Pipeline & Process Services Market by Asset Type (Pipeline: T&D; Process: FPS, Refinery & Petrochemical, Gas Storage & Processing), Operation (Pre-commissioning & Commissioning, Maintenance, Decommissioning), Region - Global Forecast to 2025

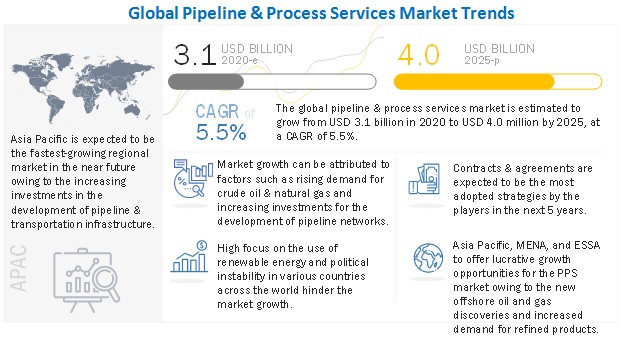

[284 Pages Report] The global pipeline & process services market in terms of revenue was estimated to be worth $3.1 billion in 2020 and is poised to reach $4.0 billion by 2025, growing at a CAGR of 5.5% from 2020 to 2025. The rising demand for crude oil & natural gas, especially from Asia Pacific, and the increasing need for safe, economical, and reliable connectivity drive the growth of the pipeline & process services market.

To know about the assumptions considered for the study, Request for Free Sample Report

Pipeline & Process Services Market Dynamics

Driver: Growing need for crude oil and natural gas, especially from APAC

With the increase in global population and rapid industrialization, the demand for oil and other energy resources is increasing speedily. According to the International Energy Outlook published by the Energy Information Administration (EIA), the global energy demand is primarily driven by non-OECD countries, such as Argentina, Brazil, India, Malaysia, Singapore, South Africa, and Thailand, with strong population growth and economic development. However, the energy demand from OECD nations such as the US, the UK, Czech Republic, Germany, Norway, and France, is likely to increase gradually with growth in the gross domestic product (GDP). The US, the European Union, and APAC are the major geographies demanding oil. According to the BP Statistical Review of the World Energy 2020, the global oil consumption increased by 0.9% from 2018 to 2019, whereas the global oil production decreased by 0.1% from 2018 to 2019, with south and central America, Europe, and the Middle East witnessing a decline of 4.9%, 3.4%, and 4.8%, respectively. The unfilled gap between the consumption and production of oil is expected to drive the developments in the offshore reserves and support the construction of offshore pipelines, such as the flowlines and gathering lines.

In 2019, the crude oil demand in APAC reached 36.1 million barrels per day (b/d or bpd), with growing requirements from countries such as China, Vietnam, Malaysia, India, and Sri Lanka. The demand is driven by the growing economic activities in the region, contributing to around 36% of primary consumption.

Additionally, countries such as China, Indonesia, and Australia develop shale gas and are involved in coal bed methane (CBM) projects, with floating liquefied natural gas (FLNG) and drilling projects gaining momentum in offshore regions. The region will not be able to satisfy the growing energy demand, and it primarily relies on imports to meet this increasing demand. Crude oil and natural gas imports are likely to rise, which, in turn, would result in the rapid development of pipeline networks and increased demand for pipeline and process services.

Restraints: Rapid shift to renewable energy hindering demand for pipeline & process services

The decline in oil consumption in Europe is expected to continue as the region is transitioning from conventional fossil energy to renewable energy. According to the BP Outlook 2019, by 2024, 29% of the overall energy consumed by the EU is expected to come from renewables. The main objective is to reduce carbon emissions by 36% in 2040 compared with the 2017 levels.

This transition toward renewables is hampering the oil production growth rate, leading to slower than expected well-drilling activities. Thus, the growth of the PPS market is likely to be hampered. The adoption of renewables by Europe, which has always been a significant energy buyer, will have a negative impact on oil and gas production companies, which, in turn, will have an adverse impact on the pipeline and process services market.

Opportunities: Remarkable deep and ultra-deep water discoveries of oil and gas reserves

The oil & gas industry is experiencing continuous discoveries owing to the increased demand for oil but the tight supply due to the continued Organization of the Petroleum Exporting Countries (OPEC) oil production cut. Major discoveries are being experienced in the offshore region, especially in western offshore Africa. According to the BP Statistical Review of 2019, the world still had unexplored 1,729.7 billion barrels of oil reserves by the end of 2018. Such promising reserves create opportunities for well drilling and production activities, creating growth opportunities for the pipeline and process services market. In 2019, Shell Offshore Inc. (Shell), a subsidiary of Royal Dutch Shell plc, made a significant oil discovery at the Blacktip prospect in the deepwater US Gulf of Mexico. Likewise, Gazprom, a Russian oil and gas company, in 2019, discovered two new fields comprising more than 500 billion cubic meters of gas on the shelf of the Yamal Peninsula, namely the Dinkov and Nyarmeyskoye fields.

Similarly, Thai PTTEP made the largest gas discovery in the Sarawak–Luconia–East Natuna basin, Malaysia. The estimated size is 2 trillion cubic feet, making this the seventh-largest global discovery of the year 2019. The US has more than 2.5 million miles (4 million km) of pipe distributing hydrocarbon fluids across the country. In June 2017, Oil and Natural Gas Corporation (ONGC) of India discovered an oilfield with approximately 20 million tons of hydrocarbon reserves in Mumbai high offshore fields. The fields are discovered regularly in African countries, such as Mauritania and Senegal.

Moreover, a majority of E&P companies are venturing to capitalize on the discoveries in this region. For instance, ExxonMobil acquired a 30% stake in the petroleum exploration license in the Walvis Basin, offshore Namibia. These recent discoveries are expected to bring economic prospects in the region, helping to reduce oil and gas imports, and lowering carbon levels in power generation. New discoveries are also expected to result in an increase in investments in the region by 2023. Hence, a growing number of discoveries of oil and gas reserves across various regions is likely to offer lucrative opportunities for the players in the pipeline and process services market.

Challenges: Severe climatic conditions and high construction cost of offshore pipelines

Due to the rising oil demand, E&P companies are keen to explore oilfields located in remote and harsh environments. According to the US Geological Survey, the offshore arctic holds 25% of the world’s untapped reserves. Most of these reserves are located under the sea ice, creating additional challenges for the design, construction, installation, and operation of offshore pipelines.

Offshore arctic and sub-arctic areas, such as the Barents Sea, the Russian Arctic, the Alaskan Chukchi Sea, the Beaufort Sea, have created interest among upstream companies for the development of these reserves, posing challenges not only for upstream E&P operations but also to offshore pipeline EPC companies as these pipelines have to withstand severe climatic challenges, such as low temperature, ice gouging, and material issues. Moreover, these pipelines are exposed to challenging loading conditions such as permafrost, fault crossings, and ice scouring, which impose high strain on them. Hence, the load-carrying capacity and the temperature requirement parameters need to be taken into consideration while determining the material and weld procedures to be followed for strain-based designs of pipelines, which will increase the cost for designing, construction/installing, and commissioning of offshore pipelines.

