Printed Tape Market in Packaging by Product Type (Hot Melt, Acrylic), by Material (Polypropylene, PVC), by Printing Ink (Water-based, UV-curable), by Mechanism (Digital Printing, Flexography), by End-user industry (Food & Beverages, Consumer Durables) & by Region - Forecast to 2020

[250 Pages Report] The global packaging tape printing market is projected to grow from USD 21.42 Billion in 2015 to reach USD 28.78 Billion by 2020, at a CAGR of 6.08% from 2015 to 2020. Printing on the packaging tapes highlights the companys name and logo, enables ease of stock handling and identification, enhances the visibility of product, and safeguards the merchandise during transit. It also makes the product visually appealing, thereby resulting in instant recognition of the packages. The report aims at estimating the market size and future growth potential of the global packaging tape printing market across different segments such as product type, material, printing ink, mechanism, end-user industry, and country. The base year considered for the study is 2014 and the market size is projected from 2015 to 2020. The growth of the market has continued to remain robust with a significant number of brand owners harnessing the printing technology in packaging tapes.

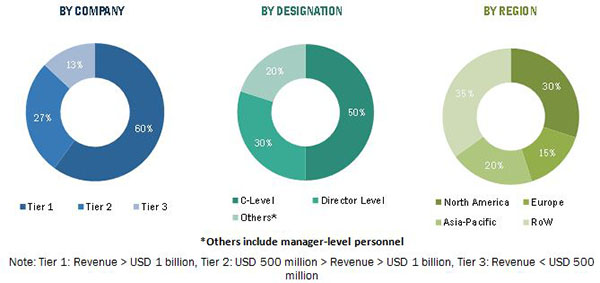

The research methodology used to estimate and forecast the global packaging tape printing market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall size of the global packaging tape printing market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, Directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is depicted in the below figure:

This report estimates the size of the packaging tape printing market in terms of value (USD Million) and volume (Million Square Meter). In this report, we have covered raw material suppliers, manufacturing companies, supply chain companies, and end-use companies. The market drivers, restraints, opportunities, challenges, and product price trends have been discussed in detail.

The global packaging tape printing market is dominated by key players such as Quad/Graphics Inc., Hewlett-Packard Development Company, L.P., Xerox Corporation, E.I. du Pont de Nemours and Company, and RR Donnelley & Sons. Other players such as Canon U.S.A., Inc., FLEXcon Company, Inc., SIAT S.p.A, W.S. Packaging Group, and Cenveo, Inc. accounted for a significant contribution in the printing market, which can be leveraged by the packaging tape printing industry to attain high growth in the near future.

Target audience

- Global packaging tape printing manufacturers, traders, and distributors

- Raw material suppliers

- Global packaging tape printing importers and exporters

- Global packaging tape printing suppliers

- Government and research organizations

- Associations and industry bodies

- End users such as manufacturers of food & beverages, consumer durables, and transportation & logistics

Scope of the Report

The research report segments the global packaging tape printing market into the following submarkets:

By Product Type:

- Hot melt carton sealing tape

- Acrylic carton sealing tape

- Natural rubber carton sealing tape

By Mechanism:

- Flexography

- Lithography

- Digital printing

- Screen printing

- Gravure

- Others (Letterpress, Offset)

By Material:

- Polypropylene

- Polyvinyl chloride

- Others (polyethylene, polyamide, and others)

By Printing Ink:

- Water-based ink

- UV-curable ink

- Solvent-based ink

By End-user Industry:

- Food & beverages

- Consumer durables

- Transportation & logistics

- Others (construction, health care, cosmetics & toiletries, and others)

By Region:

- Asia-Pacific

- Europe

- North America

- RoW (Brazil, Argentina, South Africa, and others)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

Product matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American packaging tape printing market

- Further breakdown of the European packaging tape printing market

- Further breakdown of the Asia-Pacific packaging tape printing gases market

- Further breakdown of the RoW packaging tape printing market

Company Information

Detailed analysis and profiling of additional market players

MarketsandMarkets projects the global packaging tape printing market size to grow from USD 21.42 Billion in 2015 to USD 28.78 Billion by 2020, at a CAGR of 6.08% from 2015 to 2020. This high growth can be attributed to the fact that a significant number of brand owners are harnessing the printing technology over the packaging tapes. Growth in the packaging printing industry, demand for aesthetic appeal, product differentiation, and technological advancements are some of the drivers behind the growth of the packaging tape printing market.

Printing on the packaging tapes highlights the companys name and logo, enables ease of stock handling and identification, enhances the visibility of product, and safeguards the merchandise during transit. It also makes the product visually appealing, thereby resulting in instant recognition of the packages. The global packaging tape printing industry has undergone significant transformation from being a heavy-machinery-using industry to a more software-centric business model. Nowadays, printer convertors are well equipped with the latest computer-controlled printing machines and flow lines for binding, whereas state-of-the-art digital technologies are used in the pre-press. An increase in demand for digital printing is an opportunity for the packaging tape printing market as there is rise in demand for economical, sustainable, and innovative printing technologies. The advent of global brands, rising consumerism, and growth of the packaging industry have witnessed an increase in the scope for the packaging tape printing market.

Water-based inks offer better performance and low printing cost with less damage to both people and environment. It exhibits high level of compliance with the current environmental protection standards. Water-based inks are projected to have the largest market share and dominate the packaging tape printing market from 2015 to 2020, as the increased demand of ink having low volatile organic compound (VOC) content is fueling the market to grow. UV curable inks are projected to witness the highest growth rate during the forecast period. As these inks are cured by exposure to strong UV light, they can be applied to a wide range of uncoated substrates and produce a robust image. The UV-curable inks dry as soon as they are cured, thereby enhancing the print speed. These inks possess high density, and are also capable to print onto rigid substrates.

Digital printing in the packaging tape printing market is the fastest growing printing mechanism with its ability to provide a high-quality and cost-effective solution for manufacturing high designed printed tapes along with the recycling options. Printer convertors are adding digital printers in their printing press to leverage its benefits of improved productivity, reliability, and cost-effectiveness over higher runs.

