Automotive Natural Gas Vehicle Market Analysis for Commercial Vehicles by Fuel Type (CNG & LNG), by Vehicle Type (Medium Duty & Heavy Duty) & by Geography [Asia-Oceania, Europe, Americas, ROW (Rest of the World)] - Industry Trends & Forecast to 2019

[149 Pages Report] The market for natural gas commercial vehicles is gaining traction in many countries due to the combined effects of low-cost CNG and LNG and higher prices of diesel.The conversion options available in commercial vehicles make them an attractive option in terms of reduction in running costs and overall cost of ownership. The low cost of conversion and prospect of significant emission reduction will increase the penetration of alternativefuels, worldwide.

However, the key to sustained growth in the natural gascommercial vehicle market will be environmental legislation and the development of refueling infrastructure. Though Compressed Natural Gas (CNG) commercial vehicles are leading by a massive margin incomparison to LNG commercial vehicles, it is anticipated that LNG commercial vehicles will have a significant share in the coming future.

The report segments the Automotive Natural Gas Vehicle market based on commercial vehicle types (heavy &medium duty), geography (Asia-Oceania, Europe, Americas,and the Rest of the World), fuel type (CNG&LNG)and provides market forecast for 2019 in terms of volume (‘000 units) for the aforesaid segments.It contains qualitative data such as comparison of cost of ownership of CNG & LNG commercial vehicles withdiesel commercial vehicles.It outlines the key strategies of OEMs and governments for promoting CNG and LNG commercialvehicles, the recent developments & products, agreements, partnerships, collaborations, and joint ventures of OEMs,globally.It also provides detailed information on fuelling stations and cost of fuel (diesel/LNG/CNG), by geography The keyplayers in this market include Dongfeng Motors Group Limited, AB Volvo, Beiqi Foton Motors Group Limited, Shaanxi Automobile Group Company Limited, Daimler AG, and CNH Industrial(Iveco).

Scope of the Report

The automotive natural gas vehicle market analysis for commercial vehiclesis analyzed in terms of volume(units) for the aforesaid vehicle types, fuel types, by region, and respective major countries.

- By Region

- Asia-Oceania

- Europe

- Americas

- RoW

- By Vehicle Type

- Medium duty commercial vehicles

- Heavy dutycommercial vehicles

- By Fuel Type

- CNG

- LNG

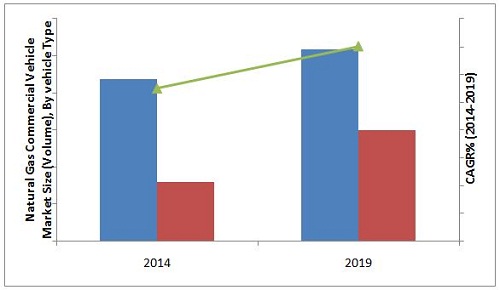

Natural Gas Commercial Vehicle Market Growth, By vehicle type (2014-2019)

Source: MarketsandMarkets Analysis

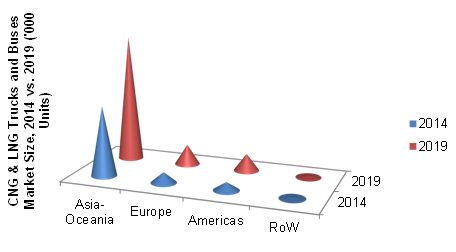

The OE CNG & LNG trucks and buses market size to reach 418,889 units by 2019

The global crude oil market is continuously witnessing a rise in cost and an irregular supply pattern due tothe increasing unrest in the Middle East and Africa. The use of conventional fuels has increased the pollution levels in many countries with the air quality degrading to substantial levels inmetropolitan cities. This has a substantial impact on human health leading to respiratory and skin diseases. To alleviate these effects, governments have encouraged the usage of cost-effective and environment-friendly mobility solutions.

Natural gas (CNG or LNG) has lower carbon content as compared todiesel or gasoline. Usage of these gases results in a cleaner burning of fuel whereinthe emissions produced are also low. Also, the price of natural gas is comparatively lower and stable than diesel. This has resulted in an increase in the adoption of natural gas trucks and buses as fleet operators can save on fuel as well as reduce their carbon footprint. The natural gas trucks and buses market has seen an increase in adoption by government fleets due to the environmental benefits. Another benefit is that the usage of natural gas helps the government to reduce the direct impact of the rising crude oil price. Countries such as the U.S. and Russia can achieve energy independence as large natural gas reserves enable to domestically produce the required fuel. However, fuelling infrastructure and range anxiety still remain a major cause of concern.

