Maritime Patrol Aircraft Market Size by Type (Armored, Unarmored), Propulsion System (Jet Engine, Electric Propulsion), Application (Surveillance and Reconnaissance, Combat Support, Search and Rescue, Coastal Patrolling), Mode of Operation, and Region - Global Forecast to 2028

Update:: 19.05.25

Maritime Patrol Aircraft Market Size & Share

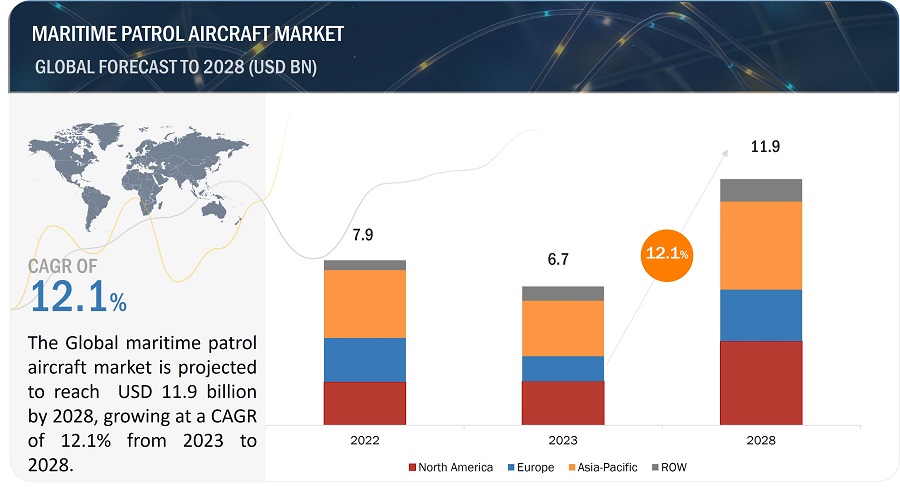

The Maritime Patrol Aircraft Market Size is projected to grow from USD 6.7 billion in 2023 to USD 11.9 billion by 2028, growing at a CAGR of 12.1% from 2023 to 2028. The Maritime Patrol Aircraft (MPA) industry is experiencing significant growth due to increasing demand for advanced surveillance, reconnaissance, and defense capabilities across global naval forces. Technological advancements in sensors, radar systems, and communication technologies have enhanced the operational efficiency of MPAs, allowing for better detection of surface and underwater threats. The rising need for maritime security, border control, and anti-submarine warfare, particularly in regions with high geopolitical tensions, is driving market expansion. Furthermore, the integration of unmanned systems and artificial intelligence in MPAs is expected to boost demand, offering greater autonomy and precision in maritime operations.

Maritime Patrol Aircraft Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Maritime Patrol Aircraft Market Trends

Maritime Patrol Aircraft Market Dynamics

Driver: Growing Maritime Threats and Security Concerns

Escalating maritime challenges, including piracy, illegal activities, and territorial disputes, necessitate enhanced surveillance capabilities, propelling the demand for maritime patrol aircraft. Maritime surveillance is the monitoring of maritime activities to detect and prevent illegal activities such as piracy, smuggling, and illegal fishing. MPAs are used for maritime surveillance, as they can cover large areas of ocean and stay on station for long periods of time.

The annual report on piracy and armed robbery against ships, compiled by the International Maritime Bureau (IMB), offers a comprehensive analysis of 115 maritime incidents involving piracy and armed robbery globally. These incidents were reported to the IMB Piracy Reporting Centre (PRC) within the timeframe of January 1st to December 31st, 2022. The report serves as a comprehensive assessment of the prevailing security landscape in maritime domains across the world, shedding light on the nature, frequency, and geographical distribution of such incidents. It offers a valuable insight into the challenges faced by the maritime industry and highlights areas where collective efforts are needed to enhance maritime security and safeguard global shipping routes. The meticulous analysis presented in this report contributes to the maritime community's understanding of evolving threats and aids in formulating strategies to mitigate risks and ensure safe navigation for vessels and seafarers.

China has been constructing a sequence of surveillance installations across sections of the South China Sea (SCS), with numerous situated within Chinese territories and several positioned in international waters. As disclosed through the research by CSIS’ Asian Maritime Transparency Initiative, these surveillance platforms constitute a component of China's "Blue Ocean Information Network". Partial details regarding these platforms were disclosed during the Langkawi International Maritime and Aerospace exhibition held in 2019.

Restraints: Stringent regulatory norms for manufacturing of maritime aircraft components.

