Point of Care Diagnostics Market Size by Product (Glucose, HIV, Hep C, HPV, Hematology, Pregnancy), Platform (Microfluidic, Dipstick, RT-PCR, INAAT), Sample (Blood, Urine), Purchase (OTC, Rx), End User (Pharmacy, Hospitals, Home Care) & Region - Global Forecast to 2028

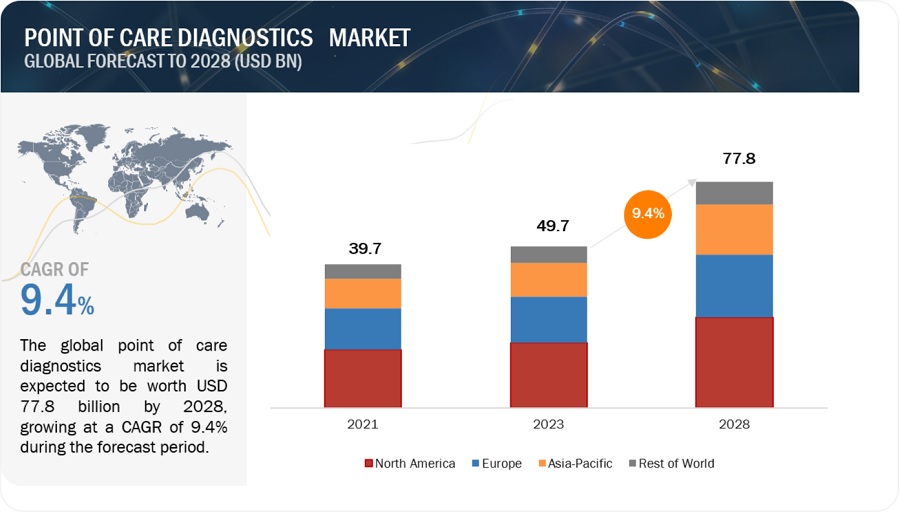

The size of global point of care diagnostics market in terms of revenue was estimated to be worth $49.7 billion in 2023 and is poised to reach $77.8 billion by 2028, growing at a CAGR of 9.4% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Point-of-care diagnostics devices provide quick results and help in making better treatment decisions. The key factors driving market growth include the rising incidence of infectious diseases such as influenza, HIV, tuberculosis, moreover, favourable government policies promoting the adoption of POC testing, rising CLIA-waived point of care tests, and shift towards healthcare decentralization are some of the major factors contributing towards the growth of market during the forecast period. However, the rising pricing pressure on these devices due to reimbursement cuts, and the stringent regulatory approval processes for commercializing POC products is expected to restrain market growth during the forecast period.

Global Point of Care Diagnostics Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Point of care Diagnostics Market Dynamics

Driver: Increasing prevalence of infectious diseases globally

POC tests can primarily improve the management of infectious diseases, especially in emerging markets and resource limited settings. According to UNAIDS, approximately 39 million people were suffering from HIV-AIDS globally as of 2022, and an estimated 1.3 million individuals acquired HIV.

In 2022, Tuberculosis ranked as the second leading cause of death globally among single infectious agents following COVID-19. Globally, the newly diagnosed tuberculosis cases reached 7.5 million in 2022 (Source: WHO Global Tuberculosis Report 2023). Point-of-care tests with high sensitivity and specificity enable the rapid diagnosis of infectious diseases, initiating prompt treatment further enhancing patient outcome. The global rise in prevalence of infectious diseases such as malaria, tuberculosis, HIV are likely to boost the demand for point-of-care diagnostics

Restraint: Pricing pressure on PoC Manufacturers

Intense competition in the POC testing market can lead to pricing pressure, Moreover, decrease in reimbursement rates for POC tests from government payers, private insurers, or healthcare reimbursement programs are driving down profit margins for manufacturer significantly impacting the growth of point of care diagnostics market. Healthcare facilities, especially those in areas with limited resources or financial constraints, may have constrained budgets for investing in point-of-care testing equipment and materials, limiting the adoption of point of care testing.

