NGS Sample Preparation Market by Product (Reagents & Consumables, Workstations), Workflow (Library Prep, Target Enrichment), Sample Type (DNA), Application (Diagnostics, Drug Discovery), Method (Microfluidic, Automated), End User & Region - Global Forecast to 2028

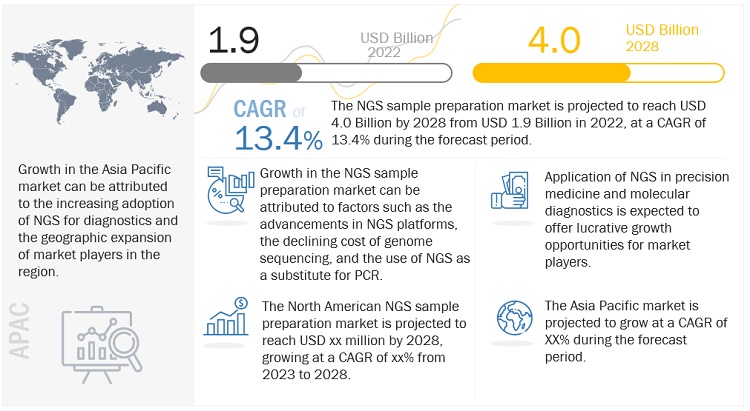

The global NGS sample preparation market in terms of revenue was estimated to be worth $1.9 billion in 2022 and is poised to reach $4.0 billion by 2028, growing at a CAGR of 13.4% from 2022 to 2028. The key factors driving the growth of the market are use of NGS as substitute for PCR, and greater efficiency of genotyping and preparation protocols. However, ethical and privacy issues in health data are expected to restrain market growth to a certain extent.

Attractive Opportunities in the NGS Sample Preparation Market

To know about the assumptions considered for the study, Request for Free Sample Report

NGS Sample Preparation Market Dynamics

DRIVERS: Greater efficiency of genotyping and preparation protocols

Human whole genome sequencing has been growing exponentially in recent years and has created a new benchmark for itself in the bacterial infection outbreak owing to its high resolution available for genotyping. NGS sample preparation has turned out to be the biggest technology for bacterial outbreak investigation owing to its application in genotyping. Illumina devices are used on the highest scale in the process of NGS sample preparation, but protocols from other key players like ThermoFisher and PerkinElmer can also be performed. Enzymatic fragmentation library preparation have an upper hand over the other protocols, owing to its properties of minimal hands-on time, and the ability to work with small quantities of DNA.

RESTRAINTS: Presence of alternative technologies

Presence of other techniques such as Sanger, antigen tests, polymerase chain reaction (PCR), and serological tests are used for the diagnosis of various diseases. For the past two decades, Sanger sequencing has dominated genomic research and achieved a number of significant accomplishments in the field of genomics. Serological tests are used for the determination of viruses in the body by screening antibodies in the blood. Serological tests are also used for the detection of a number of antibodies that are produced by the immune system.

OPPORTUNITES: Increasing collaborations and partnerships among key playerS

Many key players, such as Illumina, Thermo Fisher Scientific, and PerkinElmer, are collaborating with other research laboratories, academic institutes, hospitals, clinics, and other pharmaceutical & biotechnology companies. Owing to these strategies, the market is experiencing an introduction of new technologies, products, and research projects. These projects are expected to provide lucrative growth opportunities for market players owing to the rising adoption of NGS sample preparation.

CHALLENGES: Ethical and privacy issues in health data

The rise in population-based sequencing has resulted in several concerns related to the privacy of health data generated. For instance, there are concerns over the possibility of giant software companies engaged in NGS data management selling genomic data.

Non-invasive prenatal testing (NIPT) detects and analyzes fetal DNA in maternal blood to identify genetic and chromosomal conditions in the first trimester of pregnancy. It helps identify pregnant women at an increased risk of having a child with an abnormality. However, this testing procedure currently faces significant ethical issues and policy challenges. The ethical issues include the consequences of informed decision-making, such as enabling women to prepare for a child with a condition or trait, rights of people with disabilities, and sex-selective abortions.

