Military Cloud Computing Market by Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), Service Model (Infrastructure as a Service ,Platform as a Service, and Software as a service), Application, End User and Region - Global Forecast to 2028

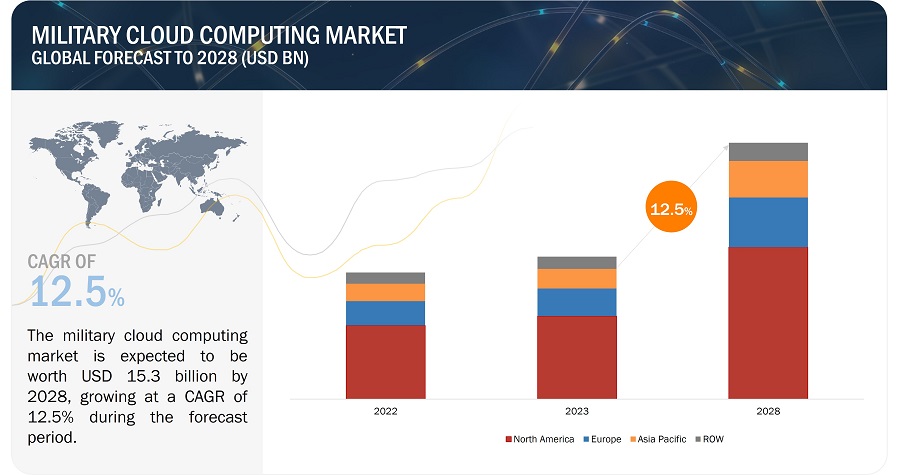

[233 Pages Report] The military cloud computing market is estimated to be USD 8.5 billion in 2023 and is projected to reach USD 15.3 billion by 2028, at a CAGR of 12.5% from 2023 to 2028. The primary key driving factor for the growth of the military cloud computing market is the increasing need for efficient and secure data management and communication in modern military operations. Modern armed forces are highly reliant on data for intelligence, surveillance, reconnaissance, decision-making, and mission-critical applications. Cloud computing offers a scalable, cost-effective, and flexible solution to manage and process vast amounts of data, ensuring that military personnel have timely access to critical information and applications. Furthermore, the cloud provides advanced security measures to protect sensitive military data and enhances interoperability for joint operations and coalition efforts.

Military Cloud Computing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military Cloud Computing Market Dynamics:

Drivers: Access to Advanced Technologies

In today's rapidly evolving defense landscape, staying ahead of adversaries and maintaining a technological edge is crucial for military organizations. Cloud computing provides a gateway to access and leverage advanced technologies that can enhance military capabilities and enable innovation. By leveraging cloud computing, military entities can harness the computational power and scalability needed to process vast amounts of data and derive valuable insights. The cloud provides the infrastructure and tools necessary to perform complex data analysis, pattern recognition, and predictive modeling, enabling military organizations to make data-driven decisions, optimize resource allocation, and identify emerging threats.

Cloud computing also enables rapid prototyping and experimentation, reducing the time and cost required to develop and test new technologies. Military organizations can leverage cloud-based environments to simulate and evaluate various scenarios, optimize equipment performance, and refine operational strategies.

Overall, access to advanced technology through cloud computing drives the military cloud computing market. The ability to harness the power of AI, ML, big data analytics, and cybersecurity advancements empowers military organizations to enhance their operational capabilities, improve decision-making processes, and maintain a technological advantage. By embracing cloud-based solutions, the military can leverage advanced technologies more effectively and efficiently, ensuring they remain at the forefront of innovation and preparedness in an ever-evolving defense landscape.

Restraints: Security Concerns

Security is a top priority for military organizations, and concerns about data breaches, unauthorized access, and cyber threats can hinder the adoption of cloud computing. Defense agencies require stringent security measures and assurances to protect sensitive and classified information stored and processed in the cloud.

One of the primary security concerns is the risk of unauthorized access to sensitive military data. With cloud-based systems, data is stored and processed in remote data centers operated by cloud service providers. This introduces the challenge of ensuring secure transmission and storage of data, protecting it from unauthorized access, interception, or breaches. The potential for cyberattacks, data breaches, or insider threats raises concerns about the confidentiality, integrity, and availability of military information.

Another security concern is the risk of data sovereignty and jurisdiction. Military organizations often have specific requirements and regulations regarding the storage and processing of sensitive data within their own national boundaries. When adopting cloud computing solutions, there is a need to ensure compliance with data sovereignty regulations and address concerns about data being stored or processed in foreign jurisdictions, which may introduce legal and geopolitical risks.

To address these security concerns, military organizations must implement robust security measures and adopt best practices for securing cloud-based systems. This includes implementing strong access controls, encryption mechanisms, intrusion detection and prevention systems, and continuous monitoring of cloud environments. It also involves establishing comprehensive security policies, conducting regular security audits, and fostering a strong security culture within the organization.