The stringent regulatory requirements governing the manufacturing of components for maritime patrol aircraft constitute a significant constraint within the MPA market. First and foremost, adhering to these stringent regulations substantially escalates manufacturing costs. Manufacturers are compelled to allocate significant resources to research, development, and testing to meet the demanding standards, which, in turn, results in elevated production expenses. Consequently, this can lead to higher acquisition costs for maritime patrol aircraft, potentially impeding affordability, particularly for nations with limited budgets. Moreover, the rigorous certification processes mandated by these regulations can considerably prolong aircraft delivery times. Manufacturers must navigate a series of meticulous testing and approval procedures, leading to extended lead times. Such delays can hinder the timely response to emergent maritime security threats. Furthermore, the existence of divergent regulations across countries and regions introduces complexities for manufacturers operating on a global scale. Complying with multiple sets of regulations demands additional resources and may introduce inconsistencies within the supply chain.

Opportunities: Leveraging IoAT for Next-Gen Maritime Patrol Operations

The concept of the "Internet of Things" (IoT) has extended to the aviation sector, giving rise to the term "Internet of Aircraft Things" (IoAT). This refers to the interconnected network of aircraft systems, components, sensors, and data sources that communicate and share information in real time. In the maritime patrol aircraft market, IoAT presents a significant opportunity to enhance operational efficiency, safety, and mission effectiveness.

The "Internet of Aircraft Things" (IoAT) presents a significant opportunity in the maritime patrol aircraft market. IoAT enables real-time data sharing between aircraft systems, sensors, and external sources, enhancing operational efficiency, real-time data analytics, situational awareness, and intelligent decision support. It also offers mission flexibility, integrated communication, and future-proofing capabilities. By leveraging IoAT technology, MPA can revolutionize maritime surveillance and security operations, ensuring efficient resource allocation, coordinated responses, and continuous adaptation to emerging trends.

Challenges: Highcost of acquisition, maintenance, and operation of maritime patrol aircraft

In the realm of maritime patrol aircraft, several challenges can impact their effectiveness and operational capabilities. One significant challenge is the high cost associated with the acquisition, maintenance, and operation of these specialized aircraft. The advanced technology and equipment required for effective surveillance and reconnaissance missions often come with a substantial price tag, which can strain defense budgets for many nations. Another challenge is the need to strike a balance between incorporating cutting-edge technology while ensuring cost-effectiveness. Manufacturers and customers alike must navigate the complexity of integrating advanced systems without escalating the overall expenses. This challenge requires careful consideration to ensure that the aircraft's performance is optimized without exceeding budget constraints.

This strategic approach focuses on addressing the challenges in the maritime patrol aircraft domain by optimizing cost-efficiency, technological integration, and adaptability. By fostering collaboration between manufacturers, defense agencies, and technology providers, stakeholders can work together to develop innovative solutions that strike the right balance between advanced capabilities and financial feasibility. This action aims to equip maritime patrol aircraft with adaptive features that can effectively counter evolving threats, ensuring sustained maritime security while maximizing resources.

Market Ecosystem Map: Maritime Patrol Aircraft Market

Maritime Patrol Aircraft Market Segmentation

Based on the type, the Armored segment is estimated to lead the Maritime Patrol Aircraft market in 2023

Based on the type, the maritime patrol aircraft market has been segmented broadly into Armored and Unarmored aircraft. Here armored aircraft is leading this segment in 2023. The surge in concerns related to piracy, territorial disputes, and smuggling has driven nations to invest in these robustly armored aircraft. They ensure the safety of personnel during critical missions, establishing them as indispensable assets for patrolling and safeguarding maritime interests. In essence, the growing demand for armored MPA is a direct response to the need for secure and resilient platforms tailored to address the evolving security challenges within the maritime patrol aircraft.

Based on the propulsion system, Jet Engine segment is estimated to lead the Maritime Patrol Aircraft market in 2023.

Based on propulsion system, the maritime patrol aircraft market has been segmented into Jet engine and electric propulsion. Jet engines segment is expected to lead the market in 2023. The jet engine segment within the market is thriving due to its pivotal role in enhancing aircraft performance. Jet engines offer greater speed, extended operational range, and enhanced capabilities, essential for effective surveillance and rapid response missions at sea. As maritime security concerns escalate, nations are increasingly investing in these high-performance engines to ensure quicker and more efficient patrolling of vast maritime territories. Furthermore, jet engines' efficiency in fuel consumption aligns with cost-conscious budgets. In essence, the growth of the jet engine segment is driven by the imperative for enhanced maritime security and cost-effective solutions within the market.

Based on the mode of operation, the Manned segment dominates the market & is projected to witness the largest share in 2023.