Offshore construction of pipeline involves several challenges specific to ultra-deepwater regions and high-pressure conditions. These pipelines require robust and end-to-end pipeline monitoring solutions that provide visibility of the performance of equipment, machinery, and interconnectors. The designing and the accurate laying down of pipelines with their interconnections increase the cost of construction. The offshore construction cost is approximately 50% more than the onshore one. This is majorly owed to the day rate cost incurred for operating pipelaying vessels. Developments in the artic and ultra-deepwater regions are expected to pose technical challenges to companies operating offshore.

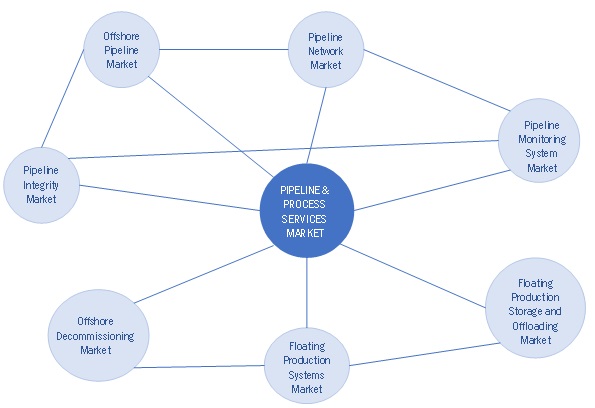

Market Interconnection

To know about the assumptions considered for the study, download the pdf brochure

By asset type, the pipeline segment is the largest contributor in the pipeline & process services market in 2019.

The pipeline segment dominated the pipeline & process services market by asset type in 2019. The rising demand for crude oil has led to an increase in offshore exploration and drilling activities, which, in turn, has driven the growth of the market for transmission pipeline services. Whereas rapid industrialization and urbanization foster the demand for distribution pipeline services. Europe, Asia Pacific, and the Middle East are expected to be the most attractive markets for pipeline services owing to the commissioning of planned offshore oil and gas projects during the forecast period. For example, the Cyprus–Greece Gas Pipeline, a 1,900 km pipeline, is expected to have a transport capacity of 16 billion cubic meters per year from the offshore gas reserves in the Levantine Basin and the potential gas reserves in Greece. The pipeline is expected to be completed by 2025.

By operation, maintenance service is expected to be the largest contributor during the forecast period.

Maintenance services are expected to hold the largest share of the operation segment during the forecast period. Oil and gas infrastructure depreciates over time, and if it is not appropriately maintained, it can pose serious threats, including the risk of injury, death, environmental destruction, and system interruption. Therefore, it is critical to carry out on-time maintenance and repair of these assets to reduce the risk of failure, improve profitability, and increase the asset life. Changes to the internal pipe surface can significantly impact both pipeline throughput and energy requirements for maintaining desired flow rates. A clean pipeline helps maximize the flow capacity of media and increase system longevity, thereby enhancing the system reliability while minimizing associated safety risks. This ultimately improves the bottom-line profitability of pipeline owners and operators. The rising emphasis on maintaining profitability, especially after the decline in crude oil price, drives the need for maintenance services.

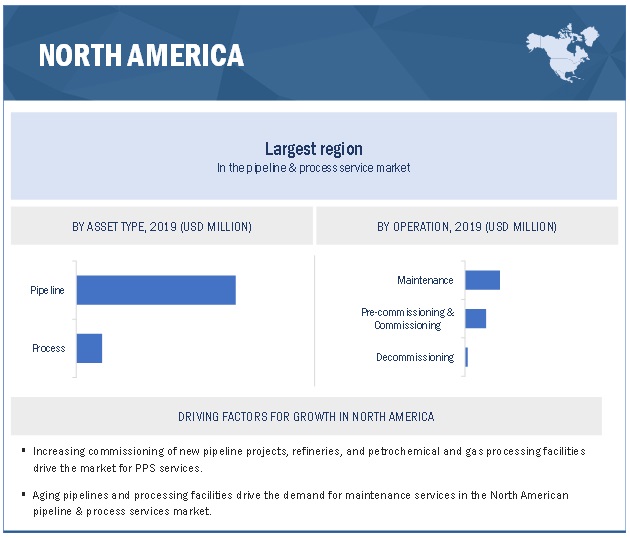

North America accounted for the largest share of the pipeline & process services market in 2019 .

North America includes the US and Canada. North America witnessed a decline in new pipeline addition as the focus shifted toward maintenance activities in 2019. The region also witnessed increasing commissioning activities for refineries, petrochemical, and gas processing facilities in 2018. The US is expected to increase its gas storage capacity with projects such as Duke Energy’s 4th LNG storage facility, having an estimated investment of USD 250 million. Matrix Service, a subsidiary of Matrix Service Company, has been awarded the contract for the construction of the facility. The project started in 2019 and is likely to be completed in 2021.

In 2018, Exxon Mobil announced a planned investment of USD 20 billion for its chemical and oil-refining plants in the US Gulf Coast by 2022. The investment is likely to be shared by 11 facilities, primarily located in Beaumont, Texas, with plans to expand polyethylene production, oil refining capacity, and liquefied natural gas exports. The announcement of construction was made in January 2019, and operations are expected to begin by 2022. Such investments are likely to boost the demand for pipeline & process services in North America

Recent Developments

- In September 2020, EnerMech won a 12 month contract in the Southern North Sea. The company will deliver a range of specialist services such as nitrogen, bolting, and flange management; pipework removal; and purging of all assets under the project. It will also provide support in the installation of new pipework, controlled bolting, and leak testing.

- In September 2020, EnerMech opened a new entity EnerMech (BN) Bhd Shd, to support the company’s growing activities in Brunei. The company took this step to enhance its presence and offer integrated end-to-end services in Brunei.

- In July 2020, IKM Group was awarded a contract from Johan Castberg for N2/He leakage testing and PSV calibration and supplementary work related to bolt work, chemical cleaning, hot oil flushing, drying, machining of flanges, cutting pipes, and machining pipe wedges, and so on.

- In April 2020, Techfem won a contract from Società Gasdotti Italia for project management, site supervision, and field safety management services in support of the construction of lots 3 and 4 of the Larino–Chieti gas pipeline. The project is part of the Dorsale Larino–Recanati, a strategic infrastructure included in the 10-year development plan of the natural gas transmission system.