The DNA accounted for the largest share of the sample type segment in NGS sample preparation market in 2022.

Based on sample type, the market is categorized into DNA, and RNA. In 2022, the DNA segment accounted for the largest share of the market. Rising number of cancer cases and growing R&D investments for studying DNA samples is expected to drive the growth of the DNA segment during the forecast period.

The workstation/ instruments segment dominated the product & services segment in NGS sample preparation market in 2022.

Based on the product & services, the segment is categorized into workstation/ instruments, reagents & consumables and services. In 2022, the workstation/ instruments segment dominated the product segment with the highest revenue share. Increasing demand for automation of NGS estimated to drive the market growth.

In 2022, the disease diagnostics segment have generated highest revenue in the application segment for NGS sample preparation market.

Based on the application, the Market is segmented into disease diagnostics, drug discovery, agricultural & animal research, and other applications. In 2022, the disease diagnostics segment have generated highest revenue in the application segment. The large share of the disease diagnostics segment can be attributed to the rising cases of cancer all over the globe and early diagnosis of various infectious diseases and monogenetic disorders, as well as in precision medicine.

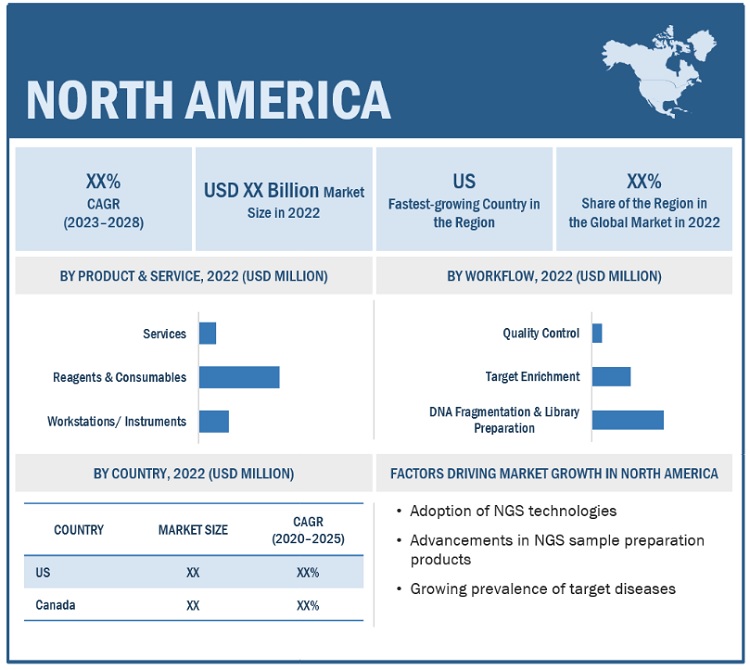

North America was the largest market for NGS Sample Preparation Market in 2022.

Geographically, the market is segmented into North America, Europe, Asia Pacific, and MEA. The market is dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period. The large share of the segment can be attributed to the favorable initiatives by government and private bodies for the adoption of NGS technologies, advancements in NGS sample preparation products, the growing prevalence of target diseases, an increasing number of NGS-based research & clinical applications, growing research on cancer, the rising awareness of NGS services, and the presence of leading NGS service providers, such as Illumina (US), Thermo Fisher Scientific (US), and Agilent Technologies (US), are driving the growth of the NGS market in North America.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the NGS sample preparation market are Illumina, Inc. (US) Thermo Fisher Scientific Inc. (US) PerkinElmer Inc. (US) F. Hoffmann-La Roche Ltd. (Switzerland) Agilent Technologies, Inc. (US) Danaher (US) Becton, Dickinson and Company (US) Merck KGaA (Germany) QIAGEN (Germany) Bio-Rad Laboratories, Inc. (US) Promega Corporation (US) Eurofins Scientific (Luxembourg) BGI (China) 10x Genomics (US) Sysmex Corporation (US) Psomagen (US) Zymo Research Corporation (US) Takara Bio Inc. (Japan) Novogene Co., Ltd. (China) New England Biolabs (US) Tecan Trading AG (US) Oxford Nanopore Technologies PLC (UK) PacBio (US) Medgenome (US) Swift Biosciences Inc. (US).

