Meat Speciation Testing Market by Species (Bos Taurus, Sus Scrofa, Gallus Gallus, Equus Caballus, Ovis Aries), Technology (PCR, ELISA, Molecular Diagnostic), Form (Raw, Cooked, Processed), and Region - Global Forecast to 2022

[150 Pages Report] The meat speciation testing market, by value, is projected to reach USD 2.22 billion by 2022, at a CAGR of 8.2% from 2016. The market growth is driven due to various factors such as regional beliefs to ensure meat species, growth in number of food frauds and recalls, stringent regulatory and labeling mandates, and testing for various certifications requirement.

The years considered for the study are as follows:

- Base year: 2015

- Forecast period: 2016 to 2022

The objectives of the report

- To define, segment, and project the meat speciation testing market, with respect to species, technology, form, and region

- To analyze the market structure by identifying various sub-segments of the market

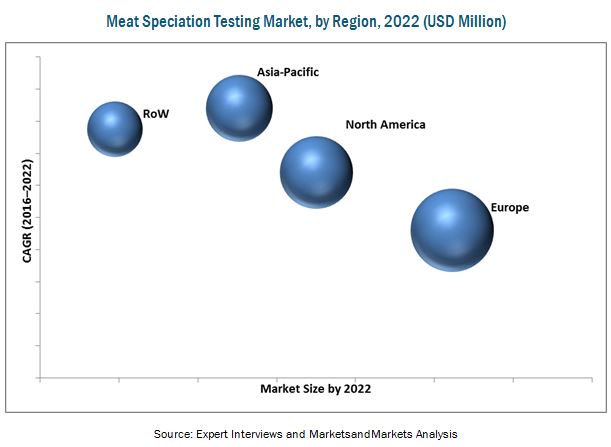

- To forecast the size of the market and its various submarkets with respect to four main regions, namely, North America, Asia-Pacific, Europe, and Rest of the World (RoW)

- To provide detailed information regarding crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape for market leaders

- To forecast the global meat speciation testing market size and its various sub-markets

- To project the market size, in terms of value, of each of the segments

- To strategically profile key players and comprehensively analyze their market developments and core competencies

- To track and analyze competitive developments, such as expansions & investments, acquisitions, and new service offerings & product launches in the meat speciation testing market

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to find the value of meat speciation testing for regions such as North America, Europe, Asia-Pacific, and RoW

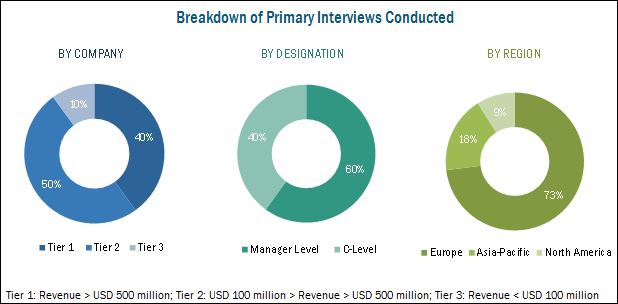

- The key players have been identified through secondary sources such as the Food & Drug Administration (FDA), the United States Department of Agriculture (USDA), and the Canadian Food Inspection Agency (CFIA), while their market shares in respective regions have been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the meat speciation testing market.

To know about the assumptions considered for the study, download the pdf brochure

Target Audience

The stakeholders for the report are as follows:

- Meat traders

- Meat processors

- Meat speciation testing service providers

- Meat speciation testing laboratories

- Research & development (R&D) institutions

- Government organizations, research organizations, and consulting firms

- Manufacturers, importers & exporters, traders, distributors, and suppliers of meat speciation testing kits, and other related consumables

Scope of the Report

This research report categorizes the meat speciation testing market based on species, technology, form, and region.

