Meal Replacement Market by Product Type (Ready-to-Drink, Bars, Powder), Distribution Channel (Offline and Online), and Region (North America, Europe, Asia Pacific, South America, and RoW) - Global Forecast to 2026

Meal Replacement Market Analysis

The global meal replacement market size was valued at USD 11.9 billion in 2021 and is expected to grow at a CAGR of 5.4% from 2021 to 2026. The revenue forecast for 2026 is projected to reach $15.5 billion. The base year for estimation is 2021, and the historical data spans from 2021 to 2026.

Globally, chronic diseases pose a serious threat to public health. The UN report suggests that the percentage of chronic disease-related mortality in the total number of deaths worldwide is predicted to rise to 70% and represent 56% of the global disease burden by 2030. Maintaining a healthy weight, exercising regularly, and eating a balanced diet are major aspects of a healthy lifestyle that may reduce the chance of developing chronic diseases by as much as 80%. Thus, individual and group consumers are making small but achievable changes to lifestyle behaviors to ensure good health. Consuming meal replacements to meet nutritional needs is one such behavior change. Meal replacements are substitutes for meals that offer a complete range of balanced and sufficient nutrients to meet daily dietary requirements. Prioritizing healthy lifestyle choices and adopting health-promoting diets are expected to increase the consumption of meal replacement market expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

Meal Replacement Market Dynamics

Increasing prevalence of obesity and diabetes, coupled with the increasing population of health-conscious consumers

The National Health and Nutrition Examination Survey (NHANES) reports that 42.4% of adults are obese, 30.7% are overweight, and 9.2% have severe obesity. Diabetes is a leading cause of kidney failure, heart attacks, strokes, and other serious health problems. Age-specific diabetes mortality rates increased by 3% between 2000 and 2019. Compared to high-income countries, the prevalence of diabetes has been growing more swiftly in low- and middle-income nations.

According to a Mintel.com survey published in 2020, consumers are becoming more willing to consume healthy snacks, and when looking for healthier options, they prioritize products with minimal sugar and fat content. Additionally, two out of every five people are now replacing traditional high-salt and high-sugar snacks with bars made of functional foods like oats, resins, nuts, and alike, thus driving the growth of the meal replacement market.

High costs of meal replacement products

A nutritious meal replacement is more expensive than a conventional meal as additional manufacturing processes are required to increase the product's nutritional value. It may deter the growth of the meal replacement market. The high expense of meal replacement is linked to the increased cost of research, development, and personalization.

The emergence of plant-based and vegan meal replacement products

Meal replacements made from vegan ingredients are stocked with plant protein, fiber, good fats, and vital vitamins and minerals. A new breed of fluid meals called vegan meal replacements can perfectly substitute regular food. Some meal replacements come in single-serving bottles that are ready-to-eat (drink), making them a fantastic alternative for food on-the-go, while others are available as a powder that can be combined with milk or water to produce a shake. They are delicious and nutrient-dense. Specifically designed for patients and athletes, the US-based Vejii Holdings launched a plant-based meal replacement called Heal in 2021 that includes plant-based protein, powdered fruits and vegetables, anti-inflammatory superfood extracts, probiotics, and prebiotics.

Misinterpretation of protein shakes for meal replacement shakes

Consumers are often perplexed by the concepts of protein shakes, and meal replacement shakes and considers them synonymous. It acts as a challenge in the growth of the meal replacement market. Protein shakes are beverages that have protein as the primary ingredient. It could be whey protein, plant-based protein made from hemp, peas, rice, soy, or a combination of grains, or it could be both. They often contain fewer other macronutrients and lower fat and carbohydrate levels. Protein shakes are designed to fulfill only the body's protein requirements and are usually consumed after an intense workout. Contrarily, a meal replacement shake is a beverage that includes vitamins, minerals, carbohydrates, fats, and protein. They can be used to substitute a whole meal for breakfast, lunch, or dinner and have the potential to meet all the nutritional requirements. They also aid in weight loss, wound healing, and recovery from illnesses.

