Conformal Coating Market by Type (Acrylic, Silicone, Epoxy, Urethane, and Parylene), End-Use (Consumer Electronics, Automotive, Aerospace & Defense, Industrial and Telecommunication), and Region - Global Forecast to 2028

Updated on : August 22, 2025

Conformal Coating Market

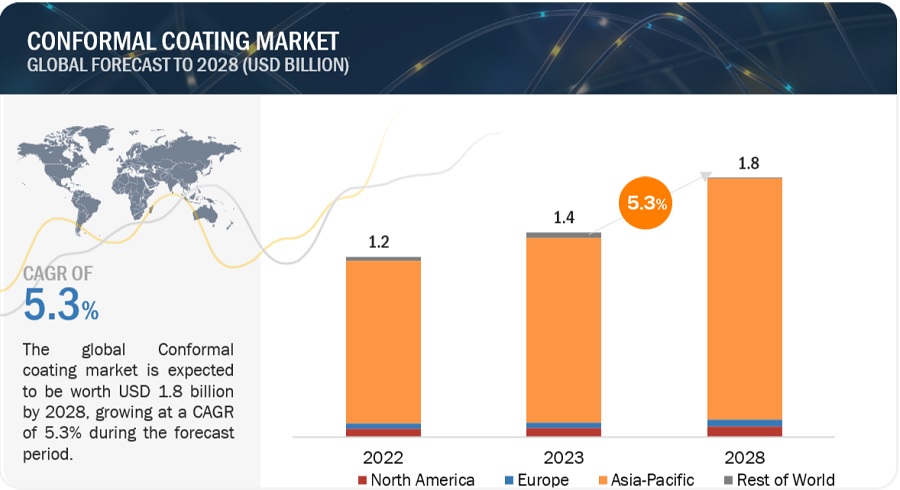

The global conformal coating market was valued at USD 1.4 billion in 2023 and is projected to reach USD 1.8 billion by 2028, growing at 5.3% cagr from 2023 to 2028. Conformal coatings refer to thin protective layers of material applied to electronic components and circuit boards, serving to shield them from environmental factors and potential damage. These coatings conform closely to the contours of the components, forming a uniform and continuous barrier that safeguards against moisture, dust, chemicals, temperature fluctuations, and mechanical stress. The global conformal coatings market has been growing steadily in recent years and is expected to continue to grow in the coming years. The market is segmented on the basis of type such as acrylic, epoxy, silicone, urethane, parylene, and others. The conformal coatings are used in several end-use industries such as Consumer Electronics, aerospace & defense, automotive, industrial, telecommunication and others.

Conformal Coating Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Conformal Coating Market

Conformal Coating Market Dynamics

Driver: Growing base of PCB manufacturing

The expanding base of printed circuit board (PCB) manufacturing is a significant driver fueling the growth of the conformal coatings market. As the electronics industry continues to thrive, the demand for PCBs – the fundamental building blocks of electronic devices – has surged. This growth is attributed to the proliferation of consumer electronics, advancements in automotive technologies, the rise of the Internet of Things (IoT), and increasing industrial automation. Conformal coatings play a pivotal role in this scenario by providing essential protection to the intricate circuitry and components housed on PCBs. As PCBs become smaller, more complex, and more densely packed, the vulnerability of these components to environmental factors such as moisture, dust, chemicals, and temperature fluctuations increases. Conformal coatings offer a tailored solution by forming a protective layer that shields PCBs from these stressors, ensuring their reliability, longevity, and optimal performance.

Restraint: Miniaturization of PCBs

The miniaturization of PCBs poses a restraint for the conformal coatings market. As electronic devices become smaller and more compact, the available space for applying conformal coatings becomes limited. The challenge lies in maintaining the delicate balance between ensuring proper coverage and protection while not impeding the functionality or connectivity of the densely packed components. Miniaturization often results in intricate designs with components situated in close proximity to one another. Applying conformal coatings to such compact and intricate structures can lead to challenges in achieving uniform coverage and avoiding issues like bridging, where the coating forms unintended connections between neighboring components. Moreover, the thickness of the coating could affect thermal dissipation and signal integrity in highly sensitive circuits.

Opportunities: Technological advancements in end-use industries

As technology advances, encompassing 5G, EVs, autonomous vehicles, IoT, SLPs, and digitalization, a transformative trend emerges in the development of intricate and robust PCBs. The importance of safeguarding these PCBs against frequent replacements becomes crucial. For instance, wearable electronics incorporating waterproofing and moisture resistance require PCB protection. These factors are expected to increase the demand for conformal coatings across various end-use industries like automotive & transportation, consumer electronics, industrial, aerospace & defense, telecommunication and others. In contrast to technological advancements, the requirement for high-speed, high-frequency, high-density, and high-capacity PCBs as pivotal components experiences rapid growth. Particularly, PCBs utilized in applications such as battery management within the automotive sector often operate under high temperatures. These aspects collectively highlight the significance of using conformal coatings for these PCBs.

