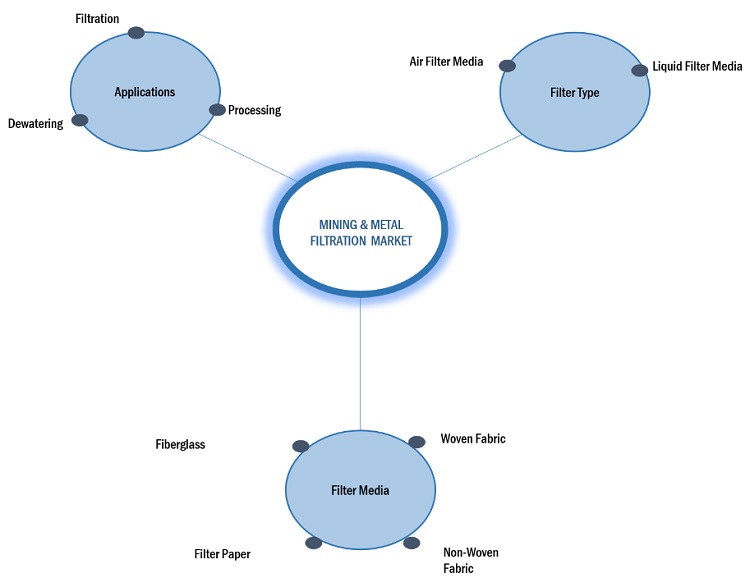

Mining & Metal Filtration Market by Filter Type (Liquid Filter Media, Air Filter Media), Filter Media (Woven Fabric, Non-Woven Fabric, Filter Paper, Fiberglass ), Application, and Region (North America, Europe, APAC, RoW) - Global Forecast to 2028

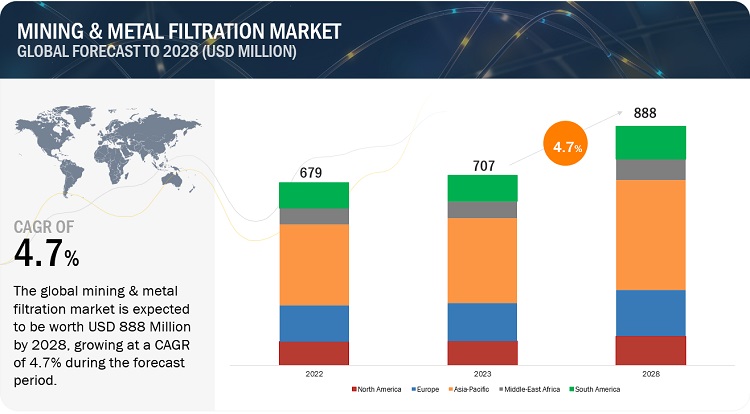

The mining & metal filtration market is projected to reach USD 888 million by 2028, at a CAGR of 4.7% from USD 707 million in 2023. Mining and metal filtration play a crucial role in the extraction and refining of valuable minerals. This process entails removing undesired impurities and substances from metal ores, guaranteeing exceptional purity and quality. By employing efficient filtration methods, businesses can boost productivity, minimize environmental harm, and optimize resource allocation. This enables them to meet industry benchmarks and provide exceptional metal products to global markets.

Attractive Opportunities in the Mining & Metal Filtration Market

To know about the assumptions considered for the study, Request for Free Sample Report

