Horticulture Lighting Market Size, Share, Industry Report, Statistics & Growth by Installation type (New Installations, Retrofit Installations), Lighting Type (Toplighting, Interlighting), Offering (Hardware, Software & Service), Cultivation Type, Technology, Application, Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Horticulture Lighting Market Size & Growth

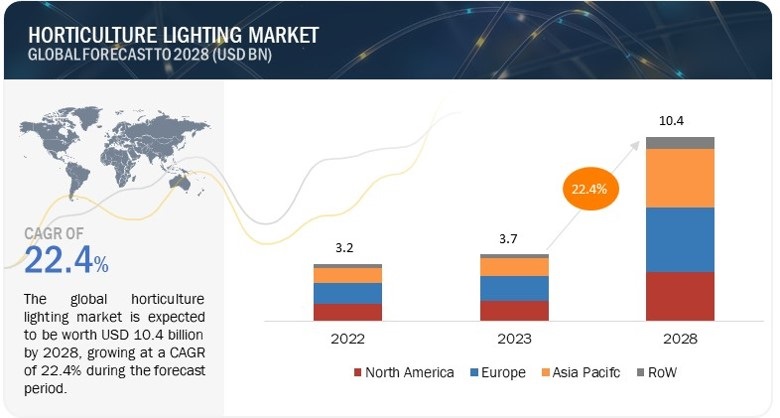

The horticulture lighting market is expected to reach USD 10.4 billion by 2028 from USD 3.7 billion in 2023, at a CAGR of 22.4% during the 2023–2028 period.

Horticulture lighting refers to the strategic use of artificial lighting to optimize the growth and quality of plants in controlled environments like greenhouses or indoor farms. This practice involves tailoring the light spectrum, intensity, and duration to mimic or supplement natural sunlight, thereby enhancing plant photosynthesis and overall development. Horticulture lighting is a key tool for improving crop yields, extending growing seasons, and ensuring consistent plant quality. By leveraging advanced lighting technologies, such as LED systems that offer precise control over light parameters, businesses can create optimal conditions for various crops, regardless of external weather or geographic limitations.

Horticulture lighting can lead to significant benefits for businesses involved in agriculture and plant-based industries. These benefits include increased production efficiency, higher crop yields, improved product quality, and the ability to grow specialty crops year-round. Moreover, the data-driven nature of modern horticulture lighting systems allows businesses to monitor and adjust lighting conditions in real-time, leading to more informed decision-making and resource allocation.

Horticulture Lighting Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Horticulture Lighting Market Dynamics

Driver: Surging demand for fresh food amid shrinking arable land

In the business landscape, there is a noticeable surge in the demand for fresh food, coupled with a concerning loss of arable land. These two critical factors have emerged as major challenges for the agricultural industry, impacting supply chains, food security, and sustainability efforts.

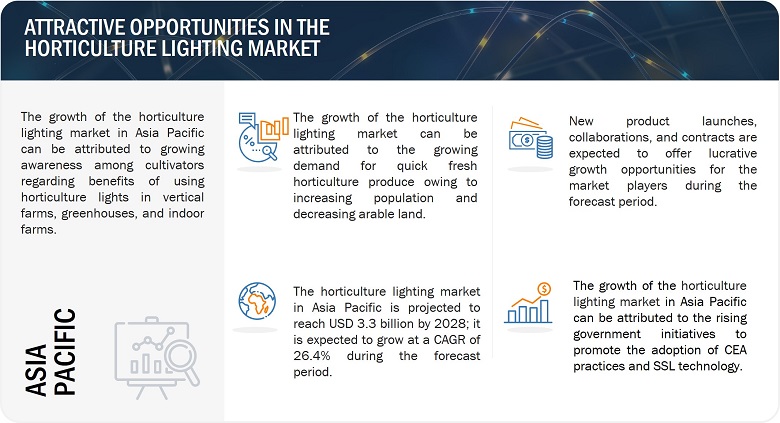

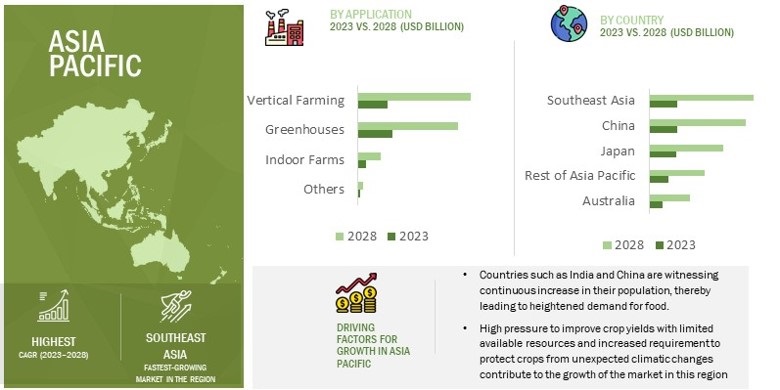

The heightened demand for fresh food is driven by shifting consumer preferences and an increasing focus on healthy and locally sourced produce. Consumers are becoming more conscious of their dietary choices, seeking nutrient-rich and minimally processed foods. As a result, businesses in the food industry are facing growing pressure to ensure a steady supply of fresh and high-quality produce to meet customer expectations and maintain their competitive edge. However, this rising demand for fresh food coincides with the loss of arable land, which poses a significant threat to the agricultural sector. Factors such as urbanization, industrialization, and climate change contribute to the dwindling availability of fertile land suitable for farming. As arable land diminishes, farmers encounter challenges in expanding their cultivation areas and meeting the increasing food demands. In response to these challenges, businesses are turning to innovative solutions such as controlled-environment agriculture (CEA) practices and advanced agricultural technologies. CEA methods, including vertical farming, hydroponics, and aquaponics, allow for the cultivation of crops in controlled indoor environments, independent of external climatic conditions and the availability of arable land. These practices enable growers to optimize space, reduce water consumption, and enhance crop yields, addressing the constraints posed by the loss of traditional farming land.

The adoption of sustainable and resource-efficient technologies, such as solid-state lighting (SSL) in horticulture, offers businesses the means to maximize crop productivity while minimizing energy consumption. SSL technology enables growers to tailor light spectra to meet the specific needs of different crops, leading to accelerated growth, improved quality, and enhanced nutritional content. By integrating SSL technology into their operations, businesses can increase crop yields without requiring additional land, thus helping to mitigate the effects of land scarcity.

Restraint: Navigating the complex light spectrum requirements for diverse crop cultivation in horticulture lighting

One of the significant restraint in the horticulture lighting industry is the complex requirement to provide varied light spectra tailored to the specific needs of different crops. Various plant species have unique and specific light requirements at different stages of their growth cycle. For instance, some plants thrive with higher levels of blue light during their vegetative phase to encourage foliage growth and root development. On the other hand, during the flowering or fruiting stage, these plants might benefit from an increased proportion of red light to promote blooming and fruit production.

Different crops may also have varying sensitivities to other parts of the light spectrum, such as far-red or green light, which can impact specific physiological processes and influence plant characteristics like taste, color, and nutrient content.

Meeting these specific light spectrum requirements for a diverse range of crops can be a complex task for growers and horticulture lighting manufacturers. As the agricultural industry continues to diversify its crop portfolio to meet changing consumer demands, the challenge intensifies, as each new crop may have unique lighting needs that must be carefully addressed.