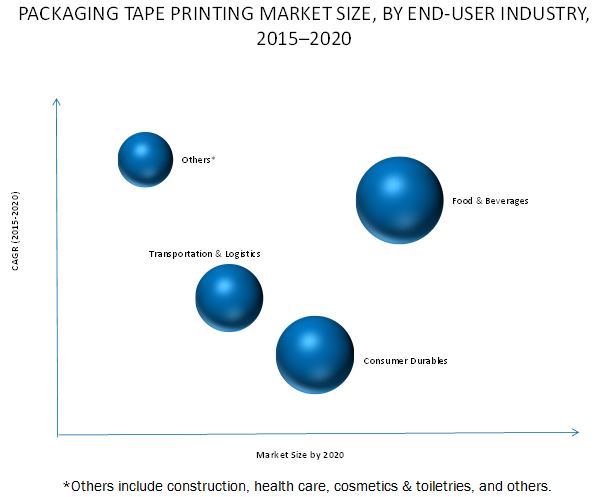

Food & beverages, consumer durables, and transportation & logistics are some of the end-user industries contributing to the high growth of the packaging tape printing market. The food & beverages industry is projected to witness the largest market size owing to the increased demand for innovative packaging and printing technologies, in order to enhance the visibility of packaged products. The market is also projected to witness growth in the consumer durables, transportation & logistics, and other end-user industries during the forecast period.

The market of hot melt carton sealing tapes is projected to be the largest market in terms of size, during the forecast period. The high demand of hot melt carton sealing tapes in a large number of industrial applications has contributed significantly in the packaging tape printing market. Polypropylene in the packaging tape printing market is projected to attain the largest market size, during the forecast period. Polypropylene films, very strong and rigid in nature, are one of the most versatile, economic, and prepotent barrier films that offer excellent moisture barrier, temperature resistance, clarity, gloss, durability, the ability to print, embossability, aroma strength, dimensional stability, and processability. It has emerged as an economically viable alternative for the packaging converters, and has thereby commanded a major market share in the packaging tape printing industry.

Asia-Pacific is projected to have the largest market share and dominate the global packaging tape printing market from 2015 to 2020. China, one of the leading manufacturers and suppliers of printing materials and equipment, exhibits high growth opportunities for the packaging tape printing, and hence commanded the largest market share in 2015 in the Asia-Pacific region. However, the market continues to face challenges due to demand for high-quality printing at low cost while adhering to the government regulations. The major players in the packaging tape printing market include Quad/Graphics (U.S.), Hewlett-Packard Development Company, L.P. (U.S.), Xerox Corporation (U.S.), E.I. du Pont de Nemours and Company (U.S.), RR Donnelley & Sons (U.S.), SIAT S.P.A (Italy), and others. These players adopted various strategies such as new product developments, mergers, partnerships, collaborations, and business expansion to cater to the needs of the packaging tape printing market.

Table of Contents

1 Introduction (Page No. - 26)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 29)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries, By Company Type, Designation, and Region

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions of the Research Study

2.4.2 Limitations of the Research Study

3 Executive Summary (Page No. - 38)

3.1 Demand From End-User Industries to Drive the Demand for Packaging Tape Printing

3.2 Evolution of Packaging Tape Printing

3.3 Packaging Tape Printing Market

3.4 Packaging Tape Printing Market Snapshot, By Value, 2015 vs 2020

3.5 Food & Beverage Industry: Largest Segment for Packaging Tape Printing Market

3.6 Packaging Tape Printing Market Size, By Material, 20152020 (USD Million)

3.7 Packaging Tape Printing Market Size, By Printing Ink, 20152020 (USD Million)

3.8 Packaging Tape Printing Market Size, By Mechanism, 20152020 (USD Million)

3.9 Packaging Tape Printing Market Share (Value) and Growth Rate, By Region, 2014

4 Premium Insights (Page No. - 46)

4.1 Attractive Market Opportunity for the Global Packaging Tape Printing Market Players

4.2 Global Packaging Tape Printing Market: Major Growth Pockets

4.3 Global Packaging Tape Printing Market, By End-User Industry

4.4 Global Packaging Tape Printing Market Attractiveness, By Product Type

4.5 Global Packaging Tape Printing Market Attractiveness, By Material

4.6 Packaging Tape Printing Market Attractiveness, By Printing Ink

4.7 Packaging Tape Printing Market Attractiveness, By Mechanism

4.8 Food & Beverages Emerged as the Largest Segment in the Global Packaging Tape Printing Market, By End-User Industry, 2015 to 2020

4.9 Packaging Tape Printing Market, By Region

5 Market Overview (Page No. - 51)

5.1 Introduction

5.2 Evolution of Global Packaging Tape Printing Market

5.3 Market Segmentation

5.3.1 By Product Type

5.3.2 By Material

5.3.3 By Printing Ink

5.3.4 By Mechanism

5.3.5 By End-User Industry

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 High Demand for Digital Printing

5.4.1.2 High Demand for Sustainable Printing

5.4.1.3 Growing Demand From End-User Industry

5.4.1.4 Growing Demand for Aesthetic Appeal and Innovative Printing Styles

5.4.1.5 Growth of the Parent Industry

5.4.2 Restraints

5.4.2.1 High Capital Investment Required

5.4.2.2 Fluctuations in the Prices of Raw Materials

5.4.3 Opportunities

5.4.3.1 Expanding Digital Expertise

5.4.3.2 Emergence of New Technologies in the Printing Industry

5.4.4 Challenges

5.4.4.1 Packaging and Printing Regulations

5.4.4.2 Difficulty in Managing the Global Packaging Tape Printing Supply Chain

6 Industry Trends (Page No. - 66)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Packaging Tape Printing Market, By Product Type (Page No. - 73)

7.1 Introduction

7.2 Hot Melt Carton Sealing Tape

7.3 Acrylic Carton Sealing Tape

7.4 Natural Rubber Carton Sealing Tape

8 Packaging Tape Printing Market, By Material (Page No. - 77)

8.1 Introduction

8.2 Polypropylene

8.3 Polyvinyl Chloride

8.4 Others

9 Packaging Tape Printing Market, By Printing Ink (Page No. - 82)

9.1 Introduction

9.2 Water-Based Ink

9.3 UV-Curable Ink

9.4 Solvent-Based Ink

10 Packaging Tape Printing Market, By Mechanism (Page No. - 86)

10.1 Introduction

10.2 Digital Printing

10.3 Flexography

10.4 Lithography

10.5 Screen Printing

10.6 Gravure

10.7 Others

11 Packaging Tape Printing Market, By End-User Industry (Page No. - 91)

11.1 Introduction

11.2 Food & Beverages

11.3 Consumer Durables

11.4 Transportation & Logistics

11.5 Others

12 Packaging Tape Printing Market, By Region (Page No. - 95)

12.1 Introduction

12.2 Asia-Pacific

12.2.1 Asia-Pacific: Packaging Tape Printing Market, By Country

12.2.1.1 China Dominated the Packaging Tape Printing Market in Asia-Pacific

12.2.2 Asia-Pacific: Packaging Tape Printing Market, By Product Type

12.2.2.1 Hot Melt Carton Sealing Tape Projected to Be the Fastest-Growing Segment in the Asia-Pacific Packaging Tape Printing Market

