Automotive Occupant Sensing System (OSS) and Whiplash Protection System (WPS) Market for Passenger Cars & by Geography - Trends and Forecasts 2014 - 2019

[291 Pages Report] The major factors driving the demand of automotive occupant sensing system and whiplash protection system are stringent safety norms, increased safety awareness, technological advancement, affordability as well as institutions such as the New Car Assessment Program (NCAP) awarding safety ratings to cars based on safety performance.

In the coming years, the increasing demand for premium or luxury cars in the regions such as Europe and Asia Pacific, mainly in China, India and Japan, is expected to drive the market. Sustainable growth in the occupant sensing system and whiplash protection system market will largely depend upon upcoming legislations in various countries and growing global vehicle sales. Car makers are also focusing on the other passive safety systems like occupant sensing and whiplash protection to prevent whiplash in case of rear-end collisions.

The report classifies and defines the automotive occupant sensing system and whiplash protection system market in terms of volume and value. This report provides comprehensive analysis and insights on occupant sensing system and whiplash protection system market (both - qualitative and quantitative). The report highlights potential growth opportunities in the coming years as well as it covers review of the - market drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects w.r.t. automotive active safety systems market. The key players in the automotive occupant sensing system and whiplash protection system market have also been identified and profiled.

Scope of the Report

The report covers the market of automotive occupant sensing system and whiplash protection system in terms of volume and value. Market size in terms of volume is provided from 2011 to 2019 in thousand units, whereas the value of the market is provided in $millions. The automotive occupant sensing system and whiplash protection system market is broadly classified by geography (Asia-Pacific, Europe, North America and RoW), focusing on key countries in each region.

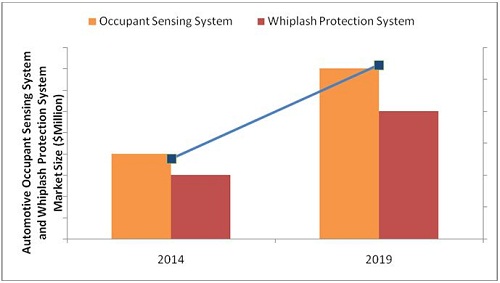

Source: MarketsandMarkets Analysis

The occupant sensing system market in terms of value is projected to grow $1.6 Billion and whiplash protection system market to grow $2.1 Billion by 2019 at a healthy CAGR of 14.3% and 13.8% respectively from 2014 to 2019.

Automotive safety systems have become advanced, sophisticated, and efficient over a period of time. Today, automotive industry is more inclined towards the use of advanced technologies to reduce number of accidents and mitigate the impact of accidents on occupants. Automotive safety systems have played an important role in achieving these targets, where these systems have made vehicles safer for the occupants. The recent rise in the attitude of the governments and consumers towards safety attributes of vehicles is one of the major drivers for the automotive safety system market.

Automotive passive safety systems have evolved from seatbelts and airbags to occupant sensing and other efficient automotive passive safety systems. These transitions took place due to several reasons; the increasing concern of consumers towards safety and their increasing willingness to pay for occupant safety, constantly updated rating system of organizations like New Car Assessment Program (NCAP) and highly competitive market made companies to do extensive R&D work.

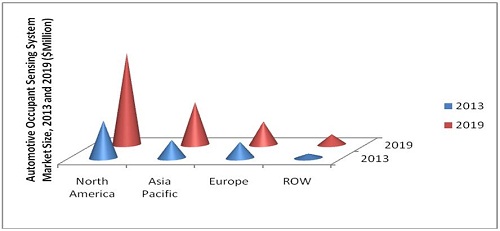

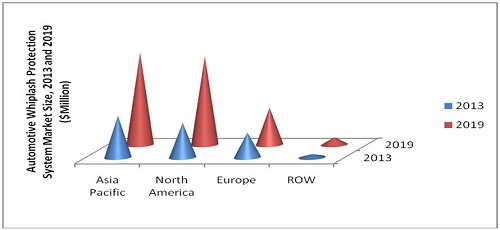

Automotive passive safety systems are growing at a significant rate in Asia-Pacific and the ROW regions because of the increase in their purchasing power, high standard of living, growing GDP rate, increase in governments regulatory actions for safety and growing vehicle sales. However, North America has the highest market share in the global occupant sensing market and Asia-Pacific has the highest market share in the global whiplash protection system market. Developing countries like India, China, Russia, Brazil, and Mexico are expected to have high growth rate in the demand for automotive occupant sensing system and whiplash protection system from 2014 to 2019.

