Nerve Repair & Regeneration Market by Products (Neuromodulation Devices (Deep Brain Stimulation, Vagus Nerve Stimulation), Biomaterials (Nerve Conduits, Nerve Wraps), Application (Neurorrhaphy, Nerve Grafting, Stem Cell Therapy) & Region - Global Forecast to 2027

Market Growth Outlook Summary

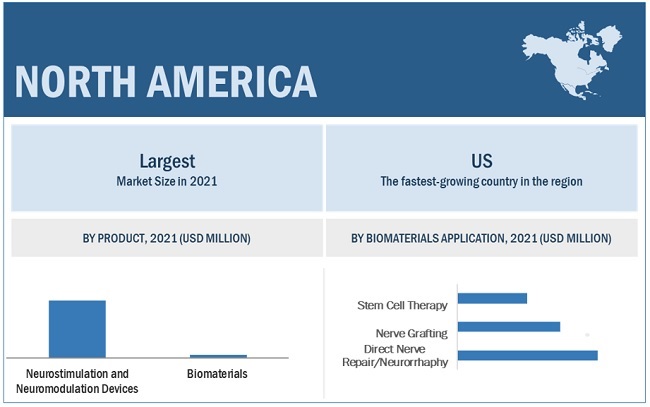

The global nerve repair market growth forecasted to transform from $6.5 billion in 2022 to $11.6 billion by 2027, driven by a CAGR of 12.1%. This growth is driven by the increasing prevalence of neurological disorders, rising geriatric population, high incidence of nerve injuries, and government support for neurological research. Key segments include neurostimulation and neuromodulation devices, which dominate the market, and direct nerve repair/neurorrhaphy. Challenges include a lack of skilled professionals, donor-site morbidity, difficulties in treating large nerve gaps, and stringent regulatory processes. North America is the largest market, attributed to a significant geriatric population, favorable reimbursement policies, and a strong presence of leading companies such as Medtronic, Boston Scientific, and Abbott Laboratories. Opportunities lie in emerging markets and advances in stem cell therapy. Recent developments include FDA approvals for neurostimulators by Medtronic and Boston Scientific, and the launch of Abbott's NeuroSphere Virtual Clinic.

Nerve Repair Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Nerve Repair Market Dynamics

Drivers: high incidence of nerve injuries; Rising focus on neuromodulation & neurostimulation technologies; expanding geriatric population and increasing government research funds for neurological diseases

The increasing prevalence of neurological disorders and high volume of cases of nerve injuries places a great demand for nerve repair & regeneration products. The geriatric population across the globe is also expanding. The vast geriatric population base and the massive prevalence and incidence of the nerve related diseases among them drives the growth of the market. The market players and researchers are more focused on advancing neurostimulation and neuromodulation technologies such as next-generation neurostimulation devices, collaborations among the companies to launch advanced products and the incoming latest technologies are pushing the growth of the market. The government investments into the studies of neurological disorder research further propels the growth rate of the market.

Opportunities: Emerging markets, Advances in stem cell therapy in nerve repair & regeneration; and growing research projects in neurology

The emerging economies such as India, China, and Brazil offer lucrative potentials in the market with their vast population base, rising incidence of neurological diseases, improving healthcare infrastructure and expenditure. The emerging technologies of stem cell therapy also offer vast opportunities of growth to the market, with several stem cell therapy studies under trial for nerve repair & regeneration purposes. The research activities in the area of neurology have been increased and are increasing from past few years.

Challenges: Dearth of skilled professionals; Donor-site morbidity; Difficulties in treating large nerve gap; Stringent regulatory frameworks and time-consuming approval processes; Greater preference for drug therapies over nerve repair & regeneration products; and Product recalls

The market faces certain challenging elements that hinders its growth rate. The large gap of demand and supply of neurologists across the globe create a dearth of the trained professionals who are needed for neurological interventions. The donor nerves often suffer from tissue morbidity which is major concern. The nerve gaps exceeding 3 centimeters in length are difficult to treat using nerve conduits. The nerve repair & regeneration product such as neuromodulation and neurostimulation devices, depending on the application, fall under Class II or Class III medical devices and require premarket notification via the 510(k) process for their approval and launch in the US market. In past few years, it has been observed that the time required for FDA internal review and abbreviated 510(k) approvals has also increased which has posed challenge to the market players in the launching of their products. The limited awareness about the nerve repair & regeneration products has higher preference of drug therapies for the neurological disorders’ therapies. The numerous medical supply and consumable product recalls have been reported globally in recent years has also negatively impacted the market.

