Plasma Lighting Market by Component (Lightron, Waveguide, and Cavity Resonator), Application (Roadways, Streets, and Tunnels Industrial, and Horticulture), Wattage (300W, 700W, and 1,000W), and Geography - Global Forecast 2025-2036

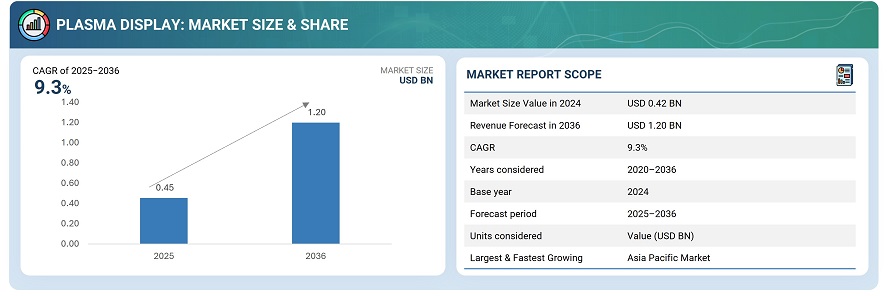

The plasma lighting market was valued at USD 0.42 billion in 2024 and is estimated to reach USD 1.20 billion by 2036, at a CAGR of 9.3% between 2025 and 2036.

The global plasma lighting market is driven by increasing adoption of high-efficiency, long-life lighting solutions across industrial, commercial, and public infrastructure applications. Rising demand for energy-efficient streetlights, sports arenas, and large-scale architectural lighting is fueling market growth. Plasma lighting offers superior luminous efficacy, uniform light distribution, and low heat emission, making it suitable for high-intensity and specialized illumination needs. Advances in lamp design, ballast technology, and dimming control are enhancing performance, reliability, and lifespan. Overall, the market is witnessing steady innovation, with manufacturers focusing on cost optimization, integration with smart lighting systems, and expansion into emerging regions to support broader deployment.

Plasma lighting is increasingly applied across industrial, commercial, and public infrastructure sectors, including stadiums, warehouses, street lighting, and large-scale architectural projects, where high-intensity, energy-efficient illumination is critical. The technology delivers uniform light distribution, superior color rendering, and long operational life, supporting precision lighting, reduced maintenance, and enhanced safety. Manufacturers are focusing on advanced lamp designs, integrated ballasts, and smart control systems to improve performance and energy efficiency, facilitating broader adoption across commercial, municipal, and specialized industrial applications.

Market by Application

Industrial

The industrial sector holds the largest share of the plasma lighting market, driven by the need for high-intensity, uniform illumination in warehouses, factories, and large manufacturing facilities. Plasma lighting’s long lifespan, energy efficiency, and superior color rendering make it ideal for precision tasks, safety, and productivity. Ongoing adoption of advanced lighting systems in industrial environments is further reinforcing this segment’s market dominance.

Horticulture

The horticulture segment is expected to witness the fastest growth, fueled by increasing adoption of plasma lighting for controlled-environment agriculture and greenhouse applications. Plasma lamps provide optimal light spectra, uniform intensity, and energy-efficient operation, enhancing plant growth, yield, and quality. Expanding use in vertical farming, urban agriculture, and commercial horticulture is driving rapid market penetration in this segment.

Roadways, Streets, and Tunnels

The roadways, streets, and tunnels segment represents a key application area for plasma lighting, driven by the need for high-intensity, uniform illumination to enhance visibility, safety, and energy efficiency. Plasma lamps provide long operational life and superior color rendering, reducing maintenance requirements for municipal and highway lighting projects. Growing urbanization and infrastructure development further support the adoption of plasma lighting in public and transport-related applications.

Sports & Entertainment

The sports & entertainment segment is witnessing increasing adoption of plasma lighting due to its ability to deliver high-intensity, uniform illumination over large venues such as stadiums, arenas, and event spaces. Superior brightness, long lifespan, and low maintenance requirements make plasma lighting ideal for professional sports, concerts, and large-scale entertainment events. Technological enhancements in lamp design and control systems are further driving their integration in this sector.

Market by Geography

Geographically, the plasma lighting market spans Europe, North America, and Asia Pacific. Europe leads the market, driven by the widespread adoption of energy-efficient lighting in public infrastructure, stadiums, airports, and commercial facilities, coupled with stringent environmental regulations promoting sustainable illumination solutions. Asia Pacific is expected to witness the fastest growth, fueled by rapid urbanization, industrial expansion, and increasing infrastructure investments in countries such as China, India, and Japan. North America shows steady adoption, supported by modern industrial facilities, large-scale sports arenas, and smart city initiatives. Overall, regional expansion is underpinned by energy efficiency mandates and technological advancements in high-intensity lighting systems.