Challenges: Cost constraints on conformal coating manufacturers

Cost constraints present a significant challenge for conformal coating manufacturers within the industry. Balancing the need for effective protection with affordability is essential, as the cost-sensitive nature of many industries, such as consumer electronics, automotive, and industrial manufacturing, demands cost-efficient solutions. Manufacturers must navigate the delicate equilibrium between producing high-quality coatings and keeping production costs reasonable. Developing and formulating conformal coatings that provide the necessary protection while minimizing material costs can be complex. Additionally, the application process itself requires specialized equipment and skilled labor, both of which contribute to overall production expenses. As a result, conformal coating manufacturers face the challenge of optimizing their production processes to maintain a competitive price point while still delivering coatings that meet performance standards.

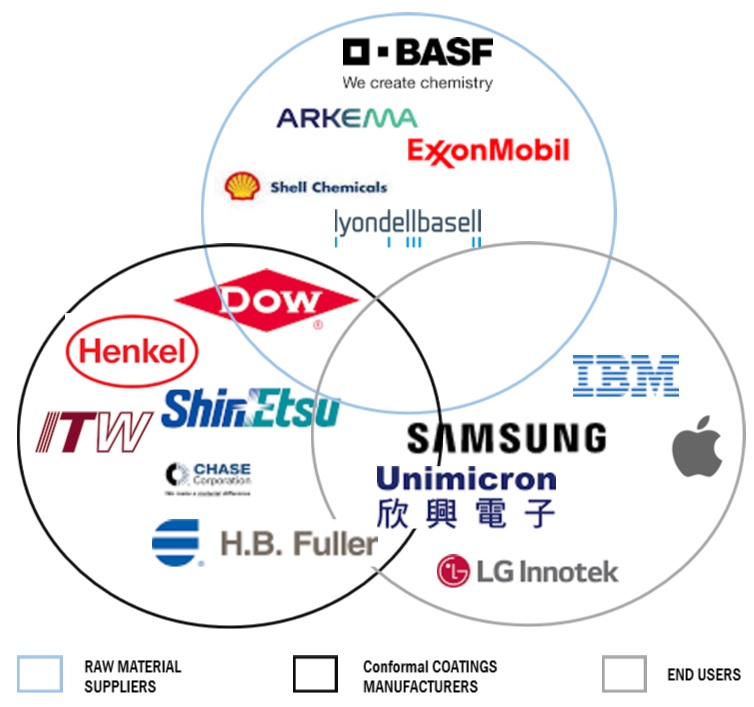

Conformal Coating Market Ecosystem

ByType, silicone segment is projected to register the highest CAGR during the forecast period.

The silicone segment's growth in the conformal coatings market is influenced by several pivotal factors. Silicone-based conformal coatings have gained traction due to their exceptional versatility and performance attributes. These coatings offer a compelling combination of flexibility and robust protection, making them well-suited for various industries and applications. Their ability to conform closely to complex shapes ensures uniform coverage and shielding against moisture, dust, chemicals, and temperature fluctuations. Silicone coatings also exhibit remarkable thermal stability, making them resilient in the face of extreme temperature variations. Moreover, their high dielectric strength aids in insulating against electrical currents, critical for safeguarding electronic integrity. The silicone segment has witnessed growth due to its extensive chemical resistance, effectively guarding against potential damage from contact with corrosive substances. Additionally, the coatings' UV and weather resistance attributes render them suitable for outdoor applications. In sectors like automotive and aerospace, where mechanical vibrations are prevalent, silicone coatings' vibration damping properties play a pivotal role in enhancing component durability. While other segments contend with challenges like cost and regulatory compliance, silicone conformal coatings capitalize on their adaptability, making them a favored choice for industries ranging from electronics manufacturing to telecommunications and beyond. In essence, the growth of the silicone segment within the conformal coatings market is a testament to its multifaceted advantages that address the intricate demands of contemporary electronics and industrial applications.

By End-Use Industry, the Automotive segment projected to register the second highest CAGR during the forecast period.

The growth of conformal coatings in the automotive sector is propelled by several pivotal factors. As automotive electronics become more sophisticated and integral to vehicle operation, the need for reliable protection against harsh conditions intensifies. Conformal coatings provide a crucial shield, safeguarding sensitive electronic components from moisture, chemicals, temperature fluctuations, and mechanical stress. With the rise of electric vehicles (EVs) and advanced driver assistance systems (ADAS), the demand for conformal coatings is further amplified. These coatings ensure the durability and optimal functioning of automotive control systems, sensors, entertainment systems, and more. As automakers continue to focus on vehicle reliability and safety, the adoption of conformal coatings is poised to surge, enhancing the longevity and performance of electronics within the automotive landscape.

