Metal Stamping Market by Process (Embossing, Blanking, Bending, Coining, Flanging), Material Thickness (=0.4mm, >0.4mm), Press Type (Hydraulic Press, Mechanical Press, Servo Press), Material, End-Use Industry, Region - Trends and Forecast to 2028

Updated on : November 11, 2025

Metal Stamping Market

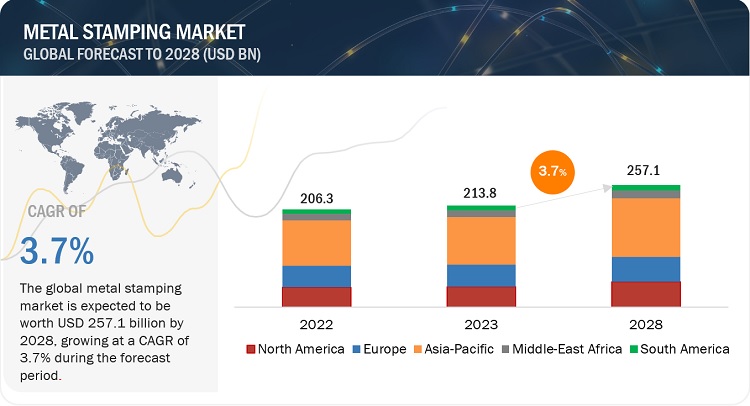

The global metal stamping market is projected to grow from USD 213.8 billion in 2023 to reach USD 257.1 billion by 2028, at a CAGR of 3.7% from 2023 to 2028. The market growth is driven by increasing use of metal stamped in the construction, medical and automotive industries as well as by their increasing demand in the electricals & electronics products. The industrial machinery is the second-largest end-use industry of metal stamping. The industrial machinery industry frequently uses metal stamping to produce a wide range of components crucial to the operation of heavy-duty machinery. Metal stamping is used in industrial machinery to make components, such as gears, bearings, housings, and brackets, of stainless steel, high-strength steel, or aluminum. Metal stamping has a significant advantage in the industrial machinery industry due to its ability to produce customized high-precision, high-strength components in large volumes quickly and cost-effectively.

Metal Stamping Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Metal Stamping Market

Metal Stamping Market Dynamics

Driver: Technological advancements and growing adoption of automation are the major drivers of the metal stamping market.

The metal stamping market is expanding due to technological advancements that have increased manufacturing efficiency, decreased costs, and increased precision and accuracy. For example, computer numerical control (CNC) machines are becoming increasingly common because they can perform tasks with excellent precision and accuracy, including drilling, milling, and turning. These computer-controlled machines can rapidly and effectively produce complex parts and components. Automation has supported the metal stamping industry by improving efficiency, lowering costs, and increasing productivity. It can also help improve consistency. The use of manual labour can be decreased, as automated stamping machines can carry out repetitive tasks quickly and accurately.

Restraint: Fluctuating raw material prices

Raw material price fluctuations can be a considerable restraint for the metal stamping market, affecting the profitability and competitiveness of metal stamping companies. Metal stamping necessitates using various raw materials, including steel, aluminum, copper, and other metals, to produce stamped parts. When the cost of these raw materials increases, the cost of production increases. If metal stamping companies pass on these increased costs to their customers, they may lose business to competitors who can offer lower prices.

Opportunities: Increasing scope of metal stamping in medical industry

The use of metal stamping in the medical industry is significant and increasing rapidly. Metal stamping is widely used in the medical sector to produce precise and high-quality metal parts for medical devices, implantable devices, surgical tools, and diagnostic equipment. The rising demand for minimally invasive surgeries, the increasing geriatric population, the rising prevalence of chronic diseases, and the growing demand for medical implants drive the growth of the medical metal stamping market. The trend toward medical device miniaturization also drives the demand for metal stamping in the medical industry.

Challenges: Lack of standardization

The lack of standardization can cause several challenges for producers and customers. For example, manufacturers struggle to ensure consistent quality across different parts and orders due to a lack of standardization in measuring the quality of stamped parts. Lack of standardized quality control procedures could result in inconsistent product quality, higher rejection rates, and ultimately lower customer satisfaction.