- In June 2019, Baker Hughes opened a multimodal facility (MMF) for oil and gas in Luanda, Angola. The facility delivers a suite of products and services across the oil and gas value chain. It will serve as a hub to support customers and projects in Angola and Southern Africa and will also serve customers globally.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Asset type, operation, and region |

|

Geographies covered |

Asia Pacific, North America, Europe & Sub-Saharan Africa, Middle East & North Africa, Euraisa, and Latin America |

|

Companies covered |

Halliburton (US), Baker Hughes Company (US), EnerMech (UK), IKM Gruppen (Norway), Enerpac Tool Group (UK), Altus Intervention (Norway), BlueFin, a GATE Energy company (US), STEP Energy, Services (US), IPEC (Iran), Trans Asia Pipelines (UAE), Chenergy (Nigeria), Techfem (Italy) |

This research report categorizes the pipeline & process services market-based on type, pump type, application, and region

On the basis of asset type, the market has been segmented as follows:

-

Pipeline

- Transmission Pipelines

- Distribution Pipelines

-

Process

- Refinery & Petrochemical facility management

- FPS management

- Gas Processing

- Gas Storage

On the basis of operation, the market has been segmented as follows:

-

Pre-commissioning & Commissioning

- Filling, cleaning and gauging

- Dewatering & Leak testing

- Nitrogen Services

- Pressure testing

- Chemical cleaning

- Hydrostatic testing

- Others (Others include Hot Oil Flushing, Umbilical Testing Services (Umbilical Flushing, Umbilical Testing), Pneumatic Testing, De-sanding, De-oiling and De-scaling using water & oil-based Gels, Corrosion Prevention, Vacuum Drying, and others)

-

Maintenance

- Flow remediation

- Nitrogen services

- Pipe freezing

- Bolting & tensioning and Flange management

- Chemical cleaning

- Others (Others includes Mechanical cleaning, Hydrostatic testing, Retro Jetting, Flushing/ Disposal, Leak testing, and Gel services)

-

Decommissioning

- Nitrogen service

- Chemical cleaning

- Bolting & tensioning

- Flushing

- Pipe Freezing

- Others (Others includes Retro Jetting, Dewatering & Swabbing, Valve Services, Washing, Disposal, Filtration, and Drying)

On the basis of region, the market has been segmented as follows:

- North America

- Asia Pacific

- Europe & Sub-Saharan Africa

- Middle East & North Africa

- Eurasia

- Latin America

Frequently Asked Questions (FAQ):

What is the current size of the pipeline & process services market?

The current market size of global pipeline & process services market is billion $3.1 in 2019.

What is the major drivers for pipeline & process services market?

The rising demand for crude oil & natural gas, especially from Asia Pacific, and the increasing need for safe, economical, and reliable connectivity drive the growth of the pipeline & process services market.

Which is the fastest growing region during the forecasted period in pipeline & process services market?

Asia Pacific is the fastest growing region during the forecasted period Asia Pacific is expected to witness increasing refining, gas storage, FPS, and petrochemical capacity additions in the next few years.

Which is the fastest growing segment, by type during the forecasted period in pipeline & process services market?

The process segment, by asset type is the fastest growing segment during the forecasted period owing increasing demand for petrochemical products, growing focus on improving refinery capacities and rising use of natural gas drive the market for process services. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 PIPELINE & PROCESS SERVICES MARKET, BY OPERATION: INCLUSIONS VS. EXCLUSIONS

1.2.2 MARKET, BY ASSET TYPE: INCLUSIONS VS. EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 PIPELINE & PROCESS SERVICES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key industry insights

2.2.2.2 Breakdown of primaries

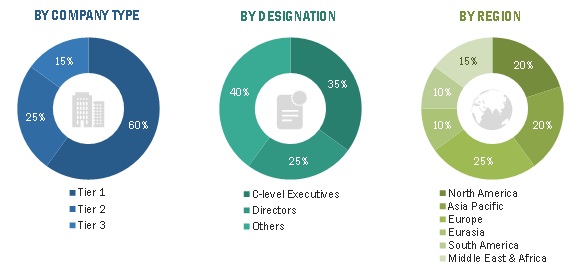

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 1 MARKET: PLAYERS/COMPANIES CONNECTED

2.3 SCOPE

2.3.1 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

2.4 MARKET SIZE ESTIMATION

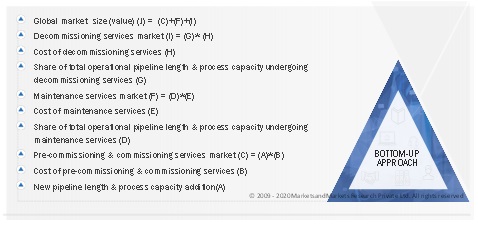

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 TOP-DOWN APPROACH

2.4.3 IDEAL DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET: DEMAND-SIDE ANALYSIS

2.4.3.1 Assumptions for demand-side analysis

2.4.3.1.1 Pipeline

2.4.3.1.2 Process

2.4.3.2 Calculation

2.4.4 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 50)

3.1 SCENARIO ANALYSIS

FIGURE 7 SCENARIO ANALYSIS: PIPELINE & PROCESS SERVICES MARKET, 2017–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 2 MARKET SNAPSHOT

FIGURE 8 PIPELINE SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

FIGURE 9 TRANSMISSION PIPELINES TO LEAD PIPELINE SERVICES MARKET DURING FORECAST PERIOD

FIGURE 10 GAS PROCESSING SEGMENT TO COMMAND PROCESS SERVICES MARKET DURING FORECAST PERIOD

FIGURE 11 MAINTENANCE OPERATIONS TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA DOMINATED MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN PIPELINE & PROCESS SERVICES MARKET DURING FORECAST PERIOD

FIGURE 13 OFFSHORE OIL AND GAS DISCOVERIES AND DEVELOPMENT OF MIDSTREAM INFRASTRUCTURE TO DRIVE GROWTH OF PIPELINE & PROCESS SERVICES MARKET

4.2 MARKET, BY ASSET TYPE

FIGURE 14 PIPELINE SEGMENT DOMINATED PIPELINE & PROCESS SERVICES MARKET IN 2019

4.3 PIPELINE SERVICES MARKET, BY TYPE

FIGURE 15 TRANSMISSION PIPELINES LED PIPELINE SERVICES MARKET IN 2019

4.4 PROCESS SERVICES MARKET, BY TYPE

FIGURE 16 GAS PROCESSING SEGMENT COMMANDED PIPELINE & PROCESS SERVICES MARKET IN 2019

4.5 MARKET, BY OPERATION

FIGURE 17 PRE-COMMISSIONING & COMMISSIONING ACTIVITIES LED PIPELINE & PROCESS SERVICES MARKET IN 2019

4.6 PIPELINE SERVICES MARKET, BY OPERATION

FIGURE 18 MAINTENANCE SEGMENT DOMINATED PIPELINE SERVICES MARKET IN 2019

4.7 PROCESS SERVICES MARKET, BY OPERATION

FIGURE 19 PRE-COMMISSIONING & COMMISSIONING ACTIVITIES LED PROCESS SERVICES MARKET IN 2019

4.8 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.9 NORTH AMERICAN PIPELINE & PROCESS SERVICES MARKET, BY ASSET TYPE & OPERATION

FIGURE 21 PIPELINE SEGMENT AND MAINTENANCE OPERATIONS DOMINATED NORTH AMERICAN MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19: GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 24 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 26 PIPELINE & PROCESS SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing need for crude oil and natural gas, especially from APAC

FIGURE 27 OIL CONSUMPTION AND PRODUCTION IN ASIA PACIFIC, 2009 TO 2019

5.5.1.2 Surging demand for safe, economical, and reliable infrastructure connectivity to transport oil and gas

5.5.1.3 Increasing investments in pipeline projects

5.5.2 RESTRAINTS

5.5.2.1 Political instability affecting cross-border projects

5.5.2.2 Rapid shift to renewable energy from conventional energy

5.5.3 OPPORTUNITIES

5.5.3.1 Remarkable deep and ultra-deepwater discoveries of oil and gas reserves

5.5.3.2 Growing demand for refined products

5.5.3.3 Rapid rise in development of midstream infrastructure across several regions

5.5.4 CHALLENGES

5.5.4.1 Severe climatic conditions and high construction cost of offshore pipelines

5.5.4.2 Considerable impact of COVID-19 on oil & gas industry

6 IMPACT OF COVID-19 ON PIPELINE & PROCESS SERVICES MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 72)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 3 GDP ANALYSIS (IN PERCENTAGE)