To overcome this challenge, growers need to have a thorough understanding of the light requirements for each crop they cultivate. They must consider factors like the crop's natural habitat, natural light conditions, and growth patterns to develop appropriate lighting strategies.

For horticulture lighting manufacturers, it entails producing a wide range of LED fixtures and lighting systems that can deliver precise light spectra combinations. Offering customizable lighting solutions allows growers to adjust the light output to match the specific needs of different crops and growth stages.

In addition to customizable fixtures, advanced lighting control systems and automation technologies play a vital role in achieving the ideal light spectra. These systems enable growers to program and schedule lighting changes, ensuring that plants receive the right light at the right time throughout their growth cycle.

Research and development efforts in the horticulture lighting industry focus on studying the effects of various light spectra on different crops to enhance our understanding of their specific needs. As scientific knowledge expands, it provides valuable insights for growers to optimize their lighting setups and improve crop productivity.

Opportunity: Expansion of DIY and home gardening market

The expansion of the DIY and home gardening market offers a significant and untapped opportunity for the horticulture lighting industry. In recent years, there has been a notable rise in interest among individuals who want to grow their own fresh produce, herbs, and flowers at home, as well as engage in small-scale indoor farming as a hobby. This trend is fueled by various factors, including a desire for sustainable living, a connection to nature, and a growing awareness of the benefits of consuming locally sourced and pesticide-free produce.

As more people explore home gardening and DIY indoor farming, the need for suitable horticulture lighting solutions becomes evident. Unlike professional growers with extensive knowledge and resources, hobbyist growers may require more accessible, user-friendly, and affordable lighting options tailored to their specific needs and capabilities. Therefore, horticulture lighting manufacturers have an opportunity to cater to this growing segment by developing specialized products that align with the DIY and home gardening market.

Challenge: Challenges in implementing controlled environment agriculture technology on a large scale and the demand for technical expertise

Controlled Environment Agriculture (CEA) technology, which involves creating carefully regulated indoor environments to optimize crop growth, offers tremendous potential for increasing agricultural productivity and overcoming weather and seasonal limitations. However, deploying CEA technology in large fields poses unique challenges that demand extensive technical know-how and careful consideration.

One of the primary complexities associated with large-scale CEA deployment is the sheer size of the operation. Covering vast areas requires significant infrastructure and investment, including sophisticated climate control systems, horticulture lighting, and automated irrigation setups. Designing and implementing such large-scale CEA systems demands expertise in engineering, horticulture, and automation to ensure seamless integration and efficient functioning.

Horticulture Lighting Market Ecosystem

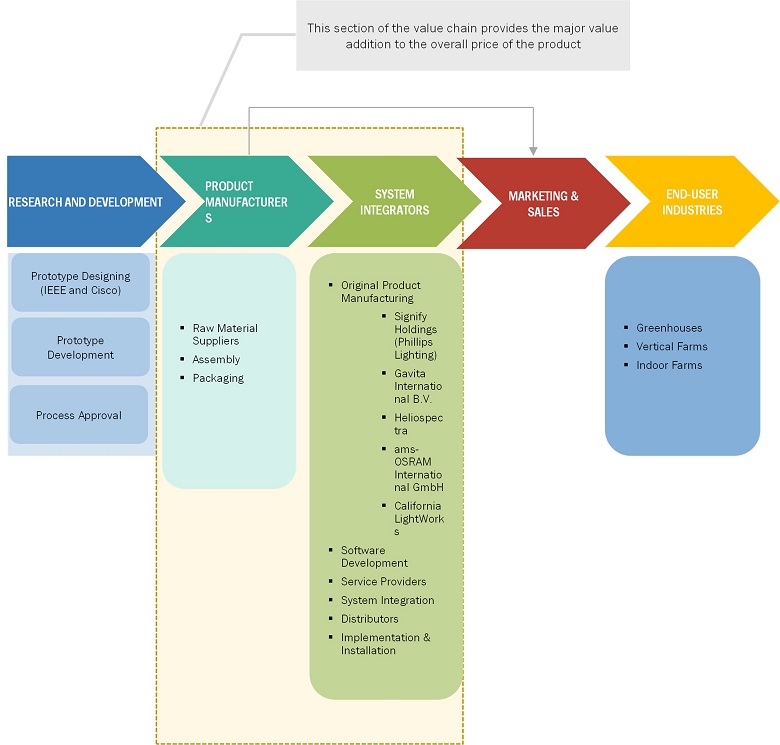

The prominent players in the horticulture lighting market are Signify Holding (Phillips Lighting) (Netherlands), Gavita International B.V.(Netherlands), Heliospectra(Sweden), ams-OSRAM International GmbH(Austria), California LightWorks(US). These companies not only boast a comprehensive product portfolio of horticulture lighting but also have a strong geographic footprint.

Cannabis in cultivation type segment is expectedto grow at the highest CAGR during the forecast period

Cannabis sativa is cultivated for its secondary metabolites and cannabinoids, which find applications in pharmaceutical, medical, and recreational industries. The primary compound extracted from Cannabis sativa flowers is Tetrahydrocannabinol (THC), known for its pain-relieving and appetite-stimulating properties. THC has also been found to improve chemotherapy tolerance in cancer patients. Hemp is a subspecies of Cannabis and is used to refer to varieties with 0.3% or less THC content (by dry weight). Hemp is used in various products such as food, ropes, clothing, paper, and construction materials. On the other hand, marijuana refers to Cannabis varieties containing more than 0.3% THC (by dry weight) and can induce psychotropic or euphoric effects in users. For the optimal growth of cannabis plants, blue light plays a critical role. Cannabis plants can exhibit a shade-avoidance syndrome if they lack sufficient blue light, leading to elongated shoots as they strive to reach adequate light. In such conditions, the leaves may curl upward (leaf hyponasty). To ensure effective cannabis plant growth, tunable LEDs and other customized LED spectrums are used. For example, Mitra, a cannabis-specific LED grow light developed by Heliospectra (Sweden), has gained widespread adoption among cannabis growers in North America.

Vertical Farming by application segment is expectedto grow at the highest CAGR during the forecast period

A prevailing trend in horticulture is the ascent of vertical farms within urban areas. These innovative indoor farms stack plants for space efficiency, utilizing aeroponics, hydroponics, and aquaponics methods. These techniques allow soil-free cultivation regardless of location or climate.

Vertical farms optimize conditions with artificial lighting, hydroponics, and climate control. This method eliminates pesticides and is effective in extreme conditions. Vertical farming maximizes yield in confined spaces, utilizing LED lights for energy efficiency, longevity, and precise illumination. LED horticulture lighting suits compact designs and aligns with environmental concerns. In contrast, HID systems emit excess heat and can harm plants if placed too closely.

Drivers for vertical farming include climate changes, local food demand, funding influx, and population growth. After the 2011 tsunami in Japan, a joint effort by the Japanese government, Mirai Co., Ltd., and General Electric transformed a former Sony semiconductor factory into the world's largest indoor farm. Vertical farming aids pharmaceutical production, as demonstrated by Caliber Biotherapeutics and Bowery Farming.

The cannabis industry is embracing vertical farming for its productivity potential. While challenges persist, LEDs are a promising solution to control temperature and optimize growth. For example, MedMen Cannabis Vertical Farm utilized LED systems from Fluence Bioengineering for enhanced efficiency. Despite ongoing developments, the growing demand for cannabis and advancements in LED technology are projected to drive vertical farming's adoption in cannabis cultivation.

