Learning Management System Market by Offering (Solutions, Services), Delivery Mode (Distance Learning, Instructor-led Learning, Blended Learning), Deployment Type, Organization Size, Application Area, User Type and Region - Global Forecast to 2028

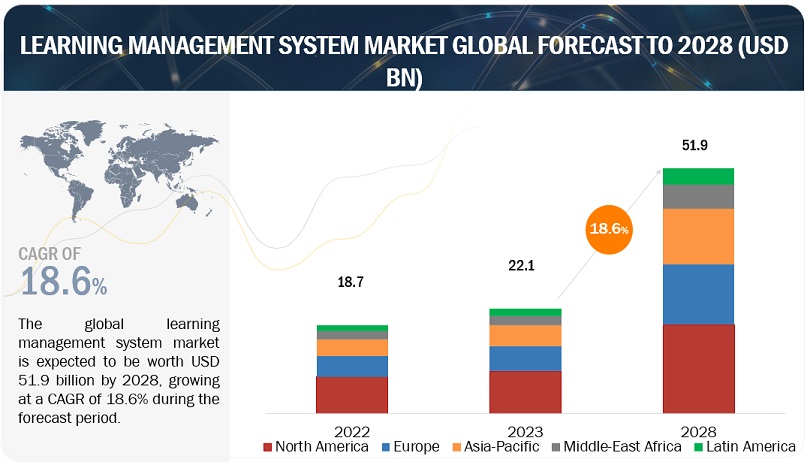

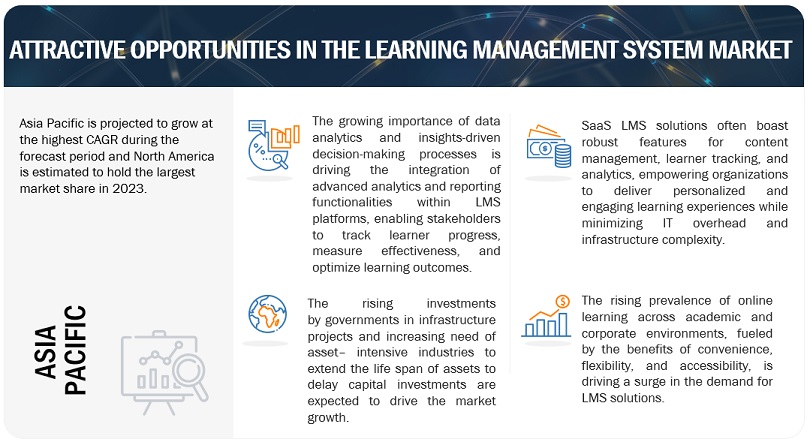

[369 Pages Report] The LMS market is expected to grow from USD 22.1 billion in 2023 to USD 51.9 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.6% during the forecast period. The market for LMS is experiencing significant growth due to various factors transforming the landscape of education and training worldwide. With the rapid digitalization of industries and the increasing demand for remote learning solutions, the LMS market has become a crucial enabler of effective and scalable learning experiences. The primary reason for the growth of the LMS market is the rising adoption of digital learning solutions in academic and corporate settings. Educational institutions are using LMS platforms to offer interactive online courses, facilitate blended learning models, and provide flexible learning options to students.

Similarly, corporations are utilizing LMS solutions to provide training programs, upskill employees, and ensure compliance with industry regulations. Moreover, the LMS market is driven by integrating advanced technologies such as AI, ML, and analytics. These technologies personalize learning experiences, automate administrative tasks, and provide actionable learner performance and engagement insights. Mobile learning solutions are becoming more popular, providing a convenient way for employees to access learning resources. The LMS market is highly competitive, with crucial players constantly innovating and developing their products to stay ahead. They focus on improving platform capabilities and user experience and expanding their offerings through strategic partnerships and acquisitions. The LMS market will continue growing, driven by the increasing emphasis on lifelong learning, upskilling and reskilling programs, and the adoption of online education. As organizations prioritize digital learning initiatives, the LMS market will offer ample opportunities for innovation and growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Learning Management System Market

