Microlearning Market by Component (Solution and Services), Organization Size, Deployment Type, Industry (Retail, Manufacturing and Logistics, BFSI, Telecom and IT, Healthcare and Life Sciences), and Region - Global Forecast to 2024

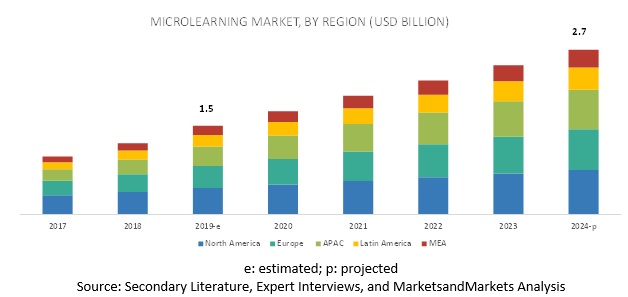

[123 Pages Report] The global microlearning market size is expected to grow from USD 1.5 billion in 2019 to USD 2.7 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 13.2% during the forecast period. Increasing demand for training deskless and mobile workers across industries and growing need for skills-based and result-oriented training among enterprises are the major factors driving the growth of the market. Lack of impetus among learners and lack of awareness of microlearning benefits are the challenges.

By vertical, the manufacturing vertical to be a significant contributor in the microlearning market during the forecast period

Microlearning in the manufacturing and logistics industry focuses on increasing efficiency, maintaining/improving quality, and complying with safety policies. Skilled technicians can greatly improve the efficiency of the manufacturing and logistics operations, and the quality of the final product. By leveraging microlearning, employees can learn content by staying on their working premises, thus increasing the overall business productivity. A short burst of training lessons is used by technicians, factory workers, drivers, and other staff members to get quickly aligned with machines, processes, and compliances.

On-premise type to hold the highest market share during the forecast period

The on-premises microlearning solution is deployed on the server of the client organization; however, the user or buyer needs to acquire a license to use the microlearning solution, which is also customizable. The setup and maintenance are taken care of by the internal IT staff of the buyer, who has full control over the microlearning solution. The on-premises microlearning solution enables enterprises to create, store, and deliver business-critical data and control access to training programs. The percentage share of on-premises microlearning solution is decreasing, as these applications demand high-initial investments and long-term developer commitment. The on-premises microlearning solution is used by enterprises in which the continuous availability of a learning system is significant for the business process outcome. With the deployment of an on-premises microlearning solution, enterprises get greater control over the investments made for setting up the infrastructure, as it decreases the overall network cost.

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific (APAC) is emerging as the fastest-growing market for microlearning solutions. APAC organizations are trying their best to gain better Return on Investment (ROI) on talent development and employee training, and receive quantifiable business outcomes. Various organizations prefer technology-enabled learning approaches to offer training and resources to their learners, which are also cost-effective, as they have tight learning budgets. Several learning solution vendors are expanding their reach and exploring opportunities in APAC by offering a personalized learning environment.

Key Microlearning Market Players

The major vendors in the microlearning market are Saba Software (US), Axonify (Canada), IBM (US), Bigtincan (US), SwissVBS (Canada), iSpring Solutions (US), Epignosis (US), Cornerstone OnDemand (US), and Qstream (US).

Axonify (Canada) is one of the leading players in the microlearning market due to its innovative and industry-specific solution. The company offers a microlearning platform, which is used by diverse industries, such as retail, manufacturing, transportation and logistics, finance, and insurance. The Axonify Platform offers various integration modules that include Axonify Learn, Axonify Exchange, Micro Content, Axonify Discover, and Axonify Impact, which improve learning and development process. Axonify Learn enables learning to be fun-filled and personalized. With Axonify Exchange, microlearning content can be created or ready to go topics can be pulled. Axonify Discover is powered by an intelligent search process that scans every resource (even video) to serve up the right information quickly for employees by connecting them with their workplace. Axonify Impact impacts the learning process by using big data. The company mostly uses a partnership strategy to expand its business.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (Solution, and Services), Organization Sizes, Deployment Types, Industries, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Saba Software (US), Axonify (Canada), IBM (US), Bigtincan (US), SwissVBS (Canada), iSpring Solutions (US), Epignosis (US), Cornerstone OnDemand (US), Qstream (US) and others |