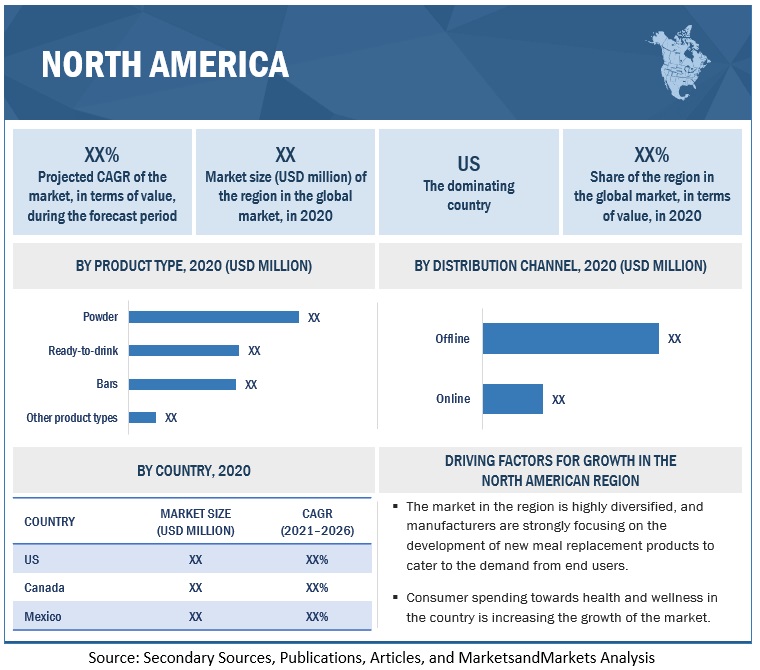

North America: Meal Replacement Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

North America dominated the meal replacement market and is projected to grow with a CAGR of 4.6% during the forecast period (2021- 2026)

North America accounted for the largest market share and is expected to grow at a CAGR of 4.6% during the forecast period. CDC suggests that chronic diseases, such as diabetes, cancer, heart disease, and stroke, affect six out of ten Americans. Chronic illnesses are the main contributors to health care costs as well as the major causes of death and disability in the United States.

Dietary Guidelines for Americans (Dietary Guidelines), provided by the US health department, offer recommendations to satisfy nutrient requirements, advance health and fend off diseases The Dietary Guidelines are updated and published every five years by the US Departments of Health and Human Services (HHS) and Agriculture (USDA). The presence of health policies focusing on healthy eating and improved lifestyle choices, together with the willingness of consumers to spend on meal replacement products, contribute to the larger share of the US.

Meal Replacement Companies

- Abbott Laboratories (US)

- Herbalife Nutrition (US)

- Amway (US)

- Glanbia Plc (Ireland)

- Atkins (US)

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2021 |

US $11.8 billion |

|

Revenue Forecast in 2026 |

US $15.4 billion |

|

Market Growth Rate |

CAGR of 5.4% from 2021 to 2026 |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Base year for estimation |

2020 |

|

Forecast period |

2021-2026 |

|

Segments covered |

Product type, distribution channel, and region |

|

Regional scope |

North America, Europe, Asia Pacific, South America, RoW |

|

Dominant Geography |

North America |

|

Key companies profiled |

|

Meal Replacement Market Highlights

In this report, the overall meal replacement market has been segmented based on offering, component, end user and region.

|

Aspect |

Details |

|

Product Segmentation |

|

|

Distribution Channel |

|

|

Region Segmentation |

|

Exactly how this report will help your business

- Determining and projecting the size of the meal replacement market, with respect to its product type, distribution channel, and regional markets, from 2021 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total market

Frequently Asked Questions (FAQ):

What are meal replacements?

Meal replacements are products designed to provide a convenient alternative to traditional meals. They typically come in the form of shakes, bars, or powders that can be mixed with water or milk to create a nutritionally balanced meal.

What are the benefits of meal replacements?

Meal replacements offer several benefits, including convenience, portion control, and the ability to ensure a balanced intake of nutrients. They can also be helpful for individuals looking to manage their weight or maintain a healthy lifestyle amidst busy schedules.

What is the current size of the meal replacement market?

The meal replacement market is estimated at USD 11.9 Billion in 2021 and is projected to reach USD 15.5 Billion by 2026, at a CAGR of 5.4% from 2021 to 2026.

Which are the key players in the meal replacement market?

