Neuroprosthetics Market by Type (Output (Cognitive, Motor Prosthetics), Input (Cochlear, Retinal Implant)), Techniques (Deep Brain, Vagus Nerve, Spinal Cord stimulation), Application (Epilepsy, Paralysis, Alzheimer’s Disease) & Region

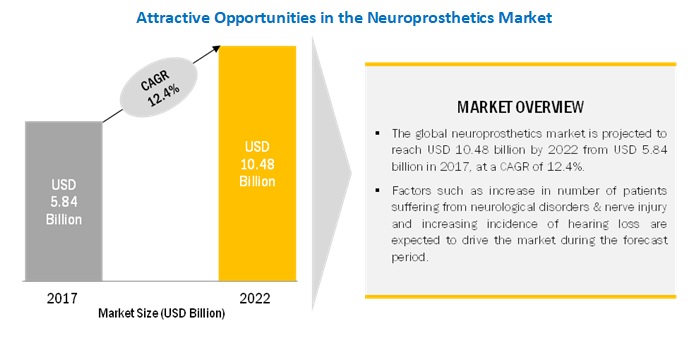

The global neuroprosthetics market is expected to grow at a CAGR of 12.4%. The major factors driving the growth of this market are the increasing number of patients suffering from neurological disorders and nerve injury, growing incidence of hearing loss, increasing cases of amputations due to the rising number of accidents & injuries, and increasing prevalence of diabetes.

Neuroprostheses uses electrodes to interface with the central or peripheral nervous system to restore lost motor or sensory capabilities. These devices can receive neural signals from the external environment & brain, and convert the signals to restore functions such as loss of hearing and vision. They have applications in cognitive disorders, ophthalmic disorders, motor disorders, and auditory disorders.

By technique, the spinal cord stimulation segment of the neuroprosthetics market is expected to hold the largest share during the forecast period.

By technique, the neuroprosthetics market is segmented into spinal cord stimulation, deep brain stimulation, vagus nerve stimulation, sacral nerve stimulation, and transcranial magnetic stimulation. In 2017, the spinal cord stimulation segment is expected to account for the largest share of the market. The large share of this segment can be primarily attributed to the increasing number of people suffering from back surgery syndrome, ischemia, and chronic pain across the globe.

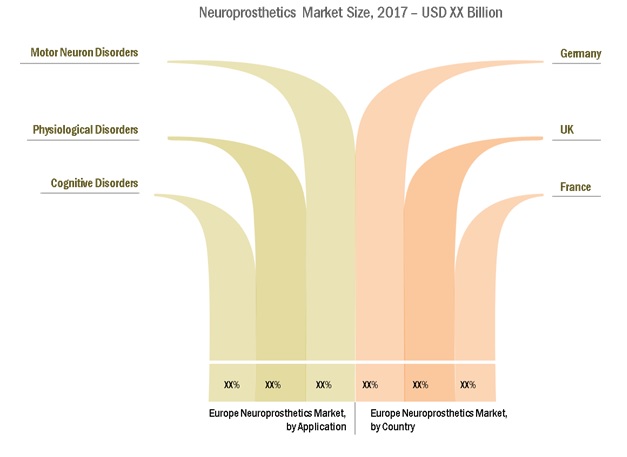

By application, the motor neuron disorders segment is expected to account for the largest share of the neuroprosthetics market during the forecast period.

Based on application, the neuroprosthetics market is segmented into motor neuron disorders, physiological disorders, and cognitive disorders. In 2017, the motor neuron disorders segment is expected to account for the largest share of the neuroprosthetics market. Increasing incidence of neurological disorders such as Parkinson’s disease and epilepsy is expected to drive the growth of this segment.

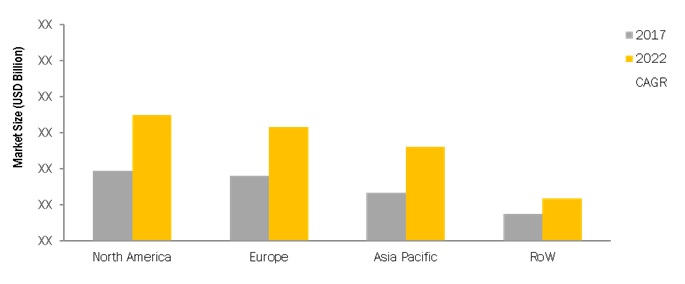

North America is expected to command the largest share of the market during the forecast period.

