Industrial Wearables Market by Device Type (AR Glasses, VR Headsets, Smartwatches, Smart Bands), Industry (Automotive, Aerospace, Manufacturing, Oil & Gas, Power & Energy), Component, and Region - Global Forecast to 2025-2036

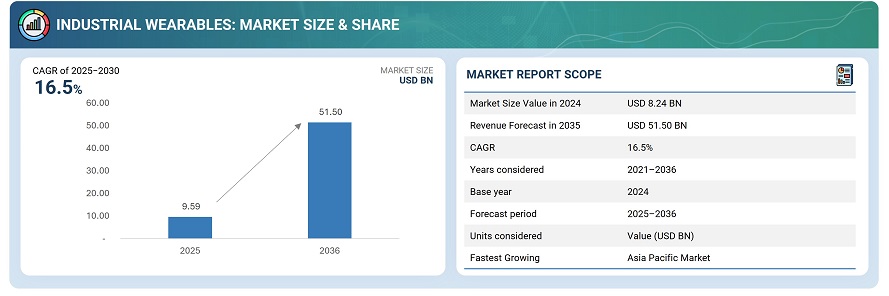

The global industrial wearables market was valued at USD 8.24 billion in 2025 and is estimated to reach USD 51.50 billion by 2036, at a CAGR of 16.5% between 2025 and 2036.

The industrial wearables market is driven by the rising need for workplace safety, productivity enhancement, and real-time data monitoring across manufacturing, oil & gas, logistics, and healthcare sectors. Increasing adoption of IoT and AI-powered wearables supports workforce tracking, preventive maintenance, and remote monitoring. Advances in biosensing technology enable continuous health and fatigue monitoring, thereby reducing downtime and improving employee well-being. Furthermore, compact, durable, and connected wearable designs like smart helmets, AR glasses, and exoskeletons enhance hands-free operations and safety compliance, strengthening demand in Industry 4.0 environments worldwide.

Industrial wearables are rugged electronic devices designed to be worn by workers in industrial environments, such as smart helmets, AR glasses, vests, and body-worn sensors, to enhance safety and productivity. These devices provide hands-free access to real-time data, workflow guidance, and worker health monitoring, often through wireless connectivity and integrated sensors. Major market drivers include rising workplace safety regulations, demand for operational efficiency, adoption of IoT and AI for instant data sharing, and the need for proactive health surveillance in hazardous sectors like manufacturing and logistics. This facilitates fewer accidents and boosts productivity.

Here are the Top 10 Key Highlights for the Industrial Wearable Market:

-

Rapid Market Growth: The smart wearables market is expanding globally, driven by rising health awareness and technological innovation.

-

Diverse Product Categories: Key devices include smartwatches, smart bands, smart glasses, VR/AR headsets, and wearable computing devices.

-

Fitness & Health Adoption: Wearable fitness technology is a primary driver, enabling activity tracking, sleep monitoring, and heart rate analysis.

-

Industrial Applications: Automotive, aerospace, manufacturing, oil & gas, and power & energy sectors increasingly adopt wearables for safety, training, and operational efficiency.

-

AI and IoT Integration: Smart wearables leverage AI, IoT, and cloud connectivity for real-time insights and personalized recommendations.

-

Enterprise Benefits: Industrial wearables improve workflow, predictive maintenance, workforce safety, and compliance.

-

Regional Growth: Asia-Pacific is the fastest-growing market, while North America remains the largest due to high adoption rates.

-

Technological Advancements: Flexible electronics, improved sensors, enhanced battery life, and AR/VR integration are shaping device innovation.

-

Challenges: Key issues include battery limitations, data privacy, security concerns, and high device costs.

-

Future Opportunities: Growth potential lies in healthcare integration, industrial safety, immersive AR/VR experiences, and emerging wearable applications.

Market by Industry

Automotive

The automotive industry is expected to account for a major share in the wearable technology market due to growing safety and tracking concerns specific to vehicle operation and driver health. Biometric wearables like iris recognition, gesture recognition, and voice recognition enhance driver safety by monitoring health parameters and reducing accidents. These devices also improve convenience and security by features such as fingerprint recognition to prevent theft. Increasing adoption of advanced technologies and strict road safety regulations in key markets like North America drive rapid growth of wearables in automotive manufacturing and usage..

