Injectable Drug Delivery Market Size by Type (Device, Formulation), Therapeutic (Infectious Diseases, Cancer), Usage Pattern (Immunization), Administration (Skin, Musculoskeletal), Distribution Channel, Patient Care Setting, & Region - Global Forecast to 2029

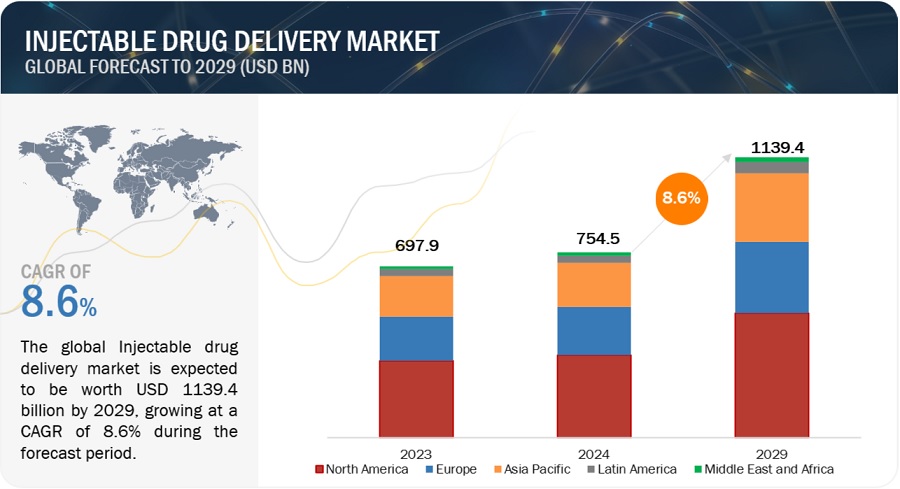

The size of global Injectable drug delivery market in terms of revenue was estimated to be worth $754.5 billion in 2024 and is poised to reach $1139.4 billion by 2029, growing at a CAGR of 8.6% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth of the Injectable drug delivery market is mainly driven by increasing prevalence of Infectious diseases, Increasing technological advancements and increasing funding scenarios for R&D for the Injectable drug delivery market.

Attractive opportunities in the Injectable drug delivery market

To know about the assumptions considered for the study, Request for Free Sample Report

Injectable Drug Delivery Market Dynamics

DRIVER: Increased Prevalence of Chronic Diseases

Injectable drug administration is critical for the treatment of a variety of infectious disorders, including bacterial, viral, fungal, and parasitic infections. Many antibiotics, antiviral treatments, antifungal agents, and antiparasitic therapies are supplied intravenously to achieve quick and effective drug concentrations in the bloodstream and target tissues.Injectable drugs are widely used to treat chronic infectious diseases such as tuberculosis (TB) and HIV/AIDS. To successfully target the TB germs and prevent medication resistance, TB treatment frequently combines oral antibiotics with injectable treatments such as rifampin, isoniazid, and streptomycin. Similarly, injectable antiretroviral medications can be used in HIV/AIDS therapy regimens to inhibit viral replication and slow disease progression.

RESTRAINT: Infections associated with needlestick injuries

Needlestick injuries, also known as percutaneous injuries, can transmit a variety of infectious pathogens if the needle or sharp instrument comes into contact with blood or bodily fluids. Other bloodborne infections that can be transmitted through needle injuries include syphilis, malaria, and human T-cell lymphotropic virus (HTLV). These infections can result in a variety of symptoms and problems, depending on the pathogen.

In addition to bloodborne pathogens, needlestick injuries can bring germs into the body, causing localized or systemic illness. Staphylococcus aureus, Streptococcus species, and gram-negative bacteria are among the most common bacterial illnesses associated with needlestick injuries.