Opportunity: High growth potential of emerging markets

Emerging markets such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities for players operating in the POC diagnostics market. This is primarily due to the high and growing prevalence of infectious and lifestyle diseases in these countries. To meet the increasing demand for POC diagnostics in emerging markets, manufacturers focus on acquiring or entering into agreements and partnerships with regional/domestic players for product distribution and manufacturing. Regulatory policies in the Asia Pacific region are flexible and have less stringent regulations than established markets in North America and Europe. The saturation of mature markets will further compel manufacturers and leading POC testing companies to shift their focus to emerging markets

Challenge: Inadequate standardization with centralized lab methods

POC test results lack alignment with central lab methods due to many pre- and post-analytical errors. Pre-analytical errors for POC testing include unsuitable indications for the performance of the test, inappropriate sampling times and techniques, lack of information about patient conditions, and other factors such as fasting before functional tests or variations in posture/position during similar tests. On the other hand, post-analytical errors include inadequate technical validation, false assignment of results, and errors in data storage.

POC testing is often conducted in emergencies to facilitate clinical decision-making. In several cases, these tests are conducted by nurses or clinical team members, not physicians. These issues can potentially lead to erroneous diagnoses and affect the quality of patient care. Considering such issues, patients & doctors can decide not to opt for POC testing. This is one of the critical challenges to the higher acceptance of POC testing.

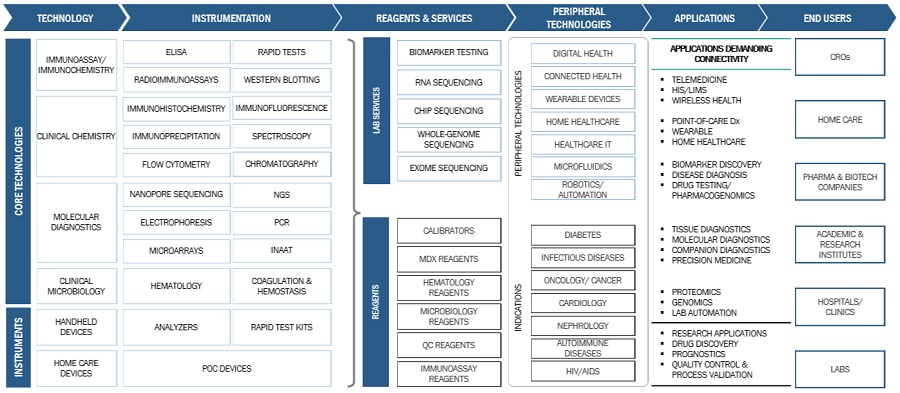

Point of care Diagnostics Market Ecosystem

The Glucose Monitoring Product segment to hold significant share of the global point of care diagnostics industry, by product type, in 2022

Based on the product, point of care diagnostics market is segmented into glucose monitoring products, cardiometabolic monitoring products, COVID-19 testing products, infectious disease testing products, coagulation monitoring products, pregnancy & fertility testing products, hematology testing products, cancer marker testing products, fecal occult testing products, urinalysis testing products, drug-of-abuse testing products, thyroid-stimulating hormone (TSH) testing products, cholesterol testing products, and other products. In 2022, the glucose monitoring testing products segment accounted for the second largest share of the market. The significant rise in the diabetes cases globally, widespread adoption of glucose monitoring kits, and greater awareness of the diabetes care are expected to propel the growth of the segment

