Mobile Application Security Testing Market by Offering, Operating System (iOS, Android), Deployment Mode (On-premises, Cloud), Organization Size, Vertical (BFSI, IT & Telecom, Retail & eCommerce) and Region - Global Forecast to 2028

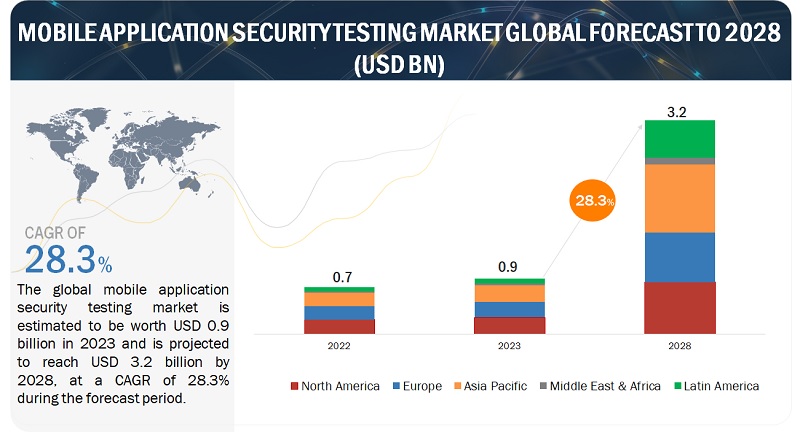

The global Mobile Application Security Testing (MAST) Market size was valued at USD 0.9 billion in 2023 and is expected to expand at a CAGR of 28.3% during the forecast period, reaching USD 3.2 billion by 2028. The driving force behind the MAST market lies in the increasing trend of remote work and the use of mobile devices for business activities. The shift toward remote work, accelerated by global events, has increased reliance on mobile applications for accessing corporate data, collaboration, and communication. This trend amplifies the potential attack surface for cyber threats, as mobile devices may connect to networks outside the traditional corporate perimeter. As employees use mobile apps to handle sensitive information and conduct business operations remotely, organizations are compelled to prioritize security testing to identify and mitigate vulnerabilities. Ensuring the resilience of mobile applications becomes paramount in this context, addressing risks associated with unsecured Wi-Fi networks, device theft or loss, and potential exposure to malicious apps. Consequently, the increased use of mobile devices for work purposes has become a driving force behind the implementation of rigorous MAST strategies to safeguard corporate data and maintain business continuity in a mobile-centric work environment.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Driver: Increasing Mobile App Usage

The proliferation of smartphones and the ubiquity of mobile applications across various sectors drive the need for robust security testing. The sheer volume and diversity of mobile apps increase the attack surface, making securing applications against potential threats and vulnerabilities essential. The driver here lies in the recognition that mobile apps have become integral to personal and business operations, necessitating a proactive approach to security.

Restraint: Skill Shortages

The shortage of skilled cybersecurity professionals capable of conducting effective MAST can hinder organizations from implementing robust security measures. The demand for individuals well-versed in mobile application development and security is high, and the scarcity of these skills may limit the effectiveness of MAST programs.

Opportunity: Increasing Awareness and Adoption

The growing awareness of cybersecurity risks and the impact of data breaches creates an opportunity for MAST providers. As businesses become more cognizant of the potential consequences of insecure applications, there is a heightened willingness to invest in MAST solutions and services to mitigate risks and enhance overall security posture.

Challenge: Diversity of Mobile Platforms

The diversity of mobile platforms, including iOS and Android, coupled with variations in device configurations, poses a challenge for MAST. Solutions need to adapt to different environments to ensure comprehensive testing coverage. This diversity requires MAST providers to develop testing methodologies that account for platform-specific vulnerabilities and nuances.