Neurostimulation and Neuromodulation Devices segment to dominate the nerve repair market

Based on product, the global market is segmented into neurostimulation and neuromodulation devices and biomaterials. The neurostimulation and neuromodulation devices segment is expected to dominate the during the forecast period. The large market share of this segment is driven mainly by rising government expenditure for neurologic disorders research studies, and the favorable policies of reimbursement.

Direct nerve repair/neurorrhaphy segment to dominate the biomaterials application for nerve repair market

Based on application, the nerve repair market is segmented into direct nerve repair/neurorrhaphy, nerve grafting, and stem cell therapy. In 2021, the direct nerve repair segment accounted for the largest share of the market, which is driven by the rising incidence of neurological disorders, worldwide.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest regional market for the nerve repair & regeneration in 2021

The nerve repair market has been analysed for North America, Europe, the Asia Pacific, and Rest of the World (Latin America and Middle East & Africa). In 2021, North America held the dominant share of the market, followed by Europe. The largest share of North America is attributed to the massive pool of geriatric population, favourable reimbursement policies, increasing incident rate of the neurological disorders, and the strong presence of leading industry players.

Prominent players in the nerve repair market include Medtronic, plc. (Ireland), Boston Scientific Corporation (US), and Abbott Laboratories (US).

Nerve Repair Market Scope

|

Report Metrics |

Details |

|

Market Size Value in 2022 |

USD 6.5 billion |

|

Revenue Forecast in 2027 |

USD 11.6 billion |

|

Growth Rate |

CAGR of 12.1% From 2022 to 2027 |

|

Forecast Year |

2022-2027 |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Table of Content |

|

|

Market Segmentation |

Product, Application, End User And Regional. |

|

Nerve Repair Market Growth Drivers |

High incidence of nerve injuries; Rising focus on neuromodulation & neurostimulation technologies |

|

Nerve Repair Market Growth Opportunities |

Emerging markets, Advances in stem cell therapy in nerve repair & regeneration |

|

Report Highlights |

|

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the Nerve Repair Market into the following segments and subsegments:

By Product

-

Neurostimulation and neuromodulation devices

-

Internal Neurostimulation Devices

- Spinal Cord Stimulation

- Deep Brain Stimulation

- Vagus Nerve Stimulation

- Sacral Nerve Stimulation

- Gastric Electrical Stimulation

-

External Neurostimulation Devices

- Transcutaneous Electrical Nerve Stimulation Devices

- Transcranial Magnetic Stimulation Devices

- Respiratory Electrical Stimulation Devices

-

Internal Neurostimulation Devices

-

Biomaterials

- Nerve conduits

- Nerve wraps

By Applications

-

NEUROSTIMULATION & NEUROMODULATION APPLICATIONS

- Internal neurostimulation and neuromodulation

- External neurostimulation and neuromodulation

-

NERVE REPAIR & REGENERATION BIOMATERIALS MARKET, BY APPLICATION

-

Direct Nerve Repair/Neurorrhaphy

- Epineural Repair

- Perineural Repair

- Group Fascicular Repair

-

Nerve Grafting

- Autografts

- Allografts

- Xenografts

- Stem cell therapy

-

Direct Nerve Repair/Neurorrhaphy

Recent Developments

- In 2022, Medtronic received FDA approval for its Intellis neurostimulator and the Vanta neurostimulator for the treatment of chronic pain associated with diabetic peripheral neuropathy (DPN).

- In 2022, Boston Scientific received FDA approval for its image-guided software, Vercise Neural Navigator with Stimview XT, for deep brain stimulation therapy in patients with Parkinson’s disease.

- In 2021, Abbott launched its NeuroSphere Virtual Clinic for the remote therapy and management of neuromodulation patients.

- In 2021, Neuronetics, Inc. has signed a partnership agreement with River Region Psychiatry Associates (RRPA), a leading provider of mental health services in the US. Under the agreement, Neuronetics would be the exclusive transcranial magnetic stimulation (TMS) equipment supplier to RRPA and its clinics.