Based on species the market has been segmented as follows:

- Cow (Bos taurus)

- Swine (Sus scrofa)

- Chicken (Gallus gallus)

- Horse (Equus caballus)

- Sheep (Ovis aries)

- Others (turkey, goat, and rabbit)

Based on technology the market has been segmented as follows:

- PCR

- ELISA

- Other molecular diagnostic tests (LC-MS/MS)

Based on form the market has been segmented as follows:

- Raw

- Cooked

- Processed

Based onregion the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Latin America, Africa, and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Segmental Analysis

- Further breakdown of other species in the meat speciation testing market

- Further breakdown of countries in the Rest of the World meat speciation testing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The meat speciation testing market is projected to reach USD 2.22 billion by 2022, at a CAGR of 8.2% from 2016. Religious concerns among consumers drive demand for halal and kosher certification and related speciation testing for meat & meat products. The growth of meat certification in the global market is driven by the increasing stringency of the regulatory body over safety and meat authenticity. The same, in turn, is driven by the increasing consumer demand for certified products, which are perceived to be authentic and compliant to Islam and Jewish laws for halal and kosher, respectively.

The global increase in malpractices and the number of fraud and adulteration incidents for meat & meat products have resulted in the enhanced growth of this market. Thus, given the widespread cases of adulteration and food fraud, along with growing consumer concern for safety & quality, and with increasing stringency of regulations and their effective monitoring of the supply chain, the market for speciation testing is projected to grow at a significant rate in the upcoming years.

The meat speciation testing market, based on species, has been segmented into cow (Bos taurus), swine (Sus scrofa), chicken (Gallus gallus), horse (Equus caballus), sheep (Ovis aries), and other species such as turkey, goat, and rabbit. The chicken (Gallus gallus) segment is projected to grow at the highest CAGR among all species from 2016 to 2022. However, with the increasing prices of chicken, several meat manufacturers and processors are engaged in fraudulent practices and are involved in adulteration and fraudulent substitution of chicken with pork and other contaminating species. Several cases of chicken meat adulteration have been detected around the world, which is fueling market growth for the chicken (Gallus gallus) segment.

The global market, based on technology, has been segmented into PCR, ELISA, and other technologies (such as LC-MS/MS). The PCR segment is projected to be the largest and fastest-growing by 2022. Besides the market drivers, significant growth in adoption of this technology for meat speciation testing can be attributed to drawbacks of the ELISA (enzyme-linked immunosorbent assay) technology, wherein DNA analysis is conducted by the technology for accurate determination of meat species in products even at 0.1% levels of detection.

Meat speciation testing, by form, has been segmented into raw, cooked, and processed. The market for speciation testing of raw meat is projected to be largest and the fastest-growing by 2022. Meat speciation testing of raw meat products is essential in order to authenticate claims made on product labels and prevent scope for any fraudulent practice or adulteration.

The meat speciation testing market is estimated to be dominated by the European region in 2016. Europe dominated the market, worldwide. European countries have recorded many issues related to meat adulteration, due to which the region has dominated the market. The Asia Pacific region is projected to be fastest-growing by 2022 in the market. The meat speciation market in the Asia-Pacific region is dominated by China. Food safety procedure compliance in Europe (a major importer) is more severe, and Chinese food producers have to comply with the food standards and regulations for trade.

Food systems in several developing regions lack organization, sophistication, and technology in meat speciation testing, which is restraining the market growth.

New service launches, expansions & investments, and acquisitions are the key strategies adopted by the players to ensure their growth in the market. Companies such as VWR International (US), Eurofins (Luxembourg), ALS Limited (Australia), Neogen (US), and LGC Science (UK) have acquired leading market positions through their broad service portfolios that are specific to various meat species segments. The companies are also focused on innovations and geographical diversification. In June 2015, Eurofins launched an innovative analytical method based on DNA chip technology, which enables simultaneous detection and identification of up to 21 animal species in feed and food products. This helped the company to expand its service portfolio.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Periodization Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Opportunities in the Market

4.2 Meat Speciation Testing Market: Major Countries

4.3 Market, By Species

4.4 Developed vs Emerging Markets for Meat Speciation Testing

4.5 Market, By Technology & Region

4.6 Market, By Form

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Species

5.2.2 Technology

5.2.3 Form

5.2.4 Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Number of Adulteration and Food Fraud Cases

