Low Temperature Coating (Low Cure Coating) Market by Coating Type (Powder-Based, and Liquid-Based), Resin Type (Polyester, Epoxy, Polyurethane, Acrylic), End-Use Industry (Automotive, Industrial, Heavy-Duty Equipment, Architectural, Furniture), Region - Global Forecast to 2021

[162 Pages Report] The Global Low Temperature Coating (low cure coating) Market was valued at USD 3.50 Billion in 2015 and is projected to reach USD 5.13 Billion by 2021, at a CAGR of 6.7% between 2016 and 2021. The base year considered for the study is 2015, while the forecast period is between 2016 and 2021.

Objectives of the report are as follows:

- To define and segment the market for low temperature coating (low cure coating)

- To provide detailed information regarding major factors influencing the growth of the global low temperature coating (low cure coating) market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market size of low temperature coating (low cure coating), in terms of value

- To analyze the market segmentation and project the market size, in terms of value, for key regions, such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze competitive developments, such as new product launches, capacity expansions, mergers & acquisitions, and partnerships & agreements taking place in the market

- To strategically profile key players operating in the global low temperature coating (low cure coating) market

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global low temperature coating (low cure coating) market, and to determine the sizes of various other dependent submarkets. The research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global low temperature coating (low cure coating) market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the global low temperature coating (low cure coating) market includes sourcing of basic raw materials, manufacturing and supplying of raw materials to low temperature coating (low cure coating) manufacturers, and usage of low temperature coating (low cure coating) in various end-use industries. The raw materials for low temperature coating (low cure coating) are binders, solvents, additives, and coating fillers. Suppliers of these raw materials include KISCO Limited (Japan), The Dow Chemical Company (U.S.), Cytec Solvay Group (U.S.), and BASF SE (Germany). The raw materials are used by various low temperature coating (low cure coating) manufacturers, which include PPG Industries Inc. (U.S.), The Valspar Corporation (U.S.), Axalta Coating Systems (U.S.), Bowers Industrial (U.S.), Platinum Phase SDN BHD (Malaysia), and VITRACOAT America Inc. (U.S.).

Key Target Audience:

- Raw Material Suppliers

- Low temperature coating (low cure coating) Manufacturers

- Traders, Distributors, and Suppliers of Low temperature coating (low cure coating)

- Government & Regional Agencies, Research Organizations, and Investment Research Firms

Scope of the report:

This research report categorizes the global low temperature coating (low cure coating) market on the basis of coating type, resin type, end-use industry, and region.

On the basis of Coating Type:

- Powder-Based

- Liquid-Based

On the basis of Resin Type:

- Polyester

- Epoxy

- Polyurethane

- Acrylic

- Others

On the basis of End-use Industry:

- Automotive

- Industrial

- Heavy-duty Equipment

- Architectural

- Furniture

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The market is further analyzed for key countries in each of these regions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographic Analysis:

- Further breakdown of a region with respect to major countries

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

The global low temperature coating (low cure coating) market is projected to reach USD 5.13 Billion by 2021, at a CAGR of 6.7% from 2016 to 2021. Low temperature coating (low cure coating) has been specifically formulated to develop a fully cured coating which can be set at lower oven temperatures or with shorter dwell times at conventional oven temperatures. These coatings are well suited for heat sensitive substrates and assemblies. Low temperature coating (low cure coating) is used in automotive, industrial, heavy-duty equipment, furniture, and architectural end-use industries. These end-use industries drive the low temperature coating (low cure coating) market, globally.

In 2015, the automotive segment accounted for the largest share of the global low temperature coating (low cure coating) market and is expected to continue to lead during the forecast period. Low temperature coating (low cure coating) are used in the automotive industry for the protection of automobile parts from corrosion, wear & tear, and retention of color coatings.

Based on coating type, the powder-based segment is projected to grow at the highest CAGR between 2016 and 2021. Powder-based low temperature coating (low cure coating) exhibits superior properties over conventional paints, including high resistance to corrosion, high-quality finish, chipping and abrasion resistance, durability, and cost-effectiveness. Increasing demand for powder-based low temperature coating (low cure coating) from various end-use industries such as automotive, furniture, and heavy-duty equipment are expected drive the growth of this segment during the forecast period.

