Patient Engagement Solutions Market Size, Growth, Share & Trends Analysis

Patient Engagement Solutions Market by Therapy (CVD, Diabetes, Obesity, Fitness), Functionality (Telehealth, E-Prescribing, Scheduling, Billing), End User (Hospital, Payer, Patient), Unmet Need, Investment, Market Share, Trends - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

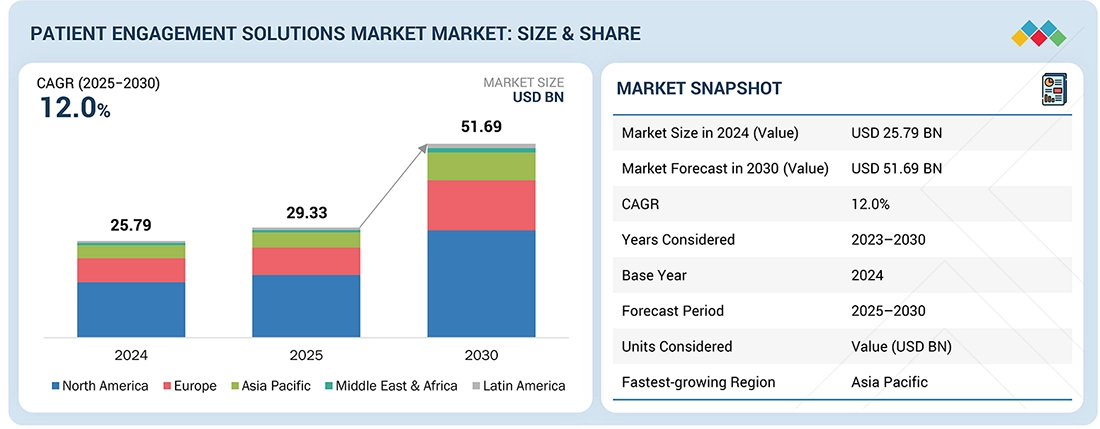

The global patient engagement solutions market, valued at USD 25.79 billion in 2024, stood at USD 29.33 billion in 2025 and is projected to advance at a resilient CAGR of 12.0% from 2025 to 2030, culminating in a forecasted valuation of USD 51.69 billion by the end of the period. The patient engagement solutions market is driven by the growing shift toward patient-centric care, rising adoption of digital health technologies, increasing prevalence of chronic diseases, and the expanding use of mobile apps, portals, and remote monitoring tools to support continuous patient interaction

KEY TAKEAWAYS

-

BY REGIONThe North America region dominates the global patient engagement solutions market, with a share of 57.4% in 2024.

-

BY COMPONENTBy component, the software segment is estimated to account for the largest market share of 58.7% in 2024.

-

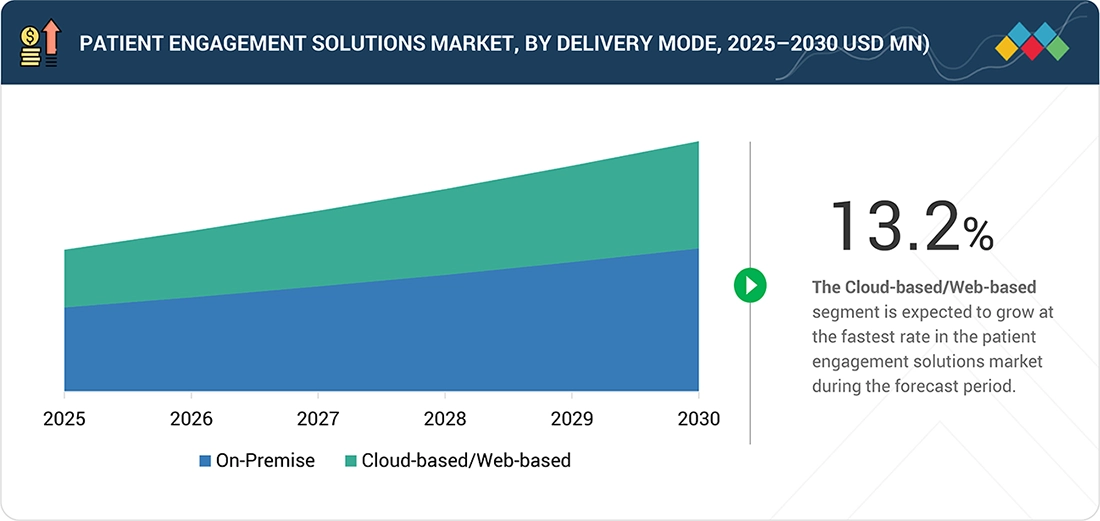

BY DELIVERY MODEBy delivery mode, the cloud-based/web-based segment is expected to register the highest CAGR of 13.2% during the forecast period.

