Location Based Entertainment (LBE) Market by Technology (Virtual Reality (VR), Augmented Reality (AR), Projection Mapping), Offering (Hardware, Software, Services), Venue (Amusement Parks, Theme Parks, Arcades) and Region - Global Forecast to 2028

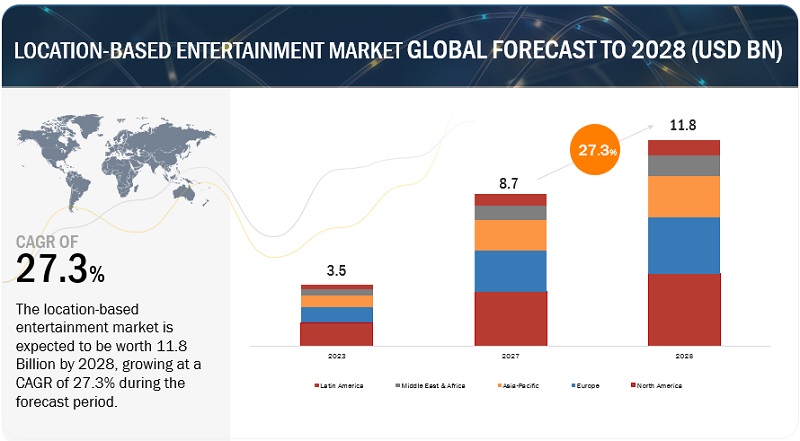

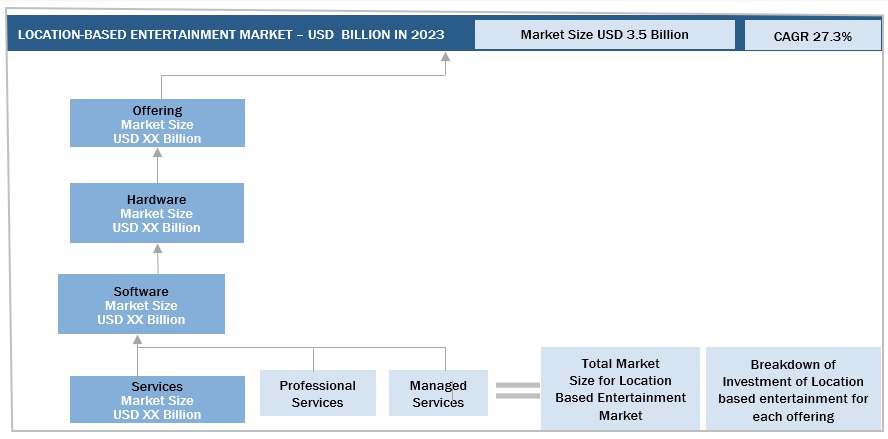

The global Location Based Entertainment Market size was valued at $3.5 billion in 2023 and it is projected to reach $11.8 billion by the end of 2028 at a CAGR of 27.3% during the forecast period. The primary factor driving the growth of LBE industry is that it allows individuals to escape from their daily routines and immerse themselves in exciting and imaginative worlds. People seek entertainment options that provide an escape from reality, and location based experiences fulfill this need by transporting them to different environments, time periods, or fictional worlds.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Location Based Entertainment Market Dynamics