The key players in this market include Abbott Laboratories (US), Amway (US), Glanbia PLC (Ireland), Herbalife Nutrition (US), and Nestle (Switzerland).

Which region is projected to account for the largest share of the meal replacement market?

North America accounted for the largest market share and is expected to grow at a CAGR of 4.6% during the forecast period. CDC suggests that chronic diseases, such as diabetes, cancer, heart disease, and stroke, affect six out of ten Americans. Chronic illnesses are the main contributors to health care costs as well as the major causes of death and disability in the United States.

What are the key opportunities in the global Meal Replacement Market?

- Changing consumer lifestyles

- Dietary supplements

- Nutrition

- Vitamins

- Minerals

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 9)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 PERIODIZATION CONSIDERED

1.5 ASSUMPTIONS FOR THE STUDY

1.6 LIMITATIONS AND RISK ASSESSMENT OF THE STUDY

2 EXECUTIVE SUMMARY (Page No. - 13)

TABLE 1 MEAL REPLACEMENT MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 2 MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 3 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD MILLION)

FIGURE 4 MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

3 MEAL REPLACEMENT MARKET OVERVIEW (Page No. - 17)

3.1 INTRODUCTION

3.2 MEAL REPLACEMENT MARKET DYNAMICS

FIGURE 5 MARKET DYNAMICS: MEAL REPLACEMENT MARKET

3.2.1 DRIVERS

3.2.1.1 Increasing prevalence of obesity and diabetes coupled with the increasing population of health-conscious consumers

3.2.1.2 Changing consumer lifestyles and availability of convenient & nutritious meals in the form of meal replacement

3.2.2 RESTRAINTS

3.2.2.1 High costs of meal replacement products

3.2.2.2 Presence of unwanted ingredients such as sugar and artificial flavors for taste enhancement

3.2.3 OPPORTUNITIES

3.2.3.1 Emergence of plant-based and vegan meal replacement products

3.2.3.2 Growth of the meal replacement market from emerging economies

3.2.4 CHALLENGES

3.2.4.1 Misinterpretation of protein shakes for meal replacement shakes

3.2.4.2 Regulatory Implications

TABLE 2 REGULATORY REQUIREMENTS FOR MEAL REPLACEMENT

4 MEAL REPLACEMENT MARKET, BY PRODUCT TYPE (Page No. - 22)

FIGURE 6 MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 3 MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 4 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (KT)

4.1 POWDER

TABLE 5 POWDER: MEAL REPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

4.2 READY-TO-DRINK

TABLE 6 READY-TO-DRINK: MARKET, BY REGION, 2019–2026 (USD MILLION)

4.3 BARS

TABLE 7 BARS: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

4.4 OTHER PRODUCT TYPES

TABLE 8 OTHER PRODUCT TYPES: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5 MEAL REPLACEMENT MARKET, BY DISTRIBUTION CHANNEL (Page No. - 26)

FIGURE 7 MEAL REPLACEMENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD MILLION)

TABLE 9 MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 10 MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

5.1 OFFLINE

TABLE 11 OFFLINE: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.1.1 HYPERMARKETS & SUPERMARKETS

TABLE 12 HYPERMARKETS & SUPERMARKETS: MEAL REPLACEMENT MARKET SIZE FOR MEAL REPLACEMENT, BY REGION, 2019–2026 (USD MILLION)

5.1.2 CONVENIENCE STORES

TABLE 13 CONVENIENCE STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.1.3 SPECIALTY STORES

TABLE 14 SPECIALTY STORES: MEAL REPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.1.4 OTHER OFFLINE STORES

TABLE 15 OTHER OFFLINE STORES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.2 ONLINE

TABLE 16 ONLINE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6 MEAL REPLACEMENT MARKET, BY REGION (Page No. - 31)

6.1 INTRODUCTION

FIGURE 8 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2021–2026

TABLE 17 MEAL REPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY REGION, 2019–2026 (KT)

6.2 NORTH AMERICA

TABLE 19 FACTS ABOUT NUTRITION-RELATED HEALTH CONDITIONS IN THE US

TABLE 20 NORTH AMERICA: MEAL REPLACEMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: MEAL REPLACEMENT PRODUCTS MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