Asia-Oceania has the largestmarket share in the CNG trucks and buses market, whereas Americas is estimated to show the highest growth owing to increasing adoption by fleet operators in the U.S. China is projected to show an increase in CNG as well as LNG usage as a huge infrastructural growth is anticipated and natural gas will help the operators to optimize their operating costs. The major driver for automotive natural gas vehicle market is the lower fuel cost which reduces the overall cost of ownership of the vehicle. Various incentives by the government which are offered to promote the adoption of natural gas also act as drivers of this market.

The global CNG & LNG trucks and buses market is dominated by OEMs, such as Daimler AG (Germany), AB Volvo (Sweden), Shaanxi Automobile Group Company Limited (China), Beiqi Foton Motor Co. Ltd. (China), Dongfeng Motor Group Company Limited (China), and CNH Industrial NV (The Netherlands) and suppliers, such as Landi Renzo( Italy) and Westport( Canada).

CNG & LNG trucks and Buses Market Size, 2014 vs. 2019 (‘000 Units)

Source: Natural Gas Vehicle Association, International Association for Natural Gas Vehicles, Gas Vehicle Report, Expert Interviews, and MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Glance At Markets Covered

1.2.1 Global CNG & LNG Trucks and Buses Market, By Geography

1.2.2 Global CNG & LNG Trucks and Buses Market, By Vehicle Type

1.2.3 Global Natural Gas Trucks and Buses Market, By Fuel Type

1.3 Market Scope

2 Research Methodology (Page No. - 19)

2.1 Description of the CNG & LNG Trucks and Buses Market Demand Model

2.2 Market Size Estimation

2.3 Market Crackdown and Data Triangulation

2.4 Key Data and Assumptions

2.4.1 Key Data Taken From Secondary Sources

2.4.2 Key Data Taken From Primary Sources

2.4.3 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Huge Market Potential in OE CNG & LNG Trucks and Buses Market

4.2 China Commands Over One-Third of the Market Share in OE CNG Trucks and Buses Market

4.3 CNG OE Trucks and Buses Market, By Vehicle Type (2014)

4.4 LNG OE Trucks and Buses Market, By Vehicle Type, 2014 vs. 2019

4.5 Global OE CNG & LNG Trucks and Buses Market, By Geography and Vehicle Type

4.6 Global CNG & LNG Trucks and Buses Cumulative Market Snapshot, 2014 vs. 2019

4.7 Cumulative CNG Trucks and Buses Market

4.8 CNG & LNG Trucks and Buses Market Snapshot for China and U.S. (2014 vs. 2019)

4.9 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Government Strategies in the Development of Alternative Type of Fuel, By Geography