Based on region, the neuroprosthetics market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2017, North America is expected to command the largest share of the neuroprosthetics market. The large share of this market can primarily be attributed to the high incidence of vision and hearing loss, rising prevalence of neurological disorders, and the strong presence of industry players in this region.

Market Dynamics

Driver: Increasing prevalence of diabetes

People suffering from diabetes may develop several foot problems, which cause damage to blood vessels and nerves. Diabetes can also damage the blood vessels in the retina, which can cause vision impairments or blindness. As a result, the increasing incidence of diabetes is expected to support the growth of the retinal/bionic eye implants market. The top five countries with the highest diabetic population in 2013 (age group of 20–79 years) were China, India, the US, Brazil, and the Russian Federation.

Dysvascular disorder- and diabetes-related amputations are expected to drive the demand for artificial limb replacements in the near future. The prevalence of diabetes has significant regional variation. Since its burden is higher in the Asia Pacific region, this factor is expected to have a more substantial effect on the market in countries in Southeast Asia and the Indian subcontinent.

Restraints: Availability of alternative treatment options

Novel therapies, such as stem cell therapy, are showcasing a significant potential for the effective treatment of various neurological disorders. Stem cell therapy is an emerging branch of medicine that has the potential to restore organ and tissue function in patients suffering from serious injuries or chronic diseases. These therapies offer advantages such as higher recovery rates and faster recovery periods for patients. Moreover, stem cells also have significant potential in the treatment of motor neuron disease, Parkinson’s disease, and Alzheimer’s disease. Furthermore, medicinal, physical, occupational, and speech therapies are available for the treatment of several neurological disorders. For instance, currently, the preference for drug therapies is higher among Parkinson’s patients due to the lower cost and convenience of the treatment. The availability of these alternative treatment options is one of the significant factors limiting the demand for and adoption of neuroprosthetic devices and implants among the target patient population.

Opportunities: Expanded target applications and new indications

Neuroprosthetic procedures involve minimally invasive techniques as opposed to alternate surgical procedures for treating tremors primarily associated with Parkinson’s, which are invasive treatments. For instance, in a pallidotomy, the surgeon destroys a tiny part of the globus pallidus by creating a scar to reduce brain activity. Doctors do not prefer this procedure and encourage the use of deep brain stimulation; instead, as it does not destroy brain tissue and has fewer risks as compared to pallidotomy. The use of DBS in newer applications/indications, such as Alzheimer’s, epilepsy, and depression, is currently in clinical trials. Similarly, the treatment of heart failure, sleep apnea, obesity, and tinnitus through VNS (Vagus Nerve Stimulation); fecal incontinence by SNS (Sacral Nerve Stimulation); and tinnitus, migraine, and stroke by TMS (Transcranial Magnetic Stimulation) are also under clinical trials. TMS is currently used to treat depression, SNS for urine incontinence, and VNS for epilepsy.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015 -2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017 -2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type, Technique, Application, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Medtronic plc (Medtronic) (US), Cochlear Ltd. (Cochlear) (Australia), Abbott Laboratories (Abbott) (US), Boston Scientific (US), LivaNova, PLC (LivaNova) (UK), and Second Sight Medical Products, Inc. (Second Sight) (US).MED-EL (Austria), Retina Implant AG (Germany), Sonova (Switzerland), Neuropace (US), NDIE Medical, LLC (Canada) Nevro (US). |

The research report categorizes the Neuroprosthetics market to forecast the revenues and analyze the trends in each of the following sub-segments:

Neuroprosthetics Market, By Type

-

Output Neural Prosthetics

- Motor Prosthetics

- Cognitive Prosthetics

-

Input Neural Prosthetics

- Cochlear Implant

- Bionic Eye/ Retinal Implant

Neuroprosthetics Market, By Technique

- Spinal Cord Stimulation

- Deep Brain Stimulation

- Vagus Nerve Stimulation

- Sacral Nerve Stimulation

- Transcranial Magnetic Stimulation

Neuroprosthetics Market, By Application

-

Motor Neuron Disorders

- Parkinson’s Disease

- Epilepsy

-

Physiological Disorders

- Auditory Processing Disorders

- Cardiovascular Disorders

- Kidney Disorders

- Ophthalmic Disorders

-

Cognitive Disorders

- Alzheimer's Disease

- Paralysis

Neuroprosthetics Market, By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

- APAC

- RoW

Key Market Players

Medtronic (US), Abbott (US), Cochlear (Australia), and Boston Scientific (US).

Recent Developments

- In 2017, Medtronic (US) received FDA approval for the Intellis Platform Spinal Cord Stimulator (SCS).

- In 2017, Abbott Laboratories (US) acquired St. Jude Medical (US) to strengthen its position in the neuroprosthetics market.

- In 2017, Cochlear (Australia) signed an agreement with Otoconsult NV (Belgium) to develop artificial intelligence technology, which helps the company strengthen its cochlear implant portfolio.

- In 2017 Retina Implant AG (Germany) underwent a merger with Okuvision (Germany) to strengthen its position in the neuroprosthetics market.

- In 2016, Boston Scientific (US) acquired Cosman Medical (US) to add the spinal cord stimulator and deep brain stimulation systems to its product portfolio.

Critical questions the report answers:

- What are the upcoming trends for the Neuroprosthetics market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Neuroprosthetics Market Overview

4.2 European Output Neural Prosthetics Market, By Application and Country

4.3 Geographic Analysis of the Neuroprosthetics Market, By Country

4.4 Output Neural Prosthetics Market, By Type

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Patients Suffering From Neurological Disorders and Nerve Injury

5.2.1.2 Increasing Incidence of Hearing Loss

5.2.1.3 Increasing Cases of Amputation Due to the Rising Number of Accidents & Injuries

5.2.1.4 Increasing Prevalence of Diabetes

5.2.2 Restraints

5.2.2.1 Availability of Alternative Treatment Options

5.2.2.2 High Cost of Neuroprosthetics and Unfavorable Reimbursement Scenario

5.2.2.3 Dearth of Trained Professionals

5.2.3 Opportunities

5.2.3.1 Higher Growth Opportunities in Emerging Economies

5.2.3.2 Expanded Target Applications and New Indications

6 Neuroprosthetics Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Output Neural Prosthetics

6.2.1 Motor Prosthetics

6.2.2 Cognitive Prosthetics

6.3 Input Neural Prosthetics

6.3.1 Cochlear Implants

6.3.2 Bionic Eye/Retinal Implants

7 Neuroprosthetics Market, By Technique (Page No. - 41)

7.1 Introduction

7.2 Spinal Cord Stimulation

7.3 Deep Brain Stimulation

7.4 Vagus Nerve Stimulation

7.5 Sacral Nerve Stimulation

7.6 Transcranial Magnetic Stimulation

8 Neuroprosthetics Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Motor Neuron Disorders

8.2.1 Parkinson’s Disease

8.2.2 Epilepsy

8.3 Physiological Disorders

8.3.1 Auditory Processing Disorders

8.3.2 Ophthalmic Disorders

8.3.3 Cardiovascular Disorders

8.3.4 Urology Disorders

8.4 Cognitive Disorders

8.4.1 Alzheimer’s Disease

8.4.2 Paralysis

9 Neuroprosthetics Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 85)

10.1 Overview

10.2 Market Share Analysis, 2016

10.3 Competitive Scenario

10.3.1 Product Launches and Approvals

10.3.2 Acquisitions

10.3.3 Agreements

10.3.4 Mergers

10.3.5 Expansions

11 Company Profiles (Page No. - 89)

(Overview, Products Offered, Recent Developments, MnM View)*

11.1 Medtronic

11.2 Abbott

11.3 Cochlear

11.4 Boston Scientific

11.5 Livanova

11.6 Second Sight

11.7 Med-El

11.8 Retina Implant

11.9 Sonova

11.10 Neuropace

11.11 NDI Medical

11.12 Nevro

*Details on Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 110)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (84 Tables)

