Molecular Biology Enzymes Market by Product (Kits, Reagents, Enzyme), Application (PCR, Sequencing, Epigenetic, Synthetic Biology), End user (Research Institutes, Pharma & Biotech Company, Hospitals) and Region - Global Forecast to 2026

Market Growth Outlook Summary

The global molecular biology enzymes market in terms of revenue was estimated to be worth $15.3 billion in 2021 and is poised to reach $29.7 billion by 2026, growing at a CAGR of 14.2% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Growth in the global market is driven by factors such as increased research activities and R&D investments in the life science industry, rising number of genome projects, technological advancements in the life science industry, and rising incidence of genetic disorders. However, limited reimbursements for genetic testing are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Molecular Biology Enzymes Market Dynamics

DRIVERS: Growing number of genome projects

Gene mutations play an important role in the etiology and the development of diseases/disorders, such as immune system disorders, metabolic diseases, cancer, and in-born genetic disorders. As a result, detailed knowledge of the human genome can significantly help researchers understand the etiology of specific diseases and develop treatment plans. The rising number of genome projects across the globe, coupled with reducing genetic analysis costs, helps advance research in various domains, such as disease treatment, personalized medicine, and microbial genetics. These processes require the use of various molecular biology enzymes and reagents and are thus expected to drive the molecular biology enzymes and kits & reagents market.

OPPORTUNITIES: R&D investments offer significant opportunities for the market

In the last two decades, genomics has evolved as a scientific research discipline. Fuelled by grants and funds from government institutions, the genomics market has witnessed significant changes on the technological front. R&D investments have presented potential growth opportunities for the molecular biology enzymes and kits & reagents market. China is one of the largest investors in R&D globally; the country is expected to overtake the US in R&D spending by 2023 (Source: Council on Foreign Relations or CFR). This has prompted many companies to expand their operations and R&D activities in China. The country’s R&D spending climbed from 10.3% to USD 378 billion (2.44 trillion Chinese yuan) in 2020.

RESTRAINTS: Limited reimbursements for genetic testing

Reimbursement policies, however, are inflexible for genetic tests. Most health insurance services in the US do not cover the cost of genetic testing unless prescribed by a physician. The coverage and reimbursement are solely dependent on the policy of the provider. For instance, Medicare covers genetic testing for people with a cancer diagnosis who qualify for coverage of genetic testing for an inherited mutation under Medicare. Such concerns are restraining market growth across the globe.

The polymerase chain reaction (PCR) segment dominated the molecular biology enzymes market in 2020:

Based on applications, the global market is segmented into polymerase chain reaction (PCR), sequencing, cloning, epigenetics, restriction digestion, synthetic biology, and other applications (mutagenesis, in vitro transcription, and molecular labeling & detection). The polymerase chain reaction (PCR) segment accounted for the largest share of 28.3% of the market in 2020, mainly due to the low cost of PCR equipment, the extensive use of PCR equipment by a majority of end users, and the increasing use of PCR for molecular diagnostic assays in hospitals and clinics.

The academic & research institutes segment accounted for the largest share in 2020

Based on end users, the global market is segmented into academic & research institutes, hospitals & diagnostic centers, pharmaceutical & biotechnology companies, and other end users (contract research organizations (CROs), food & beverage companies, and forensic agencies). In 2020, the academic & research institutes segment accounted for the largest share of 36.3% of the molecular biology enzymes market. The large market share of this segment is due to the increase in funding for life science research from governments and non-profit organizations.

To know about the assumptions considered for the study, download the pdf brochure

