Metagenomic Sequencing Market by Product & Services (Reagent, Consumables, Instrument), Workflow (Sample Preparation, Sequencing), Technology (16S rRNA, Shotgun, Whole-genome), Application (Drug Discovery, Diagnostic, Industrial) - Global Forecast to 2028

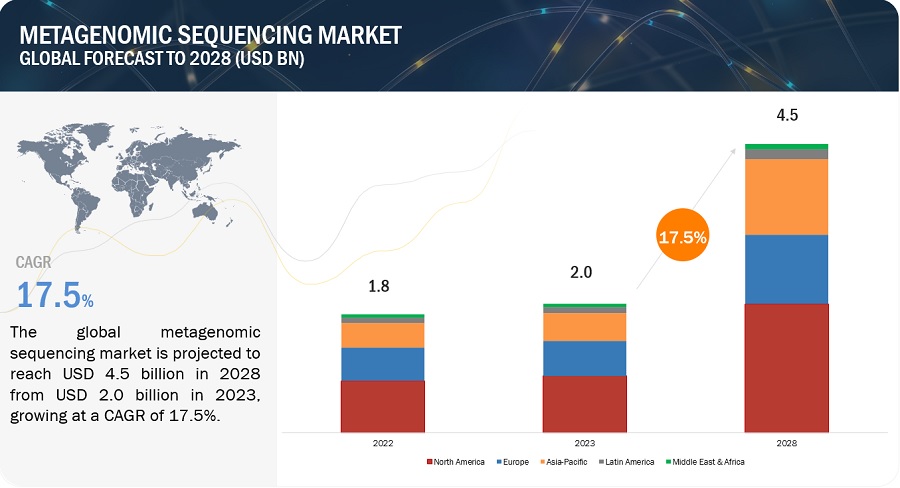

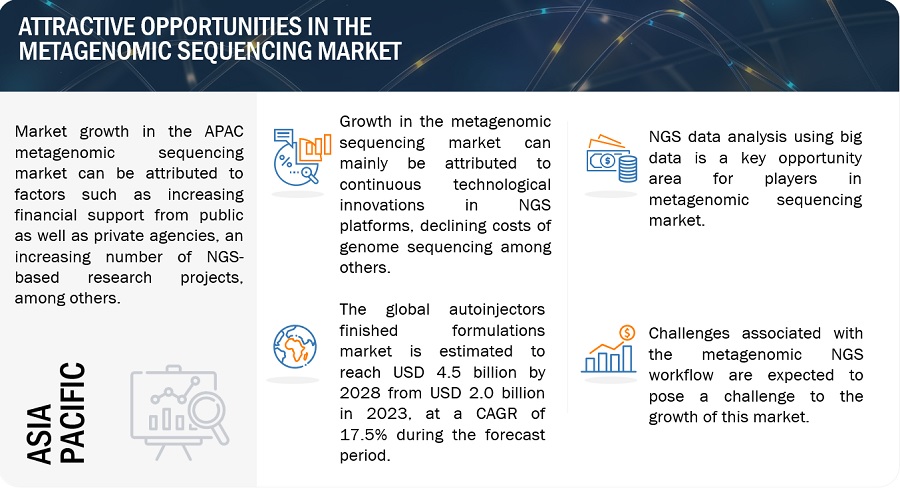

The global metagenomic sequencing market, valued at US$1.8 billion in 2022, stood at US$2.0 billion in 2023 and is projected to advance at a resilient CAGR of 17.5% from 2023 to 2028, culminating in a forecasted valuation of US$4.5billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. NGS platforms have undergone continuous technological innovations over the last several years. This has led to reduction in timelines as well as costs associated with genome sequencing and its related applications including metagenomic sequencing. This is one of the key factors driving the growth of this market. However, developing countries still have a lower adoption rate for sequencing products, services due to lack of funding support and budget constraints. This factor is expected to restraint the market to certain extent.

Attractive Opportunities in the Metagenomic sequencing market

To know about the assumptions considered for the study, Request for Free Sample Report

Metagenomic Sequencing Market Dynamics

DRIVER: Continuous technological innovations in NGS platforms

The development of effective, portable, and user-friendly NGS platforms that can deliver quick, accurate findings and faster turnaround times has been made possible by ongoing technological advancements in sequencers. Popular companies are increasingly focusing on R&D to increase their market position and share because the release of such items and technologies gives competitors an immediate competitive edge. For instance, in March 2022, Thermo Fisher Scientific launched Ion Torrent Genexus Dx Integrated Sequencer, an automated next-generation sequencing (NGS) platform. Also, in April 2019, Pacific Biosciences of California launched the Sequel II System. This system reduces project costs and timelines by approximately eight times the data output compared to the previous Sequel System. The iSeq 100 (Illumina) and Ion GeneStudio S5 System (Thermo Fisher Scientific) are other revolutionary platforms that ensure high sequencing efficiency at decreased costs.

