Managed SIEM Services Market by Application (Log Management and Reporting, Threat Intelligence, Security Analytics), Type (Fully Managed, Co-Managed), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2028

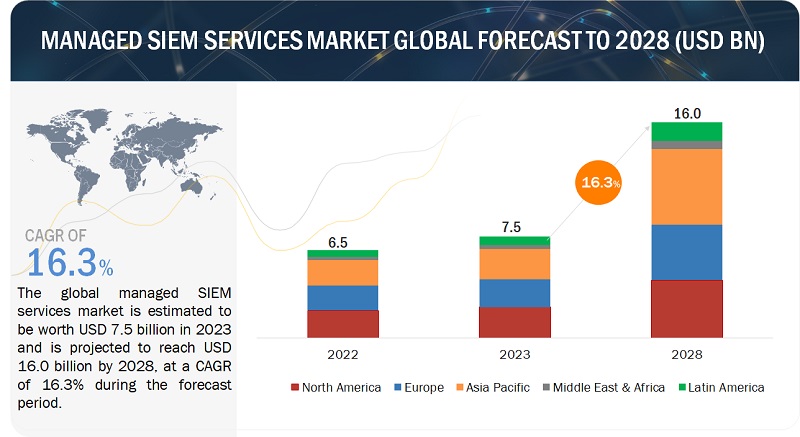

[264 Pages Report] The global managed SIEM services market is estimated to be worth USD 7.5 billion in 2023 and is projected to reach USD 16.0 billion by 2028, at a CAGR of 16.3% during the forecast period. The surge in demand for managed SIEM services is fueled by a rapidly evolving cybersecurity landscape marked by an escalation in sophisticated cyber threats, a pervasive digital transformation across industries, and a heightened awareness of the need for proactive security measures. As organizations grapple with the complexities of securing their digital assets, the shortage of skilled cybersecurity professionals further intensifies the appeal of outsourcing to managed service providers. The increasing prevalence of remote work, the growing attack surface due to the adoption of cloud technologies, and the imperative for regulatory compliance contribute to the market's momentum. Managed SIEM services are now not just a strategic option but an essential component in navigating the intricacies of modern cybersecurity challenges, offering organizations a scalable, expert-driven solution to fortify their defenses against a dynamic threat landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Driver: Growing Cybersecurity Threat Landscape

The key driver in the Managed SIEM Services market is the relentless growth and sophistication of the cybersecurity threat landscape. The increasing frequency and complexity of cyber threats, including malware, ransomware, and targeted attacks, compel organizations to seek robust solutions for continuous monitoring, threat detection, and rapid incident response. Managed SIEM services, equipped with advanced analytics and threat intelligence, address this driver by providing proactive security measures to safeguard against evolving cyber risks.

Restraint: Cost and Budget Constraints

A significant restraint in the Managed SIEM Services market is the challenge presented by cost and budget constraints for organizations, especially smaller enterprises. Implementing and maintaining robust cybersecurity measures can be resource-intensive, and the initial investment required for deploying managed SIEM services may pose a barrier for organizations with limited budgets. Overcoming this restraint involves a careful balance between cost considerations and the critical need for effective cybersecurity, highlighting the importance of flexible and scalable service models.

Opportunity: Increasing Adoption of Cloud-Based Solutions

An opportunity in the Managed SIEM Services market lies in the increasing adoption of cloud-based solutions. Cloud deployment offers scalability, flexibility, and accessibility, aligning well with the dynamic nature of cybersecurity requirements. Organizations recognize the benefits of cloud-based managed SIEM services for rapid deployment, real-time updates, and efficient scaling to address evolving security needs. This shift toward cloud solutions presents an opportunity for service providers to offer tailored and efficient services in line with the evolving technological landscape.

Challenge: Skill Shortage in the Cybersecurity Workforce

A challenge faced by the Managed SIEM Services market is the global shortage of skilled cybersecurity professionals. As the demand for expert analysis, threat detection, and incident response increases, a growing gap exists in the availability of qualified cybersecurity personnel. This shortage poses a challenge for managed service providers to acquire and retain skilled professionals, impacting their ability to offer high-quality and responsive services. Overcoming this challenge involves investing in training programs, automation, and collaborative efforts to bridge the cybersecurity skills gap.