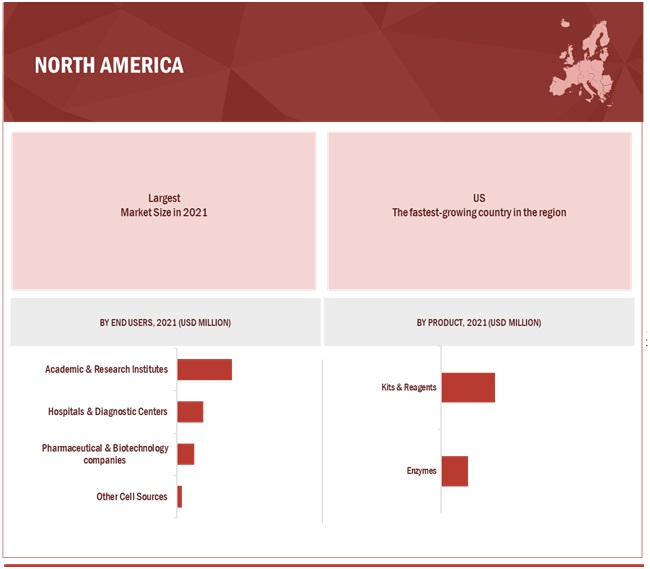

North America was the largest regional market for molecular biology enzymes and kits & reagents in 2020.

Geographically, the molecular biology enzymes markets is segmented into North America, Europe, Asia Pacific, RoW. In 2020, North America accounted for the largest share of the molecular biology enzymes and kits & reagents market, followed by Europe & Asia Pacific. The large share of North America in the global market can be attributed to the increasing research funds in translational and clinical research, the growing number of pharmaceutical and biotechnology companies, favourable reimbursement scenario for molecular diagnostics, and the growing investments in research projects in Canada.

Key players in the molecular biology enzymes and kits & reagents market include Thermo Fisher (US), Merck (Germany), Illumina (US), QIAGEN (Netherlands), New England Biolabs (US), Promega (US), Agilent (US), Roche (Switzerland), Takara Bio (Japan), Bio Basic (Canada), Jena Bioscience (Germany), Molecular Biology Resources (US), Bio-Rad Laboratories, Inc. (US).

Molecular Biology Enzymes Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$15.3 billion |

|

Estimated Value by 2026 |

$29.7 billion |

|

Growth Rate |

Poised to grow at a CAGR of 14.2% |

|

Largest Share Segments |

|

|

Market Report Segmentation |

Product, Application, End-user, and Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

Molecular Biology Enzymes Market Report Segmentation

By Product

- Kits & Reagents

- Enzymes

- Polymerases

- Ligases

- Restriction Endonucleases

- Reverse Transcriptases

- Other Enzymes

By Application

- PCR

- Sequencing

- Cloning

- Epigenetics

- Restriction Digestion

- Synthetic Biology

- Other Applications

By End users

- Academic & Research Institutes

- Pharmaceutical & Biotechnology companies

- Hospitals & Diagnostic Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World (RoW)

Recent Developments:

- In February 2021, Thermo Fisher Acquired Mesa Biotech to expand its Life Sciences Solutions business segment. Through this acquisition, the revenue of this segment is expected to increase by approximately USD 200 million in 2021.

- In October 2020, New England Biolabs (US) launched the Luna Probe One-Step RT-qPCR 4X Mix with UDG.

Frequently Asked Questions (FAQs):

What is the size of Molecular Biology Enzymes Market?

The global molecular biology enzymes market boasts a total value of $15.3 billion in 2021 and is projected to register a growth rate of 14.2% to reach a value of $29.7 billion by 2026.

Why is Molecular Biology Enzymes Market Growing?

Growth in the molecular biology enzymes and kits & reagents market is driven by factors such as increased research activities and R&D investments in the life science industry, rising number of genome projects, technological advancements in the life science industry, and rising incidence of genetic disorders. However, limited reimbursements for genetic testing are expected to restrain the growth of this market during the forecast period.

Who all are the prominent players of Molecular Biology Enzymes Market?