RESTRAINT: End user budget constraints in developing countries

Academic R&D is heavily reliant on outside financing in emerging nations. Many research and academic institutions confront budget restrictions when it comes to the purchase and usage of cutting-edge and expensive equipment and technologies, in spite of ongoing efforts by government and commercial agencies to provide funding for research across the globe. NGS sequencers remain expensive even if the cost of NGS sequencing has decreased. Priced at USD 850,000 and USD 985,000, respectively, are Illumina's two most sophisticated sequencing platforms, the NovaSeq 5000 and 6000. These sequencers can be upgraded with new hardware and software to provide sequencing capabilities that are roughly 70% quicker than most of Illumina's current platforms. The Pacific RS II and its Latest sequencing platform-sequel system are offered by Pacific Biosciences in California, another major competitor in the NGS market, for USD 750,000 and USD 350,000, respectively. Despite the introduction of inexpensive sequencing platforms like iSeq, many end users in developing APAC and LATAM nations still find their price to be prohibitive. As a result, the usage of cutting-edge technology like NGS is restricted at academic and research institutions in developing nations, which is impeding the uptake of relevant NGS products for metagenomics.

OPPORTUNITY: NGS data analysis using big data

The amount of data generated during whole genome sequencing often ranges in the terabyte range. The management of such massive amounts of data is a top concern for the NGS-based metagenome sequencing end users. Due to inconsistent data formats and a lack of industry-wide standardisation for data output from various NGS platforms, data storage requirements can be rather complex. The yield of NGS runs has, however, been greatly boosted by the use of big data technologies and AI for NGS analysis and the management of workflows. With improvements in sequencing technology, more data is generated during a sequencing run. Approximately 743 terabytes (743,000 gigabytes) of data are generated during the sequencing of a single human genome, compared to 16.2 gigabytes at the beginning of the human genome project in 2001, according to a report from the National Human Genome Research Institute as of July 2017. In order to examine and analyse this enormous amount of genetic data, which is beyond the scope of human analysis, powerful computational technologies can be used. As a result, a number of businesses are integrating cutting-edge computational technology into their sequencing solutions. As an illustration, Illumina introduced connected analytics (ICA) in January 2021. ICA is a fresh, integrated bioinformatics solution for managing, analysing, and exploring sizable volumes of multi-omics data. The market for metagenomic sequencing will see significant growth as improved NGS solutions centred around big data analytics and cloud computing are developed for handling, storing, and retrieving the massive amounts of data generated.

CHALLENGE: Challenges related to metagenomic NGS

Metagenomic sequencing or metagenomic NGS has a lot of potential, but there are still a lot of barriers to remove before this technology is widely used in laboratories. Interpreting results, such as separating contaminant colonisation from actual infections, choosing and validating databases for research, and forecasting antibiotic susceptibilities present significant hurdles. Despite the fact that metagenomic NGS is analytically more sensitive than conventional culturing techniques, the necessity of removing enormous amounts of human nucleic acid during the preparation for sequencing and the post-analytic process in some cases can reduce the sensitivity in comparison to targeted PCR approaches for many organisms. Due to the fact that metagenomic NGS has a higher analytical sensitivity than conventional culture methods, contamination of materials during specimen collection is a major concern. From evaluating reagent purity to determining acceptable genome coverage controls, there needs to be a validated quality control method. To guarantee that high quality and validated genomes are available with few database errors, bio informatic quality controls are required. The majority of clinical microbiological laboratories lack the bioinformatic specialists necessary to evaluate sequencing results for each test. Since the majority of the nucleic acids in clinical samples come from the host, the sequence reads for metagenomic NGS are heavily influenced by the host genome. As a result, infections present at relatively modest burdens may be harder to detect analytically. Metagenomic NGS testing is projected to become increasingly important in the future as sequencing and bioinformatics processing capabilities increase. However, despite its clinical relevance in the contemporary landscape of medical practise, this technology is quite difficult.

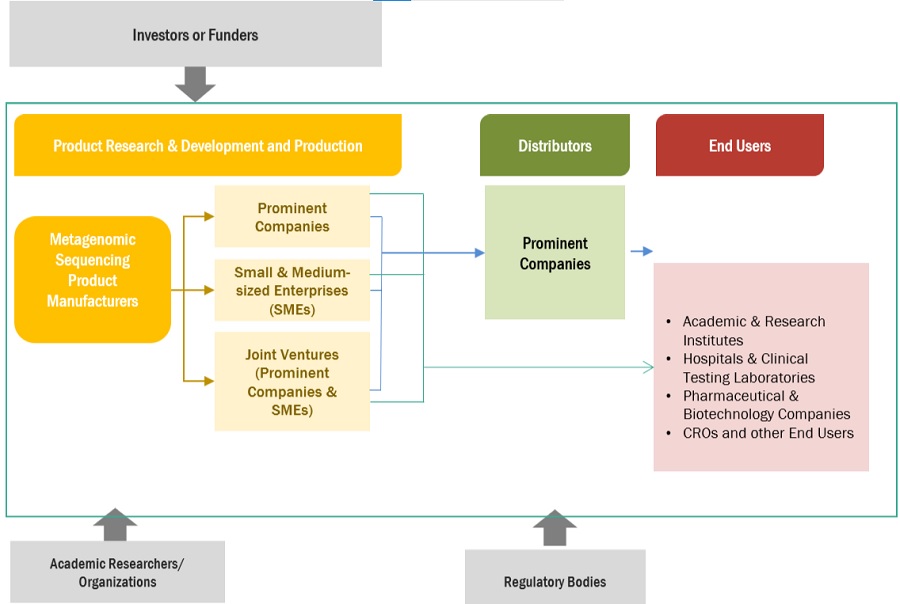

Metagenomic Sequencing Market Ecosystem

Prominent companies in the market includes companies operating in the market for several years and posess diversified product and services portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in the metagenomic sequencing market include Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), QIAGEN N.V. (Netherlands), PerkinElmer, Inc. (US), Oxford Nanopore Technologies plc. (UK), and Pacific Biosciences of California, Inc. (US).