NGS Sample Preparation Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product & Services, Workflow, Sample Type, Method, Application, End User, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and MEA |

|

Companies covered |

Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), PerkinElmer Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (US), Danaher (US), Becton, Dickinson and Company (US), Merck KGAA (Germany), QIAGEN (Germany), Bio-Rad Laboratories, Inc. (US), Promega Corporation (US), Eurofins Scientific (Luxembourg), BGI (China), 10x Genomics (US), Sysmex Corporation (US), Psomagen (US), Zymo Research Corporation (US), Takara Bio Inc. (Japan), Novogene Co., Ltd. (China), New England Biolabs (US), Tecan Trading AG (US), Oxford Nanopore Technologies PLC (UK), PacBio (US), Medgenome (US), and Swift Biosciences Inc. (US). |

This report categorizes the NGS sample preparation market into the following segments & sub-segments:

By Products & Services

- Workstations/Instruments

- Reagents & Consumables

- Services

By Workflow

- DNA Fragmentation & Library Preparation

- Target Enrichment

- QC

By Sample Type

- DNA

- RNA

By Method

- Manual Sample Preparation

- Microfluidic Sample Preparation

- Automated Liquid Handling-based Sample Preparation

By Application

- Diagnostics

- Drug Discovery

- Agricultural & Animal Research

- Others

By End User

- Academic Institutes & Research Centers

- Hospitals & Clinics

- Pharma & Biotech Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- India

- China

- Australia

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments

- In 2021, Agilent completed the acquisition of Resolution Bioscience, a leader in the development and commercialization of NGS-based precision oncology solutions. Resolution Bioscience complemented and expanded Agilent’s capabilities in NGS-based cancer diagnostics and provided the company with innovative technology to further serve the needs of the fast-growing precision medicine market.

- In 2020, Roche announced that it has entered into a 15-year, non-exclusive partnership with Illumina to broaden the adoption of distributable next-generation sequencing (NGS) based testing in oncology.

- In 2021, Thermo Fisher Scientific announced the acquisition of clinical research services provider PPD.

Frequently Asked Questions (FAQ):

What is the projected market value of the global NGS sample preparation market?

The global market of NGS sample preparation is projected to reach USD 4.0 billion.

What is the estimated growth rate (CAGR) of the global NGS sample preparation market for the next five years?

The global NGS sample preparation market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.4% from 2022 to 2028.

What are the major revenue pockets in the NGS sample preparation market currently?

Geographically, the market is segmented into North America, Europe, Asia Pacific, and MEA. The NGS sample preparation market is dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period. The large share of the segment can be attributed to the favorable initiatives by government and private bodies for the adoption of NGS technologies, advancements in NGS sample preparation products, the growing prevalence of target diseases, an increasing number of NGS-based research & clinical applications, growing research on cancer, the rising awareness of NGS services, and the presence of leading NGS service providers, such as Illumina (US), Thermo Fisher Scientific (US), and Agilent Technologies (US), are driving the growth of the NGS market in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Constant innovations in NGS platforms- Increased availability of advanced NGS systems at low costs- Use of NGS as substitute for PCR- Greater efficiency of genotyping and preparation protocolsRESTRAINTS- Presence of alternative technologies- Limited expertise and sequencing capabilities of individual laboratoriesOPPORTUNITIES- Increasing collaborations and partnerships among key playersCHALLENGES- Ethical and privacy issues in health data

- 5.3 TECHNOLOGY ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 SUPPLY AND VALUE CHAIN ANALYSISSUPPLY CHAIN ANALYSIS OF NGS SAMPLE PREPARATION MARKETVALUE CHAIN ANALYSIS OF NGS SAMPLE PREPARATION MARKET

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 REGULATORY ANALYSISFDA APPROVALSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