The global automotive occupant sensing system and whiplash protection system market is dominated by a few top players such as Robert Bosch (Germany), Autoliv Inc. (Sweden), Continental AG (Germany), Takata Corporation (Japan), and Delphi Automotive PLC (U.K.).

Automotive Occupant Sensing System Market Size, by Region, 2013 VS 2019 ($Million)

Source: MarketsandMarkets Analysis

Automotive Whiplash Protection System Market Size, by Region, 2013 VS 2019 ($Million)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Slide No. - 31)

1.1 Introduction

1.2 Objectives & Value Proposition

1.3 Key Take-Aways

1.4 Scope

1.4.1 Scope of the Report, By Region

1.4.2 Product Type

1.4.3 Product Definitions

1.4.4 Stake Holders

2 Research Methodology (Slide No. - 41)

2.1 Occupant Sensing System & Whiplash Protection System Market Research Methodology

2.2 Market Size Estimation

2.2.1 Key Data Taken From Secondary Sources

2.2.2 Key Data Taken From Primary Sources

2.2.2.1 Key Industry Insight

2.2.2.2 Break Down of Primary Interviews: By Company Type, Designation & Region

2.3 Assumptions

3 Executive Summary (Slide No. - 51)

3.1 Automotive Occupant Sensing System & Whiplash Protection System Market Outlook

3.2 Automotive Occupant Sensing System Market, By Region, 20112019

3.3 Occupant Sensing System Market (Value), By Country, 20142019 (CAGR%)

3.4 Occupant Sensing System Market Size (Value), By Country, 20142019

3.5 Automotive Whiplash Protection System Market, By Region, 20112019

3.6 Whiplash Protection System Market (Value), By Country, 20142019 (CAGR%)

3.7 Whiplash Protection System Market Size (Value), By Country, 20142019

4 Market Overview (Slide No. - 60)

4.1 Market Drivers

4.2 Market Restraints

4.3 Market Challenges

4.4 Growth Indicators Legislation Applicable for Occupant Sensing System

4.5 Growth Indicators- Growing Automobile Collision Rate, 2008 Vs. 2012

4.6 Value Chain Analysis

4.7 Legislation Analysis

4.7.1 North America: Collision Trend Analysis, 2005-2012

4.7.2 Europe: Collision Trend Analysis, 2005-2012

4.7.3 Asia-Pacific: Collision Trend Analysis, 2005-2012

4.7.4 ROW: Collision Trend Analysis, 2005-2012

4.8 Market Metrics: Economic Growth in Terms of GDP - Europe

4.9 Market Metrics: Economic Growth in Terms of GDP North America

4.10 Market Metrics: Economic Growth in Terms of GDP Asia-Pacific

4.11 Market Metrics: Economic Growth in Terms of GDP ROW

5 Technological Evolution (Slide No. - 78)

5.1 Technology Roadmap: Whiplash Protection System

6 Occupant Sensing System Market (20112019) (Slide No. - 81)

6.1 Occupant Sensing System Market Share, By Country, 2013

6.2 Occupant Sensing System Market Share (Value), By Region, 2013

6.3 Occupant Sensing System Market Size, By Region, 20112019 ($Million)

6.4 North America : Occupant Sensing System Market Size, 20112019 (Thousand Units)

6.5 North America : Occupant Sensing System Market Size, 20112019 ($Million)

6.5.1 U.S. : Occupant Sensing System Market Size, 20112019 ($Million & Million Units)

6.5.2 Canada: Occupant Sensing System Market Size, 20112019 ($Million &Thousand Units)

6.5.3 Mexico: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.6 Europe : Occupant Sensing System Market Size, 20112019 (Thousand Units)