12.2.3 Asia-Pacific: Packaging Tape Printing Market, By Material

12.2.3.1 Polypropylene Held the Largest Share in the North American Packaging Tape Printing Market

12.2.4 Asia-Pacific: Packaging Tape Printing Market, By Printing Ink

12.2.4.1 Water-Based Ink Segment Held the Largest Share in the APAC Packaging Tape Printing Market

12.2.5 Asia-Pacific: Packaging Tape Printing Market, By Mechanism

12.2.5.1 Rising Demand of Digital Printing A Driving Factor in the Growth of APAC Packaging Tape Printing Market

12.2.6 Asia-Pacific: Packaging Tape Printing Market, By End-User Industry

12.2.6.1 Rising Demand From End-User Industry A Driving Factor in the Growth of the APAC Packaging Tape Printing Market

12.2.7 China

12.2.7.1 China: Packaging Tape Printing Market, By Product Type

12.2.7.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Packaging Tape Printing Market of the China

12.2.7.2 China: Packaging Tape Printing Market, By Material

12.2.7.2.1 Polypropylene Accounted for the Largest Share in the Chinese in this Market

12.2.7.3 China: Packaging Tape Printing Market, By Printing Ink

12.2.7.3.1 Water-Based Ink Held the Largest Share in the Chinese in this Market

12.2.7.4 China: Packaging Tape Printing Market, By Mechanism

12.2.7.4.1 Digital Printing Accounted for the Largest Share in the Chinese in this Market

12.2.7.5 China: Packaging Tape Printing Market, By End-User Industry

12.2.7.5.1 Food & Beverages Accounted for the Largest Share in the Chinese in this Market

12.2.8 Japan

12.2.8.1 Japan: Packaging Tape Printing Market, By Product Type

12.2.8.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Japanese Packaging Tape Printing Market

12.2.8.2 Japan: Packaging Tape Printing Market, By Material

12.2.8.2.1 Polypropylene Accounted for the Largest Share in the Japanese in this Market

12.2.8.3 Japan: Packaging Tape Printing Market, By Printing Ink

12.2.8.3.1 Water-Based Ink Held the Largest Share in the Japanese in this Market

12.2.8.4 Japan: Packaging Tape Printing Market, By Mechanism

12.2.8.4.1 Digital Printing Accounted for the Largest Share in the Japanese in this Market

12.2.8.5 Japan: Packaging Tape Printing Market, By End-User Industry

12.2.8.5.1 Food & Beverages Accounted for the Largest Share in the Japanese in this Market

12.2.9 India

12.2.9.1 India: Packaging Tape Printing Market, By Product Type

12.2.9.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Indian Packaging Tape Printing Market

12.2.9.2 India: Packaging Tape Printing Market, By Material

12.2.9.2.1 Polypropylene Accounted for the Largest Share in the Indian in this Market

12.2.9.3 India: Packaging Tape Printing Market, By Printing Ink

12.2.9.3.1 Water-Based Ink Accounted for the Largest Share in the Indian in this Market

12.2.9.4 India: Packaging Tape Printing Market, By Mechanism

12.2.9.4.1 Digital Printing Accounted for the Largest Share in the Indian in this Market

12.2.9.5 India: Packaging Tape Printing Market, By End-User Industry

12.2.9.5.1 Food & Beverages Accounted for the Largest Share in the Indian in this Market

12.2.10 Rest of Asia-Pacific

12.2.10.1 Rest of Asia-Pacific: Packaging Tape Printing Market, By Product Type

12.2.10.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Rest of Asia-Pacific in this Market

12.2.10.2 Rest of Asia-Pacific: Packaging Tape Printing Market, By Material

12.2.10.2.1 Polypropylene Accounted for the Largest Share in the Rest of Asia-Pacific in this Market

12.2.10.3 Rest of Asia-Pacific: Packaging Tape Printing Market, By Printing Ink

12.2.10.3.1 Water-Based Ink Accounted for the Largest Share in the Rest of Asia-Pacific in this Market

12.2.10.4 Rest of Asia-Pacific: Packaging Tape Printing Market, By Mechanism

12.2.10.4.1 Digital Printing Accounted for the Largest Share in the Rest of Asia-Pacific in this Market

12.2.10.5 Rest of Asia-Pacific: Packaging Tape Printing Market, By End-User Industry

12.2.10.5.1 Food & Beverages Accounted for the Largest Share in the Rest of Asia-Pacific in this Market

12.3 Europe

12.3.1 Europe: Packaging Tape Printing Market, By Country

12.3.1.1 Germany Dominated the European Packaging Tape Printing Market

12.3.2 Europe: Packaging Tape Printing Market, By Product Type

12.3.2.1 Hot Melt Carton Sealing Tape Projected to Be the Fastest-Growing Segment in the European Packaging Tape Printing Market

12.3.3 Europe: Packaging Tape Printing Market, By Material

12.3.3.1 Polypropylene Segment Held the Largest Share in the European Packaging Tape Printing Market

12.3.4 Europe: Packaging Tape Printing Market, By Printing Ink

12.3.4.1 Water-Based Ink Segment Held the Largest Share in the European Packaging Tape Printing Market

12.3.5 Europe: Packaging Tape Printing Market, By Mechanism

12.3.5.1 Rising Demand for Digital Printing: Driving Factor in the Growth of European Packaging Tape Printing Market

12.3.6 Europe: Packaging Tape Printing Market, By End-User Industry

12.3.6.1 Rising Demand From End-User Industry: Driving Factor in the Growth of the European Packaging Tape Printing Market

12.3.7 Germany

12.3.7.1 Germany: Packaging Tape Printing Market, By Product Type

12.3.7.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Packaging Tape Printing Market in Germany

