Modular Flooring Market by Product Type (Flexible LVT, Rigid LVT, Carpet Tile, Polyolefin, Rubber, Ceramic), End use (Workplace, Education, Healthcare, Retail, Household) & Region (North America, APAC, MEA, Europe, RoW) - Global Forecast to 2026

Updated on : August 25, 2025

Modular Flooring Market

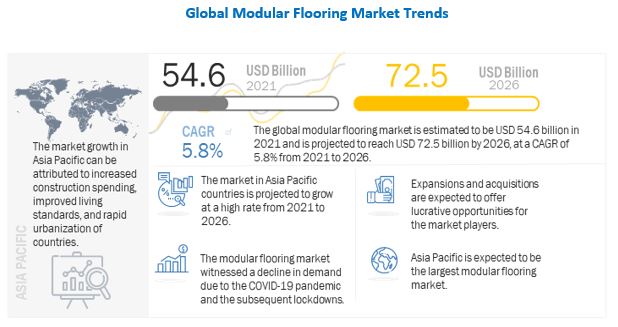

The modular flooring market was valued at USD 54.6 billion in 2021 and is projected to reach USD 72.5 billion by 2026, growing at 5.8% cagr from 2021 to 2026. The driving factors for the market growth is investments in the construction industry, coupled with a rise in the number of renovation & remodeling activities. The rise in demand from emerging economies and the growth of the organized retail sector create growth opportunities for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global modular flooring market

The COVID-19 pandemic has undoubtedly affected the construction industry, which will influence the modular flooring market. However, a recovery is expected owing to the impact of the construction sector on the economy. Although the construction activity might continue, delays and halts are expected owing to supply chain disruptions and a shortage of labor and materials. Construction workers were unable to reach construction sites and will need to adhere to new on-site protocols that will reduce productivity. This has increased new challenges associated with safety and protocols for the contractors such as more efforts to maintain hygiene and sanitation. Some building-materials supply chains were interrupted, suspending production and distribution due to lockdowns and lack of transport movement.

Reduced economic activity results in less demand for new residential and commercial facilities owing to the uncertainty of the aftermath of the pandemic. Ambiguity leads to lesser renovation works due to a lack of spending by the end-users. Lack of consumer confidence and income will negatively affect demand for housing construction or refurbishment, which will have a negative impact on the modular flooring market. According to the Organisation for Economic Co-operation and Development (OECD), construction output fell by 40% in April 2020 in the UK. The number of new residential construction projects, declined by 30% in April in the US. Various measures to curb the spread of the virus and shutdowns of construction sites in many countries impacted the income for households and enterprises affected various segments of the construction market.

The modular flooring market is going to witness an acceleration towards sustainability which includes designs for healthier living. Governments might stimulate economic growth by encouraging measures to meet carbon reduction targets, for instance—energy-efficient homes or office spaces. These efforts would impact public investments and government measures.

Modular Flooring Market Dynamics

Driver: Growing interest of consumers toward interior decoration

The increasing focus on home decor and the improving lifestyles of consumers are expected to drive the growth of the modular flooring market in the coming years. Consumers have started to pay attention to the styling and interiors of their living spaces. This includes spending on modular flooring to add to the esthetic appeal of interiors. This shift is supported by the changing lifestyles and adoption of different cultures in terms of interior décor, which has further propelled consumers' interest in interior decoration. Consumers are also attracted to modular flooring as they are durable, easy to maintain, and long-lasting.

Restraint: Rise in environmental concerns

Rise in environmental concerns related to floor coverings has been witnessed in the past few years. In the current scenario, modular flooring materials continue to gain popularity, but with numerous environmental concerns. For instance, vinyl can harm the environment in numerous ways, such as by producing toxins such as ethylene dichloride, dioxins, and vinyl chloride. The increasing concerns related to these materials are expected to shift the demand toward environment-friendly options such as bamboo flooring and cork flooring.

Opportunity: Growing investments in construction industry

Infrastructure spending is a key driver of regional economies. As a result, it is expected that the spending on capital projects and infrastructure will grow significantly in the next decade. The US, China, Japan, Germany, Australia, Canada, India, Indonesia, Brazil, and Spain are investing large amounts in the construction industry to achieve rapid and sustained economic growth. Sufficient infrastructure investment is essential for the modernization and commercialization of economic activities. Furthermore, annual investment in construction has been growing steadily since 2015, which boosts the German construction industry. Rapid urbanization in emerging markets such as China, India, Brazil, Malaysia, and Indonesia boosts the spending for vital sectors' infrastructure such as hospitality, health care, retail, and transportation.