6.1.2 SCENARIO ANALYSIS OF OIL & GAS INDUSTRY

FIGURE 28 CRUDE OIL PRICE VS. CRUDE OIL PRODUCTION (2017–2025)

6.1.3 OPTIMISTIC SCENARIO

TABLE 4 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.4 REALISTIC SCENARIO

TABLE 5 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.1.5 PESSIMISTIC SCENARIO

TABLE 6 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 PIPELINE & PROCESS SERVICES MARKET, BY ASSET TYPE (Page No. - 77)

7.1 INTRODUCTION

FIGURE 29 PIPELINE SEGMENT ACCOUNTED FOR LARGER SHARE OF PIPELINE & PROCESS SERVICES MARKET IN 2019

TABLE 7 GLOBAL MARKET, BY ASSET TYPE, 2017–2025 (USD MILLION)

7.2 PIPELINE

TABLE 8 PIPELINE SERVICES MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 9 PIPELINE SERVICES MARKET, BY TYPE, 2017–2025 (USD MILLION)

7.2.1 TRANSMISSION PIPELINES

7.2.1.1 Commissioning of new natural gas and petroleum projects drives demand for transmission pipelines services

TABLE 10 TRANSMISSION PIPELINE SERVICES MARKET, BY REGION, 2017–2025 (USD MILLION)

7.2.2 DISTRIBUTION PIPELINES

7.2.2.1 Need to develop pipeline networks drives demand for distribution pipeline services

TABLE 11 DISTRIBUTION PIPELINE SERVICES MARKET, BY REGION, 2017–2025 (USD MILLION)

7.3 PROCESS

TABLE 12 PROCESS SERVICES MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 13 PROCESS SERVICES MARKET, BY TYPE, 2017–2025 (USD MILLION)

7.3.1 REFINERY & PETROCHEMICAL FACILITY MANAGEMENT

7.3.1.1 Rising refinery capacity investments to accelerate demand for refinery and petrochemical facility management services

TABLE 14 PROCESS SERVICES MARKET FOR REFINERY & PETROCHEMICAL FACILITY MANAGEMENT, BY REGION, 2017–2025 (USD MILLION)

7.3.2 FPS MANAGEMENT

7.3.2.1 Growing number of offshore discoveries to boost demand for process services for FPS management

TABLE 15 PROCESS SERVICES MARKET FOR FPS MANAGEMENT, BY REGION, 2017–2025 (USD MILLION)

7.3.3 GAS PROCESSING

7.3.3.1 Increasing shale production drives establishment of gas processing units

TABLE 16 PROCESS SERVICES MARKET FOR GAS PROCESSING, BY REGION, 2017–2025 (USD MILLION)

7.3.4 GAS STORAGE

7.3.4.1 Surging need for development of gas storage facilities to drive market growth

TABLE 17 PROCESS SERVICES MARKET FOR GAS STORAGE, BY REGION, 2017–2025 (USD THOUSAND)

8 PIPELINE & PROCESS SERVICES MARKET, BY OPERATION (Page No. - 85)

8.1 INTRODUCTION

FIGURE 30 PRE-COMMISSIONING & COMMISSIONING SEGMENT DOMINATED PIPELINE & PROCESS SERVICES MARKET IN 2019

TABLE 18 GLOBAL MARKET, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 19 PIPELINE SERVICES MARKET, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 20 PROCESS SERVICES MARKET, BY OPERATION, 2017–2025 (USD MILLION)

8.2 PRE-COMMISSIONING & COMMISSIONING

8.2.1 GROWING REQUIREMENT FOR PRE-COMMISSIONING AND COMMISSIONING ACTIVITIES BEFORE GIVING CHARGE OF NEW OIL AND GAS FACILITY DRIVES MARKET GROWTH

TABLE 21 MARKET FOR PRE-COMMISSIONING & COMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 PIPELINE SERVICES MARKET FOR PRE-COMMISSIONING & COMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 PROCESS SERVICES MARKET FOR PRE-COMMISSIONING & COMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 MARKET FOR PRE-COMMISSIONING & COMMISSIONING, BY SERVICE TYPE, 2017–2025 (USD MILLION)

8.3 MAINTENANCE

8.3.1 RISING FOCUS ON OPERATIONAL SAFETY, AS WELL AS ON BOOSTING PROFITABILITY, DRIVES DEMAND FOR MAINTENANCE SERVICES

TABLE 25 PIPELINE & PROCESS SERVICES MARKET FOR MAINTENANCE, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 PIPELINE SERVICES MARKET FOR MAINTENANCE, BY REGION, 2017–2025 (USD MILLION)

TABLE 27 PROCESS SERVICES MARKET FOR MAINTENANCE, BY REGION, 2017–2025 (USD MILLION)

TABLE 28 PIPELINE & PROCESS SERVICES MARKET FOR MAINTENANCE, BY SERVICE TYPE, 2017–2025 (USD MILLION)

8.4 DECOMMISSIONING

8.4.1 ABANDONING OF AGING INFRASTRUCTURE FUELS DEMAND FOR DECOMMISSIONING SERVICES

TABLE 29 PIPELINE & PROCESS SERVICES MARKET FOR DECOMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 30 PIPELINE SERVICES MARKET FOR DECOMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 31 PROCESS SERVICES MARKET FOR DECOMMISSIONING, BY REGION, 2017–2025 (USD MILLION)

TABLE 32 MARKET FOR DECOMMISSIONING, BY SERVICE TYPE, 2017–2025 (USD MILLION)

9 PIPELINE & PROCESS SERVICES MARKET, BY REGION (Page No. - 94)

9.1 INTRODUCTION

FIGURE 31 NORTH AMERICA DOMINATED PIPELINE & PROCESS SERVICES MARKET IN 2019

TABLE 33 GLOBAL MARKET, BY REGION, 2017–2025 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 AGING PIPELINE AND PROCESS FACILITY INFRASTRUCTURE DRIVE THE NORTH AMERICAN PPS MARKET

FIGURE 32 NORTH AMERICA: REGIONAL SNAPSHOT

9.2.2 BY ASSET TYPE

TABLE 34 MARKET IN NORTH AMERICA, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.2.2.1 Pipeline, by asset type

TABLE 35 PIPELINE SERVICES MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

9.2.2.2 Process, by asset type

TABLE 36 PROCESS SERVICES MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

9.2.3 BY OPERATION

TABLE 37 PIPELINE & PROCESS SERVICES MARKET IN NORTH AMERICA, BY OPERATION, 2017–2025 (USD MILLION)

9.2.3.1 Pipeline, by operation

TABLE 38 PIPELINE SERVICES MARKET IN NORTH AMERICA, BY OPERATION, 2017–2025 (USD MILLION)