US is expected to have the highest market share in North America region during the forecast period.

The United States represents a promising potential market within the North American horticulture lighting sector. The growth of this market segment in the US is primarily propelled by the increased adoption of advanced agricultural methods such as vertical farming, indoor farming, and greenhouse cultivation. This growth is further supported by the escalating demand for fresh horticultural produce and augmented investments towards the establishment of vertical farms and greenhouses. Agricultural practitioners in the country are strategically focusing on the development of Controlled Environment Agriculture (CEA) facilities. These facilities enable the cultivation of chemical pesticide-free fruits and vegetables in a controlled setting, facilitating direct distribution to local retailers and eateries.

For instance, Appllarvest, an applied technology firm based in the US, is actively engaged in constructing indoor farms in the Appalachia region. This endeavor includes the creation of a high-tech CEA facility spanning over 60 acres upon completion. This greenhouse facility is designed to cultivate non-genetically modified organisms (GMOs) and pesticide-free produce, intended for distribution to local markets. The geographical location of this facility in Appalachia plays a strategic role, aiding in reaching a substantial portion of the population and substantially reducing transportation costs compared to existing suppliers in Mexico and the southwestern US. Additionally, AppHarvest's plans to establish a flagship facility spanning 2.76 million square feet for tomato cultivation further contribute to this growth trajectory.

Likewise, other key players in the market, such as Plenty, AeroFarms, and Freight Farm, have secured significant investments to enhance their operations and expand their market presence. These developments underscore the remarkable technological advancements within the US market.

Notably, the presence of these influential market players in the US grants the country a distinct advantage in terms of technological advancements. The introduction of innovative products like California Lightworks' MegaDrive Vertical series, ILUMINAR Lighting's Logis LED series, Eye Hortilux's Ascend series LED grow light systems, and LumiGrow's Joplight Hybrid smart fixture demonstrate the continuous evolution of horticulture lighting technologies in the US.

The legalization of cannabis for medicinal and recreational purposes since 2012 has significantly contributed to the expansion of the horticulture lighting market in the US. The initial approval in states like Washington and Colorado paved the way for a broader adoption of cannabis legalization for both medical and recreational use. Presently, several states, including Alaska, California, Colorado, and others, permit the recreational use of cannabis, while additional states allow certain strains for medical purposes. This legalization trend has notably spurred the growth of the horticulture lighting industry in the US.

Horticulture Lighting Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Horticulture Lighting - Key Market Players

The major players in the Horticulture lighting companies are Signify Holding (Phillips Lighting) (Netherlands), Gavita International B.V.(Netherlands), Heliospectra(Sweden), ams-OSRAM International GmbH(Austria), California LightWorks(US), Valoya (Finland), Hortilux Schréder(Netherlands), ILUMINAR Lighting(US), Current Lighting Solutions, LLC.(US), GE Lighting (SAVANT TECHNOLOGIES LLC.)(US), ACUITY BRANDS, INC.(US), Lumileds Holding B.V.(Netherlands), Cree LED an SGH company(US), TCP Lighting(US), PARsource(US), EconoLux Industries Ltd.(China), Oreon (Netherlands), GlacialLight – Division of GlacialTech Inc.(Taiwan), Black Dog Horticulture Technologies & Consulting(US), ViparSpectra(US), Active Grow(US), Agnetix(US), Thrive Agritech(US), Bridgelux, Inc.(US), and Kroptek(UK).

Scope of the Report

|

Report Metric |

Details |

| Estimated Value | USD 3.7 billion in 2023 |

| Projected Value | USD 10.4 billion by 2028 |

| Growth Rate | CAGR of 22.4% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments Covered |

By installation type, by lighting type, by offering, by cultivation type, by technology, by application, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific and RoW |

|

Companies covered |

The major players in the Horticulture lighting market are Signify Holding (Phillips Lighting) (Netherlands), Gavita International B.V.(Netherlands), Heliospectra(Sweden), ams-OSRAM International GmbH(Austria), California LightWorks(US), Valoya (Finland), Hortilux Schréder(Netherlands), ILUMINAR Lighting(US), Current Lighting Solutions, LLC.(US), GE Lighting (SAVANT TECHNOLOGIES LLC.)(US), ACUITY BRANDS, INC.(US), Lumileds Holding B.V.(Netherlands), Cree LED an SGH company(US), TCP Lighting(US), PARsource(US), EconoLux Industries Ltd.(China), Oreon (Netherlands), GlacialLight – Division of GlacialTech Inc.(Taiwan), Black Dog Horticulture Technologies & Consulting(US), ViparSpectra(US), Active Grow(US), Agnetix(US), Thrive Agritech(US), Bridgelux, Inc.(US), and Kroptek(UK). |

Horticulture Lighting Market Highlights

The study segments the Horticulture lighting market based on installation type, lighting type, offering, cultivation type, technology, application, and region at the regional and global levels.

|

Segment |

Subsegment |

|

By Installation Type |

|

|

By Lighting Type |

|

|

By Offering |

|

|

By Cultivation Type |

|

|

By Technology |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In June 2023, Signify Holding (Phillips Lighting) and INFINITEACRES are collaborating to transform vertical farm expansion. INFINITEACRES has developed a resource-efficient indoor farming technique, utilized renewable energy, and minimized food miles. Their collaboration with Signify Holding (Phillips Lighting) aims to address technological and business challenges in scaling up. As industry pioneers, 80 Acres Farms and Infinite Acres have rapidly expanded and plan to establish a high-cAsia Pacificity farm in Atlanta. Partnering with Signify has been instrumental in navigating the learning curve and attaining success in this groundbreaking field.

- In June 2023, The next generation of OSLON square hyper red LED achieves market-leading wall plug efficiency of 78.8% and is known for its compact size, robustness, and superior performance.

- In June 2023, New OSLON optimal red enables broader spectral coverage for better growth of common plant types that are grown under artificial lighting.

- In December 2022, Signify Holding (Phillips Lighting) introduces 1,040-watt Philips HPS light fixture for a low-maintenance, hybrid light installation in combination with Philips GreenPower LED toplighting.

- In Octoboer 2022, Current Lighting Solutions, LLC. and North Carolina State University (NCSU) have extended their research partnership for launching a new study into the potential of supplemental LED lighting to support commercial cannabis production.

- In August 2022, Hortilux Schréder partnered with Daeyoung GS, under the distribution agreement, Daeyoung GS is authorized to sell Hortilux Schréder products to its customers in South Korea. With this, Hortilux Schréder strengthens its presence in South Korea.

- In May 2022, OSLON optimal LEDs provide flexible mix of color and white options to meet requirements of all growing applications. It is an advanced chip technology and broad light distribution pattern and larger lens produce the robust high performance required in vertical farming and inter-lighting horticulture applications.

- In May 2022, Signify Holding (Phillips Lighting) has completed the acquisition of Fluence for strengthening its agriculture lighting growth platform.

- In March 2022, Signify Holding (Phillips Lighting) and Perfect Plants is expanding their collaboration on grow lights because the companies share their knowledge and experience and continue to learn from each other.