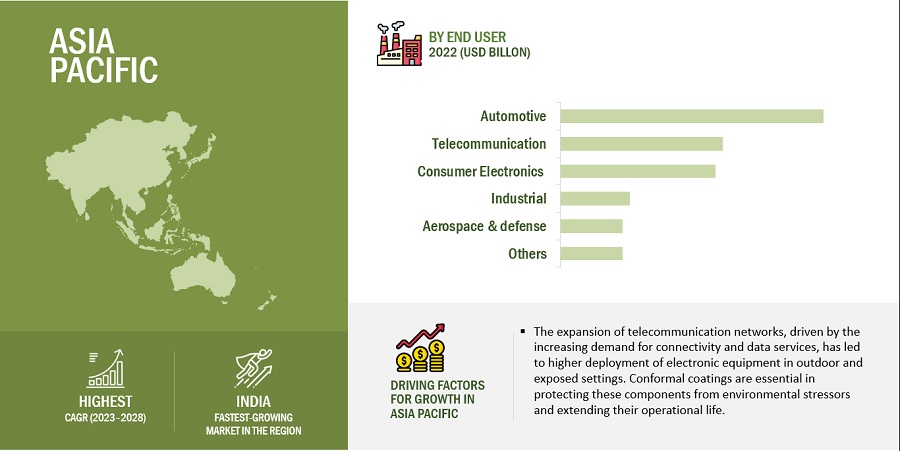

Asia Pacific is projected to register the highest CAGR in the conformal coatings market during the forecast period .

The conformal coatings market in the Asia Pacific region is witnessing robust growth driven by various significant factors. The region's role as a prominent electronics manufacturing hub and rapid industrialization are key drivers behind the escalating demand for these coatings. They serve to protect electronic components from harsh environmental conditions. The burgeoning automotive sector, alongside the expansion of telecommunication networks and renewable energy systems, is additionally fueling the requirement for effective coatings. Advancements in technology are further elevating the need for conformal coatings tailored to specific industry needs. However, challenges encompass navigating complex regulatory frameworks and ensuring the development of sustainable formulations. With a thriving electronics industry and an increasing recognition of the necessity for protection, the Asia Pacific conformal coatings market presents substantial growth prospects for manufacturers who can adeptly adapt to evolving industry dynamics and sustain adherence to environmental regulations.

To know about the assumptions considered for the study, download the pdf brochure

Conformal Coating Market Players

Conformal coatings market comprises major manufacturers such as Henkel AG & CO. KGAA (Germany), Illinois Tool Works Inc. (US), Sealed Air (US), Shin-Etsu Chemical Co. Ltd (Japan), Chase Corporation (US), H.B. Fuller (US), DOW (US) and among others were the leading players in the conformal coatings market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the conformal coatings market.

Read More: Conformal Coating Companies

Conformal Coating Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2022–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD billion), Volume (Tons) |

|

Segments |

Type, End-Use Industry, and Region. |

|

Regions |

North America, Europe, Asia Pacific (APAC), Rest of the World (RoW). |

|

Companies |

The major players are Henkel AG & CO. KGAA (Germany), Illinois Tool Works Inc. (US), Sealed Air (US), Shin-Etsu Chemical Co. Ltd (Japan), Chase Corporation (US), H.B. Fuller (US), DOW (US) and others covered in the Conformal coatings market. |

This research report categorizes the global Conformal coatings market on the basis of Type, End-Use Industry, and Region.

On the basis of by Type:

- Acrylic

- Epoxy

- Silicone

- Urethane

- Parylene

- Others

On the basis of by end-use industry:

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Industrial

- Telecommunication

- Others

On the basis of region:

- North America

- Europe

- Asia Pacific

- RoW (Rest of World)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In June 2023, A distribution agreement was established between Henkel and Labori International. As per the agreement's terms, Henkel will retain responsibility for overseeing the brand's business operations during a transitional phase.

- In July 2023, Chase Corporation has confirmed its engagement in a definitive agreement for acquisition by an affiliate of KKR, a prominent global investment firm.

- In March 2023, Shin-Etsu Chemical Co., Ltd. has introduced a new silicone rubber, named "KE-5641-U," specifically designed as an ideal insulation covering material for high-voltage cables utilized in automotive applications.

- In November 2021, Specialty Coating Systems, Inc. (SCS) has completed the acquisition of Comelec SA, a reputable and well-established company based in Switzerland, known for its expertise in delivering Parylene, Atomic Layer Deposition (ALD), and multilayer coating services.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Conformal coatings market?

The increasing demand for electronics protection in various industries is a major driver of the conformal coatings market.

What are the major challenges in the Conformal coatings market?

Balancing cost-effectiveness with the need for high-performance coatings presents a major challenge in the conformal coatings market.

What are the restraining factors in the Conformal coatings market?

Complex regulatory compliance requirements pose a significant restraining factor in the conformal coatings market.

What is the key opportunity in the Conformal coatings Market?

The transition towards eco-friendly and sustainable coating solutions presents a significant opportunity in the conformal coatings market.