Opportunities: Advanced Analytics and Intelligence

Cloud computing enables the processing and analysis of vast amounts of data in real-time, offering opportunities for advanced analytics and intelligence capabilities. Defense organizations can leverage cloud-based platforms to gain actionable insights from data collected from various sources, including sensors, surveillance systems, and social media. This empowers military decision-makers with enhanced situational awareness, predictive modeling, and intelligence-driven operations.

Advances in analytics and intelligence have significantly transformed the landscape of Military Cloud Computing (MCC), providing the military with powerful capabilities to extract valuable insights from vast amounts of data. The collection and integration of diverse data sources, ranging from sensors to unmanned systems and satellites, enables the military to gather comprehensive situational awareness and intelligence. Through the application of advanced analytics techniques, such as big data analytics, machine learning, and artificial intelligence, the military can process and analyze massive volumes of data in real-time or near-real-time. These techniques enable the identification of patterns, trends, and anomalies that may not be readily apparent through traditional analysis methods.

The integration of analytics and intelligence capabilities into the MCC ecosystem empowers military decision-makers with actionable insights for mission planning, operational optimization, threat detection, and situational awareness. It allows for rapid data-driven decision-making, enhancing the effectiveness and efficiency of military operations. Furthermore, advanced analytics and intelligence in MCC facilitate predictive analytics, enabling the military to anticipate and proactively respond to emerging threats and changing scenarios. Overall, the integration of advanced analytics and intelligence capabilities in MCC represents a significant advancement in military operations, providing the military with a competitive edge by harnessing the power of data to gain actionable insights and make informed decisions.

Challenges: Connectivity and Bandwidth Limitations

Cloud Computing (MCC) relies heavily on robust and reliable network connectivity to facilitate data transmission, real-time communication, and seamless access to cloud resources. However, in military operations, the availability of high-speed and stable network connections can be limited or compromised due to various factors.

Deploying MCC in remote or austere environments often entails dealing with limited or unreliable network infrastructure. These locations may lack sufficient internet connectivity or have limited bandwidth capacity, making it challenging to establish and maintain consistent communication with the cloud infrastructure. Bandwidth limitations can hinder the transfer of large amounts of data and affect the performance of cloud-based applications and services.

Another challenge is the need for secure and reliable connectivity between the military's on-premises systems and the cloud environment. Establishing secure connections, such as virtual private networks (VPNs) or dedicated communication channels, while maintaining high data transfer rates and low latency can be complex and resource intensive.

Collaboration between military organizations, cloud service providers, and network infrastructure providers is crucial in addressing these challenges. By leveraging advanced networking technologies, deploying robust connectivity solutions, and prioritizing the optimization of data transfer and communication, the MCC community can overcome connectivity and bandwidth limitations to ensure reliable and efficient military cloud operations.

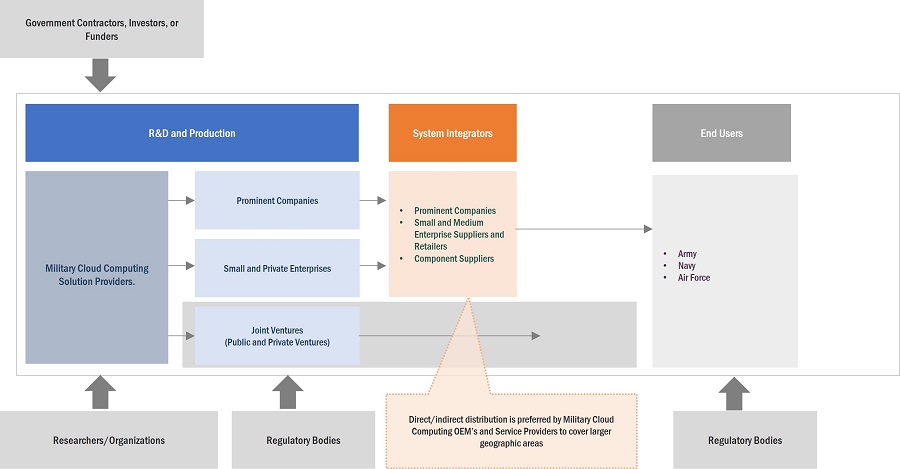

Military Cloud Computing Market Ecosystem

Amazon (US), Raytheon Technologies Corporation (US), Microsoft Corporation (US), Google (US), Atos (US), Oracle (US), IBM (US), Atos (France), General Dynamics Corporation (US), Bae Systems (UK), SAIC (US) are some of the leading companies in the military cloud computing market.