Market Dynamics

Driver: High energy efficiency and long lifespan

The plasma lighting market is primarily driven by technology’s high energy efficiency and extended operational lifespan. Plasma lamps deliver superior luminous efficacy compared to conventional lighting solutions, reducing energy consumption and maintenance costs. This makes them particularly attractive for large-scale applications such as stadiums, warehouses, and public infrastructure. Continuous improvements in lamp design and ballast technology further enhance efficiency and reliability, encouraging adoption across industrial, commercial, and municipal sectors globally.

Restraint: High initial investment costs

High initial investment costs remain a major restraint for the plasma lighting market. Premium pricing of plasma lamps and associated control systems limits accessibility, especially for price-sensitive commercial and municipal buyers. Complex manufacturing processes, specialized installation requirements, and advanced components contribute to elevated upfront costs. Until production scales up and component prices decline, the higher capital expenditure compared to LED and conventional lighting solutions may slow widespread market adoption.

Opportunity: Integration with smart lighting and IoT systems

Integration with smart lighting and IoT platforms presents significant growth opportunities for the plasma lighting market. Plasma lighting systems can be combined with sensors, automation, and remote management technologies to enable adaptive illumination, energy savings, and real-time monitoring. Expanding deployment in smart cities, automated warehouses, and intelligent public infrastructure can drive incremental revenue. Manufacturers can capitalize on these trends by offering integrated solutions tailored for connected and energy-efficient lighting ecosystems.

Challenge: Competitive pressure from LED and next-generation lighting technologies

Intense competition from LED and other advanced lighting solutions poses a key challenge for the plasma lighting market. Rapid technological advancements, declining costs, and widespread adoption of LEDs make it difficult for plasma lighting to maintain market share. Buyers often prefer lower-cost, energy-efficient alternatives that offer comparable performance. This competitive pressure requires plasma lighting manufacturers to continuously innovate, optimize costs, and differentiate their solutions to sustain adoption across industrial, commercial, and municipal applications.

Future Outlook

Between 2025 and 2036, the plasma lighting market is expected to experience steady growth as demand rises for high-intensity, energy-efficient illumination across industrial, commercial, and public infrastructure applications. Advances in lamp design, ballast technology, and thermal management will enhance luminous efficacy, reliability, and operational lifespan. Integration with smart lighting and IoT systems will further optimize energy use and enable adaptive control. Expanding adoption in stadiums, warehouses, streets, and large-scale architectural projects will drive market expansion, positioning plasma lighting as a sustainable, high-performance solution for precision and large-area illumination needs globally.

Key Market Players

Leading companies in the global plasma lighting market include Ushio Inc. (Japan), ams-OSRAM AG (Germany), Gavita International B.V. (Netherlands), Hive Lighting (US), and Ka Shui International Holdings Ltd. (China) .

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 13)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis

2.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Growth Opportunities Market

4.2 Market, By Application

4.3 Europe Market, By Country and Application

4.4 Market, By Region

5 Market Overview (Page No. - 30)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Infrastructure Development Activities in Emerging Economies

5.1.1.2 Growing Number of Indoor Farms Equipped With Plasma Lighting Across the Globe

5.1.1.3 Increasing Demand for Energy-Efficient and Long-Lasting Lights

5.1.2 Restraints

5.1.2.1 High Initial Costs of Superior Quality and Energy-Efficient Plasma Lights

5.1.3 Opportunities

5.1.3.1 Replacement of Traditional Lights With Lep Deep Submergence Lights in Marine Applications

5.1.3.2 Legalization of Marijuana Cultivation in North America Resulting in Increased Number of Greenhouses Equipped With Plasma Lighting

5.1.4 Challenges

5.1.4.1 High Costs Involved in the Replacement of Traditional Lights With Plasma Lights

5.2 Value Chain Analysis

6 Market, By Application (Page No. - 34)

6.1 Introduction

6.2 Roadways, Streets, and Tunnels

6.2.1 Increasing Demend for Energy Efficient Lighting is Expected to Propel Market in Roadways, Streets, and Tunnels

6.3 Industrial

6.3.1 The Industrial Application Accounted for A Major Share of Market in 2018

6.4 Sports & Entertainment

6.4.1 By Using Plasma Lighting Solutions, Stadium Operators Can Reach an Efficient Operational Level With Least Energy Usage and Reap the Benefits of Reduced Bills.