- In 2021, Baxter acquired certain assets related to the PerClot Polysaccharide Hemostatic System (PerClot), including distribution rights for the US and specified territories outside of the US, from CryoLife.

- In 2020, Medtronic plc acquired Stimgenics, LLC, a privately-held US-based company. This acquisition would strengthen Medtronic’s portfolio of spinal cord stimulation systems of Medtronic.

Frequently Asked Questions (FAQ):

What is the size of Nerve Repair Market ?

The global nerve repair market size is projected to reach USD 11.6 billion by 2027 , growing at a CAGR of 12.1%.

What are the major growth factors of Nerve Repair Market ?

The growth in this market is driven by growing prevalence of neurological disorders, increasing geriatric population, high incidence of nerve injuries, and rising government support for neurologic disorders studies.

Who all are the prominent players of Nerve Repair Market ?

Prominent players in the nerve repair market include Medtronic, plc. (Ireland), Boston Scientific Corporation (US), and Abbott Laboratories (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 NERVE REPAIR MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES MADE

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

TABLE 3 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 NERVE REPAIR MARKET – REVENUE SHARE ANALYSIS ILLUSTRATION: MEDTRONIC PLC

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF NERVE REPAIR & REGENERATION PRODUCTS

FIGURE 6 CAGR PROJECTIONS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 4 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 9 NERVE REPAIR & REGENERATION MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 NERVE REPAIR MARKET OVERVIEW

4.2 NERVE REPAIR & REGENERATION MARKET, BY PRODUCT & COUNTRY (2021)

4.3 NERVE REPAIR MARKET, BY REGION (2022 VS. 2027)

FIGURE 19 NORTH AMERICA TO DOMINATE THE NERVE REPAIR & REGENERATION MARKET DURING THE FORECAST PERIOD

4.4 NERVE REPAIR MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 NERVE REPAIR MARKET DYNAMICS

FIGURE 21 NERVE REPAIR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High incidence of nerve injuries

5.2.1.2 Rising focus on neuromodulation & neurostimulation technologies

5.2.1.3 Rising geriatric population and the subsequent increase in the prevalence of neurological disorders

5.2.1.4 Rising government support for research on neurological disorders

FIGURE 22 FUNDING FOR RESEARCH BY THE NIH (US)

5.2.2 OPPORTUNITIES

5.2.2.1 Emerging markets

FIGURE 23 GROWTH IN CURRENT HEALTHCARE EXPENDITURE PER CAPITA, 2012–2019

5.2.2.2 Advances in stem cell therapy in nerve repair & regeneration

5.2.2.3 Growing research projects in neurology

FIGURE 24 RESEARCH PAPERS PUBLISHED (2011-2021)

TABLE 5 INDICATIVE LIST: NEUROMODULATION CLINICAL TRAILS

5.2.3 CHALLENGES

5.2.3.1 Donor-site morbidity

5.2.3.2 Difficulties in treating large nerve gaps

5.2.3.3 Stringent regulatory frameworks and time-consuming approval processes

5.2.3.4 Greater preference for drug therapies over nerve repair & regeneration products

5.2.3.5 Shortage of trained professionals

5.2.3.6 Product recalls

TABLE 6 MAJOR PRODUCT RECALLS

5.3 IMPACT OF COVID-19 ON THE NERVE REPAIR MARKET

FIGURE 25 REVENUE OF NEUROMODULATION SEGMENT BY THE TOP THREE PLAYERS, 2019-2021 (USD MILLION)

5.4 PRICING ANALYSIS

TABLE 7 AVERAGE SELLING PRICES OF NERVE WRAP AND NERVE CONDUIT

TABLE 8 AVERAGE SELLING PRICES OF NERVE WRAP OF KEY COMPANIES

TABLE 9 AVERAGE SELLING PRICES OF NERVE CONDUITS OF KEY COMPANIES

6 NERVE REPAIR MARKET, BY PRODUCT (Page No. - 70)

6.1 INTRODUCTION

TABLE 10 NERVE REPAIR MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 11 NERVE REPAIR MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

6.2 NEUROSTIMULATION AND NEUROMODULATION DEVICES

TABLE 12 NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 13 NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 14 NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 15 NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1 INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES

TABLE 16 INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 17 INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 18 INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1.1 Spinal cord stimulation devices

6.2.1.1.1 Increasing incidence of spinal cord injuries to support the growth of this segment

TABLE 20 SPINAL CORD STIMULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 SPINAL CORD STIMULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1.2 Deep brain stimulation devices

6.2.1.2.1 Rising incidence of neurodegenerative diseases among the senior population drives the growth of this segment

TABLE 22 DEEP BRAIN STIMULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 DEEP BRAIN STIMULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1.3 Vagus nerve stimulation devices

6.2.1.3.1 Increasing incidence of epilepsy to support the market growth for VNS devices

TABLE 24 VAGUS NERVE STIMULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 VAGUS NERVE STIMULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1.4 Sacral nerve stimulation devices

6.2.1.4.1 Increasing incidence of urological disorders to drive the growth of this segment

TABLE 26 SACRAL NERVE STIMULATION DEVICES OFFERED BY SOME MARKET PLAYERS

TABLE 27 SACRAL NERVE STIMULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 28 SACRAL NERVE STIMULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.1.5 Gastric electrical stimulation devices

6.2.1.5.1 GES is mainly used for the treatment of GERD and gastroparesis

TABLE 29 GASTRIC ELECTRICAL STIMULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 GASTRIC ELECTRICAL STIMULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2 EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES

TABLE 31 EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 32 EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 33 EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION BY REGION, 2018–2020 (USD MILLION)

TABLE 34 EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2.1 Transcutaneous electrical nerve stimulation devices

6.2.2.1.1 Extensive use in healthcare and low costs to support the growth of this segment

TABLE 35 TENS DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 36 TENS DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2.2 Transcranial Magnetic Stimulation Devices

6.2.2.2.1 Minimal patient discomfort associated with TMS to support the adoption of TMS devices

TABLE 37 TMS DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 38 TMS DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2.3 Respiratory Electric Stimulation Devices

6.2.2.3.1 Increasing incidence of spinal cord injuries to support the growth of this segment

TABLE 39 RES DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 RES DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 BIOMATERIALS

TABLE 41 BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 42 BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 43 BIOMATERIALS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 BIOMATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.1 NERVE CONDUITS

6.3.1.1 Increasing research in the field of nerve repair to support segment growth

TABLE 45 NERVE CONDUITS OFFERED BY SOME MARKET PLAYERS

TABLE 46 NERVE CONDUITS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 NERVE CONDUITS MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.2 NERVE WRAPS

6.3.2.1 Increasing incidence of peripheral injuries to drive the growth of this segment

TABLE 48 NERVE WRAPS OFFERED BY SOME MARKET PLAYERS

TABLE 49 NERVE WRAPS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 50 NERVE WRAPS MARKET, BY REGION, 2021–2027 (USD MILLION)

7 NERVE REPAIR MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

7.2 NEUROSTIMULATION & NEUROMODULATION

TABLE 51 NEUROSTIMULATION & NEUROMODULATION MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 52 NEUROSTIMULATION & NEUROMODULATION MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 53 NEUROSTIMULATION & NEUROMODULATION APPLICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 NEUROSTIMULATION & NEUROMODULATION APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

7.2.1 INTERNAL NEUROSTIMULATION & NEUROMODULATION

7.2.1.1 Minimally invasive nature and reversibility to support the growth of this segment

TABLE 55 INTERNAL NEUROSTIMULATION & NEUROMODULATION MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 INTERNAL NEUROSTIMULATION & NEUROMODULATION MARKET, BY REGION, 2021–2027 (USD MILLION)

7.2.2 EXTERNAL NEUROSTIMULATION & NEUROMODULATION

7.2.2.1 Rising cases of noninvasive procedures to ensure the growth of this segment

TABLE 57 EXTERNAL NEUROSTIMULATION & NEUROMODULATION MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 EXTERNAL NEUROSTIMULATION & NEUROMODULATION MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3 NERVE REPAIR & REGENERATION BIOMATERIALS

TABLE 59 NERVE REPAIR & REGENERATION BIOMATERIALS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 60 NERVE REPAIR & REGENERATION BIOMATERIALS MARKET, BY TYPE, 2021–2027 (USD MILLION)