6.7 Europe: Occupant Sensing System Market Size, 20112019 ($Million)

6.7.1 Germany: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.7.2 France: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.7.3 U.K. : Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.7.4 Spain: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.7.5 Italy: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.8 Asia-Pacific: Occupant Sensing System Market Size, 20112019 (Thousand Units)

6.9 Asia-Pacific: Occupant Sensing System Market Size, 20112019 ($Million)

6.9.1 Australia: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.9.2 Japan: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.9.3 South Korea: Occupant Sensing System Market Size, 20112019 ($Mllion & Thousand Units)

6.9.4 India: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.9.5 Thailand: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.9.6 China: Occupant Sensing System Market Size, 20112019 ($Million & Million Units)

6.10 ROW: Occupant Sensing System Market Size, 20112019 (Thousand Units)

6.11 ROW: Occupant Sensing System Market Size, 20112019 ($Million)

6.11.1 Brazil: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.11.2 Russia: Occupant Sensing System Market Size, 20112019 ($Million & Thousand Units)

6.11.3 South Africa: Occupant Sensing System Market Size, 20112019 ($Million and Thousand Units)

7 Whiplash Protection System Market(20112019) (Slide No. - 110)

7.1 Whiplash Protection System Market Share, By Country, 2013

7.2 Whiplash Protection System Market Share (Value), 2013, By Region

7.3 Whiplash Protection System Market Size, By Region, 20112019 ($Million)

7.4 North America: Whiplash Protection System Market Size, 20112019 (Thousand Units)

7.5 North America: Whiplash Protection System Market Size, 20112019 ($Million)

7.5.1 U.S.: Whiplash Protection System Market Size, 20112019 ($Million & Million Units)

7.5.2 Canada: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.5.3 Mexico: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.6 Europe: Whiplash Protection System Market Size, 20112019 (Thousand Units)

7.7 Europe: Whiplash Protection System Market Size, 20112019 ($Million)

7.7.1 Germany: Whiplash Protection System Market Size, 20112019 ($Million & Million Units)

7.7.2 France: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.7.3 U.K.: Whiplash Protection System Market Size, 20112019 ($Million & Million Units)

7.7.4 Spain: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.7.5 Italy: Whiplash Protection System Market Size, 20112019 ($Million and Million Units)

7.8 Asia-Pacific: Whiplash Protection System Market Size, By Country, 20112019 (Thousand Units)

7.9 Asia-Pacific: Whiplash Protection System Market Size, By Country, 20112019 ($Million)

7.9.1 Australia: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.9.2 Japan: Whiplash Protection System Market Size, 20112019 ($Million & Million Units)

7.9.3 South Korea : Whiplash Protection System Market Size, 20112019 ($Mllion & Thousand Units)

7.9.4 India: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.9.5 Thailand: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.9.6 China: Whiplash Protection System Market Size, 20112019 ($Million & Million Units)

7.10 ROW: Whiplash Protection System Market Size, By Country, 20112019 (Thousand Units)

7.11 ROW: Whiplash Protection System Market Size, By Country, 20112019 ($Million)

7.11.1 Brazil: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.11.2 Russia: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