Based on the mode of operation, the maritime patrol aircraft market has been segmented into Manned and Unmanned. Manned segment seem to dominate the market in 2023. Manned aircraft provide adaptability and decision-making capabilities crucial for complex maritime missions. Experienced crews ensure efficient responses to evolving situations. These aircraft serve various roles, from anti-submarine warfare to search and rescue, adding to their versatility. With evolving maritime challenges and the need for skilled operators, the demand for manned maritime patrol aircraft remains robust, underscoring their essential role in driving growth and effectiveness within the market.

Based on the application, Surveillance and Reconnaissance seem to dominate this segment and is estimated to account for the larger share of the maritime patrol aircraft market in 2023

Based on the Application, the maritime patrol aircraft market has been segmented into Surveillance and Reconnaissance, Combat Support, Coastal Patrolling, and Search and Rescue. The Surveillance and Reconnaissance segment to dominate the market in 2023. The surveillance and reconnaissance segment in the market is propelled by the increasing demand for comprehensive maritime domain awareness. These specialized aircraft are equipped with advanced sensors, intelligence-gathering systems, and data analytics capabilities, enabling effective detection and monitoring of maritime threats and activities. Heightened concerns related to piracy, smuggling, and territorial disputes prompt nations to invest in surveillance and reconnaissance aircraft, bolstering their maritime security efforts. Furthermore, these aircraft play a pivotal role in supporting search and rescue missions and environmental monitoring. The quest for enhanced maritime situational awareness drives the growth of this segment within the market.

Maritime Patrol Aircraft Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Maritime Patrol Aircraft Market Regional Analysis

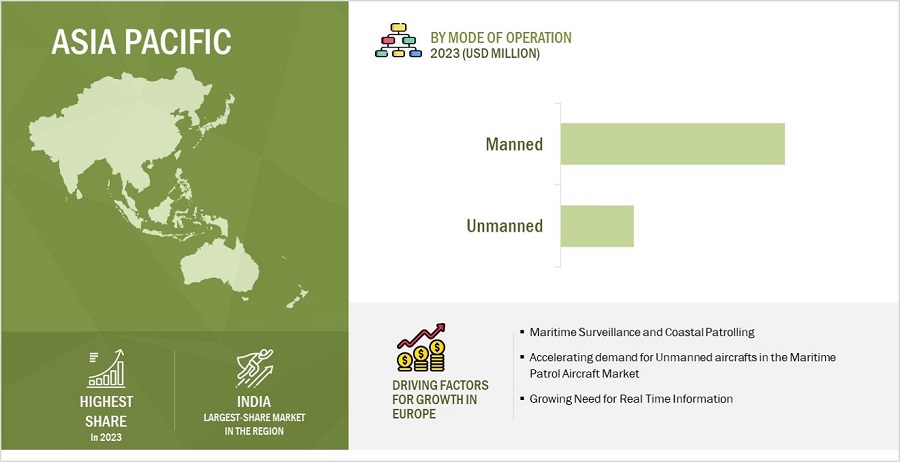

The Asia Pacific market is projected to have the largest share in 2023 in the maritime patrol aircraft market

Based on region, the maritime patrol aircraft market has been segmented into North America, Europe, Asia Pacific and Rest of the World (RoW). Asia Pacific region seem to dominate the market in 2023. Asia Pacific has a long history of innovation in aircraft technology. The region is home to renowned aircraft manufacturers such as Kawasaki Heavy Industries, and AVIC. These organizations have a wealth of technical expertise that enables them to develop and deploy cutting-edge technologies, including maritime patrol aircraft and their support systems. Asia Pacific aircraft manufacturers have been investing heavily in maritime patrol aircraft technology. This is because they recognize the potential of this technology to revolutionize maritime security and warfare capabilities.

Top Maritime Patrol Aircraft Companies - Key Market Players

The Maritime patrol aircraft companies is dominated by a few globally established players such as Boeing (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Airbus (Netherlands), Northrop Grumman Corporation (US), among others, are the key manufacturers that secured maritime patrol aircraft contracts in the last few years. The primary focus was given to the contracts and new product development due to the changing requirements of homeland security, and defense users across the world.

Maritime Patrol Aircraft Industry Overview

Scope of the Maritime Patrol Aircraft Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 6.7 Billion in 2023 |

|

Projected Market Size |

USD 11.9 Billion by 2028 |

|

Growth Rate (CAGR) |

12.1 % |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By type, by propulsion system, by mode of operation, by application, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the world |

|

Companies covered |

Boeing (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Airbus (Netherlands), and Northrop Grumman Corporation (US) are some of the major players in the maritime patrol aircraft market. (25 Companies) |

Maritime Patrol Aircraft Market Highlights

The study categorizes the market based on type, propulsion systems, application, mode of operation, and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Propulsion System |

|

|

By Application |

|

|

By Mode of Operation |

|

|

By Region |

|

Recent Developments

- In May 2023, Leonardo S.P.A. has entered into an agreement with Malaysia to provide two ATR 72 MPA (Maritime Patrol Aircraft) platforms. The Ministry of Defence of Malaysia formalized this contract through a signing event held at LIMA 2023, a significant exhibition focusing on maritime and defense affairs in the Asia-Pacific region. This occasion took place in Langkawi, Malaysia.