5.10 PATENT ANALYSIS

-

5.11 KEY CONFERENCES AND EVENTS IN 2023CONFERENCES ON NGS SAMPLE PREPARATION IN 2023

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR NGS SAMPLE PREPARATION MARKET

- 6.1 INTRODUCTION

-

6.2 WORKSTATIONS/INSTRUMENTSINCREASING DEMAND FOR AUTOMATION OF NGS TO PROPEL MARKET

-

6.3 REAGENTS & CONSUMABLESGROWING USE OF CONSUMABLES FOR NGS SAMPLE PREPARATION TO DRIVE MARKET

-

6.4 SERVICESINCREASING INSTALLATION OF NGS PLATFORMS TO SUPPORT MARKET

- 7.1 INTRODUCTION

-

7.2 DNA FRAGMENTATION & LIBRARY PREPARATIONAVAILABILITY OF PRODUCTS FROM VARIOUS PLAYERS TO DRIVE MARKET

-

7.3 TARGET ENRICHMENTLAUNCH OF ADVANCED TARGET ENRICHMENT SOLUTIONS AND TECHNOLOGIES TO DRIVE MARKET

-

7.4 QUALITY CONTROLRISING NUMBER OF RESEARCH ACTIVITIES REQUIRING QUALITY-ASSURED SAMPLES TO PROPEL MARKET

- 8.1 INTRODUCTION

-

8.2 DNARISING NUMBER OF CANCER CASES AND GROWING R&D INVESTMENTS FOR STUDYING DNA SAMPLES TO DRIVE MARKET

-

8.3 RNADECREASED COSTS OF GENOME SEQUENCING TO AUGMENT MARKET

- 9.1 INTRODUCTION

-

9.2 DISEASE DIAGNOSTICSCANCER DIAGNOSTICS- Increase in cancer patients globally and launch of NGS-based cancer panels to drive marketREPRODUCTIVE HEALTH DIAGNOSTICS- Increasing awareness about benefits of NIPT and decreasing costs of sequencing to propel marketINFECTIOUS DISEASE DIAGNOSTICS- Growing burden of healthcare-associated infections to aid marketOTHER DISEASE DIAGNOSTIC APPLICATIONS

-

9.3 DRUG DISCOVERYINCREASING USE OF NGS DURING CLINICAL TRIALS TO AUGMENT MARKET

-

9.4 AGRICULTURAL & ANIMAL RESEARCHINCREASED FUNDING AND SUPPORT FOR ANIMAL AND PLANT GENOMICS RESEARCH TO FUEL ADOPTION

- 9.5 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 MANUAL SAMPLE PREPARATIONERRORS ASSOCIATED WITH NGS MANUAL SAMPLE PREPARATION TO HINDER MARKET

-

10.3 MICROFLUIDIC SAMPLE PREPARATIONGROWING APPLICATIONS OF MICROFLUIDIC SAMPLE PREPARATION TO CREATE OPPORTUNITIES

-

10.4 AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATIONHIGH PERFORMANCE AND ACCURACY OF AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION TO BOOST GROWTH

- 11.1 INTRODUCTION

-

11.2 HOSPITALS & CLINICSADVANTAGES OF NGS TECHNOLOGY FOR DISEASE DIAGNOSIS OVER CONVENTIONAL METHOD TO FUEL ADOPTION

-

11.3 ACADEMIC INSTITUTES & RESEARCH CENTERSAVAILABILITY OF FINANCIAL SUPPORT FOR GENOMICS RESEARCH TO SUPPORT SEGMENT

-

11.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESGROWING COLLABORATIONS BETWEEN NGS MARKET PLAYERS AND PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES TO DRIVE GROWTH

- 11.5 OTHER END USERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAUS- Favorable regulatory and reimbursement scenarios to drive marketCANADA- Favorable government funding to boost genomics researchNORTH AMERICA: IMPACT OF RECESSION

-

12.3 EUROPEGERMANY- Strong R&D base and presence of several NGS players to support marketUK- Use of NGS-based tests for disease diagnosis to augment marketFRANCE- Growing government support for genomics research to propel marketREST OF EUROPEEUROPE: IMPACT OF RECESSION

