Military Non-Steerable Antenna Market by Platform (Ground, Airborne, Marine), Product (Blade, Patch, Whip, Conformal, Rubbery Ducky, Loop), Application, Frequency (HF, VHF, UHF, EHF, SHF, Multiband), Point of Sale (OEM, Aftermarket) and Region- Global Forecast to 2028

The Military Non-Steerable Antenna Market is projected to reach USD 739 Million by 2028, from USD 529 Million in 2023, at a Compound Annual Growth Rate (CAGR) of 6.9%. The Military Non-Steerable Antenna Industry is expected to grow at a significant rate in the coming years, owing to the adoption of electronic systems for communication, intelligence, and command and control in the defense sector. These military systems require antennas for transmitting and receiving data. Antennas must be rugged to withstand harsh environmental conditions. Defense modernization programs and increasing procurement of military vehicles and UAVs are also expected to fuel the growth of the military non-steerable antenna market.

Military Non-Steerable Antenna Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Military Non-Steerable Antenna Industry Driver: Modernization of Legacy Radio Systems

Modernization of legacy radio systems is a key priority for defense forces worldwide. Many military organizations are operating with outdated radio systems that may be unable to keep up with the demands of modern warfare and may be vulnerable to interference or interception by adversaries. There are several drivers for the modernization of legacy radio systems. One of the main drivers is the need for interoperability between military organizations and allied forces. Modern radio systems often use digital signal processing and other advanced technologies that enable secure communication, encryption, and other critical features for military operations. Another driver for modernization is the need for improved situational awareness. Modern radio systems can provide real-time information about the location and status of friendly and enemy forces, which is critical for effective decision-making in the field. They can also be integrated with other systems, such as GPS and unmanned aerial vehicles (UAVs), to provide a more comprehensive picture of the battlefield.

In addition, modern radio systems are often designed with a focus on ease of use and maintenance. This can reduce the training required for military personnel to operate and maintain the systems and improve their reliability and durability. The modernization of legacy radio systems is a complex process that requires careful planning, investment, and execution. It typically involves a combination of hardware and software upgrades, as well as changes to training, operational procedures, and logistics. However, the benefits of modernizing legacy radio systems can be significant, including improved communication, enhanced situational awareness, and better interoperability with allied forces.

With the radio systems being updated, antennas used on radio systems will also be replaced, increasing the demand for non-steerable antennas. For instance, in March 2022, US Army selected Thales Defense and Security Inc. (US) and L3Harris Technologies, Inc. (US) to compete for a USD 6.1 billion contract to modernize Single Channel Ground and Airborne Radio Systems (SINCGARS). In November 2022, the British army selected L3Harris Technologies, Inc.’s communication systems business to provide 1,300 new ground-based radios under a contract valued at approximately USD 109 million. Multi-mode receiver (MMR) devices are designed to support military ground-to-ground and ground-to-air communications at multiple security classification levels, as well as to interoperate with those of US and NATO allies.

Military Non-Steerable Antenna Industry Restraints: Limited Range

While non-steerable antennas can effectively transmit signals in a specific direction, they may have a limited range compared with steerable antennas. This may limit their usefulness in certain military applications. The range of a non-steerable antenna depends on several factors, including its gain, frequency, and physical size. Non-steerable antennas with higher gain can transmit signals further, but they may also have narrower beam widths, making them more difficult to aim accurately. Additionally, non-steerable antennas operating at higher frequencies may have shorter ranges than those operating at lower frequencies, as higher-frequency signals are more easily absorbed by atmospheric and other environmental factors.

In military applications, the range is often a critical factor, as it can impact the ability of personnel to communicate and exchange information over long distances. The limited range of non-steerable antennas may make them less suitable for military applications requiring long-distance communication. To overcome the limited range of non-steerable antennas, military organizations may need to invest in additional infrastructure, such as relay stations or signal boosters, to extend their coverage area. Alternatively, they may need to consider other solutions, such as steerable antennas or other communication technologies, to ensure reliable communication over long distances.

Military Non-Steerable Antenna Industry Opportunities: High Demand for Military Unmanned Aerial Vehicles (UAVs)

Unmanned aerial vehicles (UAVs) are becoming increasingly popular in military operations due to their ability to provide aerial surveillance, reconnaissance, and strike capabilities without risking human lives. However, they require reliable and secure communication channels to effectively transmit data and commands between the ground control station and the vehicle. Non-steerable antennas can be integrated into UAVs to provide such communication channels. These antennas can be designed to be lightweight, durable, and highly efficient, allowing them to perform reliably in harsh environmental conditions. Additionally, the use of non-steerable antennas in UAVs allows for a more streamlined and efficient design, which is critical for unmanned vehicles that rely on battery power and need to maximize their flight time.

As the demand for UAVs in military operations continues to grow, there is a growing market for lightweight, high-performance non-steerable antennas that can be integrated into these vehicles. This presents an opportunity for manufacturers to develop new products and technologies that can meet the unique requirements of UAVs, such as small size, low weight, and high efficiency. With the increasing importance of UAVs in modern military operations, the demand for non-steerable antennas in this market is expected to continue to grow in the coming years.

