Metal Biocides Market by Type (Silver, Copper & Alloys, Zinc), End-use Industry (Paints & Coatings, Medical, Textile, Wood Preservation, Foods & Beverages, Pesticides (Agriculture)), and Region - Global Forecast to 2021

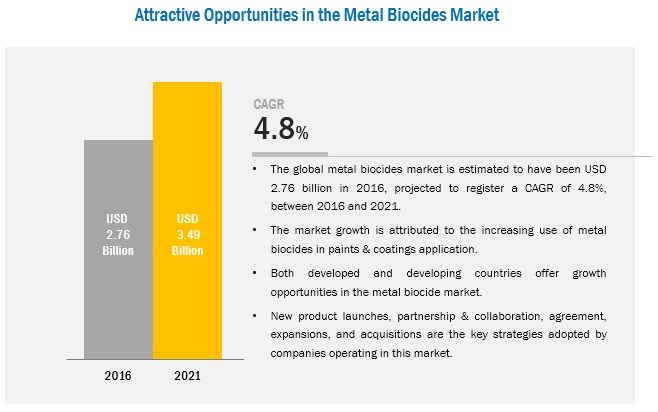

[159 Pages Report]The global metal biocides market is projected to reach USD 3.49 billion by 2021 at a CAGR of 4.8% from 2016 to 2021. The market is driven by the increasing growth of its major end-use industries, such as, paints & coatings, medical, and water treatment.

Market Dynamics

Drivers

- Discovery Of New Application Areas For metal Biocides

- Rising Paints & Coatings Industry In Asia-Pacific

Restraints

- Existence Of Substitute Products

- Regulatory Restrictions On Certain metal Biocides

Opportunities

- Short Term High Growth Potential In Emerging Nations

- Long Term Stable Growth Potential In Regulated Market

Rising Paints & Coatings Industry In Asia-Pacific

Paints & coatings industry in the Asia-Pacific region is estimated to grow at a CAGR of 6.0% from 2016 to 2021. Rising population pressure and robust industrial growth are the key driving factors for the market on domestic as well as commercial front. Moreover, the region currently accounts for around 50% of the global consumption of paint & coating industry. The demand for metal biocides is the highest in this industry. Therefore, future demand for metal biocides in the region is also estimated to grow at a faster rate.

Objectives of the Study:

- To define, describe, and forecast the metal biocides market on the basis of technology, application, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the metal biocides market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

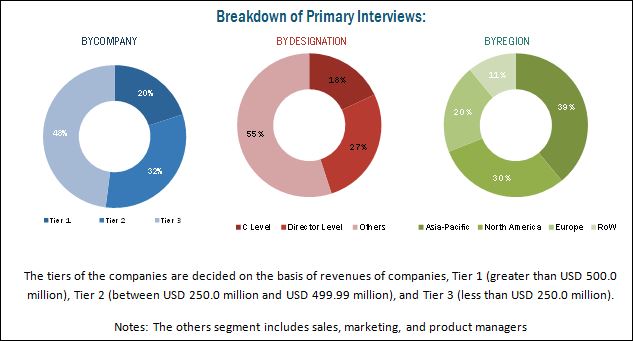

Both, the top-down and bottom-up approaches have been used to estimate and validate the size of the global metal biocides market and to estimate the size of various other dependent submarkets. Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, the Biocides and Biosciences Group (BBG), European Commission, Securities And Exchange Commission (SEC), and other government and private websites were involved in order to identify and collect information useful for this technical, market-oriented, and commercial study of the global metal biocides market.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The metal biocides value chain includes raw material manufacturers, metal biocide manufacturers, and end-users. The leading plyers profiled in this study include, BASF SE (Germany), Clariant AG (Germany), The Dow Chemical Company (U.S.), SANITIZED AG (Switzerland), Lonza Group Ltd (Switzerland), Troy Corporation (U.S.), Milliken Chemical Company (U.S.), SteriTouch Ltd. (U.K.), Noble Biomaterials, Inc. (U.S.), and Renaissance Chemicals Ltd (U.K.).