9.2.3.2 Process, by operation

TABLE 39 PROCESS SERVICES MARKET IN NORTH AMERICA, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 40 STAKEHOLDERS IN NORTH AMERICAN MARKET

FIGURE 33 TOTAL SHARE OF OPERATIONAL PIPELINES IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 34 TOTAL OPERATIONAL PIPELINES IN NORTH AMERICA, 2020—2025 (KILOMETERS)

FIGURE 35 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 36 TOTAL OPERATIONAL REFINERY CAPACITY IN NORTH AMERICA, 2020—2025 (THOUSAND BARRELS/DAY)

FIGURE 37 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 38 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY IN NORTH AMERICA, 2020—2025 (MILLION METRIC TONS)

FIGURE 39 TOTAL SHARE OF OPERATIONAL GAS STORAGE CAPACITY IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 40 TOTAL OPERATIONAL GAS STORAGE CAPACITY IN NORTH AMERICA, 2020—2025 (BILLION CUBIC FEET)

FIGURE 41 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 42 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN NORTH AMERICA, 2020—2025 (MILLION CUBIC FEET/DAY)

FIGURE 43 TOTAL SHARE OF FPS CAPACITY IN NORTH AMERICA, BY COUNTRY, 2019

FIGURE 44 FPS CAPACITY IN NORTH AMERICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 41 KEY PIPELINE PROJECTS IN NORTH AMERICA

TABLE 42 KEY PROJECTS RELATED TO PROCESS IN NORTH AMERICA

9.3 EUROPE & SUB-SAHARAN AFRICA

9.3.1 INCREASING DEVELOPMENT OF GAS PROCESSING AND STORAGE FACILITIES DRIVE THE PPS MARKET IN EUROPE & SUB-SAHARAN AFRICA

FIGURE 45 EUROPE & SUB-SAHARAN AFRICA: REGIONAL SNAPSHOT

9.3.2 BY ASSET TYPE

TABLE 43 PIPELINE SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.3.2.1 Pipeline, by asset type

TABLE 44 PIPELINE SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY TYPE, 2017–2025 (USD MILLION)

9.3.2.2 Process, by asset type

TABLE 45 PROCESS SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY TYPE, 2017–2025 (USD MILLION)

9.3.3 BY OPERATION

TABLE 46 PIPELINE & PROCESS SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

9.3.3.1 Pipeline, by operation

TABLE 47 PIPELINE SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

9.3.3.2 Process, by operation

TABLE 48 PROCESS SERVICES MARKET IN EUROPE & SUB-SAHARAN AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 49 STAKEHOLDERS IN EUROPEAN & SUB-SAHARAN AFRICAN PIPELINE SERVICES MARKET

FIGURE 46 TOTAL SHARE OF OPERATIONAL PIPELINES IN EUROPE & SUB-SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 47 TOTAL OPERATIONAL PIPELINES IN EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (KILOMETERS)

FIGURE 48 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 49 TOTAL OPERATIONAL REFINERY CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (THOUSAND BARRELS/DAY)

FIGURE 50 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 51 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (MILLION METRIC TONS)

FIGURE 52 TOTAL SHARE OF OPERATIONAL GAS STORAGE CAPACITY IN EUROPE & SUB SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 53 TOTAL OPERATIONAL GAS STORAGE CAPACITY EUROPE & SUB SAHARAN AFRICA, 2020—2025 (BILLION CUBIC FEET)

FIGURE 54 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 55 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (MILLION CUBIC FEET PER DAY)

FIGURE 56 TOTAL SHARE OF FPS CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, BY GEOGRAPHY, 2019

FIGURE 57 FPS CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

FIGURE 58 TOTAL SHARE OF LNG CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, BY COUNTRY, 2019

FIGURE 59 LNG CAPACITY IN EUROPE & SUB-SAHARAN AFRICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 50 KEY PIPELINE PROJECTS IN EUROPE & SUB-SAHARAN AFRICA

TABLE 51 KEY PROCESS-RELATED PROJECTS IN EUROPE & SUB-SAHARAN AFRICA

9.4 ASIA PACIFIC

9.4.1 DEVELOPMENT OF MIDSTREAM INFRASTRUCTURE DRIVE THE DEMAND FOR PPS MARKET IN ASIA PACIFIC

9.4.2 BY ASSET TYPE

TABLE 52 PIPELINE & PROCESS SERVICES MARKET IN ASIA PACIFIC, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.4.2.1 Pipeline, by asset type

TABLE 53 PIPELINE SERVICES MARKET IN ASIA PACIFIC, BY TYPE, 2017–2025 (USD MILLION)

9.4.2.2 Process, by asset type

TABLE 54 PROCESS SERVICES MARKET IN ASIA PACIFIC, BY TYPE, 2017–2025 (USD MILLION)

9.4.3 BY OPERATION

TABLE 55 PIPELINE & PROCESS SERVICES MARKET IN ASIA PACIFIC, BY OPERATION, 2017–2025 (USD MILLION)

9.4.3.1 Pipeline, by operation

TABLE 56 PIPELINE SERVICES MARKET IN ASIA PACIFIC, BY OPERATION, 2017–2025 (USD MILLION)

9.4.3.2 Process, by operation

TABLE 57 PROCESS SERVICES MARKET IN ASIA PACIFIC, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 58 STAKEHOLDERS IN PIPELINE SERVICES MARKET IN ASIA PACIFIC

FIGURE 60 TOTAL SHARE OF OPERATIONAL PIPELINES IN ASIA PACIFIC, BY COUNTRY, 2019

FIGURE 61 TOTAL OPERATIONAL PIPELINES IN ASIA PACIFIC, 2020—2025 (KILOMETERS)

FIGURE 62 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN ASIA PACIFIC, BY COUNTRY, 2019

FIGURE 63 TOTAL OPERATIONAL REFINERY CAPACITY IN ASIA PACIFIC, 2020—2025 (THOUSAND BARRELS PER DAY)

FIGURE 64 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN ASIA PACIFIC, BY COUNTRY, 2019

FIGURE 65 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY IN ASIA PACIFIC, 2020—2025 (MILLION METRIC TONS)

FIGURE 66 TOTAL SHARE OF OPERATIONAL GAS STORAGE CAPACITY IN ASIA PACIFIC, BY COUNTRY 2019

FIGURE 67 TOTAL OPERATIONAL GAS STORAGE CAPACITY IN ASIA PACIFIC, 2020—2025 (BILLION CUBIC FEET)

FIGURE 68 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN ASIA PACIFIC, BY COUNTRY, 2019

FIGURE 69 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN ASIA PACIFIC, 2020—2025 (MILLION CUBIC FEET PER DAY)

FIGURE 70 TOTAL SHARE OF FPS CAPACITY IN ASIA PACIFIC, BY GEOGRAPHY, 2019

FIGURE 71 FPS CAPACITY IN ASIA PACIFIC, 2020—2025 (MILLION METRIC TONS PER ANNUM)

FIGURE 72 TOTAL SHARE OF LNG CAPACITY IN ASIA PACIFIC, BY COUNTRY, 2019

FIGURE 73 LNG CAPACITY IN ASIA PACIFIC, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 59 KEY PIPELINE PROJECTS IN ASIA PACIFIC