- In March 2023, On March 10, 2023, the Ministry of Defence concluded an agreement to acquire six Dornier-228 aircraft from Hindustan Aeronautics Limited (HAL) for the Indian Air Force (IAF) at a total expense of Rs 667 crore ($80.2 million). This acquisition is anticipated to enhance the IAF's operational capabilities in the Northeast region and the nation's island territories, as stated by the Ministry of Defence.

- In December 2022, The French Defense Procurement Agency (DGA) has granted study contracts to Airbus Defense and Space (Netherland) and Dassault Aviation. These contracts focus on designing a forthcoming maritime patrol aircraft (Patmar), utilizing the Airbus A320neo and Dassault Falcon 10X platforms. In the scope of these 18-month studies, each contract valued at 10.9 million euros ($11.93 million), the two aerospace manufacturers are tasked with devising a commercially viable solution aligned with the operational needs of the French Navy beyond 2030.

- In September 2022, Lockheed Martin has been granted a firm-fixed price contract by the U.S. Navy to manufacture 12 additional Sikorsky MH-60R Seahawk® helicopters for the Royal Australian Navy (RAN). The procurement will take place through the U.S. Government's Foreign Military Sales agreement. These new helicopters will establish a third 'Romeo' squadron with exceptional capabilities for the RAN's Fleet Air Arm, further enhancing their operational capacity.

Key Questions Addressed by the Report

Which are the major companies in the maritime patrol aircraft market? What are their major strategies to strengthen their market presence?

Some of the key players in the maritime patrol aircraft market are Boeing (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Airbus (Netherlands), Northrop Grumman Corporation (US), among others are the key manufacturers that secured maritime patrol aircraft contracts in the last few years. Contracts were the key strategies these companies adopted to strengthen their maritime patrol aircraft market presence.

What are the drivers and opportunities for the maritime patrol aircraft market?

The maritime patrol aircraft market experiences robust demand driven by escalating maritime security concerns, including piracy and illegal trafficking. Geopolitical tensions and territorial disputes further bolster the need for advanced surveillance and reconnaissance capabilities. Technological advancements in sensor and communication systems fuel the imperative for modernization and upgrades. Export opportunities and international collaborations play a pivotal role, facilitating partnerships for joint development and procurement. Governments prioritize maritime patrol aircraft to safeguard maritime interests amid evolving threats, underpinning steady market growth for these vital assets.

Which region is expected to grow most in the next five years?

The market in Europe is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for maritime patrol aircraft in the region. One key factor driving the Europe market is the rising demand for maritime aircraft due to on-going tensions between the countries and security threats.

Which type of maritime patrol aircraft will significantly lead in the coming years?

An armored segment of the maritime patrol aircraft market is projected to witness the highest CAGR due to the increasing need for the defensive and protective systems against the enemy aircrafts between 2023 to 2028.

Which are the key technology trends prevailing in the maritime patrol aircraft market?

Technological trends in maritime patrol aircraft are reshaping the industry. Advances in sensor capabilities, such as synthetic aperture radar and advanced sonar systems, bolster detection and tracking of submarines and surface vessels. Integration of unmanned aerial vehicles (UAVs) extends surveillance range and endurance. Data fusion and AI-driven analytics enhance data processing for improved situational awareness. Fuel-efficient engines and lightweight materials lower operational costs. Satellite communication systems ensure seamless connectivity for real-time information exchange. These trends drive innovation in maritime patrol aircraft, offering businesses growth opportunities and a competitive edge in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in maritime threats and security concerns- Growing emphasis on unmanned maritime patrol aircraft- Integration of advanced technologies into maritime patrol aircraftRESTRAINTS- Extended manufacturing timelines for maritime patrol aircraft- Stringent regulatory norms for manufacturing maritime patrol aircraft componentsOPPORTUNITIES- Advent of Internet of Aircraft Things (IoAT)- Boost in maintenance, repair, and overhaul (MRO) activitiesCHALLENGES- High cost associated with procurement, maintenance, and operation of maritime patrol aircraft

- 5.3 MARKET SCENARIOS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.5 VALUE CHAIN ANALYSIS