OPPORTUNITY: Increase in demand for biosimilars and generic medicine

The need for biosimilars and generic injectable pharmaceuticals allows pharmaceutical companies to diversify their product portfolios in the injectable drug delivery sector. Companies can develop and manufacture a wide range of injectable biosimilars and generic pharmaceuticals for a variety of therapeutic areas, including oncology, autoimmune diseases, diabetes, and infectious diseases, to fulfill the growing demand for affordable and accessible treatments. Biosimilars and generic injectable drugs are less expensive and more affordable than brand-name medications, making them more accessible to individuals, healthcare providers, and healthcare systems. Injectable drug delivery systems are critical in the administration of biosimilars and generic pharmaceuticals, providing safe, effective, and easy delivery options for patients undergoing long-term or chronic therapies.

CHALLENGE: Preference for other modes of drug delivery

The injectable mode of drug delivery offers a large surface area for absorption as a result of which it achieves rapid systemic levels of absorption. However, the use of injectables can lead to needlestick injuries and infections, needle phobia, anxiety, and pain. All these factors limit the market for injectables to a certain extent. Among the various routes of drug delivery, the oral route is the most preferred as it is easy to use, convenient, cost-effective, safe, and acceptable.

Inhalation facilitates rapid absorption due to the huge surface area of the respiratory endothelium; bronchodilators and inhaled steroids can be targeted at the lungs with low levels of systemic absorption. The topical route of drug administration is considered better than injections as drugs are applied directly to the skin and it is non-invasive, easy, and there is a high level of patient compliance.

This preference for other routes of drug administration is a major challenge for the injectable drug delivery technology market.

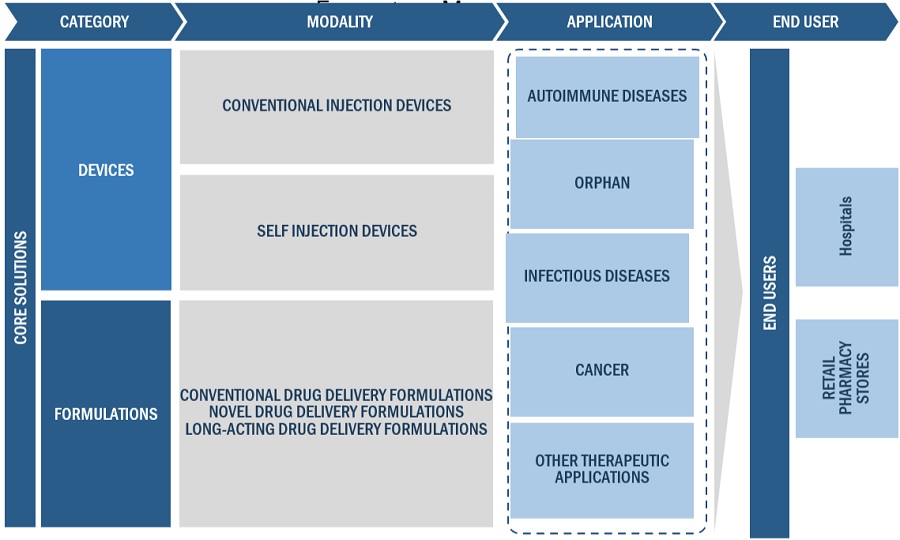

Injectable drug delivery industry Ecosystem

The Formulations segment of the Injectable drug delivery industry is witnessed to have the highest growth during the forecast period.

Injectable formulations serve a wide range of therapeutic needs, including oncology, diabetes, autoimmune illnesses, cardiovascular disease, and infectious diseases. Each therapeutic category may necessitate unique formulations tailored to the drug's properties and the needs of the patient population, adding to the formulation segment's diversity. Continuous improvements in drug delivery technology enable the creation of novel formulations with improved features such as sustained release, targeted distribution, and increased stability. These developments fuel market expansion by increasing the number of injectable formulations available to healthcare practitioners and patients.

By Therapeutic application Infectious diseases segment of the Injectable drug delivery industry holds the largest share for 2023.