5.1.1.1 Asia-Oceania

5.1.1.1.1 China

5.1.1.1.2 India

5.1.1.1.3 Japan

5.1.1.1.4 South Korea

5.1.1.1.5 Thailand

5.1.1.2 Europe

5.1.1.2.1 Russia

5.1.1.3 Americas

5.1.1.3.1 U.S.

5.1.1.3.2 Colombia

5.1.1.4 ROW

5.1.1.4.1 Armenia

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Energy Security

5.2.1.2 Environmental Benefits

5.2.1.3 Fuel Cost Savings

5.2.2 Restraints

5.2.2.1 Higher Initial Cost

5.2.2.2 Infrastructural Challenges

5.2.3 Opportunity

5.2.3.1 Growing Popularity of Green Transportation

5.3 Specific Industries’ Interest in Natural Gas

5.3.1 Refuse

5.3.2 Delivery, Long Haul, and Logistics

5.3.3 Transit and Busing

5.3.4 Yard Operations

5.3.5 Energy Security Issues

5.3.6 Environmental Benefits

5.4 Value Chain

5.5 Porter’s Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

5.6 Pest Analysis

5.6.1 Political Factors

5.6.2 Economic Factors

5.6.3 Social Factors

5.6.4 Technological Factors

6 Technological Overview (Page No. - 49)

6.1 Chemical Characteristics of Natural Gas

6.1.1 CNG

6.1.2 LNG

6.1.3 Bio-Methane

6.2 Natural Gas Supply

6.2.1 Hydraulic Fracturing

6.2.2 Drilling

6.2.3 Shipping and Pipelines

6.3 CNG Storage

6.3.1 Cylinders

6.3.2 Adsorbed Natural Gas

6.4 LNG On-Vehicle Storage

7 Total Cost of Ownership Comparison of CNG and LNG Vehicles to Diesel Vehicles (Page No. - 54)

7.1 Introduction

7.2 Total Cost to Consumer in Five Years, By Country

7.2.1 China

7.2.2 U.S.

7.2.3 India

7.2.4 Ukraine

8 CNG and LNG Vehicles Market, By Fuel Type (Page No. - 58)

8.1 Introduction

8.1.1 Market By Fuel Type

8.1.1.1 Compressed Natural Gas (CNG)

8.1.1.1.1 OE Annual Sales

8.1.1.1.2 Cumulative Vehicles

8.1.1.2 Liquefied Natural Gas (LNG)

8.1.1.2.1 OE Annual Sales

8.1.1.2.2 Cumulative Vehicles

8.2 CNG Vehicle Market

8.2.1 Asia-Oceania

8.2.1.1 China

8.2.1.1.1 OE Annual Sales

8.2.1.1.2 Cumulative Vehicles

8.2.1.2 India

8.2.1.2.1 OE Annual Sales

8.2.1.2.2 Cumulative Vehicles

8.2.1.3 Japan

8.2.1.3.1 OE Annual Sales

8.2.1.3.2 Cumulative Vehicles

8.2.1.4 South Korea

8.2.1.4.1 OE Annual Sales

8.2.1.4.2 Cumulative Vehicles

8.2.1.5 Thailand

8.2.1.5.1 OE Annual Sales

8.2.1.5.2 Cumulative Vehicles

8.2.2 Europe

8.2.2.1 Russia

8.2.2.1.1 OE Annual Sales

8.2.2.1.2 Cumulative Vehicles

8.2.2.2 Ukraine

8.2.2.2.1 OE Annual Sales

8.2.2.2.2 Cumulative Vehicles

8.2.3 Americas

8.2.3.1 Colombia

8.2.3.1.1 OE Annual Sales

8.2.3.1.2 Cumulative Vehicles

8.2.3.2 U.S.

8.2.3.2.1 OE Annual Sales

8.2.3.2.2 Cumulative Vehicles

8.2.4 ROW

8.2.4.1 Armenia

8.2.4.1.1 OE Annual Sales

8.2.4.1.2 Cumulative Vehicles

8.3 LNG Vehicle Market

8.3.1 China

8.3.1.1 OE Annual Sales

8.3.1.2 Cumulative Vehicles

8.3.2 U.S.

8.3.2.1 OE Annual Sales

8.3.2.2 Cumulative Vehicles

9 CNG & LNG Vehicles Market, By Vehicle Type (Page No. - 85)

9.1 Introduction

9.1.1 By Vehicle Type

9.1.1.1 Medium Duty

9.1.1.1.1 Annual Sales

9.1.1.1.2 Cumulative Vehicles

9.1.1.2 Heavy Duty

9.1.1.2.1 Annual Sales

9.1.1.2.2 Cumulative Vehicles

9.2 Medium Duty Vehicles

9.2.1 Medium Duty Buses

9.2.1.1 Annual Sales

9.2.1.2 Cumulative Vehicles

9.2.1.3 Asia-Oceania: Annual Sales

9.2.1.4 Asia-Oceania: Cumulative Vehicles

9.2.1.5 Europe: Annual Sales

9.2.1.6 Europe: Cumulative Vehicles

9.2.1.7 Americas: Annual Sales

9.2.1.8 Americas: Cumulative Vehicles

9.2.2 Medium Duty Trucks

9.2.2.1 Annual Sales

9.2.2.2 Cumulative Vehicles

9.2.2.3 Asia-Oceania: Annual Sales

9.2.2.4 Asia-Oceania: Cumulative Vehicles

9.2.2.5 Europe: Annual Sales

9.2.2.6 Europe: Cumulative Vehicles

9.2.2.7 Americas: Annual Sales

9.2.2.8 Americas: Cumulative Vehicles

9.3 Heavy Duty Vehicles

9.3.1 Heavy Duty Buses

9.3.1.1 Annual Sales

9.3.1.2 Cumulative Vehicles

9.3.1.3 Asia-Oceania: Annual Sales

9.3.1.4 Asia-Oceania: Cumulative Vehicles

9.3.1.5 Europe: Annual Sales

9.3.1.6 Europe: Cumulative Vehicles

9.3.1.7 Americas: Annual Sales

9.3.1.8 Americas: Cumulative Vehicles

9.3.2 Heavy Duty Trucks

9.3.2.1 Annual Sales

9.3.2.2 Cumulative Vehicles

9.3.2.3 Asia-Oceania: Annual Sales

9.3.2.4 Asia-Oceania: Cumulative Vehicles