This research report categorizes the microlearning market to forecast revenues and analyze trends in each of the following submarkets:

By component, the microlearning market has been segmented as follows:- Solution

- Services

- Consulting and Implementation

- Support and Maintenance

By organization type, the microlearning market has been segmented as follows:

- Large Enterprises

- SMEs

By deployment type, the microlearning market has been segmented as follows:

- On-premises

- Cloud

By industry, the microlearning market has been segmented as follows:

- Retail

- Manufacturing and Logistics

- BFSI

- Telecom and IT

- Healthcare and Life Sciences

- Others (Education, Travel and Hospitality, Media and Entertainment, and Energy and Utilities)

By regions, the microlearning market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- China

- India

- Rest of APAC

- MEA

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin Americ

Key Questions Addressed by the Report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the microlearning market?

- Which are the major factors expected to drive the market?

- Which region would offer high growth for vendors in the market?

- Which solution would gain the highest market share in the market?

Frequently Asked Questions (FAQ):

Who are the top companies providing Microlearning Platform Services?

Saba Software, Mindtree, Axonify, IBM, Bigtincan, SwissVBS, iSpring Solutions, Epignosis, Cornerstone OnDemand, Qstream, Pryor Learning Solutions, count5, mLevel, Gnowbe, Trivantis, SweetRush, Multiversity, and Neovation Learning Solutions.

What are the industries adopting Microlearning Platform Services?

The following are major industries adopting Microlearning Platform Services; retail, manufacturing & logistics, BFSI, Telecom & IT and Healthcare & Lifesciences.

What are various trends in Microlearning Platform Services?

Driver:

- Increasing Demand for Training Deskless and Mobile Workers Across Industries

- Growing Need for Skills-Based and Result-Oriented Training Among Enterprises

Opportunities:

- Gamification of Training and Education to Boost the Adoption of Microlearning

- Growing Traction for Personalized and Adaptive Microlearning to Drive Market Growth

- Increasing Usage of AR, VR, AI and ML, and Mobile Technology to Boost the Growth of Microlearning Market

What are challenges faced by Microlearning Platform Services?

The following are the challenges faced by Microlearning market;

- Lack of Impetus Among Learners

- Lack of Awareness Regarding Microlearning Benefits

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Microlearning Market

4.2 Market in North America, By Industry and Country, 2019

4.3 Market Major Countries

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Training Deskless and Mobile Workers Across Industries

5.2.1.2 Growing Need for Skills-Based and Result-Oriented Training Among Enterprises

5.2.2 Restraints

5.2.2.1 Reluctance of Enterprises to Spend Huge Amount on Transforming Existing Training Content Into Microcontent

5.2.3 Opportunities

5.2.3.1 Gamification of Training and Education to Boost the Adoption of Microlearning

5.2.3.2 Growing Traction for Personalized and Adaptive Microlearning to Drive Market Growth

5.2.3.3 Increasing Usage of AR, VR, AI and ML, and Mobile Technology to Boost the Growth of Microlearning Market

5.2.4 Challenges

5.2.4.1 Lack of Impetus Among Learners

5.2.4.2 Lack of Awareness Regarding Microlearning Benefits

5.3 Use Cases

5.3.1 Bloomingdales

5.3.2 Raymour & Flanigan

5.3.3 Concussion Legacy Foundation

6 Microlearning Market By Component (Page No. - 36)

6.1 Introduction

6.2 Solution

6.2.1 Increasing Demand for Short Duration Learning and Development Programs Leading to the Growth of Microlearning Solutions