Challenge: Disposal of waste

Waste disposal poses as the main challenge for the global modular flooring market. As the modular flooring market is growing steadily, it is also creating extensive waste. The issue becomes more critical as there is no proper management to deal with the same. Improper management, lack of support in the supply chain, technical protocols, and increased complexity of products result in massive waste generation. Several flooring manufacturing firms have taken vital steps to use recycled raw materials in the manufacturing process. Despite these efforts, a majority of the waste material either goes through incineration or landfill, which are harmful to the environment.

Carpet tile segment among the other product types to dominate the modular flooring market during the forecast period

Carpet tile flooring is a type of flooring that can be used as an alternative to the more commonly used broadloom carpet (rolls). They provide warmth and underfoot comfort expected from carpet and is available in its pre-sized squares and planks, patterns, and materials. Modular carpet tiles are four times more efficient as compared to broadloom carpet. Modular tiles are not only easy to fit, but also much easier to store and even easier to replace the same color & design after years of use. Carpet tiles are gaining popularity in commercial environments, such as restaurants, retail stores, and the hospitality sector as well as the residential segment. They are easy to maintain, install and offer unique designs for a comfortable environment. They allow quicker installation along with waste reduction. Acoustic features enable the usage of carpet tiles in areas where sound insulation is needed. This flooring material is gaining popularity due to its cost-effective nature, durability, and aesthetic design range, owing to the integration of new technologies.

Workplace segment to witness higher cagr during the forecast period.

Workplaces require special attention since busy workplace corridors need durable floors that can withstand heavy foot traffic and are easy to clean and maintain. The factors that need to be considered while choosing modular flooring for workplaces are aesthetics and functionality. Further, budget, traffic, design, and maintenance requirements play a significant role in installing the right flooring at the workplace. Suitable modular flooring for workplaces must be of commercial grade too.

The appropriate floors for workplaces can withstand the daily traffic and movements of chairs and other furniture. Another important thing to consider in the workplace is noise. Depending on the type of work, most workplaces require a quiet environment. A carpet is a suitable option for sound insulation; however, it might not be ideal for workplaces with heavy footfall as they can add to additional cleaning and maintenance. For such a situation, hard surface floors such as laminate or engineered wood and luxury vinyl tile can work if an underlayment is installed for noise reduction.

Considering workplace safety as a major aspect, anti-slip or slip resistance flooring is necessary. According to Consumer Product Safety Commission (CPSC), floors and flooring materials contribute directly to more than 2 million fall injuries a year. Trends such as fitting offices with adequate wayfinding and office zoning measures as per the government guidelines are critical for workplace safety. By embedding signage within the floor, employees have a clear, constant, and visual reminder of navigating the workplace. Modular flooring solutions such as carpet tiles and luxury vinyl tiles (LVT) products offer multiple varieties in terms of colors and patterns, which can be used independently and together.