5.3.1.2 Religious Beliefs Drive Demand for Speciation Testing

5.3.1.3 Compliance With Labeling Laws

5.3.1.4 Stringent Regulation and Consumer Demand for Certified Products

5.3.2 Restraints

5.3.2.1 Lack of Food Control Systems, Technology, Infrastructure, and Resources in Developing Countries

5.3.3 Opportunities

5.3.3.1 Scope for Technological Advancements

5.3.3.2 Increasing Consumer Awareness About Safety and Quality of Meat & Other Food Products in Emerging Markets

5.3.4 Challenges

5.3.4.1 Lack of Harmonization of Food Safety Standards

5.3.4.2 Gaps in Supply Chain for Meat Certification

5.3.4.3 Time Consumed in Certification Procedures

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Input Market

6.2.2 Meat Market

6.2.3 Distribution

6.3 Porters Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Threat of New Entrants

7 Meat Speciation Testing Market, By Species (Page No. - 53)

7.1 Introduction

7.2 Cow (Bos Taurus)

7.3 Swine (Sus Scrofa)

7.4 Chicken (Gallus Gallus)

7.5 Horse (Equus Caballus)

7.6 Sheep (Ovis Aries)

7.7 Others Species

8 Meat Speciation Testing, By Technology (Page No. - 80)

8.1 Introduction

8.2 Polymerase Chain Reaction (PCR)

8.3 Enzyme-Linked Immunosorbent Assay (ELISA)

8.4 Other Molecular-Diagnostic Tests (LC-MS/MS)

9 Meat Speciation Testing Market, By Form (Page No. - 88)

9.1 Introduction

9.2 Raw

9.3 Cooked

9.4 Processed Meat

10 Meat Speciation Testing Market, By Region (Page No. - 93)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Latin America

10.5.2 Middle East

10.5.3 Africa

11 Competitive Landscape (Page No. - 112)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation & Trends

11.3.1 New Service Launches: the Key Strategy, 20112016

11.4 New Service Launches

11.5 Expansions & Investments

11.6 Acquisitions

12 Company Profiles (Page No. - 117)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 VWR International LLC

12.3 Eurofins Scientific SE

12.4 ALS Limited

12.5 Neogen Corporation

12.6 LGC Science Group Ltd.

12.7 Genetic ID NA, Inc.

12.8 International Laboratory Services Ltd.

12.9 AB Sciex LLC

12.10 Geneius Laboratories Ltd.

12.11 Scientific Analysis Laboratories Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 139)

13.1 Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Company Developments

13.4.1 New Service Launches

13.4.2 Expansions & Investments

13.4.3 Acquisitions

13.5 Introducing RT: Real Time Market Intelligence

13.6 Available Customizations

13.7 Related Reports

13.8 Author Details

List of Tables (82 Tables)

Table 1 Meat Speciation Testing Market Size, By Species, 20142021 (USD Million)

Table 2 Cow: Market Size, By Technology, 20142021 (USD Million)

Table 3 Cow (Bos Taurus): Market, By Region, 2014-2022 (USD Million)

Table 4 Cow (Bos Taurus): North America Market, By Country, 2014-2022 (USD Million)

Table 5 Cow (Bos Taurus): Europe Market, By Country, 2014-2022 (USD Million)

Table 6 Cow (Bos Taurus): Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 7 Cow (Bos Taurus): RoW Market, By Region, 2014-2022 (USD Million)

Table 8 Swine: Meat Speciation Testing Market Size, By Technology, 20142021 (USD Million)

Table 9 Swine (Sus Scrofa): Market, By Region, 2014-2022 (USD Million)

Table 10 Swine (Sus Scrofa): North America Market, By Country, 2014-2022 (USD Million)

Table 11 Swine (Sus Scrofa): Europe Market, By Country, 2014-2022 (USD Million)

Table 12 Swine (Sus Scrofa): Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 13 Swine (Sus Scrofa): RoW Market, By Region, 2014-2022 (USD Million)

Table 14 Chicken: Meat Speciation Testing Market Size, By Technology, 20142021 (USD Million)

Table 15 Chicken (Gallus Gallus): Market, By Region, 2014-2022 (USD Million)

Table 16 Chicken (Gallus Gallus): North America Market, By Country, 2014-2022 (USD Million)

Table 17 Chicken (Gallus Gallus): Europe Market, By Country, 2014-2022 (USD Million)

Table 18 Chicken (Gallus Gallus): Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 19 Chicken (Gallus Gallus): RoW Market, By Region, 2014-2022 (USD Million)

Table 20 Horse: Meat Speciation Testing Market Size, By Technology, 20142021 (USD Million)

Table 21 Horse (Equus Caballus): Market, By Region, 2014-2022 (USD Million)