-

BY APPLICATIONBy application, the health management segment is expected to register the highest CAGR during the forecast period.

-

BY THERPAEUTIC AREABy therapeutic area, the chronic diseases segment held the largest share of the overall market in 2024.

-

BY FUNCTIONALITYBy functionality, the patient/client scheduling segment is expected to dominated the market during the forecast period.

-

BY END USERBy end user, the providers segment is estimated to account for the largest market share during the forecast period.

-

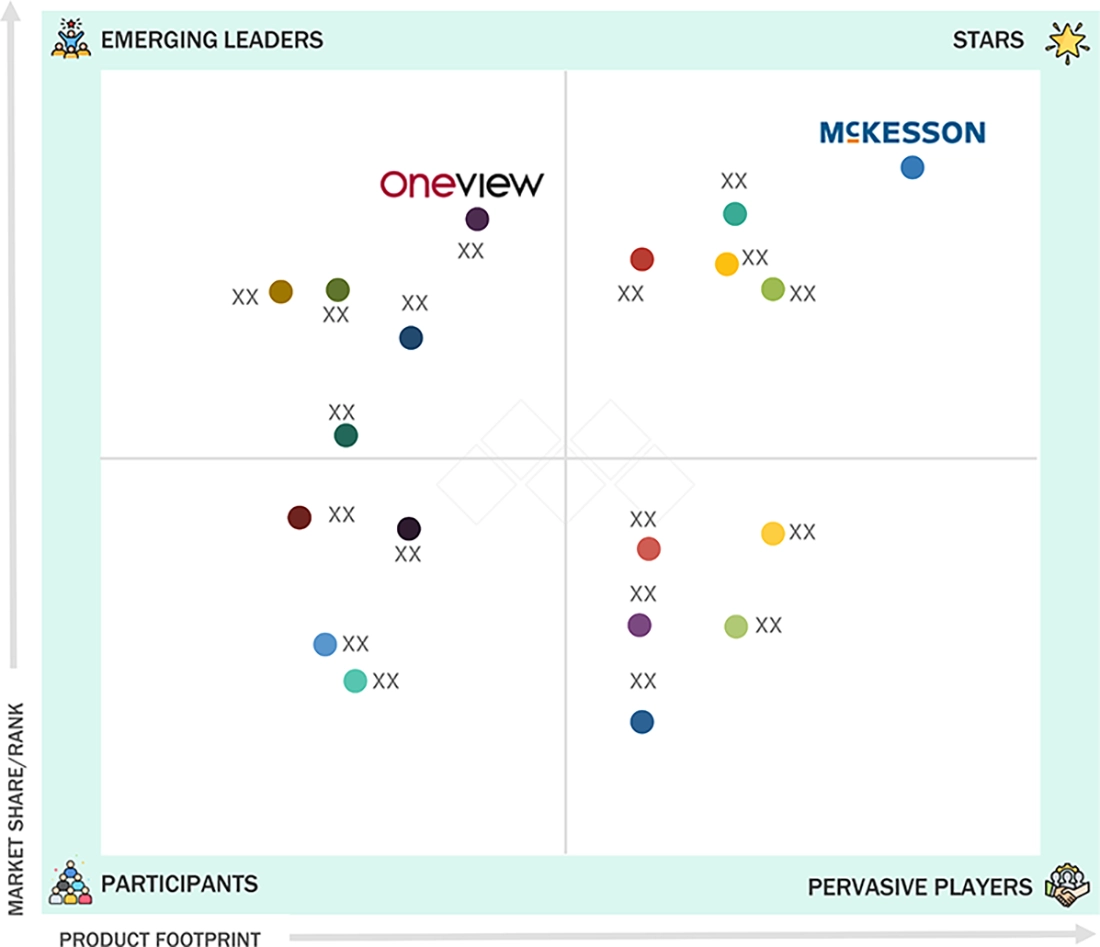

COMPETITIVE LANDSCAPEMcKesson Corporation, Oracle, and Medhost were identified as some of the star players in the patient engagement solutions market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEWellStack, Relatient, and Xealth, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The patient engagement solutions market is fueled by the rapid digitalization of healthcare, increasing demand for personalized care experiences, and the growing emphasis on improving patient adherence and health literacy. In addition, healthcare organizations are investing heavily in platforms that enhance patient empowerment, streamline appointment and medication management, and support coordinated care

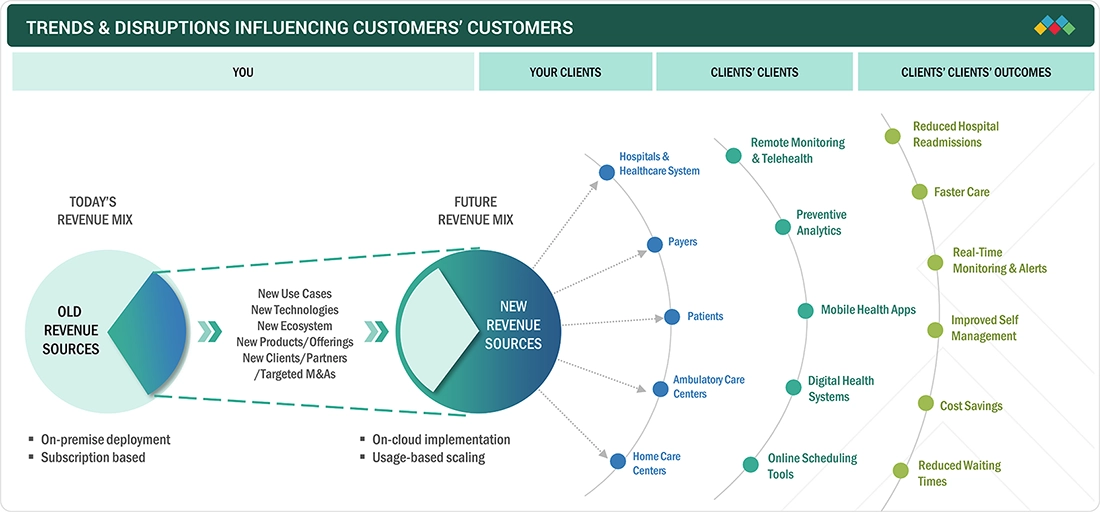

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The patient engagement solutions market is rapidly evolving with the rising adoption of mobile health apps, telehealth, AI-driven personalization, and cloud-based platforms. The growing demand for real-time monitoring, seamless EHR integration, and hybrid care models among hospitals, payers, patients, ambulatory care centers, and home healthcare providers is transforming care delivery, driving a shift toward more digital, accessible, and patient-centered engagement tools.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Implementation of government regulations and initiatives to promote patient-centric care

-

Increasing adoption of patient engagement solutions

Level

-

Large investment requirements for healthcare infrastructure

-

Protection of patient information

Level

-

Growth opportunities in emerging markets

-

Wearable health technology

Level

-

High deployment costs of healthcare IT systems

-

Low levels of healthcare literacy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Implementation of government regulations and initiatives to promote patient-centric care

With the rising needs for quality healthcare, healthcare institutions globally are adopting innovative technologies that help minimize costs, improve healthcare quality, and eliminate inefficiencies in administration. High-quality healthcare needs are met when patients and healthcare professionals are provided access to their comprehensive electronic healthcare records. Patient engagement solutions provide comprehensive patient illness histories and tools to analyze records, enabling proactive steps to improve diagnosis, prevent errors, and save time. Also, integrated or managed patient engagement solutions support the formation of accountable care organizations (ACOs). The French government proposed an investment plan (2022) of USD 686 million, divided into five axes, to accelerate the national digital health strategy as part of the Health Innovation 2030 plan.