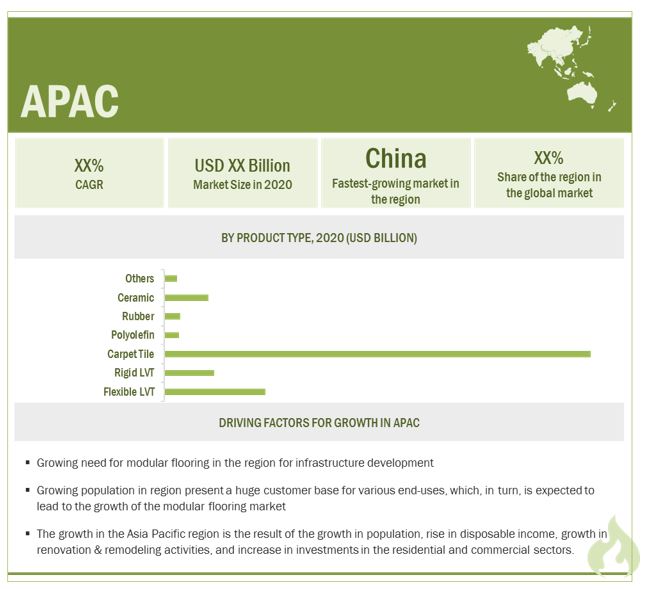

APAC is the largest market for modular flooring

Asia Pacific accounted for the largest share of 34.29% of the modular flooring market, in terms of value, in 2020. Asia Pacific is the fastest-growing market for modular flooring. The market in Asia Pacific is led by the growing demand from China and India. Asia Pacific and Europe have well-established markets for modular flooring, owing to which the growth in these regions is slower than that in the Asia Pacific region. The growth in the Asia Pacific region is the result of the growth in population, rise in disposable income, growth in renovation & remodeling activities, and increase in investments in the residential and commercial sectors.

The increasing number of new housing units and huge investments in the infrastructural sector are fueling the demand for modular flooring in this region. The growth in demand for modular flooring in the region is also driven by the increasing demand in countries, such as China, Australia, India, Japan, Thailand, Vietnam, and Indonesia, due to the tremendous growth of the construction opportunities in these countries. China is estimated as the largest manufacturer and consumer of modular flooring in this region, and the market in this country is projected to grow further. According to the World Bank, the Asia Pacific was the fastest-growing region, in terms of both population and economic growth.

To know about the assumptions considered for the study, download the pdf brochure

Modular Flooring Market Players

The modular flooring market is dominated by a few globally established players, such as Mohawk Industries (US), Shaw Industries (US), Tarkett (France), Armstrong Flooring (US), Forbo (Switzerland) and Gerflor (France) among others.

Modular Flooring Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 54.6 billion |

|

Revenue Forecast in 2026 |

USD 72.5 billion |

|

CAGR |

5.8% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

Product Type, End use, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, Australia & New Zealand and South America |

|

Companies Covered |

Some of the leading players operating in the modular flooring market include Mohawk Industries (US), Shaw Industries (US), Tarkett (France), Armstrong Flooring (US), Forbo (Switzerland), Gerflor (France). |

This research report categorizes the modular flooring market based on product type, end use, and region.

Modular Flooring Market, By Product Type

-

Flexible LVT

- 5.0 Flexible

- 2.5 Flexible

- 2.0 Flexible

- Others

-

Rigid LVT

- 5.0 Rigid

- 6.5 Rigid

- Others

- Carpet Tile

- Polyolefin (Non-vinyl)

- Rubber

- Ceramic

- Others

Modular Flooring Market, By End Use

- Workplace

- Healthcare

- Education

- Retail

- Household

- Others

Modular Flooring Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- Australia & New Zealand

- South America

Recent Developments

- In November 2021, Shaw Industries Group, Inc. (Shaw) planned to expand its operations in Aiken County. The investment will create more than 300 new jobs at the manufacturing facility, creating fiber used to manufacture residential carpets. The expansion is expected to be completed by the end of 2024.

- In October 2018, Tarkett completed the acquisition of Lexmark Carpet Mills, reinforcing its presence in the North American hospitality segment. The addition of Lexmark to the North America division enables Tarkett to establish a robust hospitality business that leverages both companies' broad product portfolios, strategically positioning the company better to serve the complete needs of its hospitality customers. Tarkett has also identified sales and supply chain synergies, enabling optimized performance and contributing to seamless integration.

Frequently Asked Questions (FAQ):

Which region will be the global leader in the Modular Flooring Market?

North America, Europe, APAC, Middle East & Africa, South Africa, Australia & New Zealand

What is the current size of global modular flooring market?

The global modular flooring market is estimated to be USD 54.6 billion in 2021 and is projected to reach USD 72.5 billion by 2026, at a CAGR of 5.8% from 2021 to 2026.

How is the modular flooring market aligned?

The modular flooring market is fragmented in terms of market share, with small and medium-scale manufacturers competing with each other and the big players.

Who are the key players in the global modular flooring market?