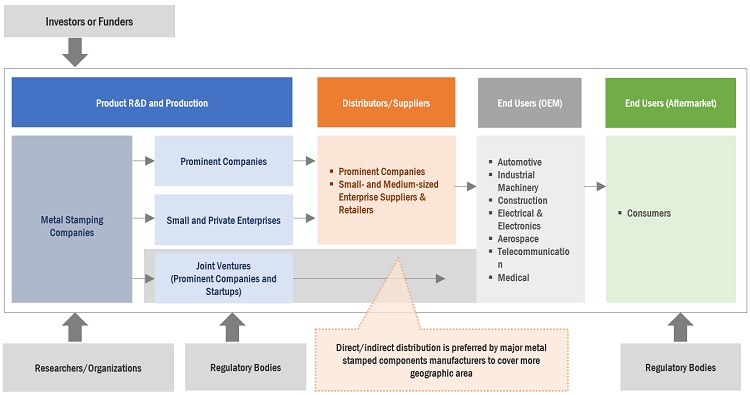

Metal Stamping Market Ecosystem

By Process, Blanking process accounted for the highest CAGR during the forecast period

Blanking is a metal stamping process used to cut sheet metal into a desired shape or size. It is preferred because it allows for high accuracy, speed, material efficiency, versatility, and can be easily automated. Blanking minimizes scrap material, making it a cost-effective process for high-volume production runs.

By Material, Steel material accounted for the highest CAGR during the forecast period

Steel is used in almost every building and construction process due to its lightweight structure, cost efficiency, corrosion resistance, and energy efficiency. Steel is used in almost every type of manufacturing and construction, from surgical equipment to household items. Steel products have a lifespan of about 40 years and are 100% recyclable. Because the magnetic properties remain unchanged, this metal can be recycled continuously. Recycled steel can be used as an input for BF-BOF (Blast Furnace Basic Oxygen Route) and EAP (Electric Arc Furnace) methods, resulting in the production of a variety of new steel products. These factors make the steel most popular material in metal stamping industry.

By Material thickness, ≤0.4 mm accounted for the highest CAGR during the forecast period

Materials with thicknesses of ≤0.4 mm are also known as “thin-gauge materials” in metal stamping Thin-gauge materials combine strength, flexibility, and precision in these applications, making them ideal for manufacturing complex parts with high tolerances and strict dimensional requirements. In addition to being strong and flexible, thin-gauge materials are very cost-effective because they require less raw material. As a result, they are ideal for mass-production applications where cost-effectiveness is critical.

By Press type, Mechanical press accounted for the highest CAGR during the forecast period

Mechanical presses are a versatile and efficient tool for a wide range of metal stamping applications. Mechanical presses are widely used in metal stamping applications due to their high efficiency and ability to apply significant force to the metal. Mechanical presses are commonly used in metal stamping for various operations such as blanking, piercing, forming, coining, embossing, and drawing. They are versatile and efficient tools that can apply significant force to metal and shape it into specific sizes and contours.

By End Use Industry, medical accounted for the highest CAGR during the forecast period

The manufacturing of medical devices, particularly implants, must be carried out with the utmost precision and care to prevent any contaminants or defects, given their use in delicate medical procedures. Due to their sensitive nature, medical devices are manufactured to exceptionally high standards. Metal stamping offers several advantages, such as high precision, fast production, and low cost, making it an attractive manufacturing method for producing medical components in high volumes. Components manufactured via metal stamping include implants, connectors, surgical devices, temperature probes, pump & motor components, equipment housings & sleeves, couplings, fittings, and prosthetics.

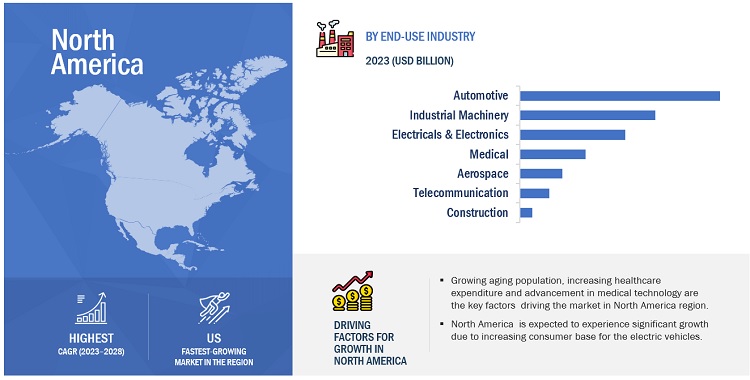

North America is projected to account for the highest CAGR in the metal stamping market during the forecast period

The demand for metal stamping is expected to be driven by new product development and product innovation initiatives by the market players in North America. The automotive segment is projected to be the largest end-use industry in the North America. The transition to EVs is gaining traction, with major automakers investing heavily in this area. North America has several major automakers, including General Motors, Ford, and Fiat Chrysler (now known as Stellantis). These companies have a significant presence in the region, with several manufacturing facilities and R&D centres. Aside from automakers, North America has a thriving auto parts manufacturing industry. Many of the world's leading auto parts manufacturers, including Magna International, Linamar, and Martinrea International, have facilities in North America.