Military Non-Steerable Antenna Industry Challenges: Competition From Steerable Antennas

Steerable antennas are widely used in military applications for long-range communication and surveillance. These antennas can be electronically or mechanically adjusted in a specific direction, providing more precision and flexibility. This can limit the market for non-steerable antennas, particularly in applications where range and mobility are critical. Steerable antennas can also provide higher gain and directivity than non-steerable antennas, which increases the antenna’s ability to pick up or deliver signals, especially in noisy or crowded surroundings.

Furthermore, steerable antennas can provide other benefits, such as the ability to track moving targets, null out interference, and provide more secure communication by directing the signal towards a specific location. Since these antennas may be changed in different directions, they are more responsive to changing mission needs. Steerable antennas can also provide more secure communications by aiming the signal toward a specific location and minimizing the risk of interception or jamming.

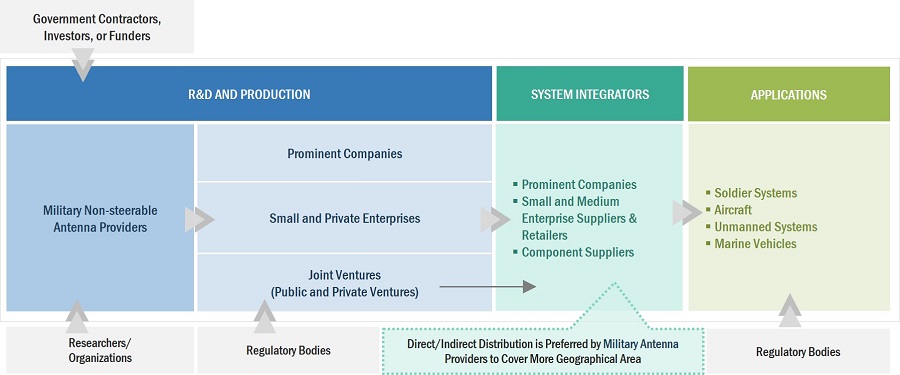

Military Non-Steerable Antenna Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of military non-steerable antenna. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include L3Harris Technologies, Inc. (US), Cobham Advanced Electronic Solutions (US), Rohde & Schwarz (Germany), Comrod Communication Group (Norway), and RAMI (US).

Based on Platform, the Airborne Segment is Projected to Grow at the Highest CAGR During the Forecast Period.

Based on platform, the military non-steerable antenna market is segmented into airborne, ground, and marine. The airborne segment is projected to register the highest CAGR during the forecast period. Military non-steerable antennas are increasingly used in the aerospace industry for different types of military aircraft. Airborne military non-steerable antennas are mounted on manned or unmanned aircraft such as fixed-wing and rotary-wing aircraft. These antennas enable improved communication, navigation, and target identification. They are also used for jamming. Since military and defense communications are assumed to be reliable, fast, secure, and accurate, it has resulted in the development of advanced airborne military non-steerable antennas used by the defense forces of the US, the UK, Russia, and China. The increasing procurement of military drones globally is one of the major factors driving this segment.

Based on Application, the Communication Segment is Projected to Lead the Market During the Forecast Period

Based on application, the military non-steerable antenna market is segmented into communication, satellite communication (SATCOM), electronic warfare, and navigation. The communication segment is estimated to command the military non-steerable antenna market in 2023. This is due to the increasing demand for effective long-range communication capabilities in compact hardware systems that can be deployed across platforms worldwide.

Military Non-Steerable Antenna Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific Region is Projected to Lead the Military Non-Steerable Antenna Market in the Forecast Period

The Asia Pacific Military Non-Steerable Antenna market is projected to lead the market during the forecast period. The Asia Pacific military non-steerable antenna market has been studied for China, India, Australia, Japan, South Korea, and the Rest of Asia Pacific. The increased focus of international and domestic players on the military non-steerable antenna market contributes to the high demand for digitizing the military, benefitting the market. Increasing insurgencies, territorial and political disputes, and terror attacks in the Asia Pacific region fuel the growth of the military non-steerable antenna market. Favorable regulatory policies for the approval of new AI products are further intensifying the interest of players in the market.

Military Non-Steerable Antenna Industry Companies: Top Key Market Players:

The Military Non-Steerable Antenna Companies are dominated by globally established players such as L3Harris Technologies, Inc. (US), Cobham Advanced Electronic Solutions (US), Rohde & Schwarz (Germany), Comrod Communication Group (Norway), and RAMI (US).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

$ 529 Million |

|

Projected Market Size |

$ 739 Million |

|

Growth Rate |

6.9% |

|

Market Size Available for Years |

2020–2028 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Platform, By Application, By Product, By Frequency, By Point of sale |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and RoW |

|

Companies Covered |

L3Harris Technologies, Inc. (US), Cobham Advanced Electronic Solutions (US), Rohde & Schwarz (Germany), Comrod Communication Group (Norway), and RAMI (US) and others. Total 25 Market Players |

Military Non-Steerable Antenna Market Highlights

The study categorizes the military non-steerable antenna market based on Platform, Application, Product, frequency, Point of sale, and region.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Product |

|

|

By Application |

|

|

By Frequency |

|

|

By Point of Sale |

|

|

By Region |

|

Recent Developments

- In February 2023, CAES was awarded an IDIQ contract valued at USD 38.5 million over five years from the US Navy for spares, engineering services, and repairs on antenna assemblies to support the SEWIP Block 2 program.