Based on Deployment Type, the private cloud segment accounts for the highest market share in military cloud computing during the forecast period

Private military cloud computing accounts for the highest market share due to its ability to meet the unique and stringent requirements of military organizations. Unlike public clouds, private clouds are dedicated to a single entity, ensuring complete control over data and infrastructure, which is a paramount concern for the military. Security is of utmost importance, and private clouds allow for the implementation of highly customized security measures, including strict access controls, encryption, and compliance with military and government standards. Additionally, military operations often involve sensitive and classified information, making data sovereignty a critical factor. Private clouds enable military organizations to maintain data within their own jurisdiction, ensuring sovereignty and compliance with national regulations.

Based on Service Model, the Infrastructure as a Service segment accounts for the highest market share in military cloud computing during the forecast period.

Infrastructure as a Service (IaaS) commands the highest market share in military cloud computing due to its fundamental role in providing the essential building blocks for a wide range of military applications and operations. IaaS offers military organizations a comprehensive and flexible cloud infrastructure, including virtualized computing resources, storage, and networking capabilities. IaaS provides military users with a high degree of customization and control over their virtualized infrastructure. This level of flexibility is crucial in addressing the diverse and dynamic needs of military operations, allowing them to tailor resources to specific mission requirements.

Based on End User, the air force segment is projected to grow at the highest CAGR during the forecast period.

The Air Force segment is experiencing the highest growth in the global military cloud market for several compelling reasons. Firstly, air operations have become increasingly data-intensive, relying on real-time information from a multitude of sensors, drones, and surveillance systems. Military cloud computing provides the necessary infrastructure to collect, process, and disseminate this data efficiently, enhancing situational awareness and decision-making capabilities.

Secondly, the Air Force's need for agility and rapid response has driven the adoption of cloud solutions. Cloud computing allows for the quick provisioning of resources, enabling the deployment of critical applications and services in a matter of minutes, a vital capability in an ever-changing operational environment.

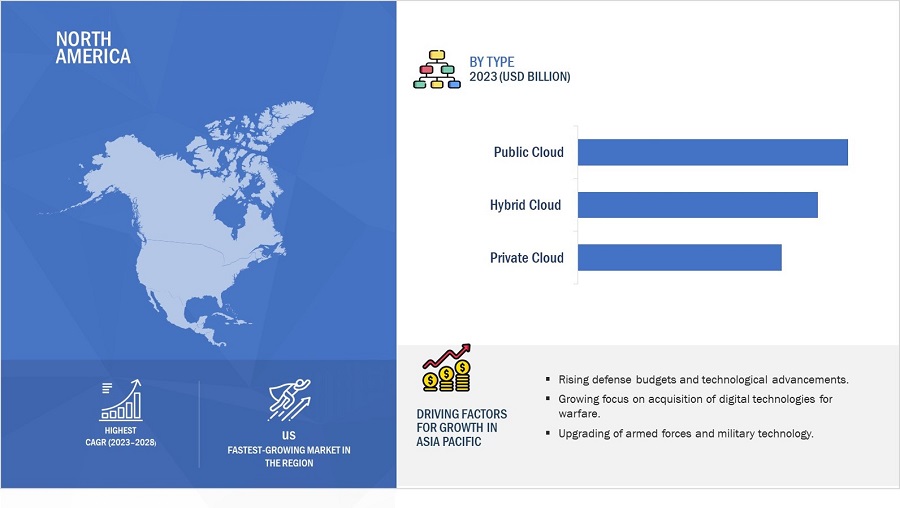

North America is expected to lead the military cloud computing market in 2023.

Military Cloud Computing in the North America region are experiencing significant growth due to several key factors.

- Technological Advancements: North America, particularly the United States, is a global leader in technology innovation. The region is home to numerous tech giants and cloud service providers that have pioneered cloud computing solutions for various industries, including the military.

- Defense Budget: The United States, in particular, maintains the largest defense budget in the world, allowing for substantial investments in military cloud computing infrastructure, research, and development.

- Cybersecurity Focus: Cybersecurity is a top priority for North American militaries. Leading cloud providers in the region invest heavily in security measures, including advanced threat detection, encryption, and access controls, aligning with stringent military and government security standards.

Military Cloud Computing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key market players

Amazon (US), Raytheon Technologies Corporation (US), Microsoft Corporation (US), Google (US), Atos (US), Oracle (US), IBM (US), Atos (France), General Dynamics Corporation (US), Bae Systems (UK), SAIC (US) are some of the leading companies in the military cloud computing companies. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Deployment type, Service Model, Application, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

Amazon (US), Google (US), Microsoft Corporation (US), Oracle (US), Dell Technologies (US), Thales Group (France), IBM (US), Cisco, Atos (France) |

Military Cloud Computing Market Highlights

This research report categorizes military cloud computing market based on Deployment type, Service Model, Application, End User, and Region

|

Segment |

Subsegment |

|

By Deployment Type: |

|

|

By Service Model: |

|

|

By Range: |

|

|

By Application: |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments

- In December 2022, US Depeartment of Defense (DoD) awarded a contract USD 9 billion as part of its Joint Warfighter Cloud Capability to 4 companies which includes Amazon (US), Microsoft Corporation (US), Oracle (US), Google (US). The Contract is awarded for a duration of 6 years.