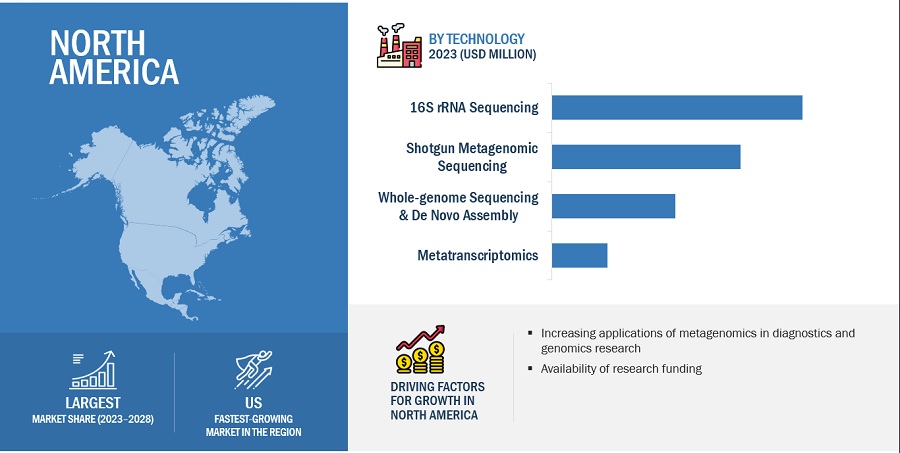

The 16S rRNA Sequencing technology accounted for the largest share of the technology segment in overall metagenomic sequencing industry in 2023.

Based on technology, the metagenomic sequencing market is segmented into 16S rRNA Sequencing, Shotgun Metagenomic Sequencing, Whole-Genome Sequencing & De Novo Assembly and Metatranscriptomics. The 16S rRNA Sequencing technology accounted for the largest share of this market owing to benefits such as high accuracy and affordability are few of the factors driving the growth of the 16S rRNA sequencing market.

The subcutaneous administration segment dominated the route of administration segment in overall metagenomic sequencing industry in 2023.

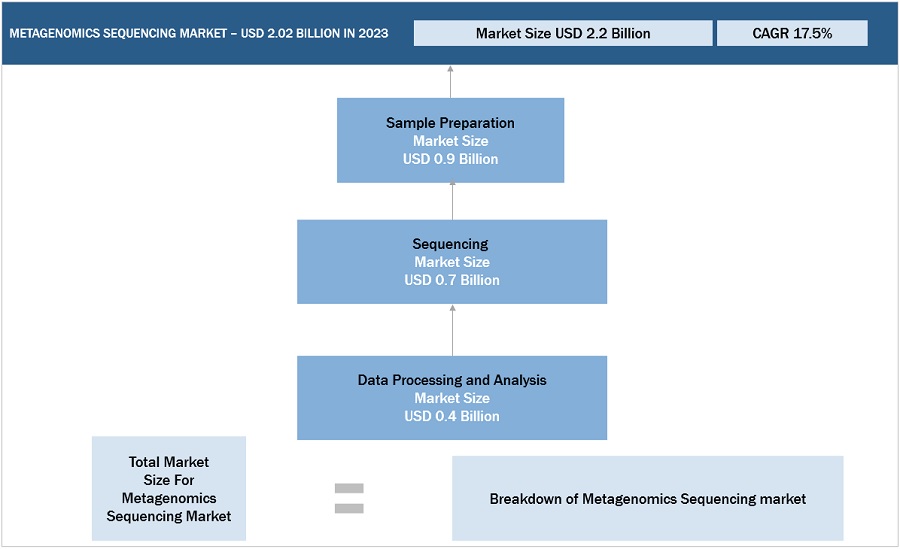

Based on the workflow, the segment of the metagenomic sequencing market is categorized into sample preparation, sequencing and data processing and analysis. Sample preparation accounted for the largest share of the market owing to factors such as the growing number of metagenome sequencing research projects being conducted, the availability of technologically advanced sample processing and library preparation assay kits among others.

North America was the largest market for overall metagenomic sequencing industry in 2022 and also during the forecast period.

