Outdoor LED Lighting Market by Installation (New, Retrofit), Offering, Sales Channel, Communication, Wattage (Below 50W, 50-150W, Above 150W), Application (Streets and Roads, Architecture, Sports, Tunnels) and Geography - Global Forecast to 2027

Updated on : April 17, 2025

Outdoor LED Lighting Market is experiencing robust growth, driven by rising demand for energy-efficient and environmentally friendly lighting solutions. As municipalities and businesses seek to reduce energy costs and carbon footprints, LED technology has become the preferred choice for streetlights, parking lots, and outdoor public spaces. Key trends influencing this market include the integration of smart lighting systems, which offer enhanced control and automation through IoT connectivity, as well as advancements in solar-powered LED fixtures. The increasing focus on sustainability and government initiatives promoting green infrastructure are further propelling market expansion. Looking towards the future, the Outdoor LED Lighting Market is expected to continue its upward trajectory, with innovations in design and functionality enhancing user experience while contributing to safer, more sustainable urban environments.

Outdoor LED Lighting Market Size & Growth

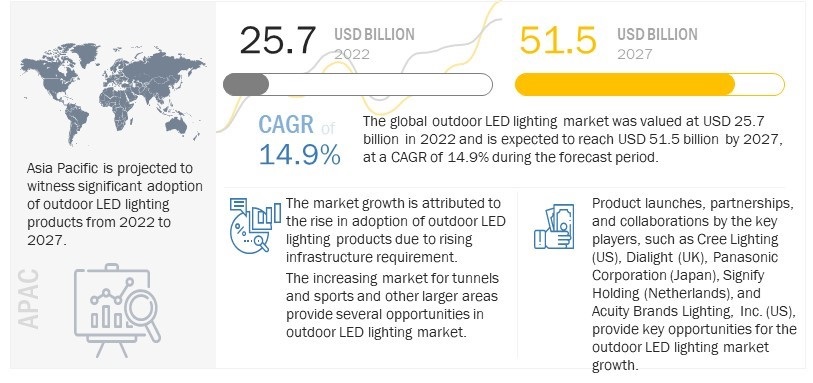

The global outdoor LED lighting market size is estimated to be USD 25.7 billion in 2022 and is projected to reach USD 51.5 billion by 2027, growing at a CAGR of 14.9% from 2022 to 2027

Some of the major factors contributing to the high demand for outdoor LED lighting market include the increasing need for highly energy-efficient lighting systems with low maintenance costs, the increasing number of construction and infrastructure projects, the rising demand for energy-efficient lighting systems, modernization, and development of infrastructure such as smart cities. These factors lead to the implementation of lighting systems based on IoT, reduction in prices of LEDs, and increasing penetration of LEDs as a light source in outdoor lighting applications such as architecture, highways and roadways, and public places.

Outdoor LED Lighting Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Outdoor LED Lighting Market Dynamics :

Driver : High demand for LED lighting

The application area of LED lighting extends to warehouses, residential and commercial facilities, government buildings, and other areas. Electricity is mainly used for lighting streets and public spaces, cities, towns, and villages worldwide. A paradigm shift from traditional lighting systems to connected LED technology is the key to energy and cost effectiveness in all lighting applications. LED bulbs are well known for their energy efficiency and have the additional benefit of a long life span, which reduces maintenance and replacement costs. Government officials in cities across US are focused on the latest innovations in lighting as they treat it as more than an illuminating tool. Smart lights can communicate wirelessly with various networks, collecting various types of data such as nearby foot traffic and even helping to reduce crime rates, which cannot be achieved using traditional lightbulbs. The LED lighting system is gaining traction from emerging countries as it forms part of their economic modernization plan.

Restraint : Development of laser lights as alternative technologies

The development of alternative lighting technologies, such as laser lights, can be viewed as a restraint for the outdoor LED lighting industry . Laser lights have been proven more efficient than LEDs and are almost equally cost-effective in manufacturing. Applications of laser lights in entertainment displays and architectural lighting are already becoming popular, which can lead to the stagnating growth of LED lighting in architectural applications.

Opportunity : Development of wireless technology for LED street lighting systems

LED lighting, which initially started with wired technologies, has entered the era of wireless technologies. The introduction of wireless technologies has boosted the market for retrofit lighting systems, leading to the growth of the outdoor LED lighting market. Wireless technologies have reduced the use of wires and avoided the reconstruction of existing buildings, thereby creating flexibility for end users.

In recent years, developments have been taking place toward integrating wired and wireless technologies. BACnet has added wireless networking options by adding the ZigBee profile to the LED lighting system. ZigBee is a wireless technology designed to address the requirements of the low-cost, low-power wireless sensors and control networks in the LED lighting system. This integration between BACnet and ZigBee would create an efficient and connected LED lighting system. The other wireless communication technologies used in LED lighting systems are EnOcean, Z-Wave, and Wi-Fi. These wireless networks offer one of the biggest opportunities in connected outdoor lighting, especially in the areas of the retrofit segment.

Challenge: Rapid rise in product testing costs

The rapid rise in product testing costs has become a major concern for manufacturers with the increasing number of products and product variations entering the market. Although per-product testing plays a crucial role in early product quality and buyers’ confidence in LED technology, it hinders product line expansion. Testing costs need to be decreased to meet the needs of the lighting market to allow faster and more efficient LED product line development.

Hardware segment to dominate outdoor LED lighting market between 2022 and 2027

The hardware segment led the global outdoor LED lighting market in 2021 and is expected to continue its dominance by 2027 due to the increasing deployment of lamps, luminaires, and control systems in numerous outdoor applications, such as streets and roads, public places, sports complexes, and large areas. The luminaire hardware segment is expected to provide a lucrative opportunity during the forecast period. New installations of outdoor LED lighting would generate increasing demand for luminaires, leading to its high growth. The control system hardware segment is likely to register the fastest growth by 2027 due to the increasing deployment of lighting fixtures with IoT devices for lighting control for outdoor applications, including public places lighting and architecture.