Manufacturing

The manufacturing industry accounts for a significant share in the industrial wearable market due to its focus on enhancing workplace safety, productivity, and operational efficiency. Industrial wearables help monitor worker health, reduce accidents, and improve workflow through real-time data and activity tracking. The sector's adoption is driven by Industry 4.0 initiatives, the need for remote monitoring, and increasing automation. Additionally, manufacturing environments benefit from wearables like smart glasses, wrist-wear devices, and sensors that aid in training, maintenance, and quality control, making this industry a key market segment for wearable technology.

Oil & Gas

The oil & gas industry is expected to account for a considerable share in the industrial wearable market due to its high safety risks and harsh operational environments. Wearable devices such as smart helmets, eyewear, and smartwatches enhance workforce safety by monitoring vital health signs, detecting hazards, and facilitating real-time communication. The adoption of IoT and AI technologies in oil & gas drives productivity, asset management, and remote monitoring. Stringent safety regulations and the growing need for efficient workforce management also fuel market growth..

Market by Device Type

AR-Glasses

The AR glasses segment to contribute major share in the industrial wearable market due to its capability to provide hands-free access to real-time data, digital manuals, and remote assistance in industries like manufacturing, logistics, oil & gas, and utilities. AR glasses enhance productivity, reduce errors, and improve compliance by overlaying digital information onto the physical environment, facilitating faster decision-making and safer operations. Technological advancements, including AI integration, miniaturization, and improved connectivity (5G, Wi-Fi 6), further drive adoption. Despite high costs, enterprises prioritize AR glasses for their operational benefits, accelerating their deployment in large-scale industrial settings. This segment holds over 34% of the industrial wearable market share, leading growth.

Smartwatches

The smartwatch segment is expected to play a significant role in the industrial wearable market due to its multifunctionality, ease of use, and advanced health and safety features. Smartwatches provide real-time health monitoring (heart rate, ECG, SpO2), activity tracking, and seamless connectivity with smartphones and IoT devices, supporting worker safety and productivity. Their compact design allows hands-free operation, ideal for industrial environments. Additionally, increasing health awareness and demand for fitness tracking, combined with AI integration and GPS capabilities, boost adoption. The segment's growth is further fueled by continuous innovation and expanding applications in workplace safety and remote monitoring..

Market by Geography:

Geographically, the industrial wearables market is experiencing widespread adoption across North America, Europe, Asia Pacific, and the Middle East & Africa. North America accounts significant market share due to early adoption of advanced technologies, strong presence of key industry players, and high investment in workplace safety and productivity solutions. Meanwhile, Asia Pacific is the fastest-growing region, driven by rapid industrialization, government initiatives promoting digitalization, and increasing adoption in emerging economies like China and India. Europe plays a pivotal role in the said market with steady growth driven by strong regulations and advanced healthcare systems. The Middle East and Africa show considerable growth with opportunities in oil, gas, and mining sectors. South America is gradually adopting wearables amid economic and political challenges

The wearable technology market in North America is anticipated to attain a valuation of USD 69.1 billion by 2030, increasing from USD 34.1 billion in 2025, at a CAGR of 15.2% from 2025 to 2030. Wearable technology comprises electronic devices worn on the body, such as smartwatches, fitness trackers, and smart glasses, which utilize sensors, processors, and wireless connectivity to monitor health metrics, record activity, and deliver real-time notifications. These devices enhance daily living by providing biofeedback on fitness, sleep, and vital signs, while seamlessly integrating with smartphones for data synchronization and hands-free operation.

Market Dynamics

Driver: Increased interests of enterprises in utilizing AR technology especially in production area and VR technology in specifically in training domain

Industrial wearables are increasingly driven by enterprise interest in augmented reality (AR) and virtual reality (VR) technologies, especially in production and training domains. AR enhances production by overlaying real-time digital instructions, safety alerts, and posture guidance, making complex manufacturing tasks more efficient, accurate, and safer. Enterprises benefit from AR-powered smart glasses that improve workflow inspections and error prevention through real-time feedback. VR, on the other hand, is primarily used in training, enabling safe simulation of complex assembly procedures and skill development without physical risks. These technologies accelerate knowledge transfer, reduce errors, and boost productivity, fueling adoption of industrial wearables in Industry 4.0 and 5.0 environments.