9.3.2.5 Europe: Annual Sales

9.3.2.6 Europe: Cumulative Vehicles

9.3.2.7 Americas: Annual Sales

9.3.2.8 Americas: Cumulative Vehicles

10 Refuelling Infrastructure (Page No. - 108)

10.1 CNG Refueling Infrastructure, By Region

10.1.1 CNG Fuelling Stations, By Region, 2014

10.1.2 Asia-Oceania (CNG Fuelling Stations), 2014

10.1.3 Europe (CNG Fuelling Stations), 2014

10.1.4 Americas (CNG Fuelling Stations), 2014

10.1.5 ROW (CNG Fuelling Stations), 2014

10.2 LNG Refueling Infrastructure

10.2.1 LNG Refueling Infrastructure, By Region

10.2.1.1 LNG Gas Stations, By Country, 2014

10.2.1.2 Gas Grid Access and Alternatives

10.3 Competing Fuel Technology

10.3.1 Electric and Hybrid

10.3.2 Fuel Cell

10.3.3 Gasoline/Diesel

10.3.4 Propane

10.3.5 Biofuels

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Market Competition of Natural Gas Truck Industry, By Company

11.3 Competitive Situation and Trends

11.4 Battle for Market Share: New Product Launches Was the Key Strategy

11.5 New Product Launches

11.5.1 Agreements, Partnerships, Collaborations & Joint Ventures

11.5.2 Mergers & Acquisitions

11.5.3 Expansions

11.5.4 Supply Contracts

12 Company Profiles (Page No. - 121)

(Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 AB Volvo

12.3 Beiqi Foton Motor Co. Ltd.

12.4 Dongfeng Motor Group Company Limited

12.5 CNH Industrial NV

12.6 Daimler AG

12.7 Westport Innovations Inc.

12.8 Clean Energy Fuels Corp.

12.9 Landi Renzo SPA

12.1 Clean Air Power Ltd.

12.11 Agility Fuel Systems Inc.

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (80 Tables)

Table 1 Vehicle Definitions

Table 2 Low Cost of Fuel is Propelling the Growth of the Market

Table 3 Higher Initial Cost is Restraining Market Growth

Table 4 Growing Popularity of Green Transportation Opening Up New Opportunities for Adoption of Natural Gas Vehicles

Table 5 Cost of Fuel, By Country, 2014

Table 6 Global OE Annual CNG Sales, By Region, 2012-2019 (Units)

Table 7 Global Cumulative CNG Vehicles, By Region, 2012-2019 (Units)

Table 8 Global OE Annual LNG Sales, By Region, 2012-2019 (Units)

Table 9 Global Cumulative LNG Vehicles, By Region, 2012-2019 (Units)

Table 10 Asia-Oceania: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 11 Asia-Oceania: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 12 China: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 13 China: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 14 India: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 15 India: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 16 Japan: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 17 Japan: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 18 South Korea: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 19 South Korea: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 20 Thailand: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 21 Thailand: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 22 Europe: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 23 Europe: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 24 Russia: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 25 Russia: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 26 Ukraine: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 27 Ukraine: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 28 Americas: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 29 Americas: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 30 Colombia: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 31 Colombia: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 32 U.S.: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 33 U.S.: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 34 Armenia: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 35 Armenia: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 36 China: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 37 China: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 38 U.S.: OE Annual Sales, By Vehicle Type, 2012-2019 (Units)