Restraint: Large investment requirements for healthcare infrastructure

Currently, most healthcare providers lack adequate infrastructure in terms of technology, data storage, and other resources to effectively manage complex healthcare cases. Providers need to invest heavily in infrastructural development to implement patient engagement solutions successfully. In IT infrastructure, investments are required to increase data storage and processing capabilities. Web-based and mobile tools, such as Android and iOS apps, need to be adopted, and in-house software ensures patient participation and facilitates the exchange of health information. Additional investments would be required to maintain the infrastructure at the site of care and remotely, as healthcare services are expected to be delivered to patients’ homes. In addition, the financial benefits of patient engagement are not realized immediately, which makes stakeholders reluctant to make huge investments.

Opportunity: Growth opportunities in emerging markets

Several factors, including the implementation of government initiatives that support the adoption of HCIT solutions, rising government healthcare expenditures, and the presence of skilled IT experts in emerging Asian countries such as China and India, are expected to drive the growth of the patient engagement solutions market. Technological advancements play a key role in reforming the country’s healthcare management sector. China is currently facing challenges, including underfunded rural health centers, overburdened city hospitals, and a nationwide shortage of doctors. The Indian Government started the Digital India campaign to ensure that government services are made available to citizens electronically by improving IT infrastructure & improving internet connectivity. The e-Health initiative, under the Digital India campaign, will involve the integration of patient electronic health records in a digital locker, which can be maintained over a lifetime

Challenge: High deployment costs of healthcare IT systems

Healthcare IT systems are high-priced software solutions. Moreover, the maintenance and software update costs of these systems may exceed the software price. Support and maintenance services, which include software upgrades as per the changing user requirements, represent a recurring expenditure, which amounts to almost 30% of the total cost of ownership. The lack of internal IT expertise in the healthcare industry necessitates training for end users to maximize the efficiency of various healthcare IT solutions, thereby adding to the cost of ownership of the systems. Evaluating information systems in healthcare can also be challenging, as the organizational impact & benefits of IT systems in healthcare are often intangible.

PATIENT ENGAGEMENT SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers digital engagement platforms that support patient outreach, medication adherence programs, and care coordination through integrated communication tools and pharmacy connectivity | Enhances patient adherence and satisfaction, improves continuity of care, and reduces medication errors through more personalized and timely interactions |

|

Provides AI-driven patient engagement platforms integrated with EHR and analytics systems, enabling personalized communication, automated reminders, virtual care support, and patient education workflows | Improves patient activation and self-management, supports proactive care delivery, strengthens clinical decision-making, and drives operational efficiency across care teams |

|

Delivers patient engagement tools embedded within practice management and EHR systems, supporting appointment scheduling, messaging, chronic care management, and real-time patient insights | Increases patient-provider connectivity, enhances chronic disease management, reduces administrative burden, and improves overall clinical performance |

|

Develops multi-channel engagement solutions, including patient portals, mobile apps, telehealth, and automated outreach tools tied to real-time clinical data | Boosts patient access and engagement, streamlines workflow automation, reduces no-shows, and strengthens quality measure performance for value-based care |

|

Data-driven, personalized patient outreach using analytics to engage patients across the care journey (pre-visit to post-care) via automated, omnichannel communication | Improved patient experience, higher care adherence, reduced no-shows/readmissions, better population health outcomes, and stronger value-based care performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The patient engagement solutions market ecosystem consists of key players (Veradigm, Oracle, athenahealth) that offer tools like patient portals, mobile apps, telehealth platforms; startups (xealth, Yosi Health), cloud-service providers (Amazon Web Service, IBM Cloud), support scalable deployment, secure data exchange, and enterprise-wide access across multi-site healthcare networks; and end users (Mayo clinics, The Royal Melbourne Hospital, Cleveland Clinic) that rely on these platforms to improve communication, enhance care coordination, and support continuous patient involvement.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Patient Engagement Solutions Market, By Component

In 2024, the software segment dominated the patient engagement solutions market, driven by the growing use of digital platforms that improve communication, care coordination, and patient self-management. Some of these solutions include patient engagement platforms, mHealth solutions, telecare platforms, remote monitoring software, and automated communication solutions that facilitate personalized engagement. With healthcare payers adopting value-based healthcare delivery models and a focus on digital transformation, software solutions enable instant engagement, patient education, and improved patient compliance. This growth is being fueled by the increasing use of digital platforms that make it easier for patients and providers to stay connected, coordinate care, and support patients in managing their health more confidently.