Restraint: Data security and privacy issues

Data security and privacy issues are significant restraints for the industrial wearable market. Wearables continuously collect sensitive personal and health data, which, if inadequately protected, are vulnerable to data breaches, unauthorized access, and misuse by hackers or third parties such as insurers or advertisers. Lack of transparency in data collection, insufficient encryption, poor breach notification protocols, and inconsistent privacy policies across wearable device manufacturers raise major concerns. Additionally, regulatory challenges and the absence of universal data protection standards create gaps in data governance. These issues reduce user trust and slow enterprise adoption, limiting the market growth potential..

Opportunity Rising trend of Industry 4.0 /5.0 and smart manufacturing

The rising trend of Industry 4.0 /Industry 5.0 propelled by smart manufacturing presents a significant opportunity for the industrial wearable market. Industry 4.0 emphasizes digital transformation through AI, IoT, cloud computing, and data analytics, enabling connected factories with real-time monitoring and predictive maintenance. Industry 5.0 moves towards human-machine collaboration, combining automation with worker well-being, sustainability, and mass personalization. Wearables play a crucial role in this ecosystem by providing real-time data, enhancing worker safety, enabling remote operation, and augmenting human capabilities. These trends drive demand for industrial wearables to support smart, efficient, and flexible manufacturing.

Challenge: Dearth of skills and expertise to manage connected devices

The industrial wearable market faces a significant challenge due to the shortage of skills and expertise required to manage and utilize connected devices effectively. Many industries struggle to find and retain workers with the technical know-how to operate wearables, analyze data, and maintain these systems. Additionally, the industrial sector is experiencing aging workforces and difficulty attracting younger talent, which exacerbates the skill gap. This shortage slows technology adoption and limits the potential benefits of wearables. Companies must invest in training, upskilling, and user-friendly designs to overcome this barrier and fully leverage wearable technology.

Glasses

Smart glasses are increasingly used in both consumer and industrial applications, providing hands-free access to information, augmented reality (AR) overlays, and real-time notifications. In professional settings, glasses enhance productivity by enabling remote collaboration, visual guidance, and workflow optimization, while in consumer segments, they support fitness tracking, navigation, and multimedia interaction. Advanced sensor integration and AI capabilities make smart glasses an essential wearable device bridging digital and physical environments.

VR Headsets

Virtual reality (VR) headsets immerse users in simulated environments, making them ideal for training, simulation, and design applications. In industries such as automotive, aerospace, and manufacturing, VR headsets are used for employee training, safety drills, product prototyping, and virtual testing, reducing costs and risks. In the consumer market, they provide gaming, fitness, and interactive experiences, fueling the overall growth of the wearable electronics and immersive technology market.

Smartwatches

Smartwatches are among the most widely adopted wearable devices, offering fitness tracking, heart rate monitoring, sleep analysis, and real-time notifications. Beyond personal health, smartwatches are increasingly integrated into enterprise applications, enabling employee monitoring, emergency alerts, and communication in industrial and corporate settings. Their multifunctional capabilities, combined with compact form factors and AI-driven insights, continue to drive growth in the wearable technology market.

Smart Bands

Smart bands are cost-effective wearable devices focused on activity tracking, health monitoring, and daily fitness management. They are particularly popular among consumers for step counting, calorie tracking, and sleep monitoring, while enterprises and healthcare providers leverage smart bands for employee wellness programs and remote patient monitoring. Their lightweight design, long battery life, and seamless connectivity make them an attractive entry-level option in the smart wearables ecosystem.

Automotive

In the automotive sector, smart wearables and AR/VR technologies enhance vehicle design, production, maintenance, and driver experience. Engineers use VR headsets for virtual prototyping, while smart glasses and wearable sensors assist technicians in assembly and maintenance operations. Additionally, wearables support driver safety and health monitoring, making automotive a key application area for connected wearable devices and industrial wearables.