Table 22 Horse (Equus Caballus): North America Market, By Country, 2014-2022 (USD Million)

Table 23 Horse (Equus Caballus): Europe Market, By Country, 2014-2022 (USD Million)

Table 24 Horse (Equus Caballus): Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 25 Horse (Equus Caballus): RoW Market, By Region, 2014-2022 (USD Million)

Table 26 Sheep: Meat Speciation Testing Market Size, By Technology, 20142021 (USD Million)

Table 27 Sheep (Ovis Aries): Meat Speciation Testing Market, By Region, 2014-2022 (USD Million)

Table 28 Sheep (Ovis Aries): North America Market, By Country, 2014-2022 (USD Million)

Table 29 Sheep (Ovis Aries): Europe Market, By Country, 2014-2022 (USD Million)

Table 30 Sheep (Ovis Aries): Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 31 Sheep (Ovis Aries): RoW Market, By Region, 2014-2022 (USD Million)

Table 32 Other Species: Market Size, By Technology, 20142021 (USD Million)

Table 33 Others: Meat Speciation Testing Market, By Region, 2014-2022 (USD Million)

Table 34 Others: North America Market, By Country, 2014-2022 (USD Million)

Table 35 Others: Europe Market, By Country, 2014-2022 (USD Million)

Table 36 Others: Asia-Pacific Market, By Country, 2014-2022 (USD Million)

Table 37 Others: RoW Market, By Region, 2014-2022 (USD Million)

Table 38 Meat Speciation Testing Market Size, By Technology, 20142022 (USD Million)

Table 39 PCR: Market Size, By Region, 2014-2022 (USD Million)

Table 40 PCR: Market Size, By Species, 20142022 (USD Million)

Table 41 PCR: Market Size, By Form, 20142022 (USD Million)

Table 42 ELISA: Meat Speciation Testing Market Size, By Region, 2014-2022 (USD Million)

Table 43 ELISA: Market Size, By Species, 20142022 (USD Million))

Table 44 ELISA: Market Size, By Form, 20142022 (USD Million)

Table 45 Other Molecular-Diagnostic Tests: Meat Speciation Testing Market Size, By Region, 2014-2022 (USD Million)

Table 46 Other Molecular Diagnostic Tests: Market Size, By Species, 20142022 (USD Million)

Table 47 Other Molecular Diagnostic Tests: Market Size, By Form, 20142022 (USD Million)

Table 48 By Market Size, By Form, 20142022 (USD Million)

Table 49 Raw Meat Speciation Testing Market Size, By Technology, 20142022 (USD Million)

Table 50 Cooked Meat Speciation Testing Market Size, By Technology, 20142022 (USD Million)

Table 51 Processed Meat Speciation Testing Market Size, By Technology, 20142022 (USD Million)

Table 52 Global Meat Speciation Testing Market, By Region, 2014-2022 (USD Million)

Table 53 North America: Meat Speciation Testing Market, By Country, 2014-2022 (USD Million)

Table 54 North America: Market, By Species, 2014-2022 (USD Million)

Table 55 U.S.: Market, By Species, 2014-2022 (USD Million)

Table 56 Canada: Market, By Species, 2014-2022 (USD Million)

Table 57 Mexico: Market, By Species, 2014-2022 (USD Million)

Table 58 Europe: Market, By Country, 2014-2022 (USD Million)

Table 59 Europe: Market, By Species, 2014-2022 (USD Million)

Table 60 Germany: Market, By Species, 2014-2022 (USD Million)

Table 61 France: Market, By Species, 2014-2022 (USD Million)

Table 62 U.K.: Market, By Species, 2014-2022 (USD Million)

Table 63 Italy: Market, By Species, 2014-2022 (USD Million)

Table 64 Rest of Europe: Market, By Species, 2014-2022 (USD Million)

Table 65 Asia-Pacific: Market, By Country, 2014-2022 (USD Million)

Table 66 Asia-Pacific: Market, By Species, 2014-2022 (USD Million)

Table 67 China: Market, By Species, 2014-2022 (USD Million)

Table 68 Japan: Market, By Species, 2014-2022 (USD Million)

Table 69 India: Market, By Species, 2014-2022 (USD Million)

Table 70 Australia: Market, By Species, 2014-2022 (USD Million)

Table 71 Rest of Asia-Pacific: Market, By Species, 2014-2022 (USD Million)