Driver: Advancement in VR and AR Technologies

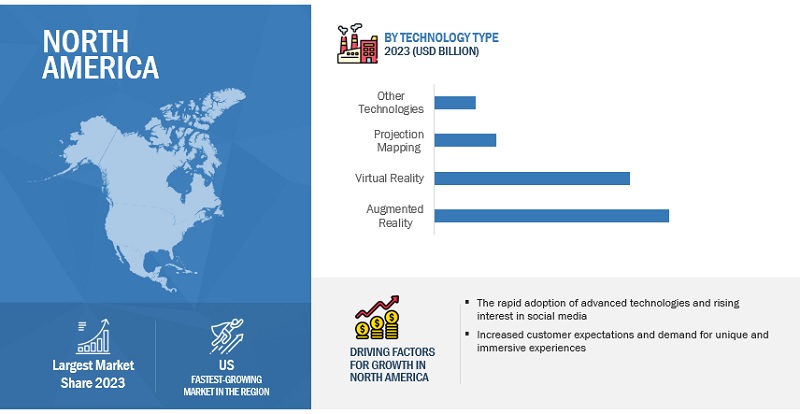

Advances in virtual reality (VR) and augmented reality (AR) technologies have been a major driver of growth in the location based entertainment market. VR technology creates a completely immersive experience through a headset, allowing users to feel like they are in a different environment. This can be used for interactive games, virtual tours, and educational simulations, among others. AR technology overlays digital information onto the real world, enabling visitors to see and interact with digital content in real-time. Both VR and AR technologies can provide highly immersive and interactive experiences, leading to increased engagement, longer visit times, and higher revenue.

Restraint: Limited Scalability

Limited scalability is a major constraint that LBE businesses face, as their experiences are constrained by physical space and capacity. Unlike digital or online experiences, LBE businesses cannot easily scale up their operations to meet high demand, and expanding their physical footprint can be costly and challenging. This can limit their ability to grow and compete with other entertainment options, particularly in regions where available space is limited or expensive. For example, expanding an amusement park or escape room attraction may require the construction of new buildings, the purchase of new equipment, and the hiring of additional staff. These costs can be significant, and may limit a business's ability to expand.

Opportunity: Wearables offerings unique opportunities for location based entertainment

Wearable devices, including fitness trackers and smartwatches, have the potential to revolutionize location based entertainment by providing a personalized and immersive experience to users. With their GPS technology, these devices can track users' movements and provide them with real-time information about nearby attractions, events, and activities that match their preferences. This customization leads to more enjoyable experiences. Additionally, these devices can also incorporate interactive elements like gamification and augmented reality to make the entertainment more engaging. As technology evolves, wearable devices will likely continue to play a significant role in shaping the future of location based entertainment.

Challenge: Rapid pace of technological changes

The location based entertainment market faces the challenge of keeping up with the rapidly changing technology landscape. As technology is a critical component of LBE experiences, new advancements can quickly make existing equipment and technology outdated. Consequently, businesses require significant capital investment to stay competitive and innovative. This can be particularly challenging for smaller or newer businesses with limited budgets. Additionally, maintaining and updating technology and equipment is essential to provide an optimal customer experience. Failure to do so may result in customer dissatisfaction, lost revenue, and damage to the business's reputation. The LBE industry must, therefore, continuously adapt and evolve to keep up with the changing technology landscape while also meeting the demands of its customers.

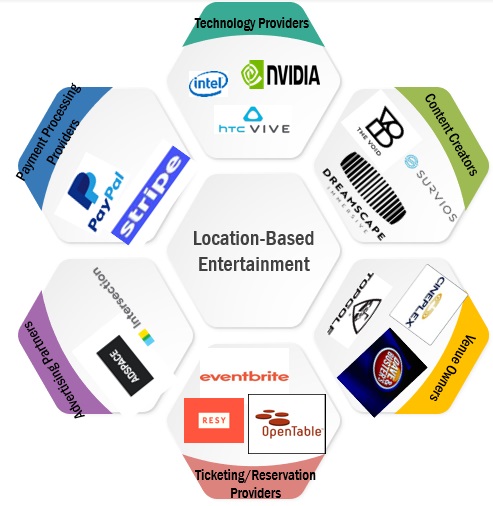

Location Based Entertainment Market Ecosystem

Prominent companies in this market include well-established, financially stable provider of location based entertainment hardware, software and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Google (US), Meta (US), Microsoft (US), Nvidia (US), Unity Technologies (US).

Based on venue, the arcades segment is expected to grow with the highest CAGR during the forecast period.