7.11.3 South Africa: Whiplash Protection System Market Size, 20112019 ($Million & Thousand Units)

8 Opportunity & Installation Trend Analysis (Slide No. - 139)

8.1 Introduction

8.2 Occupant Sensing System & Whiplash Protection System: Installation Trend Analysis for North America

8.3 Occupant Sensing System & Whiplash Protection System: Installation Trend Analysis for Europe

8.4 Occupant Sensing System & Whiplash Protection System: Installation Trend Analysis for Asia-Pacific

8.5 Occupant Sensing System & Whiplash Protection System: Installation Trend Analysis for Rest of the World

8.5.1 Opportunity Analysis for U.S.

8.5.2 Opportunity Analysis for Canada

8.5.3 Opportunity Analysis for Mexico

8.5.4 Opportunity Analysis for Germany

8.5.5 Opportunity Analysis for France

8.5.6 Opportunity Analysis for U.K.

8.5.7 Opportunity Analysis for Spain

8.5.8 Opportunity Analysis for Italy

8.5.9 Opportunity Analysis for China

8.5.10 Opportunity Analysis for Japan

8.5.11 Opportunity Analysis for India

8.5.12 Opportunity Analysis for Australia

8.5.13 Opportunity Analysis for South Korea

8.5.14 Opportunity Analysis for Thailand

8.5.15 Opportunity Analysis for ROW

8.6 Product Life Cycle Analysis, Occupant Sensing System & Whiplash Protection System, By Region

8.7 Global: Pestel Analysis

8.7.1 North America : Pestel Analysis

8.7.2 Europe: Pestel Analysis

8.7.3 Asia-Pacific: Pestel Analysis

8.7.4 ROW: Pestel Analysis

9 Competitive Landscape (Slide No. - 166)

9.1 Introduction

9.1.1 Key Findings

9.2 Key Growth Strategies

10 Company Profiles (Slide No. - 171)

10.1 Introduction

10.2 Autoliv, Inc.

10.2.1 Company Overview

10.2.2 Financials

10.2.3 Products offered

10.2.4 Recent Developments

10.2.5 Strategy

10.2.6 Strengths

10.2.7 Weakness

10.2.8 Opportunities

10.2.9 Threats

10.3 Robert Bosch GMBH

10.3.1 Company Overview

10.3.2 Financials

10.3.3 Products offered

10.3.4 Recent Developments

10.3.5 Strategy

10.3.6 Strengths

10.3.7 Weaknesses

10.3.8 Opportunities

10.3.9 Threats

10.4 Continental AG

10.4.1 Company Overview

10.4.2 Financials

10.4.3 Products offered

10.4.4 Recent Developments

10.4.5 Strategy

10.4.6 Strengths

10.4.7 Weaknesses

10.4.8 Opportunities

10.4.9 Threats

10.5 Delphi Automotive PLC

10.5.1 Company Overview

10.5.2 Financials

10.5.3 Products offered

10.5.4 Recent Developments

10.5.5 Strategy

10.5.6 Strengths

10.5.7 Weaknesses

10.5.8 Opportunities

10.5.9 Threats

10.6 Takata Corporation

10.6.1 Company Overview

10.6.2 Financials

10.6.3 Products offered

10.6.4 Recent Developments

10.6.5 Strategy

10.6.6 Strengths

10.6.7 Weaknesses

10.6.8 Opportunities

10.6.9 Threats

10.7 TRW Automotive

10.7.1 Company Overview

10.7.2 Financials

10.7.3 Products offered

10.7.4 Recent Developments

10.7.5 Strategy

10.7.6 Strengths

10.7.7 Weaknesses

10.7.8 Opportunities

10.7.9 Threats

10.8 Hyundai Mobis Co., Ltd.

10.8.1 Company Overview

10.8.2 Financials

10.8.3 Products offered

10.8.4 Developments

10.8.5 Strategy

10.8.6 Strengths

10.8.7 Weaknesses

10.8.8 Opportunities

10.8.9 Threats

10.9 Key Safety Systems Inc.

10.9.1 Company Overview

10.9.2 Products offered

10.9.3 Developments

10.9.4 Strategy

10.9.5 Strengths

10.9.6 Weaknesses

10.9.7 Opportunities

10.9.8 Threats

10.10 Grammer AG

10.10.1 Company Overview

10.10.2 Financials

10.10.3 Products offered

10.10.4 Developments

10.10.5 Strategy

10.10.6 Strengths

10.10.7 Weaknesses

10.10.8 Opportunities

10.10.9 Threats

10.11 Lear Corporation

10.11.1 Company Overview

10.11.2 Financials

10.11.3 Products offered

10.11.4 Developments

10.11.5 Strategy

10.11.6 Strengths

10.11.7 Weaknesses

10.11.8 Opportunities

10.11.9 Threats

11 Appendix (Slide No. - 288)

List of Tables (71 Tables)