- In November 2020, general Dynamics Corporation (US) was awarded a contract by the US Department of defense to support DoD cloud strategy. The Contract was valued at USD 4.4 billion and was awarded for a duration of 10 years.

Key Questions Addressed by the Report

What is the current size of the military cloud computing market?

The military cloud computing market is estimated to be USD 8.5 billion in 2023 and is projected to reach USD 15.3 billion by 2028, at a CAGR of 12.5% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the military cloud computing market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the military cloud computing market. Amazon (US), Raytheon Technologies Corporation (US), Microsoft Corporation (US), Google (US), Atos (US), Oracle (US), IBM (US), Atos (France), General Dynamics Corporation (US), Bae Systems (UK), SAIC(US) are some of the leading companies in the military cloud computing market.

What new emerging technologies and use cases disrupt the military cloud computing Market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of quantum computing, block chain and hyperspectral imaging.

Who are the key players and innovators in the ecosystem of the military cloud computing market?

Response: . Amazon (US), Raytheon Technologies Corporation (US), Microsoft Corporation (US), Google (US), Atos (US), Oracle (US), IBM (US), Atos (France), General Dynamics Corporation (US), Bae Systems (UK), SAIC(US).

Which region is expected to hold the highest market share in the military cloud computing market?

Response: In 2023, North America is expected to hold the greatest market share for military cloud computing during the forecast period, US is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Improved collaboration and information sharing- Digital transformation- Scalability and flexibility- Access to advanced technologies- StandardizationRESTRAINTS- Security concerns- Cultural and organizational resistance- Legacy systems integrationOPPORTUNITIES- Advanced analytics and intelligence- Secure collaboration and interoperability- Cost savings and resource optimization- Emerging technologies integration- Global market expansionCHALLENGES- Connectivity and bandwidth limitations- Compliance and regulatory challenges- Dependence on third-party providers

-

5.3 TRENDS IMPACTING CUSTOMER BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY CLOUD COMPUTING SOLUTION PROVIDERS

-

5.4 RECESSION IMPACT ANALYSISRECESSION IMPACT ON MILITARY CLOUD COMPUTING MARKET

-

5.5 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TECHNOLOGICAL ANALYSIS

-

5.8 USE CASE ANALYSISUSE CASE 1: MISSION PLANNING AND SIMULATION SIMULATES ACCURATE AND EFFICIENT MISSION PLANNING TO PREPARE FOR COMPLEX OPERATIONSUSE CASE 2: SECURE DATA STORAGE AND MANAGEMENT MANAGES INTELLIGENCE REPORTS, SURVEILLANCE FOOTAGE, AND MISSION-CRITICAL INFORMATION

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL TRENDSEDGE COMPUTINGARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)INTERNET OF THINGS (IOT) AND SENSOR NETWORKSCYBERSECURITY AND ENCRYPTIONVIRTUALIZATION AND CONTAINERIZATIONQUANTUM COMPUTING5G NETWORKSQUANTUM KEY DISTRIBUTION (QKD)AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR)SOFTWARE-DEFINED NETWORKING (SDN) AND NETWORK FUNCTION VIRTUALIZATION (NFV)

- 6.3 IMPACT OF MEGATRENDS

-

6.4 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 PUBLIC CLOUDLOWER INVESTMENT AND MAINTENANCE REQUIREMENTS TO DRIVE DEMAND FOR PUBLIC CLOUD

-

7.3 PRIVATE CLOUDRISING SECURITY CONCERNS TO DRIVE MARKET

-

7.4 HYBRID CLOUDFLEXIBILITY OF DATA STORAGE TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 INFRASTRUCTURE-AS-A-SERVICE (IAAS)RISING DEMAND FOR HIGH-PERFORMANCE COMPUTING TO DRIVE MARKETPRIMARY STORAGEDISASTER RECOVERY & BACKUPARCHIVINGCOMPUTE

-

8.3 PLATFORM-AS-A-SERVICE (PAAS)RISING DEMAND FOR PROTOTYPING AND DEVELOPMENT TOOLS FOR MILITARY APPLICATIONS TO DRIVE MARKETAPPLICATION DEVELOPMENT AND PLATFORMSAPPLICATION TESTING AND QUALITYANALYTICS AND REPORTINGINTEGRATION AND ORCHESTRATIONDATA MANAGEMENT

-

8.4 SOFTWARE-AS-A-SERVICE (SAAS)NEED FOR TACTICAL MAPPING AND GEOSPATIAL INTELLIGENCE TO DRIVE MARKETLOGISTICS AND SUPPLY CHAIN MANAGEMENTCYBERSECURITY SOLUTIONSCOLLABORATION AND COMMUNICATIONGEOGRAPHIC INFORMATION SYSTEMS (GIS)