7.3.1 DIRECT NERVE REPAIR/NEURORRHAPHY

TABLE 61 DIRECT NERVE REPAIR/NEURORRHAPHY MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 62 DIRECT NERVE REPAIR/NEURORRHAPHY MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 63 DIRECT NERVE REPAIR/NEURORRHAPHY MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 DIRECT NERVE REPAIR/NEURORRHAPHY MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.1.1 Epineural repair

7.3.1.1.1 Short operating times, ease, and minimal suturing requirements to drive the growth of this segment

TABLE 65 EPINEURAL REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 66 EPINEURAL REPAIR MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.1.2 Perineural repair

7.3.1.2.1 Perineural repair is a highly complex surgery, which has affected its prospects in this market

TABLE 67 PERINEURAL REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 PERINEURAL REPAIR MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.1.3 Group fascicular repair

7.3.1.3.1 Long procedural time to restrain the growth of this market

TABLE 69 GROUP FASCICULAR REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 GROUP FASCICULAR REPAIR MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.2 NERVE GRAFTING

TABLE 71 NERVE GRAFTING MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 72 NERVE GRAFTING MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 73 NERVE GRAFTING MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 NERVE GRAFTING MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.2.1 Autografts

7.3.2.1.1 Autografts are considered the gold standard for nerve gap treatment

TABLE 75 AUTOGRAFTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 76 AUTOGRAFTS MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.2.2 Allografts

7.3.2.2.1 Benefits of allografts over autograft usage to drive the growth of this segment

TABLE 77 ALLOGRAFTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 78 ALLOGRAFTS MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.2.3 Xenografts

7.3.2.3.1 Need for immunosuppression associated with xenograft use to restrain the growth of this segment

TABLE 79 XENOGRAFTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 80 XENOGRAFTS MARKET, BY REGION, 2021–2027 (USD MILLION)

7.3.3 STEM CELL THERAPY

7.3.3.1 The high future growth prospects counterbalance the low penetration of stem cell therapy

TABLE 81 STEM CELL THERAPY MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 82 STEM CELL THERAPY MARKET, BY REGION, 2021–2027 (USD MILLION)

8 NERVE REPAIR MARKET, BY REGION (Page No. - 102)

8.1 INTRODUCTION

TABLE 83 NERVE REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 84 NERVE REGENERATION MARKET, BY REGION, 2021–2027 (USD MILLION)

8.2 NORTH AMERICA

TABLE 85 NORTH AMERICA: NERVE REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: NERVE REPAIR & REGENERATION MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: NERVE REGENERATION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: NERVE REPAIR MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: BIOMATERIALS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: BIOMATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 102 NORTH AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: BIOMATERIALS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: BIOMATERIALS MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: BIOMATERIALS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 106 NORTH AMERICA: BIOMATERIALS MARKET, BY TYPE, 2021–2027 (USD MILLION)

8.2.1 US

8.2.1.1 The high prevalence of neurological disorders drives the demand for nerve repair & regeneration products in the US

TABLE 107 COMPANY PRODUCTS THAT RECEIVED FDA APPROVAL IN THE US

TABLE 108 US: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 109 US: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 110 US: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 111 US: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 112 US: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 113 US: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 114 US: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 115 US: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Rising health expenditure and increasing disease prevalence will drive market growth

TABLE 116 NEUROLOGICAL CONDITIONS IN CANADA

TABLE 117 CANADA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 118 CANADA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 119 CANADA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 120 CANADA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 121 CANADA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 122 CANADA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 123 CANADA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 124 CANADA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3 EUROPE

TABLE 125 EUROPE: NERVE REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 126 EUROPE: NERVE REPAIR MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 127 EUROPE: NERVE REPAIR & REGENERATION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 128 EUROPE: NERVE REGENERATION MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 129 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 130 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 131 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 132 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 133 EUROPE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 134 EUROPE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 135 EUROPE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 136 EUROPE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 137 EUROPE: BIOMATERIALS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 138 EUROPE: BIOMATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 139 EUROPE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 140 EUROPE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 141 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 142 EUROPE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 143 EUROPE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 144 EUROPE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 145 EUROPE: BIOMATERIALS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 146 EUROPE: BIOMATERIALS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Rising healthcare expenditure and favorable reimbursement policies to ensure strong market growth

