Laboratory Gas Generators Market by type (Nitrogen, Hydrogen, Zero Air, Purge Gas, ToC), Application (Gas Chromatography, LC-MS), End user (Life Science Industry, Chemical & Petrochemical Industry, Food & Beverage Industry) - Global Forecast to 2026

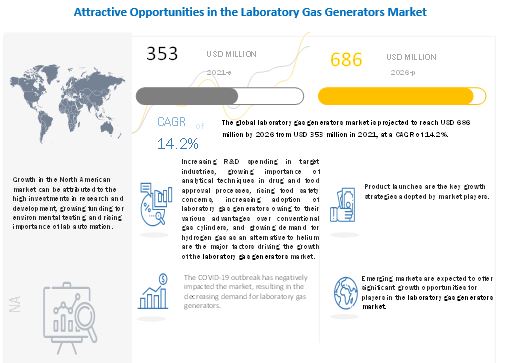

The global laboratory gas generators market in terms of revenue was estimated to be worth $353 million in 2021 and is poised to reach $686 million by 2026, growing at a CAGR of 14.2% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of the laboratory gas generators industry is primarily driven by the growing importance of analytical techniques in drug and food approval processes, rising food safety concerns, increasing adoption of laboratory gas generators owing to their various advantages over conventional gas cylinders, growing demand for hydrogen gas as an alternative to helium, and the increasing R&D spending in target industries. On the other hand, reluctance shown by lab users in terms of replacing conventional gas supply methods with modern laboratory gas generators and the availability of refurbished products are the major factors expected to hamper the growth of this market.

To know about the assumptions considered for the study, download the pdf brochure

Laboratory Gas Generators Market Dynamics

DRIVER: Increasing R&D spending in target industries

With a growing focus on developing and delivering effective solutions, there has been a significant increase in the overall R&D activities in industries such as life sciences, chemical and petrochemical, and food and beverages. In 2019, Pharmaceutical Research and Manufacturers of America (PhRMA) members invested USD 83 billion in R&D, establishing the biopharmaceutical industry as the most R&D-intensive sector in the US. Similarly, the European Commission’s new framework, Horizon 2020, proposed a budget allocation of USD 110.99 billion (EUR 100 billion) for research activities for the period of 2021 to 2027 (Source: European Commission).

OPPORTUNITY: Opportunities in the life sciences industry

The demand for the analytical testing of cannabis for ensuring its safety before human consumption has increased in recent years, as medical cannabis is being legalized in a number of countries/states across the globe. Medical cannabis has proven effective in various medical applications, such as reducing nausea caused due to chemotherapy, stimulating appetite in AIDS patients, controlling muscular spasms in multiple sclerosis patients, and reducing intraocular pressure in patients with glaucoma. Owing to their health benefits, governments in various countries are legalizing the use of medical cannabis. Australia (2016), Canada (2015), South Korea (2018), Portugal (2001), the UK (2006), Germany (2017), Italy (2013), the Netherlands (2003), and Brazil (2017) have all legalized the use of medical cannabis in recent years.

CHALLENGE: Availability of refurbished products

The availability of refurbished laboratory gas generators is a major challenge to the growth of this market. KRSS Ltd. (US), SpectraLab Scientific Inc. (Canada), McKinley Scientific (US), and GenTech Scientific LLC (US) are some of the companies offering refurbished laboratory gas generators such as hydrogen gas generators, nitrogen gas generators, and zero air generators. Many end users, mainly small and medium-sized laboratories, look for cost-effectiveness and opt for refurbished systems, particularly in price-sensitive markets in developing countries.

The hydrogen gas generators segment accounted for the highest growth rate in the laboratory gas generators industry, by type, during the forecast period

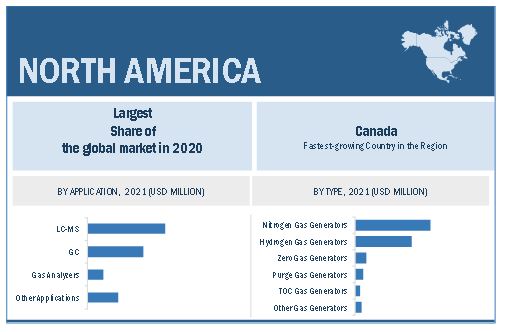

Based on type, the laboratory gas generators market is segmented into nitrogen gas generators, hydrogen gas generators, zero air generators, purge gas generators, TOC gas generators, and other gas generators. The hydrogen gas generators segment accounted for the highest growth rate in the Labortaory gas generators market in 2020. This can be attributed to the growing preference for hydrogen as a cost-effective alternative to helium, as it offers faster analysis and optimal results.