To know about the assumptions considered for the study, download the pdf brochure

Metal Stamping Market Players

Metal stamping market comprises key manufacturers such as Gestamp Automoción, S.A. (Spain), Arconic Corporation (US), American Axle & Manufacturing Holdings, Inc. (US), CIE Automotive S.A. (Spain), Interplex Holdings Pte. Ltd. (Singapore), AAPICO Hitech Public Company Limited (Thailand), Clow Stamping Company (US), Wiegel Tool Works, Inc. (US), Harvey Vogel Manufacturing Co. (US), ACRO Metal Stamping (US), Boker’s, Inc. (US), and Kenmode, Inc. (US) and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the metal stamping market. Major focus was given to the new product development due to the changing requirements of transportation and electronics product consumers across the world.

Read More: Metal Stamping Companies

Metal Stamping Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 213.8 billion |

|

Revenue Forecast in 2028 |

USD 257.1 billion |

|

CAGR |

3.7% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion) |

|

Segments |

By Process, Material, Material Thickness, Press Type, End-Use Industry and Region. |

|

Regions |

North America, Europe, Asia Pacific, South America and Middle East & Africa. |

|

Companies Covered |

Gestamp Automoción, S.A. (Spain), Arconic Corporation (US), American Axle & Manufacturing Holdings, Inc. (US), CIE Automotive S.A. (Spain), Interplex Holdings Pte. Ltd. (Singapore), AAPICO Hitech Public Company Limited (Thailand), Clow Stamping Company (US), Wiegel Tool Works, Inc. (US), Harvey Vogel Manufacturing Co. (US), ACRO Metal Stamping (US), Boker’s, Inc. (US), and Kenmode, Inc. (US) and others are covered in the metal stamping market. |

This research report categorizes the global metal stamping market on the basis of process, material, material thickness, press type, end-use industry and region.

Metal Stamping Market by Process

- Embossing

- Blanking

- Bending

- Coining

- Flanging

Metal Stamping Market by Material

- Steel

- Copper

- Aluminum

Metal Stamping Market by Material Thickness

- ≤0.4 mm

- >0.4 mm

Metal Stamping Market by Press Type

- Mechanical

- Hydraulic

- Servo

Metal Stamping Market by End Use

- Automotive

- Industrial Machinery

- Construction

- Electricals & Electronics

- Aerospace

- Telecommunication

- Medical

Metal Stamping Market by Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In December 2022, Gestamp Automoción S.A. acquired a 33% strategic stake in Gescrap Group to enhance its ESG (Environmental, Social, and Governance) plan.

- In November 2022, Arconic Corporation completed the sale of its Russian operations to Promyshlennye Investitsii LLC due to increasing uncertainty in light of the current geopolitical environment in Russia.

- In May 2022, Gestamp Hotstamping Japan announced a new plant building on its premises in Matsusaka. The expansion of the Matsusaka plant is scheduled to be operational by June 2023.

- In February 2022, American Axle & Manufacturing Holdings, Inc. invested USD 15 million in Autotech Ventures in a partnership providing access to new opportunities that complement AAM’s mission to develop and produce the industry’s most efficient and powerful electric drivelines.

- In January 2021, Interplex has acquired OCP Group, Inc (OCP), a custom connector and cable assembly design and manufacturer based in San Diego, California, US.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the metal stamping market?

The metal stamping market is expected to witness significant growth in the future due to the growing demand for lightweight materials, growing adoption of automation, technological advancements and growing demand for high-quality, precision parts in end-use industries.

What are the major challenges in the metal stamping market?

The major challenges in the metal stamping market are issues caused by lightweight material usage, global semiconductor shortage, lack of standardization and poor-quality stamping and tool wear.

What are the restraining factors in the metal stamping market?

The major restraining factor faced by the metal stamping market fluctuating raw material prices and trade policies and tariffs.

What is the key opportunity in the metal stamping market?

Industrialization and urbanization in emerging economies and increasing scope of metal stamping in medical industry are key opportunity in the metal stamping market.

What are the end-use industries where metal stamped components are used?