Sports and large areas segment to witness highest growth rate during forecast period

The sports and large areas segment under the application segment would witness the highest growth rate, with the increasing encouragement toward sports and recreational activities across the globe. The number of developments in terms of infrastructure related to sports stadiums or large areas or grounds is expected to increase in the coming years. The replacement of existing conventional light sources with new energy-efficient LED lighting systems in existing sports complexes and sports arena parking lots is expected to propel the growth of this segment by 2027.

50-150W range of wattage type segment to dominate market during forecast period

50-150W type segment accounted for ~55% of the overall outdoor LED lighting market in 2021. This higher market share is mainly due to the increased usage and demand of 50-150W type LED lighting products in a large number of outdoor applications. LED lights and luminaires of wattage type with a capacity range of 50–150 W are widely used across highway and roadway applications. This ultimately boosts the adoption of outdoor LED lighting of the said range during the forecast period.

Retail/wholesale segment to hold largest market share by 2027

The retail/wholesale segment is likely to dominate in market size between 2022 and 2027 as it is the most preferred buying choice among consumers. The presence of large retail and wholesale distribution channels of leading players offering LED lighting products in different parts of the world is among the major factors driving the market growth. Key market players offering outdoor LED lighting products are associated with major retailers and local distributors in different parts of the world, leading to higher sales through this channel.

New installations accounted for larger market share

The new installation segment is expected to account for the largest market share between 2022 and 2027, owing to the surging demand for energy-efficient and easy-to-install lighting systems in new construction and infrastructure projects. With the increase in the number of commercial infrastructure and roadways, the demand for new installations would increase. The new installation replaces a traditional lighting system after fully phasing out the lamp and its assorted controls and fixtures with the LED lamp and associated controls and fixtures.

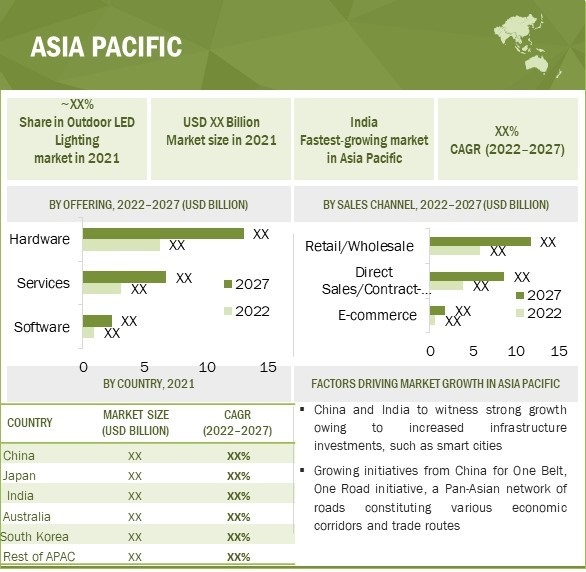

Asia Pacific to be largest and fastest-growing market during forecast period

Outdoor LED Lighting Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is expected to be the fastest-growing region in the outdoor LED lighting market during the forecast period. LEDs have a huge potential in the region due to the increasing acceptance of LED lighting among local municipalities in emerging economies as an integral part of smart city and public infrastructure development projects.

China is expected to lead the outdoor LED lighting market in Asia Pacific owing to the increasing government expenditure on public infrastructure and constant commercial and industrial building construction growth. The country has expertise in manufacturing lighting equipment and adopts technologies faster than other nations in the region. The country plans to invest heavily in renewable energy resources, which is anticipated to boost the need for LED lighting. The growing demand for LED-based lamps and luminaires in outdoor applications such as roads and streets, tunnels, and architectural and urban landscapes is further expected to propel the outdoor LED lighting market growth in the Asia Pacific region.

Key Market Players in Outdoor LED Lighting Market

The Outdoor LED lighting companies such as Signify Holding (Netherlands), Acuity Brands (US), Cree Lighting (US), Dialight (UK), and Panasonic Corporation (Japan) .

Outdoor LED Lighting Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 25.7 Billion |

| Revenue Forecast in 2027 | USD 51.5 Billion |

| Growth Rate | 14.9% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Billion) and Volume (Million Units) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Key Market Driver | High demand for LED lighting |

| Key Market Opportunity |

Development of wireless technology for LED street lighting systems |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Sports and large areas segment |

Outdoor LED Lighting Market Highlights

This research report categorizes the outdoor LED Lighting market by offering, installation, sales channel, application, wattage type, interfacing standard, communication, and geography

|

Aspect |

Details |

|

Based on Offering: |

|

|

Based on Application: |

|

|

Based on Installation: |

|

|

Based on Sales Channel : |

|

|

Based on Wattage Type: |

|

|

Based on Communication: |

|

|

Based on Interfacing Standard: |

|

|

Based on Region: |

|

Recent Developments in Outdoor LED Lighting Industry

- In May 2022, Signify completed the acquisition of Fluence from ams OSRAM (SIX: AMS).

- In March 2022, ams OSRAM (SIX: AMS) agreed to sell its independent and dedicated AMLS (Automotive Lighting Systems GmbH) business to Plastic Omnium (Euronext:

- In March 2022, Acuity Brands, Inc. (NYSE: AYI) launched Verjure, a professional-grade horticulture LED lighting solution that offers efficacious and consistent performance for indoor horticulture applications.

- In Nov 2021, Eureka, a brand of Acuity Brands, an established leader in decorative lighting solutions, announced the release of its Billie large-scale architectural luminaire.

- In July 2021, Signify (Euronext: LIGHT) acquired Telensa Holdings Ltd, a UK-based expert in smart city wireless monitoring and control systems.

- In April 2021, Acuity Brands, Inc. (NYSE: AYI) (Acuity), a leading industrial technology company, announced its definitive agreement to purchase ams OSRAM’s North American Digital Systems (DS) business

- In May 2021, Luminis, an Acuity brand, introduced decorative shrouds and a 180-degree shield as options for its Lumistik family of luminaires.