6.2.1 US

TABLE 24 US: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.2.2 CANADA

TABLE 25 CANADA: MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.2.3 MEXICO

TABLE 26 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3 EUROPE

TABLE 27 EUROPE: MEAL REPLACEMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 29 EUROPE: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 30 EUROPE: MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

6.3.1 UK

TABLE 31 UK: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3.2 GERMANY

TABLE 32 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3.3 ITALY

TABLE 33 ITALY: MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3.4 SPAIN

TABLE 34 SPAIN: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3.5 FRANCE

TABLE 35 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.3.6 REST OF EUROPE

TABLE 36 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.4 ASIA PACIFIC

TABLE 37 PREVALENCE AND TOTAL NO. OF ADULT DIABETIC PATIENTS IN ASIA PACIFIC, 2020

TABLE 38 ASIA PACIFIC: MEAL REPLACEMENT MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 41 ASIA PACIFIC: MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

6.4.1 CHINA

TABLE 42 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.4.2 INDIA

TABLE 43 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.4.3 JAPAN

TABLE 44 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.4.4 REST OF ASIA PACIFIC

TABLE 45 REST OF ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.5 SOUTH AMERICA

TABLE 46 SOUTH AMERICA: MEAL REPLACEMENT MARKET SIZE FOR MEAL REPLACEMENT, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 48 SOUTH AMERICA: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 49 SOUTH AMERICA: MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

6.5.1 BRAZIL

TABLE 50 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.5.2 ARGENTINA

TABLE 51 ARGENTINA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.5.3 REST OF SOUTH AMERICA

TABLE 52 REST OF SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.6 REST OF THE WORLD

TABLE 53 PREVALENCE AND TOTAL NO. OF ADULT DIABETIC PATIENTS IN THE MIDDLE EAST & AFRICA, 2020

TABLE 54 REST OF THE WORLD: MEAL REPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 55 REST OF THE WORLD: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 56 REST OF THE WORLD: MARKET SIZE, BY DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

TABLE 57 REST OF THE WORLD: MARKET SIZE, BY OFFLINE DISTRIBUTION CHANNEL, 2019–2026 (USD MILLION)

6.6.1 MIDDLE EAST

TABLE 58 MIDDLE EAST: MEAL REPLACEMENT MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.6.2 AFRICA

TABLE 59 AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

7 COMPETITIVE LANDSCAPE (Page No. - 54)

7.1 OVERVIEW

7.2 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

7.2.1 STARS

7.2.2 PERVASIVE PLAYERS

7.2.3 EMERGING LEADERS

7.2.4 PARTICIPANTS

FIGURE 9 MEAL REPLACEMENT MARKET, COMPANY EVALUATION QUADRANT, 2020

8 COMPANY PROFILES (Page No. - 56)

8.1 ABBOTT LABORATORIES

8.2 AMWAY

8.3 GLANBIA PLC

8.4 HERBALIFE NUTRITION

8.5 NESTLE

8.6 USANA HEALTH SCIENCES INC.

8.7 NU SKIN ENTERPRISES, INC.

8.8 ATKINS

8.9 KELLOGG CO.

8.10 HUEL

The study involved four major activities in estimating meal replacement market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Meal Replacement Market Size Estimation

Both the demand-side and supply-side approaches were used to estimate and validate the total size of meal replacement market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of meal replacement market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Meal Replacement Products Market Trends

The meal replacement products market is steadily growing due to increasing interest in health and wellness, rising demand for plant-based and vegan options, personalization, and convenience. Consumers seek out meal replacement products for their convenience and as a healthy and effective way to get the nutrients needed for a healthy diet. Companies are responding by developing products that cater to specific dietary requirements or are tailored to certain fitness goals, and that are easy to prepare and consume. As a result, the meal replacement products market is expected to continue growing as consumers increasingly seek out healthy, convenient, and personalized options for their daily nutrition needs.

Target Audience:

- Processed food & beverage manufacturers

- Government and research organizations

- Meal replacement product manufacturers

- Health food & beverage product manufacturers

- Meal replacement product distributors

- Marketing directors

- Key executives from various key companies and organizations in meal replacement market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific meal replacement market, by key country

- Further breakdown of the Rest of European meal replacement market, by key country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Meal Replacement Market