-

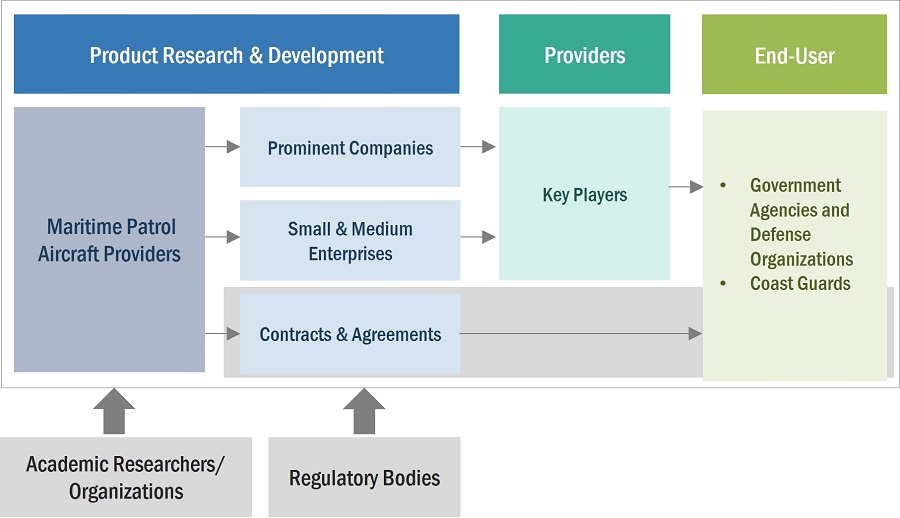

5.6 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.8 USE CASE ANALYSISBOEING P-8MH-60R SEAHAWK

- 5.9 TRADE ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.11 PRICING ANALYSIS

- 5.12 VOLUME DATA

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSADVANCED SENSORSAUTONOMOUS FLIGHT TECHNOLOGYARTIFICIAL INTELLIGENCECYBERSECURITYCLOUD COMPUTING

-

6.3 IMPACT OF MEGATRENDSELECTRONIC WARFARE SYSTEMSELECTRIC PROPULSION

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 PATENT ANALYSIS

- 6.6 TECHNOLOGICAL ROADMAP FOR MARITIME PATROL AIRCRAFT MARKET

- 7.1 INTRODUCTION

-

7.2 ARMOREDFOCUS ON MARITIME SECURITY TO DRIVE GROWTH

-

7.3 UNARMOREDINCREASE IN DEMAND FOR COST-EFFECTIVE MARITIME SURVEILLANCE SOLUTIONS TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 JET ENGINETURBOFAN- Extensive use in maritime surveillance and patrol missions to drive growthTURBOPROP- Advancements in avionics and sensor technology to drive growthTURBOSHAFT- Rapid development of advanced engines to drive growth

-

8.3 ELECTRIC PROPULSIONINCREASING FOCUS ON ENVIRONMENTAL SUSTAINABILITY TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 MANNEDNEED FOR REAL-TIME ANALYSIS IN COMPLEX MARITIME MISSIONS TO DRIVE GROWTH

-

9.3 UNMANNEDADVANCEMENTS IN TECHNOLOGY TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 SURVEILLANCE AND RECONNAISSANCERISE IN MARITIME SECURITY CONCERNS TO DRIVE GROWTH

-

10.3 COMBAT SUPPORTBOOST IN TACTICAL ADVANTAGES TO DRIVE GROWTH

-

10.4 SEARCH AND RESCUECRITICAL EMERGENCY RESPONSE OPERATIONS TO DRIVE GROWTH

-

10.5 COASTAL PATROLLINGINTEGRATION OF ADVANCED SURVEILLANCE TECHNOLOGIES TO DRIVE GROWTH

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISUS- Emphasis on national security to drive growthCANADA- Increased investments in maritime security to drive growth

-

11.4 EUROPERECESSION IMPACT ANALYSISPESTLE ANALYSISRUSSIA- Need for robust maritime security infrastructure to drive growthFRANCE- Compliance with maritime regulations to drive growthGERMANY- Continuous investments in advanced maritime solutions to drive growthUK- Domestic efforts to mitigate maritime risks to drive growthITALY- Advancements in coastal surveillance and security solutions to drive growthREST OF EUROPE

-

11.5 ASIA PACIFICRECESSION IMPACT ANALYSISPESTLE ANALYSISCHINA- Domestic security concerns and technological prowess to drive growthJAPAN- Increasing focus on innovation to drive growthINDIA- Increased awareness toward Indian Ocean Region (IOR) security to drive growthAUSTRALIA- Government initiatives for maritime security to drive growthSOUTH KOREA- Shift in attention towards maritime security to drive growthREST OF ASIA PACIFIC