- In March 2020, Signify (Euronext: LIGHT) upgraded its portfolio of compact Philips Xitanium Sensor Ready Xtreme LED drivers for outdoor applications with the recently granted D4i certification.

Frequently Asked Questions (FAQ):

Who are the key players in the outdoor LED lighting market? What are the major growth strategies they have taken to strengthen their position in the market?

Major companies operating in the outdoor LED lighting market are Signify Holding (Netherlands), Acuity Brands (US), Cree Lighting (US), Dialight (UK), and Panasonic Corporation (Japan. Product launches and developments, acquisitions, collaborations, and agreements were among the major strategies adopted by these players to compete in the market.

What are the new opportunities for emerging players in the outdoor LED lighting market?

Newer infrastructure development, such as tunnels, stadiums, highways, etc., are expected to offer substantial opportunities to outdoor LED lighting manufacturers during the forecast period. The easy availability of LED lights with various color combinations in attractive shapes and sizes, coupled with the growing use of highly energy-efficient products to reduce energy bills, is the major factor propelling the growth of the market.

Which applications of outdoor LED Lighting are expected to drive the growth of the market in the next 5 years?

Streets and roads, architectural buildings, sports complexes, and tunnels are expected to grow at a higher rate during the forecast period. LED lights are ideal for outdoor applications as they are brighter white than traditional halide street lamps, helping better illuminate streets, sidewalks, parking lots, etc. LEDs, depending on their usage. They can last up to 50,000 hours, which is nearly 25 years. LEDs offer more lumens per watt, which means fewer burnt-out of streetlights. Streets and roadways are continuously illuminated. Hence, there is a high requirement for energy. Therefore, switching to LED lighting is a better choice. Streets and roadways are expected to provide lucrative opportunities to outdoor LED lighting market players.

What new technology in the outdoor LED lighting market offers higher growth potential?

Outdoor LED lighting technology is increasingly adopted because of the growing need for energy conservation and modern décor. LED-based human-centric lighting is controllable and tunable across a spectrum of correlated color temperatures (CCTs) and can positively impact outdoor environments. Such lighting can stimulate particular biological responses as it is based on circadian rhythm. IoT smart lighting uses wireless switches, eliminating the need to wire light switches directly to fixtures. With the evolution of IoT, a range of devices and sensors can now communicate wirelessly over the Internet. Smart devices integrated for lighting control are bound to become more self-governing and intelligent in sharing data with building automation systems and, ultimately, the cloud. Those bulbs are then connected to a network, monitored, and controlled from the cloud. The user can manage individual lights or groups of lights via the web or a mobile app based on occupancy.

Which region is expected to offer lucrative growth for the outdoor LED lighting market by 2027?

Asia Pacific is likely to lead the outdoor LED lighting market during the forecast period. The region is also expected to witness the highest CAGR during the forecast period. Europe is expected to witness the second-highest growth rate between 2022 to 2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 OUTDOOR LED LIGHTING MARKET: MARKET SEGMENTATION

1.3.2 REGIONAL SEGMENTATION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 PACKAGE SIZE

1.6 STUDY LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 OUTDOOR LED LIGHTING MARKET: RESEARCH METHODOLOGY

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.2.2 List of major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Capturing market share of application by bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Capturing market share of application by top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 FACTOR ANALYSIS

2.3.1 SUPPLY SIDE ANALYSIS

2.3.2 DEMAND SIDE ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: OUTDOOR LED LIGHTING MARKET

2.5.1 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.6 RESEARCH ASSUMPTIONS

FIGURE 9 KEY RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 GLOBAL OUTDOOR LED LIGHTING MARKET

FIGURE 11 HARDWARE OFFERING TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 12 SPORTS AND LARGE AREAS SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 13 NEW INSTALLATION TYPE TO HOLD LARGER MARKET DURING FORECAST PERIOD

FIGURE 14 WIRED COMMUNICATION TYPE TO POSSESS LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 15 E-COMMERCE TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 16 50-150 W TYPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 17 ASIA PACIFIC TO WITNESS FASTEST GROWTH RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OUTDOOR LED LIGHTING MARKET

FIGURE 18 SIGNIFICANT ADOPTION OF LED LIGHTING IN OUTDOOR APPLICATIONS TO DRIVE MARKET

4.2 OUTDOOR LED LIGHTING MARKET, BY APPLICATION

FIGURE 19 SPORTS AND LARGE AREAS APPLICATION SEGMENT TO POSSESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.3 MARKET, BY OFFERING

FIGURE 20 HARDWARE SEGMENT TO HOLD LARGEST SHARE IN MARKET DURING FORECAST PERIOD

4.4 MARKET, BY SALES CHANNEL

FIGURE 21 E-COMMERCE SALES CHANNEL TO WITNESS FASTEST GROWTH IN DURING FORECAST PERIOD

4.5 MARKET, BY INSTALLATION TYPE

FIGURE 22 RETROFIT SEGMENT TO POSSESS SIGNIFICANT GROWTH IN MARKET BETWEEN 2022 AND 2027

FIGURE 23 SOFTWARE TO HAVE HIGHEST GROWTH IN ASIA PACIFIC MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Need for improvement in visibility and safety

5.2.1.2 High demand for LED lighting for infrastructural developments

5.2.1.3 Need for energy-efficient lighting systems for highways

5.2.1.4 Demand for smart controls in street lighting systems

5.2.1.5 Adoption of LED bulbs and luminaires for net-zero emissions by 2050

TABLE 3 LIGHTING TYPES, INSTALLED UNITS, AND ENERGY SAVINGS IN US (2018)

FIGURE 25 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness regarding installation costs for smart lighting and payback periods

5.2.2.2 Functional problems associated with LED technology

5.2.2.3 Short-to-medium-term impact due to US-China trade conflict and Russia–Ukraine war

FIGURE 26 OUTDOOR LED LIGHTING MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of wireless LED lighting systems for outdoor applications