Gas chromatography segment of the laboratory gas generators industry accounted for the highest CAGR

Based on application, the laboratory gas generators market is segmented into gas chromatography (GC), liquid chromatography-mass spectrometry (LC-MS), gas analyzers, and other applications. In 2020, gas chromatography accounted for accounted for the highest growth rate. The major factors driving the growth of this is the adoption of hydrogen over helium due to the latter’s high cost and scarcity in gas chromatography.

Life science industry accounted for the largest share of the laboratory gas generators industry

Based on end user, the laboratory gas generators market is segmented into the life science industry, chemical and petrochemical industry, food and beverage industry, and other end users (environmental companies and research & academic institutes). The life science industry accounted for the largest share of the global market. The major factors driving the growth of this segment are the rising demand for laboratory analytical instruments, increase in drug research activities, and stringent regulations relating to the drug discovery process.

North America accounted for the largest share of the laboratory gas generators industry

The laboratory gas generators market is divided into five regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America dominated the global market. The large share of the North American region is mainly attributed to the high investments in R&D in the US and Canada, which has led to a higher demand for efficient and advanced laboratory equipment.

Some of the major players operating in this market are Parker Hannifin Corporation (US), PeakGas (UK), and Linde plc (Ireland). In 2019, Parker Hannifin Corporation held the leading position in the laboratory gas generators market. The company has installed over 40,000 units of laboratory gas generators globally. The company offers a wide range of products in the market. The company’s gas generators produce gas purity levels that are the highest in the industry.PeakGas held the second position in the market in 2019.

Scope of the Laboratory Gas Generators Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$353 million |

|

Projected Revenue by 2026 |

$686 million |

|

Revenue Rate |

Poised to grow at a CAGR of 14.2% |

|

Market Driver |

Increasing R&D spending in target industries |

|

Market Opportunity |

Opportunities in the life sciences industry |

This research report categorizes the laboratory gas generators market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Nitrogen Gas Generators

- Hydrogen Gas Generators

- Zero Air Generators

- Purge Gas Generators

- TOC Gas Generators

- Other Gas Generators

By Application

- Gas Chromatography

- Liquid Chromatography-Mass Spectrometry

- Gas Analyzers

- Other Applications

By End User

- Life Science Industry

- Chemical & Petrochemical Industry

- Food & Beverage Industry

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- RoAPAC

- Rest of the World

Recent Developments of Laboratory Gas Generators Industry

- In 2020, PeakGas launched various laboratory gas generators such as Genius XE SCI 2, MS Bench (G) SCI 2, MS Bench SCI 2, and i-Flow O2 oxygen gas generator.

- In 2019, Laboratory Supplies Ltd. (Ireland), a supplier of scientific, industrial, and laboratory apparatus, joined the distributor network of the Asynt Ltd.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory gas generators market?

The global laboratory gas generators market boasts a total revenue value of $686 million by 2026.

What is the estimated growth rate (CAGR) of the global laboratory gas generators market?

The global laboratory gas generators market has an estimated compound annual growth rate (CAGR) of 14.2% and a revenue size in the region of $353 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LABORATORY GAS GENERATORS: MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

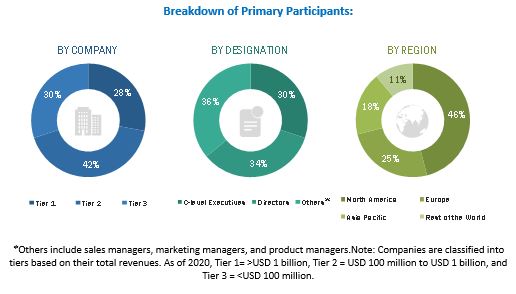

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 ECONOMIC ASSESSMENT

2.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 11 LABORATORY GAS GENERATORS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 LABORATORY GAS GENERATORS INDUSTRY, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 LABORATORY GAS GENERATORS MARKET OVERVIEW