Patient Engagement Solutions Market, By Delivery Mode

In 2024, the on-premise segment held the largest share of the patient engagement solutions market, driven by healthcare institutions' preference for a higher degree of control over data security, as well as the potential for customized solutions integrated with their current IT infrastructure. Needless to say, many healthcare companies, especially those with access to valuable patient data, continue to favor on-premise solutions to maintain control over data governance. Furthermore, traditional systems of this nature, as well as a reputation for reliability, are also working in support of on-premise usage in spite of a growing adoption of cloud technology.

Patient Engagement Solutions Market, By Application

In 2024, the health management segment held the largest share of the patient engagement solutions market, driven by a growing need for solutions that provide support for chronic care management, preventive care, and patient care management for an extended period of time. Care management, medication compliance management, lifestyle management, and telemonitor management fall under this category. Due to the shift in care delivery from volume-based to value-based, healthcare organizations are increasingly turning to health management solutions to effectively manage patients, enhance patient empowerment, and reduce hospitalizations.

Patient Engagement Solutions Market, By Therapeutic Area

In 2024, the chronic diseases segment held the largest share of the patient engagement solutions market. The increasing demand for care services related to chronic diseases, such as diabetes, cardiovascular diseases, and hypertension, requires ongoing monitoring, adherence tools, and a digital platform for their long-term management. It outpaces acute care and health & wellness, with widespread chronic illness in many adults of developed nations. The integration of digital health, along with value-based initiatives focusing on prevention and sustained engagement of patients, gives the market promising growth scenarios across the decade.

Patient Engagement Solutions Market, By Functionality

In 2024, the patient/client scheduling segment held the largest share of the patient engagement solutions market. This is attributed to the increasing use of technology that has streamlined patient appointments. The use of automated patient scheduling has become crucial for enhancing patient engagement, optimizing no-show rates, improving patient flow, and increasing patient convenience. The role of patient engagement in healthcare has become a key priority for healthcare institutions.

Patient Engagement Solutions Market, By End User

In 2024, the healthcare providers segment held the largest share of the patient engagement solutions market. An increasing number of hospitals, clinics, and health systems are integrating web-based solutions to facilitate communication, streamline operations, and drive improved outcomes. Healthcare organizations use engagement platforms for appointment scheduling, telemonitoring, portals, education solutions, and medication reminders, among others, due to an ever-increasing emphasis on leveraging provider-driven innovation in patient engagement solutions based on performance criteria related to improved patient experience and optimized clinical operating efficiencies.

REGION

Asia Pacific to be fastest-growing region in patient engagement solutions market during forecast period

The Asia Pacific is the fastest-growing region in the patient engagement solutions market due to the rapid digitalization of healthcare infrastructure in countries in the region, the widespread adoption of mobile and internet technology by patients, and the adoption of telehealth strategies by healthcare providers in the region. Countries in the Asia Pacific region are also heavily investing in health care information technology to ensure increased patient access, care coordination, and health care efficiency, while the large population base of the countries in the region, as well as the rise of chronic diseases, are also fueling the demand for digital patient engagement solutions.

PATIENT ENGAGEMENT SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the patient engagement solutions market matrix, McKesson Corporation (Star) leads with a dominant market position due to its strong digital health ecosystem and solutions, such as patient communication platforms, medication adherence programs, and integrated care management tools that enhance coordination among patients, providers, and pharmacies. Oneview Healthcare (Emerging Leader) provides digital care platforms that enhance inpatient experience, streamline clinical workflows, and enable real-time communication between patients and care teams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- McKesson Corporation (US)

- Veradigm LLC (US)

- Oracle (US)

- athenahealth (US)

- Health Catalyst (US)

- GetWellNetwork, Inc. (US)

- Lincata, Inc. (US)

- Cognizant (US)

- TruBridge (US)

- Oneview Healthcare (Ireland)

- AdvancedMD, Inc. (US)

- Epic Systems Corporation (US)

- Harris Healthcare (US)

- Medical Information Technology, Inc. (US)

- Tebra Technologies, Inc (US)

- Televox (US)

- Modhost (US)

- Nuance Communications, Inc. (US) (Microsoft)