- 9.1 INTRODUCTION

-

9.2 DATA STORAGE AND MANAGEMENTRISING DEMAND FOR DATA-DRIVEN DECISION-MAKING TO DRIVE MARKET

-

9.3 COMMAND AND CONTROLINCREASED APPLICATION OF CLOUD COMPUTING FOR DECISION-MAKING TO DRIVE MARKET

-

9.4 ANALYTICS AND INTELLIGENCEINCREASED DEMAND FOR INTELLIGENCE CAPABILITIES TO DRIVE MARKET

-

9.5 COLLABORATION AND INFORMATION SHARINGINCREASE IN JOINT OPERATIONS TO DRIVE MARKET

-

9.6 VIRTUAL TRAINING AND SIMULATIONDEVELOPMENT OF NEW TECHNOLOGIES LIKE AUGMENTED REALITY TO PROPEL MARKET

-

9.7 CYBERSECURITY AND THREAT INTELLIGENCEINCREASING THREATS OF CYBERATTACKS TO DRIVE MARKET

-

9.8 RAPID DEPLOYMENT AND SCALABILITYINCREASING DEMAND FOR GLOBAL MOBILITY AND REMOTE ACCESS TO DRIVE MARKET

-

9.9 PREDICTIVE ANALYTICS AND DECISION SUPPORTDEMAND FOR DATA-DRIVEN SITUATIONAL AWARENESS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 ARMYINCREASED INVESTMENT AND COLLABORATION IN CLOUD COMPUTING TO DRIVE MARKET

-

10.3 NAVYINCREASED DOMAIN AWARENESS TO DRIVE MARKET

-

10.4 AIR FORCEINCREASE IN SIMULATION, MAINTENANCE, AND ANALYTICS TO DRIVE MARKET

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICAPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSISUS- Rising defense budget to drive marketCANADA- Growing adoption of data sovereignty to drive market

-

11.4 EUROPEPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSISUK- Rising investments in defense cloud to drive marketFRANCE- Collaboration with different countries to drive marketGERMANY- Major cloud programs in army to drive marketREST OF EUROPE

-

11.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFIC- Political- Economic- Social- Technological- Legal- EnvironmentalRECESSION IMPACT ANALYSIS: ASIA PACIFICCHINA- Increasing investment to strengthen military to drive marketINDIA- Rising investments in army modernization to drive marketJAPAN- High-end indigenous military technologies to drive marketSOUTH KOREA- Rising cyber threats to drive marketREST OF ASIA PACIFIC

-

11.6 REST OF THE WORLDMIDDLE EAST & AFRICA- Defense modernization efforts to drive marketLATIN AMERICA- Increasing demand for unmanned military ground vehicles to drive market

- 12.1 INTRODUCTION

- 12.2 RANKING ANALYSIS

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS

- 12.5 COMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

12.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSAMAZON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewORACLE CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDELL TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsATOS- Business overview- Products/Solutions/Services offered- Recent developmentsBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSAIC- Business overview- Products/Solutions/Services offered- Recent developmentsRACKSPACE TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developmentsCAPGEMINI- Business overview- Products/Solutions/Services offered- Recent developmentsSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSCGIDXC TECHNOLOGYSOAR TECHNOLOGYSPARKCOGNITIONHADEANPERATONSMARTRONIXWIND RIVER SYSTEMSSPLUNK

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN MILITARY CLOUD COMPUTING MARKET

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MILITARY CLOUD COMPUTING MARKET ECOSYSTEM

- TABLE 4 MISSION PLANNING AND SIMULATION

- TABLE 5 SECURE DATA STORAGE AND MANAGEMENT

- TABLE 6 MILITARY CLOUD COMPUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SERVICE MODELS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE SERVICE MODELS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MILITARY CLOUD COMPUTING MARKET: CONFERENCES & EVENTS, 2023–2024

- TABLE 15 MILITARY CLOUD COMPUTING MARKET: KEY PATENTS, 2020−2022

- TABLE 16 MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 17 MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 18 MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 19 MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 20 MILITARY CLOUD COMPUTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 21 MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 22 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 23 MILITARY CLOUD COMPUTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 24 MILITARY CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 28 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 US: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 34 US: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 35 US: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 36 US: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 37 CANADA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 38 CANADA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 39 CANADA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 40 CANADA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 41 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 42 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 43 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 44 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 45 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 46 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 47 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 48 EUROPE: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 UK: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 50 UK: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 51 UK: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 52 UK: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 53 FRANCE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 54 FRANCE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 55 FRANCE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 56 FRANCE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 57 GERMANY: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 58 GERMANY: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 59 GERMANY: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 60 GERMANY: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 61 REST OF EUROPE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 62 REST OF EUROPE: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 63 REST OF EUROPE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 64 REST OF EUROPE: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 65 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 CHINA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 74 CHINA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 75 CHINA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 76 CHINA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 77 INDIA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 78 INDIA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 79 INDIA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 80 INDIA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 81 JAPAN: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 82 APAN: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 83 JAPAN: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 84 JAPAN: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 85 SOUTH KOREA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 86 SOUTH KOREA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 87 SOUTH KOREA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 88 SOUTH KOREA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 93 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 94 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 95 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 96 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 97 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: MILITARY CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 106 LATIN AMERICA: MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 107 LATIN AMERICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2019–2022 (USD MILLION)