- In January 2023, CAES was awarded a contract valued at more than USD 24 million from Northrop Grumman to provide M-code GPS antennas to support precision guidance kits (PGK). The contract calls for CAES to deliver 80,000 antennas over the next three years to support Northrop Grumman’s PGK production for the US Army.

- In November 2022, The UK Ministry of Defence (MoD) signed a £90 million (USD 95 million) contract with L3Harris Technologies, Inc. for a raft of new radios designed to improve military communications on the battlefield. Technical advances and upgrades will allow the radios to work across a range of security classifications, with the first being delivered to the British Army before the end of the year, ahead of further deliveries in 2023. The MoD plans to spend £11.7 billion (USD 12.3 billion) over the next 10 years to update or replace its digital systems to keep pace with potential adversaries.

- In November 2022, MTI Wireless Edge Limited announced that its antenna division had won a contract worth about USD 0.75 million from a local customer in Israel. The AIM-traded firm said the contract would see the development and delivery of several prototype antennas for defense use, to be supplied in the next 12 months. If the prototypes met the specialist performance criteria, there was the potential for further larger-scale orders.

- In July 2022, L3Harris Technologies, Inc. was awarded USD 176 million in orders for multi-channel handheld and vehicular radio systems by the US Marine Corps to enable interoperability across the US Department of Defense, Special Operations Command, and key allies.

Frequently Asked Questions (FAQ):

Which Are the Major Platform Considered in This Study and Which Segments Are Projected to Have a Promising Military Non-Steerable Antenna Share in the Future?

The ground airborne and marine segments are considered in the report and Airborne segment is projected to grow fast in the upcoming years. The increasing procurement of military drones globally is one of the major factors driving this segment.

What Are Some of the Drivers Fuelling the Growth of the Military Non-Steerable Antenna Market?

Global Military Non-Steerable Antenna Market is characterized by the following drivers:

- Need for secure and reliable communication

Secure communication is essential for military operations, as it allows personnel to communicate sensitive information without the risk of interception or tampering by adversaries. Non-steerable antennas are often used to provide secure communication channels, as they can transmit signals in a specific direction, making it difficult for unauthorized parties to intercept the transmission. These antennas can also be used to create directional beams that can be aimed at a specific receiver, further improving communication security. This is particularly important in environments where radio frequency interference or jamming is a concern, as non-steerable antennas can help minimize the impact of interference and enable communication to continue under challenging conditions.

To provide secure communication, non-steerable antennas can be used in combination with other technologies, such as encryption and authentication systems. Encryption can be used to encode the information being transmitted, making it difficult for unauthorized parties to access the information even if they are able to intercept the transmission. Authentication systems can be used to verify the identity of the parties involved in the communication, ensuring that only authorized personnel are able to access the information.

Before Making a Purchase, I Would Like to Understand the Research Technique Used to Determine the Military Non-Steerable Antenna Market Size and Segmentation Splits. Can You Explain This to Me in More Detail?

Yes, during a scheduled call, a thorough explanation of the research technique can be given. Additionally, it will allow us to respond fully to all of your questions. For an overview and basic information: Several strategies have been used to comprehend the complete picture of this sector, including:

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What Kind of Information is Included in the Military Non-Steerable Antenna Market Competitive Landscape Section?

The company profiles section provides business overview insights about the company's revenue mix, business revenue mix, business segments, financials, and geographic presence. The company profiles section also includes information on product offerings, SWOT analysis, key developments associated with the company, and MnM view to elaborate analyst view on the company.

Which Are the Top Players in the Military Non-Steerable Antenna Market?

The Top 5 players in the Military Non-Steerable Antenna Market consist of L3Harris Technologies, Inc. (US), Cobham Advanced Electronic Solutions (US), Rohde & Schwarz (Germany), Comrod Communication Group (Norway), and RAMI (US). They have an established portfolio of reputable products and services, a robust market presence, strong business strategies, a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Modernization of legacy radio systems- Need for secure and reliable communication- Increased military spending on advanced equipmentRESTRAINTS- Limited range- Susceptivity to environmental factors- Limited mobilityOPPORTUNITIES- High demand for military unmanned aerial vehicles (UAVs)CHALLENGES- Competition from steerable antennas- Poor transmission of signals- Inability to address threats

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 AVERAGE SELLING PRICE ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY NON-STEERABLE ANTENNA MANUFACTURERS

-

5.6 MILITARY NON-STEERABLE ANTENNA MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.7 RECESSION IMPACT ANALYSISIMPACT OF RECESSION ON MILITARY NON-STEERABLE ANTENNA MARKET

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 OPERATIONAL DATA

-

5.10 TRADE ANALYSISIMPORT DATA FOR GROUND VEHICLES, BY REGION, 2017−2020IMPORT AND EXPORT DATA STATISTICS FOR MILITARY DRONES

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS, 2022–2023

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL TRENDSMINIATURIZATION OF MILITARY ANTENNASDEVELOPMENT OF METAMATERIAL ANTENNASWIDE-SCALE USE OF PLASMA ANTENNASNEED FOR LOW-PROFILE ANTENNAS