Major Market Developments

- In May 2016, BASF SE has launch zinc oxide based biocide under its Z-Cote brand. This product is specially designed to be used for all kinds of formulations from skin care and sun care to decorative cosmetics.

- In April 2014, Clariant AG has introduced an antimicrobial master batches named CESA antimicro for foot wear industries. This metal biocide will provide protection against odor-causing bacteria in shoes, boots, sandals and other footwear made with polymeric insoles.

- In May 2015, DOW Microbial Control, a division of The DOW Chemical Company collaborated with Strategic Partners, Inc. (U.S.A.) to develop medical scrubs and lab coats which will use SILVADUR Antimicrobial which will help inhibit the growth of bacteria on apparel and increase the life of garments.

Key Target Audience:

- Inorganic metal manufacturers

- Metal biocides manufacturers

- Equipment manufacturers

- Paints & coatings producers

- Food & beverage manufacturers

- Textile manufacturers

- Medical device manufacturers

- Traders, distributors, and suppliers of metal biocides

- Regional manufacturers’ associations and general metal biocides associations

- Government and regional agencies and research organizations

- Investment research firms

“The study answers several questions for the stakeholders, primarily the market segments that they need to focus upon during the next two-to-five years to prioritize their efforts and investments.”

Scope of the report:

This research report categorizes the global metal biocides market on the basis of form, end-use industry, and region.

On the basis of type:

- Silver

- Copper & Alloys

- Zinc

- Others

On the basis of end-use industry:

- Paints & Coatings

- Medical

- Textile

- Pesticides (Agriculture)

- Wood Preservation

- Foods & Beverages

- Others

On the basis of region:

- Asia-Pacific

- Europe

- North America

- Rest of the World

The market is further analyzed for the key countries in each of these regions.

Critical questions which the report answers

- What are the upcoming trends for metal biocides market in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

End-use industry analysis

- Application matrix that gives a detailed analysis of metal biocides applications in each end-use industry

Regional analysis

- Further breakdown of a region with respect to a particular country

Company information

- Detailed analysis and profiles of additional market players (up to five)

The global metal biocides market is projected to reach USD 3.49 billion by 2021 at a CAGR of 4.8% from 2016 to 2021. The market is primarily driven by the rapid growth of the key end-use industries, such as paints & coatings, medical, and textile.

Metal biocides are used in end-use industries such as, paints & coatings, medical, textile, pesticides (agriculture), wood preservation, foods & beverages, and others. In 2015, the medical sector accounted for the largest market share among the end-use industries, in terms of value. Whereas, the paints & coatings segment is expected to register the highest CAGR, during the forecast period. The growth of this segment is primarily attributed to the increasing demand for metal biocides in household paints, varnishes, marine antifouling agents, and so on, due to their effectiveness in inhibiting the growth of algae and fungi on applied paint.

Based on type, the metal biocides market is segmented into silver, copper & alloys, zinc, and others. In 2015, the silver-based metal biocide was the largest segment among all types. Moreover, this segment is expected to register the highest CAGR, during the forecast period. The growth of this segment is supplemented by the non-toxic, environment friendly and sustainable nature of silver biocide. Despite the high cost, silver biocide is widely used in the healthcare industry owing to its high thermal stability, effectiveness, unsurpassed safety, and the fact that it is approved by the Environment Protection Agency (EPA).