Key players in the molecular biology enzymes and kits & reagents market include Thermo Fisher (US), Merck (Germany), Illumina (US), QIAGEN (Netherlands), New England Biolabs (US), Promega (US), Agilent (US), Roche (Switzerland), Takara Bio (Japan), Bio Basic (Canada), Jena Bioscience (Germany), Molecular Biology Resources (US), Bio-Rad Laboratories, Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: MOLECULAR BIOLOGY ENZYMES MARKET

2.2 MARKET DATA ESTIMATION & TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 4 MARKET SIZE ESTIMATION APPROACH: COMPANY REVENUE ANALYSIS

FIGURE 5 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET SIZE (USD BILLION): FINAL MARKET SIZE

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 6 GROWTH RATE ASSUMPTION BASED ON MARKET DYNAMICS

FIGURE 7 FINAL CAGR PROJECTIONS (2021−2026)

2.5 INSIGHTS FROM PRIMARIES

FIGURE 8 MARKET VALIDATION FROM PRIMARY EXPERTS

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET SHARE, BY PRODUCT, 2020

FIGURE 10 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET SHARE, BY APPLICATION, 2020

FIGURE 11 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 MOLECULAR BIOLOGY ENZYMES MARKET OVERVIEW

FIGURE 13 INCREASING R&D INVESTMENTS IN THE LIFE SCIENCE INDUSTRY TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

FIGURE 14 KITS & REAGENTS TO COMMAND THE LARGEST SHARE OF THE NORTH AMERICAN MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

4.3 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION

FIGURE 15 PCR APPLICATIONS TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4.4 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 MARKETS IN THE ASIA PACIFIC REGION TO REGISTER HIGHER GROWTH RATES BETWEEN 2021 & 2026

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Growing number of genome projects

5.2.1.2 Technological advancements in the life science industry

5.2.1.3 Rising incidence of genetic disorders

5.2.2 RESTRAINTS

5.2.2.1 Limited reimbursements for genetic testing

5.2.3 OPPORTUNITIES

5.2.3.1 Increased use of personalized medicine

TABLE 2 GOVERNMENT FUNDING FOR PERSONALIZED MEDICINE

5.2.3.2 R&D investments offer significant opportunities for the market

5.3 COVID-19 IMPACT ANALYSIS

FIGURE 18 COUNTRY-WISE DAILY TESTS FOR COVID-19

5.4 TECHNOLOGY ANALYSIS

TABLE 3 TRADITIONAL BIOLOGY VS. MOLECULAR BIOLOGY

5.5 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS OF THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 20 SUPPLY CHAIN OF THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

5.7 PORTERS FIVE FORCES ANALYSIS

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 THREAT FROM SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITION RIVALRY

5.8 REGULATORY LANDSCAPE

TABLE 4 REGULATORY LANDSCAPE FOR THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

5.9 PRICING ANALYSIS

TABLE 5 PRICING ANALYSIS FOR MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS

5.10 PATENT ANALYSIS

FIGURE 21 PATENT ANALYSIS FOR THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET (2010–2020)

6 MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT (Page No. - 64)

6.1 INTRODUCTION

TABLE 6 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 KITS & REAGENTS

6.2.1 WIDE APPLICATIONS OF KITS & REAGENTS AND THEIR EXTENSIVE USAGE IN VARIOUS APPLIED INDUSTRIES TO DRIVE MARKET GROWTH

TABLE 7 MOLECULAR BIOLOGY KITS & REAGENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 8 NORTH AMERICA: MOLECULAR BIOLOGY KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 9 EUROPE: MOLECULAR BIOLOGY KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 10 APAC: MOLECULAR BIOLOGY KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 ENZYMES

TABLE 11 MOLECULAR BIOLOGY ENZYMES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 13 EUROPE: MOLECULAR BIOLOGY ENZYMES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 14 APAC: MOLECULAR BIOLOGY ENZYMES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1 POLYMERASES

6.3.1.1 Growing use of polymerases in PCR to drive segmental growth

TABLE 15 MOLECULAR BIOLOGY ENZYMES MARKET FOR POLYMERASES, BY REGION, 2019–2026 (USD MILLION)

6.3.2 LIGASES

6.3.2.1 Growing demand for ligases in cloning experiments to boost growth in this market segment

TABLE 16 MOLECULAR BIOLOGY ENZYMES MARKET FOR LIGASES, BY REGION, 2019–2026 (USD MILLION)

6.3.3 RESTRICTION ENDONUCLEASES

6.3.3.1 Wide applications of restriction endonucleases in gene mapping and genotyping—a key factor driving market growth

TABLE 17 MOLECULAR BIOLOGY ENZYMES MARKET FOR RESTRICTION ENDONUCLEASES, BY REGION, 2019–2026 (USD MILLION)