The key players operating in the modular flooring market are Mohawk Industries (US), Shaw Industries (US), Tarkett (France), Armstrong Flooring (US), Forbo (Switzerland) and Gerflor (France) among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.1 MARKET DEFINITION

1.2 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MODULAR FLOORING MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 MODULAR FLOORING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 2 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

2.3 DATA TRIANGULATION

FIGURE 6 MODULAR FLOORING MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 7 CARPET TILE SEGMENT TO DOMINATE MODULAR FLOORING MARKET

FIGURE 8 HOUSEHOLD TO BE LARGEST END USE IN MODULAR FLOORING MARKET

FIGURE 9 ASIA PACIFIC LED MODULAR FLOORING MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ASIA PACIFIC TO GROW AT A HIGHER RATE DUE TO RAPID URBANIZATION OF COUNTRIES

FIGURE 10 EXPANSIONS AND ACQUISITIONS TO OFFER LUCRATIVE OPPORTUNITIES IN MODULAR FLOORING MARKET

4.2 MODULAR FLOORING MARKET, BY PRODUCT TYPE

FIGURE 11 CARPET TILE SEGMENT TO BE THE FASTEST-GROWING PRODUCT TYPE

4.3 MODULAR FLOORING MARKET, BY REGION AND END USE

FIGURE 12 ASIA PACIFIC AND HOUSEHOLD LED THEIR RESPECTIVE SEGMENTS IN MODULAR FLOORING MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MODULAR FLOORING MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in renovation and remodeling activities

5.2.1.2 Growing interest of consumers toward interior decoration

5.2.2 RESTRAINTS

5.2.2.1 Volatile raw material prices

5.2.2.2 Rise in environmental concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand from emerging economies

5.2.3.2 Growing investments in construction industry

5.2.4 CHALLENGES

5.2.4.1 Disposal of waste

6 INDUSTRY TRENDS (Page No. - 55)

6.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 14 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS

6.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 15 MODULAR FLOORING MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 MODULAR FLOORING MARKET: PORTER'S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 ECOSYSTEM

FIGURE 16 MODULAR FLOORING ECOSYSTEM

6.4 TRADE ANALYSIS

TABLE 3 MODULAR FLOORING TRADE DATA, 2020 (USD THOUSAND)

TABLE 4 MODULAR FLOORING TRADE DATA, 2020 (USD THOUSAND)

6.5 REGULATORY ANALYSIS

6.6 PRICE TREND ANALYSIS

6.7 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN OF MODULAR FLOORING

6.8 TECHNOLOGY ANALYSIS

6.9 CASE STUDY ANALYSIS

6.9.1 INTRODUCTION

6.9.2 CASE STUDY 1: COLLINS CONSTRUCTION

6.9.3 CASE STUDY 2: EASYJET GATWICK TRAINING FACILITY

6.10 MODULAR FLOORING PATENT ANALYSIS

TABLE 5 THE GRANTED PATENTS ARE 36% OF THE TOTAL COUNT IN LAST 10 YEARS.

FIGURE 18 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 19 LEGAL STATUS

FIGURE 20 TOP JURISDICTION, BY DOCUMENT

FIGURE 21 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO. OF PATENTS

7 MODULAR FLOORING MARKET, BY PRODUCT TYPE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 22 CARPET TILE SEGMENT TO DOMINATE MODULAR FLOORING MARKET

TABLE 6 MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 7 MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

7.2 FLEXIBLE LVT

7.2.1 DEMAND IN RESIDENTIAL SECTOR HAS DRIVEN MARKET

7.2.2 5.0 FLEXIBLE

7.2.3 2.5 FLEXIBLE

7.2.4 2 FLEXIBLE

7.2.5 OTHERS

TABLE 8 MODULAR FLOORING MARKET SIZE, BY 5.0 FLEXIBLE IN END USE, 2019–2026 (USD MILLION)

TABLE 9 MODULAR FLOORING MARKET SIZE, BY 5.0 FLEXIBLE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 10 MODULAR FLOORING MARKET SIZE, BY 2.5 FLEXIBLE IN END USE, 2019–2026 (USD MILLION)

TABLE 11 MODULAR FLOORING MARKET SIZE, BY 2.5 FLEXIBLE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 12 MODULAR FLOORING MARKET SIZE, BY 2.0 FLEXIBLE IN END USE, 2019–2026 (USD MILLION)

TABLE 13 MODULAR FLOORING MARKET SIZE, BY 2.0 FLEXIBLE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 14 MODULAR FLOORING MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 15 MODULAR FLOORING MARKET SIZE, BY OTHER LVT FLEXIBLE IN END USE, 2019–2026 (MILLION SQUARE METER)