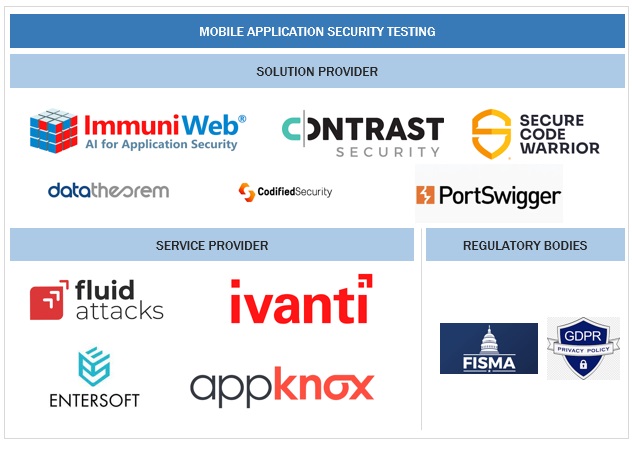

Mobile Application Security Testing Market Ecosystem

The major players in the MAST market are IBM, HCLTech, Synoypsys, OpenText, Qualys and so on. The MAST market is driven by prominent companies that have established themselves as leaders in the industry. These firms have a strong foundation, financial stability, and a demonstrated history of delivering inventive solutions and services within the MAST domain. Their varied range of products encompasses infrastructure, solutions, applications, and services, allowing them to meet the changing demands of the market. Leveraging cutting-edge technologies and broad capabilities, these companies lead the way in advancing MAST technology.

By offering, the services segment to register the highest growth rate during the forecast period.

Mobile application security testing services are a critical process aimed at identifying and addressing vulnerabilities in mobile apps to ensure the protection of sensitive data and user privacy. This type of testing involves evaluating the security posture of mobile applications across various platforms, such as iOS and Android, by assessing potential risks and weaknesses in their code, data storage, communication channels, and user authentication mechanisms.

Based on OS, the Android segment to account for the largest market size in the MTD market.

Android OS is developed by Google. It serves as the OS for various smartphones and tablets produced by multiple hardware manufacturers. Unlike iOS, Android operates on an open-source model, allowing each manufacturer to offer a customized version of the OS on its devices. MAST solutions for Android are essential to address the increasing threats and vulnerabilities associated with mobile applications on the Android platform. Android, being an open-source operating system, offers a diverse ecosystem of applications, making it susceptible to various security risks. MAST solutions play a crucial role in identifying and mitigating potential security vulnerabilities in Android applications.

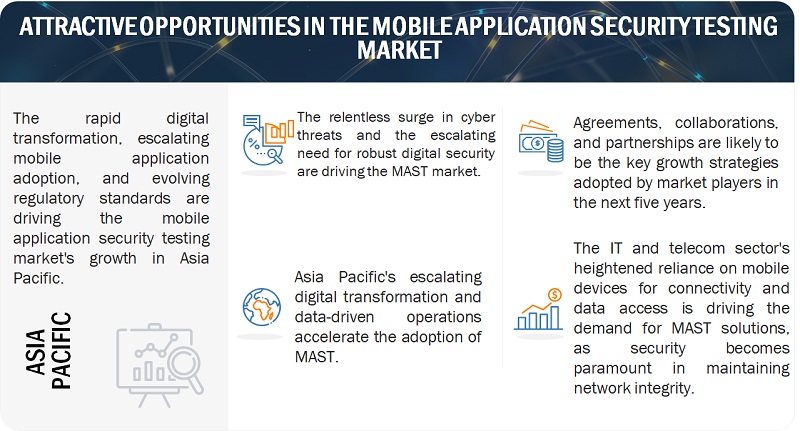

Asia Pacific to register the highest growth rate during the forecast period.

The Asia Pacific region has witnessed a substantial surge in the adoption of mobile application security testing, reflecting the growing awareness of the critical need to fortify digital assets in an increasingly connected landscape. Organizations across diverse sectors, from finance to healthcare, are recognizing the unique challenges posed by the proliferation of mobile applications and the associated security vulnerabilities. With the escalating use of smartphones and the rapid digital transformation in the region, ensuring the robustness of mobile applications has become a top priority.