TABLE 60 KEY PROCESS-RELATED PROJECTS IN ASIA PACIFIC

9.5 MIDDLE EAST & NORTH AFRICA

9.5.1 RAPID DEVELOPMENT OF REFINERY & PETROCHEMICAL FACILITIES DRIVE THE PPS MARKET IN MIDDLE EAST & NORTH AFRICA

9.5.2 BY ASSET TYPE

TABLE 61 PIPELINE SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.5.2.1 Pipeline, by asset type

TABLE 62 PIPELINE SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY TYPE, 2017–2025 (USD MILLION)

9.5.2.2 Process, by asset type

TABLE 63 PROCESS SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY TYPE, 2017–2025 (USD MILLION)

9.5.3 BY OPERATION

TABLE 64 PIPELINE & PROCESS SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

9.5.3.1 Pipeline, by operation

TABLE 65 PIPELINE SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

9.5.3.2 Process, by operation

TABLE 66 PROCESS SERVICES MARKET IN MIDDLE EAST & NORTH AFRICA, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 67 STAKEHOLDERS IN MIDDLE EASTERN & NORTH AMERICAN PIPELINE SERVICES MARKET

FIGURE 74 TOTAL SHARE OF OPERATIONAL PIPELINES IN MIDDLE EAST & NORTH AFRICA, BY COUNTRY, 2019

FIGURE 75 TOTAL OPERATIONAL PIPELINES IN MIDDLE EAST & NORTH AFRICA, 2020—2025 (KILOMETERS)

FIGURE 76 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN MIDDLE EAST & NORTH AFRICA, BY COUNTRY, 2019

FIGURE 77 TOTAL OPERATIONAL REFINERY CAPACITY IN MIDDLE EAST & NORTH AFRICA, 2020—2025 (THOUSAND BARRELS PER DAY)

FIGURE 78 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN MIDDLE EAST & NORTH AFRICA, BY COUNTRY, 2019

FIGURE 79 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY IN MIDDLE EAST & NORTH AFRICA, 2020—2025 (MILLION METRIC TONS)

FIGURE 80 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN MIDDLE EAST & NORTH AFRICA, BY COUNTRY, 2019

FIGURE 81 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN MIDDLE EAST & NORTH AFRICA (MILLION CUBIC FEET PER DAY), 2020—2025

FIGURE 82 TOTAL SHARE OF FPS CAPACITY IN MIDDLE EAST & NORTH AFRICA, BY COUNTRY, 2019

FIGURE 83 FPS CAPACITY IN MIDDLE EAST & NORTH AFRICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

FIGURE 84 TOTAL SHARE OF LNG CAPACITY IN MIDDLE EAST & NORTH AFRICA, 2019

FIGURE 85 LNG CAPACITY IN MIDDLE EAST & NORTH AFRICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 68 KEY PIPELINE PROJECTS IN MIDDLE EAST & NORTH AFRICA

TABLE 69 KEY PROCESS-RELATED PROJECTS IN MIDDLE EAST & NORTH AFRICA

9.6 EURASIA

9.6.1 INCREASING DEMAND OF NATURAL GAS FROM END-USERS BOOST THE GROWTH OF PPS MARKET IN EURASIA

9.6.2 BY ASSET TYPE

TABLE 70 PIPELINE & PROCESS SERVICES MARKET IN EURASIA, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.6.2.1 Pipeline, by asset type

TABLE 71 PIPELINE SERVICES MARKET IN EURASIA, BY TYPE, 2017–2025 (USD MILLION)

9.6.2.2 Process, by asset type

TABLE 72 PROCESS SERVICES MARKET IN EURASIA, BY TYPE, 2017–2025 (USD MILLION)

9.6.3 BY OPERATION

TABLE 73 PIPELINE & PROCESS SERVICES MARKET IN EURASIA, BY OPERATION, 2017–2025 (USD MILLION)

9.6.3.1 Pipeline, by operation

TABLE 74 PIPELINE SERVICES MARKET IN EURASIA, BY OPERATION, 2017–2025 (USD MILLION)

9.6.3.2 Process, by operation

TABLE 75 PROCESS SERVICES MARKET IN EURASIA, BY OPERATION, 2017–2025 (USD MILLION)

TABLE 76 STAKEHOLDERS IN EURASIAN PIPELINE & PROCESS SERVICES MARKET

FIGURE 86 TOTAL SHARE OF OPERATIONAL PIPELINES IN EURASIA, BY COUNTRY, 2019

FIGURE 87 TOTAL OPERATIONAL PIPELINES IN EURASIA, 2020—2025 (KILOMETERS)

FIGURE 88 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN EURASIA, BY COUNTRY, 2019

FIGURE 89 TOTAL OPERATIONAL REFINERY CAPACITY IN EURASIA, 2020—2025 (THOUSAND BARRELS PER DAY)

FIGURE 90 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN EURASIA, BY COUNTRY, 2019

FIGURE 91 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY IN EURASIA, 2020—2025 (MILLION METRIC TONS)

FIGURE 92 TOTAL SHARE OF OPERATIONAL GAS STORAGE CAPACITY IN EURASIA, BY COUNTRY, 2019

FIGURE 93 TOTAL OPERATIONAL GAS STORAGE CAPACITY IN EURASIA, 2020—2025 (BILLION CUBIC FEET)

FIGURE 94 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN EURASIA, BY COUNTRY, 2019

FIGURE 95 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN EURASIA, 2020—2025 (MILLION CUBIC FEET PER DAY)

FIGURE 96 TOTAL SHARE OF FPS CAPACITY IN EURASIA, BY GEOGRAPHY, 2019

FIGURE 97 FPS CAPACITY IN EURASIA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 77 KEY PIPELINE PROJECTS IN EURASIA

TABLE 78 KEY PROCESS-RELATED PROJECTS IN EURASIA

9.7 LATIN AMERICA

9.7.1 INCREASING FPS AND GAS STORAGE FACILITY CONSTRUCTION DRIVE THE PPS MARKET IN LATIN AMERICA

9.7.2 BY ASSET TYPE

TABLE 79 PIPELINE & PROCESS SERVICES MARKET IN LATIN AMERICA, BY ASSET TYPE, 2017–2025 (USD MILLION)

9.7.2.1 Pipeline, by asset type

TABLE 80 PIPELINE SERVICES MARKET IN LATIN AMERICA, BY TYPE, 2017–2025 (USD MILLION)

9.7.2.2 Process, by asset type

TABLE 81 PROCESS SERVICES MARKET IN LATIN AMERICA, BY TYPE, 2017–2025 (USD THOUSAND)

9.7.3 BY OPERATION

TABLE 82 PIPELINE & PROCESS SERVICES MARKET IN LATIN AMERICA, BY OPERATION, 2017–2025 (USD MILLION)

9.7.3.1 Pipeline, by operation

TABLE 83 PIPELINE SERVICES MARKET IN LATIN AMERICA, BY OPERATION, 2017–2025 (USD MILLION)

9.7.3.2 Process, by operation

TABLE 84 PROCESS SERVICES MARKET IN LATIN AMERICA, BY OPERATION, 2017–2025 (USD THOUSAND)