-

12.4 ASIA PACIFICCHINA- Favorable government initiatives for advanced life science research to aid marketJAPAN- Increased research funding to create growth opportunities for NGS-based studiesINDIA- Decreasing sequencing costs and growing prevalence of target diseases to support marketAUSTRALIA- Increasing use of NGS platforms by academic institutes to propel marketSOUTH KOREA- Increasing spending by government on NGS research to augment marketREST OF ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSION

-

12.5 LATIN AMERICABRAZIL- Rising focus on clinical genomics to drive demand for NGSMEXICO- Growing biotechnology infrastructure development to support marketREST OF LATIN AMERICALATIN AMERICA: IMPACT OF RECESSION

-

12.6 MIDDLE EAST & AFRICAINTRODUCTION OF COST-EFFECTIVE AND PORTABLE NGS TECHNOLOGIES TO STIMULATE MARKET

- 13.1 INTRODUCTION

- 13.2 KEY STRATEGIES ADOPTED BY MARKET PLAYERS

- 13.3 REVENUE SHARE ANALYSIS (TOP 5 PLAYERS)

- 13.4 MARKET SHARE ANALYSIS (2022)

-

13.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

13.7 COMPETITIVE BENCHMARKINGDETAILED LIST OF START-UPS/SMESCOMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES)

-

13.8 COMPETITIVE SCENARIO AND TRENDSKEY DEALSKEY PRODUCT LAUNCHESKEY EXPANSIONS

-

14.1 KEY PLAYERSILLUMINA, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPERKINELMER INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- MnM viewDANAHER- Business overview- Products/Services/Solutions offeredBECTON, DICKINSON AND COMPANY- Business overview- Products/Services/Solutions offeredQIAGEN- Business overview- Products/Services/Solutions offered- Recent developmentsMERCK KGAA- Business overview- Products/Services/Solutions offered- Recent developmentsBIO-RAD LABORATORIES, INC.- Business overview- Products/Services/Solutions offeredPROMEGA CORPORATION- Business overview- Products/Services/Solutions offeredEUROFINS SCIENTIFIC- Business overview- Products/Services/Solutions offeredBGI- Business overview- Products/Services/Solutions offered10X GENOMICS- Business overview- Products/Services/Solutions offeredSYSMEX CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments

-

14.2 OTHER PLAYERSPSOMAGENZYMO RESEARCH CORPORATIONTAKARA BIO INC.NOVOGENE CO., LTD.NEW ENGLAND BIOLABSTECAN TRADING AGOXFORD NANOPORE TECHNOLOGIES PLCPACBIOMEDGENOMESWIFT BIOSCIENCES INC.

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 NGS SAMPLE PREPARATION MARKET: IMPACT ANALYSIS

- TABLE 5 NGS SAMPLE PREPARATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- TABLE 11 CONFERENCES ON NGS SAMPLE PREPARATION (2023)