- TABLE 108 LATIN AMERICA: MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 109 KEY DEVELOPMENTS BY LEADING PLAYERS IN MILITARY CLOUD COMPUTING MARKET, 2019–2023

- TABLE 110 MILITARY CLOUD COMPUTING MARKET: DEGREE OF COMPETITION

- TABLE 111 COMPANY PRODUCT FOOTPRINT

- TABLE 112 DEPLOYMENT TYPE FOOTPRINT

- TABLE 113 SERVICE MODEL FOOTPRINT

- TABLE 114 REGION FOOTPRINT ANALYSIS

- TABLE 115 MILITARY CLOUD COMPUTING MARKET: PRODUCT LAUNCHES, JULY 2021–JUNE 2023

- TABLE 116 MILITARY CLOUD COMPUTING MARKET: DEALS, NOVEMBER 2019–JULY 2023

- TABLE 117 AMAZON: COMPANY OVERVIEW

- TABLE 118 AMAZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 AMAZON: DEALS

- TABLE 120 GOOGLE: COMPANY OVERVIEW

- TABLE 121 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 GOOGLE: DEALS

- TABLE 123 MICROSOFT CORPORATION: COMPANY OVERVIEW

- TABLE 124 MICROSOFT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 ORACLE CORPORATION: COMPANY OVERVIEW

- TABLE 126 ORACLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 128 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 130 DELL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 131 DELL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 DELL TECHNOLOGIES: DEALS

- TABLE 133 THALES GROUP: COMPANY OVERVIEW

- TABLE 134 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 THALES GROUP: DEALS

- TABLE 136 IBM: COMPANY OVERVIEW

- TABLE 137 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 IBM: PRODUCT LAUNCHES

- TABLE 139 CISCO: COMPANY OVERVIEW

- TABLE 140 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 CISCO: PRODUCT LAUNCHES

- TABLE 142 ATOS: COMPANY OVERVIEW

- TABLE 143 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 ATOS: PRODUCT LAUNCHES

- TABLE 145 ATOS: DEALS

- TABLE 146 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 147 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 BAE SYSTEMS: DEALS

- TABLE 149 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 150 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 151 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 152 SAIC: COMPANY OVERVIEW

- TABLE 153 SAIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 SAIC: PRODUCT LAUNCHES

- TABLE 155 SAIC: DEALS

- TABLE 156 RACKSPACE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 157 RACKSPACE TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 RACKSPACE TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 159 RACKSPACE TECHNOLOGY: DEALS

- TABLE 160 CAPGEMINI: COMPANY OVERVIEW

- TABLE 161 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 CAPGEMINI: PRODUCT LAUNCHES

- TABLE 163 CAPGEMINI: DEALS

- TABLE 164 SALESFORCE: COMPANY OVERVIEW

- TABLE 165 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SALESFORCE: PRODUCT LAUNCHES

- TABLE 167 CGI: COMPANY OVERVIEW

- TABLE 168 DXC TECHNOLOGY: COMPANY OVERVIEW

- TABLE 169 SOAR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 170 SPARKCOGNITION: COMPANY OVERVIEW

- TABLE 171 HADEAN: COMPANY OVERVIEW

- TABLE 172 PERATION: COMPANY OVERVIEW

- TABLE 173 SMARTRONIX: COMPANY OVERVIEW

- TABLE 174 WIND RIVER SYSTEMS: COMPANY OVERVIEW

- TABLE 175 SPLUNK: COMPANY OVERVIEW

- FIGURE 1 MILITARY CLOUD COMPUTING MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 MILITARY CLOUD COMPUTING MARKET: RESEARCH DESIGN

