Natural Vanillin Market by Source (Vanilla Bean Extract, Ferulic Acid Synthesis, and Eugenol Synthesis), Application (Food & Beverages, Pharmaceuticals, and Cosmetics & Personal Care), Form, and Region-Global Forecast to 2027

Natural vanillin, with its origins deeply rooted in the vanilla orchid plant, is a flavoring superstar renowned for its delicate and delightful notes of creaminess, sweetness, and floral aroma, making it a beloved ingredient in the food and beverage industry. It can be sourced by extracting it from vanilla beans or by synthesizing it from lignin found in wood pulp, offering a versatile and sustainable solution for a wide range of product applications, including baked goods, confectionery, and beverages.

To know about the assumptions considered for the study, Request for Free Sample Report

Current trends in the natural vanillin market:

- The demand for natural and clean label ingredients is driving the growth of the natural vanillin market.

- The rising popularity of plant-based and vegan diets is increasing the demand for natural vanillin.

- Natural vanillin is used as a key ingredient in fragrances and personal care products.

- Food manufacturers are increasingly using natural vanillin in their products as a replacement for synthetic vanillin.

- The use of natural vanillin is in line with the global trend towards sustainable and responsible production practices.

Natural Vanillin Market Dynamics

Demand for cost-effective and sustainable products

The demand for natural vanilla flavors is rising as consumers are highly preferred to plant-based and naturally flavored foods. Natural vanillin is the chemical compound of vanilla that is used as a flavoring agent in all applications. Natural vanillin is extracted from vanilla beans, which is more expensive. To meet consumer demand, manufacturers are producing natural vanillin through cost-effective and sustainable methods such as ferulic acid synthesis and eugenol synthesis, and other sources. Natural vanillin, which is extracted from vanilla beans unable to meet the growing demands of the food and beverage industry. Because vanilla can be grown in only specific climatic conditions and labor extensive (needs hand pollination).

Due to the scarcity and cost of natural vanilla extract, the commercial production of vanillin molecules began by utilizing natural compounds such as rice bran, wood, and clove. For instance, Borregaard offers cost-effective and sustainable vanillin products through wood-based vanillin for different applications such as bakery, caramel, chocolate, and dairy products. Oamic ingredients USA produces natural vanillin through eugenol synthesis derived from sustainably sourced clove oil. It is specially developed through innovative technology to meet the cost-effectiveness and sustainable standards of ex-clove vanillin.

The rising inclination for natural flavors and fragrances in premium products

The growing trend of premiumization will contribute to the growing consumer demand for natural vanillin. Premium products are expected to witness high demand globally in the coming years. Factors contributing to the growing inclination of customers toward premium products include the rising disposable income of people and the growing health consciousness of consumers. In European countries, there is a growing demand for vanilla extract in food & beverages and cosmetics & pharmaceutical products. Increasing consumer demand for organic and natural ingredients in food & beverages on the European market.

France has the second-largest organic food & beverage market in Europe due to the growing demand for healthier and natural food & beverage products. With the increasing risk of toxic and other harmful ingredients used in personal care products, consumers have started preferring bio-based products, especially in the developed countries of Europe and North America. In addition, skin sensitiveness and environmental impact caused as a result of the use of non-synthetic ingredients have increased the demand for natural fragrance ingredients in personal care products. The growing health hazards associated with the use of synthetic products have also encouraged consumers to pay more for less toxic and environmental-friendly products. Consumers are also ready to pay premium amounts for products with natural ingredients. This trend has led fragrance manufacturers to develop naturally sourced products to increase their profit margins.

High cost of raw materials

Vanillin is one of the ingredients which has a wide range of applications including food, beverages, pharmaceuticals, and personal care. Vanillin is largely used in beverages by producers to cut the use of sugar and other artificial sweeteners in their products. According to research by Penn State, adding vanilla to milk-based beverages can reduce the sugar requirement by 30-50%. Vanilla is rare, and the second most expensive spice, due to the extensive labor required to grow the vanilla seed pods.

The overall growing cycle of vanilla pods requires pollination, which is done manually, the workers use a stick to move the pollen-coated part of the flower, called the anther, towards the female part, called the stigma. It takes 600 hand-pollinated blossoms to produce 1 kg of cured beans. Unripe beans are sold at local markets to collectors and curers who then sort, blanch, steam, and dry the beans in the sun. They are then sorted again, dried in the shade, and fermented. The beans are continually evaluated on their aroma and quality. The demand for vanillin has surged with its prices because vanilla vines take years to mature, and natural supplies are insufficient. Extreme weather and exporters who hoard inventory and speculate on further rises have also kept prices high. Furthermore, natural vanillin is used as food ingredients which are also some of the most tested and regulated products in the world. The need for testing and regulatory compliance increases the cost of the R&D process.