Table 1 Global Market Size of Occupant Sensing System in Terms of Value, 2011-2019

Table 2 North America: Market Size of Occupant Sensing System in Terms of Volume, 2011-2019

Table 3 North America: Market Size of Occupant Sensing System in Terms of Value, 2011-2019

Table 4 U.S. : Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 5 Canada: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 6 Mexico: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 7 Europe: Market Size of Occupant Sensing System in Terms of Volume, 2011-2019

Table 8 Europe: Market Size of Occupant Sensing System in Terms of Value, 2011-2019

Table 9 Germany: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 10 France: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 11 U.K. : Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 12 Spain: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 13 Italy: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 14 Asia Pacific: Market Size of Occupant Sensing System in Terms of Volume, 2011-2019

Table 15 Asia Pacific: Market Size of Occupant Sensing System in Terms of Value, 2011-2019

Table 16 Australia: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 17 Japan: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 18 South Korea: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 19 India: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 20 Thailand: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 21 China: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 22 Rest of the World: Market Size of Occupant Sensing System in Terms of Volume, 2011-2019

Table 23 Rest of the World: Market Size of Occupant Sensing System in Terms of Value, 2011-2019

Table 24 Brazil: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 25 Russia: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 26 South Africa: Market Size of Occupant Sensing System in Terms of Value and Volume, 2011-2019

Table 27 Global Market Size of Whiplash Protection System in Terms of Value, 2011-2019

Table 28 North America: Market Size of Whiplash Protection System in Terms of Volume, 2011-2019

Table 29 North America: Market Size of Whiplash Protection System in Terms of Value, 2011-2019

Table 30 U.S. : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 31 Canada : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 32 Mexico : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 33 Europe : Market Size of Whiplash Protection System in Terms of Volume, 2011-2019

Table 34 Europe : Market Size of Whiplash Protection System in Terms of Value, 2011-2019

Table 35 Germany : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 36 France : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 37 U.K. : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 38 Spain : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 39 Italy: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 40 Asia-Pacific : Market Size of Whiplash Protection System in Terms of Volume, 2011-2019

Table 41 Asia-Pacific : Market Size of Whiplash Protection System in Terms of Value, 2011-2019

Table 42 Australia : Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 43 Japan: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 44 South Korea: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 45 India: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 46 Thailand: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 47 China: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 48 Rest of the World: Market Size of Whiplash Protection System in Terms of Volume, 2011-2019

Table 49 Rest of the World: Market Size of Whiplash Protection System in Terms of Value, 2011-2019

Table 50 Brazil: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 51 Russia: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 52 South Africa: Market Size of Whiplash Protection System in Terms of Value and Volume, 2011-2019

Table 53 Pestel Analysis for Occupant Sensing System and Whiplash Protection System Market

Table 54 Autoliv, Inc.: Total Revenue, By Segment, 20122013 ($Million)

Table 55 Autoliv, Inc.: Total Revenue, By Geography, 20122013 ($Million)

Table 56 Robert Bosch GMBH: Total Revenue, By Segment, 20112012 ($Million)

Table 57 Robert Bosch GMBH: Total Revenue, By Geography, 20112012 ($Million)

Table 58 Continental AG: Total Revenue, By Segment, 20122013 ($Million)

Table 59 Continental AG: Chassis and Safety Division Total Revenue, By Geography, 20122013 ($Million)

Table 60 Delphi Automotive PLC: Total Revenue, By Segment, 20122013 ($Million)

Table 61 Delphi Automotive PLC: Total Revenue, By Geography, 20122013 ($Million)

Table 62 Takata Corporation: Total Revenue, By Segment, 20122013 ($Million)

Table 63 Takata Corporation: Total Revenue, By Geography, 20122013 ($Million)

