Managed File Transfer Market by Solution (Application-Centric Managed File Transfer, People-Centric Managed File Transfer, and Ad-Hoc Managed File Transfer), Service, Deployment, Region, Organization Size, Vertical - Global Forecast to 2020

[117 Pages Report] The managed file transfer market size is estimated to grow from USD 939.5 Million in 2015 to USD 1,524.2 Million by 2020, at a CAGR of 10.2%.

Managed file transfer solutions provide a secure, real-time file transfer within the network as well as across a range of other platforms. These solutions are being widely adopted by sectors such as banking, financial services and insurance (BFSI) and healthcare and life sciences. They are also being implemented by government institutions and IT & telecommunications to enhance the business processes and facilitate integration.

The report aims at estimating the market size and future growth potential of the managed file transfer market across different segments, such as solutions, services, verticals, deployment types, end users, and regions. The base year considered for the study is 2014 and the market size is estimated from 2015 to 2020. However, the bigger firms in the market are increasingly acquiring small players in an attempt to expand their offerings across the globe. Organizations in the BFSI industry vertical are rapidly deploying managed file transfer solutions to facilitate faster on-boarding of new trading partners, better system availability and improved compliance through various applications in payment consolidation, DLP, images check, and claims processing.

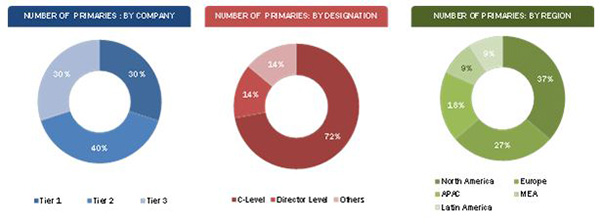

The research methodology used to estimate and forecast the managed file transfer market included capturing data on key vendor revenues through secondary research. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments which were then verified through primary research by conducting extensive interviews with key people, such as chief executive officers, vice presidents, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments. The breakdown of primary profiles is depicted below:

The managed file transfer ecosystem consists of managed file transfer solution vendors, such as IBM, Axway, Attunity, Ipswitch, GlobalSCAPE, Accellion, Coviant Software Corporation, OpenText, SAISON INFORMATION SYSTEMS CO. LTD., JSCAPE, Safe-T, and others sell their managed file transfer solutions and services to end users to cater to their unique business requirements.

Target audience

- Managed file transfer solution vendors

- System integrators

- Third party vendors

- Network operators

- Infrastructure providers

- Government

- Regulatory and compliance agencies

Scope of the Report

The research report segments the managed file transfer market into the following submarkets:

By Deployment type:

- Cloud

- On-Premises

By Solution:

- Application-centric

- People-centric

- Ad-hoc

By Service:

- Consulting and system integration

- Support and maintenance

By Organization size:

- Small and Medium Enterprises (SMEs)

- Large enterprises

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The global market size is estimated to grow from USD 827.6 Million in 2015 to USD 1524.2 Million by 2020, at a CAGR of 10.2%.

The managed file transfer market for industries such as banking, financial services, and insurance (BFSI) and healthcare and life sciences is anticipated to grow steadily in the next few years, as these verticals have been facing unique challenges of information security threats and growing compliance requirements. Managed file transfer helps organizations to eliminate such security, compliance, and governance shortcomings involved in information sharing, whether internal and external to them. Furthermore, the market is expected to be driven by opportunities such as rising trend in application integration and cloud-based managed file transfer solutions.