7.3 RIGID LVT

7.3.1 DEMAND IN COMMERCIAL SECTOR HAS DRIVEN MARKET

7.3.2 5.0 RIGID

7.3.3 6.5 RIGID

7.3.4 OTHERS

TABLE 16 MODULAR FLOORING MARKET SIZE, BY 5.0 RIGID IN END USE, 2019–2026 (USD MILLION)

TABLE 17 MODULAR FLOORING MARKET SIZE, BY 5.0 RIGID IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 18 MODULAR FLOORING MARKET SIZE, BY 6.5 RIGID IN END USE, 2019–2026 (USD MILLION)

TABLE 19 MODULAR FLOORING MARKET SIZE, BY 6.5 RIGID IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 20 MODULAR FLOORING MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 21 MODULAR FLOORING MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

7.4 CARPET TILE

7.4.1 DEMAND IN COMMERCIAL SECTOR HAS DRIVEN MARKET

TABLE 22 MODULAR FLOORING MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 23 MODULAR FLOORING MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

7.5 POLYOLEFIN

7.5.1 DEMAND IN COMMERCIAL, LIGHT COMMERCIAL, OR RESIDENTIAL SURFACES FLOORING APPLICATION

TABLE 24 MODULAR FLOORING MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 25 MODULAR FLOORING MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

7.6 RUBBER

7.6.1 DEMAND IN COMMERCIAL BUILDINGS HAS DRIVEN MARKET

TABLE 26 MODULAR FLOORING MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 27 MODULAR FLOORING MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

7.7 CERAMIC

7.7.1 HIGHER DURABILITY OF CERAMIC FLOORING HAS DRIVEN MARKET

TABLE 28 MODULAR FLOORING MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 29 MODULAR FLOORING MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

7.8 OTHERS

TABLE 30 MODULAR FLOORING MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 31 MODULAR FLOORING MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

8 MODULAR FLOORING MARKET, BY END USE (Page No. - 84)

FIGURE 23 HOUSEHOLD SEGMENT TO DOMINATE MODULAR FLOORING MARKET

8.1 INTRODUCTION

8.2 WORKPLACE

8.3 HEALTHCARE

8.4 EDUCATION

8.5 RETAIL

8.6 HOUSEHOLD

8.7 OTHERS

TABLE 32 MODULAR FLOORING MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 33 MODULAR FLOORING MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 34 MODULAR FLOORING MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 35 MODULAR FLOORING MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 36 MODULAR FLOORING MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 37 MODULAR FLOORING MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 38 MODULAR FLOORING MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 39 MODULAR FLOORING MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 40 MODULAR FLOORING MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 41 MODULAR FLOORING MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 42 MODULAR FLOORING MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 43 MODULAR FLOORING MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 44 MODULAR FLOORING MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 45 MODULAR FLOORING MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

9 MODULAR FLOORING MARKET, REGIONAL ANALYSIS (Page No. - 95)

9.1 INTRODUCTION

TABLE 46 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

FIGURE 24 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

TABLE 47 MODULAR FLOORING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 MODULAR FLOORING MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

9.2 ASIA PACIFIC

TABLE 49 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 53 ASIA PACIFIC: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 55 ASIA PACIFIC: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 57 ASIA PACIFIC: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 59 ASIA PACIFIC: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 61 ASIA PACIFIC: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 63 ASIA PACIFIC: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 69 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 70 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 71 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 72 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 73 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 75 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 76 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 77 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 79 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 81 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 82 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 83 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 85 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 87 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MODULAR FLOORING MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

9.3 NORTH AMERICA

TABLE 89 NORTH AMERICA: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 93 NORTH AMERICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 95 NORTH AMERICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 97 NORTH AMERICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 99 NORTH AMERICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 101 NORTH AMERICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 103 NORTH AMERICA: MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT, IN END USE, 2019–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 123 NORTH AMERICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 125 NORTH AMERICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

9.4 EUROPE

TABLE 129 EUROPE: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 131 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 133 EUROPE: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 135 EUROPE: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 137 EUROPE: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 139 EUROPE: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 141 EUROPE: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 143 EUROPE: MARKET SIZE, IN OTHER END USES BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 145 EUROPE: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 147 EUROPE: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 149 EUROPE: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 151 EUROPE: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 153 EUROPE: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 155 EUROPE: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 156 EUROPE: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 157 EUROPE: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 159 EUROPE: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 160 EUROPE: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 161 EUROPE: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 162 EUROPE: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 163 EUROPE: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 164 EUROPE: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 165 EUROPE: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 166 EUROPE: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 167 EUROPE: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 168 EUROPE: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