- In March 2022, Current Lighting Solutions, LLC. has unveiled two new, high-efficiency and high-performance members of its Arize Element family. The latest L1000 model offers an increased maximum output of up to 2600µmol/s, adding a new option to the existing L1000 portfolio, which already features efficacy-oriented models that offer up to 3.6µmol/J. With the all-new, 3600µmol/s Arize Element L2000,

- In March 2022, Current Lighting Solutions, LLC. has extended horticulture LED portfolio with new Arize integral intra-canopy lighting. It offers lighting output of up to 346 µmol/s and efficiency of 3.5 µmol/J, the Integral is designed to help growers maximize yields of high-wire crops such as tomatoes, cucumber, and peppers through more strategic deployment of light, deep within the plant canopy.

- In March 2022, Valoya and Greenlux Finland Oly merged to create more robust and synergistic entity. By leveraging the competencies accumulated over a decade, the aim is to accelerate product range development, enhance customer service, and strengthen the supply chain capabilities for both companies.

- In February 2022, California LightWorks launched its new MegaDrive Vertical series for indoor cannabis cultivators. This patented new LED system offers indoor cultivators the same technology that greenhouses across the nation have adopted from California LightWorks to achieve dramatically lower total installed cost while boosting return on investment by reducing heat, energy consumption, and carbon footprint.

- In February 2022, The AS7343 is a multi-purpose spectral sensor that combines 14-channel spectral analysis of visible and infrared light with XYZ functionality to match human perception of color and light intensity. It is used in horticulture, smoke and heat alarms, consumer devices.

- In December 2021, Hortilux collaborated with LLC DTK, Russia’s leading rose company, to provide them Hortilux’s HPS NXT2 fixtures, which are the perfect match for the company’s requirement. By now, the NXT2 1000W fixtures have been installed over a 3-hectare area.

- In November 2021, ILUMINAR Lighting launched the new iLogic LED series. The iLogic full spectrum LED delivers deep, penetrating light intensity along with industry-leading uniformity. Optimized for the most demanding floriculture applications, the iLogic full spectrum is designed to scale up with ease as operation grows, offering unbeatable reliability, longevity, and performance.

- In October 2021, Current Lighting Solutions, LLC partnered with Current Lighting Solutions, LLC, to help make vertical farming a more sustainable, productive, and profitable opportunity for growers and other businesses who may wish to produce their own year-round crops such as herbs and leafy greens

- In September 2021, The HORTILED multi fusion LED grow light system is tailored for indoor farming, ensuring a technical design that assures growers of consistently high production and top-quality yields.

- In July 2021, Heliospectra AB, a world leader in intelligent lighting technology for vertical farming, announced a new seller partnership with MineARC Systems, a global leader in manufacturing and supplying controlled environments. The company will represent Heliospectra’s market-leading LED lighting and lighting control solutions in the Australian market.

- In June 2021, Osram expanded its horticulture lighting portfolio with the launch of Osconiq S 5050. It addresses a key problem of used white LEDs resulting in lower energy costs and more efficient lighting for indoor farmers.

- In June 2021, Signify Holding (Phillips Lighting) signed a partnership agreement with Hortipar, an expert in realizing lighting projects for the horticultural sector worldwide. Through this agreement, Hortipar agreed to add Philips GreenPower LED grow lights to its global portfolio. Focusing on quality, flexibility, knowledge, and expertise, Hortipar offers customers a complete solution for their greenhouse from the beginning till the end of a lighting project.

- In May 2021, Hortilux introduced the HORTILED Top series. The HORTILED Top intense and Sirius deliver the best performance, are attractively priced, and stand out for their versatile and innovative design. The HORTILED Top Intense is the most flexible frow light system with the highest light output. The HORTILED Top Sirius is the most energy-efficient grow light system with high light intensity.

- In May 2021, Heliospectra AB partnered with Harahara Inc., a long-term supplier of cultivation solutions, to represent Heliospectra’s market-leading LED lighting and light control solutions in Japan.

- In May 2021, Signify Holding (Phillips Lighting) collaborated with Sweden-based pioneer of vertical farming, Ljusgarda, to help the latter expand its productivity with the help of its high-tech solutions, such as greenhouse LED production modules and GrowWise Control System.

- In April 2021, Heliospectra AB announced the launch of heliospectra 2.0., the newly upgraded state-of-the-art plant science software for leading commercial growers and research institutions globally.

- In March 2021, Signify Holding (Phillips Lighting) introduces Philips GreenPower LED gridlighting to steer uniform bud development and increase yield of top-shelf flowers. It provides optimal light intensity during each growth phase with a rotary dimming.

- In January 2021, Valoya and Hohenheim University came together for a 3-year-long research partnership on Cannabis Sativa. The goal of the research partnership is to understand the light spectrum and light technology effects on flower yields and the quality of multiple strains of cannabis.

- In December 2020, Current Lighting Solutions, LLC and Aquila Capital patner to provide funding solutions for growers looking to install low-energy LED lighting, through funds managed or advised by Aquila Capital. The partnership will allow growers across Europe who are designing new indoor farming facilities, or upgrading existing installations to the latest lighting technology, to deploy Current’s range of Arize horticultural LED solutions, faster and with the aim of no up-front capital expenditure.

- In November 2020, Current Lighting Solutions, LLC. signed three partnership agreement with Agro Top Garden, Helle-Tech Oy and Vitro HTS to make its full Lucalox HPS and ArizeLED portfolio available to more greenhouse growers across Europe and Asia.

- In October 2020, California LightWorks launched MegaDrive, a game-changing new professional grow light system that delivers unparallel results while significantly reducing both up-front and long-term operating costs. The new MegaDrive system consists of a large central power unit connected to a series of up to 30 LED fixtures in a chain. In addition, all the lights can be centrally controlled from the power unit. The result is up to 80% less installation cost and 305 less up-front fixture cost.

- In October 2020, Heliospectra AB collaborated with ISAS, the University of Tokyo, to redefine indoor tomato production. In the University lab, the research team will be using Heliospectra’s MITRA linear. This collaboration presents an opportunity for growing healthy, nutritious vine crops indoors on a global scale.

- In September 2020, Valoya entered into a licensing agreement with Citizen Electronics Co. Ltd., a leading developer of electronic devices and applied products. Through this agreement, the company’s products were included in Citizen Electronics’ product portfolio. This partnership agreement is expected to support the development of the global horticulture industry.

- In September 2020, Valoya expanded its RX-Series line of greenhouse LEDs with 2 new models: RX500 and RX600. The new models can be used as one-to-one HPS replacements and can produce up to a staggering 1,700 µmol/s of uniform light output. The high light intensity they produce enables them to be positioned high above the canopy—as much as 4 meters above it.

- In September 2020, Fluence by OSRAM, a leading global provider of energy-efficient LED lighting solutions for commercial cannabis and agriculture production, announced that it has partnered with The Lamphouse, the largest supplier of specialized lamps in Africa. With more than 40 years of experience in numerous specialty lighting sectors, The Lamphouse is Fluence’s exclusive partner serving South Africa’s professional horticulture stores and fulfilling large commercial cannabis projects.

- In September 2020, Fluence by OSRAM partnered with REMY 108 LTD (REMY) in Israel to bring energy-efficient LED lighting to commercial crop production and drive growth in its legalized cannabis market.

- In August 2020, Fluence partnered with British Columbia-based Quality Wholesale Ltd., a leading garden wholesaler specializing in distributing agricultural products (Lighting solutions) to expand the inventory of LED lighting solutions for horticulture throughout Canada.

- In August 2020, Signify Holding (Phillips Lighting) signed an agreement with Yunnan AiBiDa Greenhouse Technology Co., Ltd (China), a greenhouse floriculture production company. Through this agreement, the company aimed to expand Philips’ horticulture research partner network in China and serve its Chinese floriculture business.