12.3.7.2 Germany: Packaging Tape Printing Market, By Material

12.3.7.2.1 Polypropylene Accounted for the Largest Share in the German Packaging Tape Printing Market

12.3.7.3 Germany: Packaging Tape Printing Market, By Printing Ink

12.3.7.3.1 Water-Based Ink Segment Held the Largest Share in the German Packaging Tape Printing Market

12.3.7.4 Germany: Packaging Tape Printing Market, By Mechanism

12.3.7.4.1 Digital Printing Segment Accounted for the Largest Share in the German Packaging Tape Printing Market

12.3.7.5 Germany: Packaging Tape Printing Market, By End-User Industry

12.3.7.5.1 Food & Beverages Accounted for the Largest Share in the German Packaging Tape Printing Market

12.3.8 France

12.3.8.1 France: Packaging Tape Printing Market, By Product Type

12.3.8.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Packaging Tape Printing Market in France

12.3.8.2 France: Packaging Tape Printing Market, By Material

12.3.8.2.1 Polypropylene Accounted for the Largest Share in the Packaging Tape Printing Market of France

12.3.8.3 France: Packaging Tape Printing Market, By Printing Ink

12.3.8.3.1 Water-Based Ink Held the Largest Share in the Packaging Tape Printing Market of France

12.3.8.4 France: Packaging Tape Printing Market, By Mechanism

12.3.8.4.1 Digital Printing Accounted for the Largest Share in the Packaging Tape Printing Market of France

12.3.8.5 France: Packaging Tape Printing Market, By End-User Industry

12.3.8.5.1 Food & Beverages Accounted for the Largest Share in the Packaging Tape Printing Market in France

12.3.9 U.K.

12.3.9.1 U.K.: Packaging Tape Printing Market, By Product Type

12.3.9.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the U.K. Market

12.3.9.2 U.K.: Packaging Tape Printing Market, By Material

12.3.9.2.1 Polypropylene Segment Accounted for the Largest Share in the U.K. Packaging Tape Printing Market

12.3.9.3 U.K.: Packaging Tape Printing Market, By Printing Ink

12.3.9.3.1 Water-Based Ink Segment Accounted for the Largest Share in the U.K. Packaging Tape Printing Market

12.3.9.4 U.K.: Packaging Tape Printing Market, By Mechanism

12.3.9.4.1 Digital Printing Segment Accounted for the Largest Share in the U.K. Packaging Tape Printing Market

12.3.9.5 U.K.: Packaging Tape Printing Market, By End-User Industry

12.3.9.5.1 Food & Beverages Accounted for the Largest Share in the U.K. Packaging Tape Printing Market

12.3.10 Rest of Europe

12.3.10.1 Rest of Europe: Packaging Tape Printing Market, By Product Type

12.3.10.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Rest of Europe

12.3.10.2 Rest of Europe: Packaging Tape Printing Market, By Material

12.3.10.2.1 Polypropylene Segment Accounted for the Largest Share in the Rest of Europe Market

12.3.10.3 Rest of Europe: Packaging Tape Printing Market, By Printing Ink

12.3.10.3.1 Water-Based Ink Segment Accounted for the Largest Share in the Rest of Europe Market

12.3.10.4 Rest of Europe: Packaging Tape Printing Market, By Mechanism

12.3.10.4.1 Digital Printing Segment Accounted for the Largest Share in the Rest of Europe Market

12.3.10.5 Rest of Europe: Packaging Tape Printing Market, By End-User Industry

12.3.10.5.1 Food & Beverages Segment Accounted for the Largest Share in the Rest of Europe Market

12.4 North America

12.4.1 North American Packaging Tape Printing Market, By Country

12.4.1.1 U.S. Dominated the Packaging Tape Printing Market in North America

12.4.2 North American Packaging Tape Printing Market, By Product Type

12.4.2.1 Hot Melt Carton Sealing Tape is Projected to Be the Fastest-Growing Segment in the North American Packaging Tape Printing Market

12.4.3 North American Packaging Tape Printing Market, By Material

12.4.3.1 Polypropylene Accounted for the Largest Share in the North American Packaging Tape Printing Market

12.4.4 North American Packaging Tape Printing Market, By Printing Ink

12.4.4.1 Water-Based Ink Segment Held the Largest Value in the North American Packaging Tape Printing Market

12.4.5 North American Packaging Tape Printing Market, By Mechanism

12.4.5.1 Rising Demand of Digital Printing is the Driving Factor in the Growth of North American Packaging Tape Printing Market

12.4.6 North American Packaging Tape Printing Market, By End-User Industry

12.4.6.1 Rising Demand From End-User Industry is the Driving Factor in the Growth of the North American Packaging Tape Printing Market

12.4.7 U.S.

12.4.7.1 U.S.: Packaging Tape Printing Market, By Product Type

12.4.7.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the U.S. Packaging Tape Printing Market

12.4.7.2 U.S.: Packaging Tape Printing Market, By Material

12.4.7.2.1 Polypropylene Accounted for the Largest Share in the U.S. Packaging Tape Printing Market

12.4.7.3 U.S.: Packaging Tape Printing Market, By Printing Ink

12.4.7.3.1 Water-Based Ink Accounted for the Largest Value in the U.S. Packaging Tape Printing Market

12.4.7.4 U.S.: Packaging Tape Printing Market, By Mechanism

12.4.7.4.1 Digital Printing Accounted for the Largest Share in the U.S. Packaging Tape Printing Market

12.4.7.5 U.S.: Packaging Tape Printing Market, By End-User Industry

12.4.7.5.1 Food & Beverages Accounted for the Largest Share in the U.S. Packaging Tape Printing Market

12.4.8 Canada

12.4.8.1 Canada: Packaging Tape Printing Market, By Product Type

12.4.8.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Canadian Packaging Tape Printing Market

12.4.8.2 Canada: Packaging Tape Printing Market, By Material

12.4.8.2.1 Polypropylene Accounted for the Largest Share in the Canadian Packaging Tape Printing Market

12.4.8.3 Canada: Packaging Tape Printing Market, By Printing Ink

12.4.8.3.1 Water-Based Ink Accounted for the Largest Share in the Canadian Packaging Tape Printing Market

12.4.8.4 Canada: Packaging Tape Printing Market, By Mechanism

12.4.8.4.1 Digital Printing Accounted for the Largest Share in the Canadian Packaging Tape Printing Market

12.4.8.5 Canada: Packaging Tape Printing Market, By End-User Industry

12.4.8.5.1 Food & Beverages Accounted for the Largest Share in the Canadian Packaging Tape Printing Market

12.4.9 Mexico

12.4.9.1 Mexico: Packaging Tape Printing Market, By Product Type

12.4.9.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Mexican Packaging Tape Printing Market