5.2.3.2 Need for energy-efficient light sources in emerging economies

5.2.3.3 IoT technology in smart street lighting and smart city projects

5.2.3.4 Government initiatives toward adoption of efficient LED lighting

5.2.3.5 Continuous decline in prices of LED chips and other components of lighting systems

FIGURE 27 OUTDOOR LED LIGHTING MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of common open standards for LED lights

5.2.4.2 Slow rate of adoption of LED technology in emerging countries

FIGURE 28 MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN ANALYSIS: OUTDOOR LED LIGHTING MARKET

5.4 PORTER’S FIVE FORCE ANALYSIS

TABLE 4 IMPACT SCORE AND INTENSITY OF PORTER’S FIVE FORCES

FIGURE 30 IMPACT OF PORTER'S FIVE FORCES ON OUTDOOR LED LIGHTING MARKET

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 THREAT OF NEW ENTRANTS

5.4.3 THREAT OF SUBSTITUTES

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 BARGAINING POWER OF SUPPLIERS

5.5 AVERAGE SELLING PRICE ANALYSIS

FIGURE 31 OUTDOOR LED LIGHTING MARKET: MID AND LOW-POWER LED PACKAGE PRICING TREND

FIGURE 32 MARKET: HIGH-POWER LED PACKAGE PRICING TREND

FIGURE 33 MARKET: LED LAMP (60 W EQUIVALENT) PRICING TREND

5.6 TRADE ANALYSIS

5.6.1 TRADE ANALYSIS FOR OUTDOOR LED LIGHTING

TABLE 5 IMPORT DATA FOR LAMPS AND LIGHTING FITTINGS, HS CODE: 9405 (USD MILLION)

FIGURE 34 IMPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2017–2021

TABLE 6 EXPORT DATA FOR LAMPS AND LIGHTING FIXTURES, HS CODE: 9405 (USD MILLION)

FIGURE 35 EXPORT VALUES OF LAMPS AND LIGHTING FIXTURES, BY COUNTRY, 2017–2021

5.7 ECOSYSTEM ANALYSIS

FIGURE 36 OUTDOOR LED LIGHTING MARKET: ECOSYSTEM ANALYSIS

TABLE 7 MARKET: ECOSYSTEM ANALYSIS

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 37 REVENUE SHIFT AND NEW REVENUE POCKET FOR OUTDOOR LED LIGHTING

5.9 CASE STUDY ANALYSIS

5.9.1 ABB ATLANTA INTERNATIONAL AIRPORT (ATL) TO HAVE COMPLETE MAKEOVER WITH LED LIGHTING

5.9.2 LIGHTING OF NORDHAVNSVEI TUNNEL

5.9.3 SMART LIGHTING FOR THE STATE OF NEW YORK

5.1 PATENT ANALYSIS

TABLE 8 KEY PATENT REGISTRATIONS, 2018–2021

FIGURE 38 PATENT GRANTED WORLDWIDE, 2011-2021

TABLE 9 TOP 20 PATENT OWNERS, 2011-2021

FIGURE 39 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2011–2021

5.11 TECHNOLOGY ANALYSIS

5.11.1 LI-FI

5.11.2 HUMAN-CENTRIC LIGHTING

5.11.3 IOT LIGHTING

5.12 GOVERNMENT REGULATIONS AND STANDARDS

5.12.1 GOVERNMENT REGULATIONS

5.12.2 STANDARDS

5.12.2.1 IEEE 1789-2015 modulation frequencies for light-emitting diodes (LEDs)

5.12.2.2 Energy Star - developed by US Department of Energy (DOE) and US Environmental Protection Agency (EPA)

5.12.2.3 NEMA - ANSI C78.51 - electric lamps - LED (light-emitting diode) lamps - method of designation

5.13 KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 11 OUTDOOR LED LIGHTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.15 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.15.1 BUYING CRITERIA

6 OUTDOOR LED LIGHTING MARKET, BY APPLICATION (Page No. - 87)

6.1 INTRODUCTION

FIGURE 40 OUTDOOR LED LIGHTING MARKET, BY APPLICATION

TABLE 13 MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

FIGURE 41 STREETS AND ROADS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET BETWEEN 2022 AND 2027

TABLE 14 OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

6.2 STREETS AND ROADS

6.2.1 INCREASING NUMBER OF ROAD AND STREET DEVELOPMENT PROJECTS IN EMERGING ECONOMIES TO DRIVE MARKET

TABLE 15 STREETS AND ROADS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 16 STREETS AND ROADS: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3 ARCHITECTURAL AND URBAN LANDSCAPES

6.3.1 OUTDOOR LED LIGHTING TO WITNESS INCREASED DEMAND FROM ARCHITECTURAL LANDMARKS AND SKYSCRAPERS

TABLE 17 ARCHITECTURAL AND URBAN LANDSCAPES: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 18 ARCHITECTURAL AND URBAN LANDSCAPES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022–2027 (USD BILLION)

6.4 SPORTS AND LARGE AREAS

6.4.1 EXISTING STADIUMS AND SPORTS COMPLEXES SWITCHING TO LED LIGHTING FROM CONVENTIONAL LIGHTS

TABLE 19 SPORTS AND LARGE AREAS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 20 SPORTS AND LARGE AREAS: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.5 TUNNELS

6.5.1 UPCOMING TUNNEL CONSTRUCTION PROJECTS TO PROVIDE OPPORTUNITIES TO LED LIGHTING SYSTEM PROVIDERS

TABLE 21 TUNNELS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 22 TUNNELS: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.6 OTHERS

TABLE 23 OTHERS: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 24 OTHERS: MARKET, BY REGION, 2022–2027 (USD BILLION)

7 OUTDOOR LED LIGHTING MARKET, BY OFFERING (Page No. - 97)

7.1 INTRODUCTION

FIGURE 42 OUTDOOR LED LIGHTING MARKET, BY OFFERING

TABLE 25 MARKET, BY OFFERING, 2018–2021 (USD BILLION)

FIGURE 43 HARDWARE TO ACCOUNT LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 26 MARKET, BY OFFERING, 2022–2027 (USD BILLION)