Mining & Metal Filtration Market Dynamics

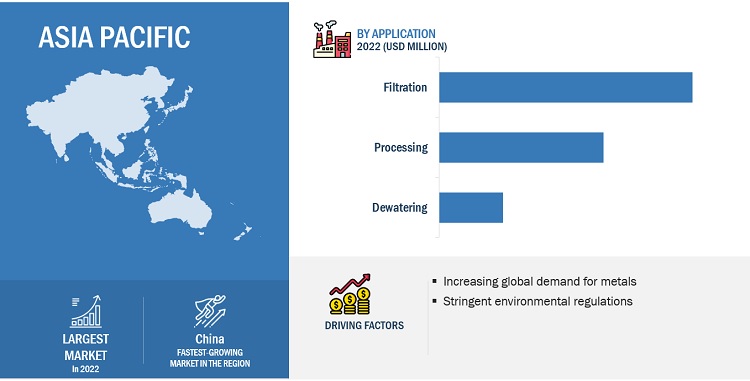

Driver: Increasing global demand for metals

The rising global demand for metals is a key catalyst for the expansion of the mining and metal filtration market. This demand surge is primarily propelled by factors like the growth of industries, increased investments in infrastructure projects, energy facilities, smart cities, and advancements in technology. Additionally, increasing global population, rising middle-class incomes, and changing consumer preferences for durable goods contribute to the growing demand for metals in various sectors. As economies continue to grow and develop, there is a rising need for metals like iron ore, copper, aluminum, and others, which are vital for various industries, including construction, automotive, electronics, and energy.

To meet this demand, mining and metal production activities are expanding worldwide. According to the World Mining Data, global mining production reached approximately 16.5 billion metric tons in 2020. In the mining and metal production industry, there is a need for effective filtration systems to address the environmental impact caused by the generation of by-products, waste materials, and emissions. Filtration solutions play a crucial role in separating solids from liquids, eliminating particulate matter, and capturing harmful pollutants from air and water streams. These filtration systems are essential for meeting environmental regulations and minimizing the industry's ecological footprint.

Restraint: Operational disruptions in metal & mining operations

Operational disruptions in filtration systems can occur due to several factors impacting the smooth functioning of the equipment. One major reason is the occurrence of clogging, where the filter media becomes obstructed with particles, impurities, or contaminants. This impedes the flow of fluids or gases through the system, reducing filtration efficiency and causing pressure build-up. Additionally, inadequate maintenance, improper filter media selection, or operating conditions beyond the recommended limits can contribute to operational disruptions. Such disruptions can lead to production delays, decreased productivity, and increased maintenance requirements, ultimately affecting operational efficiency and necessitating additional costs for maintenance, repairs, and media replacement.

Opportunity: Expanding into emerging markets for metal & mining filtration solutions

Expansion in emerging markets presents a lucrative opportunity for filtration solution providers in the metal and mining industry. The rapid industrialization, infrastructure development, and urbanization in Asia-Pacific, Latin America, and Africa are driving the surging demand for metals. To meet these increasing needs, there is a growing requirement for efficient filtration systems that ensure compliance with environmental regulations and optimize operational efficiency. Filtration solution providers can leverage this market expansion by delivering customized filtration solutions that address the unique challenges and demands of these emerging markets. By comprehending the distinct characteristics and requirements of these regions, such as water scarcity, elevated particulate matter levels, and stringent regulatory frameworks, filtration companies can develop innovative products and services that cater to the evolving needs of customers in these markets.

Challenge: High temperature environment in metal & mining operation

In metal and mining operations, high-temperature environments can be encountered, presenting unique challenges for filtration systems. These high temperatures can negatively impact the performance and durability of filtration equipment if not adequately addressed. It is essential to ensure that the filtration equipment is designed and constructed with materials and components that can withstand the elevated temperatures encountered in these processes.

The high temperatures can accelerate the degradation of filter media, reduce filtration efficiency, and increase the risk of equipment failure. Filters that are not designed to handle high temperatures may experience premature clogging, reduced filtration capacity, or even structural damage. This can lead to operational disruptions, decreased productivity, and increased maintenance costs.

Mining & Metal Filtration Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Filtration was the largest segment for mining & metal filtration market in 2022, in terms of value."