Aerospace

The aerospace industry leverages wearable technology to improve maintenance efficiency, pilot training, and operational safety. VR headsets allow immersive simulation of flight scenarios, smart glasses provide hands-free access to schematics during aircraft maintenance, and wearable sensors track employee safety and fatigue levels. These technologies reduce errors, improve compliance, and increase operational efficiency in aerospace applications.

Manufacturing

Manufacturing facilities are adopting smart wearables to optimize productivity, enhance worker safety, and streamline operations. AR glasses guide assembly line workers, smart bands monitor employee health, and VR headsets are used for training and process simulation. Wearable sensors also provide real-time data for predictive maintenance, reducing downtime and operational costs across the manufacturing sector.

Oil & Gas

In the oil & gas industry, wearable devices improve workplace safety, equipment monitoring, and real-time data collection. Smart bands and sensors track vital signs, while smart glasses provide visual instructions and hazard alerts during field operations. VR training modules prepare employees for emergency scenarios, ensuring compliance with safety protocols and reducing operational risks in high-hazard environments.

Power & Energy

Wearables in the power and energy sector enhance workforce safety, equipment monitoring, and operational efficiency. Smart bands and connected sensors monitor worker vitals, while smart glasses assist in inspections, repairs, and maintenance. VR training simulations prepare personnel for emergency situations, reducing accidents and improving compliance with industry safety standards, making wearable technology an integral part of modern energy operations.

Future Outlook

The industrial wearable market is projected to grow significantly from 2025 to 2036, driven by increasing adoption across manufacturing, healthcare, logistics, and other industrial sectors. This growth is fueled by advancements in bio-sensing technologies, Industry 4.0 and 5.0 integration, and rising demand for workforce safety and operational efficiency. Smart glasses, fitness trackers, and smartwatches will dominate product types, while North America currently leads regional adoption. The market's future also includes expanding applications in warehouse management, training, and health monitoring for better employee welfare. Emerging technologies such as AI, IoT, and AR/VR will further enhance capabilities, enabling real-time data and improved human-machine collaboration.

Key Market Players

Top Industrial Wearables companies Apple Inc (US), , Microsoft Corporation (US), Magic Leap Inc (US), Vuzix Corporation (US). Alphabet Inc (US) among others.

Frequently Asked Questions (FAQ)

Q1. What are the main types of smart wearables?

The main types of smart wearables include smartwatches, smart bands, smart glasses, VR/AR headsets, and sensor-integrated clothing. These devices are used for fitness tracking, health monitoring, lifestyle convenience, and industrial applications.

Q2. How are wearables used in industrial sectors like automotive and aerospace?

In industries such as automotive and aerospace, wearables assist in training, maintenance, assembly guidance, employee safety, and workflow optimization using AR/VR headsets, smart glasses, and wearable sensors.

Q3. What is driving the growth of the wearable fitness and smart wearables market?

Market growth is driven by increasing health and fitness awareness, technological advancements in AI and IoT, rising adoption of connected devices, and demand for remote healthcare and real-time monitoring.

Q4. What challenges do wearable devices face?

Key challenges include battery life limitations, data privacy and security concerns, interoperability issues between devices, and high costs of premium wearables for consumers and enterprises.

Q5. Which industries are adopting wearable technology the fastest?

Industries such as healthcare, automotive, aerospace, manufacturing, oil & gas, and power & energy are leading adopters due to the benefits of enhanced safety, productivity, training, and operational efficiency.

Table of Contents

1 Introduction (Page No. - 19)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in Industrial Wearables Market

4.2 Market, By Device Type

4.3 Market in North America, By Device Type and Industry

4.4 Country-Wise Growth Rate of Market

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Requirement for Effective Communication and Collaborative Working Environment

5.2.1.2 Increased Interests of Enterprises in Utilizing AR Technology Especially in Production ARea and VR Technology in Specifically in Training Domain