- TABLE 12 NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 13 NGS SAMPLE PREPARATION MARKET FOR WORKSTATIONS/INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR WORKSTATIONS/INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 EUROPE: NGS SAMPLE PREPARATION MARKET FOR WORKSTATIONS/INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR WORKSTATIONS/INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR WORKSTATIONS/INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 NGS SAMPLE PREPARATION MARKET FOR REAGENTS & CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 EUROPE: NGS SAMPLE PREPARATION MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR REAGENTS & CONSUMABLES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 NGS SAMPLE PREPARATION MARKET FOR SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 EUROPE: NGS SAMPLE PREPARATION MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 29 NGS SAMPLE PREPARATION MARKET FOR DNA FRAGMENTATION & LIBRARY PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR DNA FRAGMENTATION & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 EUROPE: NGS SAMPLE PREPARATION MARKET FOR DNA FRAGMENTATION & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DNA FRAGMENTATION & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DNA FRAGMENTATION & LIBRARY PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 NGS SAMPLE PREPARATION MARKET FOR TARGET ENRICHMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR TARGET ENRICHMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: NGS SAMPLE PREPARATION MARKET FOR TARGET ENRICHMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR TARGET ENRICHMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR TARGET ENRICHMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 NGS SAMPLE PREPARATION MARKET FOR QUALITY CONTROL, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: NGS SAMPLE PREPARATION MARKET FOR QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR QUALITY CONTROL, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 45 NGS SAMPLE PREPARATION MARKET FOR DNA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR DNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: NGS SAMPLE PREPARATION MARKET FOR DNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 NGS SAMPLE PREPARATION MARKET FOR RNA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR RNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: NGS SAMPLE PREPARATION MARKET FOR RNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR RNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR RNA, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 56 NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 CANCER DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 EUROPE: CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 LATIN AMERICA: CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 REPRODUCTIVE HEALTH DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: REPRODUCTIVE HEALTH DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: REPRODUCTIVE HEALTH DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: REPRODUCTIVE HEALTH DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 LATIN AMERICA: REPRODUCTIVE HEALTH DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 LATIN AMERICA: INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 OTHER DISEASE DIAGNOSTIC APPLICATIONS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: OTHER DISEASE DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: OTHER DISEASE DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: OTHER DISEASE DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 LATIN AMERICA: OTHER DISEASE DIAGNOSTIC APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 NGS SAMPLE PREPARATION MARKET FOR DRUG DISCOVERY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: NGS SAMPLE PREPARATION MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 NGS SAMPLE PREPARATION MARKET FOR AGRICULTURAL & ANIMAL RESEARCH, BY REGION, 2021–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR AGRICULTURAL & ANIMAL RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 EUROPE: NGS SAMPLE PREPARATION MARKET FOR AGRICULTURAL & ANIMAL RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR AGRICULTURAL & ANIMAL RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR AGRICULTURAL & ANIMAL RESEARCH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 NGS SAMPLE PREPARATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: NGS SAMPLE PREPARATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 98 NGS SAMPLE PREPARATION MARKET FOR MANUAL SAMPLE PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR MANUAL SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: NGS SAMPLE PREPARATION MARKET FOR MANUAL SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR MANUAL SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR MANUAL SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 NGS SAMPLE PREPARATION MARKET FOR MICROFLUIDIC SAMPLE PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR MICROFLUIDIC SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: NGS SAMPLE PREPARATION MARKET FOR MICROFLUIDIC SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR MICROFLUIDIC SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR MICROFLUIDIC SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 NGS SAMPLE PREPARATION MARKET FOR AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: NGS SAMPLE PREPARATION MARKET FOR AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR AUTOMATED LIQUID HANDLING-BASED SAMPLE PREPARATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 114 NGS SAMPLE PREPARATION MARKET FOR HOSPITALS & CLINICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 EUROPE: NGS SAMPLE PREPARATION MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 NGS SAMPLE PREPARATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: NGS SAMPLE PREPARATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR ACADEMIC INSTITUTES & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 124 NGS SAMPLE PREPARATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 EUROPE: NGS SAMPLE PREPARATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 NGS SAMPLE PREPARATION MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 131 EUROPE: NGS SAMPLE PREPARATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 NGS SAMPLE PREPARATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028

- TABLE 139 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028

- TABLE 140 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028

- TABLE 141 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028

- TABLE 142 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028

- TABLE 143 US: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 144 US: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 145 US: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 146 US: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 147 US: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 148 US: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 US: NGS SAMPLE PREPARATION MARKET BY END USER, 2021–2028 (USD MILLION)

- TABLE 150 CANADA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 151 CANADA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 152 CANADA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 153 CANADA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 154 CANADA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 155 CANADA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 CANADA: NGS SAMPLE PREPARATION MARKET, FOR END USER, 2021–2028 (USD MILLION)