-

6.3 TECHNOLOGY ANALYSISMULTI-BAND ANTENNASSOFTWARE-DEFINED ANTENNASSMART ANTENNAS

-

6.4 IMPACT OF MEGATRENDSSHIFT IN GLOBAL ECONOMIC POWERCLIMATE CHANGEPRODUCT CUSTOMIZATION TREND

-

6.5 USE CASESUSE CASE 1: MILITARY NON-STEERABLE ANTENNAS IN ELECTRONIC WARFAREUSE CASE 2: MILITARY NON-STEERABLE ANTENNAS IN RECONNAISSANCE OPERATIONS

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 GROUNDVEHICLE ANTENNAS- Growing demand for military vehiclesBASE STATION ANTENNAS- Used for collecting and streaming remote sensing dataMANPACK ANTENNAS- Predominant use in military operationsHANDHELD ANTENNAS- Deployment in distant and hostile environmentsBODY-WORN ANTENNAS- Used for data sharing between dismounted soldiersUNMANNED GROUND VEHICLE (UGV) ANTENNAS- Increased use in ground surveillance missions

-

7.3 AIRBORNEAIRCRAFT ANTENNAS- Development of antennas for ensured connectivity through multiple satellitesUNMANNED AERIAL VEHICLE (UAV) ANTENNAS- Increased procurement of drones by military forces

-

7.4 MARINESHIPBOARD ANTENNAS- Development of UHF antennas for navy and coast guardsSUBMARINE ANTENNAS- Development of next-gen antennas for submarinesUNMANNED MARINE VEHICLE (UMV) ANTENNAS- Need for real-time transmission of mission data in military applications

- 8.1 INTRODUCTION

-

8.2 BLADE ANTENNASPREFERENCE FOR BLADE ANTENNAS IN AIRBORNE APPLICATIONS

-

8.3 PATCH ANTENNASLIGHTWEIGHT, EASY TO MANUFACTURE, AND VERY THIN

-

8.4 WHIP ANTENNASWIDE-SCALE APPLICATION OF WHIP ANTENNAS

-

8.5 CONFORMAL ANTENNASINCREASED USE OF CONFORMAL ANTENNAS DUE TO COMPACT SIZE

-

8.6 RUBBER DUCKY ANTENNASUSED FOR GENERAL-PURPOSE COMMUNICATION APPLICATIONS

-

8.7 LOOP ANTENNASINEXPENSIVE AND EASY TO CONSTRUCT

- 8.8 OTHERS

- 9.1 INTRODUCTION

-

9.2 COMMUNICATIONNEED FOR LONG-RANGE COMMUNICATION CAPABILITIES IN HARDWARE SYSTEMS

-

9.3 SATCOMINCREASING DEMAND FOR CUSTOMIZED SATCOM SOLUTIONS

-

9.4 NAVIGATIONADVANCEMENTS IN GPS NAVIGATION ANTENNA SYSTEMS

-

9.5 ELECTRONIC WARFAREINCORPORATION OF RF TECHNOLOGY IN ELECTRONIC EQUIPMENT

- 10.1 INTRODUCTION

-

10.2 HIGH FREQUENCY (HF)UTILIZATION IN NATURAL DISASTERS AND MILITARY APPLICATIONS

-

10.3 VERY HIGH FREQUENCY (VHF)BENEFICIAL IN LONG-RANGE ACTIVITIES

-

10.4 ULTRA HIGH FREQUENCY (UHF)USED FOR VOICE AND DATA COMMUNICATION

-

10.5 SUPER HIGH FREQUENCY (SHF)DEMAND FOR RELIABLE MILITARY SATELLITE COMMUNICATION

-

10.6 EXTREMELY HIGH FREQUENCY (EHF)USED FOR TERRESTRIAL COMMUNICATION AND EXPERIMENTAL APPLICATIONS

-

10.7 MULTI-BAND FREQUENCYNEED FOR BETTER SIGNAL STRENGTH

- 11.1 INTRODUCTION

-

11.2 OEMINCREASED PROCUREMENT OF MILITARY VEHICLES AND UAVS

-

11.3 AFTERMARKETUPGRADING OF EXISTING FLEET OF MILITARY VEHICLES

- 12.1 INTRODUCTION

-

12.2 REGIONAL RECESSION IMPACT ANALYSISSMALL AND MEDIUM-SIZED BUSINESSES IN DEFENSE SECTOREFFECT OF RUSSIA-UKRAINE WAR

-

12.3 NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAPESTEL ANALYSIS: NORTH AMERICAUS- Modernization programs and defense policiesCANADA- Increased R&D investments in defense programs

-

12.4 EUROPERECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPEUK- Rapid market expansion through upgrade programsFRANCE- Procurement of new combat vehiclesGERMANY- Major global exporter of UAVs and armored vehiclesITALY- Plans to procure advanced components for MALE dronesRUSSIA- Increased procurement of modern military vehicles and drones to enhance defense capabilities during war crisesREST OF EUROPE- Significant improvements in military power