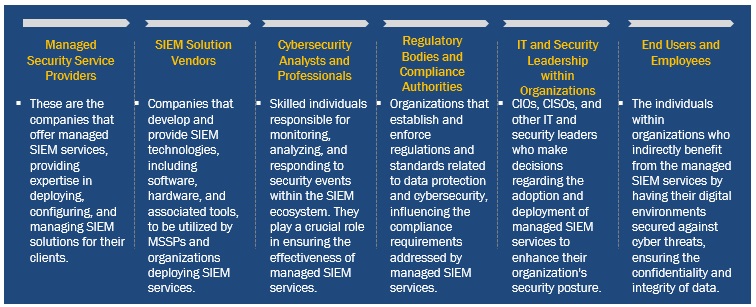

Managed Siem Services Market Ecosystem

The major players in the managed SIEM services market are Unisys, Rapid7, Trustwave, Talion, etc.The market for managed SIEM services is dominated by well-known businesses that have made a name for themselves as domain leaders. These businesses are well-known, secure financially, and have a track record of offering cutting-edge managed SIEM services and solutions. They are able to respond to the changing needs of the market owing to their broad range of products, which includes infrastructure, solutions, applications, and services. These businesses are leading the way in the advancement of managed SIEM services technology thanks to their expansive capabilities and innovative technology.

By type, the fully managed segment to register the highest growth rate during the forecast period.

The segment encompasses comprehensive outsourcing of SIEM services, where the service provider takes full responsibility for the SIEM solution's deployment, configuration, monitoring, and management. Organizations increasingly recognize the benefits of fully managed SIEM services, providing a turnkey solution that allows internal teams to focus on core business functions while ensuring a robust cybersecurity posture. The fully managed approach offers expert-driven security operations, continuous monitoring, and proactive incident response, making it an attractive choice for organizations seeking a comprehensive and hands-off solution to address the complexities of the evolving cyber threat landscape. The anticipated high growth in the fully managed segment underscores the increasing preference for a holistic and outsourced approach to cybersecurity management.

Based on organization size, the large enterprises segment to account for the largest market size in the managed SIEM services market.

The large enterprises segment is anticipated to account for the largest market size. Large enterprises, with their extensive and complex IT infrastructures, face higher security events and require sophisticated solutions to monitor, analyze, and respond to potential threats effectively. Managed SIEM services offer these organizations a comprehensive approach to cybersecurity, encompassing real-time monitoring, threat detection, and incident response. The scalability and customization capabilities of managed SIEM services align with large enterprises' diverse and expansive needs, allowing them to navigate the intricacies of the cybersecurity landscape. As these organizations prioritize robust security measures and compliance with industry regulations, adopting managed SIEM services becomes integral, solidifying the large enterprises segment as a key driver in the market.

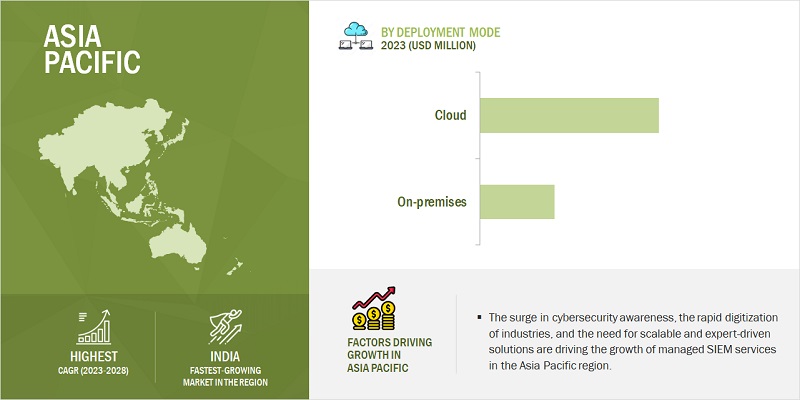

Asia Pacific will register the highest growth rate during the forecast period.

The surge is driven by the region's rapid digital transformation, increased connectivity, and a heightened awareness of the critical need for robust cybersecurity measures. As businesses in Asia Pacific increasingly embrace technology to fuel their growth, the demand for managed SIEM services is surging to counter evolving cyber threats effectively. Additionally, the region's dynamic economic landscape and the proliferation of digital initiatives contribute to the heightened significance of advanced security solutions. The growth in remote work practices and the escalating adoption of cloud technologies further amplify the demand for managed SIEM services in Asia, positioning it as a pivotal driver in the global market.