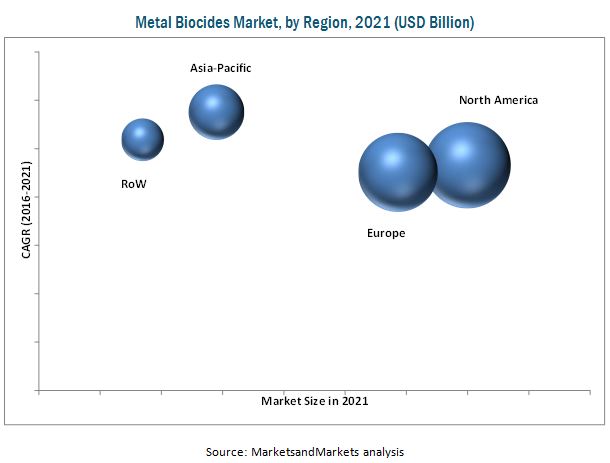

The Asia-Pacific region, North America, Europe, and rest of the world are the main metal biocides markets considered for the report. The North American region is leading the global metal biocides market, both, in terms of volume and value. The rising demand for metal biocides in this region is mainly driven by the presence of key market players such as, The Dow Chemical Company (U.S.), Troy Corporation (U.S.), Milliken Chemical Company (U.S.), and Noble Biomaterials Inc. (U.S.). Intense competition among the major players in the market has led to price stabilization in the past few years. The growing demand for metal biocides in the medical and foods & beverages industries in the U.S. is driving the metal biocide market in the region.

The global metal biocides market is growing at a moderate rate. Stringent regulations for the production and consumption of metal biocides, coupled with the requirement of high capital investments are the key factors restraining market growth. These factors create a huge entry barrier for new entrants in the global metal biocides market, which in turn discourages competition and lowers overall market growth.

Metal biocides are used in many applications such as paints & coatings, medical, textiles, and others.

Paints & Coatings

Paint & coating is the main industry where metal-based biocides have maximum usage. Household paint, varnishes, marine antifouling paint, and industrial paint are some of the important areas where biocide is effective to inhibit the growth of algae and fungi on applied paint. Biocide is effective in inhibiting the growth of microorganisms. It can be used to address the problems in:

- Exterior coatings: Environmental exposure causes development of airborne algae and fungi in exterior applications. In such cases, biocides that are UV stable and less soluble in water are effective for long term stability.

- Interior coatings: Mold contamination takes place in internal coating based on humidity of rooms (kitchens, bathrooms). Biocides applied in such cases should have the property of low solubility in water and protection against mold.

Medical

Utility of silver and copper biocides in medical industry is already a proved fact. Both silver and copper-based biocides are used for coating of medical devices to inhibit the growth of bacteria and fungi for a long period of time. Moreover, the ongoing researches are finding their use in more number of applications in the same field. Clinical researches have proved that copper and alloys are effective against several viruses, such as influenza A viruses, methicillin-resistant Staphylococcus aureus (MRSA), and E. Coli O157:H7.

Textiles

Silver-based biocide has commercial usage in the textile industry due to its antimicrobial quality. It is estimated that in North America and Europe, both silver and copper biocides are gaining importance in terms of usage in regular clothing as well as medical textile.

BASF SE (Germany), Clariant AG (Germany), The Dow Chemical Company (U.S.), SANITIZED AG (Switzerland), Lonza Group Ltd (Switzerland), Troy Corporation (U.S.), Milliken Chemical Company (U.S.), SteriTouch Ltd. (U.K.), Noble Biomaterials Inc. (U.S.), and Renaissance Chemicals Ltd (U.K.) are the leading companies, with an excellent foothold in the global market. These companies are expected to account for a large market share in the near future.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Currency and Pricing