6.3 Services

6.3.1 Consulting and Implementation

6.3.1.1 Growing Requirement Among Organizations to Implement Efficient and Engaging Learning Solutions to Drive the Growth of Consulting and Implementation Services

6.3.2 Support and Maintenance

6.3.2.1 Growing Need for Thorough Support and Maintenance of the Microlearning Solution to Drive the Demand for Support and Maintenance Services

7 Microlearning Market By Organization Size (Page No. - 43)

7.1 Introduction

7.2 Large Enterprises

7.2.1 Large Enterprises to use Microlearning for Streamlining Training Programs

7.3 Small and Medium-Sized Enterprises

7.3.1 Need to Reduce the Cost and Time for Learning Activities to Fuel the Growth of the Microlearning Solution in Small and Medium-Sized Enterprises

8 Microlearning Market By Deployment Type (Page No. - 47)

8.1 Introduction

8.2 On-Premises

8.2.1 Higher Security Leveraged Through On-Premises Solution

8.3 Cloud

8.3.1 Growing Demand for Scalable and Cost-Effective Solutions to Boost the Adoption of Cloud-Based Microlearning Solution

9 Microlearning Market By Industry (Page No. - 51)

9.1 Introduction

9.2 Retail

9.2.1 Frequent Upgrades Related to Product and Promotions to Fuel the Growth of the Market in the Retail Industry

9.3 Manufacturing and Logistics

9.3.1 Transition From Traditional Methods of Learning to On-The-Go Methods of Learning to Fuel the Microlearning Market Growth

9.4 Banking, Financial Services and Insurance

9.4.1 Providing Regular Training to Employees Concerning Compliance to Boost the Market Growth in the BFSI Industry

9.5 Telecom and IT

9.5.1 Growing Need for Skills-Based and Result-Oriented Efficient Training and Development Programs to Boost the Adoption of Microlearning in the Telecom and IT Industry

9.6 Healthcare and Life Sciences

9.6.1 Growing Need to Enhance Performance of Frontline Employees to Drive the Growth of Microlearning in the Healthcare and Life Sciences Industry

9.7 Others

10 Microlearning Market, By Region (Page No. - 59)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Presence of a Large Number of Microlearning Solution Providers to Drive the Market Growth in the US

10.2.2 Canada

10.2.2.1 Growing Adoption of Short Training Modules for Employee Learning to Boost the Market in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Requirement of Continuous Training of Employees to Increase the Microlearning Market in the UK

10.3.2 Germany

10.3.2.1 Growing Need Among Large Enterprises for Short and Efficient Training to Drive Adoption of Microlearning in Germany

10.3.3 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Growing Requirement of Flexible Training Programs to Fuel the Growth of the Market in China

10.4.2 India

10.4.2.1 Government Initiatives to Promote the Growth of the Market in India

10.4.3 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 United Arab Emirates

10.5.1.1 Growing Need Among Enterprises for Efficient and Result Oriented Training Programs to Drive Adoption of Microlearning in UAE

10.5.2 Kingdom of Saudi Arabia

10.5.2.1 Government Initiatives to Boost Adoption of Microlearning in Ksa

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Government Initiatives for Digitalization of Education to Fuel the Adoption of Microlearning Solutions in Brazil

10.6.2 Mexico

10.6.2.1 Focus on Adoption of Digital Mediums for Efficient Training and Development of Employees By Enterprises to Drive the Microlearning Market in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 79)

11.1 Introduction

11.2 Competitive Scenario

11.2.1 New Product/Service Launches and Product Enhancements

11.2.2 Partnerships, Collaborations, and Agreements

11.2.3 Mergers and Acquisitions

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Dynamic Differentiators

11.3.3 Innovators

11.3.4 Emerging Companies

12 Company Profiles (Page No. - 85)

(Business Overview, Platforms, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Saba Software

