Patient Experience Technology Market Size, Growth, Share & Trends Analysis

Patient Experience Technology Market by Offering, Function [Appointment (Online Booking), Registration (Intake), Virtual Care (Telehealth, RPM), Communication, Feedback], End User (Providers, Payers, Pharma & Biotech), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global patient experience technology market is projected to reach USD 1.16 billion by 2030, up from USD 0.66 billion in 2025, growing at a CAGR of 11.8%. This robust growth is due to the rising adoption of telemedicine and AI-driven engagement tools, coupled with government-backed digital health initiatives that promote patient-centered care and accessibility.

KEY TAKEAWAYS

- By offering, the software segment accounted for 67.5% revenue share in 2024.

- By function, the patient communication segment is projected to grow at the fastest rate from 2025 to 2030.

- By end user, the healthcare payers segment is expected to register the highest CAGR of 13.0%.

- The North America patient experience technology market accounted for a 44.6% revenue share in 2024.

- Epic, IQVIA, and Press Ganey were identified as some of the star players in the patient experience technology market (global), given their strong market share and product footprint.

- Vital, Nexhealth, and Collectly, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The patient experience technology market is witnessing steady growth, driven by rising patient demand for convenience through digital-first services, such as mobile apps and self-service portals. Additionally, integration of interoperable health data systems is driving adoption, enabling seamless care coordination, improved outcomes, and stronger trust between patients and providers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hot belts are the clients of patient experience technology manufacturers, and target applications are the clients of patient experience technology manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of patient experience technology manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for digital engagement platforms and personalized patient care

-

Increasing adoption of telehealth, mobile health apps, and AI-powered analytics

Level

-

Data privacy and cybersecurity concerns

-

High implementation and integration costs for healthcare providers

Level

-

Growth opportunities in emerging markets

-

Adoption of AI-driven personalization and predictive analytics for patient care

Level

-

Need to ensure accuracy and reliability of patient feedback data

-

Rapid technological evolution

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for digital engagement platforms and personalized patient care

The global shift toward patient-centric and accessible care models is driving strong demand for digital engagement platforms that enable appointment scheduling, diagnostic access, secure communication, and personalized reminders. These tools are becoming essential for enhancing satisfaction, continuity of care, and provider competitiveness. According to Athenahealth’s 2025 survey, over 75% of patients reported that digital tools simplify healthcare interactions, with many preferring portals and mobile apps for managing health records. In 2024, Vital (US) partnered with Children’s Hospital Los Angeles (CHLA) to launch an AI-powered “MyVisit” app, offering real-time updates on wait times, lab results, and discharge progress all without logins or downloads. Such solutions underscore how engagement platforms are transforming care delivery. Providers adopting these tools report measurable gains in Net Promoter Scores, reduced attrition, and improved operational efficiency. As expectations evolve, digitally enabled, personalized care will become a foundational requirement for healthcare competitiveness.

Restraint: Data privacy and cybersecurity concerns restricting adoption

Heightened concerns over data privacy and cybersecurity remain a key barrier to adoption. Patient experience tools collect and exchange sensitive health data, exposing providers to risks from ransomware, unauthorized access, or integration flaws. Compliance with frameworks such as HIPAA, GDPR, and local data protection laws adds technical and operational complexity, while reliance on cloud solutions raises questions around sovereignty and vendor accountability. Despite advances in encryption and zero-trust architecture, lingering trust gaps persist. Consequently, many providers adopt cautiously, delaying broader rollouts despite the proven benefits of digital engagement.

Opportunity: Expansion in emerging markets with growing healthcare infrastructure

Emerging economies across Asia Pacific, the Middle East, Latin America, and Africa present strong growth potential as healthcare infrastructure modernizes and digital access expands. Governments and private investors are driving digitization through electronic records, telehealth adoption, and mobile health platforms. Rising smartphone use and improving connectivity further enable patient engagement at scale. Vendors offering cloud-based, affordable, and culturally adaptable solutions can capture early-mover advantages. Public–private partnerships and international initiatives are accelerating uptake, creating accessible entry points for global technology providers to support inclusive, digitally enabled healthcare.