The filtration process is an essential stage in mining and metal filtration, enabling the extraction and refinement of valuable minerals. It comprises several key steps that aim to separate solid particles from liquids or slurries, ensuring the production of superior end products. Pre-treatment optimizes the material for filtration, followed by the actual filtration process where impurities are eliminated. The resulting filtrate, a clarified liquid, is collected, while the solid particles form a filter cake, which undergoes additional processing or disposal.

"Liquid filter media was the largest type for mining & metal filtration market in 2022, in terms of value."

Liquid filter media play a pivotal role in the operational success of metal and mining filtration processes. These media, including filter cloths, filter cartridges, and filter membranes, are specifically engineered to withstand the demanding operating conditions and effectively capture and retain solid particles. By selecting the appropriate liquid filter media based on factors like particle size, chemical compatibility, and flow rates, companies can ensure efficient and reliable filtration operations, leading to improved productivity, reduced downtime, and enhanced product quality in the metal and mining industry.

"Asia Pacific was the largest market for mining & metal filtration in 2022, in terms of value."

Asia Pacific was the largest market for global mining & metal filtration market, in terms of value, in 2022. China is the largest market in Asia Pacific. It is projected to witness the second-highest growth during the forecast period considering of high usage of fabric filters in the region for mining & metal processing application.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Clear Edge Filtration Inc, (US), Valmet (Finland), Lydall Inc. (US), Kimberly-Clark Professional (US), Sefar (Switzerland), Khosla Profil Pvt. Ltd. (India), Markert Group Corporation (Germany), Testori Group (Italy), Micronics Engineered Filtration Group, Inc. (US), Finsa (Spain), Arvind Advanced Materials (India), Solaft Filtration Solutions (Australia) and GKD Group (Germany). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of fabric filters have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Million Square Meter); Value (USD Million) |

|

Segments |

Filter Type, Filter Media, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Clear Edge Filtration Inc, (US), Valmet (Finland), Lydall Inc. (US), Kimberly-Clark Professional (US), Sefar (Switzerland), Khosla Profil Pvt. Ltd. (India), Markert Group Corporation (Germany), Testori Group (Italy), Micronics Engineered Filtration Group, Inc. (US), Finsa (Spain), Arvind Advanced Materials (India), Solaft Filtration Solutions (Australia) , GKD Group (Germany) |

This report categorizes the global mining & metal filtration market based on filter type, filter media, application, and region.

Based on filter type, the mining & metal filtration market has been segmented as follows:

- Liquid Filter Media

- Air Filter Media

Based on filter media, the mining & metal filtration market has been segmented as follows:

- Woven fabric

- Non-Woven Fabric

- Filter Paper

- Fiberglass

Based on region, the mining & metal filtration market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2021, Clear Edge Filtration, Inc. announced the expansion of their existing Minnesota plant to accommodate continuing growth and future market development plans. This facility will also facilitate technical support, patent of products, and new product development. This facility will add fabrication of liquid filtration media and belting products to its capabilities, using state-of-the-art infrastructure.

- In September 2021, Clear Edge Filtration, Inc. has launched new filter media- Lotus range for the mining and mineral industry to provide longer-life, decrease the frequency of filter cloth changes, and increase efficiency in mining and mineral processing dewatering operations.

- In December 2022, Valmet have signed a two-year service agreement with Karara Mining Ltd for the delivery of filter cloths for tailings filtration to Karara’s mine in Western Australia.

- In June 2021, Valmet has recently made a strategic investment in a state-of-the-art forming fabric weaving machine at its production facility located in Tianjin, China. This move strengthens the company’s capability to serve the customers with high quality fabrics.

- In November 2022, Markert Group acquired 100% of the shares of Cross Filtration LLC in Moravia, New York State. This expansion is a part of company’s development plan to penetrate in the North American market.

- In June 2022, Testori Group has announced the foundation of Testori LATAM, a new company, registered and located in Santiago (Republic of Chile). With this new company, the group aims at developing an ever-growing customer base of end users in those industrial sectors whose processes extensively employ equipment for liquid-solid separation, such as press and vacuum filters.