1.2.1 Market Definition

1.2.2 Market Scope

1.2.2.1 By Application

1.2.2.2 By Geography

1.2.2.3 By Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Metal Biocides Market Research Data

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.3 Key Industry Insights

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary

4 Premium Insights

4.1 Opportunities in Metal Biocides Market

4.2 High Growth Potential in Asia-Pacific Metal Biocides Market, 2016–2021

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

6 Industry Trends

6.1 Value Chain Analysis

6.2 Porter’s Five Forces Analysis

6.2.1 Bargaining Power of Suppliers

6.2.2 Bargaining Power of Buyers

6.2.3 Threat of New Entrants

6.2.4 Threat of Substitutes

6.2.5 Intensity of Rivalry

7 Metal Biocides Market (2016-2021), By Type

7.1 Introduction

7.2 Silver

7.3 Copper & Alloys

7.4 Zinc

7.5 Others

8 Metal Biocides Market (2016-2021), By Application

8.1 Introduction

8.2 Paints & Coatings

8.3 Medical

8.4 Textile

8.5 Pesticides (Agriculture)

8.6 Wood Preservation

8.7 Foods & Beverages

8.8 Others

9 Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Italy

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 Australia

9.4.2 China

9.4.3 India

9.4.4 Japan

9.4.5 South Korea

9.4.6 Rest of Asia-Pacific

9.5 Rest of World

10 Competitive Landscape

10.1 New Product Launches, 2012-2016

10.2 Partnerships & Collaborations, 2012-2016

10.3 Agreements, 2012-2016

10.4 Acquisitions, 2012-2016

10.5 Expansions, 2012-2016

11 Company Profiles

11.1 BASF SE

11.1.1 Products & Services

11.1.2 Recent Developments

11.1.3 BASF SE: SWOT Analysis

11.1.4 MnM View

11.2 Clariant AG

11.2.1 Products & Services

11.2.2 Recent Developments

11.2.3 Clariant AG: SWOT Analysis

11.2.4 MnM View

11.3 The DOW Chemical Company

11.3.1 Products & Services

11.3.2 Recent Developments

11.3.3 The DOW Chemical Company: SWOT Analysis

11.3.4 MnM View

11.4 Lonza Group Ltd

11.4.1 Products & Services

11.4.2 Recent Developments

11.4.3 Lonza Group: SWOT Analysis

11.4.4 MnM View

11.5 Troy Corporation

11.5.1 Products & Services

11.5.2 Troy Corporation: SWOT Analysis

11.6 Milliken Chemical Company

11.6.1 Products & Services

11.7 Sanitized AG

11.7.1 Products & Services

11.8 Steritouch Ltd.

11.8.1 Products & Services

11.9 Noble Biomaterials Inc.

11.9.1 Products & Services

11.10 Renaissance Chemicals Ltd

11.10.1 Products & Services

12 Appendix

12.1 Discussion Guide

List of Tables (66 Tables)

Table 1 Metal Biocides Market Size, By Type, 2016-2021 (KT)

Table 2 By Market Size, By Type, 2016-2021 (USD Million)

Table 3 Forms of Silver-Based Biocides

Table 4 Silver Biocide Market Size, By Geography, 2016-2021 (KT)

Table 5 Silver Biocide Market Value, By Geography, 2016-2021 (USD Million)

Table 6 Biocidal Properties of Copper-Based Compounds

Table 7 Copper & Alloy Biocide Market Size, By Geography, 2016-2021 (KT)

Table 8 Copper & Alloy Biocide Market Size, By Geography, 2016-2021 (USD Million)

Table 9 Types of Zinc-Based Biocides

Table 10 Zinc Biocide Market Size, By Geography, 2016-2021 (KT)

Table 11 Zinc Biocide Market Size, By Geography, 2016-2021 (USD Million)

Table 12 Types of Other Biocides

Table 13 Metal Biocides Market Size, By Application, 2016-2021 (KT)

Table 14 Market By Size, By Application, 2016-2021 (USD Million)

Table 15 Metal Biocides Application in Paints & Coatings

Table 16 Market By Size in Paints & Coatings Segment, By Geography, 2016-2021 (KT)

Table 17 Metal Biocides Application in Medical Industry

Table 18Market By Size in Medical Segment, By Geography, 2016-2021 (KT)

Table 19 Silver Nanoparticle Application in Textile

Table 20 Market By Size in Textile Segment, By Geography, 2016-2021 (KT)

Table 21 Market By Size in Pesticides (Agriculture) Segment, By Geography, 2016-2021 (KT)