6.3.4 REVERSE TRANSCRIPTASES

6.3.4.1 Increasing demand for RT-PCR diagnostic tests to fuel the adoption of reverse transcriptases

TABLE 18 MOLECULAR BIOLOGY ENZYMES MARKET FOR REVERSE TRANSCRIPTASES, BY REGION, 2019–2026 (USD MILLION)

6.3.5 OTHER ENZYMES

TABLE 19 MOLECULAR BIOLOGY ENZYMES MARKET FOR OTHER ENZYMES, BY REGION, 2019–2026 (USD MILLION)

7 MOLECULAR BIOLOGY ENZYMES MARKET, BY APPLICATION (Page No. - 73)

7.1 INTRODUCTION

TABLE 20 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 POLYMERASE CHAIN REACTION

7.2.1 TECHNOLOGICAL ADVANCEMENTS IN PCR TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 21 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PCR APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PCR APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PCR APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PCR APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 SEQUENCING

7.3.1 DECREASING COST OF SEQUENCING, COUPLED WITH RISING DEMAND FOR PERSONALIZED MEDICINE, TO DRIVE MARKET GROWTH

TABLE 25 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SEQUENCING APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SEQUENCING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 27 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SEQUENCING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SEQUENCING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 CLONING

7.4.1 RISING APPLICATIONS OF CLONING KITS TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 29 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR CLONING APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR CLONING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 31 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR CLONING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 32 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR CLONING APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 EPIGENETICS

7.5.1 HIGH PREVALENCE OF CANCER IS LIKELY TO BOOST MARKET GROWTH

TABLE 33 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR EPIGENETICS APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR EPIGENETICS APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 35 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR EPIGENETICS APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR EPIGENETICS APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 SYNTHETIC BIOLOGY

7.6.1 DECREASING MARKET PRICES FOR GENE SYNTHESIS TO DRIVE MARKET GROWTH

TABLE 37 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SYNTHETIC BIOLOGY APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SYNTHETIC BIOLOGY APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 39 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SYNTHETIC BIOLOGY APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR SYNTHETIC BIOLOGY APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 RESTRICTION DIGESTION

7.7.1 GROWTH IN GENE-BASED RESEARCH ACTIVITIES HAS BOOSTED SEGMENTAL GROWTH

TABLE 41 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR RESTRICTION DIGESTION APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR RESTRICTION DIGESTION APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR RESTRICTION DIGESTION APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR RESTRICTION DIGESTION APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

7.8 OTHER APPLICATIONS

TABLE 45 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8 MOLECULAR BIOLOGY ENZYMES MARKET, BY END USER (Page No. - 88)

8.1 INTRODUCTION

TABLE 48 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 ACADEMIC & RESEARCH INSTITUTES

8.2.1 INCREASING RESEARCH ACTIVITIES BACKED BY FUNDING FROM GOVERNMENT AND PRIVATE ORGANIZATIONS TO DRIVE MARKET GROWTH

TABLE 49 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 51 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 HOSPITALS & DIAGNOSTIC CENTERS

8.3.1 INCREASING LAUNCHES OF PRODUCTS USED IN HOSPITALS & DIAGNOSTIC CENTERS TO DRIVE MARKET GROWTH

TABLE 53 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 55 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 56 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

8.4.1 INCREASING DRUG RESEARCH AND R&D EXPENDITURE TO DRIVE GROWTH IN THIS END-USER SEGMENT

TABLE 57 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 59 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 60 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER END USERS

TABLE 61 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 MOLECULAR BIOLOGY ENZYMES MARKET, BY REGION (Page No. - 97)

9.1 INTRODUCTION

FIGURE 22 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET SNAPSHOT

TABLE 65 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS (HOME BREW TEST) MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 23 NORTH AMERICAN MOLECULAR BIOLOGY ENZYMES MARKET SNAPSHOT

TABLE 67 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing research in genomics to propel market growth in the US