Rising end-use application.

There is a rising global demand for new, improved, and application-specific food ingredients in the food industry. New product launches and technological innovations are key strategies adopted by the leading market players in the natural-vanillin market. For instance, Solvay has added three new natural flavor ingredients “Rhovanil Natural Delica, Alta, and Sublima to the lineup of Rhovanil Natural CW, one of its signature products. With these new solutions, the Group will help the food & beverage industries meet rising customer demands for healthier, safer, tastier, and more natural products, as well as cost-effectively make the conversion to natural.

Rhovanil Natural Delica, Alta, and Sublima are based on Rhovanil Natural CW, the industry standard for natural vanillin demands. Ferulic acid, a naturally occurring substance found in rice bran, is converted into vanillin by this process. For manufacturers of food & beverages around the world, this non-GMO natural vanillin flavor ensures quality and value by balancing taste performance and cost-in-use.

Lack of inconsistency in labeling regulations

Due to strong customer demand, clean and clear labels have evolved from trends to industry standards across the food & beverage market. Customers choose products with all-natural, well-known, straightforward ingredients that are simple to understand. They also want transparency regarding the methods utilized to source and prepare ingredients, as well as their origins. Growing worries about allergies brought on by additional compounds make this need even more important. Hence, the market for natural flavors such as vanilla or vanillin is legally compelled to go by the guidelines established by various regulatory standards. International bodies such as the National Food Safety and Quality Service (SENASA), Canadian Food Inspection Agency (CFIA), US Food and Drug Administration (FDA), World Health Organization (WHO and the Committee on the Environment, Public Health, and Food Safety (EU) among others. These organizations have control over the use of different chemicals and materials used in food processing, directly or indirectly. When deciding whether a flavor is natural, most international organizations take the US's or the EU's lead. The regulatory requirements in the US and the EU are comparable, yet they can differ significantly. For instance, what might be regarded as natural in the United States might not be in Europe which can affect market growth.

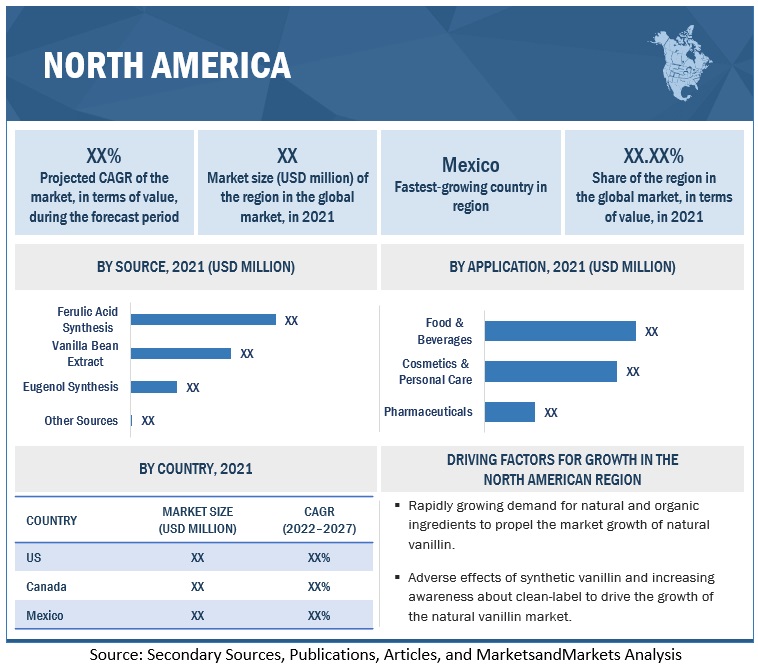

North America: Natural Vanillin Market Snapshot

North America dominated the natural vanillin market in 2021, and the market is projected to grow with a CAGR of 8.1% during the forecast period (2022-2027)

North America accounted for the largest share of the global natural vanillin market, with 36.4% in 2021, and is projected to grow at a CAGR of 8.1% during the forecast period. The growth in the region is attributed to increasing demand for clean-label food products and high purchasing power. The US imports major portions of natural vanillin in the global market accounting for 18% of the total share. This is due to the presence of leading food processing companies and the high consumption of natural vanillin. In addition, According to FAO, in 2021, Mexico is the third leading producer of vanilla beans throughout the world. Almost 70% of vanilla beans produced in Mexico are exported to other countries, where they are processed further into a vanilla extract and other by-products.