- In June 2020, Fluence by OSRAM launched 4 additional spectra on its VYPR top light series, featuring market-leading efficacies up to 3.8 µmol/J. From broad white to high red, Fluence’s extended PhysioSpec spectra enable growers to optimize lighting strategies for any crop in any growth stage or geographic location.

- In May 2020, Fluence by OSRAM (Fluence) was selected by Wageningen University & Research (WUR) as the lighting provider for Serre Red, the university’s new, high-tech quarantine greenhouse. Serre Red will be used for critical research on plant diseases—caused by viruses, bacteria, fungi, and parasitic nematodes—including quarantine pathogens and research on genetically modified organisms.

- In April 2020, Signify Holding (Phillips Lighting) and RIAT, an innovative farming enterprise of Russia, collaboratively pioneered the growing of tomatoes and cucumbers in vertical farms where Signify Holding (Phillips Lighting) provided its Greenpower LED grow lighting to achieve a yield performance comparable with traditional greenhouse operations.

- In April 2020, The Gavita 1700e LED lighting fixture was certified by the DesignLights Consortium (DLC). This certification means that the growers who purchase the fixture are eligible for state and national rebates—potentially cutting upfront equipment costs by as much as half, making it increasingly appealing for growers to utilize more efficient LEDs inside their facilities.

- In March 2020, Hortilux collaborated with TLS (Norway), a turf lighting service provider, to test how Premier League turf responds to several spectra of LED grow light offered by Hortilux. Based on the test results and specialized knowledge of Hortilux and TLS, tailored grow light solutions are likely to be provided to improve turf quality.

- In March 2020, Signify Holding (Phillips Lighting) acquired Cooper Lighting Solutions (US), a leading provider of professional lighting, lighting controls, and connected lighting, from Eaton. Eaton is a leading provider of professional lighting, lighting controls, and connected lighting. With this acquisition, the company can strengthen its position in the North American market.

- In March 2020, Signify Holding (Phillips Lighting) collaborated with Planet Farms, a leading Europe-based operator of vertical farms based in Italy. Under this agreement, Signify Holding (Phillips Lighting) agreed to provide horticulture LED grow lights to 5 additional vertical farms that Planet Farms is planning to build in different European countries.

- In January 2020, Osram launched the new generation of the Oslon Square Hyper Red with a wavelength of 660 nm, which is the flagship product in Osram Opto Semiconductors’ comprehensive horticulture portfolio. In addition to the better efficiency values, greenhouse operators benefit from a radiant flux of 1.030 mW at 73% WPE (wall-plug efficiency) and a photon flux of 5.7 µmol/s at an efficacy of 4.0 µmol/J at 700 mA.

- In January 2020, OSRAM launched the new generation of the Oslon Square Hyper Red with a wavelength of 660 nm, which is the flagship product in Osram Opto Semiconductors’ comprehensive horticulture portfolio. In addition to the better efficiency values, greenhouse operators benefit from a radiant flux of 1.030 mW at 73% WPE (wall-plug efficiency) and a photon flux of 5.7 µmol/s at the efficacy of 4.0 µmol/J at 700 mA.

- In January 2020, ILUMINAR Lighting launched a new HASH Controller, which provides complete access to control and view lighting settings from a computer or smartphone. The new product runs CMH, HPS, MH (Metal Halide), and T5 lighting fixtures, as well as LED fixtures, all on one channel and allows users to remotely manage vapor pressure deficit (VPD), temperature, CO2, photosynthetically active radiation (PAR), humidity, and other parameters throughout the growth cycle.

Frequently Asked Questions (FAQ):

What is the current size of the global horticulture lighting market?

The horticulture lighting market is expected to reach USD 10.4 billion by 2028 from USD 3.7 billion in 2023, at a CAGR of 22.4% during the 2023–2028 period.

Who are the winners in the global horticulture lighting market?

Companies such as Signify Holding(Philips Lighting), ams-OSRAM International GmbH , Lumileds Holding B.V. , Acuity Brands, Inc., GE Lighting (SAVANT TECHNOLOGIES LLC.)

Which region is expected to hold the highest market share?

Europe is expected to dominate the horticulture lighting market during the forecast period.

What are the major drivers and opportunities related to the horticulture lighting market?

The driver for the market is rising investments in vertical farms, greenhouses, and legalized cannabis cultivation and the opportunity is rising role of horticulture lighting software and calculators

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, collaborations, and partnerships to strengthen their position in the horticulture lighting market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of sustainable year-round crop production practices- Optimization of plant growth using customizable light spectra- Government-led initiatives to promote controlled environment agriculture (CEA) practices- Optimization of space for agricultural practices amidst arable land scarcity- Rising investments in modern agricultural techniques- Widespread adoption of LED fixtures as reliable lighting source- Adoption of artificial lighting to enhance energy efficiencyRESTRAINTS- High installation and setup costs- Navigation of complex light spectrum for crop cultivation- High energy consumptionOPPORTUNITIES- Emerging trend of farm-to-table concept- Growing prospects for vertical farming in Asian and Middle Eastern markets- Availability of weather-resilient solutions for crop production- Prominence of horticulture lighting software and calculators- Expansion of home gardening market- Integration of sustainable architectureCHALLENGES- Limited regulations and standards- Shortage of large-scale technical expertise- Need for standardized testing for product quality assessment- Complexities associated with integration of components and technologies into advanced agriculture facilities

-

5.3 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENTPRODUCT MANUFACTURERSSYSTEM INTEGRATORSMARKETING AND SALESEND-USER INDUSTRIES

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 TECHNOLOGY ANALYSISSOLID-STATE LIGHTING TECHNOLOGYFULL-SPECTRUM LED GROW LIGHTING SYSTEMCENTRALIZED POWER SUPPLYADVANCED UV-LED TECHNOLOGYSMART LIGHTING SOLUTIONSLIGHTING SYSTEMS WITH INTERNET OF THINGS (IOT)

-

5.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERS

-

5.8 PATENT ANALYSISDOCUMENT TYPEPUBLICATION TRENDJURISDICTION ANALYSISTOP PATENT OWNERS

- 5.9 TRADE ANALYSIS

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF PRODUCTS OFFERED BY TWO KEY PLAYERS, BY TECHNOLOGYAVERAGE SELLING PRICE (ASP) TREND FOR FLUORESCENT, HIGH-INTENSITY DISCHARGE (HID), AND LIGHT-EMITTING DIODE (LED), 2019–2028

-

5.11 CASE STUDY ANALYSISTOPLINE GERBERA ACHIEVED REMARKABLE ENERGY SAVINGS AND ENHANCED FLOWER QUALITY USING PHILIPS HORTICULTURE LED SOLUTIONSSIGNIFY HOLDING WITH BAIYI YINONG INTERNATIONAL FLOWER PORT HELPED CHINA REVOLUTIONIZE ROSE PRODUCTIONHELIOSPECTRA PROVIDED CUTTING-EDGE SMART LED LIGHT SOLUTIONS TO NORTH AMERICAN AGTECH TO TRANSFORM AGRICULTURAL LANDSCAPESIGNIFY HOLDING HELPED GOODLEAF COMMUNITY FARMS ENHANCE FOOD PRODUCTION CAPABILITIES

