Multimodal Imaging Market by Technology (PET-CT, SPECT-CT, PET-MR, OCT/FMT), Application (Oncology, Cardiology, Brain, Ophthalmology), End User (Hospitals, Diagnostic Centers, Academia, Research) & Region - Global Forecast to 2028

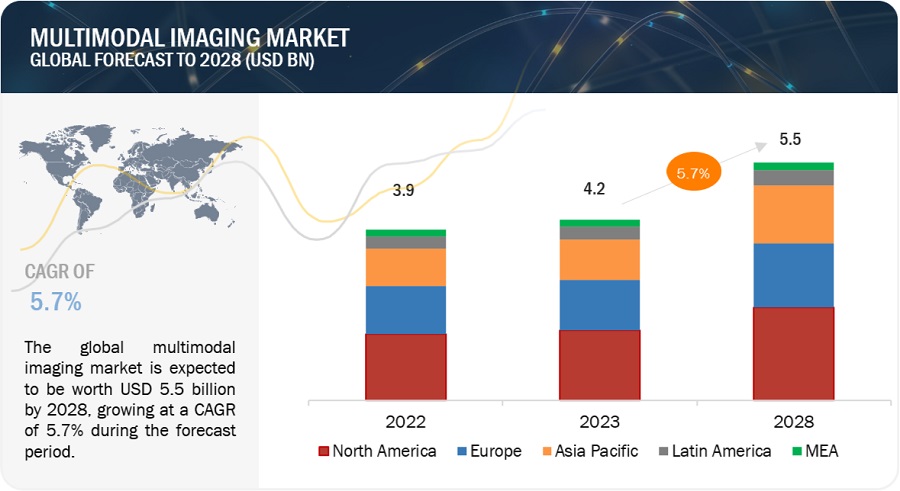

The global multimodal imaging market, valued at US$3.9 billion in 2022, stood at US$4.2 billion in 2023 and is projected to advance at a resilient CAGR of 5.7% from 2023 to 2028, culminating in a forecasted valuation of US$5.5 billion by the end of the period. The increasing patient population, rising prevalence of target diseases, and rising focus on accurate procedures are expected to drive the market during the forecast period.

Global Multimodal Imaging Market

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Multimodal Imaging Market Dynamics

Driver: Growing application of multimodal imaging systems

Multimodal imaging systems are experiencing a growing application across diverse fields, driven by their capacity to provide comprehensive and complementary information. In neuroscience, the combination of fMRI and EEG has yielded valuable insights into brain network dynamics (Journal of Neuroscience, 2016). In oncology, PET-CT has become a standard for detecting distant metastases and impacting clinical management decisions in breast cancer patients (Journal of Clinical Oncology, 2018). Cardiac imaging benefits from PET-MRI, allowing assessment of myocardial viability and inflammation in cardiomyopathy (Circulation, 2016). Alzheimer's research employs PET-MRI to understand tau pathology and disease progression (Neurology, 2019).

In preclinical studies, multimodal imaging enables tracking of disease progression and evaluating therapeutic efficacy (Nature Communications, 2021). Robotics and autonomous vehicles use multimodal sensor suites, including cameras, LIDAR, and radar, to enhance perception and decision-making capabilities. In environmental sciences, satellites like Sentinel use multimodal imaging to monitor land use, deforestation, and natural disasters. Materials science benefits from multimodal imaging in studying materials' microstructure and chemical composition (Science Advances, 2020). These examples highlight the versatility and increasing adoption of multimodal imaging, promising significant advancements in research, diagnostics, and technology across various domains. As technology progresses, multimodal imaging's applications are likely to expand further, leading to transformative developments in the future.