12.4.9.2 Mexico: Packaging Tape Printing Market, By Material

12.4.9.2.1 Polypropylene Accounted for the Largest Share in the Mexican Packaging Tape Printing Market

12.4.9.3 Mexico: Packaging Tape Printing Market, By Printing Ink

12.4.9.3.1 Water-Based Ink Accounted for the Largest Share in the Mexican Packaging Tape Printing Market

12.4.9.4 Mexico: Packaging Tape Printing Market, By Mechanism

12.4.9.4.1 Digital Printing Accounted for the Largest Share in the Mexican Packaging Tape Printing Market

12.4.9.5 Mexico: Packaging Tape Printing Market, By End-User Industry

12.4.9.5.1 Food & Beverages Accounted for the Largest Share in the Mexican Packaging Tape Printing Market

12.5 Rest of the World (RoW)

12.5.1 Rest of the World: Packaging Tape Printing Market, By Country

12.5.1.1 Brazil Dominated the Packaging Tape Printing Market in Rest of the World

12.5.2 Rest of the World: Packaging Tape Printing Market, By Product Type

12.5.2.1 Hot Melt Carton Sealing Tape: Projected to Be the Fastest-Growing Segment in the Rest of the World Packaging Tape Printing Market

12.5.3 Rest of the World: Packaging Tape Printing Market, By Material

12.5.3.1 Polypropylene Held the Largest Share in the RoW Packaging Tape Printing Market

12.5.4 Rest of the World: Packaging Tape Printing Market, By Printing Ink

12.5.4.1 Water-Based Ink Segment Held the Largest Share in the RoW Packaging Tape Printing Market

12.5.5 Rest of the World: Packaging Tape Printing Market, By Mechanism

12.5.5.1 Rising Demand for Digital Printing A Driving Factor in the Growth of RoW Packaging Tape Printing Market

12.5.6 Rest of the World: Packaging Tape Printing Market, By End-User Industry

12.5.6.1 Rising Demand From End-User Industry A Driving Factor in the Growth of the RoW Packaging Tape Printing Market

12.5.7 Brazil

12.5.7.1 Brazil: Packaging Tape Printing Market, By Product Type

12.5.7.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Packaging Tape Printing Market of Brazil

12.5.7.2 Brazil: Packaging Tape Printing Market, By Material

12.5.7.2.1 Polypropylene Accounted for the Largest Share in the Packaging Tape Printing Market of Brazil

12.5.7.3 Brazil: Packaging Tape Printing Market, By Printing Ink

12.5.7.3.1 Water-Based Ink Held the Largest Share in the Packaging Tape Printing Market of Brazil

12.5.7.4 Brazil: Packaging Tape Printing Market, By Mechanism

12.5.7.4.1 Digital Printing Accounted for the Largest Share in the Packaging Tape Printing Market of Brazil

12.5.7.5 Brazil: Packaging Tape Printing Market, By End-User Industry

12.5.7.5.1 Food & Beverages Accounted for the Largest Share in the Packaging Tape Printing Market of Brazil

12.5.8 Argentina

12.5.8.1 Argentina: Packaging Tape Printing Market, By Product Type

12.5.8.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Packaging Tape Printing Market of Argentina

12.5.8.2 Argentina: Packaging Tape Printing Market, By Material

12.5.8.2.1 Polypropylene Accounted for the Largest Share in the Packaging Tape Printing Market of Argentina

12.5.8.3 Argentina: Packaging Tape Printing Market, By Printing Ink

12.5.8.3.1 Water-Based Ink Held the Largest Share in the Packaging Tape Printing Market of Argentina

12.5.8.4 Argentina: Packaging Tape Printing Market, By Mechanism

12.5.8.4.1 Digital Printing Accounted for the Largest Share in the Packaging Tape Printing Market of Argentina

12.5.8.5 Argentina: Packaging Tape Printing Market, By End-User Industry

12.5.8.5.1 Food & Beverages Accounted for the Largest Share in the Packaging Tape Printing Market of Argentina

12.5.9 South Africa

12.5.9.1 South Africa: Packaging Tape Printing Market, By Product Type

12.5.9.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the South African Packaging Tape Printing Market

12.5.9.2 South Africa: Packaging Tape Printing Market, By Material

12.5.9.2.1 Polypropylene Accounted for the Largest Share in the South African Packaging Tape Printing Market

12.5.9.3 South Africa: Packaging Tape Printing Market, By Printing Ink

12.5.9.3.1 Water-Based Ink Accounted for the Largest Share in the South African Packaging Tape Printing Market

12.5.9.4 South Africa: Packaging Tape Printing Market, By Mechanism

12.5.9.4.1 Digital Printing Accounted for the Largest Share in the South African Packaging Tape Printing Market

12.5.9.5 South Africa: Packaging Tape Printing Market, By End-User Industry

12.5.9.5.1 Food & Beverages Accounted for the Largest Share in the South African Packaging Tape Printing Market

12.5.10 Other Countries in RoW

12.5.10.1 Other Countries in RoW: Packaging Tape Printing Market, By Product Type

12.5.10.1.1 Hot Melt Carton Sealing Tape Segment Projected to Grow at the Highest Rate in the Other Countries in RoW Packaging Tape Printing Market

12.5.10.2 Other Countries in RoW: Packaging Tape Printing Market, By Material

12.5.10.2.1 Polypropylene Accounted for the Largest Share in the Other Countries in RoW Packaging Tape Printing Market

12.5.10.3 Other Countries in RoW: Packaging Tape Printing Market, By Printing Ink

12.5.10.3.1 Water-Based Ink Accounted for the Largest Share in the Other Countries in RoW Packaging Tape Printing Market

12.5.10.4 Other Countries in RoW: Packaging Tape Printing Market, By Mechanism

12.5.10.4.1 Digital Printing Accounted for the Largest Share in the Other Countries in RoW Packaging Tape Printing Market

12.5.10.5 Other Countries in RoW: Packaging Tape Printing Market, By End-User Industry

12.5.10.5.1 Food & Beverages Accounted for the Largest Share in the Other Countries in RoW Packaging Tape Printing Market