5.2.1.3 Technological Advancements and Automation in Manufacturing Plants

5.2.2 Restraints

5.2.2.1 Data Security and Privacy Issues

5.2.3 Opportunities

5.2.3.1 Rising Trend of Industry 4.0 and Smart Manufacturing

5.2.3.2 Growing Significance of Wearables in Warehouse Applications

5.2.4 Challenges

5.2.4.1 Dearth of Skills and Expertise to Manage Connected Devices

6 Industrial Wearables Market, By Device Type (Page No. - 47)

6.1 Introduction

6.2 AR Glasses

6.2.1 AR Glasses to Lead Market During 2019–2024

6.3 VR Headsets

6.3.1 VR Headsets are Used Primarily to Ensure Smooth Conduction of Employee Training

6.4 Smartwatches

6.4.1 Industrial Smartwatches Send Alerts About Required Tasks to Be Done and Improve Product Quality By Providing Accurate Information to Workers

6.5 Smart Bands

6.5.1 Smart Bands Help in Effective Management of Workers’ Health and Safety

6.6 Others

6.6.1 Smart Clothing

6.6.2 Wearable Cameras

7 Industrial Wearables Market, By Component (Page No. - 72)

7.1 Introduction

7.2 Processors and Memory Modules

7.2.1 Processors and Memory Modules Likely to Command Market in Coming Years

7.3 Optical Systems and Displays

7.3.1 Oled Displays Gaining Traction for Wearables

7.4 Electromechanicals, Cases, and Frames

7.4.1 Electromechanical Components Ensure Support and Rigidity of Devices

7.5 Touchpads and Sensors

7.5.1 Touchpads and Sensors Ensure Smooth Monitoring of Different Health Parameters and Functioning of Wearable Devices

7.6 Connectivity Components

7.6.1 Connectivity Components are Critical for Transmitting Data to Different Devices

7.7 Camera Modules

7.7.1 Increased Application of Camera Modules in Different Industrial Wearables

7.8 Others

8 Applications of Industrial Wearables (Page No. - 77)

8.1 Introduction

8.2 Field Repair Services

8.3 Operation and Assembly

8.4 Employee Monitoring

8.5 Warehouse Management

8.6 Emergency Response

8.7 Employee Training

9 Industrial Wearables Market, By Industry (Page No. - 79)

9.1 Introduction

9.2 Automotive

9.2.1 Increasing Adoption of New Technologies to Improve Productivity and Quality Drives Market Growth

9.3 Aerospace & Defense

9.3.1 Need for Real-Time Assistance in Complex Assembly Operations Drives Demand for Industrial Wearables

9.4 Manufacturing

9.4.1 Industrial Wearables are Used to Reduce Downtime and Enhance Operational Efficiency

9.5 Oil & Gas

9.5.1 Critical Industries Require Safe Working Environment to Ensure Proper Functioning

9.6 Power & Energy

9.6.1 Growing Use of Wearable and AR Technologies to Increase Productivity and Reduce Workplace Hazards Augments Market Growth for Power & Energy

9.7 Chemicals

9.7.1 Rising Adoption of Industrial Wearables to Streamline Supply Chain Accelerates Growth of Market for Chemicals Industry

9.8 Others

10 Geographic Analysis (Page No. - 103)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Presence of Leading Providers of Industrial Wearables in Country to Propel Market Growth

10.2.2 Canada

10.2.2.1 Adoption of Modern Technologies By Process and Discrete Industries to Provide Growth Opportunities to Canadian Market for Industrial Wearables

10.2.3 Mexico

10.2.3.1 Implementation of Cutting-Edge Technologies to Create Prospects for New Technologies

10.3 Europe

10.3.1 Germany

10.3.1.1 German Automotive Industry, Being Early Adopter of Advanced Technologies, to Boost Growth of Industrial Wearables Market

10.3.2 UK

10.3.2.1 Deployment of Smart Manufacturing and Industry 4.0 Technologies in Different Industries to Create Opportunity for Market

10.3.3 France

10.3.3.1 Aerospace Industry in France Creates Ample Opportunities for Players in Industrial Wearables Market

10.3.4 Italy

10.3.4.1 Collaborations and Strategic Partnerships Within Different Government Bodies Provide Chance to Italian Market to Grow

10.3.5 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 Need to Adopt Effective Automation Strategy and Government Support to Facilitate Industrial Revolution Would Accelerate Demand for Industrial Wearables