- In February 2023, Finsa launched the new patented Eyeletless System. The main objective of this system is to eliminate any non-textile component of the clothes by substituting the possible use of metallic eyelets and/or the use of plastic laces or flanges.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the mining & metal filtration market?

The forecast period for the mining & metal filtration market in this study is 2023-2028. The mining & metal filtration market is expected to grow at a CAGR of 4.7%, in terms of value, during the forecast period.

Who are the major key players in the mining & metal filtration market?

Clear Edge Filtration Inc, (US), Valmet (Finland), Lydall Inc. (US), Kimberly-Clark Professional (US), Sefar (Switzerland), Khosla Profil Pvt. Ltd. (India), Markert Group Corporation (Germany), Testori Group (Italy), Micronics Engineered Filtration Group, Inc. (US), Finsa (Spain), Arvind Advanced Materials (India), Solaft Filtration Solutions (Australia) and GKD Group (Germany) are the leading manufacturers of fabric filters.

What are the drivers and opportunities for the mining & metal filtration market?

Increasing global demand for metals is driving the market during the forecast period. Expanding into emerging markets for metal & mining filtration solutions acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the mining & metal filtration market?

The key technologies prevailing in the mining & metal filtration market include nanofiltration, and automated filtration systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing global demand for metals- Stringent environmental regulations- Emphasis on product quality and consistencyRESTRAINTS- Operational disruption in filtration systems- Use of alternative renewable energy sourcesOPPORTUNITIES- Expansion in emerging marketsCHALLENGES- High temperature to degrade filter media

-

5.3 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPESPUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP APPLICANTSPATENTS BY REINHOLDPATENTS BY KANE BIOTECH INC.TOP PATENT OWNERS

-

5.4 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTTOTAL MINERAL PRODUCTION, BY COUNTRY

-

5.7 CASE STUDY ANALYSISIDENTIFYING COST-EFFECTIVE FIBER TO MEET REFINING REQUIREMENTSOFFERING CUTTING-EDGE FILTRATION SOLUTIONS TO ENHANCE LONGEVITY OF FILTER BAGS

-

5.8 FILTRATION EQUIPMENT AND MAJOR OEMSDIEMME FILTRATION SRL- Overview- Key equipment supplied- Future trendsANDRITZ- Overview- Key equipment supplied- Future trendsTENOVA S.P.A.- Overview- Key equipment supplied- Future trendsMETSO OUTOTEC OYJ- Overview- Key equipment supplied- Future trendsFLSMIDTH- Overview- Key equipment supplied- Future trendsGAUDFRIN- Overview- Key equipment supplied- Future trendsANT GROUP CO., LTD.- Overview- Key equipment supplied- Future trendsMATEC INDUSTRIES S.P.A.- Overview- Key equipment supplied- Future trendsPRAYON- Overview- Key equipment supplied- Future trendsBOKELA GMBH- Overview- Key equipment supplied- Future trendsHASLER GROUP- Overview- Key equipment supplied- Future trends

-

5.9 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

-

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

5.11 TARIFF & REGULATORY LANDSCAPEREGULATIONS- North America- Asia Pacific- Europe- Middle East & Africa and South AmericaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN THE BUYING PROCESSBUYING CRITERIA- QUALITY- SERVICE

-

5.13 TECHNOLOGY ANALYSISPRESSURE FILTRATIONVACUUM FILTRATIONNANOFILTRATION AND MEMBRANE TECHNOLOGIESSUSTAINABLE FILTRATION AND TAILINGS MANAGEMENT

