Insulin Delivery Devices Market Size by Type (Insulin Pens [Reusable, Disposable], Insulin Pumps (Tethered, Tubeless), Insulin Syringes, Insulin Pen Needles (Standard, Safety)), End User (Hospitals & Clinics, Patients/Homecare) - Global Forecast to 2028

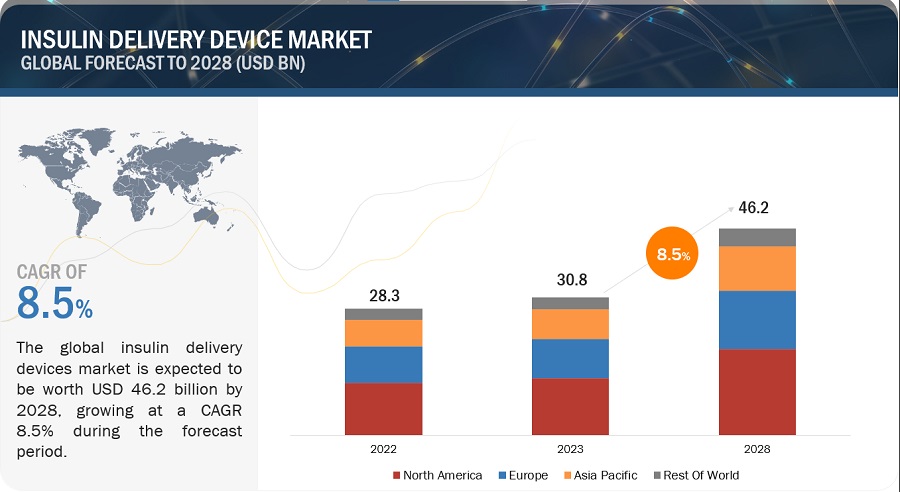

The size of global insulin delivery devices market in terms of revenue was estimated to be worth $30.8 Billion in 2023 and is poised to reach $46.2 billion by 2028, growing at a CAGR of 8.5% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth in the market is mainly driven by factors such as the growing prevalence of the diabetic population, government support and favorable reimbursements, technological advancements in insulin delivery devices. However, the high cost and lack of reimbursement in developing countries are expected to restrain market growth to a certain extent.

Global Insulin Delivery Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Insulin Delivery Devices Market Dynamics

Driver: Growing prevalence of diabetic population

Diabetes is one of the most common non-communicable diseases across the globe. According to the World Health Organization, 422 million people worldwide have diabetes, and 1.5 million deaths are directly attributes to diabetes each year. Among the seven IDF regions, North America and Caribbean has the highest prevalence of diabetes (13.3%), followed by the Middle East and North Africa. Moreover, modern lifestyle characterized by reduced physical activities, rapid urbanization associated with changes in dietary patterns, reduced physical activities, increased consumption of processed foods, and genetic factors have contributes to the increased prevalence of diabetes.