TABLE 72 US: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 73 US: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 74 US: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing investments and funding in research projects to drive the growth of the Canadian market

TABLE 75 CANADA: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 76 CANADA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 77 CANADA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 78 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: MOLECULAR BIOLOGY ENZYMES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing pharmaceutical R&D in Germany to drive market growth in the coming years

TABLE 83 GERMANY: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 84 GERMANY: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 GERMANY: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 UK

9.3.2.1 The 100,000 Genomes Project drives the demand for molecular biology enzymes and kits & reagents in the UK

TABLE 86 UK: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 87 UK: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 UK: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Investments in the Genomic Medicine 2025 plan to drive market growth

TABLE 89 FRANCE: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 90 FRANCE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Large biotechnology and pharmaceutical industry in Italy to drive market growth

TABLE 92 ITALY: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 93 ITALY: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 ITALY: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.5 ROE

TABLE 95 ROE: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 96 ROE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 ROE: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 24 APAC MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET SNAPSHOT

TABLE 98 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 99 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 100 APAC: MOLECULAR BIOLOGY ENZYMES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 102 APAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Growing focus on cancer research and treatment is expected to augment market growth in Japan

TABLE 103 JAPAN: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 104 JAPAN: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 JAPAN: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing R&D investments and outsourcing of clinical research activities to China to drive market growth

TABLE 106 CHINA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 107 CHINA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 CHINA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Development of bio-clusters and biotech parks to propel the biotechnology industry in India

TABLE 109 INDIA: MOLECULAR BIOLOGY ENZYMES MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 110 INDIA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 INDIA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.4 ROAPAC

TABLE 112 ROAPAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 113 ROAPAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 ROAPAC: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

TABLE 115 ROW: MOLECULAR BIOLOGY ENZYMES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 116 ROW: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 117 ROW: MOLECULAR BIOLOGY ENZYMES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ROW: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 119 ROW: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.1 LATIN AMERICA

9.5.1.1 Investments in research backed by workshops and conferences to drive market growth

TABLE 120 LIST OF COURSES AND WORKSHOPS HELD IN LATIN AMERICA BY THE INTERNATIONAL CENTRE FOR GENETIC ENGINEERING AND BIOTECHNOLOGY (ICGEB)

TABLE 121 LATIN AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 122 LATIN AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 123 LATIN AMERICA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Growing prevalence of cancer and increasing funding for molecular diagnostics to drive market growth

TABLE 124 MEA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 125 MEA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 MEA: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

10.3 MARKET SHARE ANALYSIS

FIGURE 26 MOLECULAR BIOLOGY ENZYMES MARKET RANK, BY KEY PLAYER, 2020

TABLE 127 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: DEGREE OF COMPETITION

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 27 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: COMPANY EVALUATION QUADRANT (2020)

10.5 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: SME EVALUATION MATRIX, 2020

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

FIGURE 28 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: STARTUP/SME EVALUATION MATRIX, 2020

10.6 COMPANY PRODUCT FOOTPRINT

TABLE 128 PRODUCT PORTFOLIO ANALYSIS: MOLECULAR BIOLOGY ENZYMES MARKET

10.7 COMPANY GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN THE MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET

TABLE 129 GEOGRAPHIC REVENUE MIX: MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET (2020)

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 130 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: PRODUCT LAUNCHES, FEBRUARY 2020–FEBRUARY 2021

10.8.2 DEALS

TABLE 131 MOLECULAR BIOLOGY ENZYMES AND KITS & REAGENTS MARKET: DEALS, JANUARY 2018–FEBRUARY 2021

10.8.3 OTHER DEVELOPMENTS

TABLE 132 MOLECULAR BIOLOGY ENZYMES MARKET: OTHER DEVELOPMENTS, JULY 2018–DECEMBER 2020

11 COMPANY PROFILES (Page No. - 143)

11.1 MAJOR PLAYERS

(Business Overview, Products/Solutions Offered, Recent Developments, Right to Win)*

11.1.1 THERMO FISHER SCIENTIFIC, INC.

TABLE 133 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 29 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2020)