10.4.2 Japan

10.4.2.1 Automotive, Consumer Electronics, and Industrial Sectors Likely to Contribute Most to Market Growth in Japan

10.4.3 India

10.4.3.1 Digital Transformation of Industries to Boost Industrial Wearable Market Growth in India

10.4.4 South Korea

10.4.4.1 Government Support to Modernize Manufacturing Industry Open Doors for Market

10.4.5 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.1.1 Adoption of Technologies for Improving Industrial Supply Chain to Create Demand for Industrial Wearables

10.5.2 Middle East & Africa

10.5.2.1 Implementation of Advanced Technologies in Oil & Gas and Mining Industries Offer Opportunity to Market

11 Competitive Landscape (Page No. - 118)

11.1 Overview

11.2 Market Ranking Analysis

11.2.1 Product Launches

11.2.2 Agreements, Partnerships, and Collaborations

11.2.3 Expansions

11.2.4 Acquisitions

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Players

11.4 Strength of Product Portfolio

11.5 Business Strategy Excellence

12 Company Profiles (Page No. - 126)

12.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Key Players

12.2.1 Microsoft

12.2.2 Google

12.2.3 Epson

12.2.4 Vuzix

12.2.5 Magic Leap

12.2.6 Apple Inc.

12.2.7 Fujitsu

12.2.8 Honeywell

12.2.9 Oculus VR (Facebook)

12.2.10 Samsung Electronics Co., Ltd.

12.3 Right to Win

12.4 Other Key Players

12.4.1 Asus

12.4.2 Fitbit

12.4.3 Fossil

12.4.4 HTC

12.4.5 Olympus

12.4.6 Optinvent

12.4.7 RealWear

12.4.8 Thirdeye

12.4.9 Workerbase

12.4.10 Zepcam

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 157)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (107 Tables)

Table 1 Industrial Wearables Market, By Device Type, 2016–2024 (USD Million)

Table 2 Market for AR Glasses, By Industry, 2016–2024 (USD Million)

Table 3 Market for AR Glasses, By Region, 2016–2024 (USD Million)

Table 4 AR Glasses Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 5 AR Glasses Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 6 AR Glasses Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 7 AR Glasses Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 8 AR Glasses Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 9 AR Glasses Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 10 AR Glasses Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 11 Market for VR Headsets, By Industry, 2016–2024 (USD Million)

Table 12 Market for VR Headsets, By Region, 2016–2024 (USD Million)

Table 13 VR Headsets Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 14 VR Headsets Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 15 VR Headsets Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 16 VR Headsets Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 17 VR Headsets Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 18 VR Headsets Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 19 VR Headsets Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 20 Market for Smartwatches, By Industry, 2016–2024 (USD Million)

Table 21 Market for Smartwatches, By Region, 2016–2024 (USD Million)

Table 22 Smartwatches Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 23 Smartwatches Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 24 Smartwatches Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 25 Smartwatches Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 26 Smartwatches Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 27 Smartwatches Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 28 Smartwatches Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 29 Market for Smart Bands, By Industry, 2016–2024 (USD Million)

Table 30 Market for Smart Bands, By Region, 2016–2024 (USD Million)

Table 31 Smart Bands Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 32 Smart Bands Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 33 Smart Bands Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 34 Smart Bands Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 35 Smart Bands Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 36 Smart Bands Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 37 Smart Bands Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 38 Market for Other Devices, By Industry, 2016–2024 (USD Million)

Table 39 Market for Other Devices, By Region, 2016–2024 (USD Million)

Table 40 Other Devices Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 41 Other Devices Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 42 Other Devices Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 43 Other Devices Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 44 Other Devices Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 45 Other Devices Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 46 Other Devices Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 47 Industrial Wearables Market, By Component, 2016–2024 (USD Million)

Table 48 Market, By Industry, 2016–2024 (USD Million)

Table 49 Market for Automotive Industry, By Device Type, 2016–2024 (USD Million)

Table 50 Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 51 Market in North America for Automotive Industry, By Country, 2016–2024 (USD Million)

Table 52 Market in Europe for Automotive Industry, By Country, 2016–2024 (USD Million)

Table 53 Market in APAC for Automotive Industry, By Country, 2016–2024 (USD Million)

Table 54 Market in RoW for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 55 Market for Aerospace & Defense Industry, By Device Type, 2016–2024 (USD Million)

Table 56 Market for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 57 Market in North America for Aerospace & Defense Industry, By Country, 2016–2024 (USD Million)