The impact of a recession on the market is medium-term mainly. Vendors offering learning management systems are also mildly affected. Although recessions may initially pose challenges for the LMS market due to budget constraints and reduced spending, they can also increase demand for online learning solutions because organizations and educational institutions seek cost-effective ways to invest in workforce development and adapt to changing economic conditions. As a result, the long-term impact of a recession on the LMS market may be influenced by broader trends in digital transformation, remote work, and education. To cut costs, organizations may prioritize cost-effective solutions. They might favor cloud-based LMS platforms, which often involve lower upfront costs and scalable subscription models over on-premises solutions. While some training initiatives may face budget constraints, there could be an increased focus on upskilling and reskilling employees to meet changing business needs during economic uncertainties. LMS platforms that offer targeted and efficient training may still find demand.

Learning Management System Market Dynamics

Driver: Global shift towards digitalization in education and corporate training

The increasing recognition of the effectiveness of online learning methods, coupled with the need for remote education and training solutions, has accelerated the adoption of LMS across various sectors. The proliferation of digital content, eBooks, and multimedia resources and the demand for personalized and adaptive learning experiences have fueled the need for robust learning management systems. Educational institutions and businesses leverage LMS to provide scalable, accessible, and engaging learning environments. Moreover, the pandemic has further intensified the reliance on digital learning solutions, expanding the LMS market as organizations seek versatile platforms to manage and deliver educational content efficiently. Integrating AI and ML into LMS platforms enhances their capabilities as technology evolves, offering educators and administrators adaptive learning paths, personalized content recommendations, and data-driven insights. The growing emphasis on upskilling and continuous learning in the workforce also drives the adoption of LMS in corporate settings. Organizations recognize the importance of cultivating a learning culture to stay competitive and address evolving skill requirements.

Restraint: Lack of performance tracking and measuring RoI

Organizations and educational institutions often encounter challenges in assessing the impact and outcomes of their training programs conducted through LMS platforms. One key aspect of this restraint is the difficulty in accurately tracking learners' performance. Traditional metrics such as completion rates or quiz scores may not comprehensively understand the practical application of acquired knowledge or skills. Assessing factors such as on-the-job performance improvement, application of learned skills, or behavioral changes can be complex and require more sophisticated tracking mechanisms. Moreover, measuring the RoI of training initiatives facilitated by LMS platforms poses challenges. Determining the direct correlation between the investment made in training and the tangible benefits or improvements in organizational outcomes is often intricate. Many organizations struggle to establish clear connections between training efforts and critical performance indicators, hindering their ability to demonstrate a positive ROI. There is a growing need for more robust analytics and reporting features within LMS platforms to address this restraint. Advanced analytics can provide insights into learner engagement, progress, and application of skills in real-world scenarios. Additionally, integrating LMS data with broader organizational performance metrics can contribute to a more comprehensive evaluation of the impact of training initiatives.

Opportunity: Increasing demand for adaptive learning solutions

Adaptive learning leverages technology, AI, and data analytics to tailor educational experiences to the individual needs of learners. This approach recognizes and adapts to each student or trainee's unique learning styles, preferences, and proficiency levels. The opportunity arises from the recognition that traditional, one-size-fits-all learning models may not effectively cater to the diverse needs of modern learners. Adaptive learning platforms within the LMS market offer personalized content delivery, real-time feedback, and dynamic adjustments to learning paths based on learner performance; this enhances engagement and promotes more effective knowledge retention and skill development. The adaptive learning market is driven by the desire for more personalized and efficient learning experiences in educational institutions and corporate training settings.

Challenge: absence of multi-language support in LMS platforms

As educational institutions and organizations operate in diverse linguistic environments, the absence of robust multi-language capabilities in LMS platforms hinders their ability to cater to the needs of a global or linguistically varied user base. This challenge becomes particularly pronounced in international educational settings, where students and instructors may come from different linguistic backgrounds. Without adequate multi-language support in the LMS, there can be difficulties in delivering content, instructions, and assessments in a manner that is accessible and meaningful to users with varying language proficiencies.