13 Competitive Landscape (Page No. - 208)

13.1 Overview

13.2 Leading Players in the Global Packaging Tape Printing Market

13.3 Competitive Situations & Trends

13.4 New Product Launches & Technological Advancements: the Key Strategy, 2011-2015

13.4.1 Mergers & Acquisitions

13.4.2 Expansions

13.4.3 New Product Launches & Technological Advancements

13.4.4 Partnerships& Agreements

14 Company Profiles (Page No. - 215)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

14.1 Introduction

14.2 Hewlett-Packard Development Company, L.P.

14.3 E. I. Du Pont De Nemours and Company

14.4 Quad/Graphics Inc.

14.5 Xerox Corporation

14.6 RR Donnelley & Sons Company

14.7 Cenveo, Inc.

14.8 Canon U.S.A, Inc.

14.9 Flexcon Company Inc.

14.10 Siat SPA

14.11 Ws Packaging Group

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 245)

15.1 Discussion Guide

15.2 Introducing RT: Real Time Market Intelligence

15.3 Available Customization

15.4 Related Reports

List of Tables (224 Tables)

Table 1 Global Packaging Tape Printing Product Types & Their Descriptions

Table 2 Global Packaging Tape Printing Materials & Their Descriptions

Table 3 Global Packaging Tape Printing Inks & Their Descriptions

Table 4 Global Packaging Tape Printing Mechanisms & Their Descriptions

Table 5 Global Packaging Tape Printing End-User Industries & Their Descriptions

Table 6 Growing Demand From the End-User Industry Driving the Growth of Global Packaging Tape Printing Market

Table 7 High Capital Investment has Played A Major Role in Restraining the Growth of the Global Packaging Tape Printing Market

Table 8 Emergence of New Technologies Enfolds Plethora of Opportunities for the Global Packaging Tape Printing Market

Table 9 High Demand for Hygienic Packaging has Played A Major Role in Driving the Growth of the Global Packaging Tape Printing Market

Table 10 Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 11 Packaging Tape Printing Market Size, By Product Type, 20132020 (Million Square Meter)

Table 12 Packaging Tape Printing Market Size, By Material, 20132020 (USD Million)

Table 13 Packaging Tape Printing Market Size, By Material, 20132020 (Million Square Meter)

Table 14 Packaging Tape Printing Market Size, By Printing Ink, 20132020 (USD Million)

Table 15 Packaging Tape Printing Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 16 Packaging Tape Printing Market Size, By Mechanism, 20132020 (USD Million)

Table 17 Packaging Tape Printing Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 18 Packaging Tape Printing Market Size, By End-User Industry, 20132020 (USD Million)

Table 19 Packaging Tape Printing Market Size, By End-User Industry, 20132020 (Million Square Meters)

Table 20 Packaging Tape Printing Market Size, By Region, 20132020 (USD Million)

Table 21 Packaging Tape Printing Market Size, By Region, 20132020 (Million Square Meter)

Table 22 Asia-Pacific: Packaging Tape Printing Market Size, By Country, 20132020 (USD Million)

Table 23 Asia-Pacific: By Market Size, By Country, 20132020 (Million Square Meter)

Table 24 Asia-Pacific: By Market Size, By Product Type, 20132020 (USD Million)

Table 25 Asia-Pacific: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 26 Asia-Pacific: By Market Size, By Material, 20132020 (USD Million)

Table 27 Asia-Pacific: By Market Size, By Material, 20132020 (Million Square Meter)

Table 28 Asia-Pacific: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 29 Asia-Pacific: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 30 Asia-Pacific: By Market Size, By Mechanism, 20132020 (USD Million)

Table 31 Asia-Pacific: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 32 Asia-Pacific: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 33 Asia-Pacific: By MarketMarket Size, By End-User Industry, 20132020 (Million Square Meter)

Table 34 China: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 35 China: By MarketSize, By Product Type, 20132020 (Million Square Meter)

Table 36 China: By Market Size, By Material, 20132020 (USD Million)

Table 37 China: By Market Size, By Material, 20132020 (Million Square Meter)

Table 38 China: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 39 China: By MarketSize, By Printing Ink, 20132020 (Million Square Meter)

Table 40 China: By Market Size, By Mechanism, 20132020 (USD Million)

Table 41 China: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 42 China: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 43 China: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 44 Japan: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 45 Japan: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 46 Japan: By Market Size, By Material, 20132020 (USD Million)

Table 47 Japan: Packaging Tape Printing Market Size, By Material, 20132020 (Million Square Meter)

Table 48 Japan: By MarketSize, By Printing Ink, 20132020 (USD Million)

Table 49 Japan: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 50 Japan: By Market Size, By Mechanism, 20132020 (USD Million)

Table 51 Japan: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 52 Japan: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 53 Japan: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 54 India: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 55 India: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 56 India: By Market Size, By Material, 20132020 (USD Million)

Table 57 India: By Market Size, By Material, 20132020 (Million Square Meter)

Table 58 India: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 59 India: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 60 India: By Market Size, By Mechanism, 20132020 (USD Million)

Table 61 India: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 62 India: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 63 India: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 64 Rest of Asia-Pacific: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 65 Rest of Asia-Pacific: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 66 Rest of Asia-Pacific: By Market Size, By Material, 20132020 (USD Million)

Table 67 Rest of Asia-Pacific: By Market Size, By Material, 20132020 (Million Square Meter)

Table 68 Rest of Asia-Pacific: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 69 Rest of Asia-Pacific: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 70 Rest of Asia-Pacific: By Market Size, By Mechanism, 20132020 (USD Million)

Table 71 Rest of Asia-Pacific: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 72 Rest of Asia-Pacific: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 73 Rest of Asia-Pacific: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 74 Europe: Packaging Tape Printing Market Size, By Country, 20132020 (USD Million)

Table 75 Europe: By Market Size, By Country, 20132020 (Million Square Meter)

Table 76 Europe: By Market Size, By Product Type, 20132020 (USD Million)

Table 77 Europe: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 78 Europe: By Market Size, By Material, 20132020 (USD Million)

Table 79 Europe: By Market Size, By Material, 20132020 (Million Square Meter)

Table 80 Europe: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 81 Europe: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 82 Europe: By Market Size, By Mechanism, 20132020 (USD Million)

Table 83 Europe: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 84 Europe: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 85 Europe: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 86 Germany: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 87 Germany: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 88 Germany: By Market Size, By Material, 20132020 (USD Million)

Table 89 Germany: By Market Size, By Material, 20132020 (Million Square Meter)

Table 90 Germany: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 91 Germany: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 92 Germany: By Market Size, By Mechanism, 20132020 (USD Million)

Table 93 Germany: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 94 Germany: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 95 Germany: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 96 France: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 97 France: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 98 France: By Market Size, By Material, 20132020 (USD Million)