Key Market Players:

The major players in the managed SIEM services market are AT&T (US), Advantio (Spain), BlueVoyant (US), BT (UK), CyberCX (Australia), Capgemini (France), GoSecure (US), Cyderes (US), IBM (US), Integrity360 (Ireland), Redscan (UK), NCC Group (UK), NTT (Japan), Optiv (US), Proficio (US), ReliaQuest (US), SharkStriker (US), Stratejm (Canada), Talion (UK), TCS (India), Trustwave (US), Unisys (US), Verizon (US), Vodafone (UK), Wipro (India), Rapid7 (US), ManageEngine (US), Sumo Logic (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By application, type, deployment mode, organization size, and vertical |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

AT&T (US), Advantio (Spain), BlueVoyant (US), BT (UK), CyberCX (Australia), Capgemini (France), GoSecure (US), Cyderes (US), IBM (US), Integrity360 (Ireland), Redscan (UK), NCC Group (UK), NTT (Japan), Optiv (US), Proficio (US), ReliaQuest (US), SharkStriker (US), Stratejm (Canada), Talion (UK), TCS (India), Trustwave (US), Unisys (US), Verizon (US), Vodafone (UK), Wipro (India), Rapid7 (US), ManageEngine (US), Sumo Logic (US) |

This research report categorizes the managed SIEM services market to forecast revenues and analyze trends in each of the following submarkets:

Based on application:

- Log Management and Reporting

- Threat Intelligence

- Security Analytics

- Other Applications

Based on type:

- Fully Managed

- Co-Managed

Based on deployment mode:

- Cloud

- On-Premises

Based on organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- BFSI

- Government

- Healthcare

- Telecommunication

- IT and ITeS

- Retail and eCommerce

- Energy and Utilities

- Manufacturing

- Other Verticals

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- India

- China

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- Nov 2023 - ConnectWise announced improved alerting for its security information and event management (SIEM) solutions as part of its Cybersecurity Management advancements to enhance threat detection. By producing high-fidelity notifications that identify which occurrences are important and which are not, the system reduces the time needed for triage and investigation. TSPs may respond more proactively to any security events and have better visibility into threats by enhancing threat detection using the SIEM's enhanced alerting feature.

- Apr 2023 - A recent ManageEngine survey indicates that there is a cybersecurity labor shortage in organizations right now. Given budgetary restrictions and the present state of the economy, it is challenging for businesses to solve security issues and advance to a higher security maturity level. Moreover, companies are discovering that the total cost of managed security services is less than that of implementing and maintaining security systems, such as SIEM solutions. These reasons have led to an increase in businesses turning to MSSPs for their security requirements.

- Oct 2022 - Through a workflow for threat detection, investigation, and response, the new Exabeam Security Operations Platform is intended to provide security teams with the "greatest fighting chance" of beating adversaries. The three main components of New-Scale SIEM—cloud-scale security log management, behavioral analytics, and an automated investigative experience—are combined in the new product portfolio.

- Sep 2021 - Wipro and Securonix have announced a partnership that combines Wipro's global reach and cybersecurity intelligence capabilities with Securonix's cloud-first SIEM, analytics-driven detection, and automated response tools to give organizations better governance and security threat protection.

Frequently Asked Questions (FAQ):

What are managed SIEM services?

Managed Security Information and Event Management (SIEM) services refer to comprehensive cybersecurity solutions outsourced to third-party providers. These services involve the deployment and management of SIEM technology, which integrates Security Information Management (SIM) and Security Event Management (SEM) to provide real-time analysis of security alerts and events within an organization's IT infrastructure. Managed SIEM services include functions such as log collection, correlation, and analysis, enabling the detection of potential security threats and incidents. Security experts from the service provider monitor and respond to alerts, conduct threat intelligence analysis, and ensure continuous improvement of the SIEM system's effectiveness. By outsourcing these services, organizations can benefit from enhanced security capabilities, 24/7 monitoring, and expert-driven responses to emerging cyber threats, allowing them to focus on their core business functions while maintaining a robust cybersecurity posture.

What is the market size of the managed SIEM services market?

The global managed SIEM services market is estimated to be worth USD 7.5 billion in 2023 and is projected to reach USD 16.0 billion by 2028, at a CAGR of 16.3% during the forecast period.

What are the major drivers in the managed SIEM services market?

The managed SIEM services market is driven by several key factors, with the foremost being the rapidly evolving cybersecurity landscape and the increasing sophistication of cyber threats. Organizations across various industries face a growing number of security challenges, including advanced malware, targeted attacks, and insider threats. This complexity propels the demand for managed SIEM services, providing businesses with expert-driven solutions for real-time security monitoring, threat detection, and incident response. Additionally, the shortage of skilled cybersecurity professionals further fuels the adoption of managed services, enabling organizations to leverage the expertise of external providers. The need for regulatory compliance, the rising prevalence of remote work, and the continuous expansion of digital footprints also contribute to the increasing reliance on managed SIEM services as organizations seek proactive and scalable cybersecurity measures to safeguard their critical assets.