11.1.2 MERCK KGAA

TABLE 134 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 30 MERCK KGAA: COMPANY SNAPSHOT (2020)

11.1.3 PROMEGA CORPORATION

TABLE 135 PROMEGA CORPORATION: BUSINESS OVERVIEW

11.1.4 NEW ENGLAND BIOLABS

TABLE 136 NEW ENGLAND BIOLABS: BUSINESS OVERVIEW

11.1.5 ILLUMINA, INC.

TABLE 137 ILLUMINA, INC.: BUSINESS OVERVIEW

FIGURE 31 ILLUMINA, INC.: COMPANY SNAPSHOT (2020)

11.1.6 TAKARA BIO, INC.

TABLE 138 TAKARA BIO, INC.: BUSINESS OVERVIEW

FIGURE 32 TAKARA BIO, INC.: COMPANY SNAPSHOT (2020)

11.1.7 QIAGEN N.V.

TABLE 139 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 33 QIAGEN N.V.: COMPANY SNAPSHOT (2020)

11.1.8 AGILENT TECHNOLOGIES, INC.

TABLE 140 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 34 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2020)

11.1.9 F. HOFFMANN-LA ROCHE LTD.

TABLE 141 F. HOFFMANN-LA ROCHE: BUSINESS OVERVIEW

FIGURE 35 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2020)

11.1.10 BIO BASIC INC.

TABLE 142 BIO BASIC INC.: BUSINESS OVERVIEW

11.1.11 JENA BIOSCIENCE GMBH

TABLE 143 JENA BIOSCIENCE GMBH: BUSINESS OVERVIEW

11.1.12 MOLECULAR BIOLOGY RESOURCES, INC.

TABLE 144 MOLECULAR BIOLOGY RESOURCES, INC.: BUSINESS OVERVIEW

11.1.13 BIO-RAD LABORATORIES, INC.

TABLE 145 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 36 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2020)

*Business Overview, Products/Solutions Offered, Recent Developments, Right to Win might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 ZYMO RESEARCH CORPORATION

11.2.2 INTEGRATED DNA TECHNOLOGIES, INC.

11.2.3 LGC BIOSEARCH TECHNOLOGIES

11.2.4 NZYTECH, LDA. - GENES & ENZYMES

11.2.5 LUCIGEN CORPORATION

11.2.6 MOBITEC GMBH

11.2.7 GENEKAM BIOTECHNOLOGY AG

11.2.8 ALDEVRON

11.2.9 RANDOX LABORATORIES LTD.

11.2.10 ADS BIOTEC

11.2.11 HANGZHOU MATRIDX BIOTECHNOLOGY CO. LTD.

11.2.12 GOLDSITE DIAGNOSTICS INC.

12 APPENDIX (Page No. - 267)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the molecular biology enzymes and kits & reagents market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the molecular biology enzymes and kits & reagents market.

Some of the key secondary sources referred to for this study include publications from government sources World Bank, World Health Organization (WHO), World Intellectual Property Organization (WIPO), International Union of Biochemistry and Molecular Biology (IUBMB), National Institutes of Health (NIH), National Human Genome Research Institute (NHGRI), Centers for Disease Control and Prevention (CDC), American Cancer Society (ACS), American Society for Biochemistry and Molecular Biology (ASBMB), Canadian Society for Molecular Biosciences (CSMB), Genome Canada. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

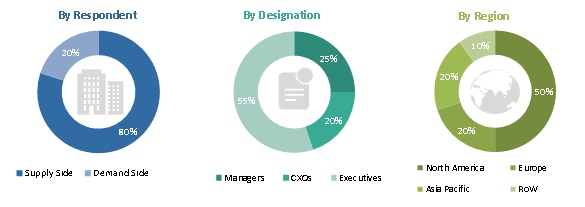

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the molecular biology enzymes and kits & reagents market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the molecular biology enzymes and kits & reagents business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the molecular biology enzymes and kits & reagents market based on product, application, end users and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, opportunities, and trends)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall molecular biology enzymes and kits & reagents market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the molecular biology enzymes and kits & reagents market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Molecular Biology Enzymes Market