-

11.6 REST OF THE WORLDRECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Focus on counter-terrorism operations to drive growthLATIN AMERICA- Rising procurement of modern maritime patrol aircraft to drive growth

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 RANKING ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS, 2020–2022

-

12.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPANY FOOTPRINT

-

12.7 START-UP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

12.9 COMPETITIVE SCENARIODEALS

-

13.1 KEY PLAYERSBOEING- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIRBUS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDASSAULT AVIATION- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsTEXTRON INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHINDUSTAN AERONAUTICS LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsKAWASAKI HEAVY INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsEMBRAER- Business overview- Products/Solutions/Services offeredGENERAL ATOMICS AERONAUTICAL SYSTEMS INC.- Business overview- Products/Solutions/Services offeredSHINMAYWA INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offeredISRAEL AEROSPACE INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsHARBIN AIRCRAFT INDUSTRY (GROUP) CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSANTONOV COMPANYPILATUS AIRCRAFT LTDAVIC XI’AN AIRCRAFT INDUSTRY GROUP CO., LTD. (XI’AN AIRCRAFT)VIKING AIR LTD.AERONAUTICSAEROVIRONMENT, INC.NOVAER CRAFT EMPREENDIMENTOS AERONÁUTICOS LTDA.DIAMOND AIRCRAFT INDUSTRIESGULFSTREAM AEROSPACE CORPORATIONTEKEVER

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES

- TABLE 4 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 5 MARITIME PATROL AIRCRAFT MARKET: COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 6 MARITIME PATROL AIRCRAFT INDUSTRY: COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 AVERAGE SELLING PRICE OF MARITIME PATROL AIRCRAFT, BY MODE OF OPERATION (USD MILLION)

- TABLE 12 VOLUME DATA, BY MODE OF OPERATION (UNITS)

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MARITIME PATROL AIRCRAFT, BY MODE OF OPERATION (%)

- TABLE 14 KEY BUYING CRITERIA FOR MARITIME PATROL AIRCRAFT, BY MODE OF OPERATION

- TABLE 15 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 KEY PATENTS

- TABLE 17 MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 18 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 19 MARKET, BY PROPULSION SYSTEM, 2020–2022 (USD MILLION)

- TABLE 20 MARKET, BY PROPULSION SYSTEM, 2023–2028 (USD MILLION)

- TABLE 21 JET ENGINE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 22 JET ENGINE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 MARITIME PATROL AIRCRAFT MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 24 MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 26 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 28 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: MARITIME PATROL AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY PROPULSION SYSTEM, 2020–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: MARKET, BY PROPULSION SYSTEM, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 37 US: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 38 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 US: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 40 US: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 41 CANADA: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 42 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 CANADA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 44 CANADA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 45 EUROPE: MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 46 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 EUROPE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 48 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY PROPULSION SYSTEM, 2020–2022 (USD MILLION)

- TABLE 50 EUROPE: MARKET, BY PROPULSION SYSTEM, 2023–2028 (USD MILLION)

- TABLE 51 EUROPE: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 52 EUROPE: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 53 RUSSIA: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 54 RUSSIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 RUSSIA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 56 RUSSIA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 57 FRANCE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 58 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 59 FRANCE: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 60 FRANCE: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 61 GERMANY: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 62 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 GERMANY: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 64 GERMANY: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 65 UK: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 66 UK: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 UK: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 68 UK: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 69 ITALY: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 70 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 71 ITALY: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 72 ITALY: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 74 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 76 REST OF EUROPE: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MARITIME PATROL AIRCRAFT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY PROPULSION SYSTEM, 2020–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY PROPULSION SYSTEM, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 85 CHINA: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 86 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 87 CHINA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 88 CHINA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 89 JAPAN: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 90 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 JAPAN: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 92 JAPAN: MARITIME PATROL AIRCRAFT MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 93 INDIA: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 94 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 95 INDIA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 96 INDIA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 97 AUSTRALIA: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 98 AUSTRALIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 AUSTRALIA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 100 AUSTRALIA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 103 SOUTH KOREA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 104 SOUTH KOREA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 109 REST OF THE WORLD: MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 110 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 REST OF THE WORLD: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 112 REST OF THE WORLD: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MARKET, BY PROPULSION SYSTEM, 2020–2022 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MARKET, BY PROPULSION SYSTEM, 2023–2028 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 116 REST OF THE WORLD: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 122 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: MARKET, BY MODE OF OPERATION, 2020–2022 (USD MILLION)

- TABLE 124 LATIN AMERICA: MARKET, BY MODE OF OPERATION, 2023–2028 (USD MILLION)