Geographically, the metagenomic sequencing market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. The metagenomic sequencing market was dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period between 2023 and 2028. The market for metagenomic sequencing is expanding in the region as a result of factors like the growing application of metagenomics in genomics and diagnostics research, the availability of research funding, and the development of NGS data analysis tools.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the metagenomic sequencing market are Illumina Inc (US), Thermo Fisher Scientific Inc (US), QIAGEN N.V. (Netherlands), Bio-Rad Laboratories Inc. (US) , PerkinElmer, Inc. (US),, F. Hoffmann-La Roche AG (Switzerland), Oxford Nanopore Technologies plc. (UK), and Pacific Biosciences of California, Inc. (US).;

Scope of the Metagenomic Sequencing Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.0 billion |

|

Projected Revenue in 2028 |

$4.5 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 17.5% |

|

Market Driver |

Continuous technological innovations in NGS platforms |

|

Market Opportunity |

NGS data analysis using big data |

This report categorizes the Metagenomic Sequencing Market market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

- Reagents and Consumables

- Instruments

- Sequencing Services

- Analysis and Data Interpretation Solutions

By Workflow

- Sample Preparation

- Sequencing

- Data Processing and Analysis

By Technology

- 16s Rrna Sequencing

- Shotgun Metagenomic Sequencing

- Whole-Genome Sequencing and De Novo Assembly

- Metatranscriptomics

By Type

- Drug Discovery

- Clinical Diagnostic

- Soil Microbiome

- Industrial Applications

- Ecological and Environmental

- Veterinary

- Other applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East and Africa

Recent Developments of Metagenomic Sequencing Industry

- In September 2022, Illumina, Inc. (US) launched the NovaSeq X series production-scale sequencers, which are capable of generating more than 20,000 whole genomes per year (which is 2.5 times the throughput of prior sequencers from Illumina).

- In September 2021, Thermo Fisher Scientific, Inc. (US) and AstraZeneca(UK) co-developed an NGS-based companion diagnostic. The collaboration was focused on commercializing NGS-based diagnostics in Russia.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global metagenomic sequencing market?

The global metagenomic sequencing market boasts a total revenue value of $4.5 billion in 2028.

What is the estimated growth rate (CAGR) of the global metagenomic sequencing market?

The global metagenomic sequencing market has an estimated compound annual growth rate (CAGR) of 17.5% and a revenue size in the region of $2.0 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Continuous technological innovations in NGS platforms- Initiatives and funding from government & private bodies for large-scale sequencing projects- Declining cost of genome sequencing- Significant applications of metagenomics in various fieldsRESTRAINTS- End-user budget constraints in developing countries- Stagnation in NGS product market in developed countriesOPPORTUNITIES- NGS data analysis using big dataCHALLENGES- Challenges associated with metagenomic NGS

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSCOMPETITIVE RIVALRY AMONG EXISTING PLAYERS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PATENT ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

-

5.8 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICAMIDDLE EAST

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS

-

5.10 TRADE ANALYSISTRADE ANALYSIS FOR METAGENOMIC SEQUENCING MARKET

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.12 KEY CONFERENCES & EVENTS, 2023–2024

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR METAGENOMIC SEQUENCING MARKET

- 6.1 INTRODUCTION

-

6.2 REAGENTS & CONSUMABLESRISING ADOPTION OF METAGENOMIC SEQUENCING TO DRIVE ADOPTION OF REAGENTS & CONSUMABLES

-

6.3 INSTRUMENTSLAUNCH OF ADVANCED NGS PLATFORMS TO SUPPORT GROWTH

-

6.4 SEQUENCING SERVICESCOST-EFFECTIVENESS OF OUTSOURCING NGS PROJECTS TO BOOST DEMAND FOR SERVICES

-

6.5 ANALYSIS & DATA INTERPRETATION SOLUTIONSAVAILABILITY OF WIDE RANGE OF SOLUTIONS TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 16S RRNA SEQUENCINGCOST-EFFECTIVE TECHNIQUE FOR IDENTIFICATION OF BACTERIAL STRAINS TO DRIVE DEMAND

-

7.3 SHOTGUN METAGENOMIC SEQUENCINGSHOTGUN METAGENOMIC SEQUENCING SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

-

7.4 WHOLE-GENOME SEQUENCING & DE NOVO ASSEMBLYABILITY OF WGS TO SEQUENCE COMPLETE METAGENOME OF ENVIRONMENTAL SAMPLES TO BOOST ADOPTION

-

7.5 METATRANSCRIPTOMICSABILITY OF METATRANSCRIPTOMICS TO STUDY ACTIVE FUNCTIONAL PROFILE OF MICROBIAL COMMUNITY TO FUEL GROWTH

- 8.1 INTRODUCTION

-

8.2 SAMPLE PROCESSING & LIBRARY PREPARATIONAVAILABILITY OF TECHNOLOGICALLY ADVANCED SAMPLE PROCESSING AND LIBRARY PREPARATION ASSAY KITS TO DRIVE MARKET GROWTH

-

8.3 SEQUENCINGGROWING PREFERENCE FOR SANGER SEQUENCING OVER NGS DUE TO ITS ADVANTAGES AND RAPIDITY TO BOOST MARKET

-

8.4 DATA PROCESSING & ANALYSISTECHNOLOGICAL ADVANCEMENTS AND AVAILABILITY OF BROAD RANGE OF TOOLS TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 DRUG DISCOVERYDRUG DISCOVERY APPLICATIONS TO ACCOUNT FOR LARGEST SHARE OF METAGENOMIC SEQUENCING MARKET DURING FORECAST PERIOD