Table 58 Market in Europe for Aerospace & Defense Industry, By Country, 2016–2024 (USD Million)

Table 59 Market in APAC for Aerospace & Defense Industry, By Country, 2016–2024 (USD Million)

Table 60 Market in RoW for Aerospace & Defense Industry, By Region, 2016–2024 (USD Million)

Table 61 Market for Manufacturing Industry, By Device Type, 2016–2024 (USD Million)

Table 62 Market for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 63 Market in North America for Manufacturing Industry, By Country, 2016–2024 (USD Million)

Table 64 Market in Europe for Manufacturing Industry, By Country, 2016–2024 (USD Million)

Table 65 Market in APAC for Manufacturing Industry, By Country, 2016–2024 (USD Million)

Table 66 Market in RoW for Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 67 Market for Oil & Gas Industry, By Device Type, 2016–2024 (USD Million)

Table 68 Market for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 69 Market in North America for Oil & Gas Industry, By Country, 2016–2024 (USD Million)

Table 70 Market in Europe for Oil & Gas Industry, By Country, 2016–2024 (USD Million)

Table 71 Market in APAC for Oil & Gas Industry, By Country, 2016–2024 (USD Million)

Table 72 Market in RoW for Oil & Gas Industry, By Region, 2016–2024 (USD Million)

Table 73 Market for Power & Energy Industry, By Device Type, 2016–2024 (USD Million)

Table 74 Market for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 75 Market in North America for Power & Energy Industry, By Country, 2016–2024 (USD Million)

Table 76 Market in Europe for Power & Energy Industry, By Country, 2016–2024 (USD Million)

Table 77 Market in APAC for Power & Energy Industry, By Country, 2016–2024 (USD Million)

Table 78 Market in RoW for Power & Energy Industry, By Region, 2016–2024 (USD Million)

Table 79 Market for Chemicals Industry, By Device Type, 2016–2024 (USD Million)

Table 80 Market for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 81 Market in North America for Chemicals Industry, By Country, 2016–2024 (USD Million)

Table 82 Market in Europe for Chemicals Industry, By Country, 2016–2024 (USD Million)

Table 83 Market in APAC for Chemicals Industry, By Country, 2016–2024 (USD Million)

Table 84 Market in RoW for Chemicals Industry, By Region, 2016–2024 (USD Million)

Table 85 Market for Other Industries, By Device Type, 2016–2024 (USD Million)

Table 86 Market for Other Industries, By Region, 2016–2024 (USD Million)

Table 87 Market in North America for Other Industries, By Country, 2016–2024 (USD Million)

Table 88 Market in Europe for Other Industries, By Country, 2016–2024 (USD Million)

Table 89 Market in APAC for Other Industries, By Country, 2016–2024 (USD Million)

Table 90 Market in RoW for Other Industries, By Region, 2016–2024 (USD Million)

Table 91 Market, By Region, 2016–2024 (USD Million)

Table 92 Market in North America, By Country, 2016–2024 (USD Million)

Table 93 Market in North America, By Industry, 2016–2024 (USD Million)

Table 94 Market in North America, By Device Type, 2016–2024 (USD Million)

Table 95 Market in Europe, By Country, 2016–2024 (USD Million)

Table 96 Market in Europe, By Industry, 2016–2024 (USD Million)

Table 97 Market in Europe, By Device Type, 2016–2024 (USD Million)

Table 98 Market in APAC, By Country, 2016–2024 (USD Million)

Table 99 Market in APAC, By Industry, 2016–2024 (USD Million)

Table 100 Market in APAC, By Device Type, 2016–2024 (USD Million)

Table 101 Market in RoW, By Region, 2016–2024 (USD Million)

Table 102 Market in RoW, By Industry, 2016–2024 (USD Million)

Table 103 Industrial Wearables Market in RoW, By Device Type, 2016–2024 (USD Million)

Table 104 Product Launches, 2018–2019

Table 105 Agreements, Partnerships, and Collaborations, 2019

Table 106 Expansions, 2017

Table 107 Acquisitions, 2018

List of Figures (49 Figures)