- TABLE 125 STRATEGIES ADOPTED BY KEY PLAYERS IN MARITIME PATROL AIRCRAFT MARKET

- TABLE 126 MARKET: DEGREE OF COMPETITION, 2022

- TABLE 127 COMPANY FOOTPRINT

- TABLE 128 TYPE FOOTPRINT

- TABLE 129 MODE OF OPERATION FOOTPRINT

- TABLE 130 REGION FOOTPRINT

- TABLE 131 MARITIME PATROL AIRCRAFT MARKET: KEY START-UPS/SMES

- TABLE 132 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 133 MARKET: DEALS, MARCH 2020–JULY 2023

- TABLE 134 BOEING: COMPANY OVERVIEW

- TABLE 135 BOEING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 BOEING: DEALS

- TABLE 137 AIRBUS: COMPANY OVERVIEW

- TABLE 138 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 AIRBUS: DEALS

- TABLE 140 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 141 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 143 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 144 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 145 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 146 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 147 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 LEONARDO S.P.A.: DEALS

- TABLE 149 DASSAULT AVIATION: COMPANY OVERVIEW

- TABLE 150 DASSAULT AVIATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 DASSAULT AVIATION: DEALS

- TABLE 152 SAAB AB: COMPANY OVERVIEW

- TABLE 153 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 SAAB AB: DEALS

- TABLE 155 TEXTRON INC.: COMPANY OVERVIEW

- TABLE 156 TEXTRON INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 TEXTRON INC.: DEALS

- TABLE 158 HINDUSTAN AERONAUTICS LIMITED: COMPANY OVERVIEW

- TABLE 159 HINDUSTAN AERONAUTICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 HINDUSTAN AERONAUTICS LIMITED: DEALS

- TABLE 161 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 162 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 KAWASAKI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 164 EMBRAER: COMPANY OVERVIEW

- TABLE 165 EMBRAER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 GENERAL ATOMICS AERONAUTICAL SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 167 GENERAL ATOMICS AERONAUTICAL SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 SHINMAYWA INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 169 SHINMAYWA INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 171 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 ISRAEL AEROSPACE INDUSTRIES: DEALS

- TABLE 173 HARBIN AIRCRAFT INDUSTRY (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 174 HARBIN AIRCRAFT INDUSTRY (GROUP) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 HARBIN AIRCRAFT INDUSTRY (GROUP) CO., LTD.: DEALS

- TABLE 176 ANTONOV COMPANY: COMPANY OVERVIEW

- TABLE 177 PILATUS AIRCRAFT LTD: COMPANY OVERVIEW

- TABLE 178 AVIC XI’AN AIRCRAFT INDUSTRY GROUP CO., LTD. (XI’AN AIRCRAFT): COMPANY OVERVIEW

- TABLE 179 VIKING AIR LTD.: COMPANY OVERVIEW

- TABLE 180 AERONAUTICS: COMPANY OVERVIEW

- TABLE 181 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 182 NOVAER CRAFT EMPREENDIMENTOS AERONÁUTICOS LTDA.: COMPANY OVERVIEW

- TABLE 183 DIAMOND AIRCRAFT INDUSTRIES: COMPANY OVERVIEW

- TABLE 184 GULFSTREAM AEROSPACE CORPORATION: COMPANY OVERVIEW

- TABLE 185 TEKEVER: COMPANY OVERVIEW

- FIGURE 1 MARITIME PATROL AIRCRAFT MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ARMORED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 9 MANNED SEGMENT TO SECURE LEADING MARKET POSITION IN 2023

- FIGURE 10 JET ENGINE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 SURVEILLANCE AND RECONNAISSANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 EUROPE TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 13 INCREASE IN DEMAND FOR MARITIME SURVEILLANCE AND REAL-TIME INFORMATION

- FIGURE 14 SURVEILLANCE AND RECONNAISSANCE SEGMENT TO ACQUIRE MAXIMUM MARKET SHARE IN 2023

- FIGURE 15 UNMANNED SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 CANADA TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

- FIGURE 17 MARITIME PATROL AIRCRAFT MARKET DYNAMICS

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 ECOSYSTEM MAPPING

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MARITIME PATROL AIRCRAFT, BY MODE OF OPERATION

- FIGURE 23 KEY BUYING CRITERIA FOR MARITIME PATROL AIRCRAFT, BY MODE OF OPERATION

- FIGURE 24 SUPPLY CHAIN ANALYSIS

- FIGURE 25 EVOLUTION OF MARITIME PATROL AIRCRAFT

- FIGURE 26 MARITIME PATROL AIRCRAFT MARKET, BY TYPE, 2023–2028

- FIGURE 27 MARKET, BY PROPULSION SYSTEM, 2023–2028

- FIGURE 28 MARKET, BY MODE OF OPERATION, 2023–2028

- FIGURE 29 MARKET, BY APPLICATION, 2023–2028

- FIGURE 30 MARKET, BY REGION, 2023–2028

- FIGURE 31 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 33 EUROPE: MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 REST OF THE WORLD: MARITIME PATROL AIRCRAFT MARKET SNAPSHOT