9.5 MIDDLE EAST & AFRICA

TABLE 169 MIDDLE EAST & AFRICA: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 171 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 179 MIDDLE EAST & AFRICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 191 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 193 MIDDLE EAST & AFRICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 195 MIDDLE EAST & AFRICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 197 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 199 MIDDLE EAST & AFRICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 201 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 203 MIDDLE EAST & AFRICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 205 MIDDLE EAST & AFRICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 207 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

9.6 AUSTRALIA & NEW ZEALAND

9.6.1 INCREASING NEW RESIDENTIAL AND COMMERCIAL CONSTRUCTIONS DRIVE MARKET

TABLE 209 AUSTRALIA & NEW ZEALAND: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 210 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 211 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 212 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 213 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN WORKPLACE BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 214 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN WORKPLACE BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 215 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN HEALTHCARE BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 216 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN HEALTHCARE BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 217 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN EDUCATION BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 218 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN EDUCATION BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 219 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN RETAIL BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 220 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN RETAIL BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 221 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN HOUSEHOLD BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 222 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN HOUSEHOLD BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 223 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 224 AUSTRALIA & NEW ZEALAND: MARKET SIZE, IN OTHER END-USE INDUSTRIES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 225 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 226 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 227 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 228 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 229 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 230 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 231 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 232 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 233 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 234 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 235 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 236 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 237 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 238 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 239 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 240 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 241 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 242 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 243 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 244 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 245 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 246 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 247 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 248 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

9.7 SOUTH AMERICA

TABLE 249 SOUTH AMERICA: MODULAR FLOORING MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 250 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 251 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 252 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 253 SOUTH AMERICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 254 SOUTH AMERICA: MARKET SIZE, IN WORKPLACE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 255 SOUTH AMERICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 256 SOUTH AMERICA: MARKET SIZE, IN HEALTHCARE, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 257 SOUTH AMERICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 258 SOUTH AMERICA: MARKET SIZE, IN EDUCATION, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 259 SOUTH AMERICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 260 SOUTH AMERICA: MARKET SIZE, IN RETAIL, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 261 SOUTH AMERICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 262 SOUTH AMERICA: MARKET SIZE, IN HOUSEHOLD, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 263 SOUTH AMERICA: MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 264 SOUTH AMERICA: MARKET SIZE, IN OTHER END USES, BY PRODUCT TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 265 SOUTH AMERICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 266 SOUTH AMERICA: MARKET SIZE, BY 5.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 267 SOUTH AMERICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 268 SOUTH AMERICA: MARKET SIZE, BY 2.5 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 269 SOUTH AMERICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 270 SOUTH AMERICA: MARKET SIZE, BY 2.0 FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 271 SOUTH AMERICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 272 SOUTH AMERICA: MARKET SIZE, BY OTHER FLEXIBLE LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 273 SOUTH AMERICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 274 SOUTH AMERICA: MARKET SIZE, BY 5.0 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 275 SOUTH AMERICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 276 SOUTH AMERICA: MARKET SIZE, BY 6.5 RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 277 SOUTH AMERICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (USD MILLION)

TABLE 278 SOUTH AMERICA: MARKET SIZE, BY OTHER RIGID LVT IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 279 SOUTH AMERICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (USD MILLION)

TABLE 280 SOUTH AMERICA: MARKET SIZE, BY CARPET TILE IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 281 SOUTH AMERICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (USD MILLION)

TABLE 282 SOUTH AMERICA: MARKET SIZE, BY POLYOLEFIN IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 283 SOUTH AMERICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (USD MILLION)

TABLE 284 SOUTH AMERICA: MARKET SIZE, BY RUBBER IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 285 SOUTH AMERICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (USD MILLION)

TABLE 286 SOUTH AMERICA: MARKET SIZE, BY CERAMIC IN END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 287 SOUTH AMERICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (USD MILLION)

TABLE 288 SOUTH AMERICA: MARKET SIZE, BY OTHER PRODUCT TYPES IN END USE, 2019–2026 (MILLION SQUARE METER)