To know about the assumptions considered for the study, download the pdf brochure

A few of the natural vanillin companies in the US include Sensient Technologies Corporation, Prova, McCormick & Company, Inc. IFF, Aurochemicals, Advanced Biotech, Nielsen-Massey, and Comax Flavors.

Key Market Players

The key players in the natural vanillin market include Givaudan (Switzerland), Firmenich SA (Switzerland), Symrise (Germany), Kerry Group plc (Ireland), Solvay (Belgium), International Flavors and Fragrances (US), Sensient Technologies Corporation (US), McCormick & Company, Inc. (US), Mane (France), and Lesaffre (France).

Scope of the Report

|

Report Metric |

Details |

|

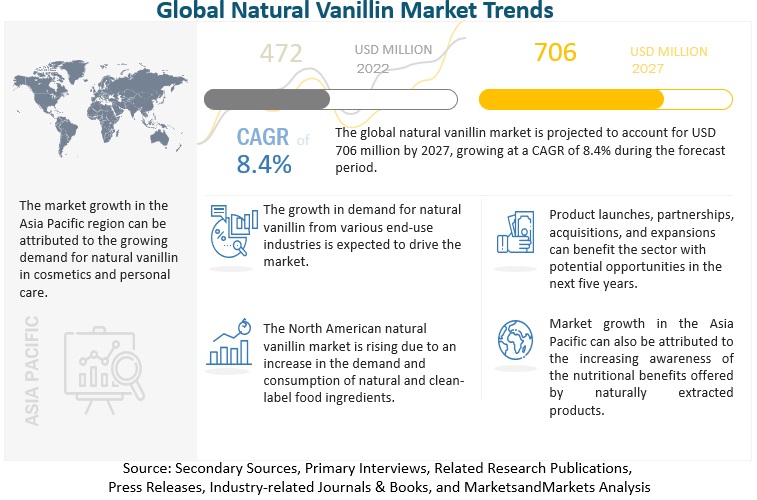

Market measurement in 2022 |

USD 472 million |

|

Financial outlook in 2027 |

USD 706 million |

|

Progress rate |

CAGR of 8.4% |

|

Market size available for years |

2022-2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Customization Available |

Yes! You can approach us for report customization as per your business needs |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Source |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Givaudan (Switzerland), Firmenich SA (Switzerland), Symrise (Germany), Kerry Group plc (Ireland), Solvay (Belgium), International Flavors and Fragrances (US), Sensient Technologies Corporation (US), McCormick & Company, Inc. (US), Mane (France), and Lesaffre (France). |

|

Research coverage |

The report segments the natural vanillin market on the basis of source, application, and region. In terms of insights, this report has focused on various levels of analyses - the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global natural vanillin market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. |

This research report categorizes the natural vanillin market, based on source, application, and region.

Target Audience

- Natural vanillin manufacturers

- Natural vanillin distributors

- Academicians and research organizations

- Processed food manufacturers.

- Ready-to-eat meal manufacturers.

- Pharmaceutical manufacturers

- Cosmetics and personal care manufacturers

Report Scope:

Natural Vanillin Market:

By Source

- Vanilla Bean Extract

- Eugenol Synthesis

- Ferulic acid Synthesis

- Other Sources

By Application

-

Food & Beverages

-

Bakery & Confectionery

- Bread

- Mixes

- Others (Snack bars, Cereals)

-

Beverages

- Dairy alternatives

- Flavored milk

- RTD Beverages

- Other beverages

-

Dairy

- Ice Cream

- Yogurt

- Creamers

- Other dairy products

- Other Food & Beverage Products

-

Bakery & Confectionery

- Pharmaceuticals

- Cosmetics & Personal Care

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In December 2022, Mane opened its innovation center in Hyderabad with an investment of Euro 3 million (USD 3.5 million) to explore various categories of flavors and taste end applications. This is strategically located in one of India’s fastest-growing metro cities and is well connected to other parts of the country.

- In November 2022, Mane opened its new manufacturing facility in Dahej, Gujarat, with an investment of Euro 20 million (USD 23.8 million) to meet the growing demand for flavors and fragrances in India and across the Asia Pacific region.

- In September 2022, Solvay launched three new flavor ingredients: Rhovanil Natural Delica, Alta, and Sublima, to expand the natural vanillin portfolio for the food & beverage industries. This product launch aims to meet the growing consumer demand for healthier, safer, and tastier natural products.