FIGURE 15 INCREASING R&D SPENDING IN TARGET INDUSTRIES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY APPLICATION & COUNTRY (2020)

FIGURE 16 LC-MS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 LABORATORY GAS GENERATORS: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 LABORATORY GAS GENERATORS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing R&D spending in target industries

TABLE 1 INDICATIVE LIST OF INSTRUMENT SALES IN 2018

5.2.1.2 Growing importance of analytical techniques in drug approval processes

5.2.1.3 Rising food safety concerns

TABLE 2 STRINGENT REGULATIONS IN FOOD TESTING

5.2.1.4 Increasing adoption of laboratory gas generators owing to their various advantages over conventional gas cylinders

TABLE 3 LABORATORY GAS GENERATORS VS. CONVENTIONAL GAS CYLINDERS

5.2.1.5 Growing demand for hydrogen gas as an alternative to helium

5.2.2 MARKET OPPORTUNITIES

5.2.2.1 Growing demand for laboratory automation

5.2.2.2 Opportunities in the life sciences industry

5.2.2.2.1 Cannabis testing

5.2.2.2.2 Proteomics

5.2.3 MARKET CHALLENGES

5.2.3.1 Reluctance to replace conventional gas supply methods with modern laboratory gas generators

5.2.3.2 Availability of refurbished products

5.3 COVID-19 IMPACT ON THE MARKET

FIGURE 19 STATUS OF RESEARCH LABORATORIES DURING THE COVID-19 PANDEMIC

5.4 REGULATORY LANDSCAPE

5.4.1 NORTH AMERICA

5.4.2 EUROPE

5.4.3 EMERGING MARKETS

5.5 TECHNOLOGY ANALYSIS

TABLE 4 RECENT PRODUCT LAUNCHES WITH ADVANCED TECHNOLOGIES IN THE MARKET

5.6 PRICING ANALYSIS

5.6.1 AVERAGE SELLING PRICE

TABLE 5 LABORATORY GAS GENERATORS: AVERAGE SELLING PRICE IN 2020

TABLE 6 PRICES OF PURGE GAS GENERATORS AND TOC GAS GENERATORS IN 2020

TABLE 7 PERKINELMER: PRICES OF HYDROGEN GAS GENERATORS IN 2020

TABLE 8 PERKINELMER: PRICES OF NITROGEN GAS GENERATORS IN 2020

TABLE 9 PERKINELMER: PRICES OF ZERO AIR GENERATORS IN 2020

5.6.2 COST ANALYSIS: CONVENTIONAL GAS CYLINDERS VS. PEAKGAS LABORATORY GAS GENERATORS IN AUSTRALIA & NEW ZEALAND

TABLE 10 COSTS ASSOCIATED WITH CONVENTIONAL GAS CYLINDERS (USD)

TABLE 11 COSTS ASSOCIATED WITH PEAKGAS LABORATORY GAS GENERATORS (USD)

5.6.3 COST ANALYSIS: HELIUM GAS CYLINDERS VS. PEAKGAS HYDROGEN GAS GENERATORS

TABLE 12 COSTS ASSOCIATED WITH HELIUM GAS CYLINDERS (USD)

TABLE 13 COSTS ASSOCIATED WITH PEAK GAS HYDROGEN GAS GENERATORS (USD)

5.7 TRADE ANALYSIS

5.7.1 TRADE ANALYSIS FOR LABORATORY GAS GENERATORS

TABLE 14 IMPORT DATA FOR PRODUCER GAS GENERATORS (INCLUDING LABORATORY GAS GENERATORS), BY COUNTRY, 2016-2020 (USD MILLION)

TABLE 15 EXPORT DATA FOR PRODUCER GAS GENERATORS (INCLUDING LABORATORY GAS GENERATORS), BY COUNTRY, 2016-2020 (USD MILLION)