-

9.3 CLINICAL DIAGNOSTICSADVANTAGES OF METAGENOMIC NGS TO INCREASE APPLICATIONS IN DIAGNOSTICS

-

9.4 SOIL MICROBIOME APPLICATIONSNORTH AMERICA TO REGISTER HIGH DEMAND FOR METAGENOMIC SEQUENCING IN SOIL MICROBIOME APPLICATIONS

-

9.5 INDUSTRIAL APPLICATIONSENERGY- Declining fossil fuel reserves and growing energy needs to drive demandBIOREMEDIATION- Need to monitor pollutant impact and contamination to provide opportunities for metagenomic sequencing in bioremediationOTHER INDUSTRIAL APPLICATIONS

-

9.6 ECOLOGICAL & ENVIRONMENTAL APPLICATIONSABILITY OF METAGENOMIC SEQUENCING TO IDENTIFY INVASIVE AND ENDANGERED SPECIES TO BOOST ADOPTION

-

9.7 VETERINARY APPLICATIONSGROWING DEMAND FOR RAPID AND ACCURATE PATHOGEN DIAGNOSIS TO SUPPORT MARKET GROWTH

- 9.8 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Well-established infrastructure and availability of funding to drive market growthCANADA- Increasing government initiatives and workshops to support growthNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Growing investments in next-generation technologies to boost marketFRANCE- Government initiatives to support genomics research to drive growthUK- Favorable funding scenario for genomics research to support adoption of NGSREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- Increasing focus of key market players on strengthening their presence and offerings in China to drive market growthJAPAN- Rising use of metagenomic sequencing for various applications to drive market growth in JapanINDIA- Increasing collaborations and partnerships by various private and government bodies to drive market growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 LATIN AMERICAINTRODUCTION OF LOW-COST SEQUENCING TECHNOLOGIES TO DRIVE MARKETLATIN AMERICA: RECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICARISING AWARENESS OF ADVANCED SEQUENCING TECHNOLOGIES TO DRIVE MARKET GROWTH IN COMING YEARSMIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.1 KEY PLAYER STRATEGIES

- 11.2 MARKET SHARE ANALYSIS

- 11.3 REVENUE ANALYSIS

-

11.4 COMPANY EVALUATION QUADRANT (2022)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.5 COMPETITIVE LEADERSHIP MAPPING (START-UPS) (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIESRESPONSIVE COMPANIES

-

11.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSPRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

- 11.7 COMPETITIVE BENCHMARKING OF START-UPS/SMES

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSILLUMINA, INC.- Business overview- Products & services offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products & services offered- Recent developments- MnM viewPERKINELMER, INC.- Business overview- Products & services offered- Recent developments- MnM viewQIAGEN N.V.- Business overview- Products & services offered- Recent developments- MnM viewOXFORD NANOPORE TECHNOLOGIES, PLC- Business overview- Products & services offered- Recent developmentsPACIFIC BIOSCIENCES OF CALIFORNIA, INC.- Business overview- Products & services offered- Recent developmentsBGI GROUP- Business overview- Products & services offered- Recent developmentsPSOMAGEN, INC.- Business overview- Products & services offered- Recent developmentsEUROFINS SCIENTIFIC- Business overview- Products & services offeredAZENTA, INC. (PART OF BROOKS AUTOMATION, INC.)- Business overview- Products & services offeredNOVOGENE CO., LTD.- Business overview- Products & services offered- Recent developmentsZYMO RESEARCH CORPORATION- Business overview- Products & services offered- Recent developmentsTECAN TRADING AG- Business overview- Products & services offeredINTEGRAGEN SA- Business overview- Products & services offered- Recent developmentsMICROSYNTH AG- Business overview- Products & services offeredDNASTAR, INC.- Business overview- Products & services offered

-

12.2 OTHER COMPANIESCOSMOSID, INC.MEDGENOMETERRA BIOFORGE (FORMERLY VARIGEN BIOSCIENCES CORPORATION)VERITAS GENETICSBASECLEAR B.V.METAGENOMICOMPUTOMICSNEW ENGLAND BIOLABSINTACT GENOMICS, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 GLOBAL SEQUENCING INITIATIVES

- TABLE 3 METAGENOMIC SEQUENCING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 SUPPLY CHAIN ECOSYSTEM

- TABLE 5 INDICATIVE LIST OF PATENTS IN METAGENOMIC SEQUENCING MARKET

- TABLE 6 US FDA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 9 AVERAGE SELLING PRICE OF NGS SYSTEMS (2021)

- TABLE 10 IMPORT DATA FOR HS CODE 902780, BY COUNTRY, 2016–2020 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 902780, BY COUNTRY, 2016–2020 (USD THOUSAND)