-

5.12 REGULATORY LANDSCAPEREGIONAL REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 NEW INSTALLATIONSRISING ADOPTION OF VERTICAL FARMING TO FUEL SEGMENTAL GROWTH

-

6.3 RETROFIT INSTALLATIONSINCREASED INSTALLATION OF RETROFITTING LIGHT FIXTURES TO BOOST MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 TOPLIGHTINGADOPTION OF TOPLIGHTING IN CONTROLLED ENVIRONMENT AGRICULTURE (CEA) FACILITIES TO BOOST SEGMENTAL GROWTH

-

7.3 INTERLIGHTINGGROWING DEMAND FOR INTERLIGHTING IN COMMERCIAL GREENHOUSES TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 HARDWARELIGHTING FIXTURES- Growing need for effective commercial operations to boost adoptionLIGHTING CONTROLS- Adoption of lighting controls to regulate light levels in CEA facilities to drive market

-

8.3 SOFTWARE AND SERVICESADOPTION OF HORTICULTURE LIGHTING SOFTWARE AND SERVICES TO DRIVE SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 FRUITS AND VEGETABLESINCREASING DEMAND FOR ORGANIC FRUITS AND VEGETABLES TO BOOST ADOPTION OF HORTICULTURE LIGHTING IN VERTICAL FARMS AND GREENHOUSES

-

9.3 FLORICULTURENEED TO FACILITATE CORRECT LIGHT RATIO TO REDUCE FLOWERING TIME AND INCREASE FLOWER PRODUCTION TO DRIVE DEMAND

-

9.4 CANNABISADOPTION OF BLUE LIGHTS TO ENSURE EFFECTIVE CANNABIS PLANT GROWTH TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 FLUORESCENTT5 FLUORESCENT LIGHTS- Rising need for efficiency in indoor cultivation to drive demand for T5 fluorescent lightsCOMPACT FLUORESCENT LAMP (CFL)- Increasing adoption of compact fluorescent lamps attributed to adaptability and cost-effectiveness to drive market

-

10.3 HIGH-INTENSITY DISCHARGE (HID)HIGH-PRESSURE SODIUM (HPS) LAMPS- Rising adoption of high-pressure sodium lamps in greenhouse settings to support market growthMETAL-HALIDE (MH) LAMPS- Adoption of metal-halide lamps to boost initial vegetative stage of plant growth to drive marketCOMPARISON BETWEEN HPS AND MH HORTICULTURE LAMPS

-

10.4 LIGHT-EMITTING DIODE (LED)DEMAND FOR LED LIGHTS IN INDOOR FARMING TO DRIVE SEGMENTAL GROWTH

- 10.5 OTHERS

- 11.1 INTRODUCTION

-

11.2 GREENHOUSESUTILIZATION OF HORTICULTURE LIGHTS IN GREENHOUSES TO INCREASE CROP YIELD TO DRIVE MARKET

-

11.3 VERTICAL FARMSINCREASED DEMAND FOR HORTICULTURE LIGHTING IN VERTICAL FARMS TO DRIVE SEGMENTAL GROWTHRECENT DEVELOPMENTS IN VERTICAL FARMING MARKET, BY REGION

-

11.4 INDOOR FARMSINCREASING FOCUS ON INFRASTRUCTURE DEVELOPMENT TO SUPPORT MARKET GROWTH

- 11.5 OTHERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAUS- Increased adoption of vertical farms and greenhouses to support market growthCANADA- Presence of challenging climatic conditions to increase adoption of horticulture lightingMEXICO- Increasing adoption of controlled agricultural practices to drive marketRECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN NORTH AMERICA

-

12.3 EUROPEUK- Emerging vertical farms and greenhouses to stimulate market growthGERMANY- Adoption of advanced farming techniques to fuel demandNETHERLANDS- Presence of leading horticulture lighting providers to drive marketSCANDINAVIA- Rising focus on minimizing fresh fruit and vegetable imports to increase demandREST OF EUROPERECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN EUROPE

-

12.4 ASIA PACIFICCHINA- Increasing adoption of Controlled Environment Agriculture (CEA) practices to drive marketJAPAN- Growing adaption of urban agriculture to support market growthSOUTHEAST ASIA- Government-led initiatives and scarcity of natural resources to drive demandAUSTRALIA- Legalization of cannabis cultivation to drive demandREST OF ASIA PACIFICRECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN ASIA PACIFIC

-

12.5 ROWSOUTH AMERICA- Growing installation of vertical farms by startups to support market growthMIDDLE EAST & AFRICA- Rising focus on sustainable food production to boost market growthRECESSION IMPACT ON HORTICULTURE LIGHTING MARKET IN ROW

- 13.1 OVERVIEW

- 13.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 13.3 MARKET SHARE AND RANKING ANALYSIS, 2022

- 13.4 COMPANY REVENUE ANALYSIS, 2018–2022

-

13.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 COMPETITIVE BENCHMARKING

-

13.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.8 LIST OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.10 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSSIGNIFY HOLDING (PHILIPS LIGHTING)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGAVITA INTERNATIONAL B.V.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELIOSPECTRA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAMS-OSRAM INTERNATIONAL GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCALIFORNIA LIGHTWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVALOYA- Business overview- Products/Solutions/Services offered- Recent developmentsHORTILUX SCHRÉDER- Business overview- Products/Solutions/Services offered- Recent developmentsILUMINAR LIGHTING- Business overview- Products/Solutions/Services offered- Recent developmentsCURRENT LIGHTING SOLUTIONS, LLC.- Business overview- Products/Solutions/Services offered- Recent developmentsGE LIGHTING (SAVANT TECHNOLOGIES LLC.)- Business overview- Products/Solutions/Services offered

-

14.3 OTHER PLAYERSACUITY BRANDS, INC.LUMILEDS HOLDING B.V.CREE LED, AN SGH COMPANYTCP LIGHTINGPARSOURCEECONOLUX INDUSTRIES LTD.OREONGLACIALLIGHT – DIVISION OF GLACIALTECH INC.BLACK DOG HORTICULTURE TECHNOLOGIES & CONSULTINGVIPARSPECTRAACTIVE GROWAGNETIXTHRIVE AGRITECHBRIDGELUX, INC.KROPTEK

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 COMPANIES AND THEIR ROLE IN HORTICULTURE LIGHTING ECOSYSTEM

- TABLE 3 HORTICULTURE LIGHTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 PATENTS FILED

- TABLE 5 TOP 20 PUBLISHED PATENT OWNERS IN LAST 10 YEARS

- TABLE 6 EXPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE: 9405-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF PRODUCTS OFFERED BY TOP TWO PLAYERS, BY TECHNOLOGY (USD)

- TABLE 9 HORTICULTURE LIGHTING MARKET: REGULATORY FRAMEWORK

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 15 HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 16 NEW INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 17 NEW INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 RETROFIT INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 RETROFIT INSTALLATIONS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019–2022 (USD MILLION)

- TABLE 21 HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023–2028 (USD MILLION)

- TABLE 22 TOPLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 TOPLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 INTERLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 INTERLIGHTING: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 27 HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 28 HARDWARE: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 HARDWARE: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 HORTICULTURE LIGHTING MARKET, BY HARDWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 31 HORTICULTURE LIGHTING MARKET, BY HARDWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 32 SOFTWARE & SERVICES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 SOFTWARE & SERVICES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019–2022 (USD MILLION)

- TABLE 35 HORTICULTURE LIGHTING MARKE, BY CULTIVATION TYPE, 2023–2028 (USD MILLION)