-

12.5 ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increased investments to strengthen militaryINDIA- Increased military expenditure and modernization of armed forcesAUSTRALIA- Upgrading of military vehiclesJAPAN- High-end indigenous military technologiesSOUTH KOREA- Increased defense spending to strengthen military vehicle capabilitiesREST OF ASIA PACIFIC- Unmanned armored vehicles to fuel market

-

12.6 MIDDLE EASTRECESSION IMPACT ANALYSIS: MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTSAUDI ARABIA- Increased deployment of military non-steerable antennas for communication and navigationTURKEY- Upgrading of strategic communication systemsISRAEL- Development of latest technologies

-

12.7 REST OF THE WORLDRECESSION IMPACT ANALYSIS: REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDLATIN AMERICA- Increased demand for military UAVsAFRICA- Growing R&D in military drones

- 13.1 INTRODUCTION

- 13.2 COMPANY OVERVIEW

- 13.3 MARKET RANKING ANALYSIS, 2022

- 13.4 REVENUE ANALYSIS, 2022

- 13.5 MARKET SHARE ANALYSIS, 2022

-

13.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.8 COMPETITIVE BENCHMARKING

-

13.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOBHAM ADVANCED ELECTRONIC SOLUTIONS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROHDE & SCHWARZ- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCOMROD COMMUNICATION GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewRAMI- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBARKER & WILLIAMSON- Business overview- Products/Services/Solutions offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsGENERAL DYNAMICS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsHASCALL-DENKE- Business overview- Products/Services/Solutions offered- Recent developmentsHR SMITH GROUP OF COMPANIES- Business overview- Products/Services/Solutions offered- Recent developmentsALARIS HOLDINGS LIMITED- Business overview- Products/Services/Solutions offered- Recent developmentsTRIVAL ANTENE D.O.O- Business overview- Products/Services/Solutions offered- Recent developmentsSHAKESPEARE COMPANY, LLC- Business overview- Products/Services/Solutions offered- Recent developmentsMTI WIRELESS EDGE LIMITED- Business overview- Products/Services/Solutions offered- Recent developments

-

14.3 OTHER PLAYERSRADIALLANTCOMDAYTON-GRANGERSOUTHWEST ANTENNASANTENNA EXPERTSANTENNA PRODUCTS CORPORATIONPPM SYSTEMSACR ELECTRONICS, INC.SENSOR SYSTEMS INC.SOUTH MIDLANDS COMMUNICATIONS LTD.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 4 AVERAGE SELLING PRICE TRENDS OF MILITARY AIRBORNE ANTENNAS, 2022 (USD/UNIT)

- TABLE 5 AVERAGE SELLING PRICE TRENDS OF MILITARY GROUND ANTENNAS, 2022 (USD/UNIT)

- TABLE 6 MILITARY NON-STEERABLE ANTENNA MARKET ECOSYSTEM

- TABLE 7 RECESSION IMPACT ANALYSIS

- TABLE 8 PORTER’S FIVE FORCE ANALYSIS

- TABLE 9 ACTIVE SOLDIERS PERSONNEL COUNT, BY COUNTRY, 2017−2022

- TABLE 10 NEW AIRCRAFT DELIVERIES, BY TYPE, 2017–2022

- TABLE 11 IMPORT DATA FOR ARMORED VEHICLES, BY REGION, 2017−2020

- TABLE 12 IMPORT AND EXPORT STATISTICS FOR MILITARY DRONES

- TABLE 13 COUNTRY-WISE IMPORTS, 2019–2021 (USD THOUSAND)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MILITARY NON-STEERABLE ANTENNAS, BY PLATFORM (%)

- TABLE 15 KEY BUYING CRITERIA FOR MILITARY NON-STEERABLE ANTENNAS, BY PLATFORM

- TABLE 16 MILITARY NON-STEERABLE ANTENNA MARKET: CONFERENCES AND EVENTS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 20 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 22 INNOVATIONS AND PATENT REGISTRATIONS, 2021–2023

- TABLE 23 MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 24 MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 25 GROUND: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 26 GROUND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 AIRBORNE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 28 AIRBORNE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 MARINE: MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 30 MARINE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 32 MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 33 MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 34 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 36 MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY POINT OF SALE, 2020–2022 (USD MILLION)

- TABLE 38 MARKET, BY POINT OF SALE, 2023–2028 (USD MILLION)

- TABLE 39 MARKET, BY REGION, 2020−2022 (USD MILLION)

- TABLE 40 MARKET, BY REGION, 2023−2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: MARKET, BY PRODUCT, 2020−2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: MARKET, BY PRODUCT, 2023−2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY COUNTRY, 2023−2028 (USD MILLION)

- TABLE 51 US: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 52 US: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 53 US: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 54 US: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 55 US: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 56 US: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 57 CANADA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 58 CANADA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 59 CANADA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 60 CANADA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 61 CANADA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 62 CANADA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY PRODUCT, 2020−2022 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY PRODUCT, 2023−2028 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY COUNTRY, 2023−2028 (USD MILLION)