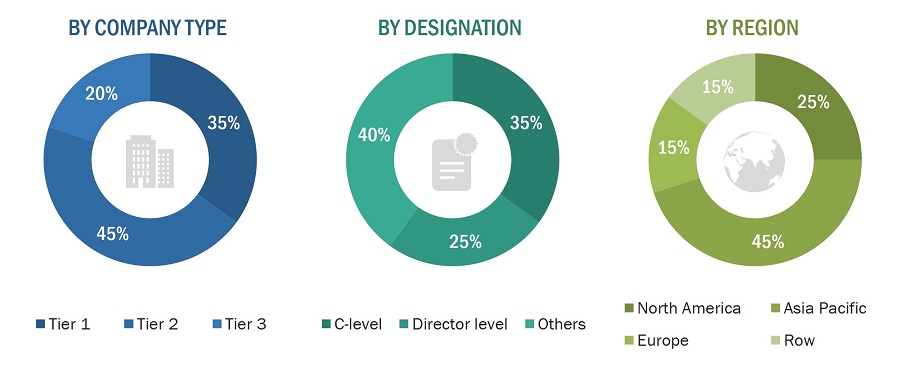

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

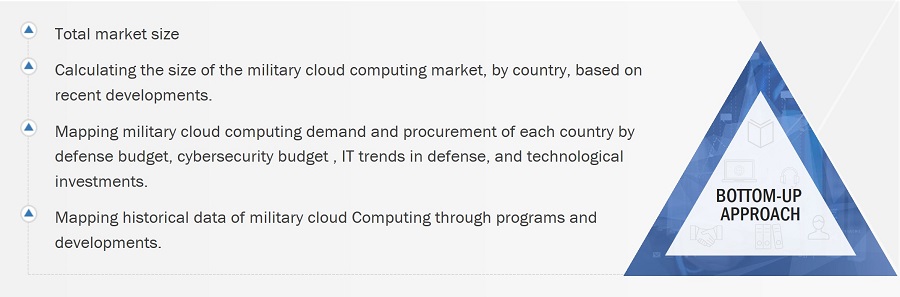

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

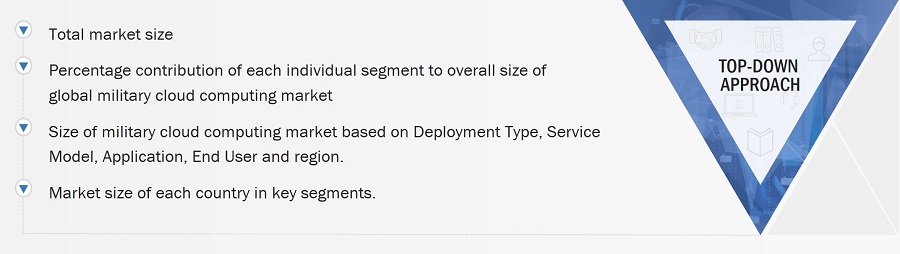

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 9 PRIVATE CLOUD SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 10 PLATFORM-AS-A-SERVICE SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 ARMY SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASING ADOPTION BY ARMED FORCES TO DRIVE DEMAND FOR MILITARY CLOUD COMPUTING

- FIGURE 14 PRIVATE CLOUD SEGMENT TO LEAD MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 INFRASTRUCTURE-AS-A-SERVICE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ARMY SEGMENT TO HAVE MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

- FIGURE 19 MILITARY CLOUD COMPUTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 REVENUE SHIFT IN MILITARY CLOUD COMPUTING MARKET

- FIGURE 21 RECESSION IMPACT ANALYSIS ON MILITARY CLOUD COMPUTING MARKET

- FIGURE 22 MILITARY CLOUD COMPUTING MARKET ECOSYSTEM

- FIGURE 23 VALUE CHAIN ANALYSIS: MILITARY CLOUD COMPUTING MARKET

- FIGURE 24 TECHNOLOGICAL ROADMAP

- FIGURE 25 MILITARY CLOUD COMPUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SERVICE MODELS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE SERVICE MODELS

- FIGURE 28 MILITARY CLOUD COMPUTING MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- FIGURE 29 MILITARY CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- FIGURE 30 MILITARY CLOUD COMPUTING MARKET, BY END USER, 2023–2028 (USD MILLION)

- FIGURE 31 NORTH AMERICA TO BE LARGEST MILITARY CLOUD COMPUTING MARKET IN 2023

- FIGURE 32 NORTH AMERICA: MILITARY CLOUD COMPUTING MARKET SNAPSHOT

- FIGURE 33 EUROPE: MILITARY CLOUD COMPUTING MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MILITARY CLOUD COMPUTING MARKET SNAPSHOT

- FIGURE 35 MARKET RANKING OF TOP FIVE PLAYERS, 2023

- FIGURE 36 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- FIGURE 37 REVENUE OF TOP FIVE PLAYERS, 2022

- FIGURE 38 MILITARY CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 MILITARY CLOUD COMPUTING MARKET (START-UP/SME): COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 AMAZON: COMPANY SNAPSHOT

- FIGURE 41 GOOGLE: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 ORACLE CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 46 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 47 IBM: COMPANY SNAPSHOT

- FIGURE 48 CISCO: COMPANY SNAPSHOT

- FIGURE 49 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 50 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 RACKSPACE TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 52 SALESFORCE: COMPANY SNAPSHOT