Restraint: High cost of multimodal imaging systems

The high cost of multimodal imaging systems is a significant challenge in their widespread adoption, limiting accessibility and affordability in many healthcare settings. Several factors contribute to these elevated costs, including the complexity of integrating multiple imaging modalities into a single system, the specialized hardware and software requirements, and ongoing maintenance and updates to ensure optimal performance. Additionally, each imaging modality involved, such as PET, CT, MRI, or SPECT, has its own considerable expenses, which are compounded when combined into a multimodal system. For example, a study published in the Journal of Medical Imaging and Radiation Sciences (2019) conducted a cost analysis of PET-CT scanners, revealing substantial initial investments and significant operational expenses, making it a considerable financial burden for healthcare institutions. Moreover, the need for specialized training and expertise in operating and interpreting data from multimodal imaging systems adds to the overall costs, requiring well-trained professionals and potentially increasing staffing expenses. Despite these challenges, the potential benefits of multimodal imaging in terms of improved diagnostic accuracy, better patient outcomes, and reduced need for additional tests could lead to long-term cost savings and justify the initial investment. Nonetheless, addressing the high cost remains essential to make these advanced imaging technologies more accessible to a broader range of patients and medical facilities.

Opportunity: Availability of reimbursement and insurance coverage for multimodal imaging scans

The availability of reimbursement and insurance coverage for multimodal imaging scans varies across different healthcare systems and countries, and it can be influenced by factors such as the specific imaging modalities included in the multimodal system, the clinical indications for which it is used, and the policies of individual insurance providers or government healthcare programs. In some cases, reimbursement for multimodal imaging scans may be available for specific medical conditions where the combined data from different modalities is deemed necessary for accurate diagnosis and treatment planning. For instance, in the United States, Medicare and private insurance companies provide reimbursement for certain PET-CT scans for cancer staging, monitoring treatment response, and assessing myocardial viability in cardiology. However, the level of reimbursement may not fully cover the high costs of acquiring and maintaining multimodal imaging systems, leading to financial challenges for healthcare providers. Additionally, reimbursement policies might be subject to ongoing changes and updates, impacting the availability of coverage over time. Moreover, in some regions with limited healthcare resources, the availability of multimodal imaging and insurance coverage might be even scarcer, limiting patient access to these advanced diagnostic technologies. Advocacy efforts, research demonstrating the clinical benefits, and cost-effectiveness analyses may play pivotal roles in advocating for broader insurance coverage and reimbursement for multimodal imaging scans, ultimately increasing their availability and affordability for patients worldwide.

Challenge: Growing end-user preference for refurbished equipment

The growing end-user preference for refurbished medical imaging equipment has emerged as a significant trend within the healthcare industry. This shift in preference can be attributed to several factors that highlight the advantages and benefits of choosing refurbished equipment over new purchases. Firstly, cost-effectiveness stands out as a primary driver. Healthcare institutions, especially those with limited budgets or in resource-constrained regions, find refurbished equipment to be a financially prudent choice. Refurbished imaging systems often come at a fraction of the cost of new ones, enabling healthcare providers to allocate their resources efficiently while still obtaining high-quality diagnostic capabilities. This cost savings can be redirected towards other critical areas, such as staffing, patient care, or facility upgrades. Secondly, the rapid pace of technological advancement plays a role. The medical imaging field constantly evolves, leading to the regular introduction of newer, more advanced equipment. However, not all healthcare facilities require the latest technology for their specific needs. Refurbished equipment provides a practical alternative, offering adequate functionality for routine diagnostic procedures without the premium associated with the latest features. This makes it an attractive option for healthcare providers who want to maintain diagnostic accuracy while managing their budgets. Moreover, advancements in refurbishment processes have improved the quality and reliability of refurbished equipment. Certified refurbishment programs often involve thorough inspections, repairs, replacements, and rigorous testing to ensure that the equipment meets manufacturer specifications and performance standards. This level of assurance gives healthcare providers confidence in the functionality and longevity of the refurbished equipment.

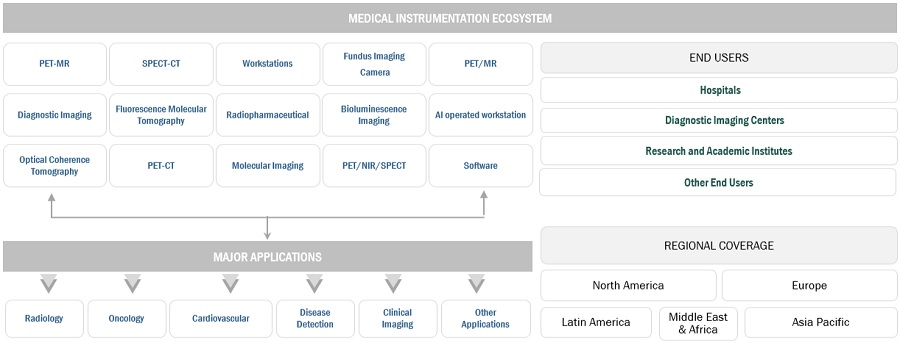

Multimodal Imaging Market Ecosystem

By technology, the PET-CT segment accounted for the largest share of the multimodal imaging industry in 2022