- TABLE 36 FRUITS AND VEGETABLES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 FRUITS AND VEGETABLES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 FLORICULTURE: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 FLORICULTURE: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CANNABIS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 CANNABIS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 43 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 44 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (THOUSAND UNITS)

- TABLE 45 HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023–2028 (THOUSAND UNITS)

- TABLE 46 FLUORESCENT: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 FLUORESCENT: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 HID: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 HID: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 LED: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 LED: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 OTHERS: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 OTHERS: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 57 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY 2023–2028 (USD MILLION)

- TABLE 58 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 GREENHOUSES: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 61 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 62 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 VERTICAL FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 DEVELOPMENTS IN NORTH AMERICAN VERTICAL FARMING MARKET

- TABLE 65 DEVELOPMENTS IN EUROPEAN VERTICAL FARMING MARKET

- TABLE 66 DEVELOPMENTS IN ASIA PACIFIC VERTICAL FARMING MARKET

- TABLE 67 DEVELOPMENTS IN ROW VERTICAL FARMING MARKET

- TABLE 68 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 69 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 70 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 INDOOR FARMS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHERS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 73 OTHERS: HORTICULTURE LIGHTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 74 OTHERS: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 OTHERS: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: HORTICULTURE LIGHTING MARKET, BY COUNTRY 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ROW: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 115 ROW: HORTICULTURE LIGHTING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 ROW: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 ROW: HORTICULTURE LIGHTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 ROW: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2019–2022 (USD MILLION)

- TABLE 119 ROW: HORTICULTURE LIGHTING MARKET, BY LIGHTING TYPE, 2023–2028 (USD MILLION)

- TABLE 120 ROW: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2019–2022 (USD MILLION)

- TABLE 121 ROW: HORTICULTURE LIGHTING MARKET, BY CULTIVATION TYPE, 2023–2028 (USD MILLION)

- TABLE 122 ROW: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2019–2022 (USD MILLION)

- TABLE 123 ROW: HORTICULTURE LIGHTING MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 124 ROW: HORTICULTURE LIGHTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 ROW: HORTICULTURE LIGHTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 HORTICULTURE LIGHTING MARKET: DEGREE OF COMPETITION

- TABLE 127 COMPANY FOOTPRINT

- TABLE 128 APPLICATION: COMPANY FOOTPRINT

- TABLE 129 REGION: COMPANY FOOTPRINT

- TABLE 130 HORTICULTURE LIGHTING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 131 HORTICULTURE LIGHTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 132 HORTICULTURE LIGHTING MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 133 HORTICULTURE LIGHTING MARKET: DEALS, 2020–2023

- TABLE 134 SIGNIFY HOLDING (PHILLIPS LIGHTING): COMPANY OVERVIEW

- TABLE 135 SIGNIFY HOLDING (PHILLIPS LIGHTING): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 SIGNIFY HOLDING (PHILLIPS LIGHTING): PRODUCT LAUNCHES

- TABLE 137 SIGNIFY HOLDING (PHILLIPS LIGHTING): DEALS

- TABLE 138 SIGNIFY HOLDING (PHILLIPS LIGHTING): OTHERS

- TABLE 139 GAVITA INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 140 GAVITA INTERNATIONAL B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 GAVITA INTERNATIONAL B.V.: OTHERS

- TABLE 142 HELIOSPECTRA: COMPANY OVERVIEW

- TABLE 143 HELIOSPECTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 HELIOSPECTRA: PRODUCT LAUNCHES

- TABLE 145 HELIOSPECTRA: DEALS

- TABLE 146 HELIOSPECTRA: OTHERS

- TABLE 147 AMS-OSRAM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 148 AMS-OSRAM INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 AMS-OSRAM INTERNATIONAL GMBH: PRODUCT LAUNCHES

- TABLE 150 AMS-OSRAM INTERNATIONAL GMBH: DEALS

- TABLE 151 AMS-OSRAM INTERNATIONAL GMBH: OTHERS

- TABLE 152 CALIFORNIA LIGHTWORKS: COMPANY OVERVIEW

- TABLE 153 CALIFORNIA LIGHTWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 CALIFORNIA LIGHTWORKS: PRODUCT LAUNCHES

- TABLE 155 VALOYA: COMPANY OVERVIEW

- TABLE 156 VALOYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 VALOYA: PRODUCT LAUNCHES

- TABLE 158 VALOYA: DEALS

- TABLE 159 HORTILUX SCHRÉDER: COMPANY OVERVIEW

- TABLE 160 HORTILUX SCHRÉDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HORTILUX SCHRÉDER: PRODUCT LAUNCHES

- TABLE 162 HORTILUX SCHRÉDER: DEALS

- TABLE 163 ILUMINAR LIGHTING: COMPANY OVERVIEW

- TABLE 164 ILUMINAR LIGHTING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 ILUMINAR LIGHTING: PRODUCT LAUNCHES

- TABLE 166 CURRENT LIGHTING SOLUTIONS, LLC: COMPANY OVERVIEW

- TABLE 167 CURRENT LIGHTING SOLUTIONS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 CURRENT LIGHTING SOLUTIONS, LLC: PRODUCT LAUNCHES

- TABLE 169 CURRENT LIGHTING SOLUTIONS, LLC: DEALS

- TABLE 170 GE LIGHTING (SAVANT TECHNOLOGIES LLC.): COMPANY OVERVIEW

- TABLE 171 GE LIGHTING (SAVANT TECHNOLOGIES LLC.): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 HORTICULTURE LIGHTING MARKET SEGMENTATION

- FIGURE 2 HORTICULTURE LIGHTING MARKET: GEOGRAPHICAL SCOPE

- FIGURE 3 HORTICULTURE LIGHTING MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATED BY KEY HORTICULTURE LIGHTING PROVIDERS (SUPPLY SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF REVENUE ESTIMATION OF KEY MARKET PLAYER (SUPPLY SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP ESTIMATION, BY REGION (DEMAND SIDE)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS

- FIGURE 11 LIMITATIONS

- FIGURE 12 HORTICULTURE LIGHTING MARKET: IMPACT OF RECESSION

- FIGURE 13 LED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 14 GREENHOUSES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 15 FRUITS AND VEGETABLES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 16 HORTICULTURE LIGHTING MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 GROWING ADOPTION OF CONTROLLED ENVIRONMENT AGRICULTURAL PRACTICES IN URBAN AREAS

- FIGURE 18 HARDWARE SEGMENT TO ACCOUNT FOR LARGER SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 19 RETROFIT INSTALLATIONS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 20 TOPLIGHTING SEGMENT TO ACCOUNT FOR LARGER SHARE OF HORTICULTURE LIGHTING MARKET IN 2028

- FIGURE 21 SOUTHEAST ASIA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 22 HORTICULTURE LIGHTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 HORTICULTURE LIGHTING MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 24 HORTICULTURE LIGHTING MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 25 HORTICULTURE LIGHTING MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 26 HORTICULTURE LIGHTING MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 27 HORTICULTURE LIGHTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN HORTICULTURE LIGHTING MARKET

- FIGURE 29 HORTICULTURE LIGHTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 IMPACT ANALYSIS OF PORTER’S FIVE FORCES

- FIGURE 31 PATENTS FILED, 2013–2022

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, 2013–2022

- FIGURE 33 JURISDICTION ANALYSIS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PUBLISHED PATENT APPLICATIONS, 2013–2022