- TABLE 73 UK: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 74 UK: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 75 UK: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 76 UK: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 77 UK: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 78 UK: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 79 FRANCE: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 80 FRANCE: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 81 FRANCE: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 82 FRANCE: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 83 FRANCE: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 84 FRANCE: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 86 GERMANY: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 87 GERMANY: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 88 GERMANY: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 89 GERMANY: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 90 GERMANY: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 91 ITALY: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 92 ITALY: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 93 ITALY: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 94 ITALY: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 95 ITALY: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 96 ITALY: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 97 RUSSIA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 98 RUSSIA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 99 RUSSIA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 100 RUSSIA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 101 RUSSIA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 102 RUSSIA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY PRODUCT, 2020−2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY PRODUCT, 2023−2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY COUNTRY, 2020−2022 (USD BILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY COUNTRY, 2023−2028 (USD BILLION)

- TABLE 119 CHINA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 120 CHINA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 121 CHINA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 127 INDIA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 128 INDIA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 129 INDIA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 130 INDIA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 131 AUSTRALIA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 132 AUSTRALIA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 133 AUSTRALIA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 134 AUSTRALIA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 135 AUSTRALIA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 136 AUSTRALIA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 137 JAPAN: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 138 JAPAN: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 139 JAPAN: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 140 JAPAN: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 141 JAPAN: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 142 JAPAN: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH KOREA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 144 SOUTH KOREA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 146 SOUTH KOREA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 148 SOUTH KOREA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 156 MIDDLE EAST: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 157 MIDDLE EAST: MARKET, BY PRODUCT, 2020−2022 (USD MILLION)

- TABLE 158 MIDDLE EAST: MARKET, BY PRODUCT, 2023−2028 (USD MILLION)

- TABLE 159 MIDDLE EAST: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 160 MIDDLE EAST: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 161 MIDDLE EAST: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST: MARKET, BY COUNTRY, 2020−2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: MARKET, BY COUNTRY, 2023−2028 (USD MILLION)

- TABLE 165 SAUDI ARABIA: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 166 SAUDI ARABIA: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 167 SAUDI ARABIA: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 168 SAUDI ARABIA: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 169 SAUDI ARABIA: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 170 SAUDI ARABIA: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 171 TURKEY: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 172 TURKEY: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 173 TURKEY: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 174 TURKEY: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 175 TURKEY: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 176 TURKEY: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 177 ISRAEL: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 178 ISRAEL: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 179 ISRAEL: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 180 ISRAEL: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 181 ISRAEL: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 182 ISRAEL: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 183 ROW: MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 184 ROW: MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 185 ROW: MARKET, BY PRODUCT, 2020−2022 (USD MILLION)

- TABLE 186 ROW: MARKET, BY PRODUCT, 2023−2028 (USD MILLION)

- TABLE 187 ROW: MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 188 ROW: MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 189 ROW: MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 190 ROW: MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 191 ROW: MARKET, BY REGION, 2020−2022 (USD MILLION)

- TABLE 192 ROW: MARKET, BY REGION, 2023−2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 198 LATIN AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 199 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY PLATFORM, 2020−2022 (USD MILLION)

- TABLE 200 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY PLATFORM, 2023−2028 (USD MILLION)

- TABLE 201 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 202 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY APPLICATION, 2023−2028 (USD MILLION)

- TABLE 203 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY FREQUENCY BAND, 2020–2022 (USD MILLION)

- TABLE 204 AFRICA: MILITARY NON-STEERABLE ANTENNA MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- TABLE 205 KEY DEVELOPMENTS IN MILITARY NON-STEERABLE ANTENNA MARKET, 2019–2021

- TABLE 206 MILITARY NON-STEERABLE ANTENNA MARKET: DEGREE OF COMPETITION

- TABLE 207 MILITARY NON-STEERABLE ANTENNA MARKET: KEY STARTUP/SMES

- TABLE 208 MILITARY NON-STEERABLE ANTENNA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 209 MILITARY NON-STEERABLE ANTENNA MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 210 MILITARY NON-STEERABLE ANTENNA MARKET: PRODUCT LAUNCHES, APRIL 2021–FEBRUARY 2022

- TABLE 211 MILITARY NON-STEERABLE ANTENNA MARKET: DEALS, JANUARY 2020–FEBRUARY 2023

- TABLE 212 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 213 L3HARRIS TECHNOLOGIES, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 L3HARRIS TECHNOLOGIES, INC: DEALS

- TABLE 215 COBHAM ADVANCED ELECTRONIC SOLUTIONS: BUSINESS OVERVIEW

- TABLE 216 COBHAM ADVANCED ELECTRONIC SOLUTIONS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 217 COBHAM ADVANCED ELECTRONIC SOLUTIONS: DEALS

- TABLE 218 ROHDE & SCHWARZ: BUSINESS OVERVIEW

- TABLE 219 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ROHDE & SCHWARZ: NEW PRODUCT LAUNCHES

- TABLE 221 ROHDE & SCHWARZ: DEALS

- TABLE 222 COMROD COMMUNICATION GROUP: BUSINESS OVERVIEW

- TABLE 223 COMROD COMMUNICATION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 COMROD COMMUNICATION GROUP: NEW PRODUCT LAUNCHES

- TABLE 225 RAMI: BUSINESS OVERVIEW

- TABLE 226 RAMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 BARKER & WILLIAMSON: BUSINESS OVERVIEW

- TABLE 228 BARKER & WILLIAMSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 230 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 231 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 232 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 233 THALES GROUP: BUSINESS OVERVIEW