In the past many years, arcades have been known for offering a variety of machines and range of electronic games as a form of location based entertainment market. Many games are designed to be played with others, encouraging visitors to compete against each other or work together to achieve a common goal. Additionally, arcades can serve as gathering places for people to socialize and enjoy each other's company. Rewards and incentives are also commonly used in arcades to keep visitors engaged, with many machines offering tickets or other prizes that can be redeemed for rewards. Overall, arcades are expected to grow rapidly in the market in coming years.

Based on services, the professional services segment to hold the largest market size during the forecast period

Professional services are required during and after the implementation of location based entertainment solutions. These services include planning, designing, consulting, and upgrades. Companies offering these services encompass consultants, legal experts, and dedicated project management teams that specialize in design and delivery of critical decision support software, tools, services, and expertise. Growth of the professional services segment is mainly governed by the complexity of operations and growing deployment of location based entertainment solutions.

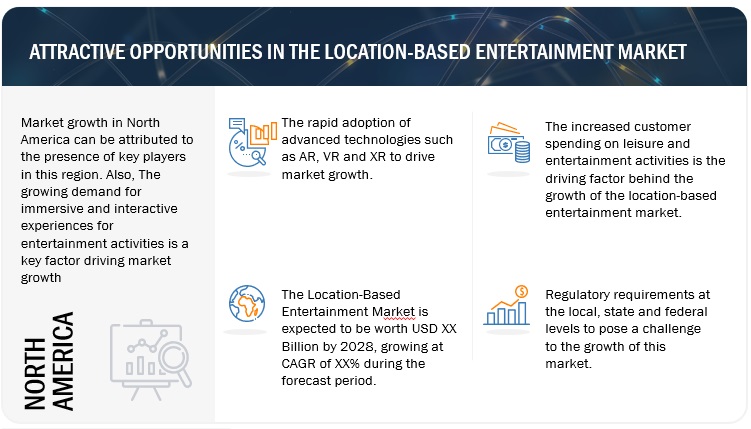

Based on region, the North America segment is expected to have largest market share during the forecast period.

North American location based entertainment market has experienced a large growth due to factors such as increased customer expectations and demand for unique and immersive experiences, increased spend on leisure and entertainment activities than ever before, rising disposable income, advancements in technologies, etc. These technologies offer users highly immersive experiences, allowing them to feel like they are part of a game or other type of interactive experience. As VR and AR technologies continue to improve and become more affordable, more location based entertainment operators are likely to adopt them, which will help to drive growth in the market.

Market Key Players:

The major players in the location based entertainment market are Google (US), Meta (US), Microsoft (US), Nvidia (US), Unity Technologies (US), Sony Interactive Entertainment (US), Samsung (South Korea), Barco Electronic Systems (Belgium), Panasonic (Japan), Huawei Technologies (China), HQ Software (Estonia), HTC Vive (Taiwan), Niantic Inc. (US), Vicon Motion Systems (UK), Optitrack (US), Springboard VR (US), 4Experience (Poland), Hologate (Germany), Ultraleap (UK), Magic Leap (US), Shape Immersive (Canada), Camon (Argentina), KatVR (US), Virtuix (US), Pico XR (US).

These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the industry.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 3.5 billion |

|

Revenue forecast for 2028 |

USD 11.8 billion |

|

Growth Rate |

27.3% CAGR |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Technology, Offering, Venue and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Companies covered |

Google (US), Meta (US), Microsoft (US), Nvidia (US), Unity Technologies (US), Sony Interactive Entertainment (US), Samsung (South Korea), Barco Electronic Systems (Belgium), Panasonic (Japan), Huawei Technologies (China) |

This research report categorizes the location based entertainment market to forecast revenues and analyze trends in each of the following submarkets:

Based on Technology:

- Augmented Reality

- Virtual Reality

- Projection-Mapping

- Other Technologies

Based on Offerings:

- Hardware

- Software

-

Services

-

Professional Services

- Consulting

- Training and Deployment

- Support and Maintenance

- Managed Services

-

Professional Services

Based on Venue:

- Amusement Parks

- Theme Parks

- Arcades

- Other Venues

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- South East Asia

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- KSA

- Israel

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, Sony Interactive Entertainment to acquire Firewalk Studios. Firewalk will collaborate alongside world-class development teams, including Bungie and Haven Interactive Studios, to define a new generation of live service experiences for PlayStation gamers.