6.5 Horticulture

6.5.1 The Demand for Horticulture Plasma Lighting Systems is Higher in Countries With Harsh Weather Conditions

6.6 Others

7 Plasma Lighting Components (Page No. - 37)

7.1 Introduction

7.2 Lightron

7.2.1 Lightron is the Most Important Component of Plasma Lighting System

7.3 Waveguide

7.3.1 Waveguide is Used to Direct Microwaves Towards Cavity Resonator

7.4 Cavity Resonator

7.4.1 Cavity Resonator Minimizes External Rf Interference

7.5 Bulb Assembly

7.5.1 A Bulb is Rotated at A Constant Speed to Evenly Distribute the Plasma and Light

8 Plasma Lighting Wattage (300w, 700w, 1,000w) (Page No. - 39)

8.1 Introduction

8.2 300w

8.2.1 Well-Lit Roadways are Preferable to Prevent Accidents

8.3 700w

8.3.1 Increasing Concerns for Saving Energy have Led to the Establishment of Stringent Regulations

8.4 1,000w

8.4.1 Plasma Lighting Systems Make Stadiums More Energy Efficient and Save Money

9 Market, By Geography (Page No. - 42)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US is Projected to Lead North America Market From 2019 to 2024

9.2.2 Canada

9.2.2.1 Promotion of Energy-Efficient Lights is Fueling Growth of Market in Canada

9.2.3 Mexico

9.2.3.1 Generation of Renewable Electric Power and Increased Use of Energy-Efficient Lighting is Contributing to Growth of Market in Mexico

9.3 Europe

9.3.1 UK

9.3.1.1 Increased Awareness for Energy Conservation is Leading to Growth of Market in UK

9.3.2 Germany

9.3.2.1 Rise in Number of Infrastructure Development Projects is Fueling Growth Market in Germany

9.3.3 The Netherlands

9.3.3.1 Increased Use of Plasma Lights in Horticulture Applications is Contributing to Growth Market in the Netherlands

9.3.4 France

9.3.4.1 Emphasis on Reducing Energy Consumption is Leading to Growth Market in France

9.3.5 Italy

9.3.5.1 Increased Focus on Reducing Emissions of Greenhouse Gases is Fueling Growth of Plasma Lighting Market in Italy

9.3.6 Rest of Europe

9.4 Asia Pacific (APAC)

9.4.1 China

9.4.1.1 Increased Investments in Manufacturing Sector are Leading to Growth Market in China

9.4.2 Japan

9.4.2.1 Use of Plasma Lights for Indoor Farming is Contributing to Growth Market in Japan

9.4.3 South Korea

9.4.3.1 Formulation of Stringent Standards for the Development of Energy-Efficient Lights is Contributing to Growth of Market in South Korea

9.4.4 Rest of Asia Pacific

10 Competitive Landscape (Page No. - 65)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Situations and Trends

10.4.1 Product Launches

10.4.2 Expansions

11 Company Profiles (Page No. - 69)

11.1 Introduction

11.2 Key Players

(Business Overview, Products/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2.1 Luma Group (Luxim)

11.2.2 Ceravision

11.2.3 Hive Lighting

11.2.4 KA Shui International Holdings

11.2.5 Green De Corp

11.2.6 Gavita

11.2.7 Fusionlux

11.2.8 Griffin & Ray

11.2.9 Guangzhou Kaiming Industries

11.2.10 Birns

* Business Overview, Products/Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11.3 Other Ecosystem Players

11.3.1 Ningbo Aishi Electric Equipment

11.3.2 Solaronix

11.3.3 RFHIC Corporation

11.3.4 Ferarf

11.3.5 Jofam Sàrl

11.4 Start Up Ecosystem Players

11.4.1 Pinkrf

11.4.2 Ampleon

11.4.3 Pure Plasma Lighting

11.4.4 LHV Energy

11.4.5 Pandora Green

12 Appendix (Page No. - 88)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (35 Tables)

Table 1 Market Size, By Application, 2016–2024 (USD Million)

Table 2 Market, By Region, 2016–2024 (USD Million)

Table 3 North America Market, By Country, 2016–2024 (USD Million)

Table 4 North America Market, By Application, 2016–2024 (USD Million)

Table 5 North America Market in Roadways, Streets, and Tunnels, By Country, 2016–2024 (USD Million)

Table 6 North America Market in Industrial, By Country, 2016–2024 (USD Million)

Table 7 North America Market in Horticulture, By Country, 2016–2024 (USD Million)

Table 8 North America Market in Sports & Entertainment, By Country, 2016–2024 (USD Million)