-

5.14 ECOSYSTEM/MARKET MAP

- 5.15 ECONOMIC RECESSION

- 5.16 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 WOVEN FABRICGOOD TENSILE STRENGTH AND MECHANICAL STABILITY

-

6.3 NONWOVEN FABRICSUPERIOR STRENGTH AND DURABILITY

-

6.4 FILTER PAPERGOOD POROSITY AND VOLUMETRIC FLOW RATE

-

6.5 FIBERGLASSRESISTANT TO CORROSION AND HIGH TEMPERATURES

- 7.1 INTRODUCTION

-

7.2 LIQUID FILTRATIONREMOVAL OF SOLID PARTICLES AND IMPURITIES FROM FLUIDS

-

7.3 AIR FILTRATIONCONTROL OF AIRBORNE POLLUTANTS AND PARTICULATE MATTER

- 8.1 INTRODUCTION

-

8.2 PROCESSINGBAUXITE & ALUMINAIRON ORE/IRON OXIDEPRECIOUS METALSBATTERY METALSBASE METALSCOLORING MINERALSFERTILIZER MINERALSCOAL PROCESSINGLIME

-

8.3 FILTRATIONBAUXITE & ALUMINAIRON ORE/IRON OXIDEPRECIOUS METALSBATTERY METALSBASE METALSCOLORING MINERALSFERTILIZER MINERALSCOAL PROCESSINGLIME

-

8.4 DEWATERINGBAUXITE & ALUMINAIRON ORE/IRON OXIDEPRECIOUS METALSBATTERY METALSBASE METALSCOLORING MINERALSFERTILIZER MINERALSCOAL PROCESSINGLIME

-

8.5 OTHERSRARE EARTHCERAMICCLAYGRAVEL

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Government initiatives for domestic production to drive marketINDIA- Sustainable development initiatives to fuel market growthINDONESIA- Increasing investments in mining sector to drive marketVIETNAM- Environmental sustainability to boost marketAUSTRALIA- Mineral exploration activities to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAUS- Adoption of advanced filtration technologies to drive marketCANADA- Management of waste streams and water conservation to fuel demand for filtration solutionsMEXICO- Focus on environmental sustainability and regulatory compliance to propel market

-

9.4 EUROPERECESSION IMPACT ON EUROPERUSSIA- Environmental regulations and sustainability to drive marketUKRAINE- Abundant mineral production to boost marketSWEDEN- Presence of prominent mining companies to fuel market growthKAZAKHSTAN- New investments and favorable business environment to drive marketNORWAY- Sustainable mining practices to fuel demand for fabric filtersPOLAND- Growth of mining sector to boost marketBULGARIA- Adoption of advanced filtration technologies to propel marketREST OF EUROPE

-

9.5 MIDDLE EAST & AFRICASOUTH AFRICA- Rich mineral resources to fuel demand for effective filtration technologiesUAE- Expansion of mining sector to fuel demand for fabric filtersIRAN- Government initiatives and foreign investments to drive marketBAHRAIN- Growth of aluminum industry to fuel demand for filtersGUINEA- Sustainable development in mining sector to fuel demand for fabric filtersCONGO DR- Abundance of mineral resources to boost marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Sustainable mining practices and adherence to environmental regulations to boost marketARGENTINA- Favorable environment for mining activities to boost marketREST OF SOUTH AMERICA