7.2 HARDWARE

7.2.1 LAMPS

7.2.1.1 Long life and durability of lamps to augment growth

7.2.2 LUMINAIRES

7.2.2.1 Availability in different varieties for various requirements to drive market

7.2.3 CONTROL SYSTEMS

7.2.3.1 Increased adoption of intelligent lighting systems to propel market

TABLE 27 HARDWARE: OUTDOOR LED LIGHTING MARKET, BY TYPE, 2018–2021 (USD BILLION)

FIGURE 44 LUMINAIRES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 28 HARDWARE: MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 29 HARDWARE: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 30 HARDWARE: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.3 SOFTWARE

7.3.1 INCREASED ACCESS TO CONTROL LIGHTING SYSTEMS TO AID MARKET

TABLE 31 SOFTWARE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 32 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.4 SERVICES

7.4.1 SERVICES HOLD SIGNIFICANT MARKET SHARE DUE TO USER-SPECIFIC NEEDS

7.4.2 PRE-INSTALLATION SERVICES

7.4.2.1 Design and installation

7.4.3 POST-INSTALLATION SERVICES

7.4.3.1 Maintenance and support

TABLE 33 SERVICES: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 34 SERVICES: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022–2027 (USD BILLION)

8 OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION (Page No. - 106)

8.1 INTRODUCTION

FIGURE 45 OUTDOOR LIGHTING MARKET, BY COMMUNICATION

TABLE 35 MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 36 MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

8.2 WIRED

8.2.1 WIDER ADOPTION DUE TO GREATER RELIABILITY TO BOOST MARKET

TABLE 37 WIRED: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 38 WIRED: MARKET, BY REGION, 2022–2027 (USD BILLION)

8.3 WIRELESS

8.3.1 COST AND ENERGY SAVINGS TO DRIVE MARKET

TABLE 39 WIRELESS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 40 WIRELESS: MARKET, BY REGION, 2022–2027 (USD BILLION)

9 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE (Page No. - 111)

9.1 INTRODUCTION

FIGURE 47 OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE

TABLE 41 MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

FIGURE 48 NEW INSTALLATION TO HOLD LARGER MARKET BETWEEN 2022 AND 2027

TABLE 42 MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

9.2 NEW

9.2.1 NEW INSTALLATIONS TO HOLD LARGER MARKET SHARE OWING TO INCREASED INFRASTRUCTURE DEVELOPMENTS

TABLE 43 NEW: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 44 NEW: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.3 RETROFIT

9.3.1 INCREASED NEED TO MODIFY EXISTING LIGHT FIXTURES TO DRIVE MARKET

TABLE 45 RETROFIT: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 46 RETROFIT: MARKET, BY REGION, 2022–2027 (USD BILLION)

10 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE (Page No. - 117)

10.1 INTRODUCTION

FIGURE 49 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE

TABLE 47 MARKET, BY WATTAGE TYPE, 2018–2021 (USD BILLION)

FIGURE 50 WATTAGE RANGE OF 50-150 W TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 48 OUTDOOR LED LIGHTING MARKET, BY WATTAGE TYPE, 2022–2027 (USD BILLION)

10.2 LESS THAN 50 W

10.2.1 LESSER ADOPTION OF LOW WATTAGE CAPACITY LIGHTING SYSTEMS TO RESTRAIN MARKET

10.3 50–150 W

10.3.1 WIDER ADOPTION IN HIGHWAYS AND ROADWAYS TO DRIVE MARKET

10.4 MORE THAN 150 W

10.4.1 INCREASED USAGE IN TUNNELS AND FLOODLIGHTING TO PROPEL MARKET

11 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL (Page No. - 121)

11.1 INTRODUCTION

TABLE 49 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

FIGURE 51 E-COMMERCE SEGMENT TO RECORD HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 50 OUTDOOR LED LIGHTING MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

11.2 RETAIL/WHOLESALE

11.2.1 RETAIL/WHOLESALE CHANNEL TO ACCOUNT FOR MAJOR MARKET SHARE

TABLE 51 RETAIL/WHOLESALE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 52 RETAIL/WHOLESALE: MARKET, BY REGION, 2022–2027 (USD BILLION)

11.3 DIRECT SALES/CONTRACT-BASED

11.3.1 LESSER INTERFERENCE FROM THIRD PARTIES IN DIRECT SALES TO RESULT IN PROCUREMENT COST REDUCTION

TABLE 53 DIRECT SALES/CONTRACT-BASED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 54 DIRECT SALES/CONTRACT-BASED: OUTDOOR LED LIGHTING MARKET, BY REGION, 2022–2027 (USD BILLION)

11.4 E-COMMERCE

11.4.1 E-COMMERCE-BASED LED LIGHTING SALES TO INCREASE SIGNIFICANTLY UNTIL 2027

TABLE 55 E-COMMERCE: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 56 E-COMMERCE: MARKET, BY REGION, 2022–2027 (USD BILLION)

12 OUTDOOR LED LIGHTING MARKET, BY INTERFACING STANDARD (Page No. - 127)

12.1 INTRODUCTION

12.2 NEMA

12.2.1 NEMA STANDARDIZATION TO BE MAJORLY USED IN AMERICAS

12.3 ZHAGA

12.3.1 ZHAGA STANDARDIZATION TO BE WIDELY USED IN EUROPE

TABLE 57 POPULAR INTERFACING STANDARDS IN DIFFERENT REGIONS

13 OUTDOOR LED LIGHTING MARKET, BY REGION (Page No. - 129)

13.1 INTRODUCTION

FIGURE 52 OUTDOOR LED LIGHTING MARKET SEGMENTATION: BY REGION

FIGURE 53MARKET: GEOGRAPHIC SNAPSHOT

TABLE 58 MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 59 MARKET, BY REGION, 2022–2027 (USD BILLION)