Restraint: High cost and lack of reimbursement in developing countries

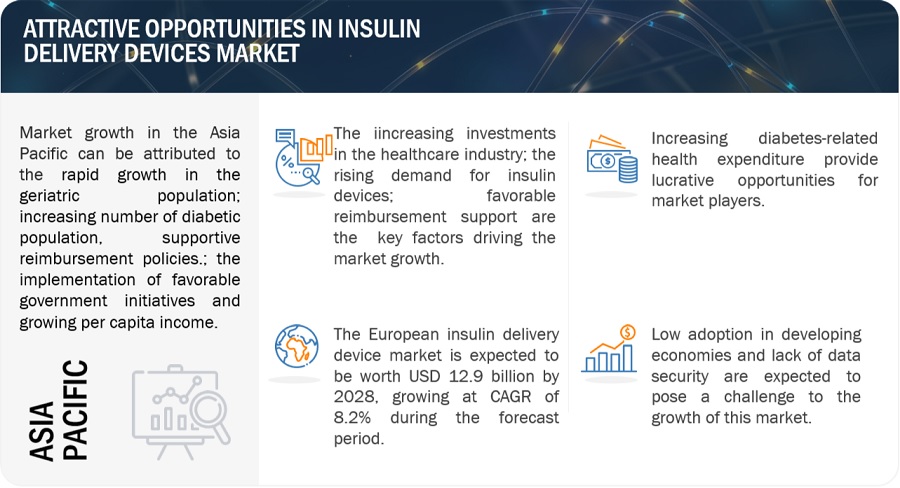

The cost of insulin delivery devices, such as smartphone connected insulin pumps, is approximately USD 4,500-6500. Moreover the average selling price of sensor-based continuous glucose monitors is USD 1,000- 1,400. Thus, due to high initial cost and the frequent use of associated consumables has put the technology advanced insulin delivery devices out of reach for large portion of users, particularly those n developing countries with an unfavourable reimbursement scenario.

Opportunity: Increasing healthcare expenditure on diabetes care

The increase in global health expenditure due to diabetes has been considerable, growing from USD 232 billion in 2007 to USD 966 billion in 2021 for adults aged 20–79 years. This represents a 316% increase over 15 years. Part of this increase can be attributed to improved data quality. The direct costs of diabetes are expected to continue to grow. The IDF estimates that total diabetes-related health expenditure will reach USD 1.03 trillion by 2030 and USD 1.05 trillion by 2045 (Source: IDF Atlas 2021). The North America and Caribbean region has the highest diabetes-related health expenditure per adult with diabetes (USD 8,209), followed by the Europe region (USD 3,086), South and Central America region (USD 2,190), and WP region (USD 1,204). This figure is USD 465 per person with diabetes in the Middle East and North Africa region, USD 547 in the Africa region, and USD 112 in the Southeast Asia region. Expenditure due to diabetes has a substantial impact on total health expenditure worldwide, representing 11.5% of the total global health spending. Considering the increasing diabetes-related health expenditure in emerging countries, many insulin delivery devices manufacturers are focusing on expanding their business in these markets to capitalize on new opportunities.

Challenge: Needlestick injuries and misuse of injection pens

The lack of proper education and training for the use of new delivery devices such as injection pen leads threatens the safety of the staff and patients. Such practices affects the adoption of injection pens in hospital settings. For instance, the National Reporting and Learning System (NRLS, UK) reported about 56 incidents associated with withdrawing insulin from insulin pens or refill cartridges between January 2013 and June 2019. In addition, the strength of insulin in the injection pen varies; thus, this poses the risk of overdose if the dose strength is not taken into consideration. However, training and education for the proper use of insulin injection pens and government regulations, along with the product development, are likely to overcome the challenge.

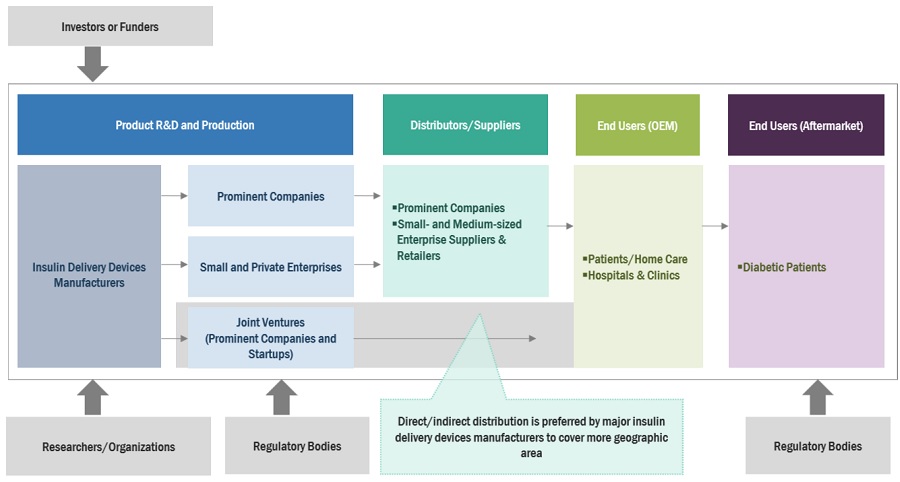

Insulin delivery devices market Ecosystem Map

By type, the insulin pen segment is projected to lead the market of the insulin delivery devices industry in 2023.