- In September 2022, Axxence Aromatic GmbH collaborated with Wageningen Plant Research, the Dutch research institute, to drive research in natural flavor substances. Customers use these substances to develop natural flavors for the food & beverage industry and natural fragrances for the perfume and cosmetics industry.

- In May 2022, Solvay collaborated with Suanfarma’s Cipan manufacturing site located in Lisbon, Portugal, to develop natural ingredients, such as natural vanillin and Rhovanil Natural CW, for the food, flavor, and fragrance industries.

- In August 2021, Oamic Ingredients USA a subsidiary of Oamic Biotech Co., Ltd. launched “Ex-clove vanillin,” which is produced by fermentation from eugenol synthesis (Ex-clove). This product is launched to meet the customers looking for environmentally friendly produced products.

- In December 2020, McCormick & Company, Inc. acquired FONA International, LLC, a manufacturer of clean and natural flavors that provides solutions for various applications, such as food, beverage, and nutritional markets. This acquisition expands flavor growth and strengthens its leadership in clean and natural flavors.

- In October 2020, Firmenich SA partnered with Authentic Products, a producer and exporter of vanilla beans in Madagascar, to strengthen the sourcing of vanilla. This partnership aims to provide employment opportunities to the youth and improve their livelihoods.

- In March 2020, International Flavors and Fragrances collaborated with Evolva, a Swiss biotech company, to develop and expand the commercialization of vanillin. This collaboration commits to supporting the increasing consumer demand for health and the environment.

- In January 2020, Solvay launched Rhovanil Natural to meet the increasing consumer demand for natural ingredients and healthier products.

- In February 2019, McCormick & Company, Inc. collaborated with IBM Research to develop an AI application for flavor and food product development. This collaboration aims to start a new era of flavor innovation by using AI for product composition.

Frequently Asked Questions (FAQ):

What is the expected market size for the global natural vanillin market in the coming years?

From 2022 to 2027, the natural vanillin market is predicted to undergo a robust growth phase. This growth is expected to culminate in a market value of USD 706 million by 2027.

What is the estimated growth rate (CAGR) of the global natural vanillin market for the next five years?

The global natural vanillin market is set for significant growth, with a projected surge at a CAGR of 8.4% during 2022-2027.

What are the major revenue pockets in the natural vanillin market currently?

North America dominates the global natural vanillin market, accounting for 36.4% in 2021, and is expected to grow at a CAGR of 8.1% during the forecast period. This growth is driven by the region's rising demand for clean-label food products and high purchasing power. The US is a major importer of natural vanillin, with 18% of the total market share, due to the presence of leading food processing companies and high consumption. Additionally, Mexico is the world's third-largest producer of vanilla beans, with almost 70% of its production exported to other countries for further processing into vanilla extract and other by-products, according to FAO.

What was the size of the global natural vanillin market in 2022?

In 2022, the natural vanillin market was valued at approximately USD 472 million in 2022, indicating a significant increase from previous years.

What kind of information is provided in the competitive landscape section?

For the list of players mentioned above, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, and MnM view to elaborate analyst view on the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for natural and clean-label ingredients- Rising inclination for natural flavors and fragrances in premium products- Demand for cost-effective and sustainable productsRESTRAINTS- High cost of raw materials- Fluctuation in raw material supply and trade worldwideOPPORTUNITIES- Suppliers seeking to increase production quantity of natural vanillin- Rising end-use applicationsCHALLENGES- Inconsistency in labeling regulations

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS’ BUSINESSES

- 6.3 TRADE ANALYSIS

-

6.4 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION & PROCESSINGCERTIFICATIONS/REGULATORY BODIESMARKETING & SALES

-

6.5 MARKET MAPPING AND ECOSYSTEMSUPPLY SIDE- Natural vanillin manufacturers- Raw material providersDEMAND SIDE- Distributors and suppliers- End-use processing companies

- 6.6 PRICING ANALYSIS

-

6.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.8 TECHNOLOGY ANALYSISELECTROCHEMICAL TECHNOLOGY TO PRODUCE VANILLINBIO-TECHNOLOGY-BASED APPROACH TO PRODUCE VANILLIN

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS IN 2022–2023

-

6.11 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CANADAEUROPEASIA PACIFIC- India- ChinaROW