Key Market Players:

The major players in the MAST market are IBM (US), HCLTech (India), OpenText (Canada), Synopsys (US), 3i Infotech (India), Qualys (US), Syhunt (Brazil), Checkmarx (US), Testhouse (UK), Ivanti (US), Digital.ai (US), Veracode (US), Onapsis (US), Snyk (US), Secure Code Warrior (Australia), eShard (France), Quokka (India), Data Theorem (US), Pradeo (France), PortSwigger (UK), ImmuniWeb (Switzerland), Contrast Security (US), Codified Security (UK), App-Ray (Austria), Entersoft Security (India), DerSecur (Israel), Fluid Attacks (US), Acunetix (US), VerSprite (US), Appknox (Singapore), and NowSecure (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By offering, OS, deployment mode, organization size, and vertical |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

IBM (US), HCLTech (India), OpenText (Canada), Synopsys (US), 3i Infotech (India), Qualys (US), Syhunt (Brazil), Checkmarx (US), Testhouse (UK), Ivanti (US), Digital.ai (US), Veracode (US), Onapsis (US), Snyk (US), Secure Code Warrior (Australia), eShard (France), Quokka (India), Data Theorem (US), Pradeo (France), PortSwigger (UK), ImmuniWeb (Switzerland), Contrast Security (US), Codified Security (UK), App-Ray (Austria), Entersoft Security (India), DerSecur (Israel), Fluid Attacks (US), Acunetix (US), VerSprite (US), Appknox (Singapore), and NowSecure (US). |

This research report categorizes the MAST market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

- Solutions

-

Services

- Professional

- Managed

Based on OS:

- iOS

- Android

- Other OS

Based on deployment mode:

- Cloud

- On-Premises

Based on organization size:

- Large Enterprises

- SMEs

Based on the vertical:

- BFSI

- IT & Telecom

- Retail & eCommerce

- Healthcare & Life Sciences

- Governement & Defense

- Manufacturing

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- India

- China

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- August 2023 - Synopsys announced two new collaboration agreements with NowSecure, recognized experts in mobile security and privacy, and Secure Code Warrior, provider of the leading agile learning platform for developer-driven security, to expand its Software Integrity Group's industry-leading portfolio of application security testing (AST) solutions.

- August 2023 - IBM completed its acquisition of Apptio. Apptio's products merged with IBM's IT automation portfolio creating a comprehensive technology management platform for businesses to optimize and automate IT decisions across their landscape.

- October 2023 - OpenText released its Cloud Editions (CE) 23.4, which includes OpenText Aviator artificial intelligence (AI) capabilities. OpenText Aviator enables AI orchestration and the creation of information flows across multiple clouds and knowledge bases.

- March 2023 - HCL AppScan releases version 10.2.0 for three application security testing solutions. Three on-premises products have now been updated with critical capabilities and user experience functionality, all based on extensive security research and customer feedback.

Frequently Asked Questions (FAQ):

What is a MAST?

According to Guardsquare, Mobile Application Security Testing (MAST) covers the processes and tools used to identify potential security issues in mobile applications. Some tools also provide input to remediate identified issues to reduce risk. Mobile Application Security Testing can be performed manually or through the use of automated tools which use a variety of techniques.

What is the market size of the MAST market?

The global MAST market is estimated to be worth USD 0.9 billion in 2023 and is projected to reach USD 3.2 billion by 2028, at a CAGR of 28.3% during the forecast period.

What are the major drivers in the MAST market?