12.2 Mindtree

12.3 Axonify

12.4 IBM

12.5 Bigtincan

12.6 SwissVBS

12.7 iSpring Solutions

12.8 Epignosis

12.9 Cornerstone OnDemand

12.10 Qstream

12.11 Pryor Learning Solutions

12.12 Count5

12.13 Crossknowledge

12.14 mLevel

12.15 Gnowbe

12.16 Trivantis

12.17 SweetRush

12.18 Multiversity

12.19 Neovation Learning Solutions

*Details on Business Overview, Platforms, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (56 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Microlearning Market Size, By Component, 20172024 (USD Million)

Table 4 Solution: Market Size By Region, 20172024 (USD Million)

Table 5 Services: Market Size By Type, 20172024 (USD Million)

Table 6 Services: Market Size By Region, 20172024 (USD Million)

Table 7 Consulting and Implementation Market Size, By Region, 20172024 (USD Million)

Table 8 Support and Maintenance Market Size, By Region, 20172024 (USD Million)

Table 9 Microlearning Market Size, By Organization Size, 20172024 (USD Million)

Table 10 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 11 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 12 Microlearning Market Size, By Deployment Type, 20172024 (USD Million)

Table 13 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 14 Cloud: Market Size By Region, 20172024 (USD Million)

Table 15 Microlearning Market Size, By Industry, 20172024 (USD Million)

Table 16 Retail: Market Size By Region, 20172024 (USD Million)

Table 17 Manufacturing and Logistics: Market Size By Region, 20172024 (USD Million)

Table 18 Banking, Financial Services and Insurance: Market Size By Region, 20172024 (USD Million)

Table 19 Telecom and IT: Microlearning Market Size, By Region, 20172024 (USD Million)

Table 20 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Million)

Table 21 Others: Market Size By Region, 20172024 (USD Million)

Table 22 Microlearning Market Size, By Region, 20172024 (USD Million)

Table 23 North America: Market Size By Component, 20172024 (USD Million)

Table 24 North America: Market Size By Service, 20172024 (USD Million)

Table 25 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 26 North America: Market Size By Deployment Type, 20172024 (USD Million)

Table 27 North America: Market Size By Industry, 20172024 (USD Million)

Table 28 North America: Market Size By Country, 20172024 (USD Million)

Table 29 Europe: Microlearning Market Size, By Component, 20172024 (USD Million)

Table 30 Europe: Market Size By Service, 20172024 (USD Million)

Table 31 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 32 Europe: Market Size By Deployment Type, 20172024 (USD Million)

Table 33 Europe: Market Size By Industry, 20172024 (USD Million)

Table 34 Europe: Market Size By Country, 20172024 (USD Million)

Table 35 Asia Pacific: Microlearning Market Size, By Component, 20172024 (USD Million)

Table 36 Asia Pacific: Market Size By Service, 20172024 (USD Million)

Table 37 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 38 Asia Pacific: Market Size By Deployment Type, 20172024 (USD Million)

Table 39 Asia Pacific: Market Size By Industry, 20172024 (USD Million)

Table 40 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 41 Middle East and Africa: Microlearning Market Size, By Component, 20172024 (USD Million)

Table 42 Middle East and Africa: Market Size By Service, 20172024 (USD Million)

Table 43 Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 44 Middle East and Africa: Market Size By Deployment Type, 20172024 (USD Million)

Table 45 Middle East and Africa: Market Size By Industry, 20172024 (USD Million)

Table 46 Middle East and Africa: Market Size By Country, 20172024 (USD Million)

Table 47 Latin America: Microlearning Market Size, By Component, 20172024 (USD Million)

Table 48 Latin America: Market Size By Service, 20172024 (USD Million)

Table 49 Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 50 Latin America: Market Size By Deployment Type, 20172024 (USD Million)

Table 51 Latin America: Market Size By Industry, 20172024 (USD Million)

Table 52 Latin America: Market Size By Country, 20172024 (USD Million)

Table 53 New Product/Service Launches and Product Enhancements, 20172019

Table 54 Partnerships, Collaborations, and Agreements, 20182019

Table 55 Mergers and Acquisitions, 20152018

Table 56 Evaluation Criteria

List of Figures (27 Figures)