5.8 PATENT ANALYSIS

5.9 VALUE CHAIN ANALYSIS

FIGURE 20 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 21 DIRECT DISTRIBUTION IS THE STRATEGY PREFERRED BY PROMINENT COMPANIES

5.11 ECOSYSTEM ANALYSIS OF THE MARKET

FIGURE 22 ECOSYSTEM ANALYSIS OF THE MARKET

5.11.1 ROLE IN THE ECOSYSTEM

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 HIGH CONSOLIDATION IN THE MARKET TO RESTRICT THE ENTRY OF NEW PLAYERS

5.12.1 DEGREE OF COMPETITION

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF SUBSTITUTES

5.12.5 THREAT OF NEW ENTRANTS

5.13 PESTLE ANALYSIS

FIGURE 23 PESTLE ANALYSIS

6 LABORATORY GAS GENERATORS MARKET, BY TYPE (Page No. - 70)

6.1 INTRODUCTION

TABLE 17 LABORATORY GAS GENERATORS INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

6.2 NITROGEN GAS GENERATORS

6.2.1 NITROGEN GAS GENERATORS WILL DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 18 PSA-BASED VS. MEMBRANE-BASED NITROGEN GENERATORS

TABLE 19 NITROGEN GAS GENERATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 NORTH AMERICA: NITROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 21 EUROPE: NITROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 22 ASIA PACIFIC: NITROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 HYDROGEN GAS GENERATORS

6.3.1 HYDROGEN GAS GENERATORS SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 23 HYDROGEN GAS GENERATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: HYDROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 25 EUROPE: HYDROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 26 ASIA PACIFIC: HYDROGEN GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 ZERO AIR GENERATORS

6.4.1 ZERO AIR GENERATORS ARE IDEAL FOR GAS CHROMATOGRAPHY APPLICATIONS

TABLE 27 ZERO AIR GENERATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 NORTH AMERICA: ZERO AIR GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 EUROPE: ZERO AIR GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 30 ASIA PACIFIC: ZERO AIR GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.5 PURGE GAS GENERATORS

6.5.1 PURGE GAS GENERATORS ARE ENGINEERED SPECIFICALLY FOR FT-IR SPECTROMETERS

TABLE 31 PURGE GAS GENERATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 NORTH AMERICA: PURGE GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 EUROPE: PURGE GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 ASIA PACIFIC: PURGE GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.6 TOC GAS GENERATORS

6.6.1 WIDE ADOPTION OF TOC GAS GENERATORS IN PHARMACEUTICAL AND ENVIRONMENTAL INDUSTRIES TO DRIVE MARKET GROWTH

TABLE 35 TOC GAS GENERATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: TOC GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 37 EUROPE: TOC GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 38 ASIA PACIFIC: TOC GAS GENERATORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.7 OTHER GAS GENERATORS

TABLE 39 OTHER MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 LABORATORY GAS GENERATORS MARKET, BY APPLICATION (Page No. - 83)

7.1 INTRODUCTION

TABLE 43 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY

7.2.1 CONVENIENCE, HIGH EFFICACY, AND WIDE ADOPTION OF LC-MS ARE SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 44 LABORATORY GAS GENERATORS USED IN LC-MS

TABLE 45 MARKET FOR LC-MS, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET FOR LC-MS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 EUROPE: MARKET FOR LC-MS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET FOR LC-MS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 GAS CHROMATOGRAPHY

7.3.1 GC IS THE FASTEST-GROWING APPLICATION SEGMENT

TABLE 49 LABORATORY GAS GENERATORS USED IN GAS CHROMATOGRAPHY

TABLE 50 MARKET FOR GC, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR GC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET FOR GC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET FOR GC, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 GAS ANALYZERS

7.4.1 PORTABILITY OF GAS ANALYZERS AND ABILITY TO SIMULTANEOUSLY MEASURE MULTIPLE GASES HAVE DRIVEN THEIR USE

TABLE 54 LABORATORY GAS GENERATORS USED IN GAS ANALYZERS

TABLE 55 MARKET FOR GAS ANALYZERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET FOR GAS ANALYZERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 57 EUROPE: MARKET FOR GAS ANALYZERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET FOR GAS ANALYZERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 OTHER APPLICATIONS