TABLE 147 GERMANY: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 148 GERMANY: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 149 GERMANY: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 150 GERMANY: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 151 GERMANY: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 152 GERMANY: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 153 GERMANY: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 154 GERMANY: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Government initiatives to drive the growth of the nerve repair market in the UK

TABLE 155 PRODUCTS RECEIVED CE APPROVAL

TABLE 156 UK: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 157 UK: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 158 UK: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 159 UK: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 160 UK: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 161 UK: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 162 UK: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 163 UK: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Favorable healthcare reforms to support the market growth in France

TABLE 164 FRANCE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 165 FRANCE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 166 FRANCE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 167 FRANCE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 168 FRANCE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 169 FRANCE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 170 FRANCE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 171 FRANCE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Easy access to healthcare services has supported the demand for nerve repair & regeneration products in Italy

TABLE 172 ITALY: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 173 ITALY: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 174 ITALY: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 175 ITALY: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 176 ITALY: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 177 ITALY: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 178 ITALY: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 179 ITALY: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 The growing geriatric population and the subsequent increase in the incidence of neurological disorders drive the market growth

TABLE 180 SPAIN: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 181 SPAIN: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 182 SPAIN: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 183 SPAIN: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 184 SPAIN: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 185 SPAIN: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 186 SPAIN: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 187 SPAIN: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 188 PERCENTAGE OF POPULATION AGED 65 YEARS OR OVER, 2017 VS. 2050

TABLE 189 ROE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 190 ROE: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 191 ROE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 192 ROE: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 193 ROE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 194 ROE: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 195 ROE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 196 ROE: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.4 ASIA PACIFIC

TABLE 197 ASIA PACIFIC: NERVE REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 198 ASIA PACIFIC: NERVE REPAIR & REGENERATION MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 199 ASIA PACIFIC: NERVE REPAIR MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 200 ASIA PACIFIC: NERVE REGENERATION MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 201 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 202 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 203 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 204 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 205 ASIA PACIFIC: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 206 ASIA PACIFIC: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 207 ASIA PACIFIC: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 208 ASIA PACIFIC: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 209 ASIA PACIFIC: BIOMATERIALS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 210 ASIA PACIFIC: BIOMATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 211 ASIA PACIFIC: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 212 ASIA PACIFIC: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 213 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 214 ASIA PACIFIC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 215 ASIA PACIFIC: BIOMATERIALS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 216 ASIA PACIFIC: BIOMATERIALS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Japan dominates the Asia Pacific market for nerve repair & regeneration due to its high geriatric population

TABLE 217 JAPAN: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 218 JAPAN: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 219 JAPAN: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 220 JAPAN: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 221 JAPAN: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 222 JAPAN: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 223 JAPAN: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 224 JAPAN: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.4.2 CHINA

8.4.2.1 Rising healthcare expenditure and growing disease prevalence to ensure strong market growth

FIGURE 28 CHINA: CURRENT HEALTH EXPENDITURE PER CAPITA (CURRENT USD)

TABLE 225 CHINA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 226 CHINA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 227 CHINA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 228 CHINA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 229 CHINA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 230 CHINA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 231 CHINA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 232 CHINA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Changing government policies to have a positive impact on the market growth for nerve repair & regeneration

TABLE 233 INDIA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 234 INDIA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 235 INDIA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 236 INDIA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 237 INDIA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 238 INDIA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 239 INDIA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 240 INDIA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC (ROAPAC)

TABLE 241 ROAPAC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 242 ROAPAC: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 243 ROAPAC: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 244 ROAPAC: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 245 ROAPAC: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 246 ROAPAC: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 247 ROAPAC: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 248 ROAPAC: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.5 REST OF THE WORLD (ROW)

TABLE 249 ROW: NERVE REPAIR MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 250 ROW: NERVE REPAIR & REGENERATION MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 251 ROW: NERVE REPAIR MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 252 ROW: NERVE REGENERATION MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

TABLE 253 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 254 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 255 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 256 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 257 ROW: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 258 ROW: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 259 ROW: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 260 ROW: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 261 ROW: BIOMATERIALS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 262 ROW: BIOMATERIALS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 263 ROW: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 264 ROW: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

TABLE 265 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 266 ROW: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 267 ROW: BIOMATERIALS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 268 ROW: BIOMATERIALS MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.5.1 LATIN AMERICA