The large share of this segment of the insulin delivery devices market is primary attributed to improved dosage accuracy and medication adherence, increasing adoption of insulin pens among diabetes patients. Short and fine needles result in less pain for the user, which is also the major factor driving the adoption of these devices. The pen devices are further subsegment into reusable insulin pen and disposable insulin pen. Factors such as fine disposable needles, dose-measuring dial, improved connectivity, accuracy and user experience are driving the insulin pen market. The insulin pumps is projected to lead the market of the market during the forecast period. Developing closed-loop insulin pump, wearable disposable insulin pump, as well as factors like growing use of tubeless patch pump for automated insulin delivery for diabetic care, are the factors contributing the insulin pump market growth.

By end user, the patients/home care is projected to lead the market of the insulin delivery devices industry during the forecast period

By end user, the insulin delivery devices market is broadly segmented into patients/home care and hospitals & clinics. Patients/ home care segment is projected to lead the global market in 2023. The high growth rate of this segment can be attributed to the greater focus on the training patients for effective use of devices for self administration of insulin, growing diabetic population and increasing diabetic healthcare expenditure.

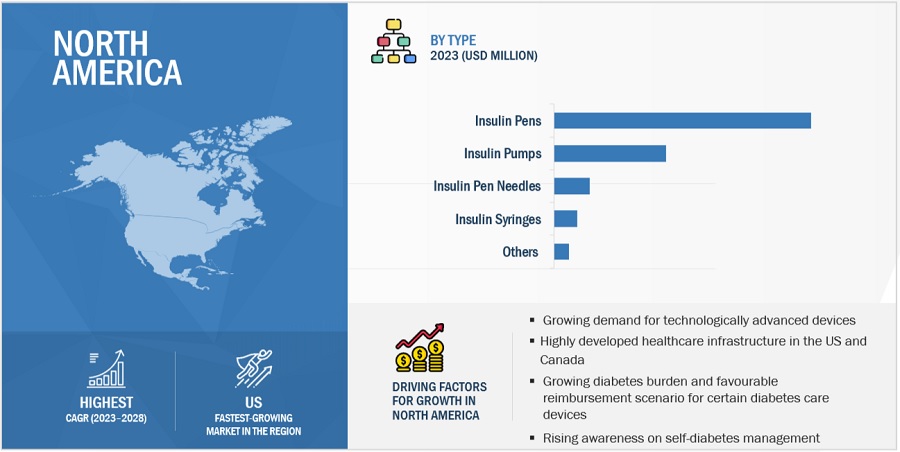

North American region of the insulin delivery devices industry to witness significant growth from 2023 to 2028

On the basis of region, the insulin delivery devices market is divided into North America, Europe, Asia Pacific and Rest of world. In 2023, North America projected to lead market share of the market. Increasing diabetes healthcare expenditure, and the favorable reimbursement in the region are driving the growth of the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players operating in the global insulin delivery devices market are Embecta Corp. (Formerly Becton, Dickinson and Company Diabetes Care Business (US), Novo Nordisk A/S (Denmark), Medtronic (Ireland), Sanofi (France), Eli Lilly and Company (US), Ypsomed Holding AG (Switzerland), Tandem Diabetes Care (US), Insulet Corporation (US), Biocon Limited (India), Roche Diabetes Care (Switzerland), Owen Mumford (England), Mrdtrum Technologies Inc. (China), Terumo Corporation (Japan), Wockhardt (India), Cerur Corporation (Switzerland), EoFlow CO., Ltd. (South Korea), Hindustan Syringes & Medical Devices Ltd (India), Sooil Developments CO., Ltd (Korea), Sungshim Medical Co., Ltd. (South Korea), Vicentra B.V. (Netherland), Debiotech SA (Switzerland), Jiangsu Delfu Medical Device Co., Ltd (China), Haselmeier (Germany), Mannkind Corporation (US), HTL-Sterfa S.A. (Poland).