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 6.13 CASE STUDY

- 6.14 MACRO INDICATORS OF RECESSION

- 7.1 INTRODUCTION

-

7.2 VANILLA BEAN EXTRACTINCREASING DEMAND FOR NATURAL INGREDIENTS AND ETHICAL PRODUCTION METHODS TO DRIVE MARKET

-

7.3 EUGENOL SYNTHESISTRANSPARENCY REGARDING ORIGINS AND PROCUREMENT OF INGREDIENTS TO DRIVE MARKET

-

7.4 FERULIC ACID SYNTHESISGROWING DEMAND FOR CLEAN “NATURAL FLAVOR” LABELS TO PROPEL MARKET GROWTH

- 7.5 OTHER SOURCES

- 8.1 INTRODUCTION

-

8.2 FOOD & BEVERAGESINCREASING DEMAND FOR HEALTHIER FOODS AND NATURAL INGREDIENTS TO ESCALATE MARKETBAKERY & CONFECTIONERY- Bread- Mixes- Other bakery & confectionery productsBEVERAGES- Dairy alternatives- Flavored milk- RTD beverages- Other beveragesDAIRY- Ice cream- Yogurt- Creamers- Other dairy productsOTHER FOOD & BEVERAGE PRODUCTS

-

8.3 PHARMACEUTICALSINCREASING USE OF NATURAL VANILLIN IN PHARMACEUTICALS TO ENHANCE TASTE OF DRUGS AND OTHER MEDICINES

-

8.4 COSMETICS & PERSONAL CAREINCREASING USE OF NATURAL AND SUSTAINABLE PRODUCTS DUE TO THEIR FUNCTIONAL PROPERTIES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing use of natural vanillin in various industrial applications to drive marketCANADA- Rise in health concerns among consumers to drive marketMEXICO- Production of high-quality vanilla beans to propel market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISFRANCE- Increase in application of natural extracts in food and cosmetic industries to boost market growthGERMANY- Rising consumer acceptance of high-quality natural ingredients to drive marketSPAIN- Increasing use of natural flavors to propel market growthITALY- Changing consumer preferences and busier lifestyles to drive marketUK- Rising demand for natural products to boost market growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Presence of large suppliers to drive marketINDIA- Increasing consumption of organic products to drive marketJAPAN- Rise in consumption of healthy and organic foods to propel market growthAUSTRALIA & NEW ZEALAND- Increase in opportunities for natural vanillin due to expansion of new markets to boost market growthREST OF ASIA PACIFIC

-

9.5 ROWROW: RECESSION IMPACT ANALYSISBRAZIL- Increased demand for cosmetics and personal care products to fuel need for natural vanillinCOLOMBIA- Increasing demand for healthy and ethnic food ingredients to propel market growthREST OF SOUTH AMERICAMIDDLE EAST- Changing consumer lifestyles and rising disposable incomes to enhance demand for natural vanillin marketAFRICA- Increasing vanilla production and awareness of clean labels to contribute toward market growth

- 10.1 OVERVIEW

- 10.2 MARKET EVALUATION FRAMEWORK

- 10.3 MARKET SHARE ANALYSIS, 2021

- 10.4 REVENUE ANALYSIS OF KEY PLAYERS

-

10.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

10.6 NATURAL VANILLIN MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSGIVAUDAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIRMENICH SA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYMRISE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKERRY GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENSIENT TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMANE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPROVA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMCCORMICK & COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERNATIONAL FLAVORS AND FRAGRANCES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLVAY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLESAFFRE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAUROCHEMICALS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewADVANCED BIOTECH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOAMIC BIOTECH CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAXXENCE AROMATIC GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOELLHAUSEN SPA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIELSEN-MASSEY VANILLAS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPPLE FLAVOR AND FRAGRANCE GROUP CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJIAN YONG’AN ZHIYUAN BIOCHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOMAX FLAVORS- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 FOOD FLAVORS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

12.4 NATURAL FOOD COLORS & FLAVORS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2018–2021

- TABLE 3 NATURAL VANILLIN MARKET SNAPSHOT, 2021 VS. 2027

- TABLE 4 TOP TEN EXPORTERS AND IMPORTERS OF VANILLA, 2021 (USD THOUSAND)

- TABLE 5 TOP TEN EXPORTERS AND IMPORTERS OF VANILLA, 2021 (METRIC TON)

- TABLE 6 NATURAL VANILLIN MARKET: ECOSYSTEM

- TABLE 7 NATURAL VANILLIN MARKET: PRICES OF INGREDIENTS

- TABLE 8 NATURAL VANILLIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO NATURAL VANILLIN, 2021–2022

- TABLE 10 NATURAL VANILLIN MARKET: KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR NATURAL VANILLIN

- TABLE 13 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 14 CASE STUDY: PREPARATION OF NATURAL VANILLIN FROM FERULIC ACID USING FERMENTATION PROCESS

- TABLE 15 NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 16 NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 17 NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (METRIC TON)