- TABLE 12 METAGENOMIC SEQUENCING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 14 METAGENOMIC SEQUENCING MARKET FOR REAGENTS & CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: METAGENOMIC SEQUENCING MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 METAGENOMIC SEQUENCING MARKET FOR INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 EUROPE: METAGENOMIC SEQUENCING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 METAGENOMIC SEQUENCING MARKET FOR SEQUENCING SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR SEQUENCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: METAGENOMIC SEQUENCING MARKET FOR SEQUENCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR SEQUENCING SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 METAGENOMIC SEQUENCING MARKET FOR ANALYSIS & DATA INTERPRETATION SOLUTIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR ANALYSIS & DATA INTERPRETATION SOLUTIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: METAGENOMIC SEQUENCING MARKET FOR ANALYSIS & DATA INTERPRETATION SOLUTIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR ANALYSIS & DATA INTERPRETATION SOLUTIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 31 16S RRNA SEQUENCING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: 16S RRNA SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 EUROPE: 16S RRNA SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: 16S RRNA SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 SHOTGUN METAGENOMIC SEQUENCING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: SHOTGUN METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: SHOTGUN METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: SHOTGUN METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 WHOLE-GENOME SEQUENCING & DE NOVO ASSEMBLY MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: WHOLE-GENOME SEQUENCING & DE NOVO ASSEMBLY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: WHOLE-GENOME SEQUENCING & DE NOVO ASSEMBLY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: WHOLE-GENOME SEQUENCING & DE NOVO ASSEMBLY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 METATRANSCRIPTOMICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: METATRANSCRIPTOMICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: METATRANSCRIPTOMICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: METATRANSCRIPTOMICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 48 METAGENOMIC SEQUENCING MARKET FOR SAMPLE PROCESSING & LIBRARY PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR SAMPLE PROCESSING & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: METAGENOMIC SEQUENCING MARKET FOR SAMPLE PROCESSING & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR SAMPLE PROCESSING & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 METAGENOMIC SEQUENCING MARKET FOR SEQUENCING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: METAGENOMIC SEQUENCING MARKET FOR SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET SEQUENCING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 METAGENOMIC SEQUENCING MARKET FOR DATA PROCESSING & ANALYSIS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR DATA PROCESSING & ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: METAGENOMIC SEQUENCING MARKET FOR DATA PROCESSING & ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR DATA PROCESSING & ANALYSIS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 METAGENOMIC SEQUENCING MARKET FOR DRUG DISCOVERY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR DRUG DISCOVERY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: METAGENOMIC SEQUENCING MARKET FOR DRUG DISCOVERY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR DRUG DISCOVERY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 METAGENOMIC SEQUENCING MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: METAGENOMIC SEQUENCING MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR CLINICAL DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 METAGENOMIC SEQUENCING MARKET FOR SOIL MICROBIOME APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR SOIL MICROBIOME APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: METAGENOMIC SEQUENCING MARKET FOR SOIL MICROBIOME APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR SOIL MICROBIOME APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 METAGENOMIC SEQUENCING MARKET FOR ENERGY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR ENERGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: METAGENOMIC SEQUENCING MARKET FOR ENERGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR ENERGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 METAGENOMIC SEQUENCING MARKET FOR BIOREMEDIATION APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR BIOREMEDIATION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: METAGENOMIC SEQUENCING MARKET FOR BIOREMEDIATION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR BIOREMEDIATION APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 METAGENOMIC SEQUENCING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 EUROPE: METAGENOMIC SEQUENCING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR OTHER INDUSTRIAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 METAGENOMIC SEQUENCING MARKET FOR ECOLOGICAL & ENVIRONMENTAL APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR ECOLOGICAL & ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 EUROPE: METAGENOMIC SEQUENCING MARKET FOR ECOLOGICAL & ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR ECOLOGICAL & ENVIRONMENTAL APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 METAGENOMIC SEQUENCING MARKET FOR VETERINARY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR VETERINARY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: METAGENOMIC SEQUENCING MARKET FOR VETERINARY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR VETERINARY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 METAGENOMIC SEQUENCING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: METAGENOMIC SEQUENCING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 METAGENOMIC SEQUENCING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 US: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 110 US: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 111 US: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 112 US: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 113 US: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 CANADA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 115 CANADA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 116 CANADA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 117 CANADA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 118 CANADA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 EUROPE: METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 EUROPE: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 122 EUROPE: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 123 EUROPE: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 EUROPE: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 GERMANY: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 126 GERMANY: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 127 GERMANY: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 128 GERMANY: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2 021–2028 (USD MILLION)

- TABLE 129 GERMANY: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 FRANCE: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 131 FRANCE: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 132 FRANCE: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 133 FRANCE: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 FRANCE: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 135 UK: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 136 UK: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 UK: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 138 UK: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 UK: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 CHINA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 152 CHINA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 153 CHINA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 154 CHINA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 155 CHINA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 JAPAN: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 157 JAPAN: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 158 JAPAN: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 159 JAPAN: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 160 JAPAN: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 INDIA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 162 INDIA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 163 INDIA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 164 INDIA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 165 INDIA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 LATIN AMERICA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: METAGENOMIC SEQUENCING MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 METAGENOMIC SEQUENCING MARKET: DEGREE OF COMPETITION

- TABLE 182 COMPANY FOOTPRINT ANALYSIS, BY PRODUCT & SERVICE

- TABLE 183 COMPANY FOOTPRINT, BY REGION

- TABLE 184 METAGENOMIC SEQUENCING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 185 METAGENOMIC SEQUENCING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 186 METAGENOMIC SEQUENCING MARKET: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 187 METAGENOMIC SEQUENCING MARKET: DEALS, JANUARY 2020–JUNE 2023