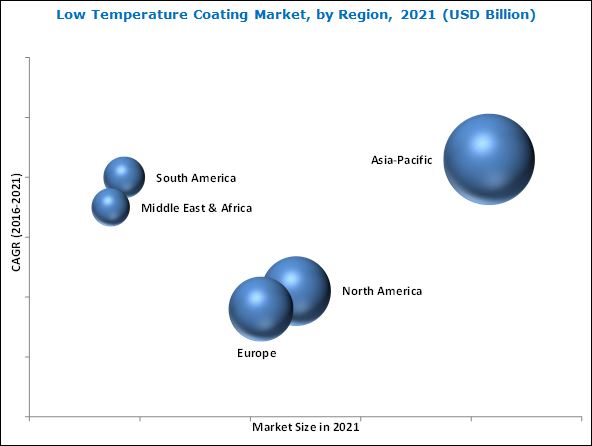

Growth in the heavy-duty equipment and manufacturing industries has led to an increase in the demand for low temperature coating (low cure coating). In 2015, the Asia-Pacific region accounted for the largest share of the global low temperature coating (low cure coating) market. China is expected to account for the largest share of the Asia-Pacific low temperature coating (low cure coating) market till 2021, whereas, this market in India is anticipated to grow at the third highest CAGR after China and Taiwan during the forecast period.

Low temperature coating (low cure coating) might not be suitable for thin film applications. It is difficult to produce thin finishes using these coatings because of the thickening of the polymer which can lead to the formation of an uneven texture. This can act as a restraint to the growth of the market.

Companies have adopted strategies such as new product developments, expansions, and mergers & acquisitions to enhance their market shares and widen their distribution networks in the global low temperature coating (low cure coating) market. These companies engage in research & development activities to innovate and develop products that can open new avenues of applications. For instance, PPG Industries Inc. launched Coraflon powder coatings at Austin Convention Center, Texas, U.S. Coraflon coatings require lower cure temperatures in comparison to liquid fluorocarbon coatings, resulting in energy savings.

Similarly, The Valspar Corporation launched the ValdeTM Extreme Flex Cure (EFC) powder coating technology that delivers exceptional performance at a much lower temperature and faster cure rate in comparison to conventional powder coatings. The Valspar Corporation has well-recognized brands of low temperature coating (low cure coating) and has a strong operational network in the U.S., which, in turn, helps the company expand its regional presence.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

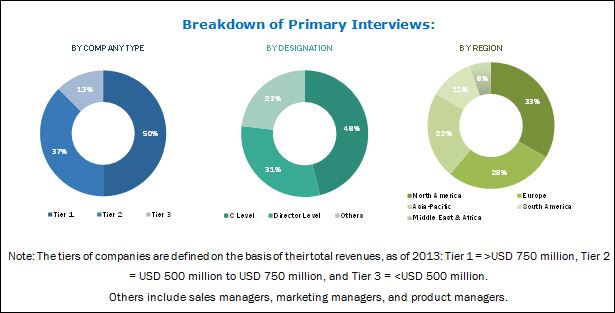

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Low Temperature Coating Market

4.2 Asia-Pacific Low Temperature Coating Market, By End-Use Industry and Country, 2015

4.3 Global Low Temperature Coating Market Attractiveness

4.4 End-Use Industries Share in Low Temperature Coating Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Energy Savings Due to Reduction in Cure Temperatures

