Logic Analyzer Market by Type (Modular Logic Analyzers, PC-Based Logic Analyzers), Channel Count (2-32, 32-80, >80), Vertical (Electronics & Semiconductor, Automotive & Transportation, Aerospace & Defense), and Geography - Global Forecast to 2024-2036

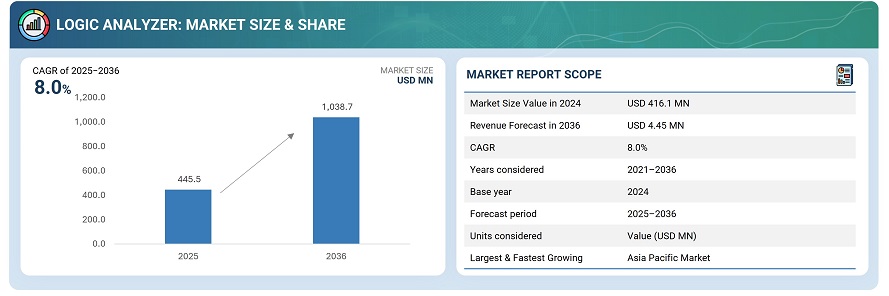

The global logic analyzer market was valued at USD 416.1 million in 2024 and is estimated to reach USD 1,038.7 million by 2036, at a CAGR of 8.0% between 2025 and 2036.

The global logic analyzer market is experiencing steady growth, driven by the increasing adoption of complex digital systems, rising demand for high-speed data analysis, and the expanding use of embedded systems across the electronics, telecommunications, automotive, aerospace, and defense industries. Logic analyzers are essential for testing, debugging, and verifying digital circuits, offering high channel counts, advanced triggering, and real-time visualization. Growing integration of IoT devices, AI automation, and advanced microcontrollers is creating new opportunities for precise signal analysis. Advancements in high-bandwidth probes, portable USB-based analyzers, and cloud-enabled testing solutions are improving accuracy and usability. Rapid semiconductor innovation in the Asia-Pacific region, particularly in China, Japan, and South Korea, along with a focus on miniaturization and higher data rates, is driving global market growth.

Logic analyzers are essential electronic test instruments that capture, display, and analyze multiple digital signals simultaneously, enabling engineers to test, debug, and validate complex digital systems. They are widely used in semiconductors, telecommunications, automotive, aerospace, and industrial automation to ensure signal integrity and efficient circuit design. Modern logic analyzers provide high channel density, advanced triggering capabilities, and real-time waveform visualization, enabling accurate diagnostics. In April 2025, Saleae, Inc. (US) released Logic 2.4.27, enhancing analog recording, export performance, and user interface functionality. These advancements improve precision, usability, and integration, supporting next-generation embedded and digital systems across industrial and commercial applications.

Market by Industry

Semiconductor & Electronics

The semiconductor & electronics industry is the largest segment in the logic analyzer market, driven by the need for precise testing, debugging, and validation of complex digital circuits and systems. Logic analyzers are widely used in integrated circuit design, microcontroller development, embedded systems, and high-speed electronic devices to ensure signal integrity, detect faults, and optimize performance. Advanced features such as high channel density, real-time waveform visualization, and precise triggering make them indispensable for verifying complex digital designs. The increasing adoption of IoT-enabled devices and automated testing solutions is enhancing efficiency, reliability, and innovation across semiconductor development and production processes.

Automotive & Transportation

The automotive & transportation industry is expected to emerge as one of the fastest-growing application areas for logic analyzers, driven by increasing adoption of advanced driver-assistance systems (ADAS), electric vehicles, and connected automotive technologies. Logic analyzers are extensively used in vehicle electronics, embedded control units, and high-speed communication networks to ensure accurate signal validation, fault detection, and system reliability under complex operating conditions. Their high channel density, real-time waveform visualization, and precise triggering capabilities provide efficient testing and diagnostics. Furthermore, these instruments enhance development efficiency, support regulatory compliance, and enable innovation in next-generation automotive and transportation electronic systems.

Industrial

The industrial sector is one of the major application areas for logic analyzers, driven by the need for precise testing, accurate validation, and reliable operation of electronic and mechatronic systems. Logic analyzers are extensively used in the design, manufacturing, and maintenance of products such as solar inverters, wind turbines, car suspensions, and steel manufacturing assemblies to ensure proper functioning under complex and demanding conditions. Their high channel density, advanced triggering, and real-time waveform visualization provide accurate diagnostics. Additionally, the increasing adoption of radar and LiDAR-based safety systems, as well as other electronic components, supports operational efficiency, reduces downtime, and ensures reliability across large-scale industrial applications.