8.5.1.1 High incidence rate of Parkinson’s disease to support the market growth

FIGURE 29 POPULATION AGED 65 YEARS AND ABOVE (AS A PERCENTAGE OF THE TOTAL POPULATION), 2013-2018

TABLE 269 LATIN AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 270 LATIN AMERICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 271 LATIN AMERICA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 272 LATIN AMERICA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 273 LATIN AMERICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 274 LATIN AMERICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 275 LATIN AMERICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 276 LATIN AMERICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

8.5.2 MIDDLE EAST & AFRICA

8.5.2.1 Lack of health awareness and poor reimbursement policies to restrict the market growth

TABLE 277 MIDDLE EAST & AFRICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA:INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 280 MIDDLE EAST & AFRICA: INTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 281 MIDDLE EAST & AFRICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 282 MIDDLE EAST & AFRICA: EXTERNAL NEUROSTIMULATION AND NEUROMODULATION DEVICES MARKET, BY TYPE, 2021–2027 (USD MILLION)

TABLE 283 MIDDLE EAST & AFRICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 284 MIDDLE EAST & AFRICA: BIOMATERIALS MARKET, BY PRODUCT TYPE, 2021–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 176)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 285 OVERVIEW OF THE STRATEGIES ADOPTED BY KEY PLAYERS IN THE NERVE REPAIR MARKET (2018 TO 2022)

9.3 MARKET SHARE ANALYSIS, 2021

FIGURE 30 GLOBAL NERVE REGENERATION MARKET SHARE ANALYSIS, 2021

TABLE 286 GLOBAL MARKET: DEGREE OF COMPETITION

9.4 COMPANY EVALUATION QUADRANT (MAJOR PLAYERS)

9.4.1 STARS

9.4.2 PERVASIVE PLAYERS

9.4.3 EMERGING LEADERS

9.4.4 PARTICIPANTS

FIGURE 31 NERVE REPAIR MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

9.5 COMPANY EVALUATION QUADRANT (SMES/STARTUPS)

9.5.1 PROGRESSIVE COMPANIES

9.5.2 RESPONSIVE COMPANIES

9.5.3 STARTING BLOCKS

9.5.4 DYNAMIC COMPANIES

FIGURE 32 NERVE REPAIR MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

9.6 COMPETITIVE BENCHMARKING

9.6.1 COMPANY PRODUCT FOOTPRINT (27 COMPANIES)

9.6.2 COMPANY REGIONAL FOOTPRINT

9.6.3 COMPANY FOOTPRINT

9.7 COMPETITIVE SITUATION AND TRENDS

9.7.1 PRODUCT LAUNCHES AND APPROVALS

TABLE 287 PRODUCT LAUNCHES AND APPROVALS, 2018–2022

9.7.2 DEALS

TABLE 288 DEALS, 2018–2022

9.7.3 OTHER DEVELOPMENTS

TABLE 289 OTHER DEVELOPMENTS, 2018–2022

10 COMPANY PROFILES (Page No. - 188)

10.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM Views, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

10.1.1 MEDTRONIC, PLC.

TABLE 290 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 33 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

10.1.2 BOSTON SCIENTIFIC CORPORATION

TABLE 291 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 34 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2021)

10.1.3 ABBOTT LABORATORIES

TABLE 292 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 35 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2021)

10.1.4 AXOGEN CORPORATION.

TABLE 293 AXOGEN CORPORATION.: BUSINESS OVERVIEW

FIGURE 36 AXOGEN CORPORATION.: COMPANY SNAPSHOT (2021)

10.1.5 BAXTER

TABLE 294 BAXTER: BUSINESS OVERVIEW

FIGURE 37 BAXTER: COMPANY SNAPSHOT (2021)

10.1.6 LIVANOVA PLC

TABLE 295 LIVANOVA PLC: BUSINESS OVERVIEW

FIGURE 38 LIVANOVA PLC: COMPANY SNAPSHOT (2021)

10.1.7 INTEGRA LIFESCIENCES

TABLE 296 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 39 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2021)

10.1.8 NEURONETICS INC.

TABLE 297 NEURONETICS INC.: BUSINESS OVERVIEW

FIGURE 40 NEURONETICS INC.: COMPANY SNAPSHOT (2021)