10 COVID-19 IMPACT ON MODULAR FLOORING MARKET (Page No. - 201)

10.1 INTRODUCTION

10.2 IMPACT OF COVID-19 ON MODULAR FLOORING MARKET

10.2.1 IMPACT OF COVID-19 ON BUILDING & CONSTRUCTION INDUSTRY

10.2.2 IMPACT OF COVID-19 ON FLOORING INDUSTRY

11 COMPETITIVE LANDSCAPE (Page No. - 204)

11.1 OVERVIEW

11.2 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2016 AND 2021

11.3 MARKET RANKING ANALYSIS

11.3.1 MOHAWK INDUSTRIES

11.3.2 SHAW INDUSTRIES

11.3.3 TARKETT

11.3.4 INTERFACE

11.3.5 GERFLOR

11.4 MARKET SHARE ANALYSIS

TABLE 289 MODULAR FLOORING MARKET: MARKET SHARE OF KEY PLAYERS

FIGURE 25 MARKET: MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

11.6 SME MATRIX, 2020

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 27 SME MATRIX: MARKET, 2020

11.7 COMPETITIVE SCENARIO

11.7.1 MERGERS & ACQUISITIONS

TABLE 290 MERGER & ACQUISITION, 2018–2021

12 COMPANY PROFILES (Page No. - 218)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 MOHAWK INDUSTRIES

TABLE 291 MOHAWK INDUSTRIES: COMPANY OVERVIEW

FIGURE 28 MOHAWK INDUSTRIES: COMPANY SNAPSHOT

12.1.2 SHAW INDUSTRIES

TABLE 292 SHAW INDUSTRIES: COMPANY OVERVIEW

12.1.3 TARKETT

TABLE 293 TARKETT: COMPANY OVERVIEW

FIGURE 29 TARKETT: COMPANY SNAPSHOT

12.1.4 ARMSTRONG FLOORING INC.

TABLE 294 ARMSTRONG FLOORING INC.: COMPANY OVERVIEW

FIGURE 30 ARMSTRONG FLOORING INC.: COMPANY SNAPSHOT

12.1.5 FORBO

TABLE 295 FORBO: COMPANY OVERVIEW

FIGURE 31 FORBO: COMPANY SNAPSHOT

12.1.6 INTERFACE

TABLE 296 INTERFACE: COMPANY OVERVIEW

FIGURE 32 INTERFACE: COMPANY SNAPSHOT

12.1.7 GERFLOR

TABLE 297 GERFLOR: COMPANY OVERVIEW

12.1.8 MANNINGTON MILLS INC.

TABLE 298 MANNINGTON MILLS INC.: COMPANY OVERVIEW

12.1.9 BEAULIEU INTERNATIONAL GROUP

TABLE 299 BEAULIEU INTERNATIONAL GROUP: COMPANY OVERVIEW

12.1.10 TOLI CORPORATION

TABLE 300 TOLI CORPORATION: COMPANY OVERVIEW

12.1.11 MILLIKEN & COMPANY

12.2 OTHER PLAYERS

12.2.1 CONGOLEUM

12.2.2 JAMES HALSTEAD

12.2.3 THE DIXIE GROUP

12.2.4 VICTORIA PLC

12.2.5 BALTA INDUSTRIES

12.2.6 LG HAUSYS

12.2.7 NORA SYSTEMS

12.2.8 RESPONSIVE INDUSTRIES LTD.

12.2.9 PARADOR

12.2.10 ADORE FLOORS

12.2.11 AMERICAN BILTRITE

12.2.12 WELLMADE PERFORMANCE FLOORS

12.2.13 JIANGSU TAIDE DECORATION MATERIALS CO., LTD

12.2.14 PARADOR

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 253)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The global modular flooring market is estimated to be USD 54.6 billion in 2021 and is projected to reach USD 72.5 billion by 2026, at a CAGR of 5.8% from 2021 to 2026. The driving factors for the modular flooring market growth in investments in the construction industry, coupled with a rise in the number of renovation & remodeling activities. The rise in demand from emerging economies and the growth of the organized retail sector create growth opportunities for the market.