Table 39 U.S.: Cumulative Vehicles, By Vehicle Type, 2012-2019 (Units)

Table 40 Global OE Medium Duty CNG & LNG Vehicle Annual Sales, By Geography, 2012-2019 (Units)

Table 41 Global Medium Duty CNG & LNG Cumulative Vehicles, By Geography, 2012-2019 (Units)

Table 42 Global OE Heavy Duty CNG & LNG Vehicle Annual Sales, By Geography, 2012-2019 (Units)

Table 43 Global Heavy Duty CNG & LNG Cumulative Vehicles, By Geography, 2012-2019 (Units)

Table 44 Global OE Medium Duty CNG & LNG Bus Sales, By Geography, 2012-2019 (Units)

Table 45 Global Medium Duty CNG & LNG Cumulative Buses, By Geography, 2012-2019 (Units)

Table 46 Asia-Oceania: OE Medium Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 47 Asia-Oceania: Medium Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 48 Europe: OE Medium Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 49 Europe: Medium Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 50 Americas: OE Medium Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 51 Americas: Medium Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 52 Global OE Medium Duty CNG & LNG Truck Sales, By Geography, 2012-2019 (Units)

Table 53 Global Medium Duty CNG & LNG Cumulative Trucks, By Geography, 2012-2019 (Units)

Table 54 Asia-Oceania: OE Medium Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 55 Asia-Oceania: Medium Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 56 Europe: OE Medium Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 57 Europe: Medium Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 58 Americas: OE Medium Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 59 Americas: Medium Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 60 Global OE Heavy Duty CNG & LNG Bus Sales, By Geography, 2012-2019 (Units)

Table 61 Global Heavy Duty CNG & LNG Cumulative Buses, By Geography, 2012-2019 (Units)

Table 62 Asia-Oceania: OE Heavy Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 63 Asia-Oceania: Heavy Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 64 Europe: OE Heavy Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 65 Europe: Heavy Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 66 Americas: OE Heavy Duty CNG & LNG Bus Sales, By Country, 2012-2019 (Units)

Table 67 Americas: Heavy Duty CNG & LNG Cumulative Buses, By Country, 2012-2019 (Units)

Table 68 Global OE Heavy Duty CNG & LNG Truck Sales, By Geography, 2012-2019 (Units)

Table 69 Global Heavy Duty CNG & LNG Cumulative Trucks, By Geography, 2012-2019 (Units)

Table 70 Asia-Oceania: OE Heavy Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 71 Asia-Oceania: Heavy Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 72 Europe: OE Heavy Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 73 Europe: Heavy Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 74 Americas: OE Heavy Duty CNG & LNG Truck Sales, By Country, 2012-2019 (Units)

Table 75 Americas: Heavy Duty CNG & LNG Cumulative Trucks, By Country, 2012-2019 (Units)

Table 76 New Product Launches, 2013-2014

Table 77 Agreements, Partnerships, Collaborations & Joint Ventures, 2013-2014

Table 78 Mergers & Acquisitions, 2013

Table 79 Expansions, 2012-2014

Table 80 Supply Contracts, 2012-2014

List of Figures (66 Figures)

Figure 1 Global CNG & LNG Trucks and Buses Market: Research Methodology

Figure 2 CNG & LNG Trucks and Buses Market Across Key Countries, 2014

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Natural Gas Trucks and Buses Market Snapshot (2014 vs 2019)

Figure 5 Global Natural Gas Trucks and Buses Market, By Country, 2019

Figure 6 Global CNG OE Trucks and Buses Market Share, 2014

Figure 7 Huge Market Potential in OE CNG & LNG Trucks and Buses Market

Figure 8 China Commands Over One-Third of the Market Share in OE CNG Trucks and Buses Market, 2014

Figure 9 CNG OE Trucks and Buses Market Snapshot, By Vehicle Type, 2014

Figure 10 Adoption of LNG is Estimated to Be Higher in Heavy Duty Buses

Figure 11 High Segmental Growth is Projected in Medium Duty Buses and Americas

Figure 12 Global CNG & LNG Trucks and Buses Cumulative Market Snapshot, 2014 vs. 2019