The metal stamped components are majorly used in automotive, industrial machinery, construction, electricals & electronics, aerospace, telecommunication and medical. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for lightweight materials- Growing adoption of automation- Technological advancements- Growing demand for high-quality, precision parts in end-use industriesRESTRAINTS- Trade policies and tariffs- Fluctuating raw material pricesOPPORTUNITIES- Infrastructural development- Industrialization and urbanization in emerging economies- Increasing scope of metal stamping in medical industryCHALLENGES- Issues caused by lightweight material usage- Global semiconductor shortage- Lack of standardization- Poor-quality stamping and tool wear

- 6.1 VALUE CHAIN ANALYSIS

-

6.2 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSRIVALRY AMONG EXISTING COMPETITORS

- 6.3 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS

-

6.4 TARIFF AND REGULATORY LANDSCAPE ANALYSISRESOURCE CONSERVATION AND RECOVERY ACTREGULATION (EU) 2018/858PHARMACEUTICALS AND MEDICAL DEVICES ACT

-

6.5 REGULATORY BODIES AND GOVERNMENT AGENCIESREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- International Automotive Task Force- US Food and Drug Administration- Vehicle Certification Agency (VCA)

- 6.6 SUPPLY CHAIN ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

-

6.8 ECOSYSTEM/MARKET MAP

-

6.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.10 KEY CONFERENCES & EVENTS, 2023–2024

- 6.11 RECESSION IMPACT: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- 6.12 TRADE ANALYSIS

-

6.13 PATENT ANALYSISDOCUMENT ANALYSISJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

6.14 CASE STUDY ANALYSISWIEGEL’S NEW HEV BATTERY AND ENGINE MODULE CONCEPT- Challenge- SolutionBERYLLIUM COPPER SPRING-CONTACT STAMPING FOR HEARING AID APPLICATIONMETAL PROCESSING COMPANY INCREASES PLANT UTILIZATION BY FOCUSING ON SCRAP MANAGEMENT- Challenge- Solution

-

6.15 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

- 7.1 INTRODUCTION

-

7.2 BLANKINGBLANKING PROCESS TO DOMINATE METAL STAMPING MARKET

-

7.3 EMBOSSINGABILITY TO CREATE VISUALLY APPEALING, DURABLE, AND VERSATILE DESIGNS TO BOOST USAGE

-

7.4 BENDINGHIGH PRECISION AND ACCURACY TO DRIVE RELIANCE ON BENDING

-

7.5 COININGHIGH-QUALITY, SMOOTH SURFACE FINISH TO SUPPORT DEMAND FOR COINING

-

7.6 FLANGINGFLANGING IS USED TO JOIN TWO OR MORE PARTS TOGETHER

- 7.7 OTHER PROCESSES

- 8.1 INTRODUCTION

-

8.2 STEELHIGH STRENGTH AND LOW COST TO DRIVE PREFERENCE FOR STEEL

-

8.3 ALUMINUMFLEXIBILITY, MALLEABILITY, AND EASE OF SHAPING TO SUPPORT USAGE

-

8.4 COPPERHIGH DUCTILITY IN VARIOUS APPLICATIONS TO SUSTAIN DEMAND

- 8.5 OTHER MATERIALS

- 9.1 INTRODUCTION

-

9.2 ≤0.4 MMFLEXIBILITY AND PRECISION TO PROPEL SEGMENT DEMAND

-

9.3 >0.4 MMSTRENGTH AND DURABILITY TO DRIVE DEMAND IN AUTOMOTIVE APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 MECHANICAL PRESSMECHANICAL PRESS TO REGISTER HIGHEST GROWTH RATE

-

10.3 HYDRAULIC PRESSGROWING USE IN FABRICATION AND MANUFACTURING OF INDUSTRIAL MACHINERY TO SUPPORT GROWTH

-

10.4 SERVO PRESSCHEAP PRODUCTION COSTS AND INCREASED PRODUCT QUALITY TO DRIVE USAGE OF SERVO PRESSES

- 10.5 OTHER PRESS TYPES

- 11.1 INTRODUCTION

-

11.2 AUTOMOTIVEAUTOMOTIVE INDUSTRY TO DOMINATE METAL STAMPING MARKET

-

11.3 INDUSTRIAL MACHINERYRISING DEMAND FOR CUSTOM COMPONENTS TO DRIVE MARKET

-

11.4 ELECTRICALS & ELECTRONICSRISING EV INDUSTRY AND INVESTMENTS IN ELECTRONICS MANUFACTURING TO PROPEL MARKET

-

11.5 AEROSPACEINCREASING AIR PASSENGER VOLUME AND INVESTMENT IN AIR DEFENSE TO BOOST MARKET

-

11.6 MEDICALIMPLANTS- Growing aging population and increasing access to healthcare to drive marketCONNECTORS- Increasing healthcare expenditure and advancement in medical technology to boost marketOTHER MEDICAL APPLICATIONS