What are the end-uses of conformal coatings market?

End uses of conformal coatings include protecting electronic components in industries such as electronics manufacturing, automotive, aerospace, telecommunications, and medical devices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from high-end applications- Growth of PCB manufacturing companies- High demand from automotive industryRESTRAINTS- Expensive replacement and repair of coatings- Miniaturization of PCBsOPPORTUNITIES- Increased adoption by telecommunication industry- Wide use of substrate-like and flexible PCBs- Technological advancements in end-use industriesCHALLENGES- Stringent government regulations- Cost constraints on conformal coatings

-

5.3 INDUSTRY TRENDSPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryMACROECONOMIC INDICATORS- GDP trends and forecastPRICING ANALYSISVALUE CHAIN ANALYSISSUPPLY CHAIN ANALYSIS- Raw material suppliers- Manufacturers- Distributors- End usersTRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS- Revenue shift for conformal coating playersREGULATORY LANDSCAPE- Conformal coating standards- Insulating Compound (For Coating Printed Circuit Assemblies) standard (MIL-I-46058C)- British defense standard (Def Stan 59/47)REGULATORY BODIES AND GOVERNMENT AGENCIES- International Electrotechnical CommissionECOSYSTEM MAPPINGKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaKEY CONFERENCES AND EVENTS, 2023–2024TRADE ANALYSISPATENT ANALYSIS- Document analysis- Jurisdiction analysis- Top applicantsCASE STUDY ANALYSIS- Enhancing reliability and longevity through conformal coatingsRECESSION IMPACT ANALYSIS

- 6.1 INTRODUCTION

-

6.2 SILICONEEMERGING TRENDS IN END-USE INDUSTRIES TO DRIVE MARKET

-

6.3 ACRYLICLOW COST OF ACRYLIC CONFORMAL COATINGS TO DRIVE MARKET

-

6.4 EPOXYADHESIVE PROPERTIES AND CHEMICAL RESISTANCE TO DRIVE MARKET

-

6.5 URETHANEDIELECTRIC PROPERTIES AND MOISTURE RESISTANCE TO DRIVE MARKET

-

6.6 PARYLENEDEMAND FROM MEDICAL AND AEROSPACE & DEFENSE SECTOR TO DRIVE MARKET

- 6.7 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 AUTOMOTIVEINCREASING RELIANCE ON AUTOMOTIVE INDUSTRY TO DRIVE MARKET

-

7.3 CONSUMER ELECTRONICSRISING DISPOSABLE INCOME AND DEVELOPMENT OF SMART DEVICES TO DRIVE MARKET

-

7.4 AEROSPACE & DEFENSEINTEGRATION OF NEW TECHNOLOGIES TO DRIVE MARKET

-

7.5 INDUSTRIALIMPLEMENTATION OF INDUSTRY 4.0 TO DRIVE MARKET

-

7.6 TELECOMMUNICATIONLAUNCH OF 5G TECHNOLOGY TO DRIVE MARKET

- 7.7 OTHER END-USE INDUSTRIES

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Increase in PCB production to drive marketTAIWAN- Presence of established PCB manufacturers to drive marketJAPAN- Rise in foreign investments to drive marketSOUTH KOREA- Increasing demand from major electronics companies to boost marketVIETNAM- Presence of established manufacturers to boost marketINDIA- Favorable government policies to drive marketTHAILAND- Growing demand for PCBs to spur marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Demand for complex PCBs from aerospace & defense sector to drive marketCANADA- Growth of electronics sector to fuel marketMEXICO- Increasing demand from automobile manufactures to drive market

-

8.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- PCB demand from EV manufacturers to drive marketFRANCE- Government policies for sustainability and green technology to boost marketRUSSIA- Technological advancements across different sectors to boost marketUK- Net import of PCBs to drive marketREST OF EUROPE

-

8.5 REST OF WORLDRECESSION IMPACT ON REST OF WORLDMIDDLE EAST & AFRICASOUTH AMERICA

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- 9.3 KEY PLAYER STRATEGIES

- 9.4 REVENUE ANALYSIS OF KEY PLAYERS

-

9.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

9.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.7 COMPETITIVE BENCHMARKING

-

9.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewILLINOIS TOOL WORKS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHIN-ETSU CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDOW- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewH.B. FULLER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHASE CORP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELECTROLUBE- Business overview- Products/Solutions/Services offered- Recent developmentsDYMAX- Business overview- Products/Solutions/Services offeredMG CHEMICALS- Business overview- Products/Solutions/Services offeredSPECIALTY COATING SYSTEMS INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

10.2 OTHER PLAYERSALTANA AGCHT UK BRIDGWATER LTD.CSL SILICONES INC.EUROPLASMA NVPETERS GROUPCONINS PUNEINDUSTRIALEXAI TECHNOLOGY, INC.MASTER BOND INC.JOHN C DOLPHACULONPRECISION COATINGS, INC.EPOXIES, ETC.SHRI MAHALUXMI CHEMICALSCRC INDIA MANUFACTURING & DISTRIBUTORS PVT LTD