- Solutionreach, Inc. (US)

- Experian Information Solutions, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 25.79 BN |

| Market Forecast in 2030 (value) | USD 51.69 BN |

| Growth Rate | CAGR of 12.0% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

| Related Segment & Geographic Reports |

Europe Patient Engagement Solutions Market Asia Pacific Patient Engagement Solutions Market US Patient Engagement Solutions Market |

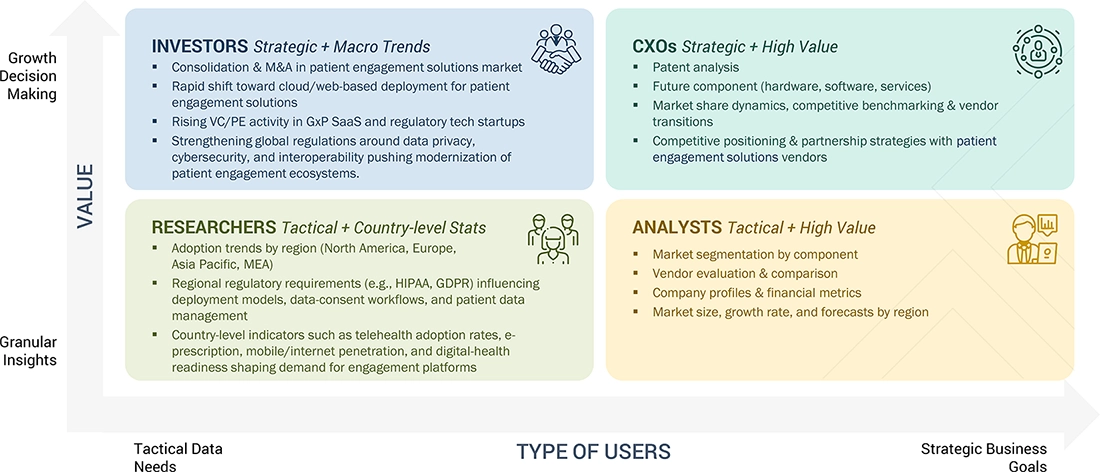

WHAT IS IN IT FOR YOU: PATIENT ENGAGEMENT SOLUTIONS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of leading patient engagement solution providers (e.g., Oracle, McKesson, Health Catalyst) covering capabilities such as patient portals, mobile apps, remote monitoring, telehealth integration, AI-driven engagement tools, deployment models (cloud/on-premise), and pricing frameworks | Enables competitive benchmarking, identifies functional and compliance gaps, and supports vendor selection, partnership evaluation, and market positioning strategies |

| Regional Market Entry Strategy | Assessment of region-wise digital health maturity, smartphone/internet penetration, provider adoption readiness, interoperability requirements with EHRs/PHRs, regulatory considerations (HIPAA, GDPR, PDPA, PIPL), and distribution/channel ecosystem across North America, Europe, Asia Pacific, and emerging markets | Reduces market entry barriers, supports localization of digital tools, accelerates compliance readiness, ensures alignment with clinical workflow standards, and helps prioritize high-growth geographies |

| Local Risk & Opportunity Assessment | Evaluation of data-privacy vulnerabilities, patient data consent regulations, cybersecurity demands, digital literacy gaps, reimbursement models for telehealth and remote monitoring, and emerging opportunities in chronic disease management, home-based care, and virtual engagement | Strengthens risk mitigation planning, informs investments in secure data governance, identifies high-opportunity use cases (e.g., chronic care, behavioral health), and highlights provider segments with strong adoption potential |

| Technology Adoption by Region | Mapping adoption trends of omnichannel engagement tools, telehealth platforms, AI-driven personalization engines, mobile health apps, remote patient monitoring, and integration maturity with EHR/CRM systems across key countries | Informs region-specific product strategy, supports targeted roll-out of advanced analytics and compliance modules, and aligns offerings with digital-transformation and safety-standard requirements |

RECENT DEVELOPMENTS

- January 2025 : Health Catalyst signed an agreement to acquire Upfront Healthcare Services, a patient engagement platform, to expand its engagement capabilities and improve personalized patient outreach and care coordination.