Based on technology, the global multimodal imaging market is segmented into PET-CT, PET-MR, SPECT-CT, OCT/FMT, and MR/Optical Imaging. In 2022, the diagnostic multimodal segment accounted for the largest market share. The rising fundings for the multimodal systems and the need for better turnaround time, high-image resolution, real-time image guidance during surgeries and enhanced precision is driving the segment growth.

By application, the neurology applications segment of the multimodal imaging industry to register significant growth in the near future

Based on application, the multimodal imaging market is divided into brain & neurology, oncology, cardiology, ophthalmology, research and other applications. Major share of the segment is attributed to the increasing number of radiology centers and the growing use of multimodal for general imaging and diagnosis purpose.

By end user, the hospitals segment accounted for the largest share of the multimodal imaging industry in 2022

On the basis of end user, the multimodal imaging market has been segmented into hospitals, diagnostic imaging centers; research and academic institutes; and other end users. However, the diagnostic imaging center segment is estimated to grow at the highest CAGR during the forecast period.

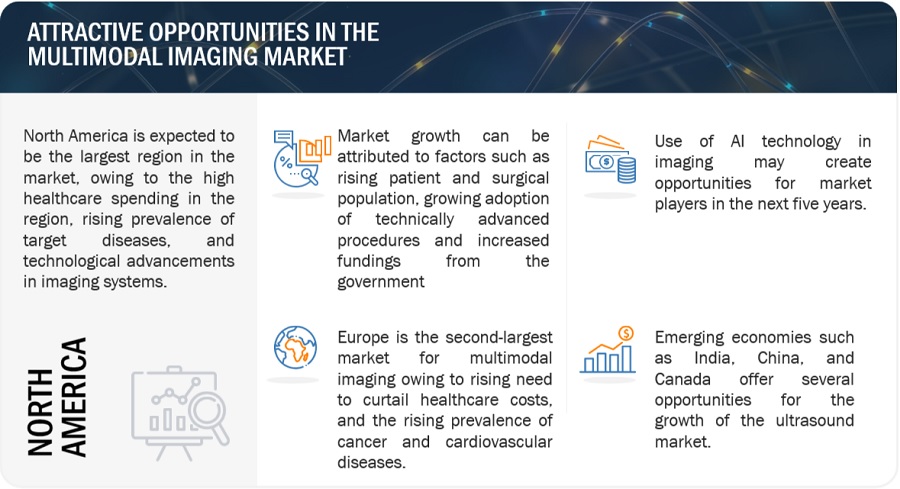

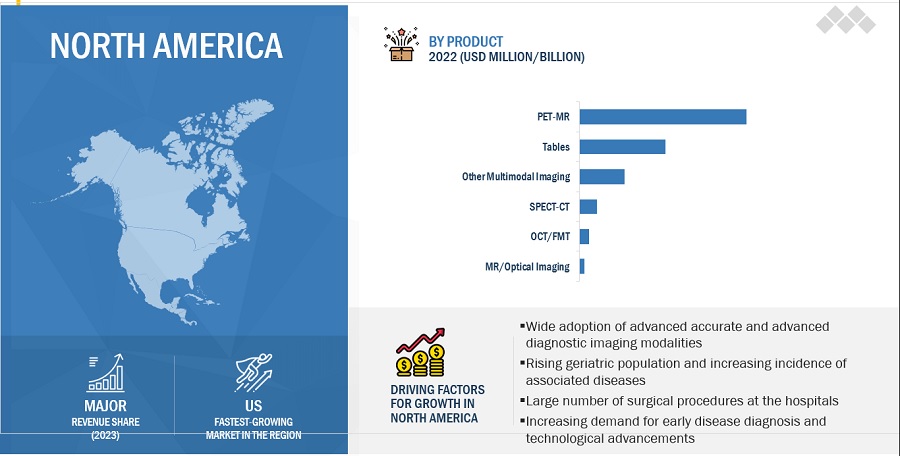

By region, North America is expected to be the largest market of the multimodal imaging industry during the forecast period