TABLE 59 MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8 LABORATORY GAS GENERATORS MARKET, BY END USER (Page No. - 93)

8.1 INTRODUCTION

TABLE 63 LABORATORY GAS GENERATORS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

8.2 LIFE SCIENCE INDUSTRY

8.2.1 RISING ADOPTION OF LABORATORY ANALYTICAL INSTRUMENTS FOR DRUG RESEARCH IS DRIVING THE GROWTH OF THIS SEGMENT

TABLE 64 R&D INVESTMENTS IN THE LIFE SCIENCE INDUSTRY, BY COUNTRY

TABLE 65 MARKET FOR LIFE SCIENCE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR LIFE SCIENCE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET FOR LIFE SCIENCE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET FOR LIFE SCIENCE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 CHEMICAL & PETROCHEMICAL INDUSTRY

8.3.1 APPLICATION OF GASES IN THE ANALYSIS OF PETROLEUM PRODUCTS TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 69 MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET FOR CHEMICAL & PETROCHEMICAL INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 FOOD & BEVERAGE INDUSTRY

8.4.1 GROWING IMPORTANCE OF FOOD SAFETY TO DRIVE THE MARKET GROWTH

TABLE 73 MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 75 EUROPE: MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET FOR FOOD & BEVERAGE INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER END USERS

TABLE 77 MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 LABORATORY GAS GENERATORS MARKET, BY REGION (Page No. - 104)

9.1 INTRODUCTION

TABLE 81 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: LABORATORY GAS GENERATORS MARKET SNAPSHOT

TABLE 82 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Growth in the US is driven by high investments in R&D

TABLE 86 US: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing focus on environment protection to support market growth

TABLE 89 CANADA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 EUROPE: LABORATORY GAS GENERATORS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany dominates the laboratory gas generators market in Europe

TABLE 96 GERMANY: LABORATORY GAS GENERATORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 98 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 The UK to register the highest growth in the European market during the forecast period

TABLE 99 UK: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Adoption of advanced technologies in R&D to drive market growth in France

TABLE 102 FRANCE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 104 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 105 ROE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 107 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: LABORATORY GAS GENERATORS MARKET SNAPSHOT

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 High investments in R&D will propel the market growth

TABLE 112 JAPAN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 JAPAN: LABORATORY GAS GENERATORS INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 China is the fastest-growing market for laboratory gas generators

TABLE 115 CHINA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 117 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 ROAPAC

TABLE 118 ROAPAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 120 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD

9.5.1 COST ADVANTAGE OFFERED BY LATIN AMERICAN COUNTRIES TO SUPPORT MARKET GROWTH

TABLE 121 ROW: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 ROW: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 123 ROW: MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 132)

10.1 OVERVIEW

FIGURE 26 KEY DEVELOPMENTS IN THE LABORATORY GAS GENERATORS MARKET, JANUARY 2018–FEBRUARY 2021

10.2 MARKET SHARE ANALYSIS

TABLE 124 LABORATORY GAS GENERATORS INDUSTRY SHARE, BY KEY PLAYER (2019)

10.3 COMPETITIVE SCENARIO

FIGURE 27 MARKET EVALUATION MATRIX, 2018-2020

10.3.1 PRODUCT LAUNCHES

TABLE 125 PRODUCT LAUNCHES

10.3.2 DEALS

TABLE 126 DEALS

10.3.3 OTHER DEVELOPMENTS

TABLE 127 OTHER DEVELOPMENTS

10.4 COMPANY EVALUATION MATRIX

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 28 MARKET: VENDOR DIVE MATRIX, 2019

10.5 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 29 MARKET: VENDOR DIVE MATRIX FOR SMES & START-UPS, 2019

10.6 COMPANY PRODUCT FOOTPRINT

FIGURE 30 PRODUCT PORTFOLIO ANALYSIS: MARKET

10.7 COMPANY GEOGRAPHIC FOOTPRINT

FIGURE 31 GEOGRAPHIC REVENUE MIX: LABORATORY GAS GENERATORS INDUSTRY (2019)