Scope of the Insulin Delivery Devices Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$30.8 billion |

|

Projected Revenue Size by 2028 |

$46.2 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.5% |

|

Market Driver |

Growing prevalence of diabetic population |

|

Market Opportunity |

Increasing healthcare expenditure on diabetes care |

This research study categorizes the global insulin delivery devices market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Insulin Pens

- Reusable Insulin Pens

- Disposable Insulin Pens

-

Insulin Pumps

- Tethered Insulin Pumps

- Tubeless Insulin Pumps

-

Insulin Pen Needles

- Standard Insulin Pen Needles

- Safety Insulin Pen Needles

- Insulin Syringes

- Other Insulin Delivery Devices (insulin transdermal patches, insulin inhalers, insulin jet injectors, etc. )

By End User

- Patients/Home Care

- Hospitals & Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- Rest of World

Recent Developments of Insulin Delivery Devices Industry

- In 2023, Embecta Corp. opened a new global headquarters office at 300 Kimball Drive, Suite 300, IN Parsippany, N.J. The site is expected to be home to members of the leadership team, global support functions and North American commercial organization to develop and provide solutions that make life better for people coping with diabetes.

- In 2023, Eli Lilly announced price reductions of 70% for its most prescribed insulins and an expansion of its Insulin Value Program that caps patients out-of-pocket cost at USD 35 or less per month.

- In 2023, Novo Nordisk launched the first smart insulin pens NovoPen 6 and NovoPen Echo Plus available in the UK.

- In 2022, Medtronic entered into a set of definitive agreements to acquire EOFlow Co. Ltd., a manufacturer of the EOPatch device- a tubeless, wearable and fully disposable insulin delivery device.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global insulin delivery devices market?

The global insulin delivery devices market boasts a total revenue value of $46.2 billion by 2028.

What is the estimated growth rate (CAGR) of the global insulin delivery devices market?

The global insulin delivery devices market has an estimated compound annual growth rate (CAGR) of 8.5% and a revenue size in the region of $30.8 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the size of the insulin delivery devices market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), American Diabetes Association (ADA), American, Association of Clinical Endocrinologists (AACE), American Association of Diabetes Educators (AADE), American Academy of Pediatrics (AAP), Asian Association for the Study of Diabetes (AASD), Brazilian Diabetes Association (BDA), Latin American Diabetes Association (ALAD), National Association of Diabetes Care, Brazil (ANAD), Juvenile Diabetes Research Foundation (JDRF), International Diabetes Federation (IDF), Diabetes Research Institute Foundation (DRI) Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include suppliers, distributors, CEOs, vice presidents, marketing and sales directors, business development managers, and technology and innovation directors of types of insulin delivery device providers. Primary sources from the demand side include industry experts such as homecare providers, healthcare professionals, diabetes patients, payers, and other related key opinion leaders.

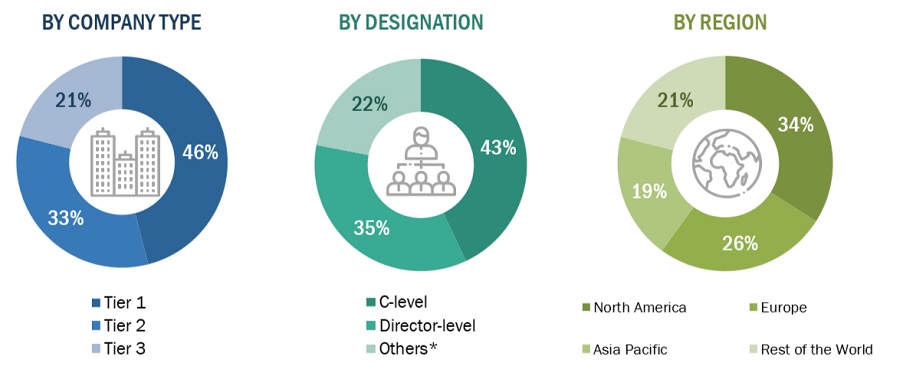

Breakdown of Primary Interviews by supply side

To know about the assumptions considered for the study, download the pdf brochure