Figure 1 Process Flow of Industrial Wearables Market Size Estimation

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 AR Glasses to Account for Largest Size of Market During Forecast Period

Figure 8 Processors and Memory Modules to Record Highest CAGR in Market, By Component, During 2019–2024

Figure 9 Automotive Industry to Lead Industrial Wearables Market During Forecast Period

Figure 10 APAC to Witness Highest CAGR in Market During Forecast Period

Figure 11 Rising Trends of Industry 4.0 and Smart Manufacturing to Provide Growth Opportunities to Market

Figure 12 AR Glasses to Hold Largest Market Size During Forecast Period

Figure 13 AR Glasses and Automotive Held Largest Share of North American Market, By Device Type and Industry, Respectively, in 2018

Figure 14 China to Register Highest CAGR in Industrial Wearables Market During 2019–2024

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Market Drivers and Their Impact

Figure 17 Market Opportunities and Their Impact

Figure 18 Market Restraints and Challenges and Their Impact

Figure 19 AR Glasses to Dominate Market During Forecast Period

Figure 20 Market for AR Glasses, 2016–2024 (Million Units)

Figure 21 Automotive Industry to Witness Highest CAGR in Market for AR Glasses From 2019 to 2024

Figure 22 North America to Hold Largest Share of Market for AR Glasses in 2024

Figure 23 APAC to Exhibit Highest CAGR in AR Glasses Market for Automotive Industry From 2019 to 2024

Figure 24 Industrial Wearables Market for VR Headsets, 2016–2024 (Million Units)

Figure 25 North America to Account for Largest Size of Market for VR Headsets in 2024

Figure 26 Market for Smartwatches, 2016–2024 (Million Units)

Figure 27 Market for Smart Bands, 2016–2024 (Million Units)

Figure 28 APAC to Register Highest CAGR in Market for Smart Bands From 2019 to 2024

Figure 29 Processors and Memory Modules to Hold Largest Size of Market in 2024

Figure 30 Industrial Wearables Market for Automotive Industry to Grow at Highest CAGR During Forecast Period

Figure 31 AR Glasses to Hold Largest Size of Market for Automotive Industry in 2024

Figure 32 APAC Market for Automotive Industry to Record Highest CAGR From 2019 to 2024

Figure 33 North America to Capture Largest Share of Market for Manufacturing Industry in 2024

Figure 34 APAC to Register Highest CAGR in Market for Oil & Gas Industry From 2019 to 2024

Figure 35 Market in APAC to Grow at Highest CAGR During 2019–2024

Figure 36 North America: Market Snapshot

Figure 37 Europe: Market Snapshot

Figure 38 APAC: Market Snapshot

Figure 39 Organic and Inorganic Strategies Adopted By Companies Operating in Industrial Wearables Market

Figure 40 Market Player Ranking, 2018

Figure 41 Market (Global) Competitive Leadership Mapping (2018)

Figure 42 Microsoft: Company Snapshot

Figure 43 Google: Company Snapshot

Figure 44 Epson: Company Snapshot

Figure 45 Vuzix: Company Snapshot

Figure 46 Apple Inc.: Company Snapshot

Figure 47 Fujitsu: Company Snapshot

Figure 48 Honeywell: Company Snapshot

Figure 49 Samsung: Company Snapshot

The study involved 4 major activities in estimating the size of the industrial wearables market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The industrial wearables market comprises several stakeholders, such as manufacturers of industrial wearable devices, manufacturers of hardware components used in wearable devices, among others in the supply chain. The demand side of this market includes OEMs and end-user industries such as automotive, aerospace & defense, manufacturing, oil & gas, power & energy, chemicals, pharmaceuticals, and mining. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These methods have also been used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Players offering various types of industrial wearables are considered, their revenue for industrial wearables has been observed to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in market.

Report Objectives

- To describe, segment, and forecast the overall size of the industrial wearables market, by device type, component, and industry, and region, in terms of value

- To describe and forecast the market for various segments with regard to main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To describe the applications of industrial wearables

- To provide detailed information regarding major factors that include drivers, restraints, opportunities, and challenges influencing the growth of market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as collaborations, agreements, partnerships, expansions, acquisitions, and product launches in market

- To benchmark players within the market using proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Industrial Wearables Market