Table 99 France: By Market Size, By Material, 20132020 (Million Square Meter)

Table 100 France: Packaging Tape Printing Market Size, By Printing Ink, 20132020 (USD Million)

Table 101 France: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 102 France: By Market Size, By Mechanism, 20132020 (USD Million)

Table 103 France: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 104 France: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 105 France: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 106 U.K.: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 107 U.K.: By Market Size, By Product Type, 20132020 (Million Square Meter)

Table 108 U.K.: By Market Size, By Material, 20132020 (USD Million)

Table 109 U.K.: By Market Size, By Material, 20132020 (Million Square Meter)

Table 110 U.K.: By Market Size, By Printing Ink, 20132020 (USD Million)

Table 111 U.K.: By Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 112 U.K.: By Market Size, By Mechanism, 20132020 (USD Million)

Table 113 U.K.: By Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 114 U.K.: By Market Size, By End-User Industry, 20132020 (USD Million)

Table 115 U.K.: By Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 116 Rest of Europe: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 117 Rest of Europe: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 118 Rest of Europe: Market Size, By Material, 20132020 (USD Million)

Table 119 Rest of Europe: Market Size, By Material, 20132020 (Million Square Meter)

Table 120 Rest of Europe: Market Size, By Printing Ink, 20132020 (USD Million)

Table 121 Rest of Europe: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 122 Rest of Europe: Market Size, By Mechanism, 20132020 (USD Million)

Table 123 Rest of Europe: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 124 Rest of Europe: Market Size, By End-User Industry, 20132020 (USD Million)

Table 125 Rest of Europe: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 126 North American: Packaging Tape Printing Market Size, By Country, 20132020 (USD Million)

Table 127 North American: Market Size, By Country, 20132020 (Million Square Meter)

Table 128 North American: Market Size, By Product Type, 20132020 (USD Million)

Table 129 North American: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 130 North American: Market Size, By Material, 20132020 (USD Million)

Table 131 North American: Market Size, By Material, 20132020 (Million Square Meter)

Table 132 North American: Market Size, By Printing Ink, 20132020 (USD Million)

Table 133 North American: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 134 North American: Market Size, By Mechanism, 20132020 (USD Million)

Table 135 North American:Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 136 North American:Market Size, By End-User Industry, 20132020 (USD Million)

Table 137 North American: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 138 U.S.: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 139 U.S.: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 140 U.S.: Market Size, By Material, 20132020 (USD Million)

Table 141 U.S.: Market Size, By Material, 20132020 (Million Square Meter)

Table 142 U.S.: Market Size, By Printing Ink, 20132020 (USD Million)

Table 143 U.S.: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 144 U.S.: Market Size, By Mechanism, 20132020 (USD Million)

Table 145 U.S.: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 146 U.S.: Market Size, By End-User Industry, 20132020 (USD Million)

Table 147 U.S.: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 148 Canada: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 149 Canada: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 150 Canada: Market Size, By Material, 20132020 (USD Million)

Table 151 Canada: Market Size, By Material, 20132020 (Million Square Meter)

Table 152 Canada: Market Size, By Printing Ink, 20132020 (USD Million)

Table 153 Canada: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 154 Canada: Market Size, By Mechanism, 20132020 (USD Million)

Table 155 Canada: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 156 Canada: Market Size, By End-User Industry, 20132020 (USD Million)

Table 157 Canada: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 158 Mexico: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 159 Mexico: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 160 Mexico: Market Size, By Material, 20132020 (USD Million)

Table 161 Mexico: Market Size, By Material, 20132020 (Million Square Meter)

Table 162 Mexico: Market Size, By Printing Ink, 20132020 (USD Million)

Table 163 Mexico: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 164 Mexico: Market Size, By Mechanism, 20132020 (USD Million)

Table 165 Mexico: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 166 Mexico: Market Size, By End-User Industry, 20132020 (USD Million)

Table 167 Mexico: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 168 Rest of the World: Packaging Tape Printing Market Size, By Country, 20132020 (USD Million)

Table 169 Rest of the World: Market Size, By Country, 20132020 (Million Square Meter)

Table 170 Rest of the World: Market Size, By Product Type, 20132020 (USD Million)

Table 171 Rest of the World: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 172 Rest of the World: Market Size, By Material, 20132020 (USD Million)

Table 173 Rest of the World: Market Size, By Material, 20132020 (Million Square Meter)

Table 174 Rest of the World: Market Size, By Printing Ink, 20132020 (USD Million)

Table 175 Rest of the World: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 176 Rest of the World: Market Size, By Mechanism, 20132020 (USD Million)

Table 177 Rest of the World: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 178 Rest of the World: Market Size, By End-User Industry, 20132020 (USD Million)

Table 179 Rest of the World: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 180 Brazil: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 181 Brazil: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 182 Brazil: Market Size, By Material, 20132020 (USD Million)

Table 183 Brazil: Market Size, By Material, 20132020 (Million Square Meter)

Table 184 Brazil: Market Size, By Printing Ink, 20132020 (USD Million)

Table 185 Brazil: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 186 Brazil: Market Size, By Mechanism, 20132020 (USD Million)

Table 187 Brazil: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 188 Brazil: Market Size, By End-User Industry, 20132020 (USD Million)

Table 189 Brazil: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 190 Argentina: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 191 Argentina: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 192 Argentina: Market Size, By Material, 20132020 (USD Million)

Table 193 Argentina: Market Size, By Material, 20132020 (Million Square Meter)

Table 194 Argentina: Market Size, By Printing Ink, 20132020 (USD Million)

Table 195 Argentina: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 196 Argentina: Market Size, By Mechanism, 20132020 (USD Million)

Table 197 Argentina: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 198 Argentina: Market Size, By End-User Industry, 20132020 (USD Million)

Table 199 Argentina: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 200 South Africa: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 201 South Africa: Market Size, By Product Type, 20132020 (Million Square Meter)

Table 202 South Africa: Market Size, By Material, 20132020 (USD Million)

Table 203 South Africa: Market Size, By Material, 20132020 (Million Square Meter)

Table 204 South Africa: Market Size, By Printing Ink, 20132020 (USD Million)

Table 205 South Africa: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 206 South Africa: Market Size, By Mechanism, 20132020 (USD Million)

Table 207 South Africa: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 208 South Africa: Market Size, By End-User Industry, 20132020 (USD Million)

Table 209 South Africa: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 210 Other Countries in RoW: Packaging Tape Printing Market Size, By Product Type, 20132020 (USD Million)