-

11.7 TELECOMMUNICATIONINCREASING INVESTMENT IN 6G TECHNOLOGY AND RISING SMARTPHONE PENETRATION TO SUPPORT GROWTH

-

11.8 CONSTRUCTIONINCREASING BUILDING AND INFRASTRUCTURE PROJECTS TO DRIVE DEMAND FOR METAL STAMPING

- 11.9 OTHER END-USE INDUSTRIES

-

12.1 INTRODUCTIONRECESSION IMPACT, BY REGION

-

12.2 ASIA PACIFICCHINA- Increasing industrial activities and high growth of automotive sector to boost marketINDIA- Growing medical and automotive industries to propel marketSOUTH KOREA- Rising production and export of medical devices to fuel market growthJAPAN- Industrial digitalization and growing electronics industry to propel marketAUSTRALIA & NEW ZEALAND- Increasing infrastructural development to drive marketREST OF ASIA PACIFIC

-

12.3 EUROPEGERMANY- Presence of leading metal stamping companies to drive marketITALY- Increasing use of environmentally friendly manufacturing methods to bolster growthFRANCE- Rising use of modern technologies for making high-quality components in automotive industry to support growthSWITZERLAND- High-quality standards and precision production in medical industry to drive marketSWEDEN- Presence of leading manufacturers of metal stamping to boost marketUK- Advancements and improvements in UK metal stamping industry to bolster productionREST OF EUROPE

-

12.4 NORTH AMERICAUS- Growth of EV sector to drive demand for metal stampingCANADA- Growth in automotive sector to propel marketMEXICO- Developing construction industry to fuel market growth

-

12.5 SOUTH AMERICABRAZIL- Fiscal sustainability and structural reforms to boost marketARGENTINA- Government initiatives to strengthen automotive sector to fuel demand for metal stampingREST OF SOUTH AMERICA

-

12.6 MIDDLE EAST & AFRICASAUDI ARABIA- Growing construction activity, expansion in automotive industry, and rising consumer goods demand to augment marketUAE- Increasing need for precise and lightweight metal-stamped parts to propel marketREST OF MIDDLE EAST & AFRICA

- 13.1 OVERVIEW

-

13.2 MARKET SHARE ANALYSISRANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

-

13.3 KEY COMPANIES’ FIVE-YEAR REVENUE ANALYSISREVENUE ANALYSIS OF TOP PLAYERS

-

13.4 COMPANY EVALUATION QUADRANT, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

13.5 COMPETITIVE BENCHMARKING OF KEY PLAYERSSTRENGTH OF PRODUCT PORTFOLIOBUSINESS STRATEGY EXCELLENCE

-

13.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.7 DETAILED LIST OF KEY STARTUP/SMESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.8 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

14.1 KEY PLAYERSGESTAMP AUTOMOCIÓN, S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARCONIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMERICAN AXLE & MANUFACTURING HOLDINGS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCIE AUTOMOTIVE S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERPLEX HOLDINGS PTE. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAAPICO HITECH PUBLIC COMPANY LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCLOW STAMPING COMPANY- Business overview- Products/Solutions/Services offered- MnM viewWIEGEL TOOL WORKS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHARVEY VOGEL MANUFACTURING CO.- Business overview- Products/Solutions/Services offeredACRO METAL STAMPING- Business overview- Products/Solutions/Services offeredBOKER’S, INC.- Business overview- Products/Solutions/Services offeredKENMODE, INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER COMPANIESD&H INDUSTRIES, INC.ULTRA TOOL & MANUFACTURING, INC.NISSAN MOTOR CO., LTD.MAGNA INTERNATIONAL, INC.DONGGUAN DINGTONG PRECISION METAL CO., LTD.TEMPCO MANUFACTURING COMPANY, INC.WISCONSIN METAL PARTS, INC.MANOR TOOL & MANUFACTURING COMPANYKLESK METAL STAMPING, CO.GOSHEN STAMPING, LLCTHOMSON LAMINATION COMPANY, INC.SERTEC GROUP LTD.HEJU STAMPING

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 METAL FORMING MARKETMARKET DEFINITION- Metal forming market for automotive, by technique- Metal forming market for automotive, by forming type- Metal forming market for automotive, by application- Metal forming market for automotive, by material- Metal forming market for automotive, by vehicle type- Metal forming market for electric and hybrid vehicles, by vehicle type- Metal forming market for automotive, by region

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 METAL STAMPING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 METAL STAMPING MARKET: SUPPLY CHAIN

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- TABLE 5 METAL STAMPING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 6 INTERCHANGEABLE TOOLS FOR HAND TOOLS EXPORT DATA, HS CODE: 8207, 2022 (USD MILLION)

- TABLE 7 INTERCHANGEABLE TOOLS FOR HAND TOOLS IMPORT DATA, HS CODE: 8207, 2022 (USD MILLION)

- TABLE 8 LIST OF PATENTS BY SUZHOU TANGSHI MACHINERY MFG.