- TABLE 234 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 THALES GROUP: DEALS

- TABLE 236 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 237 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 239 HASCALL-DENKE: BUSINESS OVERVIEW

- TABLE 240 HASCALL-DENKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 HASCALL-DENKE: DEALS

- TABLE 242 HR SMITH GROUP OF COMPANIES: BUSINESS OVERVIEW

- TABLE 243 HR SMITH GROUP OF COMPANIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ALARIS HOLDINGS LIMITED: BUSINESS OVERVIEW

- TABLE 245 ALARIS HOLDINGS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 ALARIS HOLDINGS LIMITED: OTHERS

- TABLE 247 TRIVAL ANTENE D.O.O.: BUSINESS OVERVIEW

- TABLE 248 TRIVAL ANTENE D.O.O: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 TRIVAL ANTENE D.O.O.: NEW PRODUCT LAUNCHES

- TABLE 250 SHAKESPEARE COMPANY, LLC: BUSINESS OVERVIEW

- TABLE 251 SHAKESPEARE COMPANY, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 MTI WIRELESS EDGE LIMITED: BUSINESS OVERVIEW

- TABLE 253 MTI WIRELESS EDGE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 MTI WIRELESS EDGE LIMITED: DEALS

- TABLE 255 RADIALL: COMPANY OVERVIEW

- TABLE 256 ANTCOM: COMPANY OVERVIEW

- TABLE 257 DAYTON-GRANGER: COMPANY OVERVIEW

- TABLE 258 SOUTHWEST ANTENNAS: COMPANY OVERVIEW

- TABLE 259 ANTENNA EXPERTS: COMPANY OVERVIEW

- TABLE 260 ANTENNA PRODUCTS CORPORATION: COMPANY OVERVIEW

- TABLE 261 PPM SYSTEMS: COMPANY OVERVIEW

- TABLE 262 ACR ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 263 SENSOR SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 264 SOUTH MIDLANDS COMMUNICATIONS LTD.: COMPANY OVERVIEW

- FIGURE 1 MILITARY NON-STEERABLE ANTENNA MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 GROUND SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 8 PATCH ANTENNAS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 COMMUNICATION TO SURPASS OTHER APPLICATIONS BY 2028

- FIGURE 10 SUPER HIGH FREQUENCY TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 11 OEM ESTIMATED TO ACQUIRE LARGER MARKET SHARE IN 2023

- FIGURE 12 ASIA PACIFIC TO HOLD MAJOR MARKET SHARE FROM 2023 TO 2028

- FIGURE 13 INCREASING NEED FOR SECURE AND RELIABLE COMMUNICATION WORLDWIDE

- FIGURE 14 MANPACK ANTENNAS TO ACQUIRE MAXIMUM SHARE IN 2023

- FIGURE 15 UAV ANTENNAS TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 SHIPBOARD ANTENNAS TO EXCEED OTHER MARINE PLATFORMS DURING FORECAST PERIOD

- FIGURE 17 COMMUNICATION SEGMENT TO COMMAND LEADING MARKET POSITION BY 2028

- FIGURE 18 MARKET DYNAMICS

- FIGURE 19 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (%)

- FIGURE 20 NUMBER OF COUNTRIES DEVELOPED, ACQUIRED, AND USED ARMED DRONES OVER TIME

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 REVENUE SHIFT IN MILITARY NON-STEERABLE ANTENNA MARKET

- FIGURE 23 MILITARY NON-STEERABLE ANTENNA MARKET ECOSYSTEM MAP

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF MILITARY NON-STEERABLE ANTENNAS, BY PLATFORM

- FIGURE 26 KEY BUYING CRITERIA FOR MILITARY NON-STEERABLE ANTENNAS, BY PLATFORM

- FIGURE 27 MILITARY NON-STEERABLE ANTENNA MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- FIGURE 28 MILITARY NON-STEERABLE ANTENNA MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- FIGURE 29 MILITARY NON-STEERABLE ANTENNA MARKET, BY APPLICATION, 2023–2038 (USD MILLION)

- FIGURE 30 MILITARY NON-STEERABLE ANTENNA MARKET, BY FREQUENCY BAND, 2023–2028 (USD MILLION)

- FIGURE 31 MILITARY NON-STEERABLE ANTENNA MARKET, BY POINT OF SALE, 2023–2028 (USD MILLION)

- FIGURE 32 MILITARY NON-STEERABLE ANTENNA MARKET, BY REGION, 2023–2028

- FIGURE 33 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 34 NORTH AMERICA: MILITARY NON-STEERABLE ANTENNA MARKET SNAPSHOT

- FIGURE 35 US: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 36 CANADA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 37 EUROPE: MILITARY NON-STEERABLE ANTENNA MARKET SNAPSHOT

- FIGURE 38 UK: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 39 FRANCE: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 40 GERMANY: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 41 ITALY: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016–2020

- FIGURE 42 RUSSIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016–2020

- FIGURE 43 ASIA PACIFIC: MILITARY NON-STEERABLE ANTENNA MARKET SNAPSHOT

- FIGURE 44 CHINA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 45 INDIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 46 AUSTRALIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 47 JAPAN: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 48 SOUTH KOREA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 49 SAUDI ARABIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 50 TURKEY: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 51 ISRAEL: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 52 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 53 REVENUE OF KEY PLAYERS, 2022