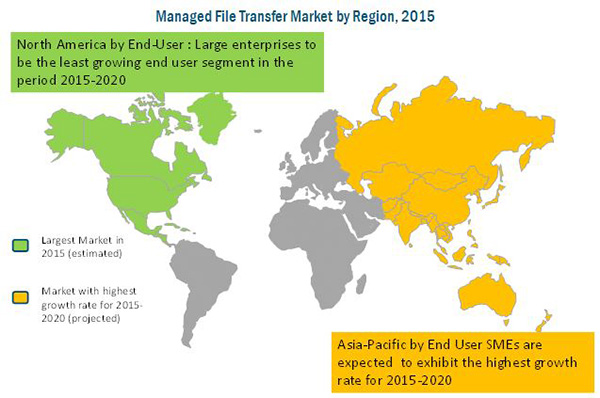

The managed file transfer market has been segmented by type of solution, by type of service, by deployment type, by vertical, by end user, and by region. Among the solutions, application-centric managed file transfer solutions segment is expected to hold the largest market share. Among the deployment types, on-premises deployment is expected to dominate the market in terms of market size. On the basis of end users, large enterprises are estimated to hold the largest share as they are adopting managed file transfer solutions extensively to confront their business challenges; however, cloud-based solutions are gaining traction among the Small and Medium Enterprises (SMEs). The market by region covers five major regional segments, namely, North America, Asia-Pacific (APAC), Europe, Latin America, and Middle East and Africa (MEA). North America is estimated to hold the largest market share of the overall market in 2015, followed by Europe and APAC. APAC is expected to have the highest growth rate during the forecast period, and Latin America and MEA regions are expected to witness a record growth in demonstrating and adopting managed file transfer solutions.

Organic growth through new product/service launch was the key strategy followed by companies such as GlobalSCAPE, Ipswitch, Accellion, JSCAPE, and IBM. This strategy accounted for 63% of the total strategic developments in the managed file transfer market during the period of 2012 to 2015. Furthermore, companies such as Axway, Attunity, GlobalSCAPE, JSCAPE, Ipswitch, and IBM have also adopted strategic partnerships and collaborations as an eminent strategy to enhance their product offerings and distribution networks in the local market. This strategy accounted for 25% of the total strategic developments in the market. However, stiff competition from file sync and share services is restraining the growth of the market.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Bottom-Up Approach

2.4 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities

4.2 Managed File Transfer Market, By Solution

4.3 Key Applications and Regions in the Market

4.4 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Evolution of the Managed File Transfer Market

5.3 Market Segmentation

5.3.1 By Solution

5.3.2 By Service

5.3.3 By Deployment Model

5.3.4 By End User

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Need of Data Security and Governance

5.4.1.2 Performance Improvements and Cost Efficiency

5.4.2 Restraints

5.4.2.1 Stiff Competition From File Sync and Share Services

5.4.3 Opportunities

5.4.3.1 Cloud-Based MFT Solutions

5.4.3.2 Rising Trend in Application Integration

5.4.4 Challenges

5.4.4.1 Lack of End User Awareness

5.4.4.2 Overdependence on Traditional File Transfer Alternatives

6 Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

7 Managed File Transfer Market Analysis, By Solution (Page No. - 39)

7.1 Introduction

7.2 Application-Centric MFT

7.3 People-Centric MFT

7.4 AD-HOC MFT

8 Managed File Transfer Market Analysis, By Service (Page No. - 43)

8.1 Introduction

8.2 Consulting and System Integration

8.3 Support and Maintenance

9 Managed File Transfer Market Analysis, By Deployment Model (Page No. - 47)

9.1 Introduction

9.2 On-Premise

9.3 Cloud

10 Managed File Transfer Market Analysis, By Organization Size (Page No. - 51)

10.1 Introduction

10.2 Small and Medium Enterprises (SME)

10.3 Large Enterprises

11 Managed File Transfer Market Analysis, By Vertical (Page No. - 55)

11.1 Introduction

11.2 Banking, Financial Services and Insurance (BFSI)

11.3 IT and Telecommunications

11.4 Government and Public Sector

11.5 Media and Entertainment

11.6 Retail & CPG

11.7 Manufacturing

11.8 Healthcare and Life Sciences

11.9 Other Verticals

12 Geographic Analysis (Page No. - 69)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 83)

13.1 Overview

13.2 Competitive Situation and Trends

13.2.1 New Product Launches

13.2.2 Agreements, Partnerships, Collaborations, and Joint Ventures

13.2.3 Mergers and Acquisitions

13.2.4 Expansions

14 Company Profiles (Page No. - 88)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

14.1 Introduction

14.2 International Business Machines Corporation

14.3 Globalscape, Inc.

14.4 Attunity, Ltd.

14.5 Axway

14.6 Ipswitch, Inc.

14.7 Coviant Software Corporation

14.8 Opentext Corporation

14.9 Accellion, Inc.

14.10 Jscape LLC

14.11 Saison Information Systems Co., Ltd

14.12 Safe-T

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 112)

15.1 Insight From Industry Expert

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (68 Tables)

Table 1 Managed File Transfer Market Size, By Solution, 20132020 (USD Million)

Table 2 Application-Centric Managed File Transfer: Market Size, By Region, 20132020 (USD Million)

Table 3 People-Centric Managed File Transfer: Market Size, By Region, 20132020 (USD Million)