North America, comprising the US and Canada, accounted for the largest share of the multimodal imaging industry in 2022. The faster growth of the multimodal imaging market in North America can be attributed to its technological leadership, robust healthcare infrastructure, high market demand driven by prevalent chronic diseases and an aging population, ample financial resources for advanced medical equipment investment, established regulatory frameworks ensuring safety and quality, active research collaboration, insurance coverage for advanced diagnostics, patient expectations for comprehensive care, and a competitive market environment fostering innovation.

To know about the assumptions considered for the study, download the pdf brochure

As of 2022, prominent players in the market are GE HealthCare (US) , Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Siemens AG (Germany), Topcon Corporation (Japan), and Neusoft. (China)

Scope of the Multimodal Imaging Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$4.2 billion |

|

Estimated Value by 2028 |

$5.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.7% |

|

Market Driver |

Growing application of multimodal imaging systems |

|

Market Opportunity |

Availability of reimbursement and insurance coverage for multimodal imaging scans |

This report has segmented the global multimodal imaging market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- PET/CT

- PET/MR

- SPECT/CT

- OCT/FMT

- Other multimodal imaging

By Application

- Brain & Neurology

- Cardiology

- Oncology

- Ophthalmology

- Research Applications

- Other Applications

By End User

- Hospitals

- Diagnostic Imaging Centers

- Research and Academic Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Multimodal Imaging Industry

- In March 2023, Philips and the Champalimaud Foundation collaborate to achieve a 50% reduction in the carbon footprint of their diagnostic imaging operations within the next five years.

- In May 2023, St. Luke's University Health Network chooses GE HealthCare for a USD 30 million purchase of state-of-the-art CT technology, incorporating the power of Artificial Intelligence.

- In November 2022, Canon Inc. revealed its plans to form a new subsidiary called Canon Healthcare USA, Inc. With this strategic move, Canon intends to enhance its position within the influential American medical market and expedite the expansion of its medical business.

- In April 2022, The enhanced partnership between GE HealthCare and Sinopharm focuses on the development and commercialization of medical equipment designed to meet the specific healthcare requirements of China.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global multimodal imaging market?

The global multimodal imaging market boasts a total revenue value of $5.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global multimodal imaging market?

The global multimodal imaging market has an estimated compound annual growth rate (CAGR) of 5.7% and a revenue size in the region of $4.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the multimodal imaging market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial multimodal imaging market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the multimodal imaging market. The primary sources from the demand side include hospitals, clinics, research labs, and pharmaceutical and biotechnology companies. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

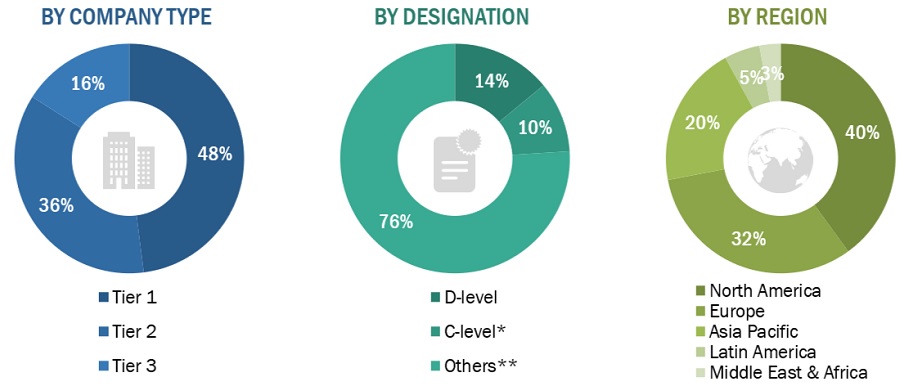

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2022: Tier 1 => USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the multimodal imaging market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