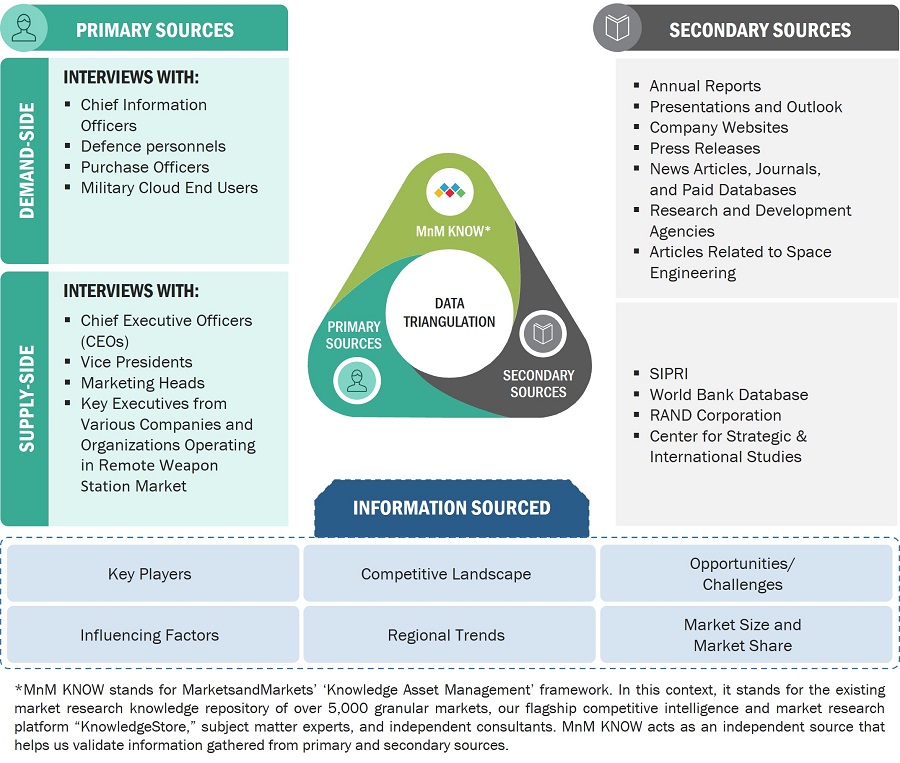

The research study conducted on the military cloud computing market involved extensive use of secondary sources, including directories, databases of articles, journals on military cloud computing, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the military cloud computing market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the military cloud computing market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the military cloud computing market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the military cloud computing industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the military cloud computing market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the military cloud computing market.

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

Extensive research into military cloud computing sources and the concurrent advances in machine learning technology have pushed technology to the level where fully configured military cloud computing are now being designed and tested for imminent deployment. Advances in AI/ML technology and its global demand propelling the demand for military cloud computing.

The top-down and bottom-up approaches were used to estimate and validate the size of the military cloud computing market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

The research methodology used to estimate the market size also included the following details:

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

- Market growth trends were defined based on approaches such as the product revenues of the major 10-15 companies from 2019 to 2022, military expenditure, cloud developments in military by different countries from 2019 to 2022, historic development patterns and budget allocation between 2019 to 2022, among others.

Data Triangulation

After arriving at the overall size of the military cloud computing market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

Military cloud computing is a specialized and highly secure cloud computing framework tailored to the unique demands and stringent requirements of military and defense organizations. It encompasses a comprehensive ecosystem of hardware, software, and services designed to facilitate the storage, processing, management, and dissemination of sensitive and mission-critical data and applications within the military sector. At its core, military cloud computing leverages cloud infrastructure and technology to provide on-demand access to computing resources, enabling military personnel to access vital information, collaborate, and execute operations more efficiently and flexibly. Security is paramount in military cloud computing, with robust encryption, access controls, and stringent compliance measures in place to safeguard sensitive data, communications, and systems from cyber threats and unauthorized access. Furthermore, military cloud computing offers scalability and agility, allowing defense agencies to rapidly adapt to changing mission requirements, optimize resource allocation, and reduce infrastructure costs. This transformative technology plays a pivotal role in modern warfare, enhancing the military's capabilities in areas such as intelligence analysis, logistics management, real-time situational awareness, and mission planning.

Key Stakeholders

- Ministry of Defense

- Regulatory Bodies

- R&D Companies

- Providers of Military Cloud Computing Services

- Providers of Components and Sub-components for Cloud Services

- Armed Forces

Report Objectives

- To define, describe, and forecast the size of the military cloud computing market based on Deployment type, Service Model, Application, End User, and Region from 2023 to 2028.

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa, Latin America.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the military cloud computing market across the globe.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the military cloud computing market.

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the military cloud computing market.

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2.

1. Micro markets refer to further segments and subsegments of the Military cloud computing market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Military Cloud Computing Market