- 10.1 OVERVIEW

-

10.2 MARKET SHARE ANALYSISRANKING ANALYSIS OF KEY MARKET PLAYERSMARKET SHARE OF KEY PLAYERS,2022

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET EVALUATION MATRIX

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSCLEAR EDGE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVALMET- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLYDALL, INC.- Business overview- Products/Solutions/Services offered- MnM viewSEFAR AG- Business overview- Products/Solutions/Services offered- MnM viewTESTORI GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKIMBERLY-CLARK PROFESSIONAL- Business overview- Products/Solutions/Services offered- MnM viewKHOSLA PROFIL PVT. LTD.- Business overview- Products/Solutions/Services offered- MnM viewMARKERT GROUP- Business overview- Products/Solutions/Services offered- MnM viewMICRONICS ENGINEERED FILTRATION GROUP, INC.- Business overview- Products/Solutions/Services offered- MnM viewFINSA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARVIND ADVANCED MATERIALS- Business overview- Products/Solutions/Services offered- MnM viewSOLAFT FILTRATION SOLUTIONS- Business overview- Products/Solutions/Services offered- MnM viewGKD- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSMENARDI FILTER ELEMENTSBOLIAN FILTRATION SOLUTIONS CO., LTD.C. CRAMER & CO. GMBHFILTRAPOL SPTESSITURA FRATELLI FONTANAJINGJIN EQUIPMENT INC.KOMLINE-SANDERSONLANDRY FILTRATIONMASTURLAL PVT. LTD.MINCHEM FILTER CLOTH CO., LTD.NAKAO FILTER MEDIA CORP.SAATI S.P.A.BRASFELTCHOQUENETDELLA TOFFOLA PACIFIC

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MINING & METAL FILTRATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MINING & METAL FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 4 TOTAL MINERAL PRODUCTION OF KEY COUNTRIES, 2021 (METRIC TON)

- TABLE 5 AVERAGE SELLING PRICES TREND, BY APPLICATION (USD/SQUARE METER)

- TABLE 6 YC & YCC SHIFT FOR MINING & METAL FILTRATION MARKET

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MINING & METAL FILTRATION SYSTEMS

- TABLE 9 MINING & METAL FILTRATION MARKET: ECOSYSTEM

- TABLE 10 MINING AND METAL FILTRATION MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 11 MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 12 MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 13 METAL & MINING FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 14 METAL & MINING FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 15 MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 16 MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 17 MINING & METAL FILTRATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 MINING & METAL FILTRATION MARKET, BY REGION, 2021–2028 (MILLION SQUARE METER)

- TABLE 19 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 21 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 23 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 25 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 27 CHINA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 28 CHINA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 29 INDIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 30 INDIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 31 INDONESIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 32 INDONESIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 33 VIETNAM: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 34 VIETNAM: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 35 AUSTRALIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 36 AUSTRALIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 37 REST OF ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 38 REST OF ASIA PACIFIC: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 39 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 41 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 43 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 45 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 47 US: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 48 US: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 49 CANADA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 51 MEXICO: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 MEXICO: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 53 EUROPE: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 55 EUROPE: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 57 EUROPE: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 59 EUROPE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 60 EUROPE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 61 RUSSIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 RUSSIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 63 UKRAINE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 UKRAINE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 65 SWEDEN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 66 SWEDEN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 67 KAZAKHSTAN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 KAZAKHSTAN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 69 NORWAY: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 NORWAY: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 71 POLAND: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 POLAND: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 73 BULGARIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 74 BULGARIA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 75 REST OF EUROPE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 77 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 79 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 81 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 83 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 85 SOUTH AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 SOUTH AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 87 UAE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 88 UAE: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 89 IRAN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 IRAN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 91 BAHRAIN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 92 BAHRAIN: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 93 GUINEA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 GUINEA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 95 CONGO DR: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 96 CONGO DR: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 97 REST OF MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 REST OF MIDDLE EAST & AFRICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 99 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE METER)

- TABLE 101 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY TYPE, 2021–2028 (MILLION SQUARE METER)

- TABLE 103 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (USD MILLION)

- TABLE 104 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY FILTER MEDIA, 2021–2028 (MILLION SQUARE METER)

- TABLE 105 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 107 BRAZIL: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 108 BRAZIL: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 109 ARGENTINA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 ARGENTINA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 111 REST OF SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 112 REST OF SOUTH AMERICA: MINING & METAL FILTRATION MARKET, BY APPLICATION, 2021–2028 (MILLION SQUARE METER)

- TABLE 113 MINING & METAL FILTRATION MARKET: DEGREE OF COMPETITION

- TABLE 114 MINING & METAL FILTRATION MARKET: REVENUE ANALYSIS (USD)