TABLE 85 STAKEHOLDERS IN PIPELINE & PROCESS SERVICES MARKET IN LATIN AMERICA

FIGURE 98 TOTAL SHARE OF OPERATIONAL PIPELINES IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 99 TOTAL OPERATIONAL PIPELINES IN LATIN AMERICA, 2020—2025 (KILOMETERS)

FIGURE 100 TOTAL SHARE OF OPERATIONAL REFINERY CAPACITY IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 101 TOTAL OPERATIONAL REFINERY CAPACITY IN LATIN AMERICA, 2020—2025 (THOUSAND BARRELS PER DAY)

FIGURE 102 TOTAL SHARE OF OPERATIONAL PETROCHEMICAL CAPACITY IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 103 TOTAL OPERATIONAL PETROCHEMICAL CAPACITY IN LATIN AMERICA, 2020—2025 (MILLION METRIC TONS)

FIGURE 104 TOTAL SHARE OF OPERATIONAL GAS STORAGE CAPACITY IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 105 TOTAL OPERATIONAL GAS STORAGE CAPACITY IN LATIN AMERICA, 2020—2025 (BILLION CUBIC FEET)

FIGURE 106 TOTAL SHARE OF OPERATIONAL GAS PROCESSING CAPACITY IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 107 TOTAL OPERATIONAL GAS PROCESSING CAPACITY IN LATIN AMERICA, 2020—2025 (MILLION CUBIC FEET PER DAY)

FIGURE 108 TOTAL SHARE OF FPS CAPACITY IN LATIN AMERICA, BY COUNTRY, 2019

FIGURE 109 FPS CAPACITY IN LATIN AMERICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

FIGURE 110 TOTAL SHARE OF LNG CAPACITY IN LATIN AMERICA, BY GEOGRAPHY, 2019

FIGURE 111 LNG CAPACITY IN LATIN AMERICA, 2020—2025 (MILLION METRIC TONS PER ANNUM)

TABLE 86 KEY PIPELINE PROJECTS IN LATIN AMERICA

TABLE 87 KEY PROCESS-RELATED PROJECTS IN LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 181)

10.1 OVERVIEW

FIGURE 112 KEY DEVELOPMENTS IN GLOBAL PIPELINE & PROCESS SERVICES MARKET, JANUARY 2017–DECEMBER 2020

10.2 MARKET CONCENTRATION, 2019

10.3 COMPETITIVE SCENARIO

TABLE 88 GROWTH STRATEGIES OF KEY PLAYERS IN MARKET, 2017–2020

10.3.1 CONTRACTS & AGREEMENTS

10.3.2 INVESTMENTS & EXPANSIONS

10.3.3 MERGERS & ACQUISITIONS

10.4 COMPETITIVE LANDSCAPE MAPPING, 2019

10.4.1 OUTLOOK OF PPS SERVICE COMPANIES

FIGURE 113 PIPELINE & PROCESS SERVICE PROVIDERS: REGIONAL PRESENCE & PRODUCT/SERVICE OFFERINGS, 2019

10.4.2 OUTLOOK OF PIPELINE & PROCESS OPERATOR COMPANIES

FIGURE 114 INTEGRATED IOC: REGIONAL PRESENCE & PRODUCT/SERVICE OFFERINGS, 2019

10.4.2.1 Outlook of FPS operators

FIGURE 115 FPS OPERATORS: REGIONAL PRESENCE & PRODUCT/SERVICE OFFERINGS, 2019

TABLE 89 FPS OPERATORS: PRODUCT/SERVICE OFFERINGS, 2019

10.4.3 OUTLOOK OF EPC COMPANIES

FIGURE 116 EPC: REGIONAL PRESENCE & OPERATING ASSET, 2019

TABLE 90 EPC COMPANIES: PRODUCT/SERVICE CAPABILITIES, 2019

FIGURE 117 EPC COMPANIES: CAPEX (USD MILLION)

FIGURE 118 EPC COMPANIES: OPEX (USD MILLION)

11 COMPANY PROFILES (Page No. - 191)

(Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

11.1 BAKER HUGHES COMPANY

FIGURE 119 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

11.2 HALLIBURTON

FIGURE 120 HALLIBURTON: COMPANY SNAPSHOT

11.3 ENERPAC TOOL GROUP

FIGURE 121 ENERPAC TOOL GROUP: COMPANY SNAPSHOT

11.4 STEP ENERGY SERVICES

FIGURE 122 STEP ENERGY SERVICES: COMPANY SNAPSHOT

11.5 ALTUS INTERVENTION

11.6 ENERMECH

11.7 IKM GRUPPEN

11.8 BLUEFIN, A GATE ENERGY COMPANY

11.9 TECHFEM

11.10 IPEC (IDEH-POUYAN ENERGY CO.)

11.11 TRANS ASIA PIPELINE & SPECIALTY SERVICES

11.12 CHENERGY SERVICES

* Business and Financial Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 229)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 OIL & GAS INTERCONNECTED MARKETS

12.4 PIPELINE INTEGRITY MARKET

12.4.1 MARKET DEFINITION

12.4.2 LIMITATIONS

12.4.3 MARKET OVERVIEW

12.4.4 PIPELINE INTEGRITY MARKET, BY SERVICE

TABLE 91 PIPELINE INTEGRITY MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

12.4.4.1 Testing services

12.4.4.1.1 Hydrostatic testing

12.4.4.1.2 Pneumatic testing

12.4.4.1.3 Vacuum testing

12.4.4.1.4 Testing plugs

12.4.4.1.5 Petroleum pipeline testing

TABLE 92 TESTING SERVICE: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.4.2 Inspection Services

12.4.4.2.1 Magnetic flux

12.4.4.2.2 Ultrasonic

12.4.4.2.3 Caliper

TABLE 93 INSPECTION SERVICE: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 94 INSPECTION SERVICE: PIPELINE INTEGRITY MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.4.4.3 Monitoring Services

TABLE 95 MONITORING SERVICES: PIPELINE INTEGRITY MARKET, BY REGION, 2017–2024 (USD MILLION)

12.4.4.4 Software services

TABLE 96 SOFTWARE SERVICES: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5 PIPELINE INTEGRITY MARKET, BY APPLICATION

TABLE 97 PIPELINE INTEGRITY MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

12.4.5.1 Onshore

TABLE 98 ONSHORE: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 99 ONSHORE: PIPELINE INTEGRITY MARKET SIZE, BY ASSESSMENT TYPE, 2017–2024 (USD MILLION)

12.4.5.1.1 Metal Loss/Corrosion

TABLE 100 METAL LOSS/CORROSION: ONSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5.1.2 Geometry Measurement & Bend Detection

TABLE 101 GEOMETRY MEASUREMENT & BEND DETECTION: ONSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5.1.3 Crack & leak detection

TABLE 102 CRACK & LEAK DETECTION: ONSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5.2 Offshore

TABLE 103 OFFSHORE: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 104 OFFSHORE: PIPELINE INTEGRITY MARKET SIZE, BY ASSESSMENT TYPE, 2017–2024 (USD MILLION)

12.4.5.2.1 Metal Loss/Corrosion

TABLE 105 METAL LOSS/CORROSION: OFFSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5.2.2 Geometry Measurement & Bend Detection