5.2.1.2 Environment-Friendly Coatings in Comparison to Conventional Liquid Paints and Varnishes

5.2.1.3 Growing End-Use Industries Driving the Low Temperature Coating Market

5.2.2 Restraints

5.2.2.1 Not Suitable for Thin Film Applications

5.2.3 Opportunities

5.2.3.1 Low Temperature Coating Suitable for Temperature-Sensitive Components

5.2.3.2 Increasing Demand From Automotive Industry in Asia-Pacific

5.2.4 Challenges

5.2.4.1 High Humidity and Complex Shape of Substrates Might Affect the Performance of Low Temperature Coating

5.2.4.2 Environmental Challenges

6 Industry Trends (Page No. - 40)

6.1 Macroeconomic Overview and Key Drivers

6.2 Manufacturing Industry Trends and Forecast, By Country

6.3 Trends of Automotive Industry

6.3.1 Passenger Cars Sales Growth, 2010-2015

6.4 Trends of Infrastructure & Construction Industry

6.5 Porters Five Forces Analysis

6.5.1 Bargaining Power of Suppliers

6.5.2 Threat of New Entrants

6.5.3 Threat of Substitutes

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competition Rivalry

6.6 Patent Analysis

7 Low Temperature Coating Market, By Coating Type (Page No. - 50)

7.1 Introduction

7.1.1 Powder-Based

7.1.2 Liquid-Based

8 Low Temperature Coating Market, By Resin Type (Page No. - 55)

8.1 Introduction

8.1.1 Polyester

8.1.2 Epoxy

8.1.3 Polyurethane

8.1.4 Acrylic

8.1.5 Others

9 Global Low Temperature Coating Market, By End-Use Industry (Page No. - 64)

9.1 Introduction

9.1.1 Automotive

9.1.2 Industrial

9.1.3 Heavy-Duty Equipment

9.1.4 Architectural

9.1.5 Furniture

9.1.6 Other End-Use Industries

10 Low Temperature Coating Market, By Region (Page No. - 75)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Japan

10.2.3 India

10.2.4 South Korea

10.2.5 Taiwan

10.2.6 Indonesia

10.2.7 Malaysia

10.2.8 Rest of Asia-Pacific

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Russia

10.3.5 Italy

10.3.6 Rest of Europe

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 South Africa

10.5.3 Rest of the Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 124)

11.1 Introduction

11.2 Dive Analysis for Low Temperature Coating Manufacturers

11.2.1 Vanguards

11.2.2 Innovators

11.2.3 Dynamic

11.2.4 Emerging

11.3 Competitive Benchmarking

11.3.1 Product Offerings

11.3.2 Business Strategy

12 Company Profiles (Page No. - 128)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 PPG Industries Inc.

12.2 E.I. Dupont De Nemours and Company

12.3 The Valspar Corporation

12.4 Axalta Coating Systems

12.5 Vitracoat America Inc.

12.6 Forrest Technical Coatings

12.7 Specialty Polymer Coatings Inc.

12.8 Platinum Phase Snd Bhd

12.9 Bowers Industrial

12.10 Tulip Paints

12.11 Other Industry Players

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 155)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (113 Tables)

Table 1 Percentage Contribution of Manufacturing Industry to GDP, By Country, (20132015)

Table 2 Passenger Cars Sales Growth, By Country

Table 3 List of Mega Construction Projects Both Under Development and Proposed, By Region, 2015

Table 4 Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 5 Low Temperature Coating Market Size, By Coating Type, 20142021 (Kiloton)

Table 6 Powder-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 7 Liquid-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 8 Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 9 Low Temperature Coating Market Size, By Resin Type, 20142021 (Kiloton)

Table 10 Polyester-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 11 Epoxy-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 12 Polyurethane-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 13 Acrylic-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 14 Other Resin-Based Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 15 Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 16 Low Temperature Coating Market Size, By End-Use Industry, 20142021 (Kiloton)

Table 17 Low Temperature Coating Market Size in Automotive, By Region, 20142021 (USD Million)

Table 18 Low Temperature Coating Market Size in Industrial, By Region, 20142021 (USD Million)

Table 19 Low Temperature Coating Market Size in Heavy-Duty Equipment, By Region, 20142021 (USD Million)

Table 20 Low Temperature Coating Market Size in Architectural, By Region, 20142021 (USD Million)

Table 21 Low Temperature Coating Market Size in Furniture, By Region, 20142021 (USD Million)

Table 22 Low Temperature Coating Market Size in Other End-Use Industries, By Region, 20142021 (USD Million)

Table 23 Low Temperature Coating Market Size, By Region, 20142021 (USD Million)

Table 24 Low Temperature Coating Market Size, By Region, 20142021 (Kiloton)

Table 25 Asia-Pacific: Low Temperature Coating Market Size, By Country, 20142021 (USD Million)

Table 26 Asia-Pacific: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 27 Asia-Pacific: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 28 Asia-Pacific: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 29 China: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 30 China: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 31 China: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 32 Japan: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 33 Japan: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 34 Japan: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 35 India: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 36 India: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 37 India: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 38 South Korea: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 39 South Korea: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 40 South Korea: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 41 Taiwan: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 42 Taiwan: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 43 Taiwan: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 44 Indonesia: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 45 Indonesia: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 46 Indonesia: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 47 Malaysia: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 48 Malaysia: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 49 Malaysia: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 50 Rest of Asia-Pacific: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 51 Rest of Asia-Pacific: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 52 Rest of Asia-Pacific: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 53 Europe: Low Temperature Coating Market Size, By Country, 20142021 (USD Million)

Table 54 Europe: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 55 Europe: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 56 Europe: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 57 Germany: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 58 Germany: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 59 Germany: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 60 France: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 61 France: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 62 France: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 63 U.K.: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 64 U.K.: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 65 U.K.: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 66 Russia: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 67 Russia: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 68 Russia: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 69 Italy: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 70 Italy: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 71 Italy: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 72 Rest of Europe: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 73 Rest of Europe Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 74 Rest of Europe: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 75 North America: Low Temperature Coating Market Size, By Country, 20142021 (USD Million)

Table 76 North America: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 77 North America: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 78 North America: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 79 U.S.: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 80 U.S.: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 81 U.S.: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 82 Canada: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 83 Canada: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 84 Canada: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 85 Mexico: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 86 Mexico: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 87 Mexico: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 88 Middle East & Africa: Low Temperature Coating Market Size, By Country, 20142021 (USD Million)

Table 89 Middle East & Africa: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 90 Middle East & Africa: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 91 Middle East & Africa: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 92 Saudi Arabia: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 93 Saudi Arabia: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 94 Saudi Arabia: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 95 South Africa: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 96 South Africa: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 97 South Africa: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 98 Rest of the Middle East & Africa: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 99 Rest of the Middle East & Africa: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 100 Rest of the Middle East & Africa: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 101 South America: Low Temperature Coating Market Size, By Country, 20142021 (USD Million)