13.2 AMERICAS

FIGURE 54 MERICAS: OUTDOOR LED LIGHTING MARKET SNAPSHOT

TABLE 60 AMERICAS: MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 61 AMERICAS: MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 62 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 63 AMERICAS: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 64 AMERICAS: MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 65 AMERICAS: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 66 AMERICAS: MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 67 AMERICAS: MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 68 AMERICAS: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 69 AMERICAS: MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 70 AMERICAS: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 71 AMERICAS: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.2.1 NORTH AMERICA

TABLE 72 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 75 NORTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 76 NORTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 77 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 78 NORTH AMERICA: MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 80 NORTH AMERICA: MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 81 NORTH AMERICA: MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 82 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 83 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.2.1.1 US

13.2.1.1.1 Advancements in LED technology due to ideal environment for innovation to propel market

13.2.1.2 Canada

13.2.1.2.1 Government energy efficiency regulations to drive adoption of outdoor LED

13.2.1.3 MEXICO

13.2.1.3.1 Government policies and initiatives to boost market

13.2.2 SOUTH AMERICA

TABLE 84 SOUTH AMERICA: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 85 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 86 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 87 SOUTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 88 SOUTH AMERICA: MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 89 SOUTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 90 SOUTH AMERICA: MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 91 SOUTH AMERICA: MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 92 SOUTH AMERICA: MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 93 SOUTH AMERICA: MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 94 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 95 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.2.2.1 Brazil

13.2.2.1.1 International collaboration to aid adoption of outdoor LED lighting products

13.2.2.2 Argentina

13.2.2.2.1 New government resolution for adoption of LED lighting products to foster growth

13.2.2.3 Rest of South America

13.3 EUROPE

FIGURE 55 EUROPE: OUTDOOR LED LIGHTING MARKET SNAPSHOT

TABLE 96 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 97 EUROPE: OUTDOOR LED LIGHTING MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 98 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 99 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 100 EUROPE:MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 101 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 102 EUROPE: MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 103 EUROPE: MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 104 EUROPE: MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 105 EUROPE: MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 106 EUROPE: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 107 EUROPE: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.3.1 GERMANY

13.3.1.1 Sustainability and momentum to reduce dependency on energy imports and stimulate market

13.3.2 UK

13.3.2.1 Government policies and collaborations for adoption of LED lighting to boost market

13.3.3 FRANCE

13.3.3.1 Government steps for environmental balance to accelerate adoption of LED lighting

13.3.4 ITALY

13.3.4.1 Reviving infrastructure and construction sectors to aid adoption of outdoor LED lighting

13.3.5 REST OF EUROPE

13.4 ASIA PACIFIC

FIGURE 56 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET SNAPSHOT

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 114 ASIA PACIFIC: OUTDOOR LED LIGHTING MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 115 OUTDOOR LED LIGHTING MARKET FOR ASIA PACIFIC, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.4.1 CHINA

13.4.1.1 Government support and presence of LED lighting manufacturers to drive market

13.4.2 JAPAN

13.4.2.1 New building energy conservation law to reduce energy consumption and aid market

13.4.3 INDIA

13.4.3.1 Government-run smart city projects to boost demand for LED lighting and control solutions

13.4.4 AUSTRALIA

13.4.4.1 High penetration rate of LED lighting systems to foster market

13.4.5 SOUTH KOREA

13.4.5.1 Presence of major LED lighting manufacturers to propel market

13.4.6 REST OF ASIA PACIFIC

13.5 REST OF THE WORLD

TABLE 120 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 121 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 122 REST OF THE WORLD: MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 123 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 124 REST OF THE WORLD: MARKET, BY OFFERING, 2018–2021 (USD BILLION)

TABLE 125 REST OF THE WORLD: MARKET, BY OFFERING, 2022–2027 (USD BILLION)

TABLE 126 REST OF THE WORLD: MARKET, BY COMMUNICATION, 2018–2021 (USD BILLION)

TABLE 127 REST OF THE WORLD: MARKET, BY COMMUNICATION, 2022–2027 (USD BILLION)

TABLE 128 REST OF THE WORLD: MARKET, BY INSTALLATION TYPE, 2018–2021 (USD BILLION)

TABLE 129 REST OF THE WORLD: OUTDOOR LED LIGHTING MARKET, BY INSTALLATION TYPE, 2022–2027 (USD BILLION)

TABLE 130 REST OF THE WORLD: MARKET, BY SALES CHANNEL, 2018–2021 (USD BILLION)

TABLE 131 REST OF THE WORLD: MARKET, BY SALES CHANNEL, 2022–2027 (USD BILLION)

13.5.1 MIDDLE EAST

13.5.1.1 Eco-friendly green building regulations and streetlight retrofitting programs to drive market

13.5.2 AFRICA

13.5.2.1 Ongoing urbanization in African regions to significantly boost market

14 COMPETITIVE LANDSCAPE (Page No. - 172)

14.1 INTRODUCTION

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 132 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

14.2.1 PRODUCT PORTFOLIO

14.2.2 REGIONAL FOCUS

14.2.3 MANUFACTURING FOOTPRINT

14.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

14.3 MARKET SHARE ANALYSIS, 2021

TABLE 133 OUTDOOR LED LIGHTING MARKET: DEGREE OF COMPETITION

14.4 REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 57 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN OUTDOOR LED LIGHTING MARKET

14.5 COMPANY EVALUATION QUADRANT

14.5.1 STARS

14.5.2 PERVASIVE PLAYERS

14.5.3 EMERGING LEADERS

14.5.4 PARTICIPANTS

FIGURE 58 OUTDOOR LED LIGHTING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

14.6 COMPANY FOOTPRINT

TABLE 134 OVERALL COMPANY FOOTPRINT

TABLE 135 COMPANY FOOTPRINT, BY OFFERING

TABLE 136 COMPANY FOOTPRINT, BY REGION

TABLE 137 COMPANY FOOTPRINT, BY APPLICATION

14.7 COMPETITIVE BENCHMARKING

TABLE 138 OUTDOOR LED LIGHTING MARKET: DETAILED LIST OF SMES

TABLE 139 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

14.8 SME EVALUATION QUADRANT

14.8.1 PROGRESSIVE COMPANIES

14.8.2 RESPONSIVE COMPANIES

14.8.3 DYNAMIC COMPANIES

14.8.4 STARTING BLOCKS

FIGURE 59 OUTDOOR LED LIGHTING MARKET (GLOBAL): START-UPS/SME EVALUATION QUADRANT, 2021

14.9 COMPETITIVE SITUATION AND TRENDS

14.9.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 140 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019–SEPTEMBER 2022