Vaccines are critical instruments for preventing infectious illnesses and mitigating their effects on public health. Injectable vaccinations are frequently used in immunization programs against a variety of infectious illnesses, including influenza, measles, polio, hepatitis, and human papillomavirus (HPV). The substantial percentage of injectable vaccinations in therapeutic applications is due to their development, manufacture, and dissemination.

Overall, the high share of infectious diseases in all therapeutic applications within the injectable drug market is due to the global burden of these diseases, the wide range of conditions they cover, the challenges posed by antimicrobial resistance, the prevalence of hospital-acquired infections, the impact of globalization and travel on disease spread, and the importance of vaccines in disease prevention and control.

By Route of Administration Skin/Intradermal accounted for the highest share of the Injectable drug delivery industry during the forecast period.

Compared to other delivery methods like intravenous or intramuscular injections, subcutaneous injections are comparatively easy to perform and don't require specific medical knowledge or equipment. In a variety of clinical settings, such as clinics, hospitals, and home healthcare settings, healthcare personnel can effortlessly provide subcutaneous injections.Drugs can be absorbed into the bloodstream more quickly and consistently in subcutaneous tissue because it has a robust blood supply and a comparatively large surface area. Because of this, subcutaneous injections are appropriate for drugs that need steady-state plasma concentrations because they enable predictable pharmacokinetics and dosage schedules.

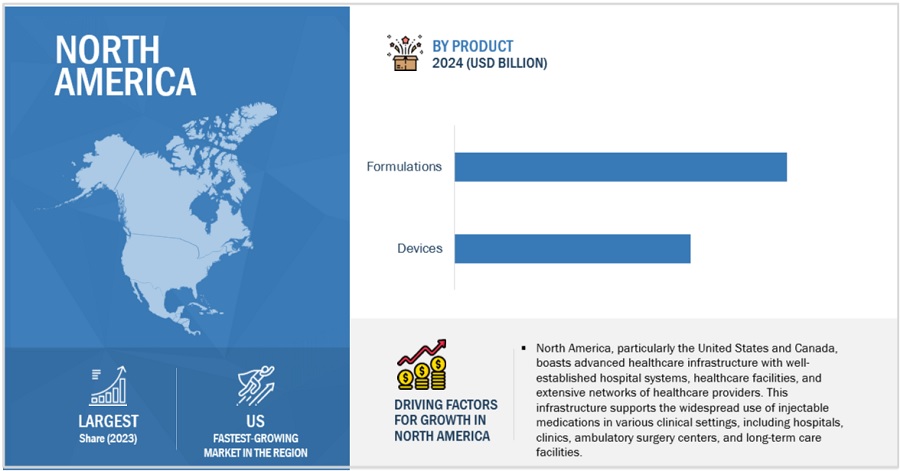

North America accounted for the largest share of the Injectable drug delivery industry in 2023.

To know about the assumptions considered for the study, download the pdf brochure

Based on the region, the Injectable drug delivery market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America accounted for the largest share of the Injectable drug delivery market. This is due to an increase in the prevalence of chronic diseases, such as cardiovascular diseases, cancer, and autoimmune disorders. North America has one of the world's highest healthcare expenditures per capita. Significant investment in healthcare infrastructure, research, and pharmaceuticals helps to promote the widespread use of injectable drug delivery systems in the region.

Scope of the Injectable Drug Delivery Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$754.5 billion |

|

Projected Revenue by 2029 |

$1139.4 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.6% |

|

Market Driver |

Increased Prevalence of Chronic Diseases |

|

Market Opportunity |

Increase in demand for biosimilars and generic medicine |

The study categorizes the injectable drug delivery market to forecast revenue and analyze trends in each of the following submarkets:

By Devices

- Conventional Injection Devices

-

By material

- Glass

- Plastic

-

By Product

- Fillable Syringes

- Prefilled Syringes

-

By Usability

- Reusable Injection Devices

- Disposable Injection Devices

- Self-injection devices

- Needle-free Injectors

-

By Product

- Fillable Needle-free Injectors

- Prefilled Needle-free Injectors

-

By Technology

- Jet-based Needle-free Injectors

- Spring-based Needle-free Injectors

-

Laser-powered needle free-injectors

- Vibration-based Needle-free Injectors

-

By Usability

- Reusable needle-free Injectors

- Disposable needle-free Injectors

- Autoinjectors

-

By Product

- Fillable Autoinjectors

- Prefilled Autoinjectors

-

By Technology

- Automated Autoinjectors

- Manual Autoinjectors

-

By Design

- Standardized Autoinjectors

- Customized Autoinjectors

-

By Usability

- Reusable Autoinjectors

- Disposable Autoinjectors

- Pen Injectors

-

By Product

- Single-chambered Pen Injectors

- Dual-chambered Pen Injectors

-

By Design

- Standard Pen Injectors

- Customized Pen Injectors

-

By Usability

- Reusable Pen Injectors

- Disposable Pen Injectors

- Wearable Injectors

- Other Devices

- FORMULATIONS

-

CONVENTIONAL DRUG DELIVERY FORMULATIONS

- Solutions

- Reconstituted/Lyophilized formulations

- Suspensions

- Emulsions

-

NOVEL DRUG DELIVERY FORMULATIONS

- Colloidal dispersions

- Niosomes

- Liposomes

- Polymeric/mixed micelles

- Nanoparticles

- Solid-lipid nanoparticles

- Nanosuspensions

- Nanoemulsions

-

MICROPARTICLES

- Microspheres

- Microcapsules

- LONG-ACTING INJECTION FORMULATIONS

By Formulation Packaging

- Introduction

- Amp0ules

- Vials

- Cartridges

- Bottles

By Therapeutic Application

- Introduction

-

Autoimmune diseases

- Rheumatoid arthritis

- Multiple Sclerosis (MS)

- Crohn’s Disease

- Psoriasis

- Other Autoimmune Diseases

-

HORMONAL DISORDERS

- Diabetes

- Anemia

- Reproductive health disease

- Antithrombotic/thrombolytic therapy

- Osteoporosis

- growth hormone deficiency(ghd)

- Orphan diseases

- Cancer

- Infectious diseases

-

Other therapeutic applications

- Pain management

- Allergies

- Aesthetic treatment

- Hepatitis c

- Hemophilia

By Usage Pattern

- Introduction

- Curative care

- Immunization

- Others

By Site of Administration

- Introduction

- Skin(Intradermal and subcutaneous)

- Circulatory/Musculoskeletal system (Intravenous, Intracardiac, Intramuscular and Intraperitoneal)

- Organs (Intravitreal and Intra-articular)

- Central Nervous system ( Intracerebral and intrathecal)

By Distribution Channel

- Introduction

- Hospitals

- Retail Pharmacy stores

By Patient Care Setting

- Introduction

- Hospitals and Clinics

- Home care settings

- Other facilities of Use

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East and Africa

- GCC Countries

- Rest of Middle East and Africa

Recent Developments

In Sep 2022 BD launched BD EffivaxTM Glass prefillable syringes. This syringe will help in growing demand for vaccines manufacturing.

In Oct 2022 GSK received its product approval for BOOSTRIX (Tetanus Toxoid, Reduced Diphtheria Toxoid and Acellular Pertussis Vaccine, Adsorbed; Tdap) for immunization during the third trimester of pregnancy to help prevent pertussis (whooping cough) in infants younger than two months old.)

In Nov 2023 Eli and Lilly received FDA approval for Zepbound injection which is the first and only obesity medication.

Prominent players in the injectable drug delivery market are Becton, Dickinson and Company (U.S.), Pfizer Inc. (U.S.), Teva Pharmaceuticals Industries Ltd. (Israel), Eli Lilly and Company (U.S.), Baxter International, Inc. (U.S.), Sandoz (Germany), Terumo (Japan), Schott AG (Germany), Gerresheimer (Germany), Ypsomed (Switzerland), and B. Braun Melsungens (Germany).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global Injectable drug delivery market?