Challenge: Need to ensure accuracy and reliability of patient feedback data

A persistent challenge is maintaining accuracy and representativeness in patient feedback. Many tools capture skewed data due to response bias, language barriers, or poorly structured surveys, limiting the reliability of insights. Inaccurate feedback can misguide service improvements and impact reimbursement outcomes, as patient experience scores are increasingly tied to value-based payments. Providers are turning to advanced analytics, multi-channel collection, and validation methods to improve data integrity. However, sustaining accuracy at scale continues to demand significant operational oversight and analytical capacity.

Patient Experience Technology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated patient portals, MyChart apps, telehealth, and scheduling tools that connect with EHRs to support appointment booking, visit summaries, and secure messaging | Streamlined access, better care coordination, and higher patient satisfaction |

|

Tracks satisfaction across inpatient, outpatient, and digital touchpoints for quality improvement in hospitals; Supports post-discharge feedback, physician performance tracking, and experience optimization across telehealth and mobile platforms | Enables healthcare providers to capture real-time patient feedback and uncover actionable insights using AI and NLP analytics; Helps improve service quality, personalize care experiences, and automate issue resolution across the patient journey |

|

Patient experience measurement platforms providing real-time feedback, healthcare consumer insights, and loyalty analytics to help hospitals and health systems understand community needs and patient expectations | Deeper patient insights, stronger loyalty, community trust, and improved care personalization |

|

Real-time patient feedback, satisfaction surveys, and reputation management platforms integrated with care delivery systems | Continuous quality improvement, stronger loyalty, and reputation enhancement |

|

Experience management (XM) platforms offering patient and caregiver surveys, sentiment analysis, and AI-powered dashboards that integrate with EHR and CRM systems for actionable insights across the care journey | Actionable experience insights, improved satisfaction, better decision-making, and higher care quality |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The patient experience technology ecosystem integrates software providers, service partners, regulators, and healthcare organizations to enhance patient engagement across the care continuum. Core players deliver cloud, on-premise, and hybrid platforms for secure data exchange, personalization, and seamless interactions. Leaders like Press Ganey, NRC Health, Phreesia, NiCE, Qualtrics, Medallia Inc., Relias LLC, Epic Systems Corporation, GetWellNetwork, CipherHealth Inc. drive solutions for pre-care access, navigation, in-encounter support, billing, and follow-up. Revenue models span SaaS subscriptions, licenses, and pay-per-use, serving hospitals, payers, and pharma companies. Regulators such as CMS, ONC, and EMA set standards, while research and tech partners advance AI, mobile health, and analytics, collectively enabling transparent, accessible, and patient-centered healthcare delivery

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Patient Experience Technology Market, By Offering

In 2025, the software segment led the patient experience technology market, driven by demand for digital tools that capture, analyze, and act on real-time patient feedback. This segment includes cloud-based, on-premise, and hybrid solutions widely used in hospitals, outpatient centers, and healthcare networks. Cloud platforms dominate due to scalability, remote access, EHR integration, and lower costs, while on-premise solutions serve large health systems needing robust data security. Hybrid models offer flexibility with compliance. Adoption is further boosted by AI analytics, voice-enabled assistants, and mobile portals, alongside growing patient-centered care, telehealth expansion, and regulatory mandates for engagement.

Patient Experience Technology Market, By Function

In 2025, the patient communication segment holds a significant share in the patient experience technology market, driven by the growing emphasis on personalized and patient-centered care. Healthcare providers increasingly invest in digital tools such as mobile health apps, patient portals, and real-time communication platforms to enhance engagement, education, and adherence. These technologies empower patients to actively participate in their healthcare journey, improving satisfaction and outcomes. Additionally, value-based care models and regulatory focus on experience metrics are pushing hospitals and payers to adopt engagement platforms that support shared decision-making, remote monitoring, and continuous feedback, strengthening this segment’s market position.

