 37 Europe: By Market Size, By Country, 2016-2023 (USD Million)

Table 38 Europe: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 39 Europe: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 40 Germany: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 41 Germany By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 42 UK: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 43 UK: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 44 Spain: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 45 Spain: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 46 Italy: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 47 Italy: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 48 Russia: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 49 Russia: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 50 Rest of Europe: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 51 Rest of Europe: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 52 Middle East & Africa: By Market Size, By Country, 2016-2023 (Kiloton)

Table 53 Middle East & Africa: By Market Size, By Country, 2016-2023 (USD Million)

Table 54 Middle East & Africa: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 55 Middle East & Africa: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 56 Saudi Arabia: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 57 Saudi Arabia: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 58 South Africa: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 59 South Africa: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 60 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 61 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 62 South America: By Market Size, By Country, 2016-2023 (Kiloton)

Table 63 South America: By Market Size, By Country, 2016-2023 (USD Million)

Table 64 South America: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 65 South America: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 66 Brazil: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 67 Brazil: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 68 Rest of South America: By Market Size, By End-Use Industry, 2016-2023 (Kiloton)

Table 69 Rest of South America: By Market Size, By End-Use Industry, 2016-2023 (USD Million)

Table 70 New Product Launch, 2015–2018

Table 71 Expansion, 2015–2018

Table 72 Supply Contract, 2015–2018

Table 73 Acquisition, Joint Venture, and Merger, 2015–2018

List of Figures (40 Figures)

Figure 1 Industrial Tubes Market Segmentation

Figure 2 Industrial Tubes Market: Research Design

Figure 3 Steel Segment Accounted for the Larger Share in the Industrial Tubes Market in 2017

Figure 4 Welded Manufacturing Method to Dominate the Industrial Tubes Market During the Forecast Period

Figure 5 Process Pipes to Witness the Highest Cagr in the Industrial Tubes Market

Figure 6 Oil & Gas and Petrochemical End-Use Industry to Account for the Largest Market Size During the Forecast Period

Figure 7 APAC is the Largest and Projected to Be the Fastest-Growing Industrial Tubes Market, By Region

Figure 8 Growth in the Construction Industry to Drive the Demand for Industrial Tubes

Figure 9 Steel to Be the Larger Segment of the Industrial Tubes Market During the Forecast Period

Figure 10 Welded Manufacturing Method to Capture the Larger Share in the Industrial Tubes Market During the Forecast Period

Figure 11 Process Pipes to Be the Largest Type of Industrial Tubes, 2018 vs. 2023

Figure 12 Oil & Gas and Petrochemical to Be the Largest End-Use Industry of Industrial Tubes

Figure 13 Oil & Gas and Petrochemical and China Accounted for the Largest Share in the Industrial Tubes Market in 2017

Figure 14 India to Grow at the Highest Rate During the Forecast Period

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Industrial Tubes Market

Figure 16 Porter’s Five Forces Analysis: Industrial Tubes Market

Figure 17 Steel Segment to Dominate the Industrial Tubes Market in 2018

Figure 18 Welded Tubes to Dominate the Industrial Tubes Market, 2016–2023

Figure 19 Process Pipes Segment to Lead the Industrial Tubes Market

Figure 20 Oil & Gas and Petrochemical Industry to Dominate the Industrial Tubes Market

Figure 21 APAC Emerging as New Hotspot in Industrial Tubes Market

Figure 22 North America: Industrial Tubes Market Snapshot

Figure 23 APAC: Industrial Tubes Market Snapshot

Figure 24 Europe: Industrial Tubes Market Snapshot

Figure 25 Companies Adopted Expansion as the Key Growth Strategy Between 2015 and 2018

Figure 26 Ranking of Key Industrial Tubes Manufacturers in 2017

Figure 27 Nippon Steel & Sumitomo Metal Corporation: Company Snapshot

Figure 28 Nippon Steel & Sumitomo Metal Corporation: SWOT Analysis

Figure 29 Vallourec: Company Snapshot

Figure 30 Vallourec: SWOT Analysis

Figure 31 Sandvik: Company Snapshot

Figure 32 Sandvik: SWOT Analysis

Figure 33 Tenaris: Company Snapshot

Figure 34 Tenaris: SWOT Analysis

Figure 35 Tata Steel: Company Snapshot

Figure 36 Tata Steel: SWOT Analysis

Figure 37 Tubacex: Company Snapshot

Figure 38 United State Steel Corporation: Company Snapshot

Figure 39 Benteler: Company Snapshot

Figure 40 Aperam: Company Snapshot

The study involved four major activities in estimating the current market size for industrial tubes. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The industrial tubes market comprises several stakeholders such as raw material suppliers, distributors of industrial tubes, steel associations, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers and suppliers of steel, copper, aluminum, and tubes. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial tubes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the steel, industrial tubes, and end-use industries.

Objectives of the Study:

- To define, describe, and forecast the industrial tubes market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, material, manufacturing method, and end-use industry

- To forecast the size of the market with respect to five regions, namely, APAC, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch, expansion, acquisition, merger, supply contract, and joint venture undertaken in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the industrial tubes market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Industrial Tubes Market