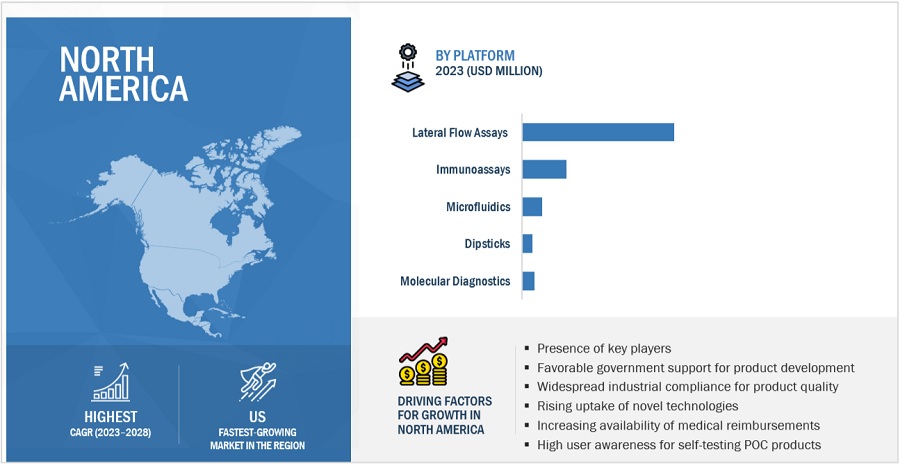

By platform, the lateral flow assay segment held the largest share of point of care diagnostics industry

Based on platform, the point of care diagnostics market is segmented into lateral flow assays, immunoassays, microfluidics, dipsticks, and molecular diagnostics. The lateral flow assays segment accounted for the largest share of the market in 2022. Lateral flow assay is more affordable compared to traditional laboratory testing methods, moreover the ease of conducting lateral flow assay makes this technology well suited for healthcare settings with limited resources, enabling rapid testing for various conditions.

By End User, home care settings and self testing of the point of care diagnostics industry to grow at a significant rate from 2023-2028

Based on end user, home care setting and self-testing segment is expected to grow at a significant rate owing to growing awareness about home care, increasing availability of user-friendly and advanced POC diagnostic products, including blood glucose, cholesterol, and pregnancy. Additionally, the COVID 19 pandemic has accelerated the adoption of home care self-testing products, particularly for diagnostic testing and monitoring of infectious diseases. Along with this the rising partnerships, and collaborations among various players to develop novel rapid testing products for home use are likely to contribute towards the rapid growth of the segment

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest share of point of care diagnostics industry during the forecast period.

North America is the expected to be the largest regional market for point of care diagnostics during the forecast period. The presence of a well-established healthcare system, rapid adoption of advanced point of care testing products, increase in the availability of medical reimbursement, favourable government support for the novel product development, and higher user awareness about the presence of point of care testing products are anticipated to support the market growth in the region

As of 2022, Prominent players in the point of care diagnostics market include Abbott Laboratories (US), F. Hoffman-La Roche Ltd. (Switzerland), BD (US), Danaher Corporation (US), Siemens Healthineers (Germany), QuidelOrtho Corporation (US), Chembio Diagnostics, Inc. (US), EKF Diagnostics Holdings plc (UK), among others

Scope of the Point of Care Diagnostics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$49.7 billion |

|

Projected Revenue Size by 2028 |

$77.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 9.4% |

|

Market Driver |

Increasing prevalence of infectious diseases globally |

|

Market Opportunity |

High growth potential of emerging markets |

This research report categorizes the point of care diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- COVID-19 test products

-

Glucose Monitoring Products

- Strips

- Meters

- Lancets & Lancing Devices

-

Cardiometabolic Monitoring Products

- Point-of-care and rapid diagnostics Products

- Blood Gas/Electrolyte Testing Products

- HbA1c Testing Products

-

Infectious Disease Testing Products

- Influenza Testing Products

- HIV Testing Products

- Hepatitis C Testing Products

-

Influenza Testing Products

-

Sexually Transmitted Disease Testing Products

- Syphilis Testing Products

- Human Papillomavirus (HPV) Testing Products

- Chlamydia Trachomatis Testing Products

- Herpes simplex virus (HSV) Testing Products

- Healthcare-associated Infection Testing Products

- Respiratory Infection Testing Products

- Tuberculosis (TB) Testing Products

- Clostridium Difficile Infection (CDI) Testing Products

- Tropical Disease Testing Products

- Other Infectious Disease Testing Products

-

Sexually Transmitted Disease Testing Products

-

Coagulation Monitoring Products

- PT/INR Testing

- ACT/APTT

-

Pregnancy & Fertility Testing Products

- Pregnancy Testing Products

- Fertility Testing Products

- Tumor/Cancer Marker Testing Products

- Urinalysis Testing Products

- Cholesterol Testing Products

- Hematology Testing Products

- Thyroid Stimulating Hormone (TSH) Testing Products

- Drugs-of-abuse Testing Products

- Fecal Occult Testing Products

- Other POC Products

Note* Other PoC products include multi-assay testing, disease-resistant bacteria testing, vitamin assay testing