Moreover, the lack of multi-language support may impede efforts to provide inclusive and equitable education, limiting the ability to reach a broader audience and create a truly global learning environment. Institutions with multilingual student populations or those offering courses to an international audience find it challenging to ensure that all users can engage with the learning materials in their preferred language.

Learning Management System Market ecosystem

Based on delivery mode, the blended learning segment will grow at a higher CAGR during the forecast period.

Blended learning is a combination of traditional face-to-face instruction with online learning activities, holds significant importance in the Learning Management System (LMS) market due to its ability to enhance learning outcomes, flexibility, and engagement. By integrating both offline and online learning modalities, blended learning leverages the strengths of each approach to create a more comprehensive and effective learning experience. In the LMS market, the incorporation of blended learning features allows organizations and educational institutions to cater to diverse learning styles, preferences, and needs of learners. Blended learning enables learners to access learning materials and resources at their own pace and convenience, while also providing opportunities for real-time interaction, collaboration, and feedback with instructors and peers. Moreover, blended learning fosters a more interactive and engaging learning environment by incorporating multimedia content, interactive assessments, simulations, and discussions, all of which can be seamlessly managed and delivered through an LMS platform.Based on user type, the corporate users segment will grow at a higher CAGR during the forecast period.

Corporate users and Learning Management Systems (LMS) are integral to modern workplace learning and development strategies. Several trends are shaping the relationship between corporate users and LMS platforms. Artificial Intelligence (AI) is being leveraged in LMS platforms to offer personalized learning experiences. AI algorithms analyze user behavior and preferences to recommend relevant content and adapt learning paths. Corporate users can access a comprehensive library of learning materials in one place, simplifying the learning process and reducing the time spent searching for relevant content. In addition, corporate users can engage in learning activities when it best suit their schedules, accommodating different learning preferences and minimizing disruptions to daily work tasks. LMS platforms assist in tracking certifications and compliance requirements for various training programs. IT and healthcare firms are vital users of LMS in the corporate space.

Based on region, North America holds the largest market share during the forecast period.

North America, which includes the US and Canada, is one of the most technologically advanced regions in the world. The region has a developed infrastructure enables LMS vendors to offer quality services to their clients. Its network infrastructure provides the fastest and most innovative global services, making it an ideal place for adopting LMS to improve employee efficiency and productivity. Moreover, North America has been an early adopter of cloud and mobile technologies, a significant booster for adopting corporate learning management solutions. Therefore, it will be the most critical contributor to the global corporate LMS market in terms of market size. Both corporate users and academic institutes use these solutions to provide a personalized learning and development experience. In education, students are more digitally connected and aware of eLearning and interactive course content. Teachers and parents have also realized the need to shift from old teaching methodologies to new and advanced ways of teaching to improve the learning experience. North America is also one of the earliest adopters of 5G technology, which has helped adopt learning management solutions early.

Key Market Players

The LMS market is dominated by a few globally established players such as Anthology (US), Cornerstone OnDemand (US), PowerSchool (US), LTG (UK), Instructure (US), D2L Corporation (Canada), IBM (US), Infor (US), Adobe (US), Google (US), Oracle (US), Moodle (Australia), SAP (Germany), Docebo (Canada), Learning Pool (UK), Absorb LMS (Canada), CrossKnowledge (France), BizLibrary(US), iSpring (US), Blue Sky eLearn (US), Trakstar (US), DigitalChalk (US), Touvti LMS (US), SkyPrep (Canada), Talent LMS (US), Acorn LMS (Australia), and LearnWorlds (Cyprus), among others, are the key vendors that secured LMS contracts in last few years. These vendors have both global and local presence in the LMS market. The LMS market is witnessing significant growth, driven by evolving learning needs, technological advancements, and the increasing adoption of digital learning solutions across various industries. Vendors are focusing on continuous product innovation to differentiate themselves in the market. This includes developing user-friendly interfaces, incorporating advanced features such as AI-driven personalized learning, gamification, social learning capabilities, and analytics to track learner performance and engagement.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Delivery Mode, Deployment Type, Organization Size, Application Area, and User Type |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Anthology (US), Moodle (Australia), Cornerstone OnDemand (US), D2L Corporation (Canada), Instructure Inc. (US), PowerSchool (US), IBM (US), Infor (US), Adobe (US), LTG (UK), Google (US), Oracle (US), SAP (Germany), Docebo (Canada), Learning Pool (UK), Absorb LMS (Canada), CrossKnowledge (France), BizLibrary(US), iSpring (US), Blue Sky eLearn (US), Trakstar (US), DigitalChalk (US), Touvti LMS (US), SkyPrep (Canada), Talent LMS (US), Acorn LMS (Australia), and LearnWorlds (Cyprus) |