TABLE 106 GEOMETRY MEASUREMENT & BEND DETECTION: OFFSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.5.2.3 Crack & leak Detection

TABLE 107 CRACK & LEAK DETECTION: OFFSHORE PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.6 PIPELINE INTEGRITY MARKET, BY PRODUCT

TABLE 108 PIPELINE INTEGRITY MARKET SIZE, BY PRODUCT, 2017–2024 (USD MILLION)

12.4.6.1 Oil

TABLE 109 OIL: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.6.2 Gas

TABLE 110 GAS: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.6.3 Refined products

TABLE 111 REFINED PRODUCTS: PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.7 PIPELINE INTEGRITY MARKET, BY REGION

TABLE 112 PIPELINE INTEGRITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

12.4.7.1 Americas

TABLE 113 AMERICAS: PIPELINE INTEGRITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

12.4.7.2 Europe

TABLE 114 EUROPE: PIPELINE INTEGRITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

12.4.7.3 Asia Pacific

TABLE 115 ASIA PACIFIC: PIPELINE INTEGRITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

12.4.7.4 Middle East & Africa

TABLE 116 MIDDLE EAST & AFRICA: PIPELINE INTEGRITY MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

12.5 OFFSHORE PIPELINE MARKET

12.5.1 MARKET DEFINITION

12.5.2 MARKET OVERVIEW

12.5.3 OFFSHORE PIPELINE MARKET, BY DIAMETER

TABLE 117 OFFSHORE PIPELINE MARKET SIZE, BY DIAMETER, 2016–2023 (USD MILLION)

12.5.3.1 Greater than 24”

TABLE 118 GREATER THAN 24” OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 119 GREATER THAN 24”: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.3.2 Below 24”

TABLE 120 BELOW 24” OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 121 BELOW 24”: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.4 OFFSHORE PIPELINE MARKET, BY PRODUCT

TABLE 122 OFFSHORE PIPELINE MARKET SIZE, BY PRODUCT, 2016–2023 (USD MILLION)

12.5.4.1 Oil

TABLE 123 OIL OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 124 OIL: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.4.2 Gas

TABLE 125 GAS OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 126 GAS: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.4.3 Refined Products

TABLE 127 REFINED PRODUCTS OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 128 REFINED PRODUCTS: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.5 OFFSHORE PIPELINE MARKET, BY LINE TYPE

TABLE 129 OFFSHORE PIPELINE MARKET SIZE, BY LINE TYPE, 2016–2023 (USD MILLION)

12.5.5.1 Transport line

TABLE 130 TRANSPORT LINE OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 131 TRANSPORT LINE: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.5.2 Export line

TABLE 132 EXPORT LINE OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 133 EXPORT LINE: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.5.3 Other lines

TABLE 134 OTHER LINES OFFSHORE PIPELINE: KEY FUTURE PROJECT LIST

TABLE 135 OTHER LINES: OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.6 OFFSHORE PIPELINE MARKET, BY REGION

TABLE 136 OFFSHORE PIPELINE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.5.6.1 Europe

TABLE 137 EUROPE: OFFSHORE PIPELINE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

12.5.6.2 Asia Pacific

TABLE 138 ASIA PACIFIC: OFFSHORE PIPELINE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

12.5.6.3 Americas

TABLE 139 AMERICAS: OFFSHORE PIPELINE MARKET SIZE, BY COUNTRY, 2016-2023 (USD MILLION)

12.5.6.4 Middle East

TABLE 140 MIDDLE EAST: OFFSHORE PIPELINE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

12.5.6.5 Africa

TABLE 141 AFRICA: OFFSHORE PIPELINE MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

12.6 SCADA OIL & GAS MARKET

12.6.1 MARKET DEFINITION

12.6.2 LIMITATIONS

12.6.3 MARKET OVERVIEW

12.6.4 SCADA OIL & GAS MARKET, BY ARCHITECTURE

TABLE 142 SCADA OIL & GAS MARKET, BY ARCHITECTURE, 2015–2022 (USD MILLION)

12.6.4.1 Hardware

TABLE 143 HARDWARE: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.4.2 Software

TABLE 144 SOFTWARE: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.4.3 Cloud-based solutions

TABLE 145 CLOUD-BASED SOLUTIONS: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.4.4 Other software solutions

TABLE 146 OTHER SOFTWARE SOLUTIONS: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.4.5 Services

TABLE 147 SERVICES: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.5 SCADA OIL & GAS MARKET, BY STREAM

TABLE 148 SCADA OIL & GAS MARKET, BY STREAM, 2015–2022 (USD MILLION)

12.6.5.1 Upstream

TABLE 149 UPSTREAM: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.5.2 Midstream

TABLE 150 MIDSTREAM: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.5.3 Downstream

TABLE 151 DOWNSTREAM: SCADA OIL & GAS MARKET, BY REGION, 2015–2022 (USD MILLION)

12.6.6 SCADA OIL & GAS MARKET, BY REGION

TABLE 152 SCADA OIL & GAS MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

12.6.6.1 North America

TABLE 153 NORTH AMERICA: SCADA OIL & GAS MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.2 Europe

TABLE 154 EUROPE: SCADA OIL & GAS MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.3 Asia Pacific

TABLE 155 ASIA PACIFIC: SCADA OIL & GAS MARKET, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.4 South-East Asia

TABLE 156 SOUTH-EAST ASIA: SCADA OIL & GAS MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.5 South America

TABLE 157 SOUTH AMERICA: SCADA OIL & GAS MARKET, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.6 Middle East

TABLE 158 MIDDLE EAST: SCADA OIL & GAS MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION)

12.6.6.7 Africa

TABLE 159 AFRICA: SCADA OIL & GAS MARKET SIZE, BY COUNTRY, 2015–2022 (USD MILLION)

13 APPENDIX (Page No. - 275)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved 4 major activities in estimating the current size of the pipeline & process services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, market sizing, and our assumptions in arriving these with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global sand control solutions market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The pipeline & process services market comprises several stakeholders, such as service providers and end users in the supply chain. The demand side of this market is characterized by its end users such as pipeline & process services asset operators / owners. The supply side is characterized by pipeline & process services, pre-commissioning & commissioning, maintenance, and decommissioning service providers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global sand control solutions market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Pipeline & Process Services market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream, midstream, and downstream sector.

Report Objectives

- To describe, segment, and forecast the pipeline services market by asset type, operation, and region, in terms of value

- To describe and forecast the size of the market in six regions: Europe and Sub-Saharan Africa, North America, Asia Pacific, Latin America, the Middle East and North Africa, and Eurasia

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the market and its subsegments with respect to individual growth trends, future expansions, and contribution of each segment to the overall market

- To analyze the impact of COVID-19 on the pipeline & process services market

- To estimate market size according to three main scenarios: pessimistic, optimistic and realistic

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape of the market

- To profile and rank key market players and comprehensively analyze their market share

- To analyze competitive developments such as contracts and agreements, investments and expansions, product developments, mergers and acquisitions, partnerships, collaborations, alliances, and joint ventures in the pipeline & process services market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pipeline & Process Services Market