- TABLE 115 MINING & METAL FILTRATION MARKET: MARKET EVALUATION MATRIX

- TABLE 116 DETAILED LIST OF COMPANIES

- TABLE 117 MINING AND METAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY FILTER MEDIA

- TABLE 118 MINING AND METAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 119 MINING AND METAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

- TABLE 120 MINING AND METAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 121 PRODUCT LAUNCHES, 2018–2023

- TABLE 122 DEALS, 2018—2023

- TABLE 123 OTHER DEVELOPMENTS, 2018–2023

- TABLE 124 CLEAR EDGE: COMPANY OVERVIEW

- TABLE 125 CLEAR EDGE: PRODUCTS OFFERED

- TABLE 126 CLEAR EDGE: PRODUCT LAUNCHES

- TABLE 127 CLEAR EDGE: DEALS

- TABLE 128 CLEAR EDGE: OTHERS

- TABLE 129 VALMET: COMPANY OVERVIEW

- TABLE 130 VALMET: PRODUCTS OFFERED

- TABLE 131 VALMET: DEALS

- TABLE 132 VALMET: OTHERS

- TABLE 133 LYDALL, INC.: COMPANY OVERVIEW

- TABLE 134 LYDALL, INC.: PRODUCTS OFFERED

- TABLE 135 SEFAR AG: COMPANY OVERVIEW

- TABLE 136 SEFAR AG: PRODUCTS OFFERED

- TABLE 137 TESTORI GROUP: COMPANY OVERVIEW

- TABLE 138 TESTORI GROUP: PRODUCTS OFFERED

- TABLE 139 TESTORI GROUP: OTHERS

- TABLE 140 KIMBERLY-CLARK PROFESSIONAL: COMPANY OVERVIEW

- TABLE 141 KIMBERLY-CLARK PROFESSIONAL: PRODUCTS OFFERED

- TABLE 142 KHOSLA PROFIL PVT. LTD.: COMPANY OVERVIEW

- TABLE 143 KHOSLA PROFIL PVT. LTD.: PRODUCTS OFFERED

- TABLE 144 MARKERT GROUP: COMPANY OVERVIEW

- TABLE 145 MARKERT GROUP: PRODUCTS OFFERED

- TABLE 146 MARKERT GROUP: DEALS

- TABLE 147 MICRONICS ENGINEERED FILTRATION GROUP, INC.: COMPANY OVERVIEW

- TABLE 148 MICRONICS ENGINEERED FILTRATION GROUP, INC.: PRODUCTS OFFERED

- TABLE 149 FINSA: COMPANY OVERVIEW

- TABLE 150 FINSA: PRODUCTS OFFERED

- TABLE 151 FINSA: PRODUCT LAUNCHES

- TABLE 152 ARVIND ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 153 ARVIND ADVANCED MATERIALS: PRODUCTS OFFERED

- TABLE 154 SOLAFT FILTRATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 155 SOLAFT FILTRATION SOLUTIONS: PRODUCTS OFFERED

- TABLE 156 GKD: COMPANY OVERVIEW

- TABLE 157 GKD: PRODUCTS OFFERED

- FIGURE 1 MINING & METAL FILTRATION MARKET SEGMENTATION

- FIGURE 2 MINING & METAL FILTRATION MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED FOR ASSESSING DEMAND FOR MINING & METAL FILTRATION