- TABLE 188 METAGENOMIC SEQUENCING MARKET: OTHER DEVELOPMENTS, JANUARY 2020–FEBRUARY 2023

- TABLE 189 ILLUMINA, INC.: BUSINESS OVERVIEW

- TABLE 190 ILLUMINA, INC.: PRODUCT LAUNCHES & APPROVALS

- TABLE 191 ILLUMINA, INC.: DEALS

- TABLE 192 ILLUMINA, INC.: OTHER DEVELOPMENTS

- TABLE 193 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 194 THERMO FISHER SCIENTIFIC, INC.: PRODUCT LAUNCHES

- TABLE 195 THERMO FISHER SCIENTIFIC, INC.: DEALS

- TABLE 196 PERKINELMER, INC.: BUSINESS OVERVIEW

- TABLE 197 PERKINELMER, INC.: PRODUCT LAUNCHES

- TABLE 198 PERKINELMER, INC.: DEALS

- TABLE 199 QIAGEN N.V.: BUSINESS OVERVIEW

- TABLE 200 QIAGEN N.V.: PRODUCT LAUNCHES

- TABLE 201 QIAGEN N.V.: DEALS

- TABLE 202 QIAGEN N.V.: OTHER DEVELOPMENTS

- TABLE 203 OXFORD NANOPORE TECHNOLOGIES, PLC: BUSINESS OVERVIEW

- TABLE 204 OXFORD NANOPORE TECHNOLOGIES, PLC: PRODUCT LAUNCHES

- TABLE 205 OXFORD NANOPORE TECHNOLOGIES, PLC: DEALS

- TABLE 206 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.: BUSINESS OVERVIEW

- TABLE 207 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.: PRODUCT LAUNCHES

- TABLE 208 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.: DEALS

- TABLE 209 BGI GROUP: BUSINESS OVERVIEW

- TABLE 210 BGI GROUP: PRODUCT LAUNCHES

- TABLE 211 BGI GROUP: DEALS

- TABLE 212 PSOMAGEN, INC.: BUSINESS OVERVIEW

- TABLE 213 PSOMAGEN, INC.: DEALS

- TABLE 214 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 215 AZENTA, INC. (PART OF BROOKS AUTOMATION, INC.): BUSINESS OVERVIEW

- TABLE 216 NOVOGENE CO., LTD.: BUSINESS OVERVIEW

- TABLE 217 NOVOGENE CO., LTD.: SERVICE LAUNCHES

- TABLE 218 NOVOGENE CO., LTD.: DEALS

- TABLE 219 ZYMO RESEARCH CORPORATION: BUSINESS OVERVIEW

- TABLE 220 ZYMO RESEARCH CORPORATION: SERVICE LAUNCHES

- TABLE 221 ZYMO RESEARCH CORPORATION: DEALS

- TABLE 222 TECAN TRADING AG: BUSINESS OVERVIEW

- TABLE 223 INTEGRAGEN SA: BUSINESS OVERVIEW

- TABLE 224 INTEGRAGEN SA: DEALS

- TABLE 225 MICROSYNTH AG: BUSINESS OVERVIEW

- TABLE 226 DNASTAR: BUSINESS OVERVIEW

- FIGURE 1 METAGENOMIC SEQUENCING MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 METAGENOMIC SEQUENCING MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2022

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE) – COLLECTIVE REVENUE OF ALL METAGENOMIC SEQUENCING PRODUCTS & SERVICES

- FIGURE 6 METAGENOMIC SEQUENCING MARKET: MARKET SIZE ESTIMATION APPROACHES

- FIGURE 7 METAGENOMIC SEQUENCING MARKET: CAGR PROJECTIONS, 2023–2028

- FIGURE 8 METAGENOMIC SEQUENCING MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 METAGENOMIC SEQUENCING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 METAGENOMIC SEQUENCING MARKET, BY WORKFLOW, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 METAGENOMIC SEQUENCING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 METAGENOMIC SEQUENCING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF METAGENOMIC SEQUENCING MARKET

- FIGURE 15 TECHNOLOGICAL INNOVATIONS IN NGS PLATFORMS TO DRIVE GROWTH IN METAGENOMIC SEQUENCING MARKET

- FIGURE 16 16S RRNA SEQUENCING TECHNOLOGY SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- FIGURE 17 SAMPLE PROCESSING & LIBRARY PREPARATION SEGMENT DOMINATED MARKET IN 2022

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 METAGENOMIC SEQUENCING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 COST OF HUMAN WHOLE-GENOME SEQUENCING, 2001–2021

- FIGURE 21 VALUE CHAIN ANALYSIS OF METAGENOMIC SEQUENCING MARKET: MANUFACTURING AND ASSEMBLY PHASES ADD MAXIMUM VALUE

- FIGURE 22 VALUE CHAIN: METAGENOMIC SEQUENCING ANALYSIS WORKFLOW—MAXIMUM VALUE ADDED DURING SEQUENCING AND ANALYSIS PHASES

- FIGURE 23 ECOSYSTEM ANALYSIS: METAGENOMIC SEQUENCING MARKET

- FIGURE 24 PATENT APPLICATIONS FOR METAGENOMIC SEQUENCING PRODUCTS, JANUARY 2012–JUNE 2023

- FIGURE 25 METAGENOMIC SEQUENCING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF METAGENOMIC SEQUENCING PRODUCTS & SERVICES IN RESEARCH & ACADEMIC INSTITUTES