Who are the major players operating in the managed SIEM services market?

The major players in the managed SIEM services market are AT&T (US), Advantio (Spain), BlueVoyant (US), BT (UK), CyberCX (Australia), Capgemini (France), GoSecure (US), Cyderes (US), IBM (US), Integrity360 (Ireland), Redscan (UK), NCC Group (UK), NTT (Japan), Optiv (US), Proficio (US), ReliaQuest (US), SharkStriker (US), Stratejm (Canada), Talion (UK), TCS (India), Trustwave (US), Unisys (US), Verizon (US), Vodafone (UK), Wipro (India), Rapid7 (US), ManageEngine (US), Sumo Logic (US).

Which key technology trends prevail in the managed SIEM services market?

Several key technology trends are shaping the landscape of the managed SIEM services market. One prominent trend is the integration of artificial intelligence and machine learning capabilities into SIEM solutions. These advanced technologies enhance threat detection efficiency by enabling systems to analyze vast amounts of data, recognize patterns, and identify anomalies in real time. Another significant trend is the adoption of cloud-based SIEM solutions, providing organizations with scalable and flexible options for deployment. The move toward orchestration and automation is also prevalent, streamlining incident response processes and allowing quicker, more precise reactions to security events. Additionally, incorporating threat intelligence feeds and collaboration with threat intelligence platforms contribute to proactively identifying and mitigating emerging cyber threats. These technology trends empower managed SIEM services to stay ahead of evolving cybersecurity challenges and provide organizations with robust, intelligent, and scalable solutions for protecting their digital environments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

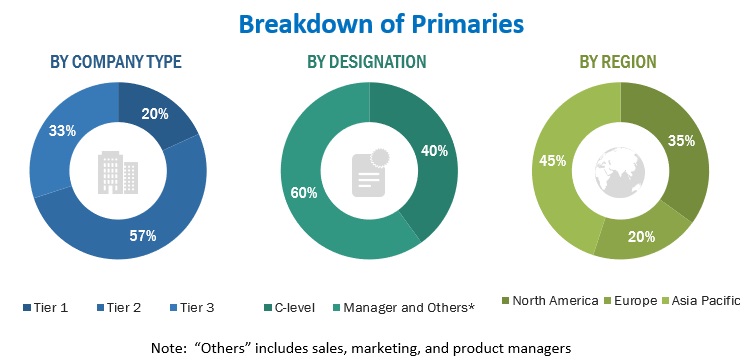

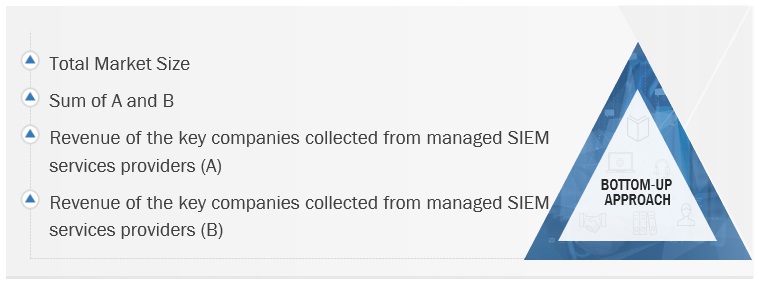

The research study involved four major activities in estimating the managed SIEM services market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the managed SIEM services market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the managed SIEM services market. The first approach involved estimating the market size by summating companies’ revenue generated through managed SIEM services solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the managed SIEM services market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Managed security information and event management services refer to outsourced solutions that provide comprehensive cybersecurity monitoring, threat detection, and incident response capabilities for organizations. The core objective of managed SIEM services is to enhance an organization's ability to identify and respond to security events in real time by leveraging advanced technologies, expert analysis, and continuous monitoring. These services typically involve the centralized collection, analysis, and correlation of security-related data from various sources across an organization's IT infrastructure. Managed SIEM services often include features such as log management, event correlation, threat intelligence integration, and 24/7 security monitoring. The goal is to help organizations mitigate security risks, detect and respond to cyber threats effectively, and maintain compliance with industry regulations and standards, all while leveraging the expertise of external security professionals.

Key Stakeholders

- Chief technology and data officers

- Software and solution developers

- Integration and deployment service providers

- Business analysts

- Information Technology (IT) professionals

- Investors and venture capitalists

- Third-party providers

- Consultants/consultancies/advisory firms

- Cyber-security firms

The main objectives of this study are as follows:

- To define, describe, and forecast the managed SIEM services market based on segments application, type, deployment mode, organization size, vertical with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global managed SIEM services market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Managed SIEM Services Market