This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global ink additives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, different sources were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized authors. Secondary research was mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and application perspectives.

Primary Research

In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, and related key executives from major companies and organizations operating in the ink additives market. Primary sources from the demand side include experts and key personnel from the ink industry.

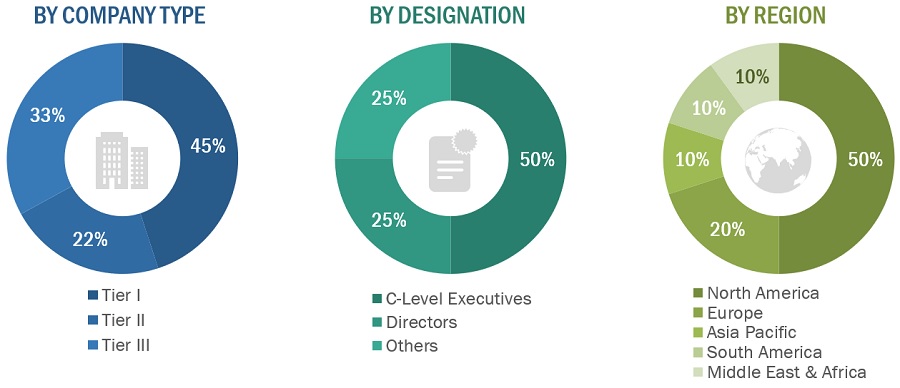

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

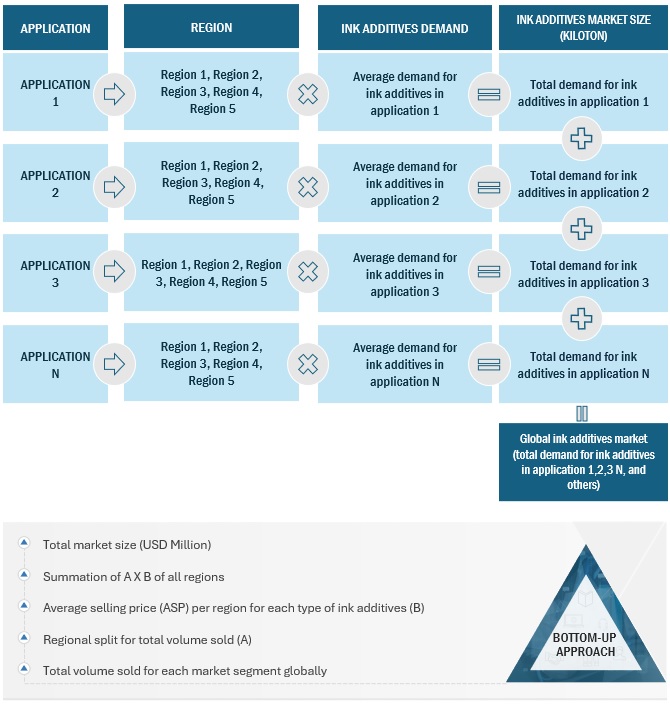

Market Size Estimation

The bottom-up approach has been employed to arrive at the overall size of the ink additives market by estimating the share of ink additives consumed in different applications considered under the scope of the study. The market size in each of the applications has been calculated with the help of the average amount of ink additives used in the pacakging applications to calculate the size of the overall market. Similarly, for other applications of ink additives, the market size has been calculated at the country/regional levels. The outcomes have been summed up to calculate the market size of ink additives at the global level. The average prices for ink additives in different applications have been taken at the regional level. The market size for ink additives, in terms of volume, and the ink additives prices have been multiplied to estimate the global market size in terms of value.

Global Ink Additives Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

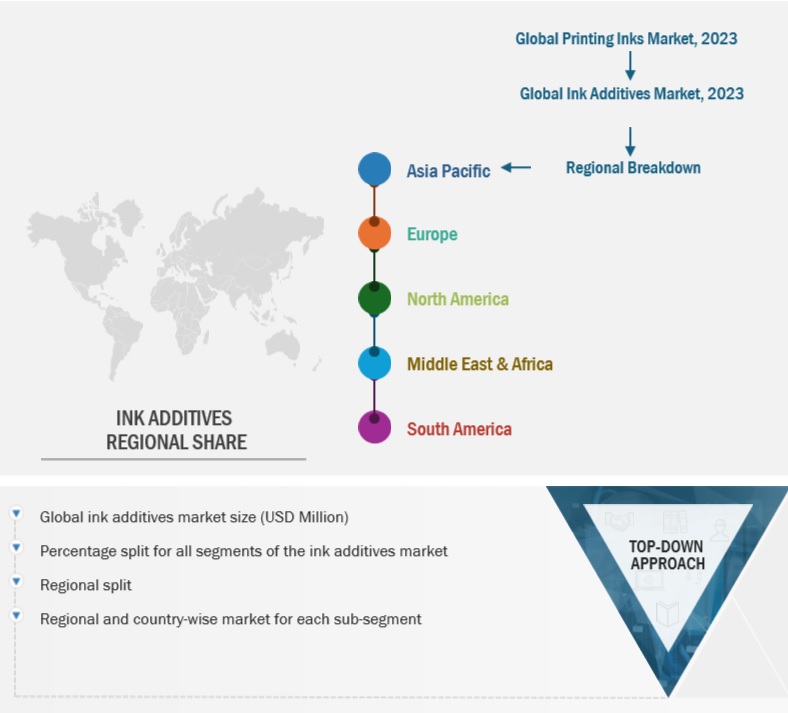

Global Ink Additives Market Size: Top-down Approach

Data Triangulation

After arriving at the total market size, the overall market was split into several segments. The data triangulation procedure was employed, wherever applicable, to complete the market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, the data was obtained through three sources, one from the top-down approach, second from the bottom-up approach, and the third from expert interviews. The data was assumed to be correct only when the values arrived at from these three points matched.

Market Definition.

According to the National Association of Printing Ink Manufacturers, “Ink additives are chemicals that play a vital role in the formulation of inks by enhancing its physical properties. These additives maintain viscosity and improve wetting of both the substrate and pigment. They also help the ink to run smoothly on the substrate. The high requirement for good wetting, surface protection, and defoaming with good pigment stabilization along with other physical properties make ink additives suitable in applications such as packaging, publishing, and printing.

Key Stakeholders

-

Senior Management

-

End User

-

Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, and forecast the size of the ink additives market in terms of value and volume

-

To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

-

To forecast the market size by type, technology, process, and application

-

To forecast the market size with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

-

To analyze competitive developments in the market, such as product development, investment & expansion, and innovation

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the subsegments of the global ink additives market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the ink additives market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Magdalena

Sep, 2019

Information on Ink Additives.

karin

Oct, 2015

Ink additives market and focus on synthetic waxess.

Sam

Oct, 2015

Interested in the market size of plasticizer in gravure ink application..

Benjamin

Jun, 2016

Interested in sheetfed inks and coatings market data covering the APAC, LATAM and Query not Clear region. Market volumes and growth rates by customer / product segment..