- In April 2023, Samsung Electronics Co has announced that it has partnered with Qualcomm and Google to build an ecosystem for extended reality (XR).

- In November 2022, Huawei launched Vision Glass, its first smart viewing glasses. It can project a digital screen of a 120-inch giant display, bringing an ultra-immersive cinematic viewing experience.

- In September 2022, Nvidia launched GeForce RTX 40 Series GPUs are powered by the ultra-efficient Nvidia Ada Lovelace architecture and deliver a quantum leap in both performance and AI-powered graphics.

- In October 2021, Unity technologies introduced Unity Metacast, an innovative new platform that will lead the real-time 3D (RT3D) evolution for professional sports. Unity Metacast is a RT3D sports platform for creating and delivering interactive content, direct to the user.

- In February 2021, Microsoft partnered with AT&T, to bring iconic characters to life with custom neutral voice at a store in Dallas, where a life-size, high-definition Bugs Bunny greets customers by name and tells he needs help to find several golden carrots hidden throughout the store.

Frequently Asked Questions (FAQ):

How big is the Location Based Entertainment Market?

What is the estimated growth rate (CAGR) of the global Location Based Entertainment Market?

Who are the key players in Location Based Entertainment Market?

What are the major revenue pockets in the global Location Based Entertainment Market currently?

What is Location Based Entertainment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

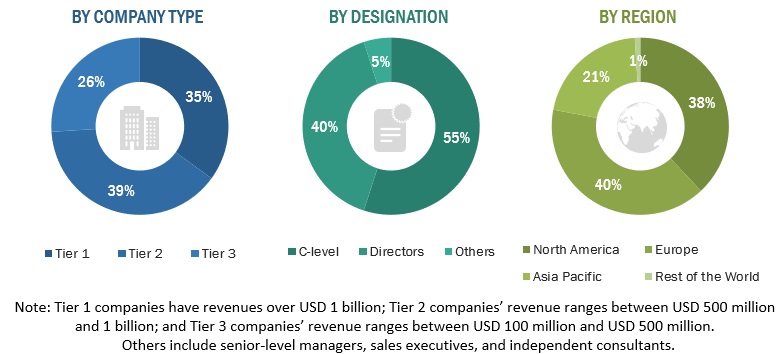

This research study involved extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the LBE market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

The market share and revenue of the companies offering LBE solutions and services for various venues were identified. The secondary data was available through paid and unpaid sources by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Information Security Officers (CISOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the LBE market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Plug XR |

AR Specialist |

|

Satyapriy Infotech |

Founder |

|

Plutomen Technologies |

Founder & CEO |

Location Based Entertainment Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global LBE market and the size of various other dependent sub-segments. The research methodology used to estimate the market size includes the following details:

- Analyzing the size of the global location based entertainment and then identifying revenues generated through the technology

- Identifying the key players in the market and their revenue contribution in the respective regions

- Estimating the size of the location based entertainment market

- Estimating the market size of other location based entertainment technology providers

Location based Entertainment Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Location based Entertainment Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size, the overall location based entertainment market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Location based entertainment (LBE) pertains to a category of entertainment that transpires in a designated physical space or setting, such as amusement parks, galleries, game arcades, and other entertainment facilities. LBE experiences usually involve active participation and immersion, incorporating cutting-edge technologies such as virtual reality (VR), augmented reality (AR), mixed reality (MR), and other sensory effects to augment the overall experience.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- LBE Providers

- Technology Providers

- Content Developers

- Venue Owners

- Investors and venture capitalists

Report Objectives

- To determine and forecast the global location based entertainment market by technology, offering, venue, and region from 2023 to 2028

- To analyze the various macroeconomic and microeconomic factors affecting the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa, Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall location based entertainment market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, partnerships & collaborations, and research & development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Location Based Entertainment (LBE) Market