The shift toward remote work, accelerated by global events, has elevated the reliance on mobile applications for accessing corporate data, collaboration, and communication. This trend amplifies the potential attack surface for cyber threats, as mobile devices may connect to networks outside the traditional corporate perimeter. As employees use mobile apps to handle sensitive information and conduct business operations remotely, organizations are compelled to prioritize security testing to identify and mitigate vulnerabilities. Ensuring the resilience of mobile applications becomes paramount in this context, addressing risks associated with unsecured Wi-Fi networks, device theft or loss, and potential exposure to malicious apps. Consequently, the increased use of mobile devices for work purposes has become a driving force behind the implementation of rigorous mobile application security testing strategies to safeguard corporate data and maintain business continuity in a mobile-centric work environment.

Who are the major players operating in the MAST market?

The major players in the MAST market are IBM (US), HCLTech (India), OpenText (Canada), Synopsys (US), 3i Infotech (India), Qualys (US), Syhunt (Brazil), Checkmarx (US), Testhouse (UK), Ivanti (US), Digital.ai (US), Veracode (US), Onapsis (US), Snyk (US), Secure Code Warrior (Australia), eShard (France), Quokka (India), Data Theorem (US), Pradeo (France), PortSwigger (UK), ImmuniWeb (Switzerland), Contrast Security (US), Codified Security (UK), App-Ray (Austria), Entersoft Security (India), DerSecur (Israel), Fluid Attacks (US), Acunetix (US), VerSprite (US), Appknox (Singapore), and NowSecure (US).

Which key technology trends prevail in the MAST market?

Several key technology trends are shaping the landscape of MAST. One notable trend is the integration of artificial intelligence (AI) and machine learning (ML) into testing tools. These technologies enhance the efficiency and effectiveness of security testing by automating the detection of vulnerabilities and adapting to evolving threat landscapes. Another trend involves the use of advanced static and dynamic analysis techniques to scrutinize app code and behavior comprehensively. Static analysis assesses source code without execution, while dynamic analysis examines the application during runtime, providing a more holistic view of security risks. Additionally, the rise of containerization and microservices architectures has led to the adoption of security testing tools designed to assess these modern app deployment models. The incorporation of DevSecOps practices, integrating security into the entire development lifecycle, is another prominent trend, ensuring that security is not an afterthought but an integral part of the development process. Finally, the emergence of blockchain technology is being explored to enhance the security and integrity of mobile applications, particularly in sectors such as finance and healthcare, where data integrity is critical. These trends collectively contribute to a more robust and adaptive MAST landscape, addressing the evolving challenges posed by sophisticated cyber threats and the dynamic nature of mobile app development. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

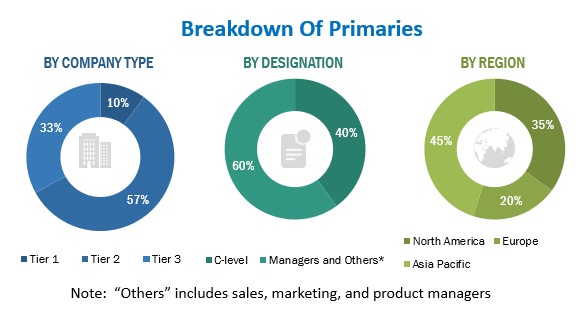

The research study involved four major activities in estimating the mobile application security testing (MAST) market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the MAST market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the MAST market. The first approach involved estimating the market size by summating companies’ revenue generated through MAST solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MAST market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to Guardsquare, "Mobile Application Security Testing (MAST) covers the processes and tools used to identify potential security issues in mobile applications. Some tools also provide input to remediate identified issues to reduce risk. Mobile Application Security Testing can be performed manually or through the use of automated tools which use a variety of techniques."

Key Stakeholders

- Chief technology and data officers

- Software and solution developers

- Integration and deployment service providers

- Business analysts

- Information Technology (IT) professionals

- Investors and venture capitalists

- Third-party providers

- Consultants/consultancies/advisory firms

- Cyber-security firms

The main objectives of this study are as follows:

- To define, describe, and forecast the MAST market based on segments based on offering, OS, deployment mode, organization size, and vertical with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the MAST market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global MAST market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global MAST market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Mobile Application Security Testing Market