- FIGURE 35 COUNTRY-WISE EXPORT DATA FOR PRODUCTS UNDER HS CODE 9405, 2018–2022 (USD THOUSAND)

- FIGURE 36 COUNTRY-WISE IMPORT DATA FOR PRODUCTS UNDER HS CODE 9405, 2018–2022 (USD THOUSAND)

- FIGURE 37 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 38 RETROFIT INSTALLATIONS SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 INTERLIGHTING SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 FRUITS AND VEGETABLES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 42 LED SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 43 VERTICAL FARMS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 44 HORTICULTURE LIGHTING, BY REGION

- FIGURE 45 ASIA PACIFIC TO RECORD HIGHEST CAGR IN HORTICULTURE LIGHTING MARKET DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: HORTICULTURE LIGHTING MARKET SNAPSHOT

- FIGURE 47 EUROPE: HORTICULTURE LIGHTING MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: HORTICULTURE LIGHTING MARKET SNAPSHOT

- FIGURE 49 ROW HORTICULTURE LIGHTING MARKET, BY REGION

- FIGURE 50 HORTICULTURE LIGHTING MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2021–2023

- FIGURE 51 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- FIGURE 52 REVENUE ANALYSIS OF THREE KEY COMPANIES, 2018–2022

- FIGURE 53 HORTICULTURE LIGHTING MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 54 HORTICULTURE LIGHTING (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 55 SIGNIFY HOLDING (PHILLIPS LIGHTING): COMPANY SNAPSHOT

- FIGURE 56 HELIOSPECTRA: COMPANY SNAPSHOT

- FIGURE 57 AMS-OSRAM INTERNATIONAL GMBH: COMPANY SNAPSHOT

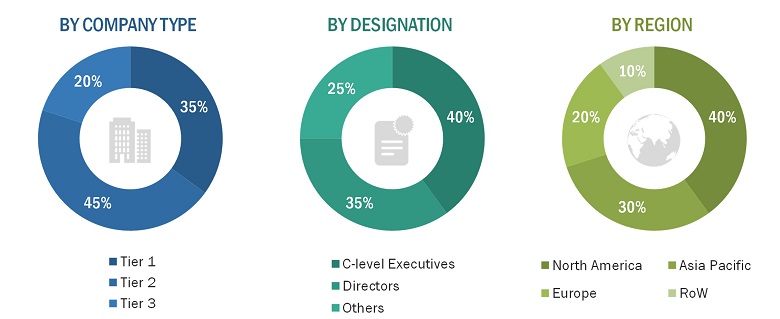

The research report includes four major activities, estimating the size of the horticulture lighting market. Secondary research has been done to gather important information about the market and peer markets. To validate the findings, assumptions, and sizing with the primary research with industry experts across the value chain is the next step. Both bottom-up and top-down approaches have been used to estimate the market size. After this, the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the horticulture lighting market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. Secondary research has been mainly used to obtain key information about the supply chain of the horticulture lighting industry to identify the key players based on their products and the prevailing industry trends in the horticulture lighting market based on the installation type, lighting type, offering, cultivation type, technology, application, and region. It also includes information about the key developments undertaken from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information related to the market across four main regions— North America, Europe, Asia Pacific, and RoW. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and a few other related key executives from major companies and organizations operating in the horticulture lighting market or related markets.

After the completion of market engineering, primary research was conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies market players adopt. Most of the primary interviews have been conducted with the supply side of the market. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used extensively in market engineering. Several data triangulation methods have also been used to perform market forecasting and estimation for the report’s overall market segments and sub-segments. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players offering horticulture lighting . The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives have also been conducted to gain insights into the key players and the horticulture lighting market. All the market shares have been estimated using secondary and primary research. This data has been consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

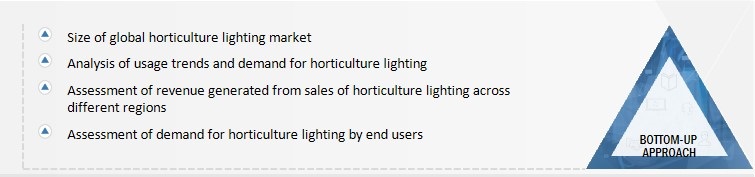

Market Size Estimation Methodology-Bottom-up Approach

The bottom-up approach has been employed to arrive at the overall size of the horticulture lighting market from the calculations based on the revenues of the key players and their shares in the market. Key players in the horticulture lighting market have been studied. The market size estimations have been carried out considering the market size of their horticulture lighting offerings.

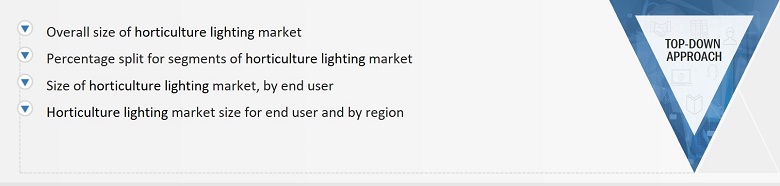

Market Size Estimation Methodology-Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets through percentage splits from secondary and primary research.

The most appropriate parent market size has been used to implement the top-down approach for the calculation of specific market segments.

The revenue shares used earlier in the bottom-up approach were verified by identifying and estimating the market share for each company. The overall parent market size and individual market sizes have been determined and confirmed in this study through the data triangulation process and data validation through the primaries.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been then split into several segments and sub-segments. Data triangulation has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Horticulture lighting refers to the electromagnetic radiation that stimulates different photoreceptors in plants to enable photosynthesis, photomorphogenesis, phototropism, and photoperiodism in them. All plants, including flowering and fruit-bearing plants, require water, light, carbon dioxide, and nutrients to survive and thrive. Light is used by plants to catalyze the chemical reaction of carbon dioxide and water to synthesize carbohydrates that allow them to grow. Plants must receive sufficient light to fuel the metabolic process, drive active growth, maintain plant quality, and achieve maximum yields. As the intensity and spectrum of sunlight fluctuate, artificial light sources are used to offer sufficient light for the growth of plants, either as supplementary light sources to the sun or as sole sources of photosynthetic and photomorphogenic light.

Key Stakeholders

- Manufacturers of horticulture lighting solutions

- Original equipment manufacturers

- Technology solution providers

- Horticulture lighting distributors and retailers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

The main objectives of this study are as follows:

- To describe and forecast the horticulture lighting market size, in terms of value, based on offering, technology, lighting type, cultivation type, application, installation type, and region

- To describe and forecast the horticulture lighting market size, in terms of value, for various segments with respect to 4 key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyse micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To forecast the shipments of horticulture lighting by technology from 2023 to 2028.

- To provide a detailed overview of the horticulture lighting value chain

- To strategically profile the key players and comprehensively analyse their market ranking in terms of revenue and core competencies2

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the horticulture lighting market

- To provide detailed analysis of the market ecosystem, technology analysis, pricing analysis, revenue shift, porter’s five forces model, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, key conferences & events and tariff and regulations related to the horticulture lighting market.

- To analyze the micro markets with regard to industry trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of horticulture lighting market and provide details of the competitive landscape for market leaders.

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the horticulture lighting market

- To track and analyze competitive developments, such as joint ventures, mergers and acquisitions, new product developments, and research and development activities in the horticulture lighting market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Country-wise Information for Asia Pacific

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Horticulture Lighting Market