- TABLE 157 EUROPE: NGS SAMPLE PREPARATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 EUROPE: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 159 EUROPE: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 160 EUROPE: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 161 EUROPE: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 162 EUROPE: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 163 EUROPE: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 164 EUROPE: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 165 GERMANY: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 166 GERMANY: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 167 GERMANY: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 168 GERMANY: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 169 GERMANY: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 170 GERMANY: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 171 GERMANY: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 UK: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 173 UK: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 174 UK NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 175 UK NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 176 UK: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 177 UK: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 UK: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 179 FRANCE: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 180 FRANCE: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 181 FRANCE: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 182 FRANCE: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 183 FRANCE: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 184 FRANCE: NGS SAMPLE PREPARATION MARKET BY DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 FRANCE: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 186 REST OF EUROPE NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 187 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 188 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 189 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 190 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 REST OF EUROPE: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 201 CHINA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 202 CHINA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 203 CHINA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 204 CHINA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 205 CHINA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 206 CHINA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 CHINA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 208 JAPAN: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 209 JAPAN: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 210 JAPAN: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 211 JAPAN: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 212 JAPAN: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 213 JAPAN: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 JAPAN: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 215 INDIA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 216 INDIA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 217 INDIA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 218 INDIA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 219 INDIA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 220 INDIA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 INDIA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 222 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 223 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 224 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 225 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 226 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 227 AUSTRALIA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 AUSTRALIA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 229 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 230 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 231 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 232 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 234 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 SOUTH KOREA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY COUNTRY,2021–2028 (USD MILLION)

- TABLE 244 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 246 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 250 LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 251 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 252 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 253 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 254 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 255 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 256 BRAZIL: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 BRAZIL: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 258 MEXICO: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 259 MEXICO: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 260 MEXICO: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 261 MEXICO: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 262 MEXICO: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 263 MEXICO: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 MEXICO: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 265 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 266 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 267 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 268 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 269 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2021–2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2021–2028 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY METHOD, 2021–2028 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET FOR DISEASE DIAGNOSTICS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: NGS SAMPLE PREPARATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 279 NGS SAMPLE PREPARATION MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 280 NGS SAMPLE PREPARATION MARKET: DETAILED LIST OF START-UPS/SMES

- TABLE 281 NGS SAMPLE PREPARATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- TABLE 282 NGS SAMPLE PREPARATION MARKET: KEY DEALS

- TABLE 283 NGS SAMPLE PREPARATION MARKET: KEY PRODUCT LAUNCHES

- TABLE 284 NGS SAMPLE PREPARATION MARKET: KEY EXPANSIONS

- TABLE 285 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 286 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 287 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 288 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 289 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 290 DANAHER: COMPANY OVERVIEW

- TABLE 291 BECTON, DICKINSON, AND COMPANY: COMPANY OVERVIEW

- TABLE 292 QIAGEN: COMPANY OVERVIEW

- TABLE 293 MERCK KGAA: COMPANY OVERVIEW

- TABLE 294 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 295 PROMEGA CORPORATION: COMPANY OVERVIEW

- TABLE 296 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 297 BGI: COMPANY OVERVIEW

- TABLE 298 10X GENOMICS: COMPANY OVERVIEW

- TABLE 299 SYSMEX CORPORATION: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS), 2021

- FIGURE 4 NGS SAMPLE PREPARATION MARKET SIZE (USD MILLION)

- FIGURE 5 NGS SAMPLE PREPARATION MARKET: FINAL CAGR PROJECTIONS (2023−2028)

- FIGURE 6 NGS SAMPLE PREPARATION MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 NGS SAMPLE PREPARATION MARKET, BY PRODUCT & SERVICE, 2022 VS. 2028 (USD MILLION)

- FIGURE 9 NGS SAMPLE PREPARATION MARKET, BY WORKFLOW, 2022 VS. 2028 (USD MILLION)

- FIGURE 10 NGS SAMPLE PREPARATION MARKET, BY SAMPLE TYPE, 2022 VS. 2028 (USD MILLION)

- FIGURE 11 NGS SAMPLE PREPARATION MARKET, BY METHOD, 2022 VS. 2028 (USD MILLION)

- FIGURE 12 NGS SAMPLE PREPARATION MARKET, BY APPLICATION, 2022 VS. 2028 (USD MILLION)