- TABLE 9 LIST OF PATENTS BY RAY ARBESMAN

- TABLE 10 LIST OF PATENTS BY HONDA MOTOR CO., LTD.

- TABLE 11 LIST OF PATENTS BY TIANJIN HUASHUN AUTO PARTS

- TABLE 12 LIST OF PATENTS BY AISIN AI CO. LTD.

- TABLE 13 US: TOP TEN PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 14 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 15 METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 16 METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 17 METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 18 METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 19 METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 20 MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 21 METAL STAMPING MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 22 ASIA PACIFIC: METAL STAMPING MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 23 ASIA PACIFIC: METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 24 ASIA PACIFIC: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 25 ASIA PACIFIC: METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 26 ASIA PACIFIC: METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 27 ASIA PACIFIC: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 28 ASIA PACIFIC: MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 29 CHINA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 30 CHINA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 31 INDIA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 32 INDIA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 33 SOUTH KOREA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 34 SOUTH KOREA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 35 JAPAN: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 36 JAPAN: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 37 AUSTRALIA & NEW ZEALAND: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 38 AUSTRALIA & NEW ZEALAND: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 39 REST OF ASIA PACIFIC: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 40 REST OF ASIA PACIFIC: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 41 EUROPE: METAL STAMPING MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 42 EUROPE: METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 43 EUROPE: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 44 EUROPE: METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 45 EUROPE: METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 46 EUROPE: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 47 EUROPE: MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 48 GERMANY: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 49 GERMANY: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 50 ITALY: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 51 ITALY: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 52 FRANCE: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 53 FRANCE: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 54 SWITZERLAND: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 55 SWITZERLAND: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 56 SWEDEN: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 57 SWEDEN: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 58 UK: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 59 UK: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 60 REST OF EUROPE: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 61 REST OF EUROPE: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 62 NORTH AMERICA: METAL STAMPING MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 63 NORTH AMERICA: METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 64 NORTH AMERICA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 65 NORTH AMERICA: METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 66 NORTH AMERICA: METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 67 NORTH AMERICA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 68 NORTH AMERICA: MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 69 US: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 70 US: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 71 CANADA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 72 CANADA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 73 MEXICO: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 74 MEXICO: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 75 SOUTH AMERICA: METAL STAMPING MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 76 SOUTH AMERICA: METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 77 SOUTH AMERICA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 78 SOUTH AMERICA: METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 79 SOUTH AMERICA: METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 80 SOUTH AMERICA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 81 SOUTH AMERICA: MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 82 BRAZIL: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 83 BRAZIL: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 84 ARGENTINA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 85 ARGENTINA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 86 REST OF SOUTH AMERICA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 87 REST OF SOUTH AMERICA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 88 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 89 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 90 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 91 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY MATERIAL THICKNESS, 2021–2028 (USD BILLION)

- TABLE 92 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY PRESS TYPE, 2021–2028 (USD BILLION)

- TABLE 93 MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 94 MIDDLE EAST & AFRICA: MEDICAL METAL STAMPING MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 95 SAUDI ARABIA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 96 SAUDI ARABIA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 97 UAE: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 98 UAE: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 99 REST OF MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY MATERIAL, 2021–2028 (USD BILLION)

- TABLE 100 REST OF MIDDLE EAST & AFRICA: METAL STAMPING MARKET, BY END-USE INDUSTRY, 2021–2028 (USD BILLION)

- TABLE 101 METAL STAMPING MARKET: DEGREE OF COMPETITION

- TABLE 102 METAL STAMPING MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 103 METAL STAMPING MARKET: DEALS, 2019 TO 2022

- TABLE 104 METAL STAMPING MARKET: OTHER DEVELOPMENTS, 2019 TO 2022

- TABLE 105 GESTAMP AUTOMOCIÓN S.A.: COMPANY OVERVIEW

- TABLE 106 GESTAMP AUTOMOCIÓN S.A.: PRODUCT LAUNCHES

- TABLE 107 GESTAMP AUTOMOCIÓN S.A.: DEALS

- TABLE 108 GESTAMP AUTOMOCIÓN S.A.: OTHERS

- TABLE 109 ARCONIC CORPORATION: COMPANY OVERVIEW

- TABLE 110 ARCONIC CORPORATION.: DEALS

- TABLE 111 ARCONIC CORPORATION: OTHERS

- TABLE 112 AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 113 AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.: DEALS