- FIGURE 36 MARKET SHARES OF TOP FIVE PLAYERS, 2022

- FIGURE 37 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 38 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022

- FIGURE 39 COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 41 BOEING: COMPANY SNAPSHOT

- FIGURE 42 AIRBUS: COMPANY SNAPSHOT

- FIGURE 43 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 46 DASSAULT AVIATION: COMPANY SNAPSHOT

- FIGURE 47 SAAB AB: COMPANY SNAPSHOT

- FIGURE 48 TEXTRON INC.: COMPANY SNAPSHOT

- FIGURE 49 HINDUSTAN AERONAUTICS LIMITED: COMPANY SNAPSHOT

- FIGURE 50 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 51 EMBRAER: COMPANY SNAPSHOT

- FIGURE 52 SHINMAYWA INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 53 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

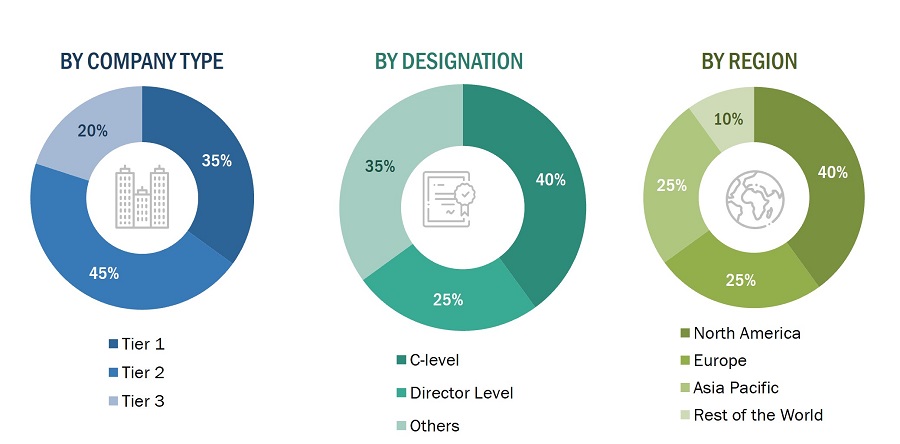

The study involved four major activities in estimating the current size of the Maritime Patrol Aircraft Market. Exhaustive secondary research was done to collect information on the maritime patrol aircraft market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Maritime Patrol AIrcraft Market.

Secondary Research

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies the performance on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering maritime patrol aircrafts and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Maritime Patrol Aircraft market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Maritime Patrol Aircraft market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW which includes the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and order volumes. Such procurements provide information on each platform's demand aspects of maritime patrol aircraft products. For each platform, all possible propulsion systems in various maritime patrol aircraft were identified.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all type, propulsion systems, application, and mode of operation was based on the recent and upcoming deliveries of maritime patrol aircraft in every country from 2020 to 2028.

Maritime Patrol Aircraft Market Size: Bottom-up Approach

Maritime Patrol Aircraft Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure that was implemented in the market engineering process to make this report on the maritime patrol aircraft market.

Market Definition

Maritime Patrol Aircraft have a vital role in safeguarding coastal regions and maritime territories. These specialized planes are equipped with advanced technologies, including radar systems, cameras, and sensors. This empowers them to conduct extensive surveillance and reconnaissance over large ocean areas. Their primary objective is to monitor shipping routes, identify and trail vessels of interest, and locate potential threats such as submarines involved in covert activities. In addition to their surveillance capabilities, maritime patrol aircraft are fitted with communication systems that enable them to promptly relay crucial information to naval and coastal authorities. Some of these aircraft are armed with defensive weaponry and feature strengthened structures, offering the capability to deter or protect against potential threats.

Market Stakeholders

- Manufacturers of Maritime Patrol Aircraft

- System Integrators

- Original Equipment Manufacturers (OEM)

- Defense Organizations

- Regulatory Authorities

Report Objectives

- To define, describe, and forecast the size of the maritime patrol aircraft market based on type, propulsion systems, application, mode of operation, and region.

- To indicate the size of the various segments of the market based on four regions—North America, Europe, Asia Pacific, Rest of the world—along with key countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To determine industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market.

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Maritime Patrol Aircraft Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Maritime Patrol Aircraft Market.

Growth opportunities and latent adjacency in Maritime Patrol Aircraft Market