- FIGURE 54 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 55 MILITARY NON-STEERABLE ANTENNA MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 56 MILITARY NON-STEERABLE ANTENNA MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 57 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 58 RAYTHEON TECHNOLOGIES CORPORATION.: COMPANY SNAPSHOT

- FIGURE 59 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 60 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 ALARIS HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 62 MTI WIRELESS EDGE LIMITED: COMPANY SNAPSHOT

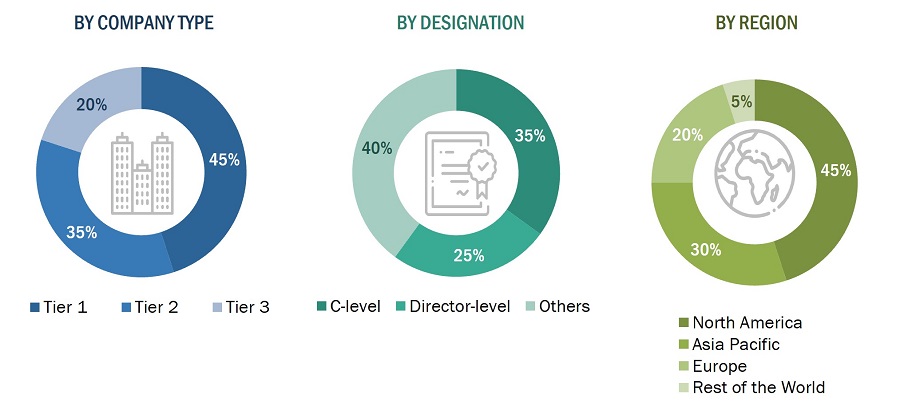

This research study on the military non-steerable antenna market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. Primary sources considered include industry experts, manufacturers, system providers, technology developers, alliances, and organizations related to all segments of the value chain of the military non-steerable antenna market. In-depth interviews with various primary respondents, including key industry participants, subject-matter experts (SME), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market, as well as to assess its growth prospects.

Secondary Research

The ranking analysis of companies in the military non-steerable antenna market was determined using secondary data from paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and diversification of their products. Primary sources further validated these data points.

Secondary sources referred for this research study on the military non-steerable antenna market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the military non-steerable antenna market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the military non-steerable antenna market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across North America, Europe, Asia Pacific, and the Middle East. The primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

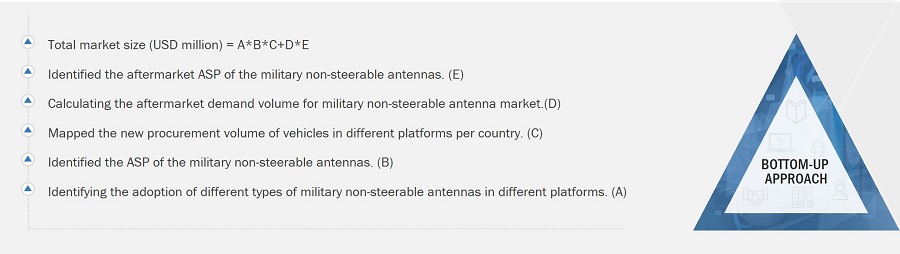

Both the top-down and bottom-up approaches were used to estimate and validate the size of the military non-steerable antenna market. The research methodology used to estimate the market size also includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Global the Military Non-Steerable Antenna Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the market, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

- Country-wise deliveries of vehicles in different platforms from 2023 to 2028 were considered for base data. Data was taken from the OEM manufacturers and various governing bodies of each country.

Market Definition

According to IEEE Standard Definitions of Terms, an antenna is any device that converts electronic signals to electromagnetic waves (and vice versa) effectively with minimum loss of signals. Military non-steerable antennas cannot be mechanically or electronically repositioned once deployed. They are typically used for communication and data transmission in military applications where a fixed direction of transmission is sufficient. Non-steerable antennas are simpler and less expensive than steerable antennas and are commonly used in ground-based, shipborne, and airborne military communication systems. These antennas are designed to be durable, reliable, and low maintenance.

Key Stakeholders

- Manufacturers of Military Antennas

- System Integrators

- Original Equipment Manufacturers (OEMs)

- Military Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Ministries of Defense

- R&D Companies

Objectives of the Report

- To analyze the size of the military non-steerable antenna market and provide projections from 2023 to 2028

- To define, describe, and forecast the size of the market based on platform, product, application, frequency band, and point of sale, along with regional analysis

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the dynamics (drivers, restraints, opportunities, and challenges) and major factors influencing the growth of the market

- To forecast the size of the market segments with respect to major countries such as the US, China, the UK, Saudi Arabia, Germany, France, Russia, India, Japan, South Korea, and Israel, among others

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To provide a detailed competitive landscape of the market, along with an analysis of the business and corporate strategies adopted by key players

- To analyze competitive developments of key market players, such as contracts, acquisitions, partnerships, expansions, and new product developments

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Military Non-Steerable Antenna market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Military Non-Steerable Antenna market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Non-Steerable Antenna Market