Table 102 South America: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 103 South America: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 104 South America: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 105 Brazil: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 106 Brazil: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 107 Brazil: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 108 Argentina: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 109 Argentina: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 110 Argentina: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

Table 111 Rest of South America: Low Temperature Coating Market Size, By Coating Type, 20142021 (USD Million)

Table 112 Rest of South America: Low Temperature Coating Market Size, By Resin Type, 20142021 (USD Million)

Table 113 Rest of South America: Low Temperature Coating Market Size, By End-Use Industry, 20142021 (USD Million)

List of Figures (45 Figures)

Figure 1 Low Temperature Coating: Market Segmentation

Figure 2 Low Temperature Coating Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Low Temperature Coating Market: Data Triangulation

Figure 6 Powder-Based Coating to Dominate Low Temperature Coating Market By 2021

Figure 7 Polyester Resin Type Dominated the Low Temperature Coating Market

Figure 8 Automotive Industry to Lead the Low Temperature Coating Market Between 2016 and 2021

Figure 9 Asia-Pacific Low Temperature Coating Market to Witness Significant Growth During the Forecast Period

Figure 10 Growing Demand for Powder-Based Low Temperature Coating to Drive the Low Temperature Coating Market

Figure 11 Automotive Segment Accounted for the Largest Share of the Low Temperature Coating Market in Asia-Pacific

Figure 12 Asia-Pacific to Be the Fastest-Growing Market During the Forecast Period

Figure 13 Automotive Segment Accounted for the Largest Share in the Global Low Temperature Coating Market

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Low Temperature Coating Market

Figure 15 List of Mega Construction Projects Both Under Development and Proposed, By Region, 2015

Figure 16 Low Temperature Coating: Porters Five Forces Analysis

Figure 17 European Patents Accounted for the Highest Share of the Low Temperature Coating Market From 2010 to 2016

Figure 18 Countries Published the Highest Number of Patents in 2016

Figure 19 Powder-Based Segment Dominated the Low Temperature Coating Market, 2015 (USD Million)

Figure 20 Asia-Pacific to Register the Highest CAGR in Powder-Based Low Temperature Coating Market

Figure 21 Asia-Pacific to Register the Highest CAGR in Liquid-Based Low Temperature Coating Market

Figure 22 Polyester-Based Low Temperature Coating Accounted for the Major Share in 2015 (USD Million)

Figure 23 Asia-Pacific to Lead the Polyester-Based Low Temperature Coating Market

Figure 24 Asia-Pacific to Register the Highest CAGR in Epoxy-Based Low Temperature Coating Market

Figure 25 South America to Register the Second-Highest CAGR in Polyurethane-Based Low Temperature Coating Market

Figure 26 South America to Register the Second-Highest CAGR in Acrylic-Based Low Temperature Coating Market

Figure 27 Asia-Pacific to Lead the Other Resin Type Segment of Low Temperature Coating Market

Figure 28 Automotive Was the Largest End-Use Industry Segment of the Low Temperature Coating Market in 2015

Figure 29 Asia-Pacific to Be the Fastest-Growing Low Temperature Coating Market for in Automotive

Figure 30 Asia-Pacific to Remain the Largest Market of Low Temperature Coating in Industrial

Figure 31 Asia-Pacific to Be the Fastest-Growing Market for Low Temperature Coating in Heavy-Duty Equipment

Figure 32 South America to Register the Highest CAGR in Architectural Between 2016 and 2021

Figure 33 South America to Register the Highest CAGR in Furniture Segment Between 2016 and 2021

Figure 34 Europe Accounted for the Largest Low Temperature Coating Market in Other End-Use Industries

Figure 35 Regional Snapshot: Rapidly Growing Markets are Emerging as New Hotspots

Figure 36 Asia-Pacific Snapshot: China to Be the Fastest-Growing Market

Figure 37 Asia-Pacific Market Snapshot: Automotive to Lead the Demand for Low-Temperature Coating

Figure 38 European Market Snapshot: Russia to Lead the Low Temperature Coating Market

Figure 39 North America Snapshot: Powder-Based Low Temperature Coating Driving the Market in the Region

Figure 40 The U.S. Accounted for Maximum Share in the North American Low Temperature Coating Market

Figure 41 Dive Chart

Figure 42 PPG Industries Inc.: Company Snapshot

Figure 43 E.I. Dupont De Nemours and Company: Company Snapshot

Figure 44 The Valspar Corporation: Company Snapshot

Figure 45 Axalta Coating Systems: Company Snapshot

Growth opportunities and latent adjacency in Low Temperature Coating (Low Cure Coating) Market