10.1.9 NEVRO CORP.

TABLE 298 NEVRO CORP.: BUSINESS OVERVIEW

FIGURE 41 NEVRO CORP.: COMPANY SNAPSHOT (2021)

10.1.10 NEUROPACE INC.

TABLE 299 NEUROPACE INC.: BUSINESS OVERVIEW

FIGURE 42 NEUROPACE INC.: COMPANY SNAPSHOT (2021)

10.1.11 POLYGANICS

TABLE 300 POLYGANICS: BUSINESS OVERVIEW

10.1.12 SOTERIX MEDICAL INC.

TABLE 301 SOTERIX MEDICAL INC.: BUSINESS OVERVIEW

10.1.13 SYNAPSE BIOMEDICAL INC

TABLE 302 SYNAPSE BIOMEDICAL INC: BUSINESS OVERVIEW

10.1.14 ALEVA NEUROTHERAPEUTICS SA

TABLE 303 ALEVA NEUROTHERAPEUTICS: BUSINESS OVERVIEW

10.1.15 COLLAGEN MATRIX INC

TABLE 304 COLLAGEN MATRIX INC: BUSINESS OVERVIEW

10.1.16 KERIMEDICAL

TABLE 305 KERIMEDICAL: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 BIOWAVEGO USA

TABLE 306 BIOWAVEGO USA: COMPANY OVERVIEW

10.2.2 NEUROSIGMA, INC.

TABLE 307 NEUROSIGMA, INC.: COMPANY OVERVIEW

10.2.3 TVNS TECHNOLOGIES GMBH

TABLE 308 TVNS TECHNOLOGIES GMBH: COMPANY OVERVIEW

10.2.4 GIMER MEDICAL

TABLE 309 GIMER MEDICAL: COMPANY OVERVIEW

10.2.5 CHECKPOINT SURGICAL INC.

TABLE 310 CHECKPOINT SURGICAL INC.: COMPANY OVERVIEW

10.2.6 RENISHAW PLC.

TABLE 311 RENISHAW PLC.: COMPANY OVERVIEW

10.2.7 ALAFAIR BIOSCIENCES, INC.

TABLE 312 ALAFAIR BIOSCIENCES, INC.: COMPANY OVERVIEW

10.2.8 ELECTROCORE, INC.

TABLE 313 ELECTROCORE, INC.: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments, MNM Views, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 228)

11.1 INDUSTRY INSIGHTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the nerve repair & regeneration market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Then, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

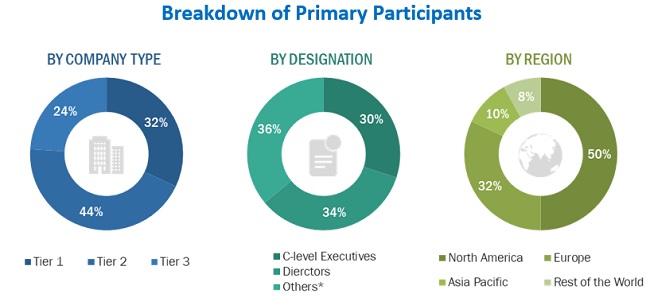

Several stakeholders, such as nerve repair and regeneration manufacturers, vendors, and distributors; researchers; and doctors from hospitals and ambulatory surgery centers, were consulted for this report. The demand side of this market is characterized by significant use of nerve repair and regeneration products due to the increasing prevalence of nerve injuries and neurological disorders and the growing aging population across the globe. The supply side is characterized by advancements in technology and a shift towards advanced devices. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Nerve Repair Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the nerve repair & regeneration market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the nerve repair & regeneration market.

Report Objectives

- To define, describe, segment, and forecast the nerve repair and regenerations market on the basis of products, application, and regions

- To provide detailed information about the factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and their core competencies2

- To track and analyze competitive developments such as partnerships, agreements, joint ventures, mergers and acquisitions, service development, and research and development (R&D) activities in the nerve repair & regeneration market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Over 24 companies profiled

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nerve Repair & Regeneration Market

What are the upcoming trends of the Nerve Repair and Regeneration Market in the world?

What are the factors driving the nerve repair and regeneration market?

Which is the largest regional market for Nerve Repair and Regeneration?