Patient Experience Technology Market, By End User

REGION

North America is expected to dominate the global patient experience technology market in 2025

North America is expected to dominate the global patient experience technology market in 2025, supported by its advanced healthcare infrastructure, strong digital adoption, and regulatory frameworks that encourage innovation. The region benefits from widespread implementation of electronic health records (EHRs), integration of patient portals, telehealth services, and analytics platforms that enable seamless care delivery and real-time feedback collection. The US leads due to its strong payer-provider ecosystem, significant investments in digital health startups, and increasing use of AI-driven personalization tools to enhance patient engagement. Canada also contributes through its focus on virtual care expansion and digital-first healthcare strategies. Key players such as Epic Systems, Press Ganey, NRC Health, and Qualtrics drive innovation with platforms that measure satisfaction, streamline communication, and provide actionable insights. Rising consumer expectations, regulatory emphasis on value-based care, and the demand for improved transparency and accessibility further reinforce North America’s position as the leading market for patient experience technologies.

Patient Experience Technology Market: COMPANY EVALUATION MATRIX

In the patient experience technology market matrix, Press Ganey (Star) leads with a strong market share and extensive product footprint, driven by its comprehensive analytics capabilities, robust patient engagement platforms, and integrated solutions for healthcare providers, payers, and life sciences companies. R1 RCM (Emerging Leader) is gaining visibility by offering specialized patient rounding, care coordination, and real-time feedback solutions, strengthening its position through innovation and niche product offerings. While Press Ganey dominates through scale, global presence, and diversified patient experience technology solutions spanning telehealth, patient surveys, and digital engagement tools, R1 RCM shows significant potential to move toward the Leaders’ Quadrant as demand for real-time patient engagement and workflow optimization continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.66 Billion |

| Market Forecast in 2030 (Value) | USD 1.16 Billion |

| Growth Rate | CAGR of 11.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Patient Experience Technology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Growth & Market Penetration | Estimated adoption rates among hospitals, pharmacists, and payers using surveys and data analytics; modeled replacement rates and reasons for churn Achieve double-digit revenue growth in the US patient portal market; estimate adoption & replacement rates | Enabled targeted go-to-market strategies and identification of high-opportunity segments; supported revenue growth forecasting and risk mitigation |

| Product Insights & User Needs – | Understand unmet needs and limitations of current products Conducted user interviews and surveys to identify benefits, limitations, and unmet needs | Prioritized high-potential accounts and optimized resource allocation for faster revenue realization |

| Competitive & Vendor Analysis – | Analyze vendor strategies, selection criteria, and decision-making Benchmarked top 10–15 global competitors, mapped strengths, market share, differentiators, product types; assessed features, cost, service offerings, and sales support | Delivered a clear competitor landscape for strategic positioning, pricing strategy, and feature prioritization; helped anticipate competitor moves |

| Financial Planning & Market Strategy – | Conducted budget/cost analysis for portal replacement; profiled niche/disruptive players and emerging trends (AI, telehealth, predictive analytics) | Supported informed investment decisions, identified emerging opportunities, and improved ROI on technology adoption |

RECENT DEVELOPMENTS

- August 2025 : Epic announced new AI solutions, including the Emmie virtual assistant and MyChart enhancements, to improve patient education, streamline prior authorization, reduce manual charting, and support health insurers in enhancing patient experiences across 3,000+ hospitals and 71,000 clinics globally.

- September 2025 : Phreesia launched VoiceAI, a conversational AI solution designed to transform call management in healthcare. The platform leverages natural language processing and real-time workflow integration to automate patient calls, reduce wait times, and improve access to care. By handling routine requests 24/7 and routing urgent calls instantly, VoiceAI enhances patient experience while easing staff workload.