Table 1 Incidence of Hearing Loss, By Region, 2012 (Million)

Table 2 Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 3 Output Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 4 Output Neural Prosthetics Market, By Region, 2015–2022 (USD Million)

Table 5 Motor Prosthetics Market, By Region, 2015–2022 (USD Million)

Table 6 Cognitive Prosthetics Market, By Region, 2015–2022 (USD Million)

Table 7 Input Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 8 Input Neural Prosthetics Market, By Region, 2015–2022 (USD Million)

Table 9 Cochlear Implants Market, By Region, 2015–2022 (USD Million)

Table 10 Bionic Eye/Retinal Implants Market, By Region, 2015–2022 (USD Million)

Table 11 Neuroprosthetics Market, By Technique, 2015–2022 (USD Million)

Table 12 Spinal Cord Stimulation Market, By Region, 2015–2022 (USD Million)

Table 13 Deep Brain Stimulation Market, By Region, 2015–2022 (USD Million)

Table 14 Vagus Nerve Stimulation Market, By Region, 2015–2022 (USD Million)

Table 15 Sacral Nerve Stimulation Market, By Region, 2015–2022 (USD Million)

Table 16 Transcranial Magnetic Stimulation Market, By Region, 2015–2022 (USD Million)

Table 17 Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 18 Neuroprosthetics Market for Motor Neuron Disorders, By Type, 2015–2022 (USD Million)

Table 19 Neuroprosthetics Market for Motor Neuron Disorders, By Region, 2015–2022 (USD Million)

Table 20 Neuroprosthetics Market for Parkinson’s Disease, By Region, 2015–2022 (USD Million)

Table 21 Neuroprosthetics Market for Epilepsy, By Region, 2015–2022 (USD Million)

Table 22 Neuroprosthetics Market for Physiological Disorders, By Type, 2015–2022 (USD Million)

Table 23 Neuroprosthetics Market for Physiological Disorders, By Region, 2015–2022 (USD Million)

Table 24 Neuroprosthetics Market for Auditory Processing Disorders, By Region, 2015–2022 (USD Million)

Table 25 Neuroprosthetics Market for Ophthalmic Disorders, By Region, 2015–2022 (USD Million)

Table 26 Neuroprosthetics Market for Cardiovascular Disorders, By Region, 2015–2022 (USD Million)

Table 27 Neuroprosthetics Market for Urology Disorders, By Region, 2015–2022 (USD Million)

Table 28 Neuroprosthetics Market for Cognitive Disorders, By Type, 2015–2022 (USD Million)

Table 29 Neuroprosthetics Market for Cognitive Disorders, By Region, 2015–2022 (USD Million)

Table 30 Neuroprosthetics Market for Alzheimer’s Disease, By Region, 2015–2022 (USD Million)

Table 31 Neuroprosthetics Market for Paralysis, By Region, 2015–2022 (USD Million)

Table 32 Neuroprosthetics Market, By Region, 2015–2022 (USD Million)

Table 33 North America: Neuroprosthetics Market, By Country, 2015–2022 (USD Million)

Table 34 North America: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 35 North America: Output Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 36 North America: Input Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 37 North America: Neuroprosthetics Market, By Technique, 2015–2022 (USD Million)

Table 38 North America: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 39 North America: Neuroprosthetics Market for Motor Neuron Disorders, By Type, 2015–2022 (USD Million)

Table 40 North America: Neuroprosthetics Market for Physiological Disorders, By Type, 2015–2022 (USD Million)

Table 41 North America: Neuroprosthetics Market for Cognitive Disorders, By Type, 2015–2022 (USD Million)

Table 42 US: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 43 US: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 44 US: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 45 Canada: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 46 Canada: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 47 Canada: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 48 Europe: Neuroprosthetics Market, By Country, 2015–2022 (USD Million)

Table 49 Europe: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 50 Europe: Output Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 51 Europe: Input Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 52 Europe: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 53 Europe: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 54 Europe: Neuroprosthetics Market for Motor Neuron Disorders, By Type, 2015–2022 (USD Million)