11 COMPANY PROFILES (Page No. - 142)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

11.1.1 PARKER HANNIFIN CORPORATION

FIGURE 32 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT (2020)

11.1.2 PEAKGAS

TABLE 128 PEAKGAS: BUSINESS OVERVIEW

11.1.3 LINDE PLC

FIGURE 33 LINDE PLC: COMPANY SNAPSHOT (2019)

11.1.4 NEL ASA

FIGURE 34 NEL: COMPANY SNAPSHOT (2019)

11.1.5 PERKINELMER, INC.

FIGURE 35 PERKINELMER: COMPANY SNAPSHOT (2019)

11.1.6 VICI DBS

TABLE 129 VICI DBS: BUSINESS OVERVIEW

11.1.7 ANGSTROM ADVANCED INC.

TABLE 130 ANGSTROM ADVANCED INC.: BUSINESS OVERVIEW

11.1.8 DÜRR GROUP

FIGURE 36 DÜRR GROUP: COMPANY SNAPSHOT (2019)

11.1.9 ERREDUE S.P.A.

TABLE 131 ERREDUE S.P.A.: BUSINESS OVERVIEW

11.1.10 F-DGSI

TABLE 132 F-DGSI: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 LABTECH S.R.L.

TABLE 133 LABTECH S.R.L: BUSINESS OVERVIEW

11.2.2 CLAIND SRL

TABLE 134 CLAIND SRL: BUSINESS OVERVIEW

11.2.3 ON SITE GAS SYSTEMS, INC.

TABLE 135 ON SITE GAS SYSTEMS, INC.: BUSINESS OVERVIEW

11.2.4 WIRAC AUTOMATION LTD.

TABLE 136 WIRAC AUTOMATION LTD.: BUSINESS OVERVIEW

11.2.5 ISOLCELL S.P.A

TABLE 137 ISOLCELL S.P.A: BUSINESS OVERVIEW

11.2.6 PCI ANALYTICS PRIVATE LIMITED

TABLE 138 PCI ANALYTICS PRIVATE LIMITED: BUSINESS OVERVIEW

11.2.7 INMATEC GASETECHNOLOGIE GMBH & CO. KG

TABLE 139 INMATEC GASETECHNOLOGIE GMBH & CO. KG: BUSINESS OVERVIEW

11.2.8 OXYMAT A/S

TABLE 140 OXYMAT A/S: BUSINESS OVERVIEW

11.2.9 NITROGENIUM INNOVATIONS & FILTERATION INDIA PVT. LTD.

TABLE 141 NITROGENIUM INNOVATIONS & FILTERATION INDIA PVT. LTD.: BUSINESS OVERVIEW

11.2.10 ANALAB SCIENTIFIC INSTRUMENTS PRIVATE LIMITED

TABLE 142 ANALAB SCIENTIFIC INSTRUMENTS PRIVATE LIMITED: BUSINESS OVERVIEW

11.2.11 LNI SWISSGAS SRL

TABLE 143 LNI SWISSGAS SRL: BUSINESS OVERVIEW

11.2.12 ASYNT LTD.

TABLE 144 ASYNT LTD.: BUSINESS OVERVIEW

11.2.13 APEX GASGEN

TABLE 145 APEX GASGEN: BUSINESS OVERVIEW

11.2.14 LEMAN INSTRUMENTS

TABLE 146 LEMAN INSTRUMENTS: BUSINESS OVERVIEW

11.2.15 LABORATORY GAS AFRICA

TABLE 147 LABORATORY GAS AFRICA: BUSINESS OVERVIEW

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 182)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the labortaory gas generators market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (laboratory equipment purchase managers, scientist, and researchers) and supply sides (laboratory gas generators manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the laboratory gas generators market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the laboratory gas generators industry.

Report Objectives

- To define, describe, and forecast the laboratory gas generators market by type, application, end user, and region

- To provide detailed information regarding the factors influencing the market growth (such as drivers, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the laboratory gas generators market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments in North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions in the laboratory gas generators market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the laboratory gas generators market into specific countries/regions in the Rest of the World, Rest of APAC, and Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Gas Generators Market