14.9.2 DEALS

TABLE 141 OUTDOOR LED LIGHTING MARKET: DEALS, JANUARY 2019–SEPTEMBER 2022

14.9.3 OTHERS

TABLE 142 MARKET: OTHERS, JANUARY 2019–SEPTEMBER 2022

15 COMPANY PROFILES (Page No. - 196)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

15.1 KEY PLAYERS

15.1.1 SIGNIFY N.V.

TABLE 143 SIGNIFY N.V.: COMPANY OVERVIEW

FIGURE 60 SIGNIFY N.V.: COMPANY SNAPSHOT

15.1.2 ACUITY BRANDS, INC.

TABLE 144 ACUITY BRANDS, INC.: COMPANY OVERVIEW

FIGURE 61 ACUITY BRANDS, INC.: COMPANY SNAPSHOT

15.1.3 CREE LIGHTING (PART OF IDEAL INDUSTRIES, INC.)

TABLE 145 CREE LIGHTING: COMPANY OVERVIEW

FIGURE 62 CREE LIGHTING: COMPANY SNAPSHOT

15.1.4 DIALIGHT PLC

TABLE 146 DIALIGHT PLC: COMPANY OVERVIEW

FIGURE 63 DIALIGHT PLC: COMPANY SNAPSHOT

15.1.5 PANASONIC CORPORATION

TABLE 147 PANASONIC CORPORATION: COMPANY OVERVIEW

FIGURE 64 PANASONIC CORPORATION: COMPANY SNAPSHOT

15.1.6 CURRENT™ (FORMERLY GE CURRENT, A DAINTREE COMPANY)

TABLE 148 CURRENT™ (FORMERLY GE CURRENT, A DAINTREE COMPANY): COMPANY OVERVIEW

15.1.7 EATON CORPORATION

TABLE 149 EATON CORPORATION: COMPANY OVERVIEW

FIGURE 65 EATON CORPORATION: COMPANY SNAPSHOT

15.1.8 FAGERHULTS BELYSNING AB

TABLE 150 FAGERHULTS BELYSNING AB: COMPANY OVERVIEW

15.1.9 ZUMTOBEL GROUP

TABLE 151 ZUMTOBEL GROUP: COMPANY OVERVIEW

FIGURE 66 ZUMTOBEL GROUP: COMPANY SNAPSHOT

15.1.10 SCHRÉDER

TABLE 152 SCHRÉDER: COMPANY OVERVIEW

15.2 OTHER COMPANIES

15.2.1 HENGDIAN GROUP TOSPO LIGHTING CO., LTD.

15.2.2 SAMSUNG

15.2.3 SHARP CORPORATION

15.2.4 OSRAM LIGHT AG (GE)

15.2.5 SYSKA LED

15.2.6 DIGITAL LUMENS INC.

15.2.7 NEPTUN LIGHT, INC.

15.2.8 ENVISION LIGHTING

15.2.9 GO GREEN LED

15.2.10 FOREST LIGHTING

15.2.11 LIGHTING SCIENCE GROUP CORPORATION

15.2.12 WIPRO LIGHTING (UNDER WIPRO LIMITED)

15.2.13 OPPLE LIGHTING CO., LIMITED

15.2.14 NVC LIGHTING TECHNOLOGY CORPORATION

15.2.15 TANKO LIGHTING INC.

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 246)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