This research report categorizes the Learning management system market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Solutions

- Services

- Consulting

- Implementation

- Support Services

By Delivery Mode:

- Distance Learning

- Instructor-led Learning

- Blended Learning

By Deployment Type:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Application Areas:

- User Management

- Course Management

- Content Management

- Corporate Training & Development

- Professional Certification & Compliance

- Onboarding & Orientation

- Other Application Areas

By User Type:

- Academic Users

- Corporate Users

- Government & Non-profit Organizations

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- South Korea

- Singapore

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2023, D2L partnered with Quality Matters, Inc. (QM), a global leader in ensuring quality in online and innovative digital teaching and learning settings. Quality Matters is dedicated to enhancing the quality of online education and student learning worldwide through research, top-tier expertise, and professional development opportunities.

- In October 2023, Moodle announced the release of Moodle Workplace 4.3, the latest evolution in its enterprise-level learning management solution. Tailored to enhance team coordination and optimize learning endeavors, Moodle Workplace 4.3 exemplifies advancements and superior performance within the realm of corporate learning.

- In April 2023, Cornerstone introduced Opportunity Marketplace, the industry's inaugural career growth and talent exchange platform. Integrated within Cornerstone's Talent Experience Platform, this innovative product merges AI technology with human-centered design to foster new individual opportunities and enhance organizational outcomes, such as employee engagement, retention, agility, and internal mobility.

- In September 2022, Anthology partnered with EDUtech Europe to showcase the latest innovations in education technology.

- In September 2021, IBM collaborated with Adobe to provide underprivileged students with design and creativity tools. IBM SkillsBuild would provide free design courses and access to Adobe Photoshop, Illustrator, and InDesign.

Frequently Asked Questions (FAQ):

What is a Learning Management System?

A learning management system (LMS) is a software application or web-based platform designed to facilitate the administration, documentation, tracking, and delivery of educational courses or training programs. It is commonly used in educational institutions, corporations, and organizations to manage and organize learning materials and activities. With the help of these solutions, companies and institutions can provide specialized training to their employees and students in the most interactive manner.

Which country was the early adopter of LMS solutions?

The US was at the initial stage of the adoption of LMS solutions.

Which are the key vendors exploring LMS Solutions?

Some of the significant vendors offering LMS solutions across the globe include Anthology (US), Moodle (Australia), Cornerstone OnDemand (US), D2L Corporation (Canada), Instructure Inc. (US), PowerSchool (US), IBM (US), Infor (US), Adobe (US), LTG (UK), Google (US), Oracle (US), SAP (Germany), Docebo (Canada), Learning Pool (UK), Absorb LMS (Canada), CrossKnowledge (France), BizLibrary(US), iSpring (US), Blue Sky eLearn (US), Trakstar (US), DigitalChalk (US), Touvti LMS (US), SkyPrep (Canada), Talent LMS (US), Acorn LMS (Australia), and LearnWorlds (Cyprus).

What is the total CAGR recorded for the LMS market from 2023 to 2028?

The LMS market will record a CAGR of 18.6% from 2023-2028

What is the projected market value of the LMS market?