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

- 11.3 ENCAPSULANTS MARKET

- 11.4 ENCAPSULANT MARKET, BY REGION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS

- TABLE 1 CONFORMAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 3 CONFORMAL COATINGS MARKET: SUPPLY CHAIN

- TABLE 4 STANDARDS AND SPECIFICATIONS PERTAINING TO CONFORMAL COATINGS

- TABLE 5 ECOSYSTEM OF CONFORMAL COATINGS MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 7 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- TABLE 8 CONFORMAL COATINGS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 9 PRINTED CIRCUITS, IMPORT DATA, HS CODE: 8534, 2022 (USD THOUSAND)

- TABLE 10 PRINTED CIRCUITS, EXPORT DATA, HS CODE: 8534, 2022 (USD THOUSAND)

- TABLE 11 PATENTS BY TAIWAN SEMICONDUCTOR

- TABLE 12 PATENTS BY IBM

- TABLE 13 PATENTS BY 3M

- TABLE 14 US: PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 15 CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 16 CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 17 CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 18 CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 19 SILICONE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 20 SILICONE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 21 SILICONE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 22 SILICONE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 23 ACRYLIC: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 24 ACRYLIC: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 25 ACRYLIC: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 26 ACRYLIC: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 27 EPOXY: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 28 EPOXY: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 29 EPOXY: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 30 EPOXY: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 31 URETHANE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 32 URETHANE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 33 URETHANE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 34 URETHANE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 35 PARYLENE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 36 PARYLENE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 37 PARYLENE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 38 PARYLENE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 39 OTHER TYPES: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 40 OTHER TYPES: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 41 OTHER TYPES: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 42 OTHER TYPES: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 43 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD THOUSAND)

- TABLE 44 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 45 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (TON)

- TABLE 46 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 47 AUTOMOTIVE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 48 AUTOMOTIVE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 49 AUTOMOTIVE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 50 AUTOMOTIVE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 51 CONSUMER ELECTRONICS: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 52 CONSUMER ELECTRONICS: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 53 CONSUMER ELECTRONICS: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 54 CONSUMER ELECTRONICS: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 55 AEROSPACE & DEFENSE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 56 AEROSPACE & DEFENSE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 57 AEROSPACE & DEFENSE: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 58 AEROSPACE & DEFENSE: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 59 INDUSTRIAL: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 60 INDUSTRIAL: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 61 INDUSTRIAL: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 62 INDUSTRIAL: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 63 TELECOMMUNICATION: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 64 TELECOMMUNICATION: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 65 TELECOMMUNICATION: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 66 TELECOMMUNICATION: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 67 OTHER END-USE INDUSTRIES: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 68 OTHER END-USE INDUSTRIES: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 69 OTHER END-USE INDUSTRIES: CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 70 OTHER END-USE INDUSTRIES: CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 71 CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (USD THOUSAND)

- TABLE 72 CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (USD THOUSAND)

- TABLE 73 CONFORMAL COATINGS MARKET, BY REGION, 2019–2021 (TON)

- TABLE 74 CONFORMAL COATINGS MARKET, BY REGION, 2022–2028 (TON)

- TABLE 75 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

- TABLE 76 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 77 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (TON)

- TABLE 78 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 79 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 80 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 81 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 82 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 83 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD THOUSAND) (HISTORICAL)

- TABLE 84 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 85 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (TON)

- TABLE 86 ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 87 CHINA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND) (HISTORICAL)

- TABLE 88 CHINA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 89 CHINA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 90 CHINA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 91 TAIWAN: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 92 TAIWAN: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 93 TAIWAN: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 94 TAIWAN: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 95 JAPAN: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 96 JAPAN: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 97 JAPAN: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 98 JAPAN: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 99 SOUTH KOREA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 100 SOUTH KOREA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 101 SOUTH KOREA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 102 SOUTH KOREA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 103 VIETNAM: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 104 VIETNAM: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 105 VIETNAM: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 106 VIETNAM: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 107 INDIA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND) (HISTORICAL)

- TABLE 108 INDIA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 109 INDIA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 110 INDIA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 111 THAILAND: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 112 THAILAND: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 113 THAILAND: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 114 THAILAND: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 115 REST OF ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 116 REST OF ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 117 REST OF ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 118 REST OF ASIA PACIFIC: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 119 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

- TABLE 120 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 121 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (TON)

- TABLE 122 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 123 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 124 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 125 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 126 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 127 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD THOUSAND)

- TABLE 128 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 129 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (TON)

- TABLE 130 NORTH AMERICA: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 131 US: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 132 US: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 133 US: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 134 US: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 135 CANADA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 136 CANADA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 137 CANADA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 138 CANADA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 139 MEXICO: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 140 MEXICO: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 141 MEXICO: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 142 MEXICO: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 143 EUROPE: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