Table 72 RoW: Market, By Country, 2014-2022 (USD Million)

Table 73 RoW: Market, By Species, 2014-2022 (USD Million)

Table 74 Latin America: Market, By Species, 2014-2022 (USD Million)

Table 75 Middle East: Market, By Species, 2014-2022 (USD Million)

Table 76 Africa: Meat Speciation Testing Market, By Species, 2014-2022 (USD Million)

Table 77 New Service Launches, 20112016

Table 78 Expansions & Investments, 20112016

Table 79 Acquisitions, 20112016

Table 80 New Service Launches, 20112016

Table 81 Expansions & Investments, 20112016

Table 82 Acquisitions, 20112015

List of Figures (52 Figures)

Figure 1 Market Snapshot: Meat Speciation Testing

Figure 2 Research Design: Meat Speciation Testing

Figure 3 Breakdown of Primaries: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Meat Speciation Testing Market Size, 2016 vs 2022 (USD Million)

Figure 8 Market Snapshot, By Type, 2016 vs 2022

Figure 9 Market Size, By Technology, 20162022

Figure 10 Market Size, By Form, 20162022 (USD Million)

Figure 11 Meat Speciation Testing Market Share (Value), By Region, 2015

Figure 12 Increasing Number of Adulteration and Food Fraud Cases Drive the Growth of the Market

Figure 13 U.S. is Projected to Be the Fastest-Growing Market During the Forecast Period

Figure 14 Swine (Sas Scrofa) Segment is Projected to Dominate the Market Through 2022

Figure 15 China, Japan, and Australia Projected to Be Emerging Markets During the Forecast Period

Figure 16 PCR Technology is Projected to Be Largest Market, 20162022

Figure 17 Raw Form is Projected to Be Largest Market, 20162022

Figure 18 Leading EMA Food Fraud Incidents, 2013

Figure 19 Leading EMA Food Fraud Incidents, By Region, 2013

Figure 20 Meat Speciation Testing Market, By Species

Figure 21 Market, By Technology

Figure 22 Market, By Form

Figure 23 Meat Speciation Testing Market, By Region

Figure 24 Market Dynamics: Meat Speciation Testing

Figure 25 Value Chain Analysis: Meat Speciation Testing

Figure 26 Porters Five Forces Analysis

Figure 27 Market Size for Meat Speciation Testing, By Species, 20162022 (USD Million)

Figure 28 Cow Meat vs Buffalo Meat Production Share, 2013

Figure 29 Major Consumers of Beef By Region & Country

Figure 30 Major Consumers of Pork, By Region, 20112016 (Thousand Tons)

Figure 31 Major Consumers of Pork, By Country, 20112016 (Thousand Tons)

Figure 32 Major Chicken Consuming Countries By Region & Country, 20112016

Figure 33 Top Importers Horse Meat (2011)

Figure 34 Top Exporters Horse Meat (2011)

Figure 35 Meat Speciation Testing Market Share, By Technology, 2015

Figure 36 By Market Share, By Form, 2015

Figure 37 U.S. Accounted for the Largest Share in the Market in 2015

Figure 38 Europe Meat Speciation Testing Market Snapshot: Germany is Estimated to Account for the Largest Share in 2016

Figure 39 Asia-Pacific Meat Speciation Testing Market Snapshot: China is Expected to Hold the Largest Share in 2016

Figure 40 Key Companies Preferred New Service Launches and Expansions & Investments Over the Last Five Years

Figure 41 Expanding Revenue Base Through New Service Launches, 20132015

Figure 42 Geographic Revenue Mix of Top Market Players

Figure 43 VWR International LLC: Company Snapshot

Figure 44 VWR International LLC: SWOT Analysis

Figure 45 Eurofins Scientific SE: Company Snapshot

Figure 46 Eurofins Scientific SE: SWOT Analysis

Figure 47 ALS Limited: Company Snapshot

Figure 48 ALS Limited: SWOT Analysis

Figure 49 Neogen Corporation: Company Snapshot

Figure 50 Neogen Corporation: SWOT Analysis

Figure 51 LGC Science Group Ltd.: Company Snapshot

Figure 52 LGC Group: SWOT Analysis

Growth opportunities and latent adjacency in Meat Speciation Testing Market