- March 2025 : Qualtrics introduced Experience Agents, AI-driven tools that deliver personalized customer and employee interactions, at X4 2025. The event also highlighted Qualtrics Edge, new XM capabilities, and research warning that USD 1.3 trillion is at risk from delayed AI adoption. In August 2024, Press Ganey launched an enhanced PX Connect Suite, allowing healthcare providers to capture and act on patient feedback directly within Epic. Early adopters include Vanderbilt University Medical Center and NYU Langone Health. AI-driven sentiment analysis guides care.

Table of Contents

Methodology

The study involved major activities to estimate the current size of the patient experience technology market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved wide use of secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, companies’ house documents; investor presentations; and the SEC filings of companies. The market for companies providing patient experience technology solutions is assessed using secondary data from both paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of patient experience technology vendors, forums, certified publications, and white papers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of patient experience technology solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

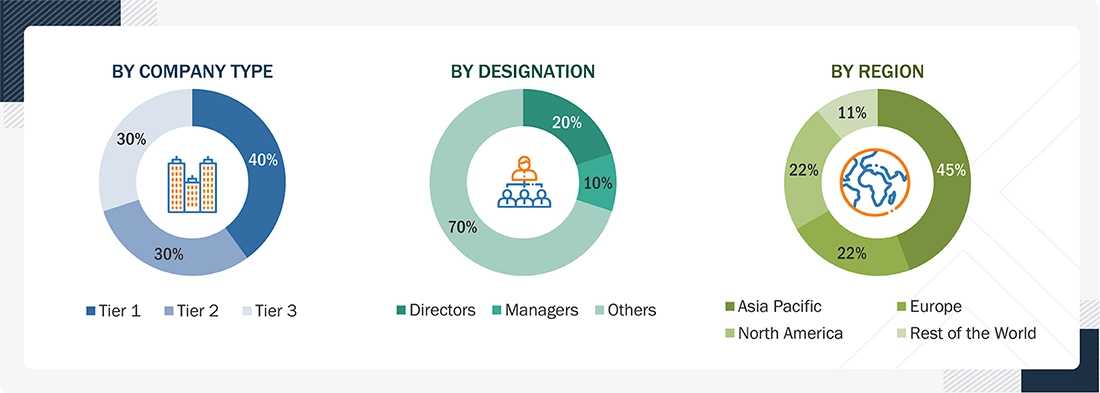

Breakdown of Primary Respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by offering, function, end user, and region).

Data Triangulation

After arriving at the overall market size, using the market size estimation processes, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the patient experience technology market.

Market Definition

The patient experience technology market refers to the range of digital solutions and platforms designed to enhance every interaction a patient has with a care provider across the patient journey. It focuses on improving convenience, transparency, and satisfaction through tools such as appointment scheduling, digital check-ins, wayfinding, real-time updates during care, billing transparency, and post-care feedback management.

These technologies create seamless care journeys and informed decision-making by integrating real-time data, analytics, and interoperability with electronic health records. They empower patients and providers alike, fostering collaboration, transparency, and better adherence to treatment plans across the continuum of care.

Stakeholders

- Healthcare Providers

- Patient Experience Technology Vendors

- Government Bodies & Regulators

- Healthcare IT & EHR Vendors

- Patients and Caregivers

- Startups & Innovators

- Healthcare Associations/Institutes

- Payers & Insurance Companies

- Venture Capitalists & Private Equity

- System Integrators & Service Providers

- Distributors & Channel Partners

- Advocacy Groups & Patient Rights Organizations

- Investors and Financial Institutions

- Industry Associations & Trade Groups

Report Objectives

- To define, describe, and forecast the global patient experience technology market, by offerings, functions, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall patient experience technology market

- To assess the patient experience technology market with regard to Porter’s Five Forces, regulatory landscape, value chain, ecosystem map, patent protection, and key buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the patient experience technology market with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the patient experience technology market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the patient experience technology market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Patient Experience Technology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Patient Experience Technology Market