Market by Type

Modular Logic Analyzers

Modular logic analyzers are the largest segment in the logic analyzer market, valued for their flexibility, scalability, and high-performance testing capabilities. These analyzers are designed to operate reliably across multiple channels and high-speed digital systems, making them suitable for applications in semiconductors, telecommunications, automotive, aerospace, and industrial electronics. They provide seamless integration with development platforms, embedded systems, and test environments, ensuring accurate signal capture, real-time waveform visualization, and precise diagnostics. With features such as configurable channels, advanced triggering, and expandable memory, modular logic analyzers offer dependable, efficient, and adaptable solutions for verifying, optimizing, and validating next-generation digital and embedded systems.

Carbon Steel

PC-based logic analyzers are the fastest-growing segment in the logic analyzer market, driven by increasing demand for portable, cost-effective, and high-performance digital testing solutions. These analyzers leverage the processing power of PCs to capture, display, and analyze multiple digital signals simultaneously, making them ideal for applications in semiconductors, telecommunications, automotive, aerospace, and industrial electronics. They provide seamless integration with development platforms and embedded systems, offering real-time waveform visualization, advanced triggering, and high channel flexibility. With features such as software-based analysis, easy scalability, and enhanced usability, PC-based logic analyzers deliver efficient, precise, and adaptable solutions for testing and validating next-generation digital and embedded systems.

Market by Geography

The Asia Pacific region is the fastest-growing and one of the major markets in the logic analyzer industry, driven by increasing electronics manufacturing, semiconductor production, and the adoption of automotive and industrial electronics in countries such as China, Japan, South Korea, and India. The rising demand for high-speed digital testing, embedded system validation, and IoT-enabled devices is driving market growth. Logic analyzers are widely used across the semiconductor, telecommunications, automotive, aerospace, and industrial electronics industries to ensure signal integrity and optimize performance. Growing R&D investments, technological advancements, and adoption of advanced testing solutions further strengthen Asia-Pacific’s position as a key market for next-generation logic analyzers.

Market Dynamics

Driver: Rising Complexity in Digital Systems Fuels Demand for Logic Analyzers

The increasing complexity of digital systems and embedded electronics is a major driver for the logic analyzer market. With the widespread adoption of microcontrollers, integrated circuits, IoT devices, and high-speed communication systems, developers require precise testing and debugging tools. Logic analyzers provide multi-channel signal capture, real-time waveform visualization, and advanced triggering to ensure signal integrity and system reliability. Sectors such as semiconductors, telecommunications, automotive, aerospace, and industrial electronics are expanding their R&D and production activities, resulting in increased demand for testing solutions. The need for accurate diagnostics, faster development cycles, and robust quality assurance continues to fuel global market growth.

Restraint: High Cost Limits Widespread Market Penetration

Advanced logic analyzers with multiple channels, large memory, and sophisticated software are often expensive, which restricts their adoption among small to medium-sized enterprises and educational institutions. The total cost of ownership, including training, calibration, and software updates, adds to the financial burden. Organizations with budget constraints often prefer entry-level or alternative testing tools, slowing demand for premium models. Cost sensitivity, especially in developing regions, continues to limit large-scale deployment despite rising technical needs, making pricing a persistent restraint for global market expansion.

Opportunity: IoT, 5G, and Industry 4.0 Open New Frontiers

The convergence of IoT, 5G rollout, and smart manufacturing presents massive opportunities for logic analyzer vendors. Modern development environments require flexible, PC-based, and modular analyzers that can handle complex, data-intensive signals. The expansion of electric vehicle electronics, semiconductor innovation, and cloud-connected devices creates new applications for real-time diagnostics and signal validation. Companies that integrate AI-assisted debugging, automation, and cloud connectivity can tap high-growth sectors, transforming logic analyzers from niche testing tools into essential instruments for the next generation of intelligent, connected technologies.

Challenge: Rapid Innovation Requires Constant Upgrades

The pace of technological change is a double-edged sword for the logic analyzer market. New interfaces, faster signal speeds, and increasingly complex semiconductor designs render older instruments obsolete quickly. Users demand cutting-edge capabilities alongside ease of use and software compatibility. Talent shortages in advanced signal analysis further complicate the adoption process. Manufacturers must continuously innovate, upgrading hardware, software, and training programs, to stay relevant, balancing cost, performance, and market expectations in an era where electronics evolve faster than ever.