Table 64 TRW Automotive: Total Revenue, By Segment, 20122013 ($Million)

Table 65 TRW Automotive: Total Revenue, By Region, 2012-2013 ($Million)

Table 66 Hyubdaimobis Co., Ltd.: Total Revenue, By Segment, 20122013 ($Million)

Table 67 Hyubdaimobis Co., Ltd.: Total Revenue, By Region, 20122013 ($Million)

Table 68 Grammer AG: Total Revenue, By Segment, 20122013 ($Million)

Table 69 Grammer AG: Total Revenue, By Region, 20122013 ($Million)

Table 70 Lear Corporation: Total Revenue, By Segment, 20122013 ($Million)

Table 71 Lear Corporation: Total Revenue, By Region, 20122013 ($Million)

List of Figures (50 Figures)

Figure 1 Primary Interviews

Figure 2 Global Market Size of Occupant Sensing System and Whiplash Protection System in Terms of Value

Figure 3 Prominent Countries in the Occupant Sensing System and Whiplash Protection System Markets for Passenger Cars, 2013

Figure 4 Global Market Size of Occupant Sensing System in Terms of Value

Figure 5 Global Market Size of Whiplash Protection System in Terms of Value

Figure 6 Legislation Applicable for Occupant Sensing and Whiplash Protection System

Figure 7 Value Chain Analysis for Occupant Sensing System and Whiplash Protection System

Figure 8 Economic Growth in Terms of GDP in Europe

Figure 9 Economic Growth in Terms of GDP in North America

Figure 10 Economic Growth in Terms of GDP in Asia Pacific

Figure 11 Economic Growth in Terms of GDP in ROW

Figure 12 Technology Road Map for Whiplash Protection System

Figure 13 Global Market Share of Occupant Sensing System in Terms of Value, 2013

Figure 14 Global Market Share of Occupant Sensing System in Terms of Value, 2013

Figure 15 Global Market Share of Whiplash Protection System in Terms of Value, 2013

Figure 16 Global Market Share of Whiplash Protection in Terms of Value, 2013

Figure 17 U.S. : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 18 Canada. : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 19 Mexico : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 20 Germany : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 21 France : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 22 U.K. : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 23 Spain : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 24 Italy : Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 25 China: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 26 Japan: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 27 India: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 28 Australia: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 29 South Korea: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 30 Thailand: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 31 ROW: Opportunity Analysis for Occupant Sensing System and Whiplash Protection System Markets

Figure 32 Product Life Cycle Analysis for Occupant Sensing System and Whiplash Protection System

Figure 33 North America: Pestel Analysis for Occupant Sensing System and Whiplash Protection System Market

Figure 34 Europe: Pestel Analysis for Occupant Sensing System and Whiplash Protection System Market

Figure 35 Asia-Pacific: Pestel Analysis for Occupant Sensing System and Whiplash Protection System Market

Figure 36 Rest of the World: Pestel Analysis for Occupant Sensing System and Whiplash Protection System Market

Figure 37 Key Growth Strategies

Figure 38 Key Growth Strategies Share, 20112014

Figure 39 Percentage Share of Prominent Players in the Overall Developments, 20112014

Figure 40 Geographic Revenue Mix for Key Players

Figure 41 SWOT Analysis for Autoliv, Inc.

Figure 42 SWOT Analysis for Robert Bosch GMBH

Figure 43 SWOT Analysis for Continental AG

Figure 44 SWOT Analysis for Delphi Automotive PLC

Figure 45 SWOT Analysis for Takata Corporation

Figure 46 SWOT Analysis for TRW Automotive

Figure 47 SWOT Analysis for Hyubdaimobis Co., Ltd.

Figure 48 SWOT Analysis for Key Safety Systems Inc.

Figure 49 SWOT Analysis for Grammer AG

Figure 50 SWOT Analysis for Lear Corporation

Growth opportunities and latent adjacency in Automotive Occupant Sensing System (OSS) and Whiplash Protection System (WPS) Market