The global Injectable drug delivery market boasts a total revenue value of $1139.4 billion by 2029.

What is the estimated growth rate (CAGR) of the global Injectable drug delivery market?

The global Injectable drug delivery market has an estimated compound annual growth rate (CAGR) of 8.6% and a revenue size in the region of $754.5 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities to estimate the current size of the Injectable drug delivery market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of apheresis Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after obtaining information regarding the apheresis market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from manufacturers; distributors operating in the Injectable drug delivery market.; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using infection control products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage and the future outlook of their business, which will affect the overall market.

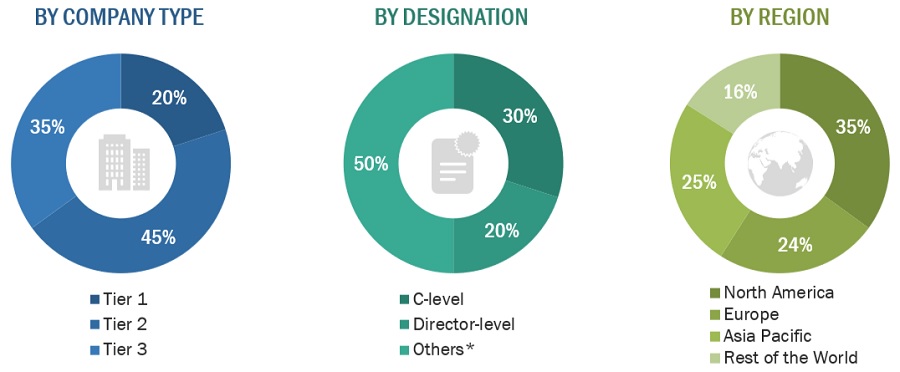

The following is a breakdown of the primary respondents:

BREAKDOWN OF PRIMARY PARTICIPANTS:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Injectable drug delivery market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the apheresis market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall apheresis market was obtained from secondary data and validated by primary participants to arrive at the total Injectable drug delivery market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall apheresis market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Injectable Drug Delivery Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Injectable drug delivery market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Injectable drug delivery market.

Market Definition:

An injectable drug delivery system refers to a method of administering medication directly into the body via injection. This system typically involves a syringe or other delivery device to transfer the medication from its container into the patient's bloodstream, muscle tissue, or specific site of action. Injectable drug delivery is often used for medications that cannot be taken orally, either because they would be broken down by the digestive system or because they need to be delivered quickly and precisely to achieve the desired therapeutic effect. These systems can include various types of injections such as intravenous (IV), intramuscular (IM), subcutaneous (SC), or intra-articular (IA), depending on the specific requirements of the medication and the patient's condition.

Key Stakeholders

- Injectable drugs and devices manufacturing companies

- Pharmaceutical and injectable drug manufacturing companies

- Healthcare institutions (hospitals and outpatient clinics)

- Distributors and suppliers of injectable drugs and devices

- Research institutes

- Health insurance payers

- Market research and consulting firms

Report Objectives

- To define, describe, segment, and forecast the global Injectable drug delivery market by type, route of administration, facility of use, formulation packaging, application, end user, and region.

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the overall Injectable drug delivery market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the apheresis market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the global apheresis market and comprehensively analyze their core competencies2 and market shares.

- To track and analyze competitive developments such as acquisitions, expansions, partnerships, agreements, and collaborations; and product launches and approvals.

- To benchmark players within the apheresis market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Product Analysis: Product matrix, which gives a detailed comparison of the product portfolios of each company

- Geographic Analysis: Further breakdown of the Latin American apheresis into specific countries and, the Middle East, and Africa apheresis into specific countries and further breakdown of the European apheresis into specific countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Injectable Drug Delivery Market