Table 22 Types of Copper & Alloys and Co-Biocides

Table 23 Market By Size in Wood Preservation Segment, By Geography, 2016-2021 (KT)

Table 24 Important Metal Biocides Used in Foods & Beverages

Table 25 Metal Biocides Market Size in Foods & Beverages Segment, By Geography, 2016-2021 (KT)

Table 26 Market By Size in Others Segment, By Geography, 2016-2021 (KT)

Table 27 Market By Size, By Geography, 2016-2021 (KT)

Table 28 Market By Size, By Geography, 2016-2021 (USD Million)

Table 29 Important Metal Biocides Regulations

Table 30 North America: Market Size, By Country, 2016-2021 (KT)

Table 31 North America: Market Size, By Country, 2016-2021 (USD Million)

Table 32 U.S.: Metal Biocides Market Size, By Type, 2016-2021 (KT)

Table 33 U.S.: By Market Size, By Type, 2016-2021 (USD Million)

Table 34 U.S.: By Market Size, By Application, 2016-2021 (KT)

Table 35 Canada: By Market Size, By Type, 2016-2021 (KT)

Table 36 Canada: By Market Size, By Type, 2016-2021 (USD Million)

Table 37 Canada: By Market Size, By Application, 2016-2021 (KT)

Table 38 Mexico: By Market Size, By Type, 2016-2021 (KT)

Table 39 Mexico: By Market Size, By Type, 2016-2021 (USD Million)

Table 40 Mexico: By Market Size, By Application, 2016-2021 (KT)

Table 41 Germany: By Market Size, By Type, 2016-2021 (KT)

Table 42 Germany: By Market Size, By Type, 2016-2021 (USD Million)

Table 43 Germany: By Market Size, By Application, 2016-2021 (KT)

Table 44 France: By Market Size, By Type, 2016-2021 (KT)

Table 45 France: By Market Size, By Type, 2016-2021 (USD Million)

Table 46 France: By Market Size, By Application, 2016-2021 (KT)

Table 47 U.K.: Metal Biocides Market Size, By Type, 2016-2021 (KT)

Table 48 U.K.: By Market Size, By Type, 2016-2021 (USD Million)

Table 49 U.K.: By Market Size, By Application, 2016-2021 (KT)

Table 50 Italy: By Market Size, By Type, 2016-2021 (KT)

Table 51 Italy: By Market Size, By Type, 2016-2021 (USD Million)

Table 52 Italy: By Market Size, By Application, 2016-2021 (KT)

Table 53 China: By Market Size, By Type, 2016-2021 (KT)

Table 54 China: By Market Size, By Type, 2016-2021 (USD Million)

Table 55 China: By Market Size, By Application, 2016-2021 (KT)

Table 56 India: By Market Size, By Type, 2016-2021 (KT)

Table 57 India: By Market Size, By Type, 2016-2021 (USD Million)

Table 58 India: By Market Size, By Application, 2016-2021 (KT)

Table 59 Japan: By Market Size, By Type, 2016-2021 (KT)

Table 60 Japan: By Market Size, By Type, 2016-2021 (USD Million)

Table 61 Japan: By Market Size, By Application, 2016-2021 (KT)

Table 62 South Korea: By Market Size, By Type, 2016-2021 (KT)

Table 63 South Korea: Metal Biocides South Korea Market Size, By Type, 2016-2021 (USD Million)

Table 64 South Korea: By Market Size, By Application, 2016-2021 (KT)

Table 65 RoW: By Market Size, By Type, 2016-2021 (KT)

Table 66 RoW: By Market Size, By Type, 2016-2021 (USD Million)

List of Figures (60 Figures)

Figure 1 Metal Biocides Market Size, By Type, 2016-2021 (KT)