- September 2025 : Oneview Healthcare partnered with Children’s Hospital of Orange County (CHOC) to implement its MyStay Mobile patient engagement platform, enhancing digital access to education, information, and services for patients and families.

- June 2024 : Veradigm, Think Healthcare, and Medsien collaborated to integrate remote patient monitoring and care tools using Veradigm’s APIs, enabling real-time data sharing that helps improve patient management, reduce emergency visits, and support proactive care.

Table of Contents

Methodology

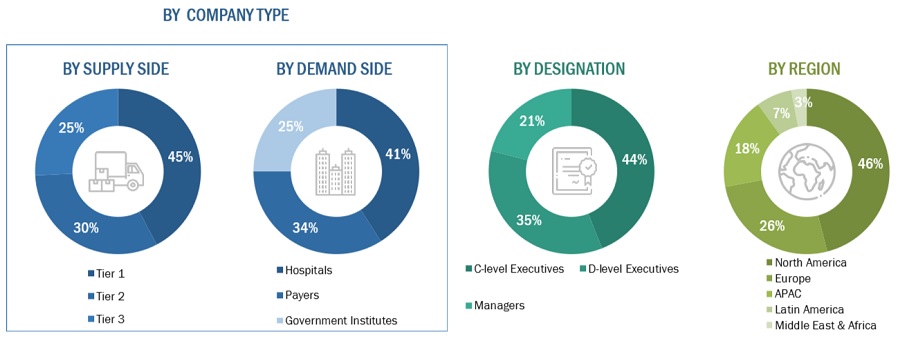

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Patient Engagement Solutions market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the patient engagement solutions market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and AAHM. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global patient engagement solutions market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global patient engagement solutions market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Note: The tier of companies is defined based on their total revenues. As of 2022, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Oracle Corporation |

Product Manager |

|

Veradigm |

Director |

|

Merative |

Senior Product Manager |

Market Size Estimation

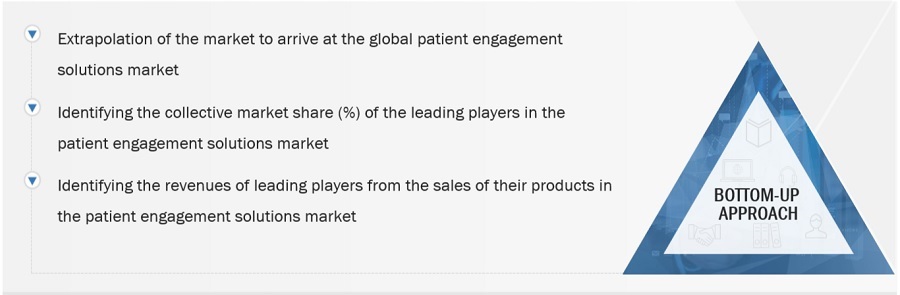

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global patient engagement solutions market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of patient engagement solutions products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size Estimation- Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation- Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the patient engagement solutions market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market.

Market Definition

Patient engagement is a key component of value-based healthcare, which focuses on improving the quality of care while reducing costs. It combines the patient’s knowledge, skills, ability, and willingness to manage individual health with the help of engagement solutions to increase activation & promote positive patient behavior. Patient Engagement solutions promote effective care coordination by facilitating seamless communication between patients and healthcare providers.

Key Stakeholders

- Healthcare institutes/providers (hospitals, medical groups, physician practices, diagnostic centers, pharmacies, ambulatory centers, and outpatient clinics)

- Healthcare insurance companies/payers

- Healthcare IT service providers

- Venture capitalists

- Government bodies

- Corporate healthcare entities

- Accountable care organizations

Report Objectives

- To define, describe, and forecast the global patient engagement solutions market based on component, delivery mode, application, therapeutic area, functionality, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall patient engagement solutions market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure and profile the key players of the patient engagement solutions market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America and the Middle East & Africa.

- To track and analyze competitive developments such as product launches, acquisitions, partnerships, agreements, and collaborations in the patient engagement solutions market during the forecast period

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 20)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Patient Engagement Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Patient Engagement Solutions Market

Ethan

Oct, 2022

What will be the value for the global Patient Engagement Solutions Market in 2030?.

Benjamin

Oct, 2022

Which of the geographical segment holds the major share of the Patient Engagement Solutions Market?.