Table 4 AD-HOC Managed File Transfer: Market Size, By Region, 20132020 (USD Million)

Table 5 Market Size, By Service, 20132020 (USD Million)

Table 6 Consulting and System Integration Services: Market Size, By Region, 20132020 (USD Million)

Table 7 Support and Maintenance: Market Size, By Region, 20132020 (USD Million)

Table 8 Global Managed File Transfer Market Size, By Deployment Model, 20132020 (USD Million)

Table 9 On-Premise: Market Size, By Region, 20132020 (USD Million)

Table 10 Cloud: Market Size, By Region, 20132020 (USD Million)

Table 11 Global Market Size, By End User, 20132020 (USD Million)

Table 12 SME: Market Size, By Region, 20132020 (USD Million)

Table 13 Large Enterprises: Market Size, By Region, 20132020 (USD Million)

Table 14 Market Size, By Vertical, 20132020 (USD Million)

Table 15 Banking, Finacial Services and Insurance: Market Size, By Region, 20132020 (USD Million)

Table 16 Banking, Finacial Services and Insurance: Market Size, By Solution, 20132020 (USD Million)

Table 17 Banking, Finacial Services and Insurance: Market Size, By Service, 20132020 (USD Million)

Table 18 IT and Telecommunications: Market Size, By Region, 20132020 (USD Million)

Table 19 IT and Telecommunications: Market Size, By Solution, 20132020 (USD Million)

Table 20 IT and Telecommunications: Market Size, By Service, 20132020 (USD Million)

Table 21 Government and Public Sector: Market Size, By Region, 20132020 (USD Million)

Table 22 Government and Public Sector: Market Size, By Solution, 20132020 (USD Million)

Table 23 Government and Public Sector: Market Size, By Service, 20132020 (USD Million)

Table 24 Media and Entertainment: Market Size, By Region, 20132020 (USD Million)

Table 25 Media and Entertainment: Market Size, By Solution, 20132020 (USD Million)

Table 26 Media and Entertainment: Market Size, By Solution, 20132020 (USD Million)

Table 27 Retail and CPG: Market Size, By Region, 20132020 (USD Million)

Table 28 Retail and CPG: Market Size, By Solution, 20132020 (USD Million)

Table 29 Retail and CPG: Market Size, By Service, 20132020 (USD Million)

Table 30 Manufacturing: Market Size, By Region, 20132020 (USD Million)

Table 31 Manufacturing: Market Size, By Solution, 20132020 (USD Million)

Table 32 Manufacturing: Market Size, By Service, 20132020 (USD Million)

Table 33 Healthcare and Life Sciences: Market Size, By Region, 20132020 (USD Million)

Table 34 Healthcare and Life Sciences: Managed File Transfer Market Size, By Solution, 20132020 (USD Million)

Table 35 Healthcare and Life-Sciences: Market Size, By Service, 20132020 (USD Million)

Table 36 Other Verticals: Market Size, By Region, 20132020 (USD Million)

Table 37 Other Verticals: Market Size, By Solution, 20132020 (USD Million)

Table 38 Other Verticals: Market Size, By Service, 20132020 (USD Million)

Table 39 Managed File Transfer Market Size, By Region, 20132020 (USD Million)

Table 40 North America: Market Size, By Vertical, 20132020 (USD Million)

Table 41 North America: Market Size, By Deployment Model, 20132020 (USD Million)

Table 42 North America: Market Size, By End User, 20132020 (USD Million)

Table 43 North America: Market Size, By Solution, 20132020 (USD Million)

Table 44 North America: Market Size, By Service, 20132020 (USD Million)

Table 45 Europe: Market Size, By Vertical, 20132020 (USD Million)

Table 46 Europe: Market Size, By Deployment Model, 20132020 (USD Million)

Table 47 Europe: Market Size, By End User, 20132020 (USD Million)

Table 48 Europe: Market Size, By Solution, 20132020 (USD Million)

Table 49 Europe: Market Size, By Service, 20132020 (USD Million)

Table 50 Asia-Pacific: Market Size, By Vertical, 20132020 (USD Million)

Table 51 Asia-Pacific: Market Size, By Deployment Model, 20132020 (USD Million)

Table 52 Asia-Pacific: Market Size, By End User, 20132020 (USD Million)

Table 53 Asia-Pacific: Market Size, By Solution, 20132020 (USD Million)