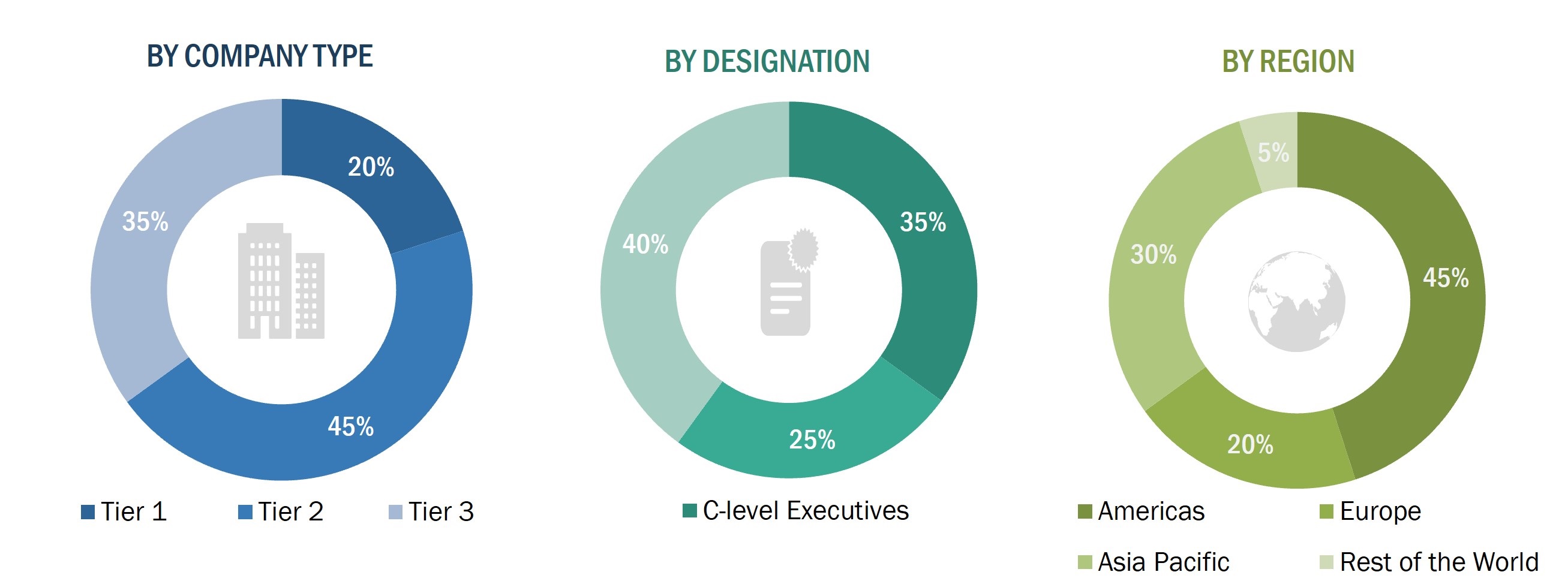

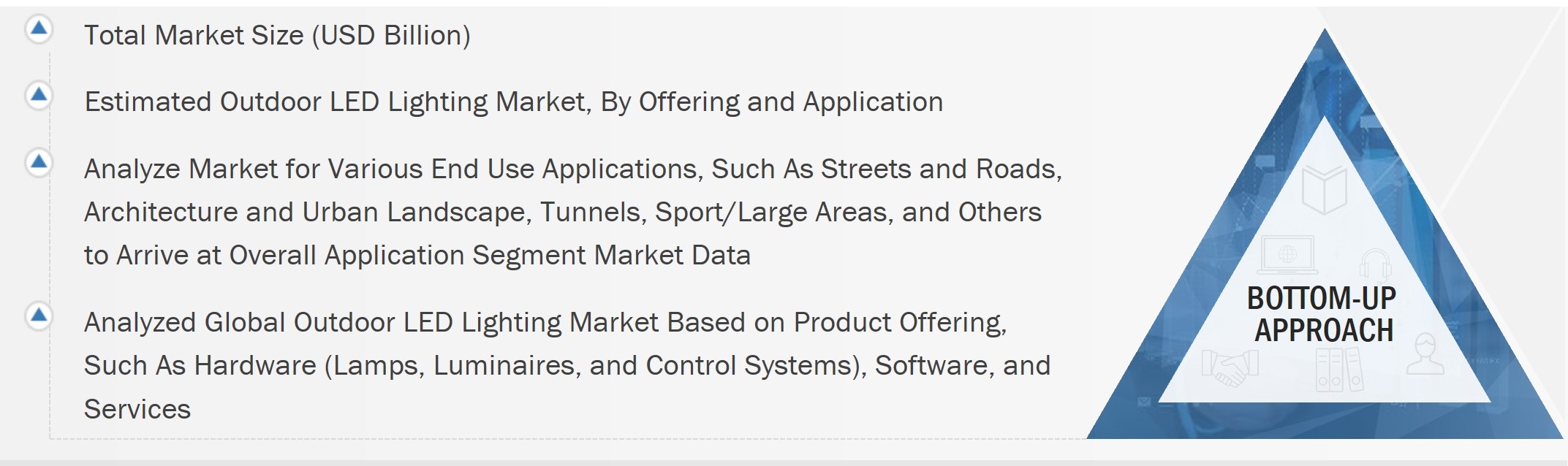

In order to estimate the size of the outdoor LED lighting market, 4 major activities were performed. Secondary research has been conducted extensively to collect information regarding the market, the peer market, and the parent market. This was followed by a primary research study involving industry experts across the value chain to validate the findings, assumptions, and sizing. The total market size has been estimated using both top-down and bottom-up approaches. Then, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred for this research study to identify and collect information. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

After understanding and analyzing the outdoor LED lighting market through secondary research, extensive primary research was conducted. Several primary interviews have been conducted with key opinion leaders from supply-side vendors and demand-side vendors in four major regions - Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Qualitative and quantitative information on the market has been obtained by interviewing various sources on both the supply and demand sides. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the outdoor LED lighting market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Identifying different outdoor LED lighting systems, including lamps and luminaires, and analyzing their demand in various geographic regions and applications

- Analyzing the adoption rate of outdoor LED lighting solutions based on different offerings such as hardware, software, and services in several applications

- Analyzing the trend of outdoor LED lighting solutions used in different geographic regions

- Referring to various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to validate the market estimations

- Conducting discussions with key opinion leaders about different technological trends, changing market environments, and emerging technologies to analyze the breakup of the scope of work by major outdoor LED lighting products providers

- The key players in the outdoor LED lighting market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research.

- Study of annual and financial reports of top players and interviews with experts such as CEOs, VPs, directors, and marketing executives for key insights (quantitative and qualitative).

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global Outdoor LED Lighting Market Size: Bottom-up Approach

Data Triangulation

With the overall market size derived from the estimation process described previously, the global market was divided into several segments and subsegments. In order to gather the exact statistics for segments and subsegments, the data triangulation and breakdown procedures have been applied wherever possible. The data has been triangulated by analyzing various factors and trends from both the demand and supply sides. Furthermore, the outdoor LED lighting market has been validated using both top-down and bottom-up approaches.

Report Objectives

To describe and forecast the size of the outdoor LED lighting market based on offering, application, installation, sales channel, communication, wattage type, and region in terms of value

- To forecast the size of the outdoor LED lighting market based on offering and region in terms of volume

- To describe and forecast the market for 4 main regions, namely, the Americas, Asia Pacific, Europe, and Rest of the World, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain of the outdoor LED lighting ecosystem, along with the average selling prices of product types

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To strategically analyze the ecosystem, Porter’s Five Forces, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and provide a detailed competitive landscape of the outdoor LED lighting market

- To analyze strategic approaches adopted by the leading players in the outdoor LED lighting market, including product launches/developments/collaborations/partnerships/expansions, and mergers & acquisitions

- To strategically profile key players and provide details of the current competitive landscape

- To analyze strategic approaches adopted by players in the LED Lighting market, such as product launches and developments, acquisitions, collaborations, contracts, expansions, and partnerships

Note: Micromarkets are defined as the further segments and subsegments of the outdoor LED lighting market included in the report.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Outdoor LED Lighting Market