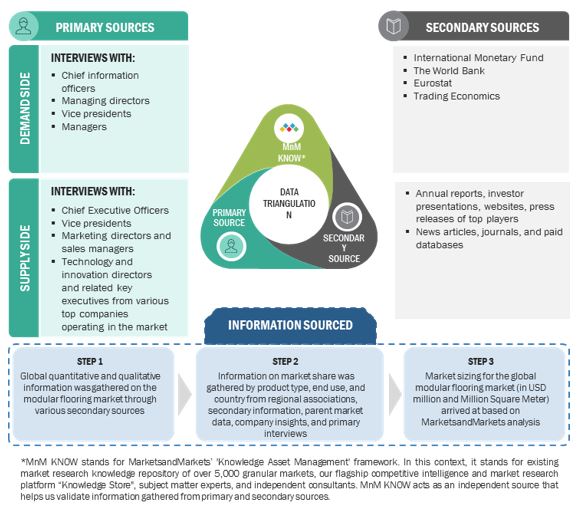

Secondary Research

In the secondary research process, different sources were referred to identify and collect information for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers; and certified publications; and articles from recognized authors. Secondary research was mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

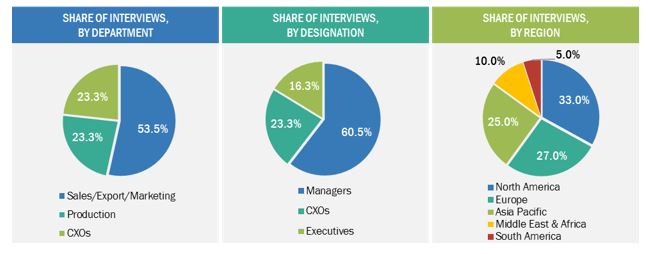

Primary Research

In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, and related key executives from major companies and organizations operating in the modular flooring market. Primary sources from the demand side include experts and key personnel in various end-use industries. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

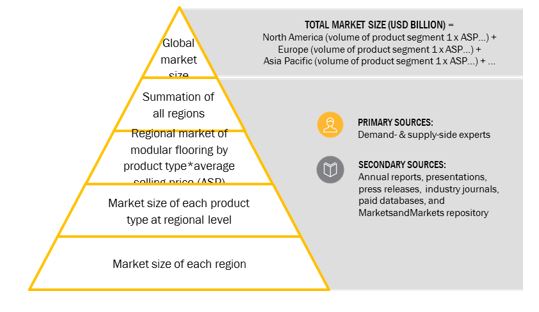

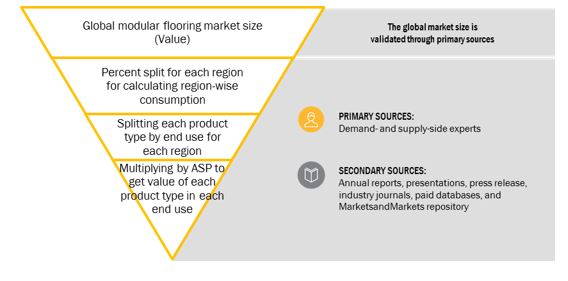

The bottom-up and top-down approaches were used to estimate the modular flooring market by product type, end-use, and region. The research methodology used to calculate the market size includes the following steps:

- The key players of each type in the modular flooring market were identified through secondary research, and their revenues were determined through primary and secondary research.

- The market size of the modular flooring market was derived from the aggregation of the market shares of the leading players in each product type, and the forecast is based on analysis of market trends, such as pricing and consumption of modular flooring in various end-use industries.

- The market size of modular flooring, by region, was calculated by using the market sizes of each product types in each end use.

- The market size for modular flooring for each end-use, in terms of value, was calculated by multiplying the average price of the product types with their volumes.

Modular flooring Market: Bottom-Up Approach

Modular flooring Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the overall market was split into several segments. In order to complete the market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there are three sources - the top-down approach, the bottom-up approach, and expert interviews. The data was assumed to be correct only when the values arrived at from the three sources matched.

Report Objectives

- To estimate and forecast the modular flooring market in terms of value and volume

- To elaborate drivers, restraints, opportunities, and challenges in the market

- To define, describe, and forecast the market size based on product type, end use, and region

- To forecast the market size along with segments and submarkets in key regions: North America, Europe, Asia Pacific, Middle East & Africa, South America, and Australia & New Zealand.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as mergers & acquisitions, expansions, investments, agreements, partnerships, joint ventures, and new product developments in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Modular Flooring Market