Table 54 Asia-Pacific: Market Size, By Service, 20132020 (USD Million)

Table 55 Middle East and Africa: Market Size, By Vertical, 20132020 (USD Million)

Table 56 Middle East and Africa: Market Size, By Deployment Model, 20132020 (USD Million)

Table 57 Middle East and Africa: Market Size, By End User, 20132020 (USD Million)

Table 58 Middle East and Africa: Market Size, By Solution, 20132020 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 20132020 (USD Million)

Table 60 Latin America: Market Size, By Vertical, 20132020 (USD Million)

Table 61 Latin America: Market Size, By Deployment Model, 20132020 (USD Million)

Table 62 Latin America: Market Size, By End User, 20132020 (USD Million)

Table 63 Latin America: Market Size, By Solution, 20132020 (USD Million)

Table 64 Latin America: Managed File Transfer Market Size, By Service, 20132020 (USD Million)

Table 65 New Product Launches, 20122015

Table 66 Agreements, Partnerships, Collaborations, and Joint Ventures, 20122015

Table 67 Mergers and Acquisitions, 20122015

Table 68 Expansions, 20132015

List of Figures (47 Figures)

Figure 1 Managed File Transfer Market: Research Methodology

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions

Figure 7 Cloud-Based Managed File Transfer Market is Expected to Gain the Highest Traction During the Forecast Period (20152020)

Figure 8 Application-Centric Managed File Transfer is Expected to Lead the Market in the Solution Segment During the Forecast Period (20152020)

Figure 9 Asia-Pacific is Expected to Gain the Highest Traction for Managed File Transfer Solution During the Forecast Period

Figure 10 Lucrative Growth Prospects in the Market

Figure 11 AD-HOC Managed File Transfer Solution is Expected to Grow at the Highest CAGR in the Market

Figure 12 Market Share of Top Three Regions and Verticals, 2015

Figure 13 Asia-Pacific is Expected to Grow Exponentially in the Coming Years

Figure 14 Evolution of the Market

Figure 15 Market Segmentation: By Solution

Figure 16 Market Segmentation: By Service

Figure 17 Market Segmentation: By Deployment Model

Figure 18 Market Segmentation: By End User

Figure 19 Market Segmentation: By Vertical

Figure 20 Market Segmentation: By Region

Figure 21 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Value Chain Analysis: Managed File Transfer

Figure 23 Strategic Benchmarking: Managed File Transfer

Figure 24 AD-HOC Managed File Transfer Market is Expected to Grow at the Highest CAGR During the Forecast Period (20152020)

Figure 25 Support and Maintenance Services Market is Expected to Grow at the Highest CAGR During the Forecast Period (20152020)

Figure 26 Cloud Deployment Will Grow at the Highest CAGR During the Forecast Period (2015-2020)

Figure 27 SMES Will Grow at the Highest CAGR During the Forecast Period (2015-2020)

Figure 28 BFSI and Healthcare and Life Sciences Will Continue to Dominate the Managed File Transfer Market During the Forecast Period (2015- 2020)

Figure 29 North America Will Continue to Lead the Market During the Forecast Period (2015 2020)

Figure 30 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 North America Market Snapshot

Figure 32 Asia-Pacifc Market Snapshot

Figure 33 Companies Adopted New Product Launch as the Key Growth Strategy During the Period 20122014

Figure 34 Market Evaluation Framework

Figure 35 Battle for Market Share: New Product Launch Was the Key Strategy

Figure 36 Geographic Revenue Mix of the Top Market Players

Figure 37 International Business Machines Corporation: Company Snapshot

Figure 38 International Business Machines Corporation: SWOT Analysis

Figure 39 Globalscape, Inc.: Company Snapshot

Figure 40 Globalscape, Inc.: SWOT Analysis

Figure 41 Attunity, Ltd.: Company Snapshot

Figure 42 Attunity Ltd: SWOT Analysis

Figure 43 Axway: Company Snapshot

Figure 44 Axway: SWOT Analysis

Figure 45 Ipswitch: SWOT Analysis

Figure 46 Opentext Corporation: Company Snapshot

Figure 47 Saison Information Systems Co., Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Managed File Transfer Market

Gather insights into the size and value of the Managed File Transfer and cloud backup markets to determine the potential value of a software solution in development.

Interested in the North America MFT market breakdown by installation method (i.e. on-premise installation or cloud (SaaS) service) and North America market breakdown WITHIN On-premise - by competitor.