Table 55 Europe: Neuroprosthetics Market for Physiological Disorders, By Type, 2015–2022 (USD Million)

Table 56 Europe: Neuroprosthetics Market for Cognitive Disorders, By Type, 2015–2022 (USD Million)

Table 57 Germany: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 58 Germany: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 59 Germany: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 60 UK: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 61 UK: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 62 UK: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 63 France: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 64 France: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 65 France: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 66 Rest of Europe: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 67 Rest of Europe: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 68 Rest of Europe: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 69 Asia Pacific: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 70 Asia Pacific: Output Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 71 Asia Pacific: Input Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 72 Asia Pacific: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 73 Asia Pacific: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 74 Asia Pacific: Neuroprosthetics Market for Motor Neuron Disorders, By Type, 2015–2022 (USD Million)

Table 75 Asia Pacific: Neuroprosthetics Market for Physiological Disorders, By Type, 2015–2022 (USD Million)

Table 76 Asia Pacific: Neuroprosthetics Market for Cognitive Disorders, By Type, 2015–2022 (USD Million)

Table 77 RoW: Neuroprosthetics Market, By Type, 2015–2022 (USD Million)

Table 78 RoW: Output Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 79 RoW: Input Neural Prosthetics Market, By Type, 2015–2022 (USD Million)

Table 80 RoW: Neuroprosthetics Market, By Technology, 2015–2022 (USD Million)

Table 81 RoW: Neuroprosthetics Market, By Application, 2015–2022 (USD Million)

Table 82 RoW: Neuroprosthetics Market for Motor Neuron Disorders, By Type, 2015–2022 (USD Million)

Table 83 RoW: Neuroprosthetics Market for Physiological Disorders, By Type, 2015–2022 (USD Million)

Table 84 RoW: Neuroprosthetics Market for Cognitive Disorders, By Type, 2015–2022 (USD Million)

List of Figures (31 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Neuroprosthetics Market, By Type, 2017 vs 2022 (USD Billion)

Figure 6 Neuroprosthetics Market, By Technique, 2017 vs 2022 (USD Billion)

Figure 7 Neuroprosthetics Market, By Application, 2017 vs 2022 (USD Billion)

Figure 8 Neuroprosthetics Market, By Region, 2017 vs 2022 (USD Billion)

Figure 9 Rising Incidence of Hearing Loss and Growing Prevalence of Neurological Disorders to Drive the Growth of the Market

Figure 10 Output Neural Prosthetics to Dominate the European Neuroprosthetics Market in 2017

Figure 11 France to Register the Highest CAGR During the Forecast Period (2017–2022)

Figure 12 Motor Prosthetics Will Continue to Register Highest Growth Rate During Forecast Period (2017-2022)

Figure 13 Neuroprosthetics Market: Drivers, Restraints, & Opportunities

Figure 14 Output Neural Prosthetics Segment to Dominate the Market Between 2017 and 2022

Figure 15 Spinal Cord Stimulation, the Largest Technique Segment in the Market

Figure 16 Motor Neuron Disorders Segment to Dominate the Neuroprosthetics Market During the Forecast Period

Figure 17 North America to Dominate the Neuroprosthetics Market in 2017

Figure 18 North America: Neuroprosthetics Market Snapshot

Figure 19 Europe: Neuroprosthetics Market Snapshot

Figure 20 Asia Pacific: Neuroprosthetics Market Snapshot

Figure 21 RoW: Neuroprosthetics Market Snapshot

Figure 22 Product Approvals & Launches- Key Strategy Adopted By Players Between 2014 and 2017

Figure 23 Share of Companies in the Neuroprosthetics Market, 2016

Figure 24 Medtronic: Company Snapshot

Figure 25 Abbott: Company Snapshot

Figure 26 Cochlear: Company Snapshot

Figure 27 Boston Scientific: Company Snapshot

Figure 28 Livanova: Company Snapshot

Figure 29 Second Sight: Company Snapshot

Figure 30 Sonova: Company Snapshot

Figure 31 Nevro: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Neuroprosthetics Market