- TABLE 18 NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (METRIC TON)

- TABLE 19 VANILLA BEAN EXTRACT: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 20 VANILLA BEAN EXTRACT: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 EUGENOL SYNTHESIS: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 22 EUGENOL SYNTHESIS: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 FERULIC ACID SYNTHESIS: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 24 FERULIC ACID SYNTHESIS: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 OTHER SOURCES: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 OTHER SOURCES: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 28 NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 29 FOOD & BEVERAGES: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 30 FOOD & BEVERAGES: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 PHARMACEUTICALS: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 32 PHARMACEUTICALS: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 COSMETICS & PERSONAL CARE: NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 COSMETICS & PERSONAL CARE: NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 NATURAL VANILLIN MARKET, BY REGION, 2018–2021 (METRIC TON)

- TABLE 38 NATURAL VANILLIN MARKET, BY REGION, 2022–2027 (METRIC TON)

- TABLE 39 NORTH AMERICA: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 40 NORTH AMERICA: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

- TABLE 42 NORTH AMERICA: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

- TABLE 43 NORTH AMERICA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 44 NORTH AMERICA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 46 NORTH AMERICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 47 US: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 48 US: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 49 US: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 50 US: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 51 CANADA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 52 CANADA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 53 CANADA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 CANADA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 55 MEXICO: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 56 MEXICO: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 57 MEXICO: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 58 MEXICO: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 59 EUROPE: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 60 EUROPE: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 61 EUROPE: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

- TABLE 62 EUROPE: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

- TABLE 63 EUROPE: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 64 EUROPE: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 65 EUROPE: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 66 EUROPE: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 67 FRANCE: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 68 FRANCE: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 69 FRANCE: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 70 FRANCE: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 71 GERMANY: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 72 GERMANY: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 73 GERMANY: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 74 GERMANY: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 75 SPAIN: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 76 SPAIN: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 77 SPAIN: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 78 SPAIN: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 79 ITALY: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 80 ITALY: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 81 ITALY: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 82 ITALY: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 83 UK: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 84 UK: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 85 UK: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 86 UK: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 87 REST OF EUROPE: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 88 REST OF EUROPE: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 89 REST OF EUROPE: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 90 REST OF EUROPE: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 91 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 92 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

- TABLE 94 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

- TABLE 95 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 99 CHINA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 100 CHINA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 101 CHINA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 CHINA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 103 INDIA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 104 INDIA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 105 INDIA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 106 INDIA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 107 JAPAN: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 108 JAPAN: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 109 JAPAN: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 110 JAPAN: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 AUSTRALIA & NEW ZEALAND: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 112 AUSTRALIA & NEW ZEALAND: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 113 AUSTRALIA & NEW ZEALAND: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 114 AUSTRALIA & NEW ZEALAND: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 119 ROW: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 120 ROW: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 121 ROW: NATURAL VANILLIN MARKET, BY COUNTRY, 2018–2021 (METRIC TON)

- TABLE 122 ROW: NATURAL VANILLIN MARKET, BY COUNTRY, 2022–2027 (METRIC TON)

- TABLE 123 ROW: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 124 ROW: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 125 ROW: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 126 ROW: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 BRAZIL: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 128 BRAZIL: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 129 BRAZIL: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 130 BRAZIL: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 131 COLOMBIA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 132 COLOMBIA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 133 COLOMBIA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 134 COLOMBIA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 135 REST OF SOUTH AMERICA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 137 REST OF SOUTH AMERICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 138 REST OF SOUTH AMERICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 139 MIDDLE EAST: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 140 MIDDLE EAST: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 141 MIDDLE EAST: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 142 MIDDLE EAST: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 AFRICA: NATURAL VANILLIN MARKET, BY SOURCE, 2018–2021 (USD MILLION)

- TABLE 144 AFRICA: NATURAL VANILLIN MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 145 AFRICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 146 AFRICA: NATURAL VANILLIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 NATURAL VANILLIN MARKET SHARE ANALYSIS, 2021

- TABLE 148 NATURAL VANILLIN MARKET: SOURCE FOOTPRINT

- TABLE 149 NATURAL VANILLIN MARKET: APPLICATION FOOTPRINT

- TABLE 150 COMPANY REGIONAL FOOTPRINT

- TABLE 151 OVERALL COMPANY FOOTPRINT

- TABLE 152 NATURAL VANILLIN: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 153 NATURAL VANILLIN MARKET: PRODUCT LAUNCHES, (2020–2022)