- TABLE 144 EUROPE: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 145 EUROPE: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (TON)

- TABLE 146 EUROPE: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 147 EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 148 EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 149 EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 150 EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 151 EUROPE: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD THOUSAND)

- TABLE 152 EUROPE: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 153 EUROPE: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (TON)

- TABLE 154 EUROPE: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 155 GERMANY: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 156 GERMANY: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 157 GERMANY: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 158 GERMANY: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 159 FRANCE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 160 FRANCE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 161 FRANCE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 162 FRANCE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 163 RUSSIA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 164 RUSSIA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 165 RUSSIA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 166 RUSSIA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 167 UK: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND) (HISTORICAL)

- TABLE 168 UK: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 169 UK: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 170 UK: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 171 REST OF EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 172 REST OF EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 173 REST OF EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 174 REST OF EUROPE: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 175 ROW: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (USD THOUSAND)

- TABLE 176 ROW: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (USD THOUSAND)

- TABLE 177 ROW: CONFORMAL COATINGS MARKET, BY COUNTRY, 2019–2021 (TON)

- TABLE 178 ROW: CONFORMAL COATINGS MARKET, BY COUNTRY, 2022–2028 (TON)

- TABLE 179 ROW: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 180 ROW: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 181 ROW: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 182 ROW: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 183 ROW: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (USD THOUSAND)

- TABLE 184 ROW: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (USD THOUSAND)

- TABLE 185 ROW: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2019–2021 (TON)

- TABLE 186 ROW: CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2022–2028 (TON)

- TABLE 187 MIDDLE EAST & AFRICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 190 MIDDLE EAST & AFRICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 191 SOUTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (USD THOUSAND)

- TABLE 192 SOUTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (USD THOUSAND)

- TABLE 193 SOUTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2019–2021 (TON)

- TABLE 194 SOUTH AMERICA: CONFORMAL COATINGS MARKET, BY TYPE, 2022–2028 (TON)

- TABLE 195 CONFORMAL COATINGS MARKET SHARE, BY DEGREE OF COMPETITION, 2022

- TABLE 196 STRATEGIC POSITIONING OF KEY PLAYERS

- TABLE 197 CONFORMAL COATINGS MARKET: KEY PLAYERS

- TABLE 198 CONFORMAL COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 199 CONFORMAL COATINGS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 200 DEALS, 2019–2023

- TABLE 201 OTHER DEVELOPMENTS, 2019–2023

- TABLE 202 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 203 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 204 HENKEL AG & CO. KGAA: DEALS

- TABLE 205 HENKEL AG & CO. KGAA: OTHER DEVELOPMENTS

- TABLE 206 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 207 ILLINOIS TOOL WORKS INC.: DEALS

- TABLE 208 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 209 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 210 SHIN-ETSU CHEMICAL CO., LTD.: OTHER DEVELOPMENTS

- TABLE 211 DOW: BUSINESS OVERVIEW

- TABLE 212 DOW: PRODUCT LAUNCHES

- TABLE 213 DOW: DEALS

- TABLE 214 H.B. FULLER: COMPANY OVERVIEW

- TABLE 215 H.B. FULLER: DEALS

- TABLE 216 CHASE CORP: COMPANY OVERVIEW

- TABLE 217 CHASE CORP: DEALS

- TABLE 218 ELECTROLUBE: COMPANY OVERVIEW

- TABLE 219 ELECTROLUBE: OTHER DEVELOPMENTS

- TABLE 220 DYMAX: COMPANY OVERVIEW

- TABLE 221 DYMAX: DEALS

- TABLE 222 DYMAX: OTHER DEVELOPMENTS

- TABLE 223 MG CHEMICALS: COMPANY OVERVIEW

- TABLE 224 SPECIALTY COATING SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 225 SPECIALTY COATING SYSTEMS INC.: DEALS

- TABLE 226 SPECIALTY COATING SYSTEMS INC.: OTHER DEVELOPMENTS

- TABLE 227 ALTANA AG: COMPANY OVERVIEW

- TABLE 228 CHT UK BRIDGWATER LTD.: COMPANY OVERVIEW

- TABLE 229 CSL SILICONES INC.: COMPANY OVERVIEW

- TABLE 230 EUROPLASMA NV: COMPANY OVERVIEW

- TABLE 231 PETERS GROUP: COMPANY OVERVIEW

- TABLE 232 CONINS PUNE: COMPANY OVERVIEW

- TABLE 233 INDUSTRIALEX: COMPANY OVERVIEW

- TABLE 234 AI TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 235 MASTER BOND INC.: COMPANY OVERVIEW

- TABLE 236 JOHN C DOLPH: COMPANY OVERVIEW

- TABLE 237 ACULON: COMPANY OVERVIEW

- TABLE 238 PRECISION COATINGS, INC.: COMPANY OVERVIEW

- TABLE 239 EPOXIES, ETC.: COMPANY OVERVIEW

- TABLE 240 SHRI MAHALUXMI CHEMICALS: COMPANY OVERVIEW

- TABLE 241 CRC INDIA MANUFACTURING & DISTRIBUTORS PVT LTD: COMPANY OVERVIEW

- TABLE 242 ENCAPSULANTS MARKET, BY REGION, 2015–2022 (USD MILLION)