Future Outlook

Between 2025 and 2036, the global logic analyzer market is expected to witness robust growth as industries increasingly demand precise, high-speed, and reliable tools for testing and debugging complex digital systems and embedded electronics. Advancements in PC-based and modular logic analyzers, high-channel-density capture, real-time waveform analysis, and AI-assisted diagnostics will enhance signal accuracy, accelerate development cycles, and improve system reliability. The expansion of automotive electronics, 5G networks, semiconductor fabrication, and IoT-enabled devices will further drive the adoption of advanced testing solutions. As the market evolves, logic analyzers will play a pivotal role in optimizing design validation, minimizing errors, reducing development costs, and ensuring safe and efficient operation of next-generation electronics across industrial, consumer, and telecommunications applications worldwide.

Key Market Players

Top logic analyzer companies include Keysight Technologies (US), Saleae, Inc (US), GAO Tek & GAO Group Inc. (US), Fortive (US), and Arm Limited (UK).

Key Questions addressed in this report:

- What is the current market size of the logic analyzer market, and how is it expected to grow between 2025 and 2036?

- Which regions are leading in the adoption of logic analyzers, and which regions are showing the fastest growth?

- What are the key industries driving the demand for logic analyzers?

- What are the global trends driving demand in the logic analyzer market?

*This is a tentative table of contents, and there might be a few changes during the study

TABLE 1 Logic Analyzer Market, by type (USD Million)

|

Type |

2022 |

2024 |

2026 |

2028 |

2030 |

2032 |

2034 |

2036 |

CAGR (2025–2036) |

|

Modular Logic Analyzers |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Portable Logic Analyzers |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

PC-Based Logic Analyzers |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 2 Logic Analyzer Market, By channel count (USD Million)

|

Channel Count |

2022 |

2024 |

2026 |

2028 |

2030 |

2032 |

2034 |

2036 |

CAGR (2025–2036) |

|

2 – 32 |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

32 – 80 |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

>80 |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 3 Logic Analyzer MARKET by vertical (USD Million)

|

Vertical |

2022 |

2024 |

2026 |

2028 |

2030 |

2032 |

2034 |

2036 |

CAGR (2025–2036) |

|

Automotive & Transportation |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Aerospace & Defense |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

IT & Telecommunications |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Education & Government |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Electronics & Semiconductor |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Industrial |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Healthcare |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 4 Logic Analyzer Market, By Region (USD Million)

|

Region |

2022 |

2024 |

2026 |

2028 |

2030 |

2032 |

2034 |

2036 |

CAGR (2025–2036) |

|

North America |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Europe |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Asia Pacific |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

RoW |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

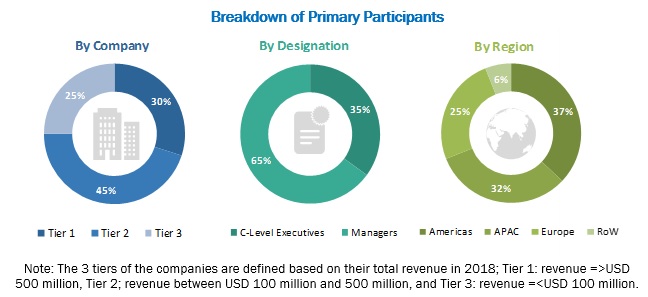

The study on the logic analyzer market involved 4 major activities for estimating the current size of the market. Exhaustive secondary research was conducted to collect information about the market, its peer markets, and its parent market. The next step was validating findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were used to estimate the overall size of the logic analyzer market. It was followed by the market breakdown and data triangulation procedures to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the logic analyzer market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; articles by recognized authors; directories; and databases. Secondary research was conducted to obtain important information about the supply chain and value chain of the industry, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the logic analyzer market through secondary research. Several primary interviews were conducted with the market experts from both, demand (commercial application providers) and supply (logic analyzer manufacturers and providers) sides across 4 major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Approximately 20% and 80% primary interviews were conducted with parties from demand and supply sides, respectively. The primary data was collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both, top-down and bottom-up approaches, along with several data triangulation methods were used to estimate and validate the size of the logic analyzer market and other dependent submarkets. The key players in the market were determined through primary and secondary research. This entire research methodology involved the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives to obtain qualitative and quantitative key insights of the logic analyzer market.

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Report Objectives

- To describe, segment, and forecast the overall logic analyzer market, in terms of value, on the basis of type, channel count, vertical, and geography

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions-North America, Europe, Asia Pacific (APAC), Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market position in

- terms of ranking and core competencies2, as well as detail the competitive landscape for market leaders

- To analyze competitive developments such as product launches and developments, partnerships, collaborations, acquisitions, and expansions, and research and development (R&D) in the logic analyzer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the value chain

Growth opportunities and latent adjacency in Logic Analyzer Market