The LMS market will grow from USD 22.1 billion in 2023 to USD 51.9 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.6% during the forecast period.

What are the significant trends in the LMS market?

Organizations are increasingly adopting cloud-based LMS solutions over traditional on-premises systems. Cloud-based LMS offers scalability, accessibility, and cost-effectiveness. LMS providers prioritize user-friendly interfaces and intuitive designs to enhance the overall user experience. Improved UX contributes to higher engagement and better adoption rates among learners. LMS platforms are integrating personalization features, leveraging data analytics and AI to tailor learning paths based on individual preferences, skills, and performance. Adaptive learning enhances engagement and relevance. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

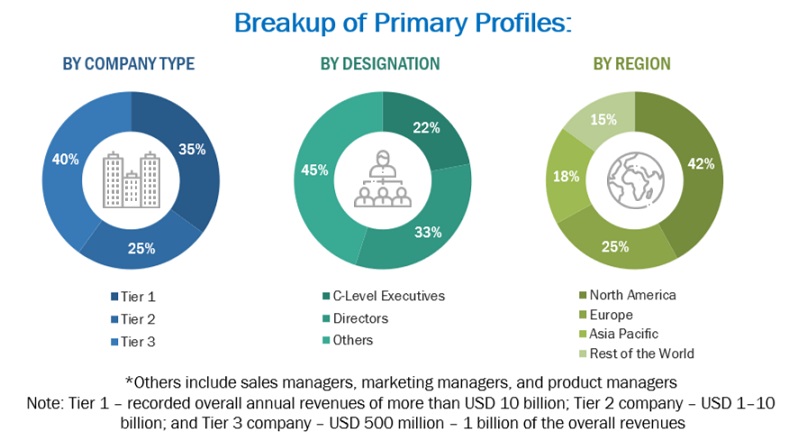

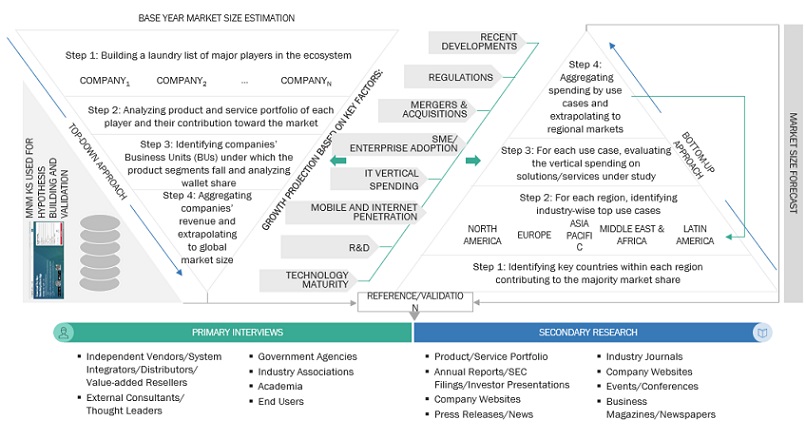

The study involved four major activities in estimating the Learning management system market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the LMS market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial LMS market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using LMS solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall LMS market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the LMS and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the LMS market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Learning management system market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the LMS market's demand and supply sides.

Market Definition

Learning Management System (LMS) is a software application or web-based platform designed to facilitate the administration, documentation, tracking, and delivery of educational courses or training programs. It is commonly used in educational institutions, corporations, and organizations to manage and organize learning materials and activities. With the help of these solutions, companies and institutions can provide specialized training to their employees and students in the most interactive manner.

Key Stakeholders

- IT Service Providers

- LMS Vendors

- Learning Service Providers

- Software Providers

- E-learning Course Providers

- System Integrators

- System Administrators

- Internet Service Providers (ISPs)

- Corporate Trainers

- Compliance Regulatory Authorities

- Cloud Service Providers (CSPs)

- Government Authorities

Report Objectives

- To define, describe, and forecast the LMS market based on offerings, delivery modes, organization sizes, deployment types, application areas, user types, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the LMS market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Learning Management System Market