Table 9 US Market, By Application, 2016–2024 (USD Million)

Table 10 Canada Market, By Application, 2016–2024 (USD Million)

Table 11 Mexico Market, By Application, 2016–2024 (USD Million)

Table 12 Europe Market, By Country, 2016–2024 (USD Million)

Table 13 Europe Market, By Application, 2016–2024 (USD Million)

Table 14 Europe Market in Roadways, Streets, and Tunnels, By Country, 2016–2024 (USD Million)

Table 15 Europe Market in Industrial, By Country, 2016–2024 (USD Million)

Table 16 Europe Market in Horticulture, By Country, 2016–2024 (USD Million)

Table 17 Europe Market in Sports & Entertainment, By Country, 2016–2024 (USD Million)

Table 18 UK Market, By Application, 2016–2024 (USD Million)

Table 19 Germany Market, By Application, 2016–2024 (USD Million)

Table 20 Netherlands Market, By Application, 2016–2024 (USD Million)

Table 21 France Market, By Application, 2016–2024 (USD Million)

Table 22 Italy Market, By Application, 2016–2024 (USD Million)

Table 23 Rest of Europe Market, By Application, 2016–2024 (USD Million)

Table 24 Asia Pacific Market, By Country, 2016–2024 (USD Million)

Table 25 Asia Pacific Market, By Application, 2016–2024 (USD Million)

Table 26 Asia Pacific Market in Roadways, Streets, and Tunnels, By Country, 2016–2024 (USD Million)

Table 27 Asia Pacific Market in Industrial, By Country, 2016–2024 (USD Million)

Table 28 Asia Pacific Market in Horticulture, By Country, 2016–2024 (USD Million)

Table 29 Asia Pacific Market in Sports & Entertainment, By Country, 2016–2024 (USD Million)

Table 30 China Market, By Application, 2016–2024 (USD Million)

Table 31 Japan Market, By Application, 2016–2024 (USD Million)

Table 32 South Korea Market, By Application, 2016–2024 (USD Million)

Table 33 Rest of Asia Pacific Market, By Application, 2016–2024 (USD Million)

Table 34 Product Launches (2016–2019)

Table 35 Expansions (2016–2018)

List of Figures (21 Figures)

Figure 1 Market: Research Design

Figure 2 Process Flow

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market, 2016–2024 (USD Million)

Figure 8 Industrial Segment is Projected to Lead Market From 2019 to 2024

Figure 9 Europe to Hold Largest Share of Assistive Robotics Market By 2018

Figure 10 Increasing Adoption of Plasma Lighting in Europe is Driving Growth of Market

Figure 11 Industrial Segment to Lead Market From 2019 to 2024

Figure 12 Germany and Industrial Segment are Projected to Lead Europe Market in 2024

Figure 13 Asia Pacific Market is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 14 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Market, By Application, 2016–2024 (USD Million)

Figure 16 Europe is Projected to Lead Market From 2019 to 2024

Figure 17 North America Market Snapshot

Figure 18 Asia Pacific Market Snapshot

Figure 19 Ranking of Key Players in Market (2018)

Figure 20 Market (Global) Competitive Leadership Mapping, 2018

Figure 21 KA Shui International Holdings: Company Snapshot

The study involved four major activities in estimating the current size of the plasma lighting market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and sub segments of plasma lighting market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include plasma lighting-related journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

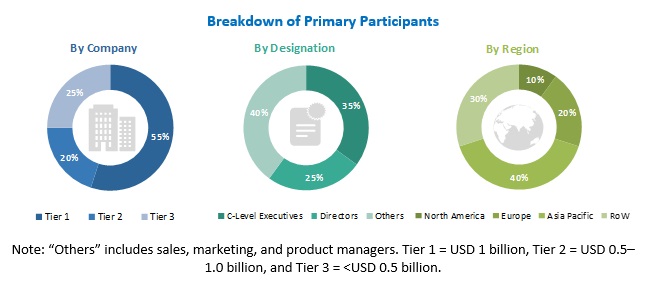

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the plasma lighting market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the abovementioned estimation process, the total market was segregated into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

The following are the major objectives of the study.

- To describe, segment, and forecast the size of the plasma lighting market based on application and region, in terms of value

- To describe and forecast the size of the market, in terms of value for North America, Europe, and Asia Pacific (APAC), along with their respective key countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro markets with respect to the individual growth trends, their prospects, and their contribution to the market

- To strategically profile key players in the market and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as expansions, and product launches, along with research & development (R&D) activities undertaken in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Plasma Lighting Market