Figure 13 U.S. Projected to Be the Fastest-Growing Market

Figure 14 LNG Will Continue to Dominate in China

Figure 15 Exponential Growth Estimated in Americas

Figure 16 Savings on Fuel Will Drive the Market for Natural Gas Powered Trucks and Buses

Figure 17 CNG & LNG Trucks and Buses Market: Value Chain

Figure 18 Huge Market Potential is Estimated to Increase the Competition

Figure 19 Government Policies Will Have A Major Impact on the Market

Figure 20 Underground Natural Gas Storage Facility

Figure 21 LNG Fuel System on-Vehicle Functioning

Figure 22 Total Cost to Consumer in Five Years, China, 2014

Figure 23 Total Cost to Consumer in Five Years, USA, 2014

Figure 24 Total Cost to Consumer in Five Years, India, 2014

Figure 25 Total Cost to Consumer in Five Years, Ukraine, 2014

Figure 26 Regional Snapshot Cagr%(2014-2019)

Figure 27 Asia-Oceania OE Market Snapshot: Demand Will Be Driven By Low Cost of CNG

Figure 28 Asia-Oceania Cumulative Vehicles Market Growth (Units)

Figure 29 European OE Market Snapshot (2014)

Figure 30 Europe: Cumulative Vehicles (Units): 2014 vs. 2019

Figure 31 Americas: OE Market Snapshot

Figure 32 Americas: Cumulative Vehicles (Units) Market, 2014 vs. 2019

Figure 33 U.S.: Lower Total Cost of Ownership is Driving the CNG Trucks & Buses Market

Figure 34 LNG: OE Sales Market Snapshot, 2014 vs. 2019

Figure 35 CNG & LNG Buses and Trucks OE Market, By Vehicle Type, 2014 vs. 2019

Figure 36 CNG & LNG Buses and Trucks Cumulative Vehicles Market, By Vehicle Type, 2014 vs. 2019

Figure 37 CNG & LNG Medium Duty Trucks and Buses Market, By Geography, 2014 vs. 2019

Figure 38 CNG & LNG Heavy Duty Trucks and Buses Market, By Geography, 2014 vs. 2019

Figure 39 CNG & LNG Medium Duty Trucks and Buses Market, By Vehicle Type, 2014 vs. 2019

Figure 40 CNG & LNG Heavy Duty Trucks and Buses Market, By Geography, 2014 vs. 2019

Figure 41 Share of CNG Fuelling Stations, By Region, 2014

Figure 42 Asia-Oceania (CNG Fuelling Stations), 2014

Figure 43 Europe (CNG Fuelling Stations), 2014

Figure 44 Americas (CNG Fuelling Stations), 2014

Figure 45 ROW (CNG Fuelling Stations), 2014

Figure 46 Number of LNG Gas Stations, By Country, 2014

Figure 47 Companies Adopted Partnerships, Agreements & Collaborations As the Key Growth Strategy Over the Last Three Years

Figure 48 Dongfeng Motor Group Company Limited Grew At the Highest Rate Between 2008 and 2013

Figure 49 Product Launches and Agreements/Joint Ventures Have Fueled the Market Growth Between 2012-2014

Figure 50 Geographic Revenue Mix of Top 5 Market Players

Figure 51 Competitive Benchmarking of Key Market Players (2008-2013)

Figure 52 AB Volvo: Business Overview

Figure 53 SWOT Analysis

Figure 54 Beiqi Foton Motor Co. Ltd.: Business Overview

Figure 55 SWOT Analysis

Figure 56 Dongfeng Motor Group Company Limited: Business Overview

Figure 57 SWOT Analysis

Figure 58 CNH Industrial (Iveco): Business Overview

Figure 59 SWOT Analysis

Figure 60 Daimler AG: Business Overview

Figure 61 SWOT Analysis

Figure 62 Westport Innovations Inc.: Business Overview

Figure 63 Clean Energy Fuels Corp.: Business Overview

Figure 64 Landi Renzo SPA: Business Overview

Figure 65 Clean Air Power Ltd.: Business Overview

Figure 66 Agility Fuel Systems Inc.: Business Overview

Growth opportunities and latent adjacency in Automotive Natural Gas Vehicle Market