Figure 1 Microlearning Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Segments With a Higher Market Share in the Microlearning Market in 2019

Figure 4 North America to Account for the Highest Market Share in 2019

Figure 5 Growing Focus of Organizations on Enhancing Employee Performance Through Efficient Training to Drive the Growth of Microlearning Market

Figure 6 Retail Industry and the United States to Account for High Market Shares in the North American Microlearning Market in 2019

Figure 7 India to Grow at the Highest CAGR During the Forecast Period

Figure 8 Drivers, Restraints, Opportunities, and Challenges: Microlearning Market

Figure 9 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 10 Support and Maintenance Segment to Grow at a Higher CAGR During the Forecast Period

Figure 11 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 12 Cloud Segment to Grow at a Higher CAGR During the Forecast Period

Figure 13 Healthcare and Life Sciences Industry to Grow at the Highest CAGR During the Forecast Period

Figure 14 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 15 North America: Market Snapshot

Figure 16 Asia Pacific: Market Snapshot

Figure 17 Key Developments By the Leading Players in the Microlearning Market During 20172019

Figure 18 Microlearning Market (Global) Competitive Leadership Mapping, 2019

Figure 19 Saba Software: SWOT Analysis

Figure 20 Mindtree: Company Snapshot

Figure 21 Mindtree: SWOT Analysis

Figure 22 Axonify: SWOT Analysis

Figure 23 IBM: Company Snapshot

Figure 24 IBM: SWOT Analysis

Figure 25 Bigtincan: Company Snapshot

Figure 26 Bigtincan: SWOT Analysis

Figure 27 Cornerstone OnDemand: Company Snapshot

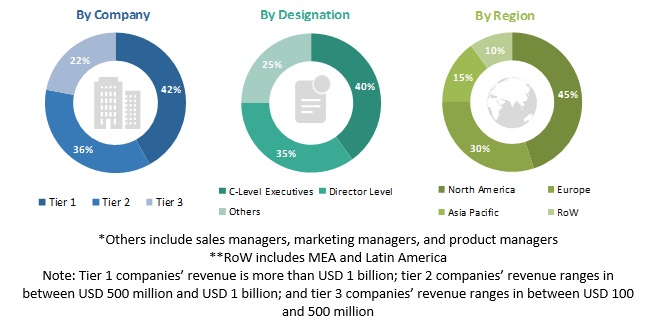

The study involved 4 major activities in estimating the current market size for the microlearning market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the microlearning market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, and various journals for e-Learning, such as Current Issues in Emerging eLearning (CIEE), The Electronic Journal of e-Learning (EJEL), International Journal of Advanced Corporate Learning (iJAC), and Australasian Journal of Educational Technology (AJET) have been referred, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The microlearning market comprises several stakeholders, such as microlearning vendors, eLearning content providers, training and education service providers, cloud solution provider, cloud service brokers, system integrators, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand-side of the market consists of enterprises across industries, including retail, manufacturing and logistics, Banking, Financial Services, and Insurance (BFSI), telecom and IT, and healthcare and life sciences. The supply-side includes microlearning solution providers offering microlearning solution and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Microlearning Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microlearning market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Various factors impacting the microlearning market, such as recent developments, regulations, technology maturity, research and development, IT spending, startup ecosystem, organization size, cloud technology, and mobile technology, have been considered in the study.

Report Objectives

- To define, describe, and forecast the microlearning market by component (solution and services), deployment type, organization size, industry, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders, by identifying the high-growth segments of the microlearning market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegments

- To analyze the competitive developments, such as product/service launches and product enhancements, partnerships, collaborations, agreements, and mergers and acquisitions, and, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market into the US and Canada

- Further breakup of the European market into the UK, Germany, and Rest of Europe

- Further breakup of the APAC market into ANZ, Japan, and Rest of APAC

- Further breakup of the MEA market into Africa and the Middle East

- Further breakup of the Latin American market into Brazil, Mexico, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Microlearning Market