By Platform

- Lateral Flow Assays

- Dipsticks

- Microfluidics

-

Molecular Diagnostics

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Other Molecular Diagnostic Technologies

- Immunoassays

By Mode of Purchase

- Prescription-based Products

- OTC Products

By Sample

- Blood Sample

- Urine Sample

- Nasal and Oropharyngeal Swabs Sample

- Other Samples

Note*Other samples include saliva, sputum, stool, and urethral/genital swabs.

By End User

- Clinical Laboratories

- Ambulatory Care Facilities and Physician Offices

- Pharmacies, retail clinics, & E-comm. Platforms

- Hospitals, Critical Care Centers, Urgent care centers

- Home Care & Self Testing

- Other End Users

Note*Other end users includes rehabilitation centers, sports centers, nursing homes, research institutes, and blood banks.

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East & Africa

- GCC Countries

- Rest of Middle East & Africa

Recent Developments of Point of Care Diagnostics Industry:

- In May 2023, bioMérieux received the US FDA CLIA-waiver for the BIOFIRE SPOTFIRE Respiratory (R) Panel Mini,a second multiplex PCR-based test cleared for use on the BIOFIRE SPOTFIRE System

- In August 2023, BD received the US FDA approval for its BD Respiratory Viral Panel (RVP) for BD MAX System, a single molecular diagnostic combination test that identifies & distinguishes SARS-CoV-2, influenza A, influenza B, and Respiratory Syncytial Virus (RSV) in ~ 2 hours.

- In December 2023, Thermo Fisher Scientific Inc. and Project HOPE, a leading global health and humanitarian organization, partnered to expand the accessibility of HIV testing services offered by Thermo Fisher among HIV Positive Youth in Sub-Saharan Africa.

Frequently Asked Questions (FAQ):

What is the projected market revenue size of global point of care diagnostics Market?

The size of global point of care diagnostics market was estimated at USD 39.7 billion in 2021 and is expected to reach USD 77.8 billion in 2028.

What is the estimated growth rate (CAGR) of global point of care diagnostics Market?

The global point of care diagnostics market has an estimated compound annual growth rate (CAGR) of 9.4% and a revenue size in the region of $49.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

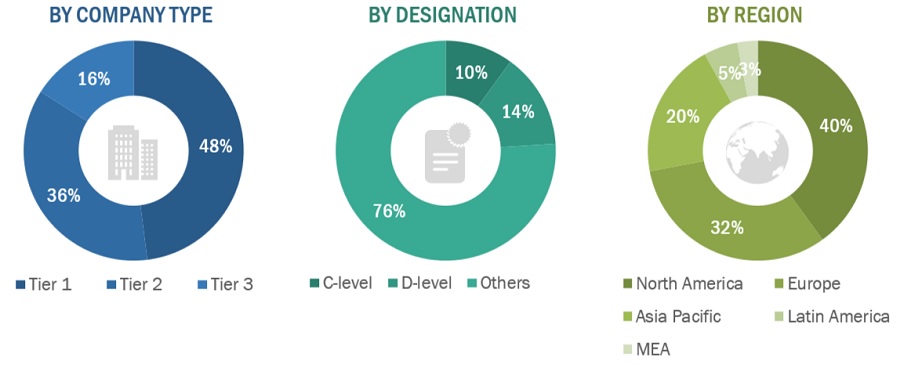

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the point of care diagnostics market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the point of care diagnostics market. The primary sources from the demand side include hospitals, clinical laboratories, pharmacies, ecommerce platforms, physician’s office, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

*C-level primaries include CEOs, CFOs, COOs, and VPs.

**Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue; as of 2021, Tier 1 = >USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = <USD 1 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

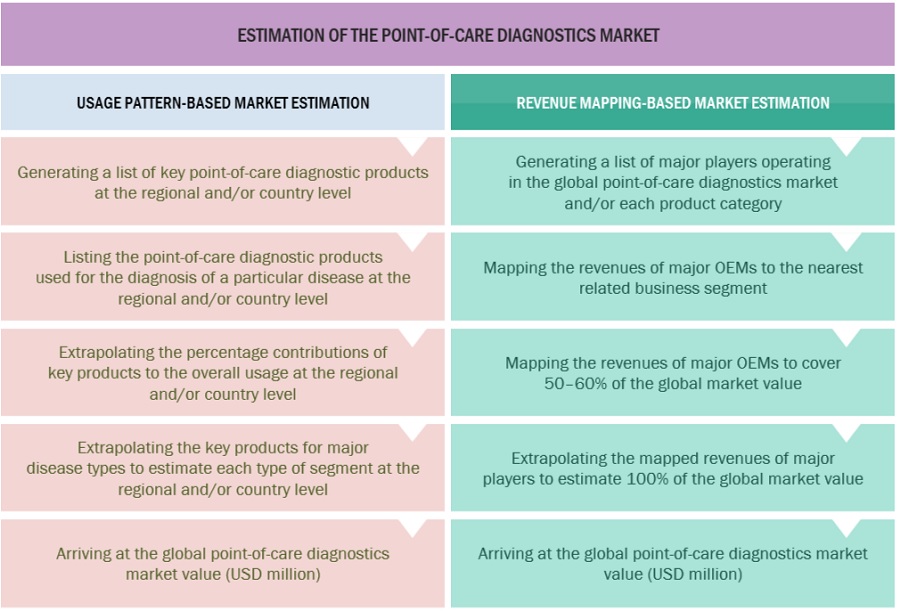

Market Estimation Methodology:

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global point of care diagnostics market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 85–90% of the market share at the global level). Also, the global point of care diagnostics market was split into various segments and sub-segments based on:

- list of major players operating in the point-of-care market at the regional and/or country level

- Product mapping of various manufacturers for point-of-care diagnostics products at the regional and/or country level

- Mapping of annual revenue generated by listed major players from point-of-care diagnostics segments (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 65–75% of the global market share as of 2022

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global point-of-care diagnostics market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation:

After deriving the overall Point of care diagnostics market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Market Definition:

Point of care testing includes conducting diagnostic tests near the patient, offering immediate results enabling helathacare providers to expedite the clinical decisions. Point of care devices are best suited for various healthcare settings, including clinical laboratories , hospitals, physician offices, ambulances, and at homes, emergency rooms

Key Market Stakeholders:

- Point-of-care Diagnostic Product Manufacturers

- Distributors, Channel Partners, and Third-party Suppliers

- Clinical Laboratories, Reference Laboratories, and Contract Testing Laboratories

- Hospitals, Diagnostic Clinics, and Sports/Military Facilities

- Contract Manufacturing Organizations (CMOs)

- Contract Research Organizations (CROs)

- R&D Companies

- Business Research and Consulting Service Providers

- Medical Research Laboratories

- Academic Medical Centers, Universities, and Hospitals

Report Objectives:

- To define, describe, and forecast the point-of-care diagnostics market by Product, Platform, Mode of Purchase, Sample, End User, and Region

- To provide detailed information about major factors influencing market growth (key drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and their contributions to the overall point-of-care and rapid diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market value of various segments and sub-segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players active in the point of care diagnostics market and comprehensively analyze their global revenue shares and core competencies

- To track and analyze competitive market-specific developments such as product approvals & commercialization, agreements, partnerships, collaborations, acquisitions, and expansions in the point-of-care diagnostics market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global point of care diagnostics market report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information:

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis:

- Further breakdown of the Rest of Europe's point of care diagnostics market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among other

- Further breakdown of the Rest of Asia Pacific point of care diagnostics market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Point of Care Diagnostics Market