Figure 2 Market Segmentation

Figure 3 Glance at Markets Covered, By Application

Figure 4 Glance at Markets Covered, By Geography

Figure 5 Years Considered for the Study

Figure 6 Metal Biocides Market: Research Design

Figure 7 Breakdown of Primary Interviews

Figure 8 Research Methodology Top-Down Approach

Figure 9 Research Methodology Bottom-Up Approach

Figure 10 Medical and Paints & Coatings to Be the Fastest-Growing Segment From 2016 to 2021

Figure 11 Asia-Pacific to Register Highest CAGR During the Forecast Period

Figure 12 High Growth in Metal Biocides Market

Figure 13 North America to Lead the Market

Figure 14 Market Share (Value), By Type & Application, 2015

Figure 15 Emerging Economies to Register High Growth Rate

Figure 16 Metal Biocides Market Impact of Drivers, Restraints and Opportunities

Figure 17 Metal Biocides Value Chain

Figure 18 Metal Biocides Porter’s Analysis

Figure 19 Bargaining Power of Suppliers

Figure 20 Bargaining Power of Buyers

Figure 21 Threat of New Entrants

Figure 22 Threat of Substitutes

Figure 23 Intensity of Competitive Rivalry

Figure 24 By Market Segmentation, By Type

Figure 25 By Market Segmentation, By Important Metal Compounds

Figure 26 By Market Segmentation, By Other Metal Compounds (Contd.)

Figure 27 By Market Share (Volume), By Type, 2015

Figure 28 Metal Biocides Market Share (Value), By Type, 2015

Figure 29 By Market Segmentation, By Application

Figure 30 Market Share (Volume), By Application, 2015

Figure 31 Different Forms of Silver Biocide Applications in Textile

Figure 32 Metal Biocides Market Share (Volume), By Geography, 2015

Figure 33 By Market Share (Value), By Geography, 2015

Figure 34 North America: Market Share (Volume), By Country, 2015

Figure 35 U.S.: Metal Biocides Market Size, By Type, 2015 (KT)

Figure 36 Canada: Market By Size, By Type, 2015 (KT)

Figure 37 Mexico: By Market Size, By Type, 2015 (KT)

Figure 38 U.S.: Metal Biocides Market Size, By Application, 2016-2021 (KT)

Figure 39 U.S.: By Market Share (Volume), By Application, 2015 & 2021

Figure 40 Canada: Metal Biocides Market Share (Volume), By Application, 2015 & 2021

Figure 41 Mexico: Market Share (Volume), By Application, 2015 & 2021

Figure 42 Europe: Metal Biocides Market Share (Volume), By Country, 2015

Figure 43 Italy :By Market Size, By Type, 2015 (KT)

Figure 44 Germany: Metal Biocides Market Size, By Type, 2015 (KT)

Figure 45 France: By Market Size, By Type, 2015 (KT)

Figure 46 U.K.: Metal Biocides Market Size, By Type, 2015 (KT)

Figure 47 Germany: By Market Share (Volume), By Application, 2015 & 2021

Figure 48 France: By Market Share (Volume), By Application, 2015 & 2021

Figure 49 U.K.: Metal Biocides Market Share (Volume), By Application, 2015 & 2021

Figure 50 Italy: By Market Share (Volume), By Application, 2015 & 2021

Figure 51 Asia-Pacific: Market Share (Volume), By Country, 2015

Figure 52 South Korea: By Market Size, By Type, 2015 (KT)

Figure 53 China: Metal Biocides Market Size, By Type, 2015 (KT)

Figure 54 India: By Market Size, By Type, 2015 (KT)

Figure 55 Japan: Market Size, By Type, 2015 (KT)

Figure 56 China: By Market Share (Volume), By Application, 2015 & 2021

Figure 57 India: Metal Biocides Market Share (Volume), By Application, 2015 & 2021

Figure 58 Japan: By Market Share (Volume), By Application, 2015 & 2021

Figure 59 South Korea: By Market Share (Volume), By Application, 2015 &. 2021

Figure 60 Battle for Market Share: Agreements is the Key Strategy

Growth opportunities and latent adjacency in Metal Biocides Market