- TABLE 243 ENCAPSULANTS MARKET, BY REGION, 2015–2022 (KILOTON)

- FIGURE 1 CONFORMAL COATINGS MARKET SEGMENTATION

- FIGURE 2 CONFORMAL COATINGS MARKET: RESEARCH DESIGN

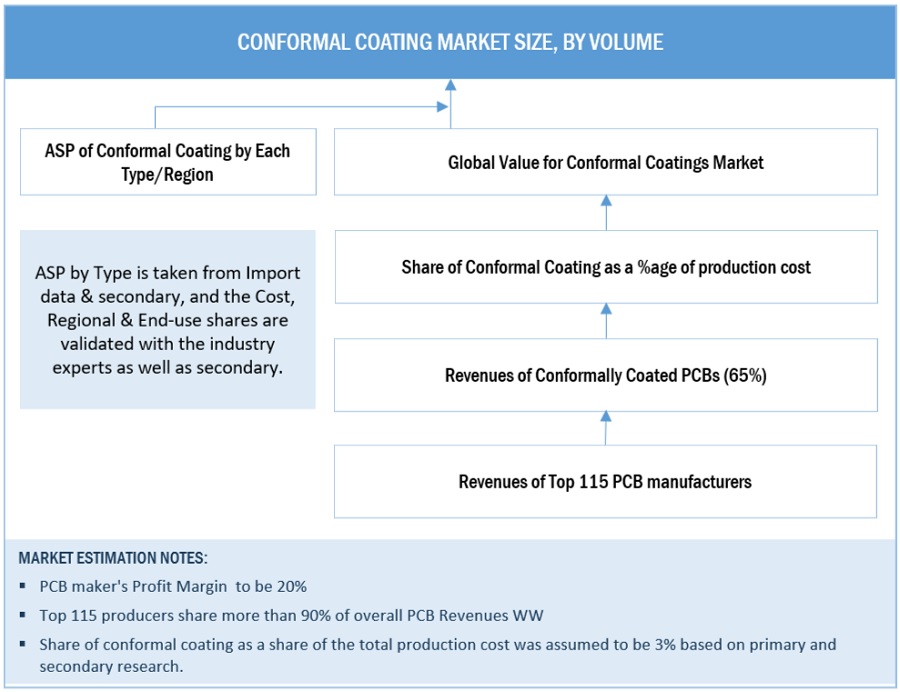

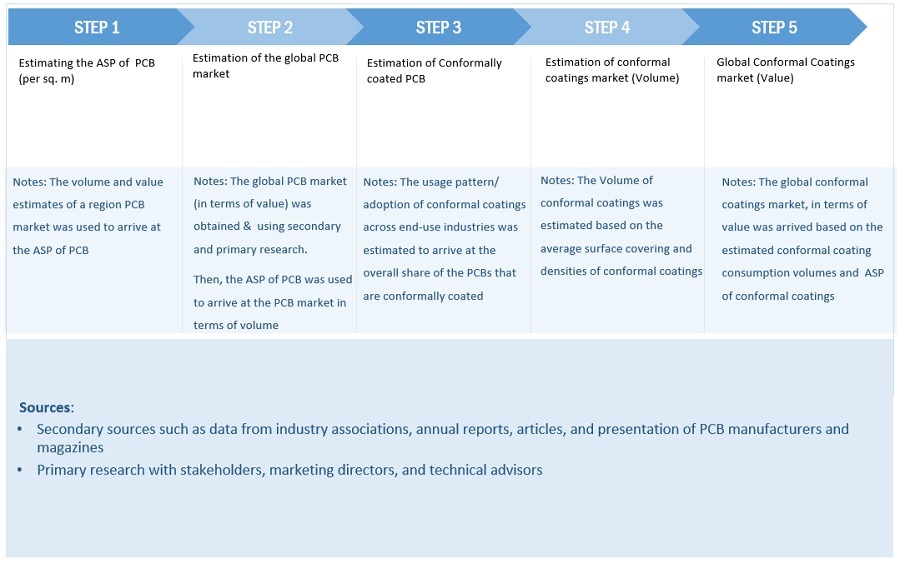

- FIGURE 3 MARKET SIZE ESTIMATION: GLOBAL PCB PRODUCTION

- FIGURE 4 MARKET SIZE ESTIMATION: PCB REVENUE

- FIGURE 5 CONFORMAL COATINGS MARKET: BOTTOM-UP APPROACH

- FIGURE 6 CONFORMAL COATINGS MARKET: TOP-DOWN APPROACH

- FIGURE 7 CONFORMAL COATINGS MARKET: DATA TRIANGULATION

- FIGURE 8 AUTOMOTIVE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 ACRYLIC TO BE LARGEST TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 INCREASE IN ELECTRONICS MANUFACTURING TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 12 ACRYLIC SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 13 AUTOMOTIVE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 CONFORMAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 PRODUCTION OF CONFORMAL COATINGS