- FIGURE 27 KEY BUYING CRITERIA FOR RESEARCH & ACADEMIC INSTITUTES

- FIGURE 28 NORTH AMERICA: METAGENOMIC SEQUENCING MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: METAGENOMIC SEQUENCING MARKET SNAPSHOT

- FIGURE 30 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN METAGENOMIC SEQUENCING MARKET

- FIGURE 31 METAGENOMIC SEQUENCING MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 32 REVENUE ANALYSIS FOR KEY COMPANIES (2020–2022)

- FIGURE 33 METAGENOMIC SEQUENCING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 COMPANY EVALUATION MATRIX FOR START-UPS, 2022

- FIGURE 35 ILLUMINA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 39 OXFORD NANOPORE TECHNOLOGIES, PLC: COMPANY SNAPSHOT (2022)

- FIGURE 40 PACIFIC BIOSCIENCES OF CALIFORNIA, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 41 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2022)

- FIGURE 42 AZENTA, INC. (PART OF BROOKS AUTOMATION, INC.): COMPANY SNAPSHOT (2022)

- FIGURE 43 TECAN TRADING AG: COMPANY SNAPSHOT (2022)

- FIGURE 44 INTEGRAGEN SA: COMPANY SNAPSHOT (2022)

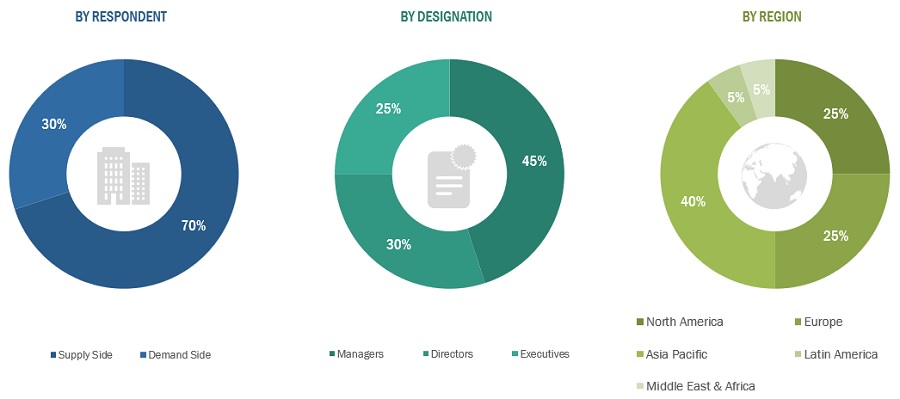

This study involved four major activities in estimating the current size of the metagenomic sequencing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the metagenomic sequencing market. The secondary sources used for this study include some of the key secondary sources referred to for this study include publications from government sources, such as the World Health Organization (WHO), Institute of Bioinformatics and Applied Biotechnology (IBAB), National Institutes of Health (NIH), Joint Genome Institute (JGI), National Human Genome Research Institute (NHGRI), National Center for Biotechnology Information (NCBI), Personalized Medicine Partnership for Cancer (PMPC), Association for Clinical Genomic Science (ACGS), American Society of Human Genetics (ASHG), European Molecular Biology Laboratory (EMBL), European Bioinformatics Institute (EMBL), European Society of Human Genetics (ESHG), Asia Pacific Society of Human Genetics (APSHG), Biotechnology and Biological Sciences Research Council (BBSRC), Department of Biotechnology (DBT), SciGenom Research Foundation (SGRF), and Malaysian Genomics Resource Centre (MGRC). Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global metagenomic sequencing market, which was validated through primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the metagenomic sequencing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the metagenomic sequencing business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global metagenomic sequencing Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global metagenomic sequencing Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Metagenomic sequencing is a fairly new approach in genomic analysis, which involves the sequencing and analysis of genetic materials obtained from environmental samples without the prior isolation and cultivation of individual species. This method provides an unbiased detection of all microbial groups, resistance markers, and virulence factors, as well as host biomarkers associated with different disease states. This technique is highly efficient in the analysis of unculturable or previously unknown microbes present in rich microbiota, hence gaining acceptance and opening new avenues in the fields of microbial ecology, virology, microbiology, environmental sciences, and biomedical research.

Key Stakeholders

- Contract research organizations (CROs)

- Metagenomic sequencing equipment manufacturers, vendors, and distributors

- Metagenomic sequencing service companies

- Research laboratories and academic institutes

- Venture capitalists and other government funding organizations

- Research and consulting firms

- Healthcare institutes

- Pharmaceutical and biotechnology companies

Report Objectives

- To define, describe, and forecast the global metagenomic sequencing market by product & service, workflow, technology, application, and region

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure and profile the key players of the global metagenomic sequencing market and comprehensively analyze their core competencies2

- To track and analyze competitive developments such as expansions, acquisitions, partnerships, collaborations, agreements, and product & service launches in the metagenomic sequencing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Twenty five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metagenomic Sequencing Market

Can you please share some insights on Metagenomics Sequencing Market Size | Industry Growth, 2028 ?

What is the market share of Metagenomic Sequencing Market Growth, Size in 2030 ?

Which are the major growth restraining factors for the global Metagenomic Sequencing Market?