- TABLE 154 NATURAL VANILLIN MARKET: DEALS, 2019–2022

- TABLE 155 NATURAL VANILLIN MARKET: OTHER DEVELOPMENTS, 2022

- TABLE 156 GIVAUDAN: BUSINESS OVERVIEW

- TABLE 157 GIVAUDAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 FIRMENICH SA: BUSINESS OVERVIEW

- TABLE 159 FIRMENICH SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 FIRMENICH SA: DEALS

- TABLE 161 SYMRISE: BUSINESS OVERVIEW

- TABLE 162 SYMRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 KERRY GROUP: BUSINESS OVERVIEW

- TABLE 164 KERRY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 166 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 167 SENSIENT TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 168 MANE: BUSINESS OVERVIEW

- TABLE 169 MANE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 MANE: OTHER DEVELOPMENTS

- TABLE 171 PROVA: BUSINESS OVERVIEW

- TABLE 172 PROVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 MCCORMICK & COMPANY, INC.: BUSINESS OVERVIEW

- TABLE 174 MCCORMICK & COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 MCCORMICK & COMPANY, INC.: DEALS

- TABLE 176 INTERNATIONAL FLAVORS AND FRAGRANCES: BUSINESS OVERVIEW

- TABLE 177 INTERNATIONAL FLAVORS AND FRAGRANCES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 178 INTERNATIONAL FLAVORS AND FRAGRANCES: DEALS

- TABLE 179 SOLVAY: BUSINESS OVERVIEW

- TABLE 180 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 SOLVAY: PRODUCT LAUNCHES

- TABLE 182 SOLVAY: DEALS

- TABLE 183 LESAFFRE: BUSINESS OVERVIEW

- TABLE 184 LESAFFRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 AUROCHEMICALS: BUSINESS OVERVIEW

- TABLE 186 AUROCHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ADVANCED BIOTECH: BUSINESS OVERVIEW

- TABLE 188 ADVANCED BIOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 OAMIC BIOTECH CO., LTD.: BUSINESS OVERVIEW

- TABLE 190 OAMIC BIOTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 AXXENCE AROMATIC GMBH: BUSINESS OVERVIEW

- TABLE 192 AXXENCE AROMATIC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 AXXENCE AROMATIC GMBH: DEALS

- TABLE 194 MOELLHAUSEN SPA: BUSINESS OVERVIEW

- TABLE 195 MOELLHAUSEN SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 NIELSEN-MASSEY VANILLAS, INC.: BUSINESS OVERVIEW

- TABLE 197 NIELSEN-MASSEY VANILLAS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 APPLE FLAVOR AND FRAGRANCE GROUP CO., LTD.: BUSINESS OVERVIEW

- TABLE 199 APPLE FLAVOR AND FRAGRANCES GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 FUJIAN YONG’AN ZHIYUAN BIOCHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 201 FUJIAN YONG’AN ZHIYUAN BIOCHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 COMAX FLAVORS: BUSINESS OVERVIEW

- TABLE 203 COMAX FLAVORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ADJACENT MARKETS TO NATURAL VANILLIN MARKET

- TABLE 205 FOOD FLAVORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 206 FOOD FLAVORS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 207 NATURAL FOOD FLAVORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 YEARS CONSIDERED

- FIGURE 4 NATURAL VANILLIN MARKET: RESEARCH DESIGN

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 NATURAL VANILLIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1

- FIGURE 7 NATURAL VANILLIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2

- FIGURE 8 NATURAL VANILLIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS CONSIDERED IN NATURAL VANILLIN MARKET

- FIGURE 11 LIMITATION AND RISK ASSESSMENT

- FIGURE 12 NATURAL VANILLIN MARKET SNAPSHOT, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 NATURAL VANILLIN MARKET SNAPSHOT, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 NATURAL VANILLIN MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 15 GROWING DEMAND FOR NATURAL FOOD INGREDIENTS TO FUEL GROWTH OF NATURAL VANILLIN MARKET

- FIGURE 16 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR NATURAL VANILLIN DURING FORECAST PERIOD

- FIGURE 17 CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC MARKET IN 2022