- FIGURE 18 SUPPLY CHAIN OF CONFORMAL COATINGS INDUSTRY

- FIGURE 19 REVENUE SHIFT & NEW REVENUE POCKETS FOR CONFORMAL COATING MANUFACTURERS

- FIGURE 20 CONFORMAL COATINGS MARKET: ECOSYSTEM MAP

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- FIGURE 23 GRANTED PATENTS BETWEEN 2013 AND 2022

- FIGURE 24 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 25 NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 26 TOP APPLICANTS WITH HIGHEST PATENT COUNT

- FIGURE 27 ACRYLIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 28 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 29 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC: CONFORMAL COATINGS MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: CONFORMAL COATINGS MARKET SNAPSHOT

- FIGURE 32 STRATEGIES ADOPTED BY KEY CONFORMAL COATING PLAYERS BETWEEN 2019 AND 2023

- FIGURE 33 RANKING OF KEY PLAYERS IN CONFORMAL COATINGS MARKET, 2022

- FIGURE 34 MARKET SHARE OF CONFORMAL COATING MANUFACTURERS, 2022

- FIGURE 35 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022

- FIGURE 36 CONFORMAL COATINGS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 STARTUP/SME EVALUATION MATRIX: CONFORMAL COATINGS MARKET, 2022

- FIGURE 38 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 39 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

- FIGURE 40 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 41 DOW: COMPANY SNAPSHOT

- FIGURE 42 H.B. FULLER: COMPANY SNAPSHOT

- FIGURE 43 CHASE CORP: COMPANY SNAPSHOT

- FIGURE 44 EPOXY ENCAPSULANT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 45 ROOM TEMPERATURE CURING TYPE TO DOMINATE ENCAPSULANTS MARKET BETWEEN 2017 AND 2022

- FIGURE 46 CONSUMER ELECTRONICS TO LEAD ENCAPSULANTS MARKET BETWEEN 2017 AND 2022

- FIGURE 47 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

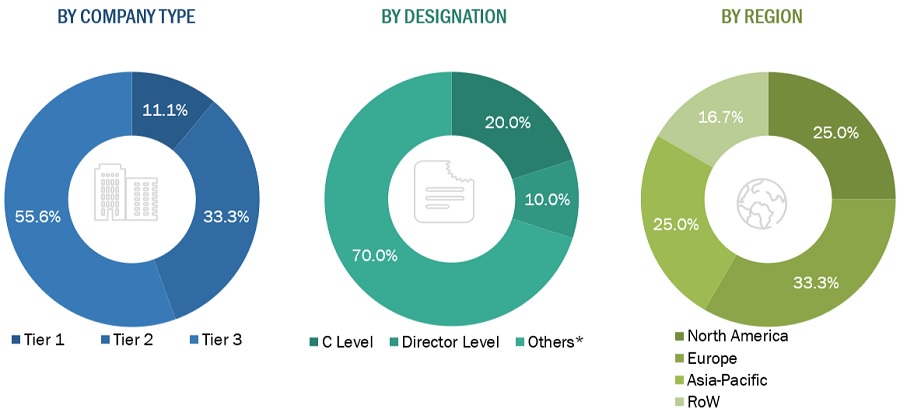

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Conformal coatings market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The Conformal coatings market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Conformal coatings market. Primary sources from the supply side include associations and institutions involved in the Conformal coatings industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Tier 1= = USD 1 Billion; Tier 2 = below USD 1 Billion to USD 500 Million; and Tier 3 = Below USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Conformal coatings market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

MARKET SIZE ESTIMATION: APPROACH

To know about the assumptions considered for the study, Request for Free Sample Report

MARKET SIZE ESTIMATION: APPROACH

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

A conformal coating is a thin film applied on a material (usually printed circuit boards) to protect it from harsh environments. It is a chemical coating or a polymer film with varying thicknesses. There are several types of conformal coatings classified based on the type of materials used in their manufacturing. These types include silicone, acrylic, epoxy, urethane, and perylene. These coatings find applications in automotive & transportation, electronics, industrial, aerospace & defense, and marine end-use industries.

Key Stakeholders

- Raw Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Conformal coatings manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Conformal coatings market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, end-use industry, region, and application.

- To analyze and forecast the conformal coatings market size based on five regions, namely, North America, Europe, Asia Pacific (APAC), Rest of the World (RoW).

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Conformal coatings market

- Further breakdown of the Rest of Europe’s Conformal coatings market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Conformal Coating Market