Table 211 Other Countries in RoW:Market Size, By Product Type, 20132020 (Million Square Meter)

Table 212 Other Countries in RoW: Market Size, By Material, 20132020 (USD Million)

Table 213 Other Countries in RoW: Market Size, By Material, 20132020 (Million Square Meter)

Table 214 Other Countries in RoW: Market Size, By Printing Ink, 20132020 (USD Million)

Table 215 Other Countries in RoW: Market Size, By Printing Ink, 20132020 (Million Square Meter)

Table 216 Other Countries in RoW: Market Size, By Mechanism, 20132020 (USD Million)

Table 217 Other Countries in RoW: Market Size, By Mechanism, 20132020 (Million Square Meter)

Table 218 Other Countries in RoW: Market Size, By End-User Industry, 20132020 (USD Million)

Table 219 Other Countries in RoW: Market Size, By End-User Industry, 20132020 (Million Square Meter)

Table 220 Rank of Companies in the Global Packaging Tape Printing Market, 2015

Table 221 Mergers & Acquisitions, 20112014

Table 222 Expansions, 20112015

Table 223 New Product Launches & Technological Advancements, 20132015

Table 224 Partnerships & Agreements, 20112015

List of Figures (55 Figures)

Figure 1 Packaging Tape Printing Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown & Data Triangulation

Figure 5 Hot Melt Acrylic Carton Sealing Tapes: Largest Segment for in Packaging Tape Printing Market

Figure 6 Food & Beverages Segment to Witness Highest Growth, 2015-2020

Figure 7 Polypropylene Projected to Be the Largest Segment Among Materials in the Packaging Tape Printing Market By 2020

Figure 8 Water-Based Inks Segment Dominated the Packaging Tape Printing Market By 2020

Figure 9 Digital Printing Projected to Be the Largest Mechanism Segment in the Packaging Tape Printing Market By 2020

Figure 10 Asia-Pacific Projected to Be the Largest and Fastest-Growing Market By 2020

Figure 11 Asia-Pacific Offers Lucrative Opportunities in the Global Packaging Tape Printing Market

Figure 12 Asia-Pacific is Expected to Grow at the Highest Rate Between 2015 & 2020

Figure 13 Food & Beverages Accounted for the Largest Share in the Global Packaging Tape Printing Market in 2015

Figure 14 Hot Melt Carton Sealing Tapes Witnessed Largest Consumption in the Global Packaging Tape Printing Market in 2015 (Million Square Meter)

Figure 15 Polypropylene Witnessed Largest Consumption in the Global Packaging Tape Printing Market in 2015 (Million Square Meter)

Figure 16 Water-Based Ink Dominated the Global Packaging Tape Printing Market in 2015 (Million Square Meter)

Figure 17 Digital Printing Dominated the Global Packaging Tape Printing Market in 2015 (Million Square Meter)

Figure 18 Food & Beverages Industry Accounted for the Largest Value in the Global Packaging Tape Printing Market During the Forecast Period (USD Billion)

Figure 19 Asia-Pacific Emerged as A Lucrative Market During the Forecast Period (USD Million)

Figure 20 Evolution of Global Packaging Tape Printing Market

Figure 21 Global Packaging Tape Printing Market Segmentation

Figure 22 High Demand for Aesthetically Appealing Printed Tapes Driving the Growth of Global Packaging Tape Printing Market

Figure 23 High Demand for Digital Printing Driving the Growth of Global Packaging Tape Printing Market, 2015-2020 (USD Million)

Figure 24 Fluctuation in the Prices of Paper Causing Unfavorable Impact on the Growth of Printing Industry

Figure 25 Value Chain Analysis for Global Packaging Tape Printing: Major Value is Added During the Assembly Phase

Figure 26 Porters Five Forces Analysis

Figure 27 Packaging Tape Printing Market Size, By Product Type, 2015 vs 2020 (USD Million)

Figure 28 Packaging Tape Printing Market, By Material, 2015 vs 2020 (USD Million)

Figure 29 Packaging Tape Printing Market, By Printing Ink, 2015 vs 2020, (USD Million)

Figure 30 Packaging Tape Printing Market, By Mechanism, 2015 vs 2020 (USD Million)

Figure 31 Packaging Tape Printing Market, By End-User Industry, 2015 vs 2020 (USD Million)

Figure 32 Geographic Snapshot (2015-2020): the U.S. and Mexico are Emerging as New Hot Spots

Figure 33 Packaging Tape Printing Market Size, By Region, 2015 vs 2020 (USD Million)

Figure 34 Packaging Tape Printing Market Snapshot: China Projected to Lead the Market Between 2015 & 2020

Figure 35 Asia-Pacific: Packaging Tape Printing Market Size, By Country, 2015 vs 2020 (USD Million)

Figure 36 European Packaging Tape Printing Market Snapshot: Germany Projected to Lead the Market Between 2015 & 2020

Figure 37 European Packaging Tape Printing Market Size, By Region, 2015 vs 2020 (USD Billion)

Figure 38 North American Packaging Tape Printing Market Snapshot: the U.S. is Projected to Be the Global Leader Between 2015 & 2020

Figure 39 North American Packaging Tape Printing Market Size, By Country, 2015 vs 2020 (USD Billion)

Figure 40 RoW: Packaging Tape Printing Market Size, By Country, 2015 vs 2020 (USD Billion)

Figure 41 Companies Adopted New Product Launches & Technological Advancements as the Key Growth Strategies Over the Last Three Years (20132015)

Figure 42 New Product Launches &Technological Advancements: the Key Strategy, 20112015

Figure 43 Geographic Revenue Mix of Top Five Market Players

Figure 44 Hewlett-Packard Development Company, L.P.: Company Snapshot

Figure 45 SWOT Analysis: Hewlett-Packard Development Company, L.P.

Figure 46 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 47 SWOT Analysis: E. I. Du Pont De Nemours and Company

Figure 48 Quad/Graphics, Inc.: Company Snapshot

Figure 49 SWOT Analysis: Quad/Graphics, Inc.

Figure 50 Xerox Corporation: Company Snapshot

Figure 51 SWOT Analysis: Xerox Corporation

Figure 52 RR Donnelley & Sons Company: Company Snapshot

Figure 53 SWOT Analysis: RR Donnelley & Sons Company

Figure 54 Cenveo, Inc.: Company Snapshot

Figure 55 Canon USA, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Printed Tape Market