- TABLE 114 AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.: OTHERS

- TABLE 115 CIE AUTOMOTIVE S.A.: COMPANY OVERVIEW

- TABLE 116 CIE AUTOMOTIVE S.A.: DEALS

- TABLE 117 CIE AUTOMOTIVE S.A.: OTHERS

- TABLE 118 INTERPLEX HOLDINGS PTE. LTD.: COMPANY OVERVIEW

- TABLE 119 INTERPLEX HOLDINGS PTE. LTD.: PRODUCT LAUNCHES

- TABLE 120 INTERPLEX HOLDINGS PTE. LTD.: DEALS

- TABLE 121 AAPICO HITECH PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 122 AAPICO HITECH PUBLIC COMPANY LIMITED: DEALS

- TABLE 123 CLOW STAMPING COMPANY: COMPANY OVERVIEW

- TABLE 124 WIEGEL TOOL WORKS, INC.: COMPANY OVERVIEW

- TABLE 125 WIEGEL TOOL WORKS, INC.: OTHERS

- TABLE 126 HARVEY VOGEL MANUFACTURING CO.: COMPANY OVERVIEW

- TABLE 127 ACRO METAL STAMPING: COMPANY OVERVIEW

- TABLE 128 BOKER’S, INC.: COMPANY OVERVIEW

- TABLE 129 KENMODE, INC.: COMPANY OVERVIEW

- TABLE 130 KENMODE, INC.: OTHERS

- TABLE 131 METAL FORMING MARKET FOR AUTOMOTIVE, BY TECHNIQUE, 2017–2025 (MILLION TON)

- TABLE 132 METAL FORMING MARKET FOR AUTOMOTIVE, BY TECHNIQUE, 2017–2025 (USD BILLION)

- TABLE 133 METAL FORMING MARKET FOR AUTOMOTIVE, BY FORMING TYPE, 2017–2025 (MILLION TON)

- TABLE 134 METAL FORMING MARKET FOR AUTOMOTIVE, BY FORMING TYPE, 2017–2025 (USD BILLION)

- TABLE 135 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION, 2017–2025 (MILLION TON)

- TABLE 136 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION, 2017–2025 (USD BILLION)

- TABLE 137 AVERAGE MASS REDUCTION ACHIEVED BY LIGHTWEIGHT MATERIALS (%)

- TABLE 138 METAL FORMING MARKET FOR AUTOMOTIVE, BY MATERIAL, 2017–2025 (MILLION TON)

- TABLE 139 METAL FORMING MARKET FOR AUTOMOTIVE, BY MATERIAL, 2017–2025 (USD BILLION)

- TABLE 140 METAL FORMING MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2017–2025 (MILLION TON)

- TABLE 141 METAL FORMING MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE, 2017–2025 (USD BILLION)

- TABLE 142 METAL FORMING MARKET FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2017–2025 (000’ TON)

- TABLE 143 METAL FORMING MARKET FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE, 2017–2025 (USD BILLION)

- TABLE 144 METAL FORMING MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (MILLION TON)

- TABLE 145 METAL FORMING MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (USD BILLION)

- FIGURE 1 METAL STAMPING MARKET: RESEARCH DESIGN

- FIGURE 2 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 6 METAL STAMPING MARKET: DATA TRIANGULATION

- FIGURE 7 BLANKING TO SHOW HIGHEST GROWTH IN METAL STAMPING MARKET, BY PROCESS

- FIGURE 8 STEEL TO DOMINATE METAL STAMPING MATERIALS MARKET OVER FORECAST PERIOD

- FIGURE 9 ≤0.4 MM MATERIAL THICKNESS TO SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 MECHANICAL PRESS TO DOMINATE PRESS TYPE MARKET TILL 2028

- FIGURE 11 ASIA PACIFIC TO DOMINATE GLOBAL METAL STAMPING MARKET

- FIGURE 12 RISING DEMAND FOR LIGHTWEIGHT AND HIGH-STRENGTH METAL COMPONENTS IN AUTOMOTIVE INDUSTRY TO DRIVE METAL STAMPING MARKET

- FIGURE 13 CHINA ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 14 MEDICAL END-USE INDUSTRY TO REGISTER HIGHEST CAGR

- FIGURE 15 IMPLANTS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: METAL STAMPING MARKET