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Market Size Estimation

The research methodology used to estimate the market size includes the following details:

Total Market Size: The total size of the insulin delivery devices market was arrived at after data triangulation from different approaches, as mentioned below. After completing each approach, the weighted average of the various approaches was taken based on the level of assumptions used in each approach.

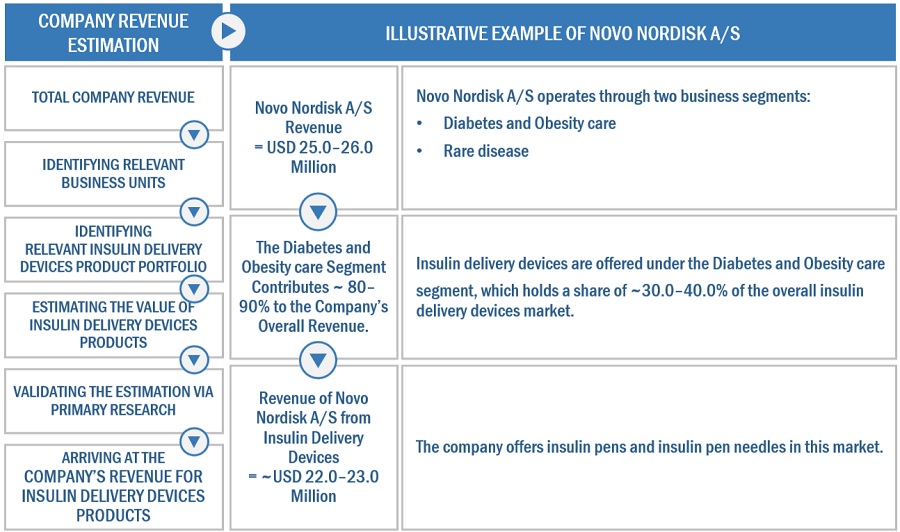

REVENUE SHARE ANALYSIS

- The revenues of individual companies were gathered from public sources and databases.

- Shares of the insulin delivery devices businesses of leading players were gathered from secondary sources to the extent available. In certain cases, shares of the insulin delivery devices market have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, geographic reach, and strength.

- Individual shares or revenue estimates were validated through expert interviews.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

Insulin delivery devices are medical devices designed to administer insulin, a hormone used in the management of diabetes, into the body. These devices are primarily used by individuals with diabetes who require insulin therapy to regulate their blood sugar levels. Insulin pens, pumps, pen needles, and syringes are the most widely used delivery devices

Key Stakeholders

- Insulin delivery device manufacturers, vendors, and distributors

- Group purchasing organizations (GPOs)

- Original equipment manufacturers (OEMs)

- Physicians/Diabetologists

- Homecare providers

- Hospitals and clinics

- Contract research organizations (CROs)

- Research institutes and government organizations

- Market research and consulting firms

- Contract manufacturing organizations (CMOs)

- Venture capitalists

- Senior Management

- Purchase & Finance Departments

- Patients

Report Objectives

- To define, measure, and describe the global insulin delivery devices market on the basis of type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, challenges, and opportunities)

- To analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and RoW

- To strategically analyze the market structure and profile key players in the global insulin delivery devices market and comprehensively analyze their core competencies

- To track and analyze company developments such as partnerships, agreements, and collaborations; expansions; joint ventures; and product launches in the insulin delivery devices market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

- Further breakdown of the Rest of the Asia Pacific insulin delivery devices market into Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe insulin delivery devices market into Italy, Spain, Belgium, Russia, the Netherlands, Switzerland, and other countries

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insulin Delivery Devices Market