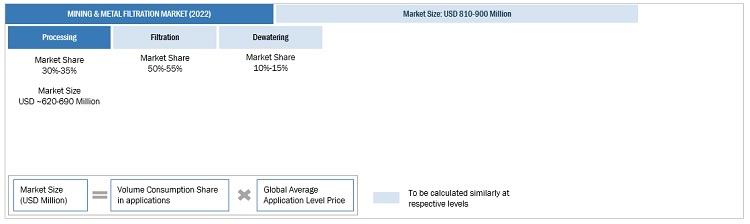

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1

- FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 2

- FIGURE 6 MINING & METAL FILTRATION MARKET: TOP-DOWN APPROACH

- FIGURE 7 MINING & METAL FILTRATION MARKET: BOTTOM-UP APPROACH

- FIGURE 8 MINING & METAL FILTRATION MARKET: DATA TRIANGULATION

- FIGURE 9 LIQUID FILTRATION TYPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NONWOVEN FABRIC TO DOMINATE MEDIA TYPE DURING FORECAST PERIOD

- FIGURE 11 FILTRATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 LIQUID FILTRATION TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- FIGURE 15 NONWOVEN FABRIC TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 FILTRATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 FILTRATION AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN 2022

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GRANTED PATENTS

- FIGURE 20 MINING & METAL FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 MINING & METAL FILTRATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND, BY REGION (USD/SQUARE METER)

- FIGURE 23 FIGURE REVENUE SHIFT FOR MINING & METAL FILTRATION MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING MINING AND METAL FILTRATION FOR DIFFERENT END-USE APPLICATIONS

- FIGURE 25 SUPPLIER SELECTION CRITERION

- FIGURE 26 MINING AND METAL ECOSYSTEM

- FIGURE 27 NONWOVEN FABRICS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 28 LIQUID FILTRATION TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 FILTRATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 30 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC: MINING & METAL FILTRATION MARKET SNAPSHOT

- FIGURE 32 EUROPE: MINING & METAL FILTRATION MARKET SNAPSHOT

- FIGURE 33 KEY GROWTH STRATEGIES ADOPTED BY COMPANIES DURING FORECAST PERIOD

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN MINING & METAL FILTRATION MARKET, 2022

- FIGURE 35 MINING & METAL FILTRATION MARKET SHARE, BY COMPANY (2022)

- FIGURE 36 MINING & METAL FILTRATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 MINING & METAL FILTRATION MARKET: STARTUP/SME MATRIX, 2022

- FIGURE 38 VALMET: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the mining & metal filtration market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The mining & metal filtration market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the mining & metal filtration market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the mining & metal filtration industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, application type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of mining & metal filtration and outlook of their business which will affect the overall market.

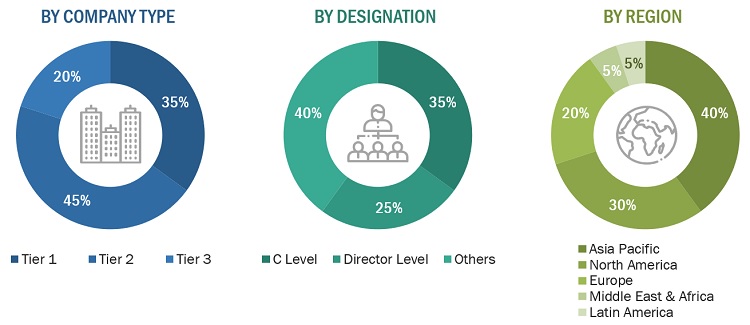

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Clear Edge Filtration, Inc. |

Individual Industry Expert |

|

Lydall Inc. |

Sales Manager |

|

Arvind Advanced Materials |

Director |

|

Testori Group |

Marketing Manager |

|

Finsa |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the mining & metal filtration market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Mining & Metal Filtration Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Mining & Metal Filtration Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Mining & metal filtration refers to the process of separating solid particles, impurities, and contaminants from fluids or liquids used in mining and metal processing operations. It encompasses the use of specialized filtration systems and media to ensure the cleanliness, purity, and quality of process water, slurry, tailings, metal concentrates, and other liquid streams associated with these industries.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the mining & metal filtration market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on filter type, filter media, and application, , and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Tariff & Regulations

Regulations and impact on mining & metal filtration market

Growth opportunities and latent adjacency in Mining & Metal Filtration Market