- FIGURE 18 METAL STAMPING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS: METAL STAMPING MARKET

- FIGURE 20 CHANGING REVENUE MIX IN METAL STAMPING MARKET

- FIGURE 21 ECOSYSTEM/ MARKET MAP

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 23 KEY BUYING CRITERIA FOR END-USE INDUSTRIES

- FIGURE 24 GRANTED PATENTS TO OVERALL PATENTS REGISTERED BETWEEN 2013 AND 2022

- FIGURE 25 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 26 NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 27 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 28 BLANKING PROCESS TO CAPTURE LARGEST SHARE OF METAL STAMPING MARKET BETWEEN 2023 AND 2028

- FIGURE 29 STEEL TO HOLD LARGEST MARKET SHARE BETWEEN 2023 AND 2028

- FIGURE 30 >0.4 MM SEGMENT TO HOLD LARGEST MARKET SHARE

- FIGURE 31 MECHANICAL PRESS TO DOMINATE METAL STAMPING MARKET

- FIGURE 32 AUTOMOTIVE INDUSTRY TO REGISTER HIGHEST GROWTH RATE OVER FORECAST PERIOD

- FIGURE 33 IMPLANTS TO CAPTURE LARGEST SHARE OF MEDICAL METAL STAMPING MARKET BETWEEN 2023 AND 2028

- FIGURE 34 INDIA TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 35 ASIA PACIFIC: METAL STAMPING MARKET SNAPSHOT

- FIGURE 36 EUROPE: METAL STAMPING MARKET SNAPSHOT

- FIGURE 37 COMPANIES ADOPTED MERGERS & ACQUISITIONS AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2022

- FIGURE 38 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 39 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 41 METAL STAMPING MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 42 METAL STAMPING MARKET: COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 43 GESTAMP AUTOMOCIÓN S.A.: COMPANY SNAPSHOT

- FIGURE 44 ARCONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 AMERICAN AXLE & MANUFACTURING HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 46 CIE AUTOMOTIVE S.A.: COMPANY SNAPSHOT

- FIGURE 47 AAPICO HITECH PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

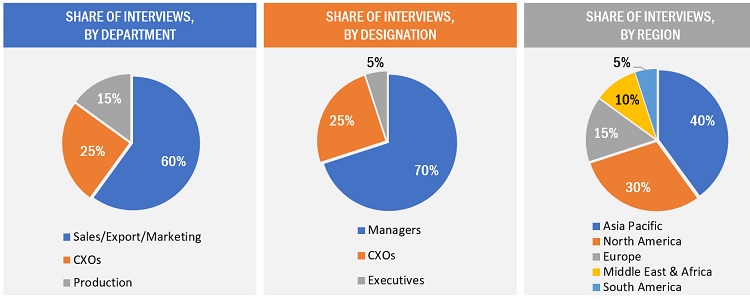

This research involved using extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect valuable information for a technical and market-oriented study of the metal stamping market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of this industry's value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The metal stamping market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, and CXOs of companies in the silicone market. Primary sources from the supply side include associations and institutions involved in the metal stamping industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate the metal stamping market by material thickness, press type, process, material, end-use industry, and region. The research methodology used to calculate the market size included the following steps:

- The key players in the metal stamping market were identified through secondary research, and their revenues were determined through primary and secondary research.

- The market size of metal stamping was derived from the aggregation of the market shares of the leading players. The forecast was based on an analysis of market trends, such as pricing and usage of metal stamping in various end-use industries.

- The market size of metal stamping, by region, was calculated using the market sizes of each process in each end-use industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

Metal stamping is a manufacturing technique that shapes flat metal sheets or strips into specific forms using a press. It is a complicated process involving various metal-forming techniques. Metal stamping has several advantages, including the capacity to manufacture large quantities of parts rapidly and cost-effectively and the capacity to manufacture complex shapes and designs with extreme accuracy and precision.

Key Stakeholders:

- Senior Management

- Finance/ Procurement Department

- R&D Department

- End user/ Operator

Data Triangulation

After arriving at the overall market size, the overall market was split into several segments. To complete the market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The market was also validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there were three sources — the top-down approach, the bottom-up approach, and interviews with experts. Data were assumed correct only when the values from these three sources matched.

Report Objectives

- To define, describe, and forecast the metal stamping market based on process, material, material thickness, press type, end-use industry, and region

- To forecast the market size, in terms of value, five main regions: Europe, Asia Pacific, North America, the Middle East & Africa, and South America

- To provide detailed information regarding the key factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze competitive developments, such as mergers & acquisitions, product launches, expansions, and partnerships & agreements, in the metal stamping market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the North America metal stamping market

- Further breakdown of the Rest of Europe's metal stamping market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metal Stamping Market