- FIGURE 18 FERULIC ACID SYNTHESIS SEGMENT TO DOMINATE NATURAL VANILLIN MARKET DURING FORECAST PERIOD

- FIGURE 19 FOOD & BEVERAGES SEGMENT TO DOMINATE NATURAL VANILLIN MARKET DURING FORECAST PERIOD

- FIGURE 20 NORTH AMERICA TO DOMINATE NATURAL VANILLIN MARKET DURING FORECAST PERIOD

- FIGURE 21 NATURAL VANILLIN MARKET: MARKET DYNAMICS

- FIGURE 22 US: CONSUMER PREFERENCE FOR CLEAN-LABEL PRODUCTS AND INGREDIENTS, 2021

- FIGURE 23 VALUE CHAIN ANALYSIS OF NATURAL VANILLIN MARKET

- FIGURE 24 NATURAL VANILLIN MARKET: ECOSYSTEM MAP

- FIGURE 25 NATURAL VANILLIN MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 ANNUAL NUMBER OF PATENTS GRANTED FOR NATURAL VANILLIN (2012–2022)

- FIGURE 27 NUMBER OF PATENTS GRANTED FOR NATURAL VANILLIN, BY YEAR AND REGION (2019–2022)

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING NATURAL VANILLIN FOR VARIOUS APPLICATIONS

- FIGURE 29 KEY BUYING CRITERIA FOR VARIOUS APPLICATIONS

- FIGURE 30 INDICATORS OF RECESSION

- FIGURE 31 GLOBAL INFLATION RATES, 2011–2021

- FIGURE 32 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 33 GLOBAL FOOD INGREDIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST, 2023 (USD BILLION)

- FIGURE 34 RECESSION INDICATORS AND THEIR IMPACT ON NATURAL VANILLIN MARKET

- FIGURE 35 GLOBAL NATURAL VANILLIN MARKET: EARLIER FORECAST VS RECESSION FORECAST, 2023 (USD BILLION)

- FIGURE 36 NATURAL VANILLIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

- FIGURE 37 NATURAL VANILLIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 38 NORTH AMERICA TO LEAD NATURAL VANILLIN MARKET IN 2021

- FIGURE 39 NORTH AMERICA: NATURAL VANILLIN MARKET SNAPSHOT

- FIGURE 40 MARKET EVALUATION FRAMEWORK, JANUARY 2019–DECEMBER 2022

- FIGURE 41 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

- FIGURE 42 NATURAL VANILLIN MARKET, COMPANY EVALUATION QUADRANT, 2021

- FIGURE 43 NATURAL VANILLIN MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- FIGURE 44 GIVAUDAN: COMPANY SNAPSHOT

- FIGURE 45 FIRMENICH SA: COMPANY SNAPSHOT

- FIGURE 46 SYMRISE: COMPANY SNAPSHOT

- FIGURE 47 KERRY GROUP: COMPANY SNAPSHOT

- FIGURE 48 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 MCCORMICK & COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 50 INTERNATIONAL FLAVORS AND FRAGRANCES: COMPANY SNAPSHOT

- FIGURE 51 SOLVAY: COMPANY SNAPSHOT

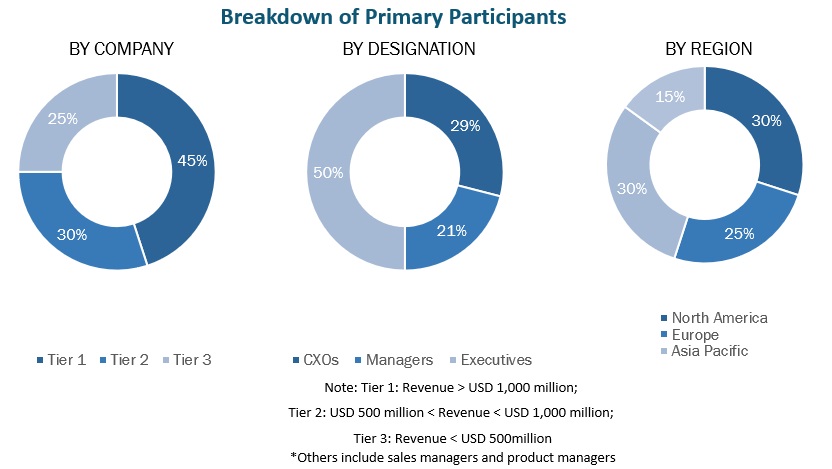

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the natural vanillin market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the natural vanillin market.

To know about the assumptions considered for the study, download the pdf brochure

Report Objectives

- To define, segment, and project the global natural vanillin market size based on sources, applications, and regions over a historical period ranging from 2018 to 2021 and a forecast period ranging from 2022 to 2027.

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five regions (along with their respective key countries): North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and Research & Development (R&D), in the natural vanillin market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe into Sweden, Belgium, Turkey, Greece, Poland, and Denmark and Others

- Further breakdown of the Rest of Asia Pacific into Indonesia, Malaysia, Vietnam, Singapore, the Philippines, and Thailand

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Natural Vanillin Market