- FIGURE 13 NGS SAMPLE PREPARATION MARKET, BY END USER, 2022 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF NGS SAMPLE PREPARATION MARKET

- FIGURE 15 ADVANCEMENTS IN NGS PLATFORMS TO DRIVE GROWTH

- FIGURE 16 REAGENTS & CONSUMABLES ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 DISEASE DIAGNOSTICS SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 NGS SAMPLE PREPARATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 COST PER HUMAN GENOME, 2001–2021

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 22 NGS SAMPLE PREPARATION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 NGS SAMPLE PREPARATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 NGS SAMPLE PREPARATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 PATENT FILING TRENDS FOR TOP 5 IPC MAIN CLASSES, 2018−2020

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN NGS SAMPLE PREPARATION MARKET

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 NGS SAMPLE PREPARATION MARKET, BY REGION, 2021 VS. 2028 (USD MILLION)

- FIGURE 29 NORTH AMERICA: NGS SAMPLE PREPARATION MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: NGS SAMPLE PREPARATION MARKET SNAPSHOT

- FIGURE 31 REVENUE ANALYSIS FOR TOP 5 COMPANIES (2019−2021)

- FIGURE 32 NGS SAMPLE PREPARATION MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS (2022)

- FIGURE 33 NGS SAMPLE PREPARATION MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 34 NGS SAMPLE PREPARATION MARKET: START-UPS/SMES EVALUATION QUADRANT (2022)

- FIGURE 35 ILLUMINA, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 38 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- FIGURE 41 BECTON, DICKINSON, AND COMPANY: COMPANY SNAPSHOT (2021)

- FIGURE 42 QIAGEN: COMPANY SNAPSHOT (2021)

- FIGURE 43 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 44 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 45 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2021)

- FIGURE 46 10X GENOMICS: COMPANY SNAPSHOT (2021)

- FIGURE 47 SYSMEX CORPORATION: COMPANY SNAPSHOT (2022)

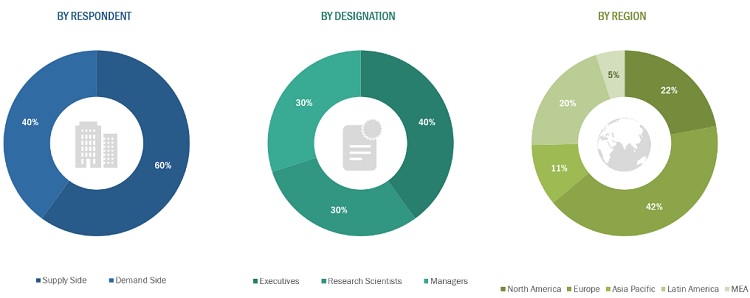

This study involved four major activities in estimating the current size of the NGS sample preparation market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the NGS sample preparation market. The secondary sources used for this study include Some of the key secondary sources referred to for this study include publications from government sources Institute of Bioinformatics and Applied Biotechnology (IBAB), National Institutes of Health (NIH), National Human Genome Research Institute (NHGRI), Personalized Medicine Partnership for Cancer, Association for Clinical Genomic Science, American Society of Gene & Cell Therapy (ASGCT), American Society for Histocompatibility and Immunogenetics (ASHI), American Society of Human Genetics, American Association for Cancer Research (ACGS), Stanford Center for Genomics and Personalized Medicine (SCGPM), GenomeCanada, European Molecular Biology Laboratory (EMBL), European Society of Human Genetics (ESHG), Asia Pacific Society of Human Genetics (APSHG), Biotechnology and Biological Sciences Research Council (BBSRC), Department of Biotechnology (DBT), Malaysian Genomics Resource Centre (MGRC), Annual Reports, Press Releases, Interviews with Experts, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the NGS sample preparation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the NGS sample preparation business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the NGS sample preparation market based on products & services, workflow, sample type, method, application, and end user.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyse micro markets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyse opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Twenty five company profiles

Regional Analysis

- Breakdown of RoW into Latin America and Middle East & Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NGS Sample Preparation Market