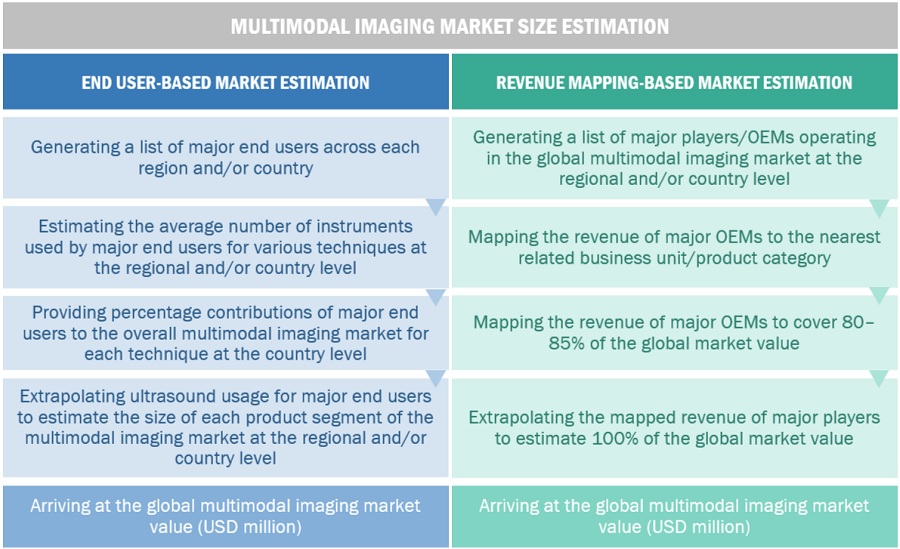

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

- Generating a list of major global players operating in the market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover a major share of the global market share, as of 2022

- Extrapolating the global value of the industry

Bottom-up approach

In this report, the size of the global multimodal imaging market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the multimodal business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

Approach 1: Company revenue estimation approach

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/product providers. This process involved the following steps:

- Generating a list of major global players operating in the market

- Mapping the annual revenues generated by major global players from the multimodal segment (or the nearest reported business unit/product category)

- Mapping the revenues of major players to cover at least 80–85% of the global market share as of 2022

- Extrapolating the global value of the multimodal industry

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of multimodal was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

- Generating a list of major customer facilities across each region and country

- Identifying the average number of multimodal product supplies used by major customer facilities across each product type at the regional/country level, annually

- Identifying the percentage contribution of major customer facilities to the overall multimodal expenditure and usage at the regional/country level, annually

- Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

- Identifying the percentage contributions of individual market segments and subsegments to the overall market at the regional/country level

Multimodal Imaging Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global multimodal imaging market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market was validated using top-down and bottom-up approaches.

Market Definition

Multimodal imaging systems represent a cutting-edge approach that revolutionizes medical diagnostics and research by seamlessly integrating two or more imaging modalities to capture complementary information about the subject being studied. Combining modalities like MRI, CT, PET, SPECT, ultrasound, and others allows clinicians and researchers to gain a comprehensive understanding of the anatomical, functional, and molecular aspects of diseases and physiological processes. This synergy enables improved diagnostic accuracy, more precise treatment planning, and better monitoring of treatment responses, especially in complex and challenging cases. Additionally, multimodal imaging systems have wide-ranging applications across various medical fields, including oncology, neurology, cardiology, and psychiatry, as well as in preclinical research and drug development. The ability to fuse different imaging data and obtain a more holistic view of the human body or other subjects has transformed medical practice, leading to more personalized and effective patient care and driving advancements in healthcare and biomedical research.

Key Stakeholders

- Multimodal product manufacturers

- Original equipment manufacturers (OEMs)

- Suppliers, distributors, and channel partners

- Healthcare service providers

- Hospitals and academic medical centers

- Radiologists

- Research laboratories

- Health insurance providers

- Government bodies/organizations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists and other public-private funding agencies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the multimodal imaging market based on technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global multimodal imaging market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Rest of Europe multimodal imaging market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

- Further breakdown of the Rest of Asia Pacific multimodal imaging market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

- Further breakdown of the RoW market into Latin America and MEA regions

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multimodal Imaging Market